DIpil Das

Store Tracker Extra: Introduction

In Coresight Research’s new US Store Tracker Extra monthly series, we offer insight into retailers’ store closure and opening announcements on a monthly basis—supplementing our Weekly US and UK Store Openings and Closures Tracker report. We include retailer-level details on closures and openings as a percentage of total store base as well as square-footage impact. This report also offers a comparison between year-to-date announced closures and openings at the end of each month in 2021 versus the comparable period in 2020. Year-to-date data in this report is as of January 29, 2021 (corresponding to week four in our Weekly US and UK Store Openings and Closures Tracker).2021 Major US Store Closures: Proportion of Store Base and Square Footage

As of January 29, 2021, major US retailers have announced 2,145 store closures for this year. This compares to 1,161 announced closures in the comparable period of 2020, as we discuss later in this report. In this section, we provide details on the estimated number of stores that various retailers will close this year and translate that into a proportion of their total store base. Overall, the announced year-to date closures equate to over 24 million square feet in closed retail space, we estimate. Below, we discuss the plans of retailers that are closing more than 100 stores in 2021:- Ascena Retail Group is set to close an estimated 195 stores this year, representing around 8% of its total store base. The retailer’s closures will account for over 826,000 square feet of total retail space. At the end of fiscal 2015, Ascena Retail Group had 4,906 stores in total. However, the retailer has since been rationalizing its store fleet on an annual basis, and it operated around 2,533 stores as of August 1, 2020. The retailer filed for Chapter 11 bankruptcy in July 2020.

- Bed Bath & Beyond announced plans in June 2020 to close 200 stores over a two-year period ending May 2022, and an estimated 100 are set to close this year—representing almost 7% of the retailer’s 3,400-strong store fleet. The retailer’s closures will account for over 3.4 million square feet of total retail space.

- Carter’s announced in October 2020 that it will close an estimated 200 stores by the end of 2022, of which an estimated 108 are set to close this year—representing around 12% of its total store base. The retailer’s closures will account for over 463,000 square feet of total retail space.

- Family Video, which operates primarily under a rental business model, has announced that it will shut all 250 of its stores. The retailer’s closures will account for approximately 1.8 million square feet of total retail space.

- Francesca’s will close an estimated 342 stores this year, which represents almost half of the retailer’s total store base. Francesca’s had been expanding its store base annually until fiscal 2018, ended February 2, 2019, when it had 727 stores in total. Since then, the retailer has been rationalizing its store fleet, and it decided to Macy’saccelerate closures following recent court approval of its bankruptcy sale. The retailer’s closures will account for approximately 500,000 square feet of total retail space.

- Chocolatier Godiva has announced that it will permanently shutter all its 116 stores in the US and 12 café locations across North America by the end of March 2021. (Square-footage data not available.)

- Pet Valu will close all its remaining stores in 2021 (estimated to be 119 in total). The retailer’s closures will account for over 803,000 square feet of total retail space. Pet Valu had closed an estimated 239 stores in 2020.

- Seven & I Holdings Co. has announced plans to to close around 300 7-Eleven stores this year, which represents around 3% of its total store base in the US. The retailer’s closures will account for approximately 2.4 million square feet of total retail space.

Figure 1. Year-to-Date Announced US Store Closures Estimates for 2021, by Retailer, in Comparison to Total Store Base (Listed by Most to Least Closures) [wpdatatable id=737 table_view=regular]

