DIpil Das

Introduction

Already in this series, we have established that the use of social media for product discovery, research and buying by US consumers is not uncommon. In this report, we assess the spending behaviors and shopping habits of those who use social media for shopping—including the types of retailers from which they purchase products. This is the second report of a four-part series in which we explore the results of a Coresight Research survey of US consumers on their use of social media for shopping. This series will include three thematic reports and an overall summary of our findings. We surveyed 1,509 US Internet users aged 18 and above in November 2019. We asked respondents about a number of topics relating to their use of social media for shopping, including the following:- Shopping channel preferences

- Monthly spending, by selected retail categories

- How often they research and discover or purchase products through social media

- What products they have recently bought on social media

Insights from Our Survey

As we have noted in a previous report, a very high proportion of surveyed respondents said they use social media as part of the shopping process. In fact, despite social media being built around content sharing, we found that buying via social media is more common than consumers simply posting about new purchases via these platforms. Users of social media shop heavily online, through online-only retailers, online marketplaces, brand e-commerce platforms and the websites of brick-and-mortar retailers. We found that US social media shoppers tend to spend more than consumers who do not use social media to shop, most notably in the beauty and apparel categories: More than four times as many social media shoppers spend $100 or more monthly on beauty products than other consumers; and the apparel sector sees the highest traction among social media shoppers, with almost one-third of them spending more than $100 monthly on clothing products.Where US Consumers Shop, Away from Social Media

