DIpil Das

What’s the Story?

Why It Matters

Coresight Research estimates that consumer spending on apparel will fall by around 12%, or $38 billion, in 2020. This would trigger a number of store closures and bankruptcies. We expect that apparel store closures will lead the casualty list for the 20,000–25,000 total US store closures that we estimate for 2020, with the sector’s closures potentially reaching the five-figure mark. Apparel store closures have a significant bearing on the retail industry for a number of reasons:- The apparel retail sector comprises well over 100,000 stores in the US, making it the largest by number of stores.

- An unfavorable environment and outlook for the sector suggest that it will be the key driver of a spike in the overall number of closures and bankruptcies in retail.

- Mall owners may acquire some struggling and bankrupt apparel retailers, particularly in the context of accelerating store closures among mall-based apparel retailers.

Major Apparel Retailers Announce Permanent Store Closures

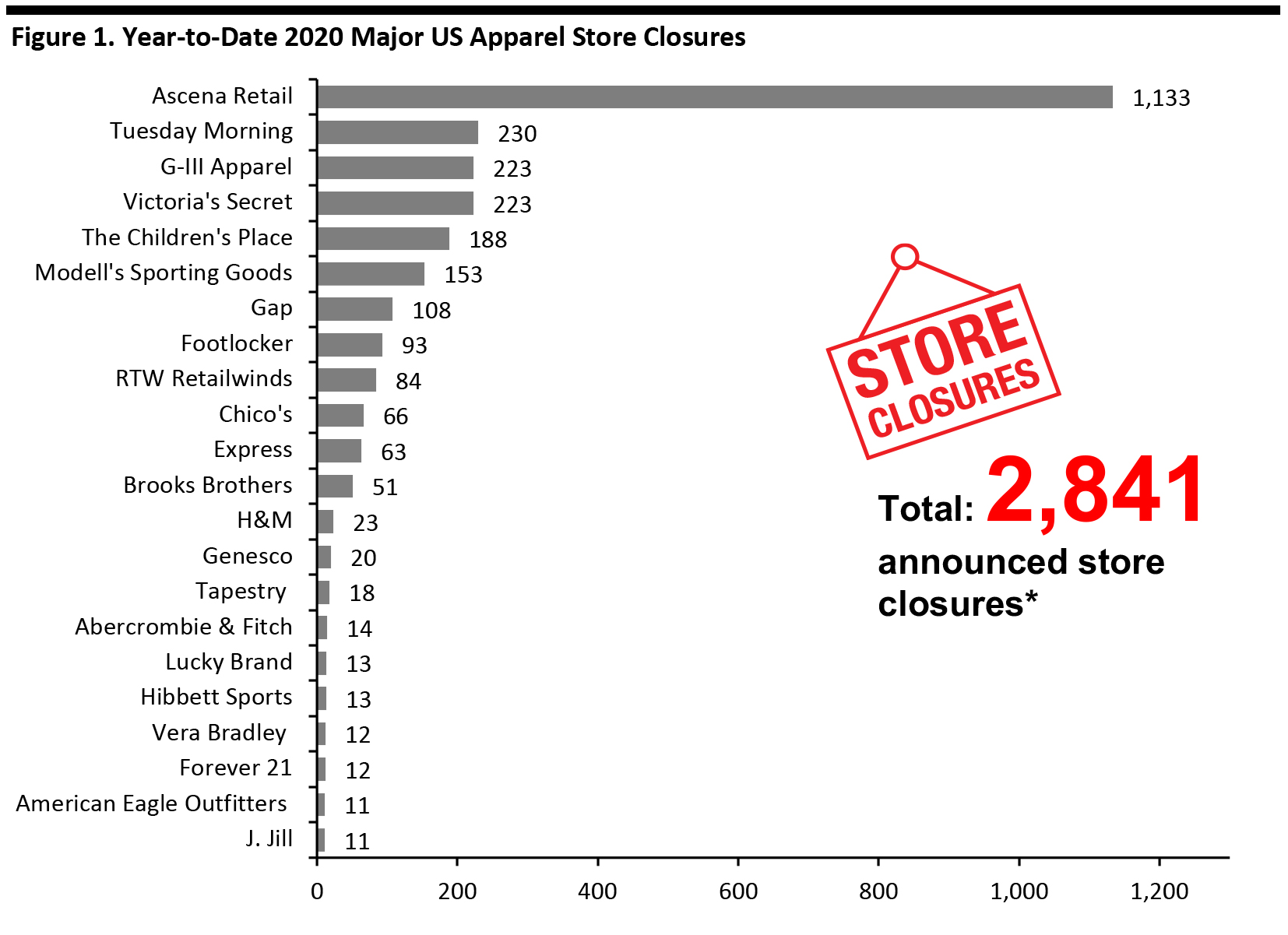

Some leading apparel retailers have already announced permanent store closures in 2020, which we summarize below.- Ascena Retail Group, owner of apparel brands Ann Taylor, Justice, Lane Bryant, LOFT and Lou & Grey chains, filed for Chapter 11 bankruptcy on July 23 and entered a restructuring support agreement with over 68% of its secured term lenders. The company announced plans to close 1,115 US stores of its over 2,800 stores, according to court documents, including 618 Justice stores, all 264 Catherines stores, 157 Lane Bryant stores, 38 Ann Taylor stores, 30 LOFT stores and eight Lou & Grey stores. Prior to this announcement, the company had closed an estimated 18 stores earlier in the year.

- Specialty apparel retailer RTW Retailwinds filed for Chapter 11 bankruptcy protection on July 13 and announced that it expects to close a significant portion, if not all, of its 378 stores. At the time of filing, the company stated that it will continue to operate its business in the short term by reopening certain stores that were closed due to the coronavirus lockdown, but it is evaluating all strategic alternatives, including the potential sale of its e-commerce business and related intellectual property.

- Brooks Brothers filed for Chapter 11 bankruptcy protection on July 8 and plans to close at least 51 stores. The retailer operates over 200 stores in North America and 500 stores globally.

- Apparel retailer G-III Apparel Group announced in June that it will close around 199 stores, which includes all 110 Wilsons Leather and all 89 G.H. Bass stores, as part of its restructuring plan. Prior to that announcement, the company had already closed 14 Wilsons Leather and 10 G.H. Bass stores earlier in the year.

