Nitheesh NH

Introduction

In the past decade, social media has transformed from a platform that connects people to a marketplace where consumers can share their experiences and make purchases. Influencers on various platforms serve as key opinion leaders (KOLs), impacting user preferences and purchasing behaviors. Social media sites are therefore looking to capitalize on consumer trends by adding e-commerce features that allow consumers to shop directly on their platforms. Social media and e-commerce together form a new social commerce channel. For younger shoppers, Instagram is at the epicenter of that channel. This is the first report of a four-part series in which we explore the results of a Coresight Research survey of US consumers on their use of social media for shopping. This series will include three thematic reports and an overall summary of our findings. We surveyed 1,509 US Internet users aged 18 and above in November 2019. We asked respondents about a number of topics relating to their use of social media for shopping, including the following:- How often they research and discover products through social media, specifically Instagram

- What products they have recently bought on Instagram

- How often influencers and celebrities affect their shopping

Insights from Our Survey

Facebook is the most widely used social media platform for shopping, but Instagram is the most popular among respondents aged 18–24. Instagram’s image-focused nature makes it a natural starting point for many who want to discover products—and our survey suggests that the platform goes beyond that starting point to drive conversion to making purchases, many of which we suspect to be impulse buys. The app has added livestreaming functionality, allowing real-time communication between bloggers and viewers. In the future, we expect brands and retailers to leverage Instagram as a new revenue opportunity. Apparel and beauty are the top categories for researching and discovering or purchasing on Instagram—reflecting these categories’ image-driven nature. Our data suggests that these categories also see the highest rate of conversion from browsers to buyers, suggesting that Instagram is successful in prompting impulse-driven purchases in frequently bought discretionary categories where appearance or imagery is key. Consumers aged 25–34 are more likely to discover and purchase beauty and personal products on social media than other age groups. Older Instagram users tend to shop less frequently on the platform. Instagram influencers have a real impact on shopping: 26.5% of Instagram shoppers aged 18 to 34 said their shopping was “often/always” affected by Instagram influencers and celebrities, versus the 19.7% average across all social media platforms. Furthermore, a total of 82.6% of Instagram shoppers follow influencers or celebrities on the platform, compared to 51.6% of social media shoppers. Consumers use Instagram to see what brands and products their favorite influencers are highlighting. More males use influencers when shopping than females—to a significant degree on both social media generally and Instagram specifically. In addition, male respondents showed more interest in becoming influencers, although the desire to be an influencer decreases as respondents’ age increases. Given the above, developing a social media/commerce strategy is imperative for most brands and retailers hoping to capture the custom of younger shoppers.Social Commerce Is Here: Top-Line Findings

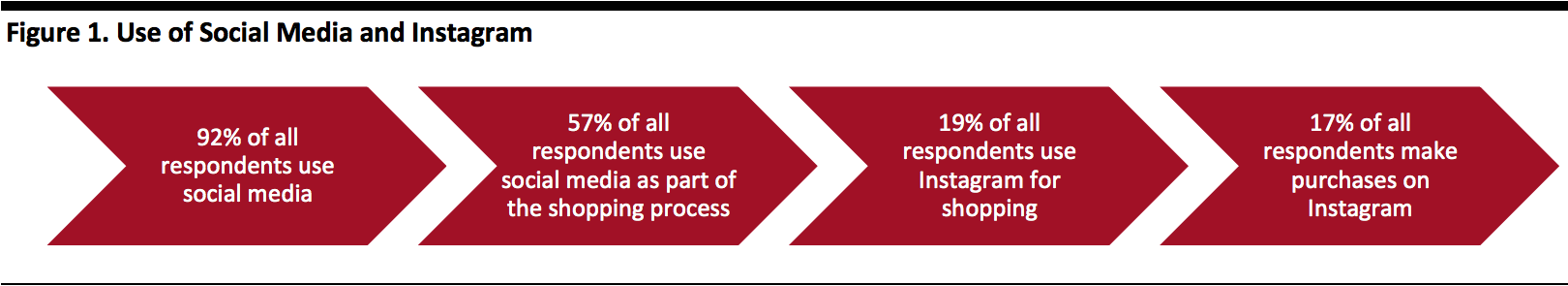

Fully 92.3% of respondents said they use social media platforms. Of these social media users, 61.3% said they use social media as part of their shopping process, which includes discovering products, researching purchases or buying products—that is equivalent to 57% of all respondents. Almost one in five respondents use Instagram for shopping, and only a slightly smaller proportion make purchases on the platform (as shown in Figure 1). [caption id="attachment_105243" align="aligncenter" width="700"] All data in this chart are shown as percentage of all respondents; later charts show percentages of subsets of respondents