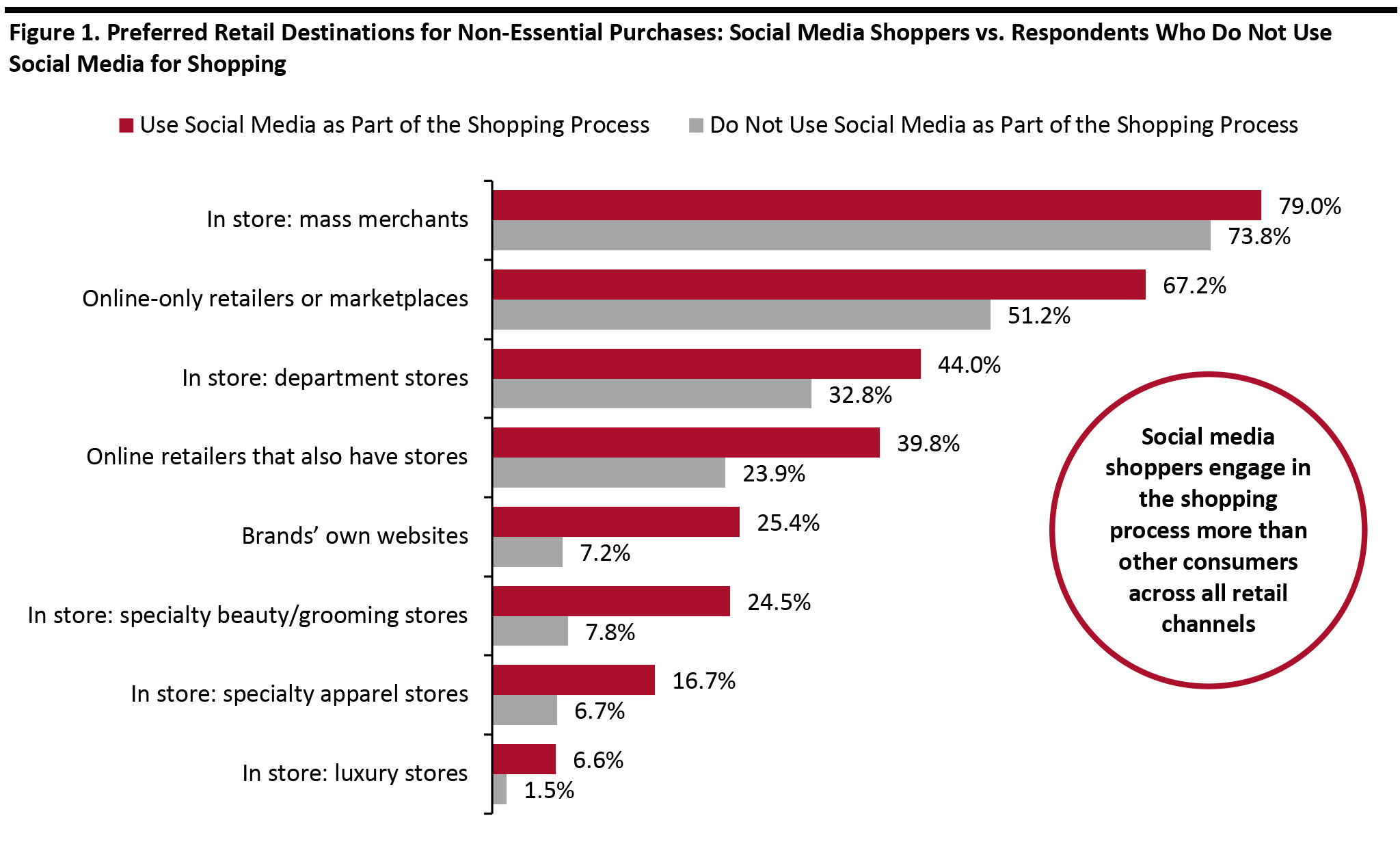

We asked respondents where they shop for non-essential retail purchases. Mass merchants, such as Target and Walmart, comprise the most popular destination for discretionary retail products, with three-quarters of all respondents stating that they use these retailers. Online-only retailers and marketplaces such as Amazon, eBay and Wayfair are the next most-preferred retail channel. Those who use social media as part of the shopping process are more likely than those who do not to buy from all types of retailers—whether online or brick-and-mortar. This likely reflects that social media shoppers are more avid shoppers, whichever channel that involves. Specialty beauty/grooming stores saw the largest gap of the brick-and-mortar destinations between traffic from social media shoppers and other consumers. Beauty brands such as Sephora and Ulta Beauty may therefore benefit significantly from the footfall driven by their marketing campaigns on social media. This will not be the case in the current retail environment, due to the recent store closures caused by the coronavirus pandemic. [caption id="attachment_106800" align="aligncenter" width="700"] Base: 1,509 US Internet respondents age 18+, including 854 who use social media as part of shopping process, surveyed in November 2019.

Base: 1,509 US Internet respondents age 18+, including 854 who use social media as part of shopping process, surveyed in November 2019. Source: Coresight Research [/caption]