- Children’s specialty apparel retailer The Children’s Place announced in June that it plans to shut 300 stores, of which 200 will take place in fiscal year 2020 and 100 in fiscal year 2021. The planned closures align with the company’s plan to reduce dependence on its brick-and-mortar channel. Following these closures, the retailer expects its mall-based portfolio to account for less than 25% of its total revenue at the outset of fiscal year 2022.

- Off-price retailer Tuesday Morning filed for Chapter 11 bankruptcy protection in May, with plans to reorganize its business in order to realign its store footprint. The retailer intends to close 230 of its 687 stores in a phased approach, and it has requested court approval to close at least 132 stores in the first phase. Tuesday Morning obtained a commitment from its lenders to provide $100 million in debtor-in-possession financing to enable the company to navigate through the reorganization process. The retailer expects to emerge out of bankruptcy with approximately 450 stores by early fall of 2020.

- L Brands announced in May that it will close around 235 Victoria’s Secret stores in its ongoing fiscal year ending February 1, 2021.

Coresight Research attributes store closures to the year in which they occurred or are expected to occur. We estimate this information for Footlocker, Gap and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Footlocker and H&M are based on the existing proportion of stores in the US. Chico’s, Gap, Genesco and Tapestry among others pertain to North America closures.

Coresight Research attributes store closures to the year in which they occurred or are expected to occur. We estimate this information for Footlocker, Gap and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Footlocker and H&M are based on the existing proportion of stores in the US. Chico’s, Gap, Genesco and Tapestry among others pertain to North America closures. *Total includes a small number of retailers that each announced fewer than 10 store closures and are not included in the chart

Source: Coresight Research [/caption] Apparel Retailer Bankruptcies The apparel sector has seen the most casualties in terms of retail bankruptcies so far this year, with 13 major apparel retailers filing for bankruptcy (see Figure 2 for the full list). More could follow over the rest of the year, given the underwhelming outlook for the sector. The following apparel retailers have filed for bankruptcy but have not confirmed how many stores they plan to close permanently:

- Lifestyle brands collective Centric Brands—The company filed for Chapter 11 bankruptcy protection in May, with plans to restructure its business. The company entered into an agreement with its lenders to secure $435 million debtor-in-possession financing so that it can operate during the restructuring process. Centric Brands also revealed that it intends to emerge from Chapter 11 as a private company. As of September 30, 2019, Centric Brands operated 97 retail stores and 337 partner shop-in-shops.