All data in this chart are shown as percentage of all respondents; later charts show percentages of subsets of respondentsBase; 1,509 US Internet users aged 18+, surveyed in November 2019

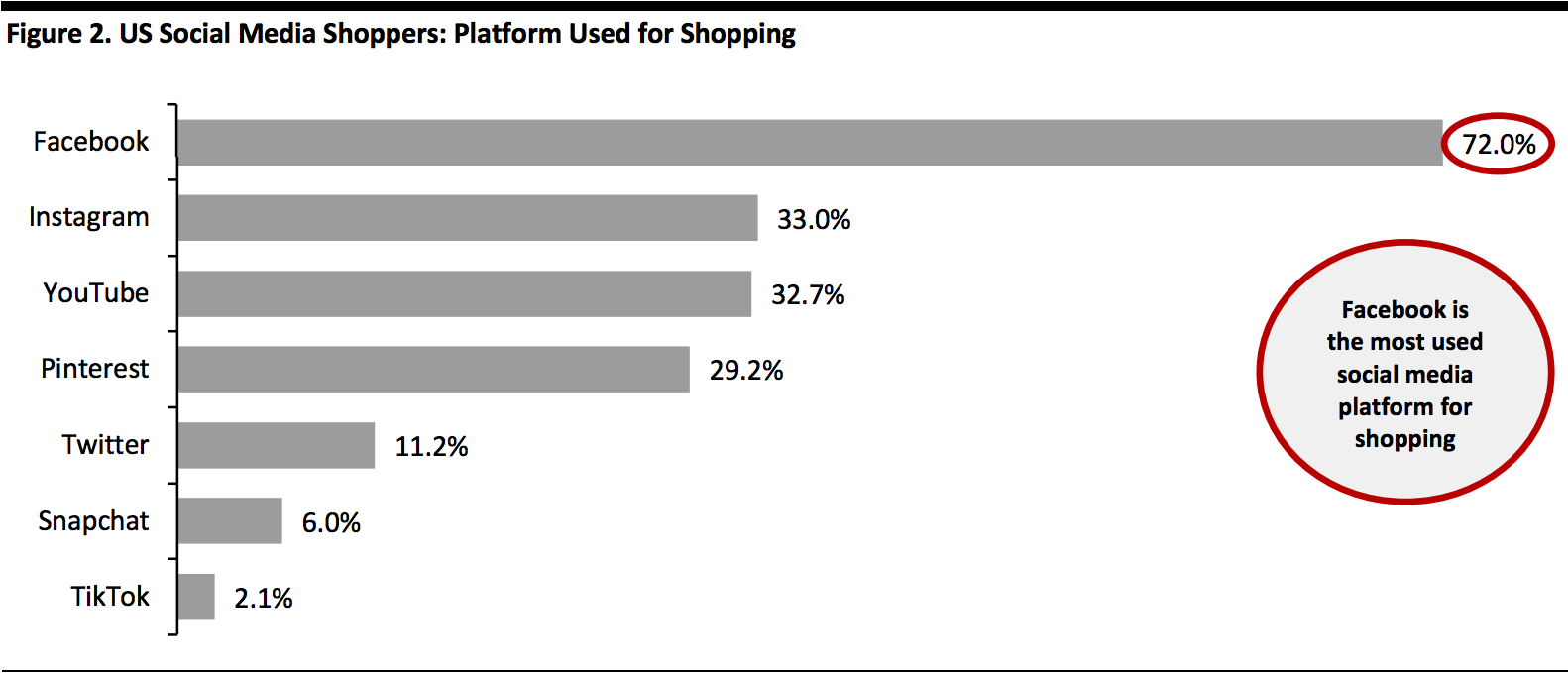

Source: Coresight Research[/caption] Among the respondents using social media as part of the shopping process, Facebook is used by 72% for shopping, making it the most popular platform—and representing a significant lead over Instagram’s 33.0%. [caption id="attachment_105242" align="aligncenter" width="700"]

Using social media for shopping is defined as “discovering products, researching purchases or buying products on social media”

Using social media for shopping is defined as “discovering products, researching purchases or buying products on social media”Base: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019