Monthly Spending Behaviors

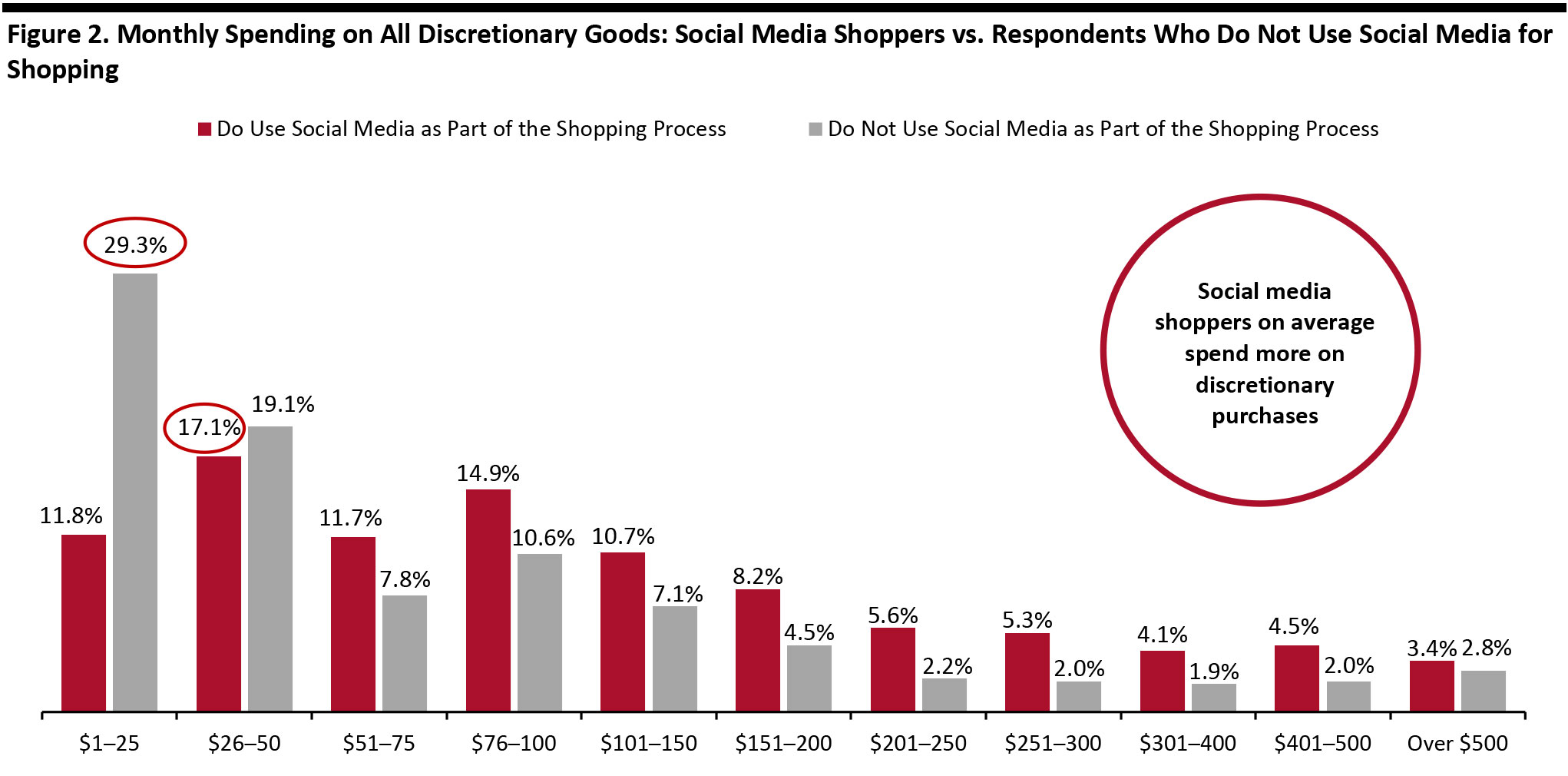

Further confirming that social media shoppers are more enthusiastic shoppers, those who use social media as part of the shopping process are more likely to spend more than those who do not. We asked respondents how much they spend on all discretionary purchases each month, as well as how much they spend on major discretionary categories such as apparel and beauty or grooming. Respondents who do not use social media as part of the shopping process register a lower peak for average monthly discretionary spending (at between $1 and £25 per month) versus those who use social media for shopping (peaking at $26–50). [caption id="attachment_106801" align="aligncenter" width="700"] Totals do not sum to 100: “$0” and “don’t know” responses not charted Base: 1,509 US Internet respondents aged 18+ including 854 who use social media as part of shopping process, surveyed in November 2019

