Nitheesh NH

Store Tracker Extra: More Data Each Month

Our US Store Tracker Extra monthly series offers insights into retailers’ monthly store closure and opening announcements, supplementing our Weekly US and UK Store Openings and Closures Tracker reports. We include retailer-level details on closures and openings as a percentage of total store base as well as square-footage impact. In the report, we also compare year-to-date announced closures and openings as of June 24, 2022 (corresponding to week 25 in our Weekly US and UK Store Openings and Closures Tracker) versus the comparable period in 2021 (the four weeks ended June 25, 2021).2022 Major US Store Closures: Proportion of Store Base and Square Footage

As of June 24, 2022, major US retailers have announced 1,766 store closures this year. This compares to 4,554 announced closures in the comparable period of 2021, as we discuss later in this report. In June 2022, the following retailers made store closure announcements: Aerie has closed two stores year to date, representing 1% of its total store base of 216 stores. The closures account for an estimated 8,000 square feet of total retail space. Athleta has closed two stores year to date, representing 1% of its total store base of 220 stores. The closures account for an estimated 8,000 square feet of total retail space. Big Lots has closed seven stores year to date, representing less than 1% of its total store base of 1,424 stores. The closures account for an estimated 227,000 square feet of total retail space. Build-A-Bear has closed one store year to date, representing less than 1% of its total store base of 305 stores. The closure accounts for an estimated 3,000 square feet of total retail space. Casey’s General Stores has closed seven stores year to date, representing less than 1% of its total store base of 2,431 stores. The closures account for an estimated 42,000 square feet of total retail space. Chico’s plans to close five stores in 2022, representing less than 1% of its total store base of 1,297 stores. The closures will account for an estimated 17,000 square feet of total retail space. Dick’s Sporting Goods has closed two stores year to date, representing less than 1% of its total store base of 730 stores. The closures account for an estimated 105,000 square feet of total retail space. Dollar General has closed 25 stores year to date, representing less than 1% of its total store base of 17,915 stores. The closures account for an estimated 265,000 square feet of total retail space. Dollar Tree has closed 20 stores year to date, representing less than 1% of its total store base of 7,984 stores. The closures account for an estimated 247,000 square feet of total retail space. Family Dollar has closed 31 stores year to date, representing less than 1% of its total store base of 7,982 stores. The closures account for an estimated 327,000 square feet of total retail space. Hibbett Sports has closed two stores year to date, representing less than 1% of its total store base of 1,096 stores. The closures account for an estimated 11,000 square feet of total retail space. King Kullen has closed two stores year to date, representing 7% of its total store base of 29 stores. The closures account for an estimated 90,000 square feet of total retail space. Kroger has closed two stores year to date, representing less than 1% of its total store base of 2,736 stores. The closures account for an estimated 131,000 square feet of total retail space. Old Navy has closed five stores year to date, representing less than 1% of its total store base of 1,257 stores. The closures account for an estimated 80,000 square feet of total retail space. Ollie’s Bargain Outlet has closed one store year to date, representing less than 1% of its total store base of 426 stores. The closure accounts for an estimated 30,000 square feet of total retail space. Roses Discount Stores has closed one store year to date, representing less than 1% of its total store base of 244 stores. The closure accounts for an estimated 126,000 square feet of total retail space. Sears Hometown plans to close 101 stores in 2022, representing 31% of its total store base of 325 stores. The closures will account for an estimated 935,000 square feet of total retail space. Vera Bradley has closed three stores year to date, representing 2% of its total store base of 147 stores. The closures account for an estimated 8,000 square feet of total retail space. Williams-Sonoma has closed 14 stores year to date, representing 3% of its total store base of 544 stores. The closures account for an estimated 150,000 square feet of total retail space. In Figure 1, we offer a breakdown of estimated closures announced by various retailers, along with the proportion of their total store base that will be impacted.Figure 1. Year-to-Date Announced US Store Closures Estimates for 2022, by Retailer, in Comparison to Total Store Base (Listed by Most to Least Closures) [wpdatatable id=2102]

Store-count information for retailers in the list above is based on the third quarter of fiscal 2022, ended February 2022 for most public companies. *Total store base is for North America as a US-specific breakdown could not be obtained. **Amazon includes Amazon 4-star and Amazon Books store banners. Macy’s includes Macy’s, Bloomingdale and Bluemercury banners. Source: Company reports/Coresight Research