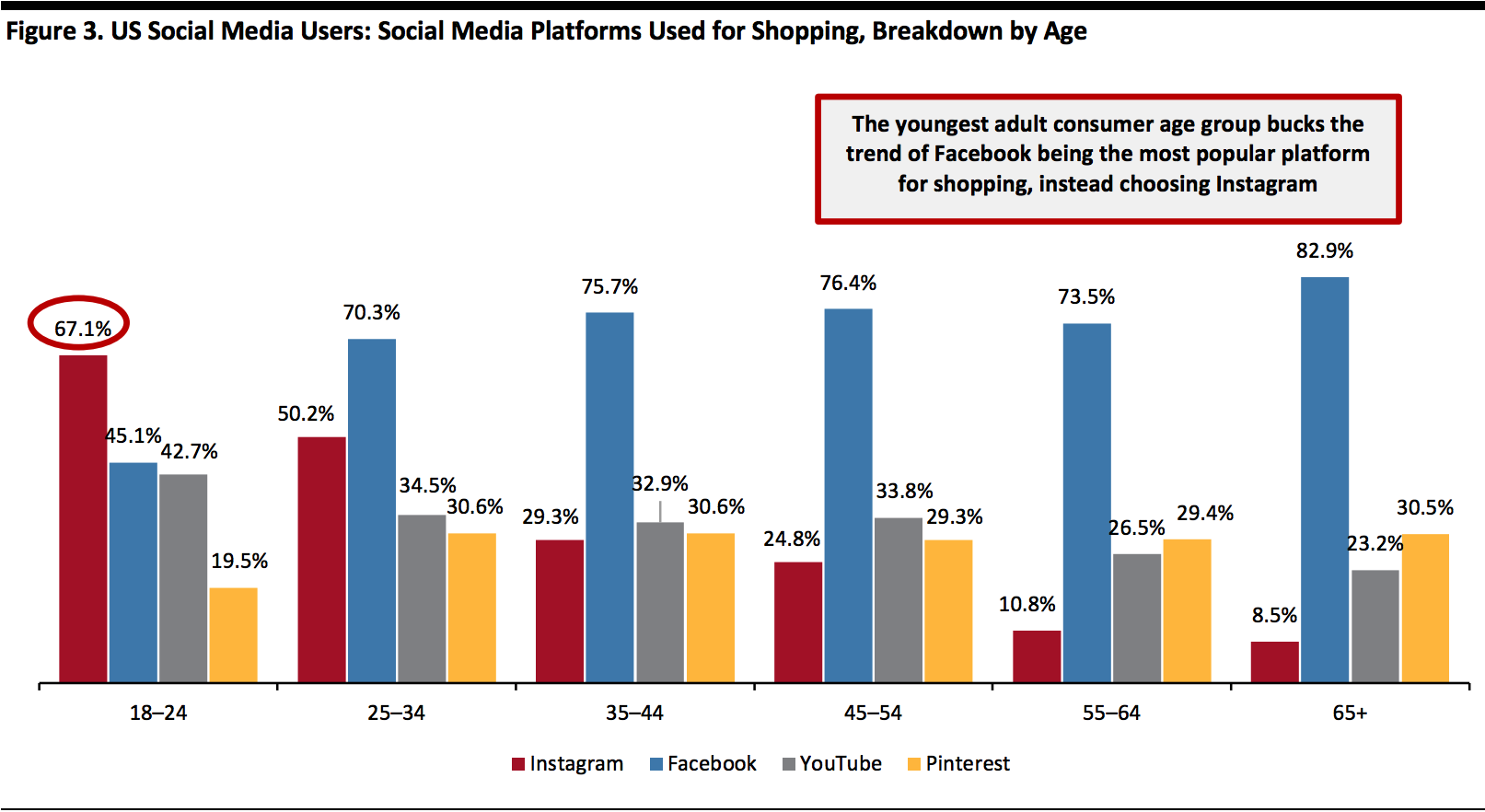

Source: Coresight Research[/caption] However, Instagram proved to be the most popular platform for social media users aged 18–24: Just over two-thirds of the youngest adult age group use Instagram for shopping, with Facebook placing second (45.1%). [caption id="attachment_105244" align="aligncenter" width="700"]

Base: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019

Base: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019Source: Coresight Research[/caption]

Researching and Buying on Instagram

For our survey, we identified shopping on Instagram as two discrete stages:- Discovering products or researching purchases on Instagram

- Purchasing via the platform

- What categories they had used Instagram for, in terms of shopping.

