DIpil Das

Overview

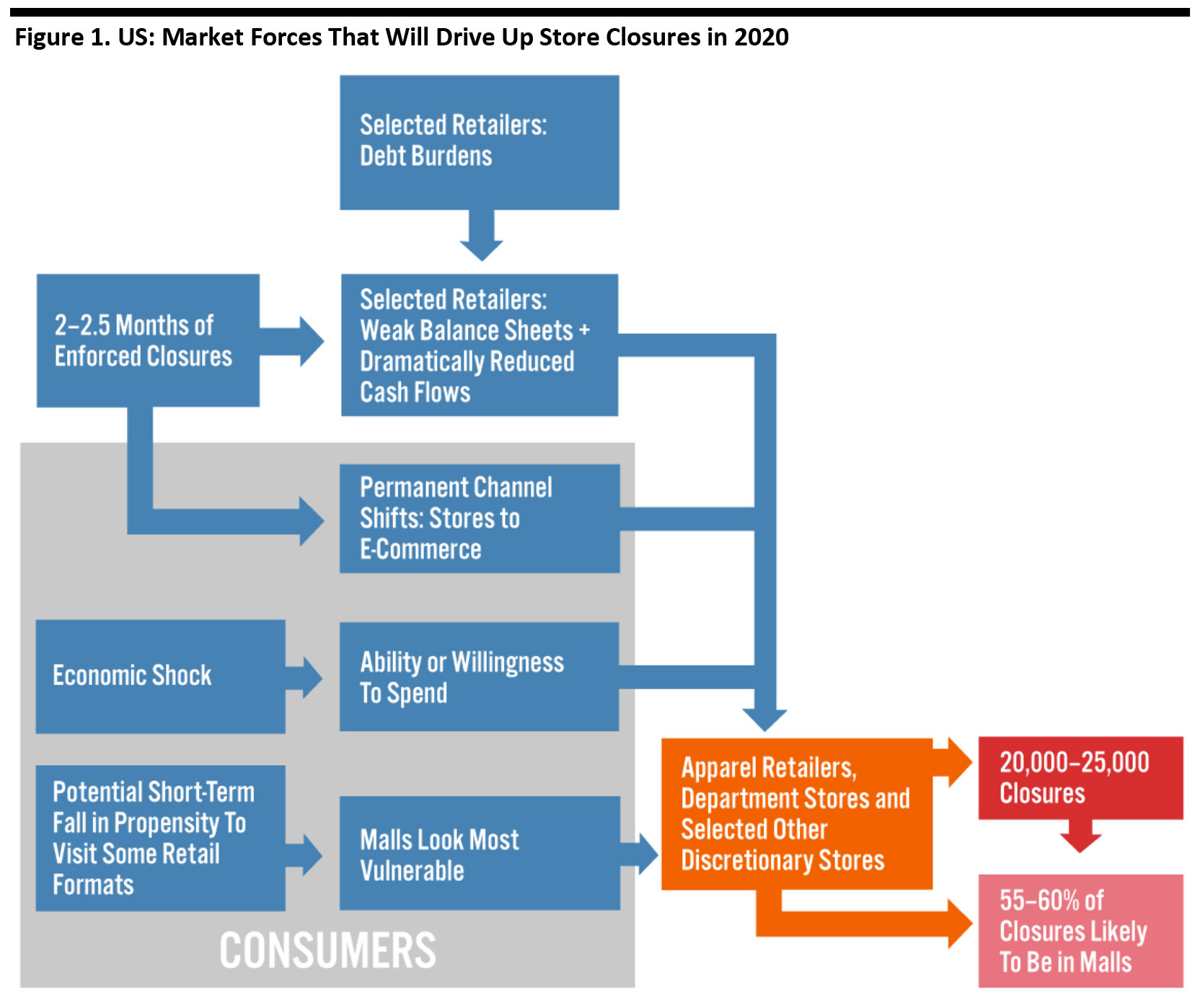

In the wake of the coronavirus crisis, Coresight Research now predicts that retail closures will rise exponentially in the US to reach a total of between 20,000 and 25,000 (gross—i.e., not accounting for openings), with the 22,500 midpoint of this range being significantly higher than our previous estimate of up to 15,000 closures (gross). This follows a record year of around 9,821 closures in 2019.