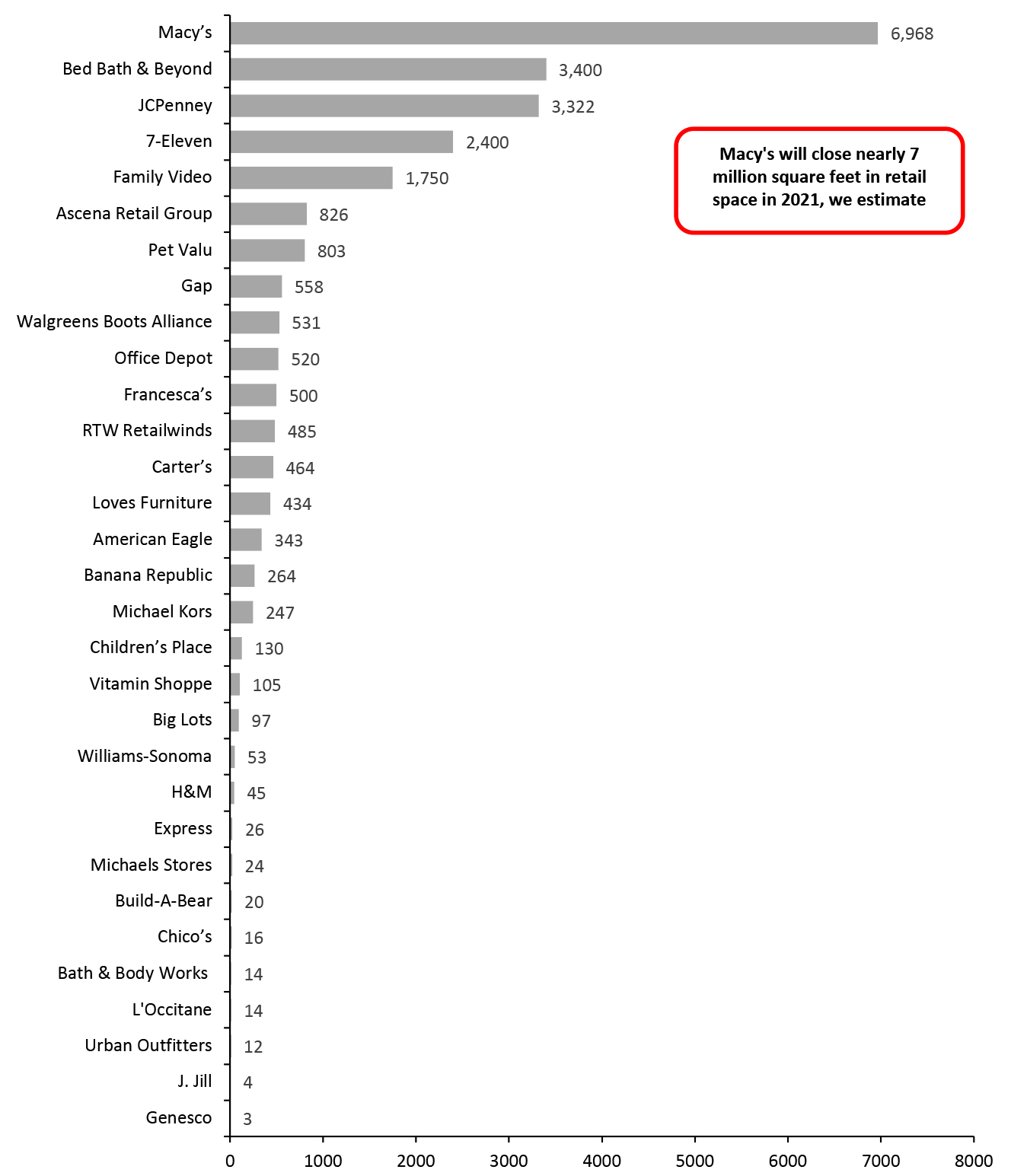

Store count information for retailers in the above list are based on latest reported count (the third quarter of the fiscal year ending January 2021 for most public companies). Total store base count represented for Genesco is for global and Michaels Stores is for North America, as a US specific breakdown could not be obtained. Source: Company reports/Coresight Research In Figure 2, we show the estimated square-footage impact of various retailers’ year-to-date store closure announcements for 2021. With plans to close an estimated 45 stores this year, spanning nearly 7 million square feet in total, department store chain Macy’s leads the way in terms of square-footage impact.

Figure 2. Year-to-Date Announced 2021 US Store Closures Estimates in Gross Square Feet, by Retailer (Thous.) [caption id="attachment_122767" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2021 Major US Store Openings: Proportion of Store Base and Square Footage

As of January 29, 2021, major US retailers have announced 1,940 store openings. This compares to 1,720 announced openings in the comparable period of 2020, which we discuss later in this report. In this section, we detail the estimated number of stores that various retailers will open this year and translate that into a proportion of their total store base. Overall, the announced year-to date openings equate to over 21 million square feet in new retail space, we estimate. Below, we discuss the plans of retailers that are opening more than 50 stores in 2021:- Aerie will open an estimated 66 stores this year, representing an approximate 40% expansion of its existing store fleet, which stood at 167 stores as of October 31, 2020. The retailer’s store openings will account for over 257,000 square feet of total retail space.