- How often they used social media for these stages.

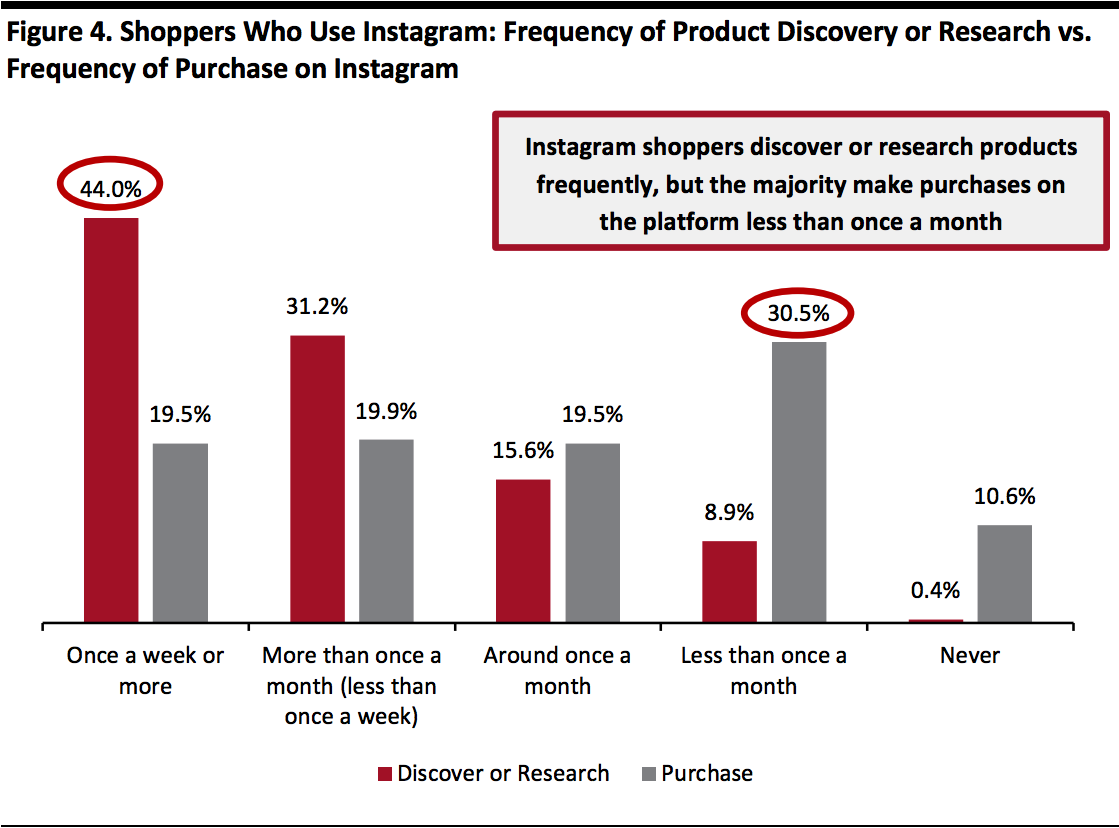

Frequency: Discovering versus Purchasing

In terms of discovering products or researching purchases, 44.0% of respondents who use Instagram as part of the shopping process utilize the platform once a week or more. This is more than double the number of social media shoppers who use Instagram to make purchases once a week or more (see Figure 4). Overall, 75.2% of respondents who use Instagram as part of the shopping process discover or research products more than once a month on Instagram. In terms of purchasing on Instagram, perhaps predictably, we see much lower frequencies of the platform being used—the peak for this consumer group is “less than once a month.” This reflects not only that consumers browse products more than they buy them, but also that shoppers often browse and discover across multiple channels, and this does not always reflect where they complete the purchase. As shown in Figure 4, although they use Instagram to discover or research products, almost 11% of Instagram shoppers never make purchases through the platform. [caption id="attachment_105249" align="aligncenter" width="580"] Base: 282 US Internet respondents aged 18+ who use Instagram as part of the shopping process, surveyed in November 2019