While there may be cases of distressed nondiscretionary retailers, those selling selected categories of discretionary goods will lead closures, driven principally by diminished cash flows on the back of enforced store closures. Apparel retail and department stores look set to feature prominently in total store closures.

Due to Covid-19 lockdowns, many US retailers temporarily closed stores from mid-March, but discretionary retailers have been reopening stores since the beginning of May. Some retailers have even reported encouraging sales recoveries. In apparel retail for example, Abercrombie & Fitch said in its first-quarter earnings call that it managed to recover 80% of sales in its reopened US stores. Gap Inc. reported that its reopened stores have managed to capture 70% of last year’s sales. However, we expect that a return to pre-crisis levels in offline discretionary retail sales overall will be gradual, as we expect consumer confidence, demand and spending to be short of normal for some time.

According to a Coresight Research consumer survey undertaken on May 27, around half of those whose spending patterns have changed think that it will take at least five to six months before their spending returns to normal. Given that recovery to pre-crisis levels may be gradual, retailers that were struggling to stay in business pre-crisis are unlikely to have the wherewithal to stay the course on the road to recovery and could end up closing a number of stores.

At the same time, the temporary closure of nonessential stores looks to have accelerated the shift to e-commerce. Any permanent migration of consumer spending online may well lead some retailers to consider rationalizing their store fleets—particularly if those retailers discovered they could achieve meaningful sales retention through e-commerce when their stores were temporarily closed.

[caption id="attachment_110996" align="aligncenter" width="700"] Source: Coresight Research[/caption]

A risk for fragile retailers that have managed to keep their heads above water is a possible second wave of coronavirus later in 2020. However, we do not factor this into our estimates, given that it does not look probable at this time.

Mall-Based Closures Likely To Lead Non-Mall-Based Closures

Of the total number of stores expected to close this year in the US, Coresight Research estimates that around 55–60% will be mall-based stores. According to real-estate analytics firm CoStar, department stores and apparel chains, which are among the most vulnerable sectors, represent 14 of the top 20 occupants of US mall space. The high dependence of malls on these two retail formats has ominous implications. Department stores and other large-format retailers have traditionally played the role of anchor tenants in malls and generate strong foot traffic that attracts other retailers to set up shop in the malls.

If the anchor tenants close stores in the mall, other tenants are likely to follow suit. Some of these may enter into co-tenancy clauses that enable them to pay lower rent or break their leases an anchor tenant leaves. Department and large apparel-chain store closures in malls will therefore create a ripple effect that spells bad news for malls.

Implications for Malls

Even before the coronavirus outbreak, many regional malls were being hit by a cycle of reduced shopper traffic and heavy store closures in the core apparel sector. This shift came about amid an environment of e-commerce disruption and the trend of discretionary spend incrementally moving from products to services, as shoppers demonstrated a preference to spend on experiences rather than discretionary product purchases.

The physical retail landscape is seeing store-rationalization trends, as retailers look to optimize their brick-and-mortar fleets in the context of sales migration to online channels. With the rationalization of mall space typically lagging behind store closures, the coronavirus-driven shutdown could represent a turning point for shopping centers, prompting the rationalization of mall space through 2020.

Year-to-Date Store Closures

Coresight Research has recorded a total of 4,005 planned US store closures, as of June 5. Pier 1 Imports (liquidation; 936 store closures), GNC (multi-year mall-focused closure plan; 304), Tuesday Morning (bankruptcy; 230), Victoria’s Secret (fleet rationalization; 223), Papyrus (bankruptcy; 178) and JCPenney (bankruptcy; 169) together account for over half of this total.