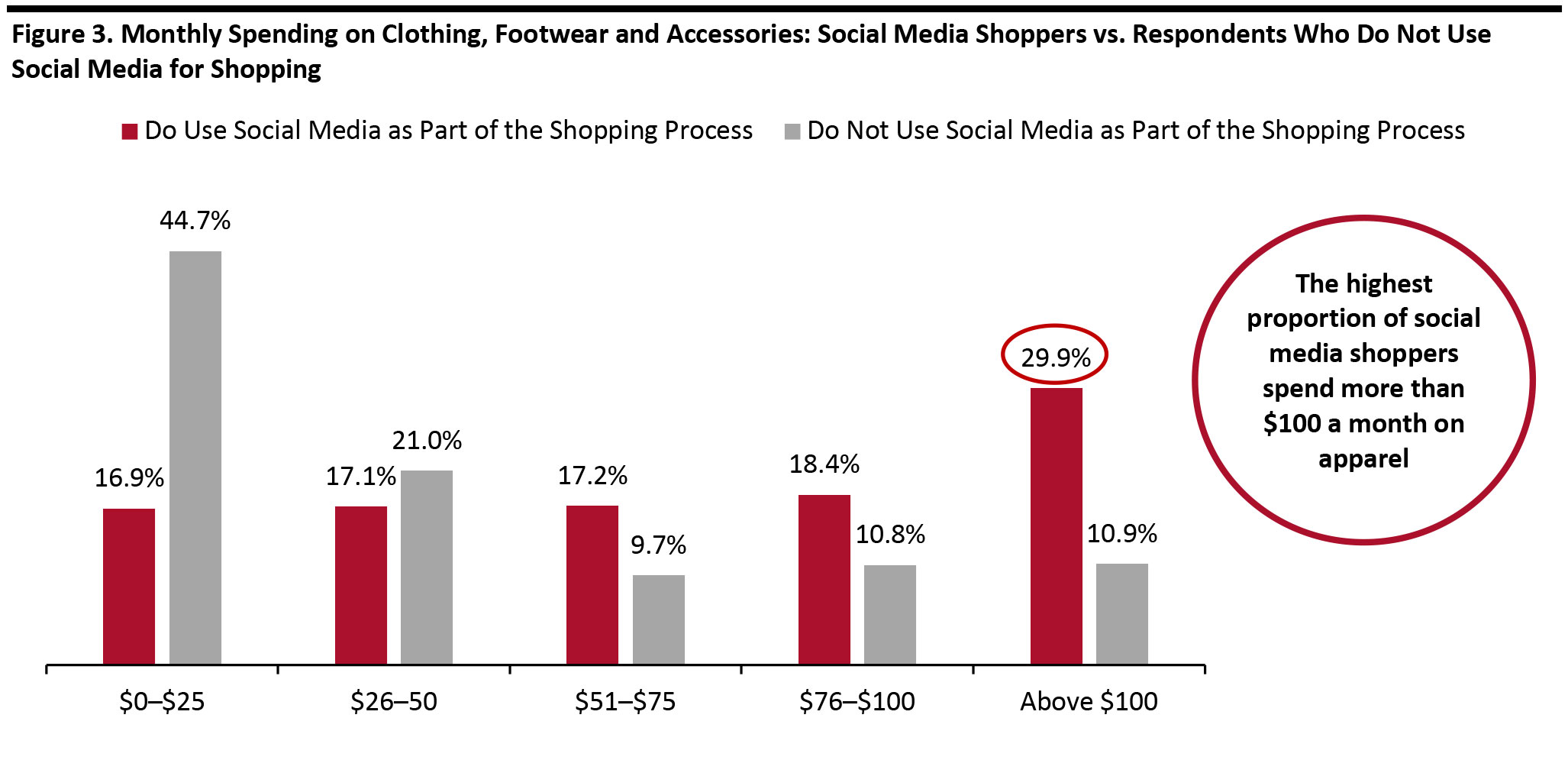

Totals do not sum to 100: “$0” and “don’t know” responses not charted Base: 1,509 US Internet respondents aged 18+ including 854 who use social media as part of shopping process, surveyed in November 2019 Source: Coresight Research [/caption] Social media use coincides most with increased apparel spending, with almost one-third of social media shoppers stating that they spend more than $100 on clothing, footwear and accessories per month, which is almost triple the proportion of respondents who spend this much but do not use social media for shopping. On the other hand, almost 50% of consumers who do not use social media as part of the shopping process spend less than $25 on this category, nearly three times the proportion of social media shoppers that spend the same. [caption id="attachment_106802" align="aligncenter" width="700"]

Base: 1,509 US Internet respondents aged 18+ including 854 who use social media as part of shopping process, surveyed in November 2019