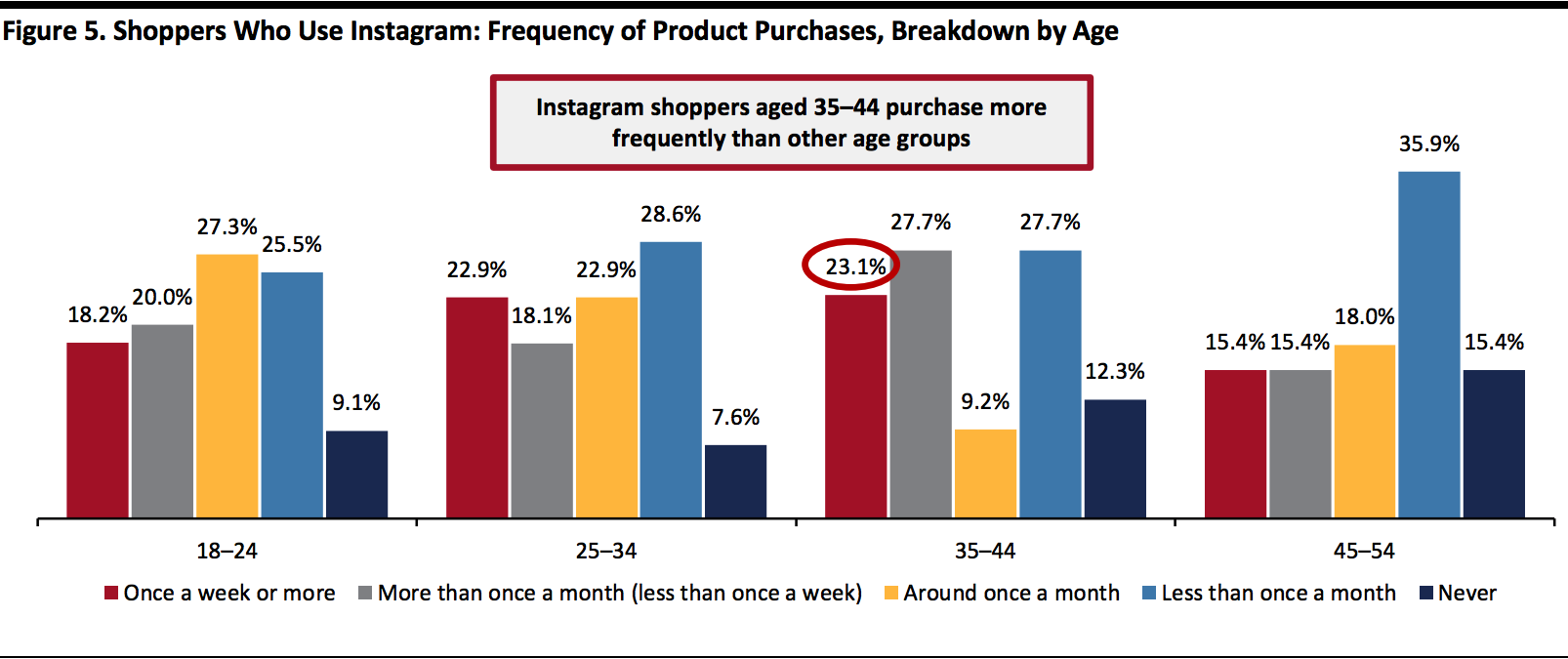

Base: 282 US Internet respondents aged 18+ who use Instagram as part of the shopping process, surveyed in November 2019Source: Coresight Research[/caption] Social media shoppers aged 35–44 purchase the most often on Instagram of any age group: 23.1% of them buy products through the platform once a week or more. Following closely behind are Instagram shoppers aged 25–34, with 22.9% making purchases once a week or more. Overall, around half of respondents aged 35-44 use Instagram to purchase products more than once a month, followed by 41.0% of respondents aged 25–34. These age groups are typically the most time starved, such as working parents with little time for shopping. [caption id="attachment_105250" align="aligncenter" width="700"]

Not all age groups shown due to small sub-samples for some age groups

Not all age groups shown due to small sub-samples for some age groupsBase: 282 US Internet respondents aged 18+ who use Instagram as part of the shopping process, surveyed in November 2019

Source: Coresight Research[/caption]