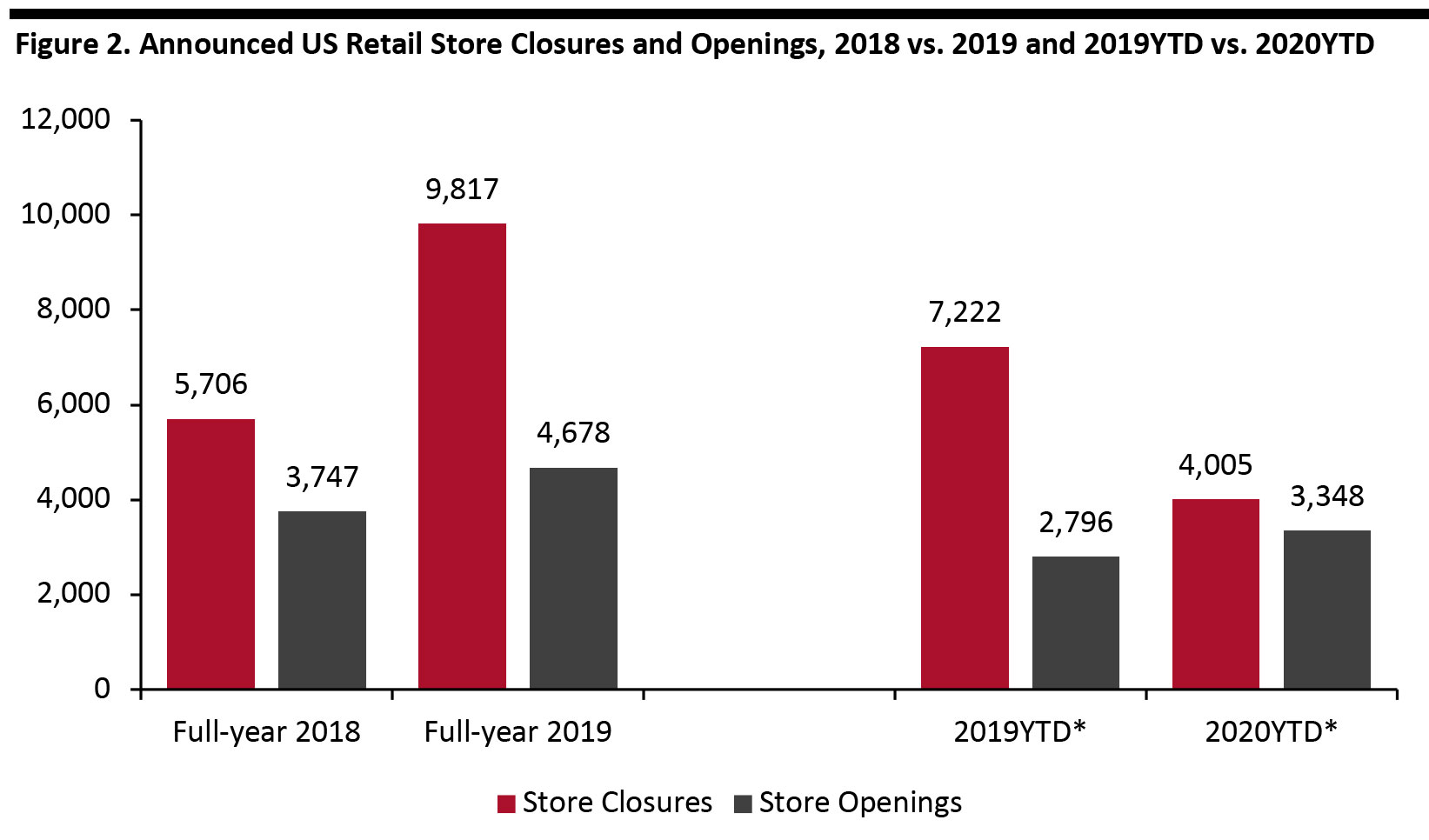

We do not expect the year-to-date trends to be representative of the full-year pattern for store closures. The total year-to-date permanent store closures in 2020 are currently significantly lower than this time in 2019 (see Figure 2), but we predict that there will be a major uptick on the back of discretionary demand levels being below normal.

[caption id="attachment_110997" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

A risk for fragile retailers that have managed to keep their heads above water is a possible second wave of coronavirus later in 2020. However, we do not factor this into our estimates, given that it does not look probable at this time.

Mall-Based Closures Likely To Lead Non-Mall-Based Closures

Of the total number of stores expected to close this year in the US, Coresight Research estimates that around 55–60% will be mall-based stores. According to real-estate analytics firm CoStar, department stores and apparel chains, which are among the most vulnerable sectors, represent 14 of the top 20 occupants of US mall space. The high dependence of malls on these two retail formats has ominous implications. Department stores and other large-format retailers have traditionally played the role of anchor tenants in malls and generate strong foot traffic that attracts other retailers to set up shop in the malls.