- We estimate that Aldi will open around an estimated 212 stores this year, as part of its multiyear expansion plan to operate 2,500 stores by the end of 2022. This would represent a 10% increase over its existing store fleet of around 2,000 stores. The retailer’s store openings will account for approximately 3.5 million square feet of total retail space.

- Casey’s General Stores will open an estimated 132 stores in 2021, as part of a store-expansion plan that it announced in January 2020, to open 350 stores over a three-year period. This would represent a 6% increase over its existing store portfolio, which stood at 2,219 as of October 31, 2020. The retailer’s store openings will account for over 789,000 square feet of total retail space.

- Dollar General will open an estimated 1,021 stores this year, a plan that will result in a 6% expansion of its total store fleet, which stood at 16,979 as of October 30, 2020. This would imply that the retailer will operate around 18,000 stores by the end of the year. The dollar store chain’s openings alone will span almost 10,000 square feet, which accounts for close to half of the total square footage of announced openings by all retailers.

- Payless, after emerging from bankruptcy in early 2020, went on to announce in August that that it plans to open at least 300 stores over three to five years. This includes an estimated 60 stores in 2021, representing an almost 9% increase of the retailer’s store portfolio, which stood at 700 as of October 30, 2020. (Square-footage data not available.)

- Sephora announced in December 2020 that it plans to open at least 60 standalone stores in 2021, which would represent an expansion of over 13%: The retailer’s existing store fleet comprises 452 stores as of December 14, 2020. The retailer’s store openings will account for around 240,000 square feet of total retail space.

- Shopko Optical announced in December 2020 that it plans to open at least 50 stores in 2021, which would represent a 54% increase to its existing portfolio of 92 stores, as of December 30, 2020. The retailer’s store openings will account for around 105,000 square feet of total retail space.

Figure 3. Year-to-Date Announced US Store Openings Estimates for 2021, by Retailer, in Comparison to Total Store Base (Listed by Most to Least Openings) [wpdatatable id=738 table_view=regular]

