What’s the Story?

With Covid-19 accelerating the growing shift in consumer behavior to online channels for shopping, some US retailers are betting on a permanent shift to e-commerce, and as a result, are reconsidering their physical space needs—resulting in the closure or repurposing of stores.

Why It Matters

Consumers’ sustained avoidance of malls and shopping centers, and their likely retention of some shopping habits from the crisis peak, are set to continue the structural shift toward online shopping—in turn resulting in long-term implications for brick-and-mortar retail:

- The trend may spur a reassessment by more retailers of the role and importance of physical stores in their overall business operations.

- The trend implies that more retailers may increase investment into enhancing their omnichannel capabilities and ensuring efficient fulfillment, which becomes the “experience” that consumers value and thereby represents a key differentiator for retailers.

Coresight Research estimates that there will be

20,000–25,000 total US store closures in 2020.

Retailers Are Betting on E-Commerce; Rethinking Store Presence and Role

The coronavirus pandemic has resulted in the shift of significant additional sales to the online channel this year, and retailers have had to pivot and accelerate their adoption of e-commerce. Coresight Research estimates that e-commerce will account for 24.7% of all US nonfood retail sales this year versus 19.6% last year. Some retailers now seem convinced that their refocus on e-commerce needs to be on a longer-term basis—even permanent. Several retailers and brand owners have announced notable strategic shifts to e-commerce. In some cases, this involves leaning more heavily on stores to fulfill online orders; in others, companies plan to close stores. We expect to see more retailers shutter a higher number of stores in 2020 and beyond than they would have done had the pandemic not amplified structural shifts in consumer behavior.

Best Buy

In the company’s second-quarter earnings call on August 25, Best Buy’s CEO Corie Barry highlighted that the company is convinced that customer preferences have permanently changed. Barry added that the surge in shopping via e-commerce has inspired experimentation at its stores and that Best Buy has launched a new pilot that will convert some stores into key centers for online fulfillment.

In September, the retailer will designate around 250 of its approximately 1,000 stores to handle a higher volume of packages, although all stores already ship online orders. The retailer expects that this initiative will aid in speeding up order fulfillment and improve efficiency for the holiday season and beyond. However, Barry clarified that the role of stores has changed but not diminished.

Best Buy managed to thrive even during lockdown by repurposing its stores for pickup services: In the last six weeks of its first quarter, ended May 2, 2020—which included the lockdown period, when its stores were closed to the public—the company was able to retain a remarkable 81% of sales versus the prior year; its stores ran a curbside-only model during those six weeks. Best Buy’s domestic e-commerce sales grew 155% year over year in the first quarter and 300% during the last six weeks of that quarter.

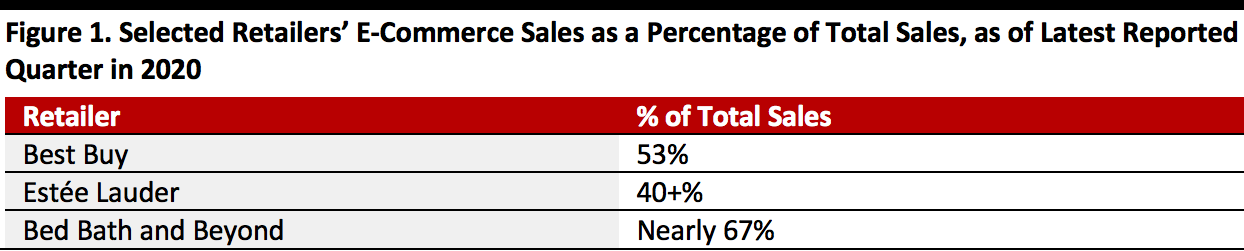

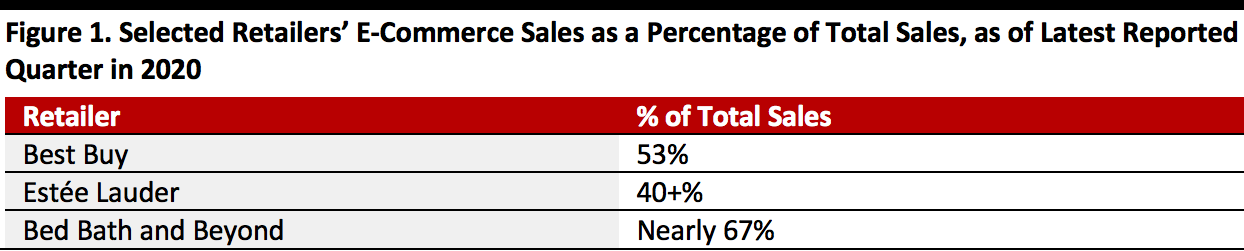

In its second quarter, ended August 1, 2020, Best Buy recorded domestic online revenue of nearly $5 billion, which constituted 53% of total domestic revenues. E-commerce sales increased 242% year over year in the second quarter on a comparable basis, and BOPIS or curbside pickup accounted for 41% of online sales.