Categories: Discovering versus Purchasing

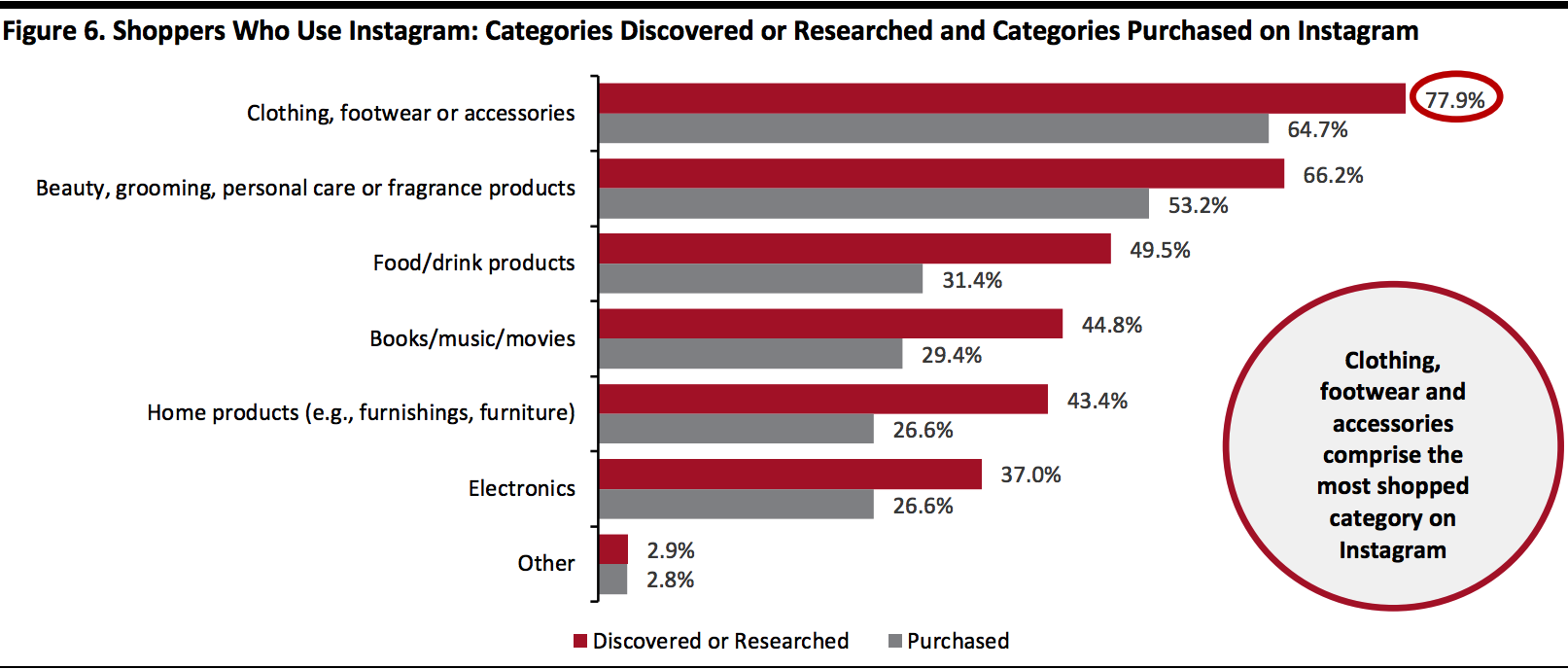

In terms of discovering products or researching purchases, apparel and beauty products are the top categories, with at least two-thirds of Instagram shoppers using the platform to discover these types of products. This is reflective of Instagram being popular among younger consumers (shown in Figure 3), who tend to be more avid purchasers of these categories in general. In addition, the visual nature of the platform dovetails with the image-driven nature of the fashion and beauty industries. In terms of purchasing, we see high numbers again for fashion and beauty, with almost two-thirds of Instagram shoppers saying they bought clothing, footwear and accessories on the platform and over half saying they had bought beauty products. [caption id="attachment_105251" align="aligncenter" width="700"] Base: 281 US Internet respondents age 18+ who use Instagram to discover products or research purchases, and 252 US Internet users aged 18+ who use Instagram to purchase products, surveyed in November 2019