- Specialty retailer J.Crew Group—The company filed for Chapter 11 bankruptcy protection on May 4. According to a company release, J.Crew stated that it had reached an agreement with its lenders whereby the lenders will convert approximately $1.65 billion of the retailer’s debt into equity. The retailer intends to restructure its debt and position its J.Crew and Madewell brands for long-term profitable growth. As a part of the agreement, Madewell will remain part of the J.Crew Group, although the retailer had previously planned to spin off the former as a public company.

- Denim retailer True Religion Apparel—The company filed for Chapter 11 bankruptcy protection on April 13 for the second time in less than three years. True Religion’s CEO Michael Buckley said that the retailer’s major lenders, ABL and Term Loan, were providing additional funding to reorganize its business under Chapter 11. True Religion operated 87 stores at the time of its bankruptcy filing.

Figure 2. Major US Apparel Retail Bankruptcies Year-to-Date in 2020 [wpdatatable id=377]

Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners. ***Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company Reports/Coresight Research

Outlook for Apparel Retail Stores

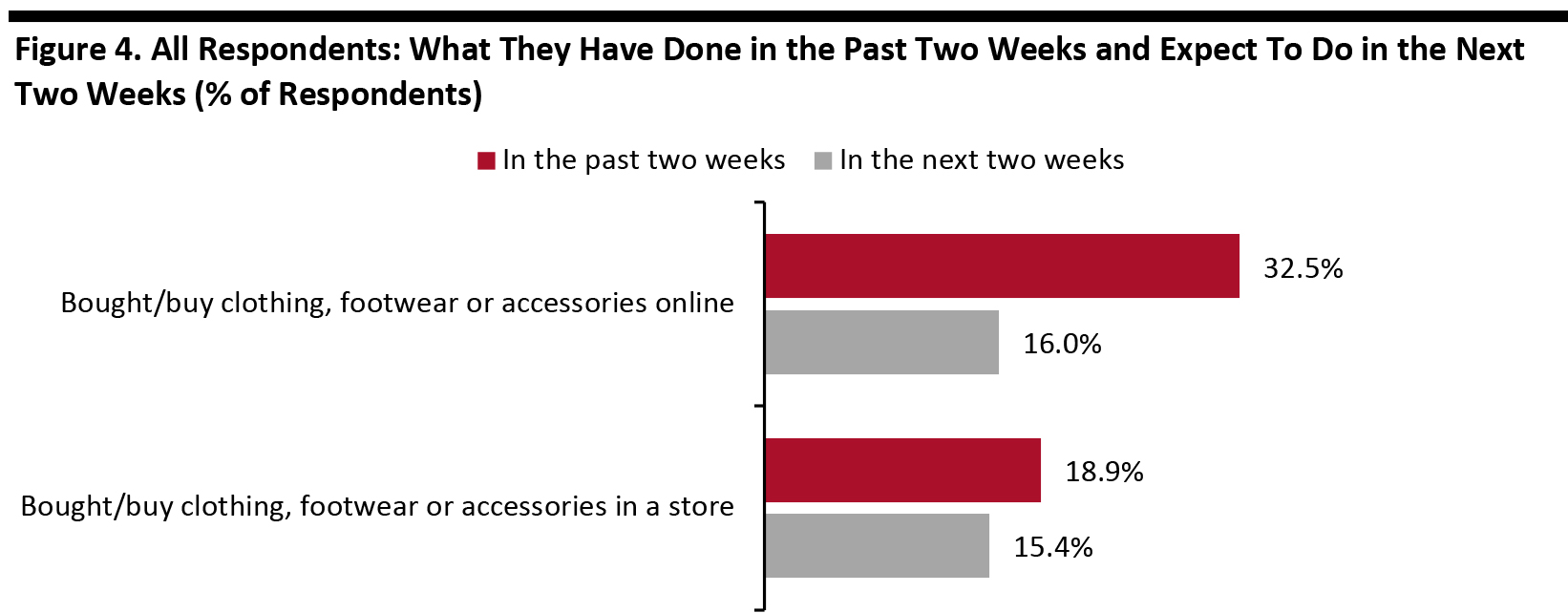

Apart from the apparel stores that have already filed for bankruptcy, some others such as Francesca’s and even L Brands are currently under bankruptcy watch. We expect that there will be an acceleration in closures during the second half of the year as consumers restrict their spending on apparel and continue to stay away from public places, including malls and stores. The recovery of consumer spending in clothing and footwear has been sluggish, as evidenced by retail sales data and Coresight Research’s weekly consumer surveys. Moreover, what demand there is is channeled through e-commerce to a much greater extent than before the crisis. Our latest US consumer survey, undertaken on August 5, presents insights into what consumers have done in the past two weeks, including spending on apparel. Some 18.9% of respondents had bought apparel in a store—a low proportion despite it representing a slight improvement from the previous week. The proportion of respondents who had bought apparel online in the past two weeks also remained relatively low, although it improved from 31.8% last week to 32.5% this week. Moreover just 16% plan to buy clothing, footwear or accessories online in the next two weeks, while just 15.4% plan to buy in store.Figure 3. All Respondents: What They Have Done in the Past Two Weeks (% of Respondents) [wpdatatable id=378]

Respondents could select multiple options Base: US Internet users aged 18+ Source: Coresight Research [caption id="attachment_114280" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption] The consumer survey also includes insights into current consumer avoidance behavior for different types of public places. Although the proportion of respondents that said they are avoiding shopping centers/malls declined slightly to 62.4% (versus 63.8% the prior week), this avoidance rate is still high. In addition, almost half of all respondents are avoiding shops in general, indicating a challenging environment for brick-and-mortar retail.

Mall Owners Could Acquire Struggling Apparel Retailers