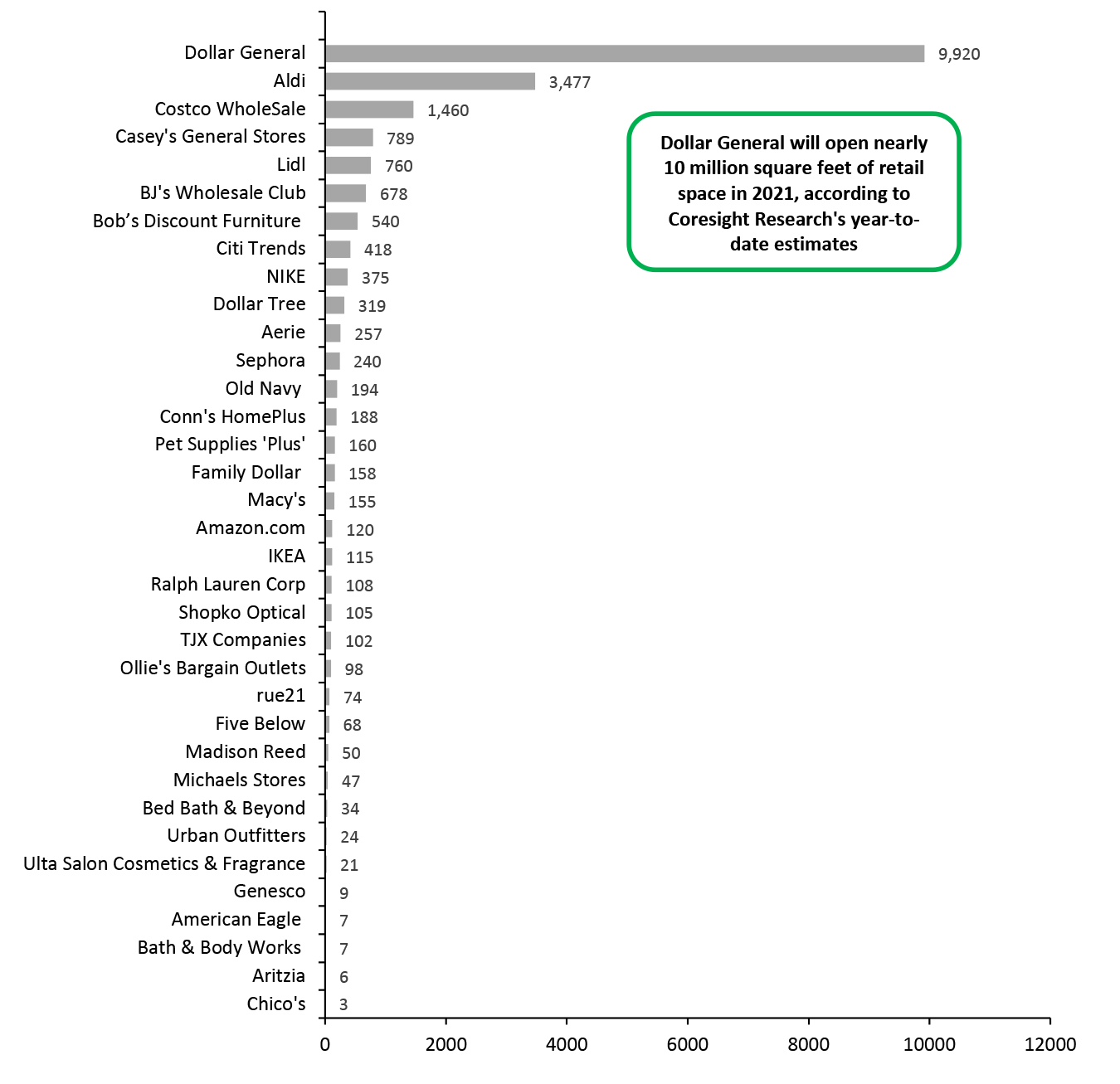

Store base considered for Genesco and Payless is global, while Michaels Stores store count is for North America. Store count information for retailers in the above list are based on latest reported count (the third quarter of the fiscal year ending January 2021 for most public companies). Source: Company reports/Coresight Research In Figure 4, we show the square-footage impact of various retailers’ year-to-date store opening announcements for 2021. With plans to open more than 1,000 stores this year, spanning nearly 10 million square feet in total, dollar store chain Dollar General is leading the charge in terms of square-footage impact in store openings.

Figure 4. Year-to-Date Announced 2021 US Store Openings Estimates in Gross Square Feet, by Retailer (Thous.) [caption id="attachment_122768" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2021 Versus 2020: A Year-to-Date Comparison

The charts below depict the week-by-week totals of announced US store closures and openings year-to-date in 2021, as well as the comparative figures for 2020. As can be seen in Figure 5, compared to this time last year, both store closure and opening announcement totals are ahead year-to-date in 2021, which appears to be consistent with our closures and openings estimate for 2021. Year-to-date announced store closures in January 2021 are led by apparel retailers, which account for 967 closures, representing 45% of the total closures. The year-to-date equivalent closures for January 2020 were led by grocery retailers, which had announced 371 closures and accounted for 32% of total announced closures. Year-to-date announced store openings in January 2021 are led by discount store retailers, which account for 1,124 openings, representing 58% of total openings. The year-to-date equivalent closures for January 2020 were also led by discount store retailers, which had announced 1,201 openings and accounted for 70% of total announced openings.Figure 5. US Announced Store Closures and Openings, January 2021 (Top) Versus January 2020 (Bottom): A Week-by-Week Comparison [wpdatachart id=158] [wpdatachart id=159]

Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies and this could involve retrospective revisions of totals for some weeks. Source: Company reports/Coresight Research