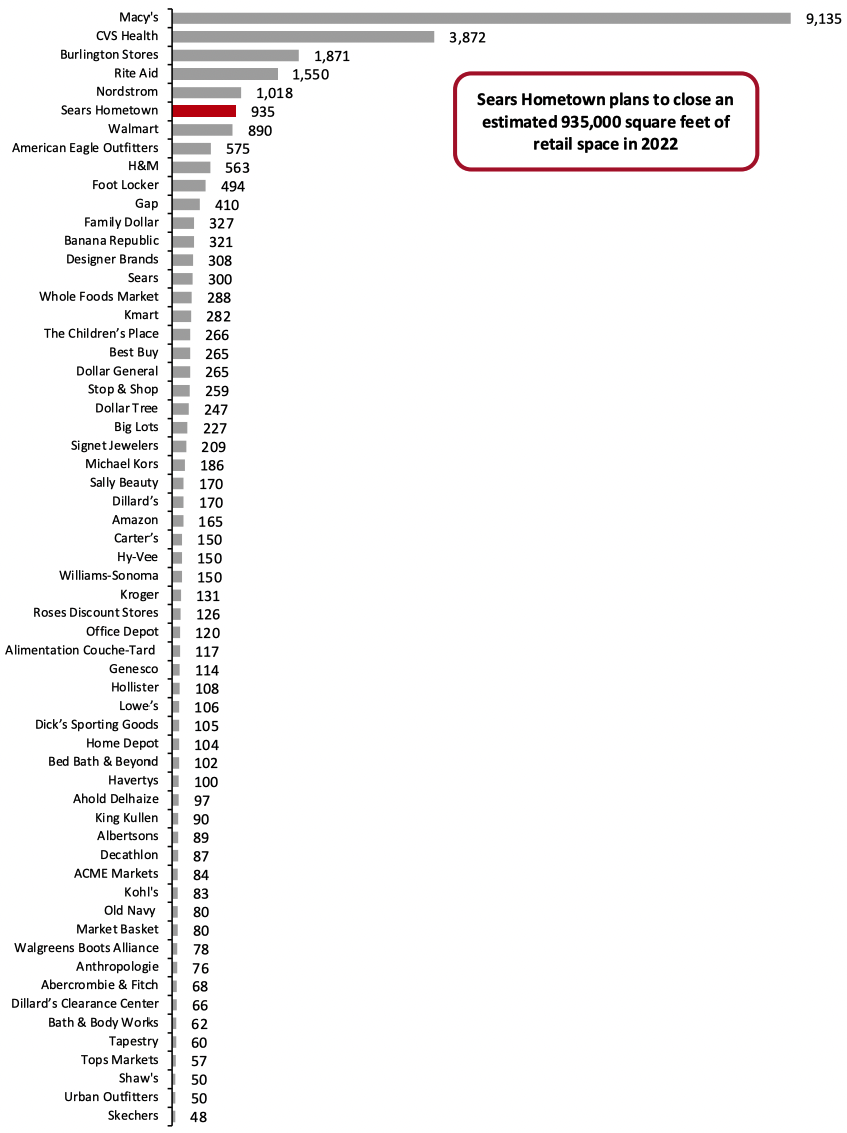

Overall, we estimate the announced year-to-date closures equate to 29.1 million square feet in closed retail space. In Figure 2, we show the estimated square-footage impact of various retailers’ year-to-date store closure announcements for 2022.Figure 2. Year-to-Date Announced 2022 US Store Closures Estimates in Gross Square Feet, by Retailer (Thous.) [caption id="attachment_150853" align="aligncenter" width="700"]

Total includes a small number of retailers that will each close less than 48,000 square feet of retail space and are not included in the chart.

Total includes a small number of retailers that will each close less than 48,000 square feet of retail space and are not included in the chart.Source: Company reports/Coresight Research[/caption]

2022 Major US Store Openings: Proportion of Store Base and Square Footage

As of June 24, 2022, major US retailers have announced 4,283 store openings. This compares to 4,130 announced openings in the comparable period of 2021, which we discuss later in this report. In June 2022, the following retailers announced store openings for 2022:- Academy Sports + Outdoors plans to open seven stores in 2022, representing 3% of its total store base of 251 stores. The openings will account for an estimated 490,000 square feet of total retail space.

- Aerie plans to open 40 stores in 2022, representing 19% of its total store base of 216 stores. The openings will account for an estimated 156,000 square feet of total retail space.

- Amazon plans to open 20 stores in 2022, representing 19% of its total store base of 107 stores. The openings will account for an estimated 780,000 square feet of total retail space.

- American Eagle plans to open 13 stores in 2022, representing 1% of its total store base of 880 stores. The openings will account for an estimated 79,000 square feet of total retail space.