With a number of major apparel retailers closing stores and filing for bankruptcy, mall owners face a challenge in terms of filling the vast expanses of open spaces left vacant by tenants. It is in this context that some leading mall owners are considering acquiring bankrupt and struggling retailers. In such contexts, malls owners would typically prioritize the acquisition of their biggest tenants, those which operate a number of stores within their malls. However, in some cases, a mall owner may assess that a brand may be worth more than its perceived value and may not require as much investment to revive compared to other larger tenants. This appears to be a key rationale behind Simon Property Group’s interest in Brooks Brothers. Simon Property Group, one of the largest US mall owners, in a joint venture with Authentic Brands (primarily known for acquiring brands with licensing potential), reportedly made a stalking horse bid of $305 million in July to acquire apparel retailer Brooks Brothers out of bankruptcy. Although Brooks Brothers is not among Simon’s largest tenants, it does operate around 50 stores in Simon Property Group’s outlet malls—and importantly, it is a brand that is popular among upscale consumers. In its bankruptcy filing, Brooks Brothers stated that it registered $991 million in revenues in 2019, of which 20% was via e-commerce. Authentic Brands and Simon Property Group had also made a stalking horse bid of $191 million in July to buy out the assets of bankrupt denim retailer Lucky Brands. We could see other similar bids for struggling apparel retailers in the months ahead. While it may not be common for mall owners to acquire brands and retailers, the strategy has been used before. In 2016 and earlier in 2020, Simon Property Group collaborated with other mall landlords to bail out two distressed apparel companies—Aéropostale and Forever 21.What We Think

Many apparel retailers were already struggling before the outbreak of the coronavirus, but the pandemic has wreaked havoc on discretionary retail, and the apparel sector was hit the hardest—with around one-third of consumers currently buying less clothing than pre-crisis, according to our survey. This has prompted a number of retailers in the sector to file for bankruptcy and permanently close stores. As consumers continue to avoid public places, including malls and stores, and limit their spending on apparel, we expect apparel store closures to accelerate over the remainder of the year, exacerbating the challenge for mall owners. To address this challenge, some mall owners may consider acquiring struggling chains. Implications for Brands/Retailers- More apparel store closures and bankruptcies will imply a much higher overall tally of retail store closures for 2020.

- We expect apparel to be the weakest major retail category this year: Data points from our weekly surveys and sector sales suggest a more sluggish recovery than in several other discretionary categories.

- A rise in the number of mall-based apparel store closures and bankruptcies will significantly impact the revenues of malls.

- These closures would also mean that mall owners would need to find new occupants for the vacant spaces, which would be challenging in the current environment.

- Mall owners may consider acquiring struggling and bankrupt apparel retailers, but such a move could be a risky proposition given that it is not their core area of expertise.