DIpil Das

What’s the Story?

Store closures are continuing to mount across various discretionary sectors in the US retail industry—with the rise in department store closures and bankruptcies a particular cause for concern for mall owners.Why It Matters

Coresight Research recently estimated that department store sector sales will fall by around 14%—or $19 billion—in 2020 and this will likely act as a catalyst to a number of store closures and bankruptcies. The closures will contribute to the 20,000–25,000 total US store closures that we expect to see in 2020. Reasons for department store closures having a significant bearing on the retail industry include the following:- More department store closures will likely translate to more store closures among other mall-based retail stores.

- Mall owners will face a challenge in finding new tenants to occupy the substantial space vacated by department stores.

- Mall owners may acquire some struggling and bankrupt department store retailers.

Major Department Stores Closures

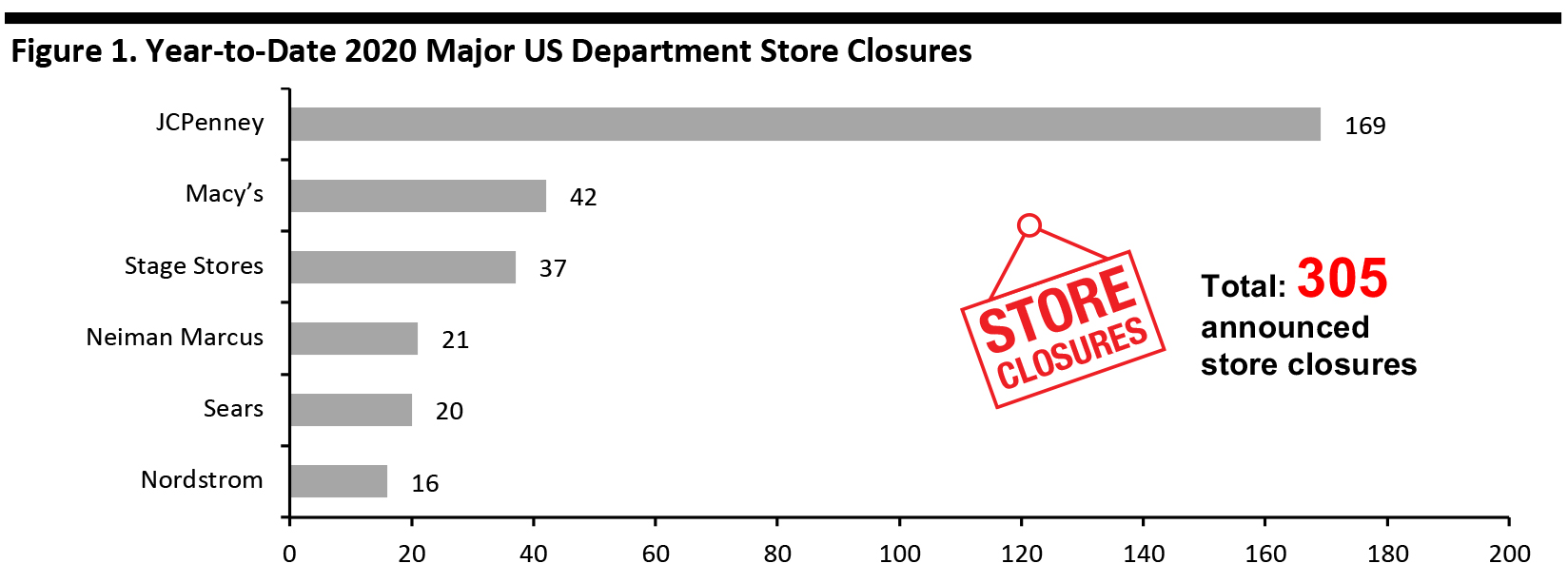

The following leading department store chains have announced store closures across the US:- JCPenney announced on May 19, 2020 that it will not reopen 242 stores (28.6% of its fleet) between fiscal year 2020 (FY20) and FY21, and anticipates closing 192 stores in FY20 and 50 more in FY21—taking its store count down from 846 to 604.

- Macy’s announced at its Analyst Day on February 5, 2020 that it would close 125 of its 613 stores (20.4% of its department-store fleet) over the next three years. The management team reported that the announced plan optimizes the company’s portfolio of stores that are mostly in class A and A+ malls, stating that “these malls are going to be vital destinations for generations to come.”