If the anchor tenants close stores in the mall, other tenants are likely to follow suit. Some of these may enter into co-tenancy clauses that enable them to pay lower rent or break their leases an anchor tenant leaves. Department and large apparel-chain store closures in malls will therefore create a ripple effect that spells bad news for malls.

Implications for Malls

Even before the coronavirus outbreak, many regional malls were being hit by a cycle of reduced shopper traffic and heavy store closures in the core apparel sector. This shift came about amid an environment of e-commerce disruption and the trend of discretionary spend incrementally moving from products to services, as shoppers demonstrated a preference to spend on experiences rather than discretionary product purchases.

The physical retail landscape is seeing store-rationalization trends, as retailers look to optimize their brick-and-mortar fleets in the context of sales migration to online channels. With the rationalization of mall space typically lagging behind store closures, the coronavirus-driven shutdown could represent a turning point for shopping centers, prompting the rationalization of mall space through 2020.

Year-to-Date Store Closures

Coresight Research has recorded a total of 4,005 planned US store closures, as of June 5. Pier 1 Imports (liquidation; 936 store closures), GNC (multi-year mall-focused closure plan; 304), Tuesday Morning (bankruptcy; 230), Victoria’s Secret (fleet rationalization; 223), Papyrus (bankruptcy; 178) and JCPenney (bankruptcy; 169) together account for over half of this total.

We do not expect the year-to-date trends to be representative of the full-year pattern for store closures. The total year-to-date permanent store closures in 2020 are currently significantly lower than this time in 2019 (see Figure 2), but we predict that there will be a major uptick on the back of discretionary demand levels being below normal.

[caption id="attachment_110997" align="aligncenter" width="700"] *2019YTD is through June 7, 2019; 2020YTD is through June 5, 2020.

*2019YTD is through June 7, 2019; 2020YTD is through June 5, 2020. Source: Company reports/Coresight Research. [/caption] Breaking the numbers down by sectors, the home and office retail sector has had the highest number of announced store closures so far in 2020 (1,161), followed by apparel, footwear and accessories (986) and grocery (480). Bankruptcies Following more medium-term store closures, we expect to see a spate of bankruptcies this year, as the debilitating impact of the coronavirus on sales will likely quell hopes of survival for a number of struggling retailers—especially debt-laden retailers. Moreover, we may see more retailers go straight to Chapter 7, wherein companies liquidate their assets. In normal circumstances, struggling retailers tend to file for Chapter 11 bankruptcy protection, in order to continue operating by restructuring their debt. This kind of bankruptcy filing typically spans several months, and companies need access to credit in the interim. However, when there is a credit crunch, these retailers will find it more challenging to obtain funding and may have no other resort but to file for Chapter 7 bankruptcy. In this extraordinary time of crisis brought about by the coronavirus, the latter scenario may become the new norm. As shown below, 15 major retailers have filed for bankruptcy to date in 2020, with a spate of filings in May on the back of the coronavirus crisis. Figure 3. Selected Retail Bankruptcy Announcements, 2020YTD [wpdatatable id=232] *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016 **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017 ***J.Crew Group includes J.Crew and Madewell banners Source: Coresight Research Summary Outlook Despite permanent store closures in the US so far this year trailing the total from this time in 2019, the coronavirus outbreak has effectively displaced the comparison as we look at expectations for the full year, as the impact that the pandemic has already had on physical retail is an ominous sign for the rest of 2020. In the weeks and months to come, a number of retailers will shutter stores permanently, and many other stores that were temporarily closed may never reopen. Coresight Research predicts that we could see between 20,000 and 25,000 store closures in the US this year (gross—i.e., not accounting for openings). We estimate that around 55–60% of these store closures will be based in malls. We expect many more US retailers to file for bankruptcy over the rest of the year, particularly if the coronavirus lingers around for the medium term. Additionally, brick-and-mortar retail in the US—especially in malls—is set to see a correction that has long been overdue. In the interim, retailers across sectors will have their resources and resolve tested, regardless of their financial and operational health, as they seek to emerge out of the current chaos with minimal adverse, long-term consequences.