We expect that a number of multichannel retailers will have been surprised at the extent of sales retention online during periods of store closures—for some retailers, this will have been the only hard evidence of possible sales-retention rates without stores (albeit in exceptional circumstances). These numbers are likely to feed into decisions on their future brick-and-mortar presence. Retailers will be looking at the extent to which these channel shifts are sustained post lockdown and some ensuing closures are therefore likely to occur into 2021.

Estée Lauder

Estée Lauder—which operates banners such as Aveda, Estée Lauder, Jo Malone London, Le Labo, Origins and M.A.C.—announced in its fourth-quarter earnings call on August 20 that it will shutter 10–15% of its freestanding retail stores, which total around 1,600 globally as of June 30, 2020, as well as closing some selected underperforming department store counters, mainly in Europe and North America. The company will step up its efforts to accommodate the accelerating consumer shift to online shopping. In line with this plan, the “Post-COVID Business Acceleration Program,” Estée Lauder will eliminate 1,500–2,000 jobs globally, equating to around 3% of its current workforce—mainly point-of-sale and support personnel attached to the retail locations that are earmarked for closure. The company expects this plan to yield benefits of up to $400 million per year.

Estée Lauder intends to increase investment in digital talent and capabilities, which includes online consultation by sales associates. The company also plans to reinvest a part of the savings from the program to enhance its digital capabilities, including the acceleration of omnichannel capabilities linked to its retail stores and the increase of digital media to reach both new and existing consumers.

In its fourth quarter (coinciding with the lockdown) of fiscal year 2020 ended June 30, 2020, the company had accelerated its programs to capture additional online growth globally, which resulted in an almost-doubling of year-over-year online sales growth. Online sales accounted for over 40% of total sales in the quarter. For the full fiscal year, online sales represented 22% of total sales—a seven-percentage-point increase year over year—and continued to outpace other channels.

Microsoft

Microsoft announced in June that it will shutter all of its 83 retail stores, including 73 in the US. The company had developed and introduced these stores over the last decade with a strong experiential focus, facilitating customers to trial new software and hardware developed by Microsoft and its partners. The company announced that it will shift its focus toward its online store, where customers can make purchases and receive support, sales, training and more, representing a move away from experiential retail, at least in the near-to-medium term.

Bed Bath & Beyond

Bed Bath & Beyond announced in April that it had converted 25% of its total store fleet into fulfillment hubs, although the company did not confirm whether this is on a permanent basis. The company subsequently announced that it will close 200 stores over two years.

In its first quarter (coinciding with lockdown period) that ended May 30, 2020, the company accelerated its pre-planned rollout of its BOPIS and curbside-pickup services in April, thereby significantly improving its fulfillment capabilities. The new capabilities drove digital sales growth of over 100% through April and May. Net sales from its digital channels increased by 82% in the first quarter and represented nearly two-thirds of its total net sales.

Earlier this month, the company announced the appointment of Wade E. Haddad as SVP of Real Estate and Construction, who will lead the company’s real estate strategy. As part of Bed Bath & Beyond’s comprehensive restructuring plan, Haddad will spearhead the drive to optimize the company's estimated 50 million-square-foot real estate portfolio, which includes its store network across all banners, along with its offices, distribution and fulfillment centers. His remit also includes establishing a strong network to support the company’s newly introduced omnichannel services, such as BOPIS, curbside pickup and same-day delivery.

[caption id="attachment_115953" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

The Role of the Store Is Changing

The coronavirus pandemic has upended the physical retail shopping environment and has prompted brick-and-mortar stores to take a greater role in online sales—especially fulfillment, such as with BOPIS, ship-from-store and curbside-pickup services, including contactless options. In August 2020, we found that 76% of the top 50 store-based retailers in the US now offer

curbside pickup, and we expect this number to rise further.

Some stores are effectively becoming fulfillment centers while remaining open to the public, and we could also see shuttered stores being converted into full distribution centers or dark stores (store-like formats open only for picking online orders). For example, Amazon has reportedly been in talks with mall owner Simon Property Group to take over closed or current JCPenney and Sears department stores and turn them into fulfillment centers—although the likelihood of an agreement being reached between the two parties is not clear so far. Such conversions may be beneficial to REITs facing the challenge of increasing store closures.

What We Think

Implications for Retailers

- We are likely to see more retailers making a strategic shift toward e-commerce and thus rationalize their store fleets. Even where stores are not culled, brick-and-mortar outlets will play a bigger role in fulfilling e-commerce orders for some retailers.

- We expect that sometimes-high online sales-retention rates during lockdowns will be one factor feeding into some retailers’ decisions on their future brick-and-mortar presence. Retailers will consider the extent to which these channel shifts are sustained post lockdown, and some resulting closures may therefore not occur until 2021.

- Although experiential retail likely to be less of a focus area for physical stores in a “mask economy,” retailers should aim to capitalize on the opportunity to offer a great experience in digital and omnichannel retail.

Implications for Real Estate Firms

- Mall owners may benefit from the conversion of stores to distribution centers and dark stores. This will further drive the longer-term shift of malls away from being pure retail spaces—adding to the repurposing of retail space for residential, leisure and business purposes in recent years.

Source: Company reports[/caption]

Source: Company reports[/caption]