- Neiman Marcus recently confirmed that it is permanently closing 21 stores. The stores earmarked for permanent closure include four Neiman Marcus stores and 17 Last Call (Neiman Marcus’ discount-chain subsidiary) stores.

- Nordstrom announced on April 30, 2020 that it would close 13.7% of its full-line stores, including 16 of its 116 full-line department stores this year. These stores are primarily located in class A malls.

Coresight Research attributes store closures to the year in which they occurred or are expected to occur. We estimate this information for JCPenney, Macy’s, Sears and Stage Stores.

Coresight Research attributes store closures to the year in which they occurred or are expected to occur. We estimate this information for JCPenney, Macy’s, Sears and Stage Stores. Neiman Marcus includes 17 Last Call Stores and four Neiman Marcus stores.

Source: Coresight Research [/caption]

Department Store Bankruptcies

Department stores are among the major casualties in terms of retail bankruptcies for the year to date. Three major department store retailers have filed for bankruptcy, and we expect this number to rise over the rest of the year given the underwhelming outlook for the sector.- Neiman Marcus filed for Chapter 11 bankruptcy protection on May 7. The company entered into an agreement with a majority of its creditors to substantially reduce its debt and provide financing. It expects to emerge from bankruptcy in the fall—at which point its creditors will become majority owners in the business. The company had 43 department stores at the time of filing.

- Stage Stores filed for Chapter 11 bankruptcy protection on May 10, and announced plans to liquidate its business. The retailer is pursuing a sale of its business while simultaneously initiating a wind-down of its operations. Stage Stores stated that it would terminate the wind-down of operations at certain locations if it receives a suitable going-concern bid. Stage Stores operated 738 stores in the US at the time of filing.

- JCPenney filed a voluntary reorganization petition under Chapter 11 bankruptcy protection on May 15. The retailer had entered into a restructuring support agreement with its lenders to implement a financial restructuring plan in order to reduce its debt. The company also announced plans to rationalize its store portfolio as detailed in the previous section.

Figure 2. Department Stores Filing for Chapter 11 During the Coronavirus Crisis [wpdatatable id=364 table_view=regular]