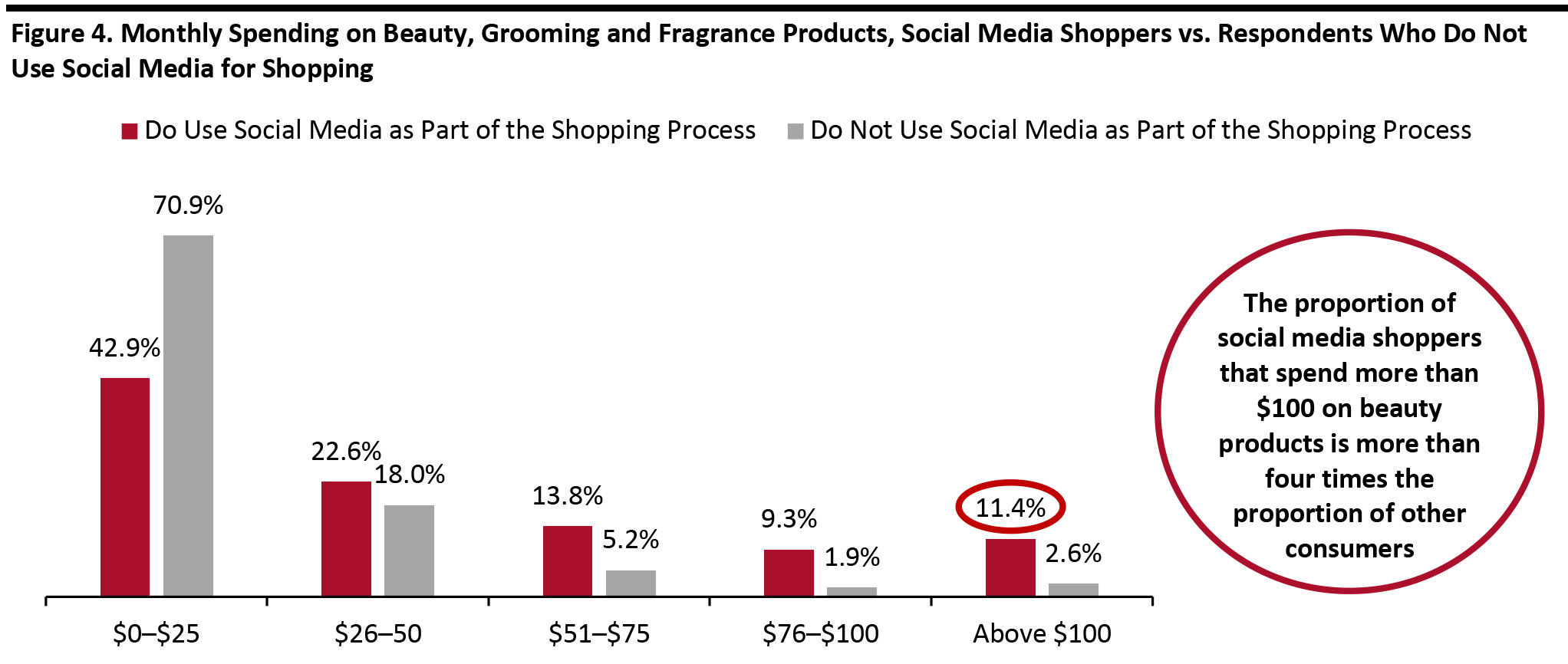

Base: 1,509 US Internet respondents aged 18+ including 854 who use social media as part of shopping process, surveyed in November 2019 Source: Coresight Research [/caption] The difference between social media shoppers and other consumers in monthly spending behavior for beauty and personal care products is smaller than in the apparel category in percentage terms. However, the proportional gap in high spenders is huge, with more than four times the proportion of social media shoppers spending more than $100 a month in the beauty sector compared to the proportion of consumers who do not use social media as part of the shopping process that spend this amount. More than one-third of social media shoppers spend more than $50 monthly on beauty, grooming and fragrance products, versus less than 10% of those who do not use social media as part of the shopping process. [caption id="attachment_106803" align="aligncenter" width="700"]

Base: 1,509 US Internet respondents aged 18+ including 854 who use social media as part of shopping process, surveyed in November 2019.