- Banana Republic has opened one store year to date, representing less than 1% of its total store base of 461 stores. The opening accounts for an estimated 8,000 square feet of total retail space.

- Big Lots plans to open 33 stores in 2022, representing 2% of its total store base of 1,424 stores. The openings will account for an estimated 1.1 million square feet of total retail space.

- BJ’s Wholesale Club plans to open eight stores in 2022, representing 4% of its total store base of 226 stores. The openings will account for an estimated 904,000 square feet of total retail space.

- Burkes Outlet plans to open 30 stores in 2022, representing 10% of its total store base of 306 stores. The openings will account for an estimated 506,000 square feet of total retail space.

- Casey’s General Stores has opened 50 stores year to date, representing 2% of its total store base of 2,431 stores. The openings account for an estimated 299,000 square feet of total retail space.

- Designer Brands has opened two stores year to date, representing less than 1% of its total store base of 508 stores. The openings account for an estimated 44,000 square feet of total retail space.

- Gap has opened one store year to date, representing less than 1% of its total store base of 538 stores. The opening accounts for an estimated 11,000 square feet of total retail space.

- Gill Marine has opened one store year to date, representing 1% of its total store base of 138 stores. The opening accounts for an estimated 125,000 square feet of total retail space.

- Hibbett Sports plans to open 33 stores in 2022, representing 3% of its total store base of 1,096 stores. The openings will account for an estimated 186,000 square feet of total retail space.

- James Avery Artisan Jewelry has opened two stores year to date, representing 1% of its total store base of 339 stores. The openings account for an estimated 8,000 square feet of total retail space.

- Lululemon has opened two stores year to date, representing 1% of its total store base of 324 stores. The openings account for an estimated 6,000 square feet of total retail space.

- Mapco has opened one store year to date, representing less than 1% of its total store base of 314 stores. The opening accounts for an estimated 6,000 square feet of total retail space.

- Roses Discount Stores has opened one store year to date, representing less than 1% of its total store base of 244 stores. The opening accounts for an estimated 39,000 square feet of total retail space.

- Sportsman’s Warehouse has opened three stores year to date, representing 2% of its total store base of 124 stores. The openings account for an estimated 76,000 square feet of total retail space.

- Tilly’s plans to open eight stores in 2022, representing 3% of its total store base of 243 stores. The openings will account for an estimated 58,000 square feet of total retail space.

- Williams-Sonoma has opened four stores year to date, representing 1% of its total store base of 544 stores. The openings account for an estimated 43,000 square feet of total retail space.

Figure 3. Year-to-Date Announced US Store Openings Estimates for 2022, by Retailer, in Comparison to Total Store Base (Listed by Most to Least Openings) [wpdatatable id=2103]

Store count information for retailers in the list above is based on reported counts from the third quarter of fiscal 2022, ended February 2022 for most public companies. *Total store base count is for North America as a US-specific breakdown could not be obtained. **Aerie includes Aerie stores and OFFLINE stores. Amazon includes Amazon Fresh and Amazon Style banners. Macy’s includes Macy’s, Bloomingdale and Bluemercury banners. TJX Companies includes HomeGoods, Homesense, Marmaxx (Marshalls and T.J. Maxx) and Sierra stores. Source: Company reports/Coresight Research