Bankruptcies

Three major US retailers—Christopher Banks, L’Occitane and Loves Furniture—filed for bankruptcy in January 2021, with Belk also announcing its intention to file. In the tables below, we offer a comparative view of year-to-date bankruptcy filings as of January 29, 2021 versus January 31, 2020. Our Retail Bankruptcies Databank offers a more detailed list of US and UK retail companies, restaurants and gyms that have filed for bankruptcy since March 2020.Figure 6. 2021 Major US Retail Bankruptcies as January 29, 2021 [wpdatatable id=741 table_view=regular]

N/A – Not Available Belk has announced that it will file for bankruptcy but has not yet filed. Source: Company reports/Coresight Research

Figure 7. 2020 Major US Retail Bankruptcies as of January 31, 2020 [wpdatatable id=742 table_view=regular]

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016 N/A – Not Available Source: Company reports/Coresight Research Belk Department store chain Belk announced on January 26, 2021 that it will file for Chapter 11 bankruptcy protection with a view to reduce its debt burden by around $450 million and recapitalize its business for the future. The retailer, which currently operates 300 stores across 16 Southeastern states, will continue with “normal operations” through the bankruptcy process. Coresight Research insight: Belk, a department store chain that has been operating for nearly 190 years, was acquired by private equity firm Sycamore Partners for a purchase consideration of $3 billion in 2015. Sycamore Partners has stated that it expects the chain to emerge from bankruptcy by the end of February and that Sycamore will retain majority control of Belk, per an agreement that it reached with some of Belk’s creditors. Belk is known to be heavily reliant on its brick-and-mortar business, with its e-commerce business trailing industry standards, and so when the Covid-19 pandemic struck, the retailer was hit hard. While it tried coping by announcing furloughs, temporary store closures, and job and salary cuts, these measures were not enough to save it from bankruptcy. Christopher & Banks Women’s apparel retailer Christopher & Banks filed for Chapter 11 bankruptcy on January 14 amid a prolonged decline in demand and defaults on major financial obligations. The retailer roped in business services and restructuring advisory firm Hilco Merchant Resources to divest the majority of its 449 stores under a liquidation sale. According to a company press release, the retailer is also in discussion with potential buyers to sell its e-commerce unit. Coresight Research insight: Covid-19 came as a debilitating blow to Christopher & Banks, and the retailer attributed its decision to file for bankruptcy primarily to the impact of the pandemic. With 75% of its revenues coming from its store sales, temporary closures during spring hurt its business badly. It recently received a stalking horse bid from term loan lender ALCC, an affiliate of Hilco Merchant Resources, for its e-commerce business. L'Occitane Beauty retailer L'Occitane filed for Chapter 11 bankruptcy on January 26, 2021, amid unsustainably high store rent obligations. The retailer plans to immediately shut 23 stores out of its total 166 stores in US. Coresight Research insight: L’Occitane’s reported that retail sales from its offline operations have declined sharply amid the Covid-19 pandemic, but its e-commerce business saw strong year-over-year growth of 71.8% for the nine months ended December 2020. Before the pandemic, the company was already struggling with a decline in its offline sales owing to the growing consumer shift to online shopping. The retailer stated that it made repeated attempts to negotiate better lease terms with its landlords, but those efforts proved to be unsuccessful, thus necessitating the bankruptcy option. Loves Furniture Loves Furniture has filed for Chapter 11 bankruptcy amid several shipping issues and a dispute with a logistics provider. The retailer has entered into an agreement with Planned Furniture Promotions, a furniture sales events company, to sell excess inventory in order to cover operating expenses. As per court filings, Loves Furniture has closed 20 stores in 2020 and plans to operate with just 12 stores going forward, as of January 7, 2021. Coresight Research insight: Loves Furniture came into existence in April 2020 to take over stores disposed by Art Van Furniture, which had filed for bankruptcy in March 2020. Following almost nine months of financial struggles, Loves Furniture has followed Art Van Furniture’s lead into bankruptcy. The company stated in its bankruptcy filings that warehousing and delivery challenges resulted in bad customer experiences and canceled orders—and ultimately led to the company's financial distress.

Other Major US Closure and Opening Announcements in January 2021

- Aritzia has announced plans to open seven new boutique stores.

- Bed Bath & Beyond has announced plans to close 43 stores by the end of February 2021.

- Charming Charlie has announced plans to open up to 25 stores.

- Citi Trends has announced plans to open 100 stores by 2023.