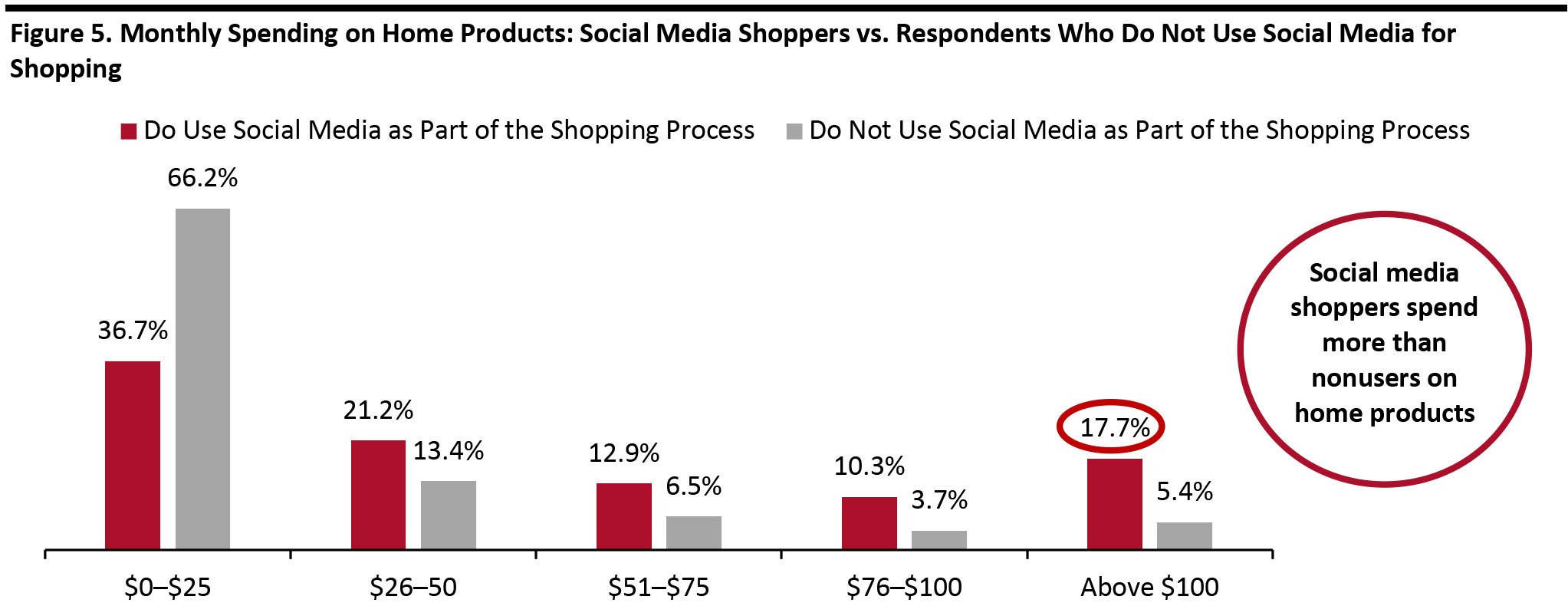

Base: 1,509 US Internet respondents aged 18+ including 854 who use social media as part of shopping process, surveyed in November 2019. Source: Coresight Research[/caption] Although we observed a similar trend in home products—with social media shoppers spending more than other consumers—the overall distribution moved slightly toward higher monthly spending, possibly simply due to the higher price tags of home products than beauty and personal care. [caption id="attachment_106804" align="aligncenter" width="700"]

Base: 1,509 US Internet respondents aged 18+ including 854 who use social media as part of shopping process, surveyed in November 2019

Base: 1,509 US Internet respondents aged 18+ including 854 who use social media as part of shopping process, surveyed in November 2019 Source: Coresight Research [/caption]