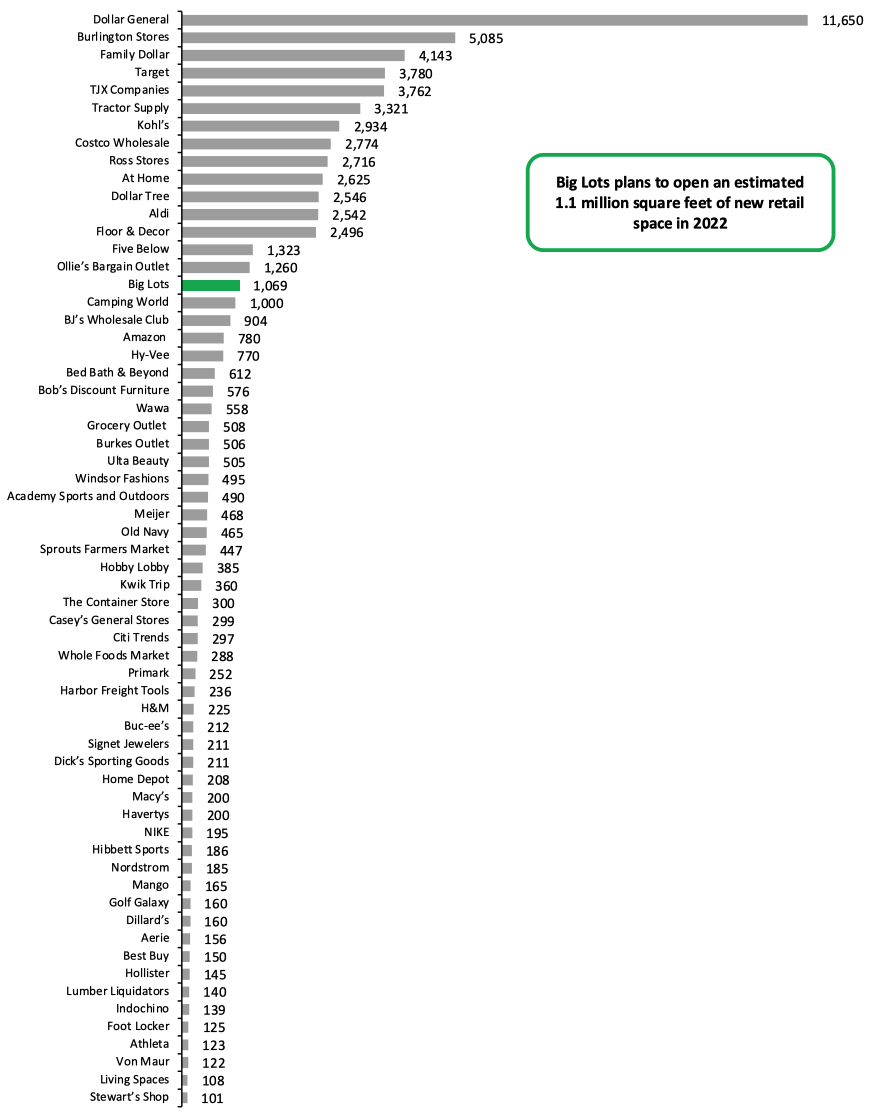

Overall, we estimate the announced year-to-date openings equate to 73.2 million square feet in new retail space. In Figure 4, we show the square-footage impact of various retailers’ year-to-date store opening announcements for 2022.Figure 4. Year-to-Date Announced 2022 US Store Openings Estimates in Gross Square Feet, by Retailer (Thous.) [caption id="attachment_150855" align="aligncenter" width="700"]

Total includes a small number of retailers that will each open less than 101,000 square feet of new retail space and are not included in the chart.

Total includes a small number of retailers that will each open less than 101,000 square feet of new retail space and are not included in the chart.Aerie includes Aerie stores and OFFLINE stores. Amazon includes Amazon Fresh and Amazon Style banners. TJX Companies includes HomeGoods, Homesense and Marmaxx (T.J. Maxx, Marshalls and Sierra) stores.

Source: Company reports/Coresight Research[/caption]

2022 Versus 2021: A Year-to-Date Comparison

The charts below depict the week-by-week totals of announced US store closures and openings year to date, as well as the comparative figures for 2021. Compared to this time last year, openings announcement totals are ahead in 2022, while closure announcements are behind. Year-to-date announced store closures in June 2022 are led by apparel retailers, which account for 575 closures, representing 33% of total closures. The year-to-date equivalent closures for June 2021 were also led by apparel retailers, which accounted for 2,054 closures, representing 45% of total closures. Year-to-date announced store openings in June 2022 are led by discount store retailers, which account for 1,940 openings, representing 45% of total openings. The year-to-date equivalent openings for June 2021 were also led by discount store retailers, which accounted for 1,931 openings, representing 45% of total openings.Figure 5. US Announced Store Closures and Openings: Week-by-Week Comparison, 2022 (Top) vs 2021 (Bottom) [wpdatachart id=464] [wpdatachart id=465]

June 2022 and 2021 span weeks 22 to 25. Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks. Source: Company reports/Coresight Research

US Retail Bankruptcies: 2022 Versus 2021

There were no major retail bankruptcies in June 2022. In the table below, we list bankruptcy filings for the comparable period of 2021, ended June 30, 2021. Our Retail Bankruptcies Databank offers a more detailed list of US and UK retail companies, restaurants and gyms that have filed for bankruptcy since March 2020.Figure 6. 2021 Major US Retail Bankruptcies as June 24, 2021 [wpdatatable id=2104]

*Belk emerged from bankruptcy in March 2021 **The Collected Group emerged from bankruptcy in June 2021 Source: Company reports/Coresight Research

Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross. Figures represent retail (B2C) closures, so closures by solely B2B companies are excluded. Total square footage being opened or closed is typically estimated from retailers’ average gross store sizes.