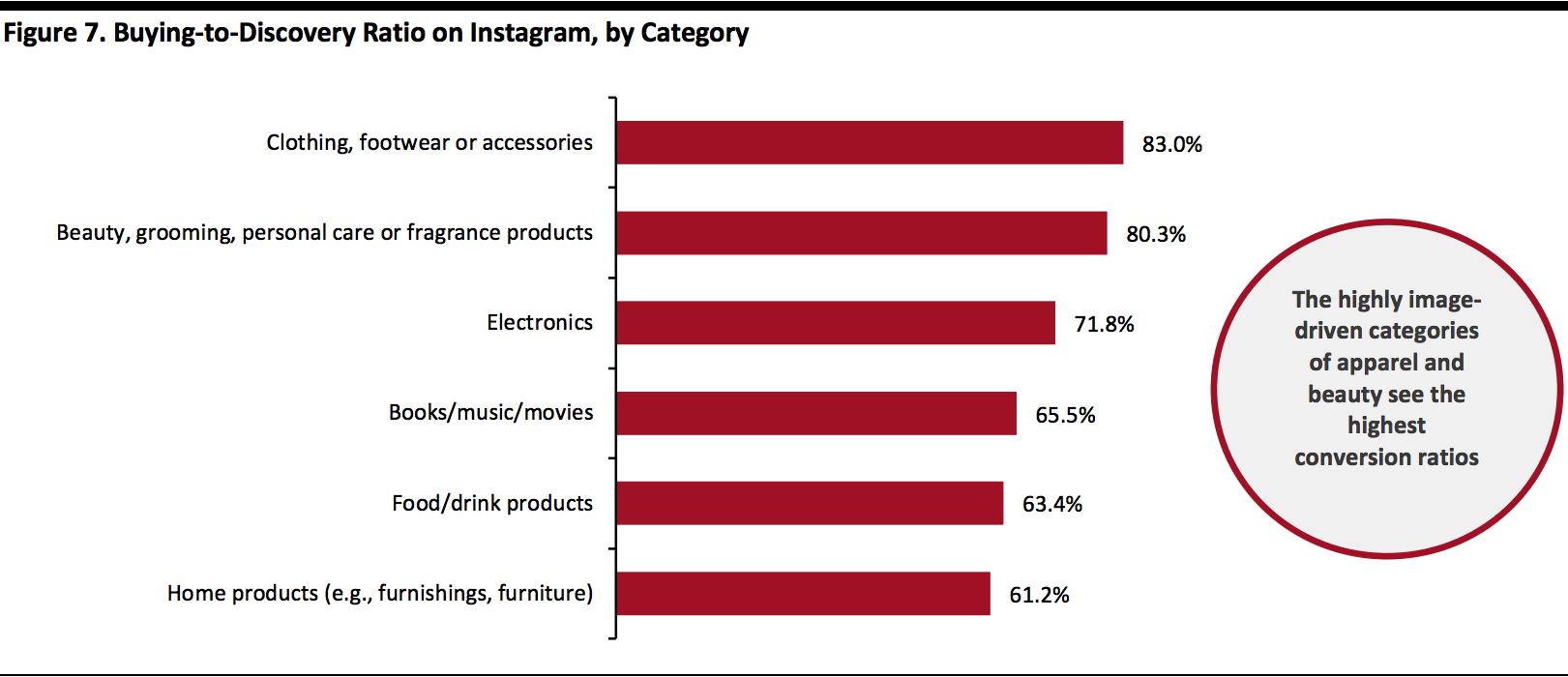

Base: 281 US Internet respondents age 18+ who use Instagram to discover products or research purchases, and 252 US Internet users aged 18+ who use Instagram to purchase products, surveyed in November 2019Source: Coresight Research[/caption] From our data on discovery versus purchasing, we can analyze the “buying-to-discovery” ratio by category—the proportion of those who make purchases on Instagram represented as a percentage of respondents who say they use the platform to discover or research products. Excluding the “other” category, the apparel and beauty segments lead in terms of discovery translating to purchasing on Instagram. This perhaps suggests that there is a bias of content and/or that key influencers are driving sales on Instagram in these categories (which we discuss later in this report). The high numbers could also be a product of the highly image-driven nature of the apparel and beauty industries, with inspirational visuals likely to prompt purchasing more than in other categories. The survey data suggests that Instagram is successful in prompting impulse-driven purchases in those frequently purchased, discretionary categories where aesthetics are key. Categories such as electronics or food, where other factors such as product specifications or ingredients, respectively, come into play, we see lower buying-to-discovery ratios. While being a strongly visual-driven category, home products sees the lowest conversion ratio on Instagram, potentially because furniture is not typically an impulse buy and customers value physical experience when making home-furnishing purchases. [caption id="attachment_105252" align="aligncenter" width="700"]

Conversion ratio shows the proportion of those who use Instagram to make purchases as a percentage of those who use Instagram for product discovery or research