*Includes 158 Gordman Stores Source: Company reports/Coresight Research

Department Store Outlook

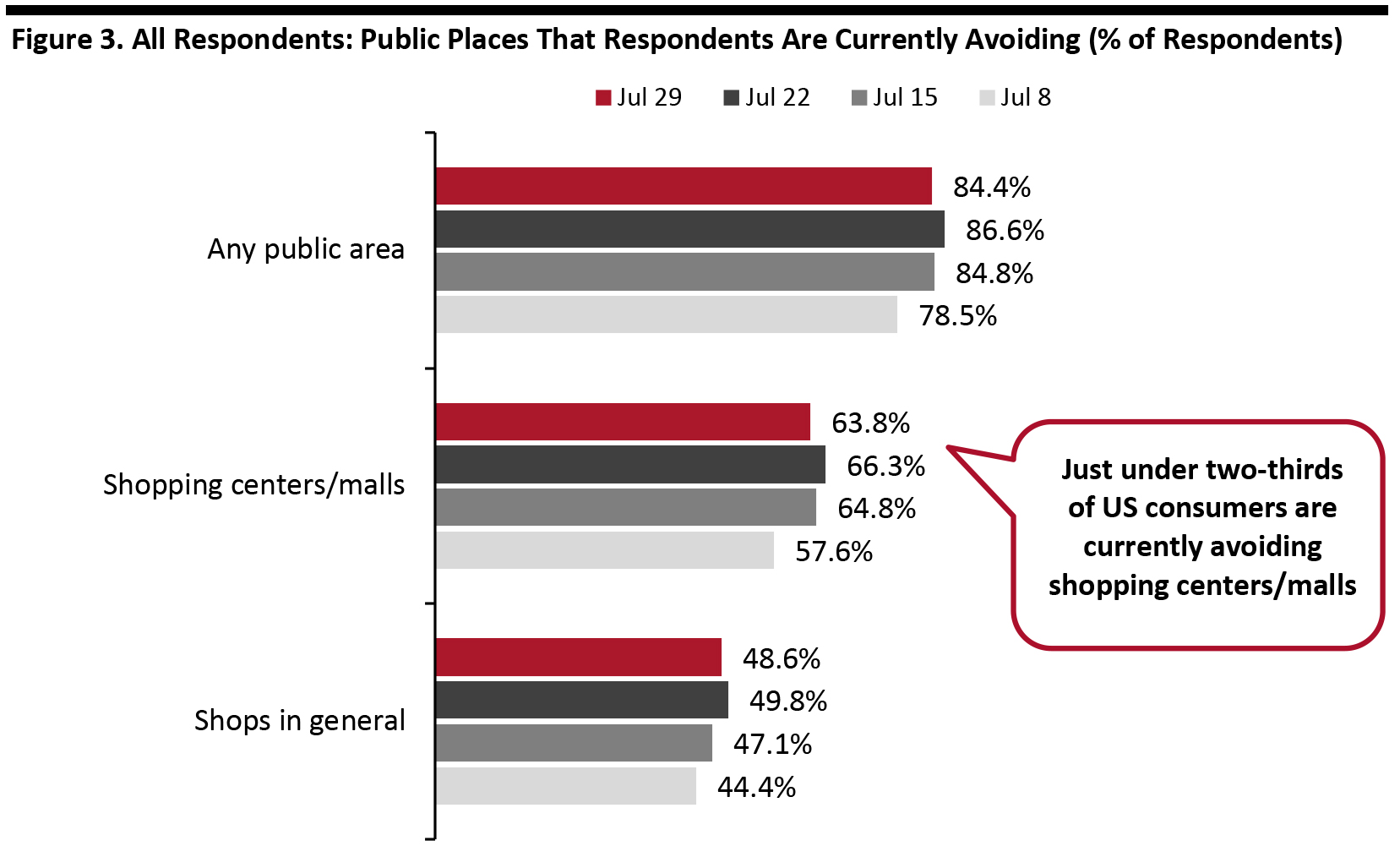

In addition to the department stores that have already filed for bankruptcy, others including Saks Fifth Avenue are currently under bankruptcy watch. We expect to see more closures over the course of the rest of the year as consumers continue to stay away from public places, including malls and stores, and plan to shift more spending from discretionary to staple categories. Our latest weekly US consumer survey from July 29 includes insights into current consumer avoidance behavior for different types of public places: 63.8% of all respondents reported that they are avoiding shopping centers and malls versus 66.3% for the week before—still a high proportion despite the improvement. In addition, half of all respondents are avoiding shops in general, which is not a good indicator for the retail industry. [caption id="attachment_113886" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption] Department Store Closures Exacerbate Challenges Faced by Mall Owners An average department store ranges from approximately 100,000 square feet to upwards of 160,000 square feet for a mall-based anchor store—considerably larger than other kinds of retail stores. Department store closures represent a significant challenge for mall owners in finding new tenants to occupy such vast retail spaces. Closures of mall-based department stores, such as JCPenney, and large-format retailers that operate as anchor tenants will have a negative effect on overall foot traffic and may lead smaller retailers to follow suit. These tenants often enter into co-tenancy clauses that enable them to pay lower rent or break their leases when an anchor tenant leaves. Department store closures in malls will therefore create a negative ripple effect throughout the mall environment. In an effort to avoid this knock-on effect, some leading mall owners are considering acquiring bankrupt and struggling retailers. For instance, Simon Property Group, one of the largest US mall owners, has partnered with Brookfield Property Partners, a unit of Brookfield Asset Management, to reportedly make a joint offer of $1.65 billion to acquire department store chain JCPenney. We anticipate a rise in similar bids for struggling department store chains in the months ahead.

What We Think

While many department stores were struggling before the pandemic, the coronavirus crisis has led to an acceleration in store closures in the sector and has already resulted in major chains filing for bankruptcy. As consumers continue to abstain from visiting public places, including malls and stores, we expect to see more department store closures over the course of the year due to declines in traffic and sales. While various discretionary goods retailers are under bankruptcy watch, mall-based department store retailer bankruptcies will weigh heavy on mall owners. To address this challenge, some mall owners may consider acquiring struggling chains. For stronger retailers, the bankruptcies and resultant closures represent an opportunity to gain market share. Implications for Brands/Retailers- More department store closures and bankruptcies will imply more store closures among other mall-based retailers.

- There will be significant challenges for malls to find new occupants for vacant spaces. Based on current store closure announcements, mall owners will have to find new tenants for around 40 million square feet in mall space.

- Department store chain bankruptcies will have significant knock-on effects for malls as a whole, given that they operate as anchor stores and generate high levels of traffic.

- Mall owners may consider acquiring struggling and bankrupt retailers—particularly anchor retailers that have the potential to recover under reorganization.