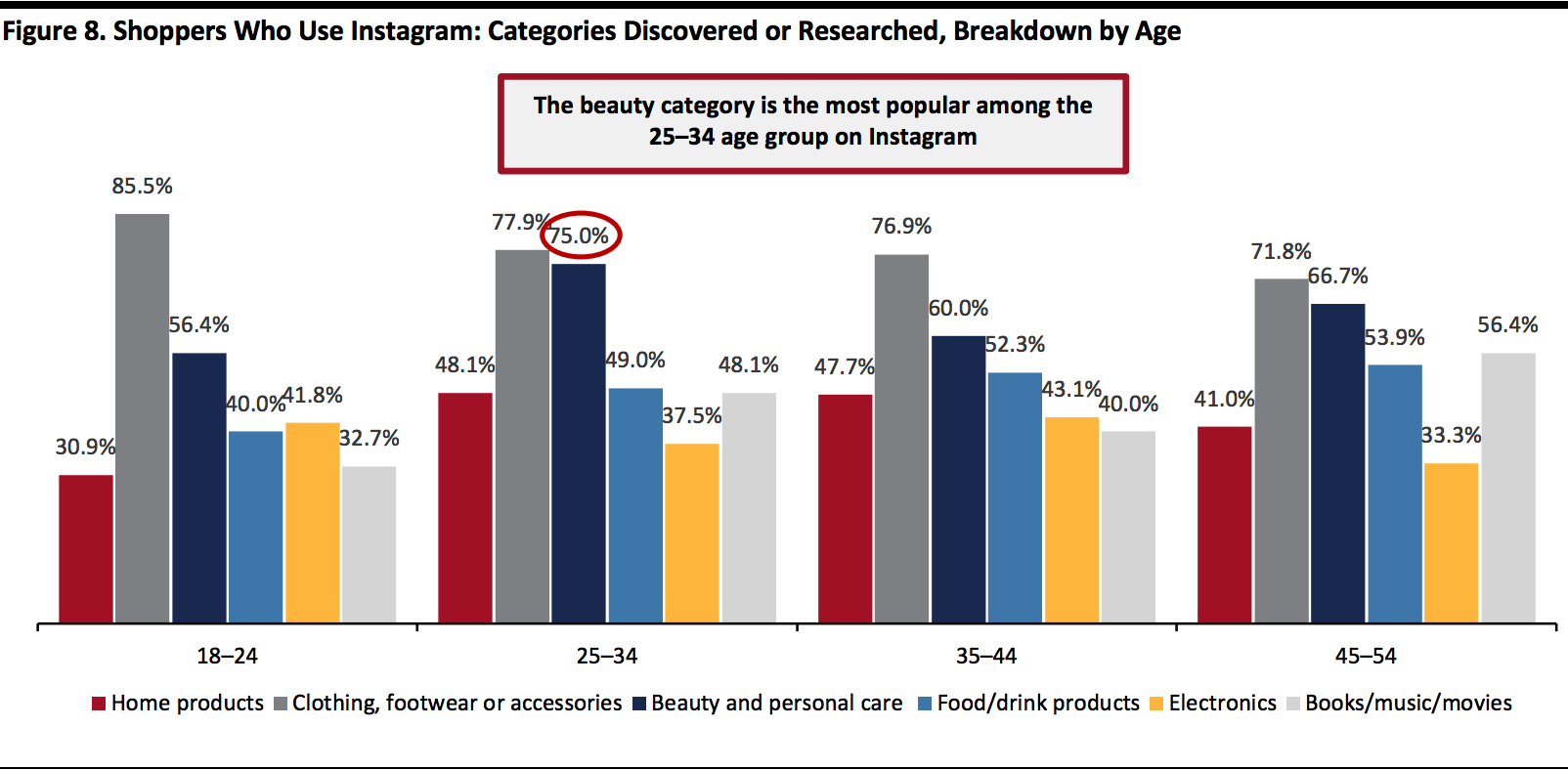

Conversion ratio shows the proportion of those who use Instagram to make purchases as a percentage of those who use Instagram for product discovery or researchSource: Coresight Research[/caption] Breaking down the numbers of shoppers who use Instagram to research or discover products, it is notable that beauty or personal care products peaked at 75.0% of Instagram shoppers aged 25–34 (shown in Figure 8). Brands and retailers can leverage this information to roll out marketing campaigns that leverage Instagram to specifically speak to these consumers. [caption id="attachment_105253" align="aligncenter" width="700"]

Not all age groups shown due to small sub-samples for some age groups

Not all age groups shown due to small sub-samples for some age groupsBase: 281 US Internet respondents age 18+ who use Instagram as part of the shopping process, surveyed in November 2019

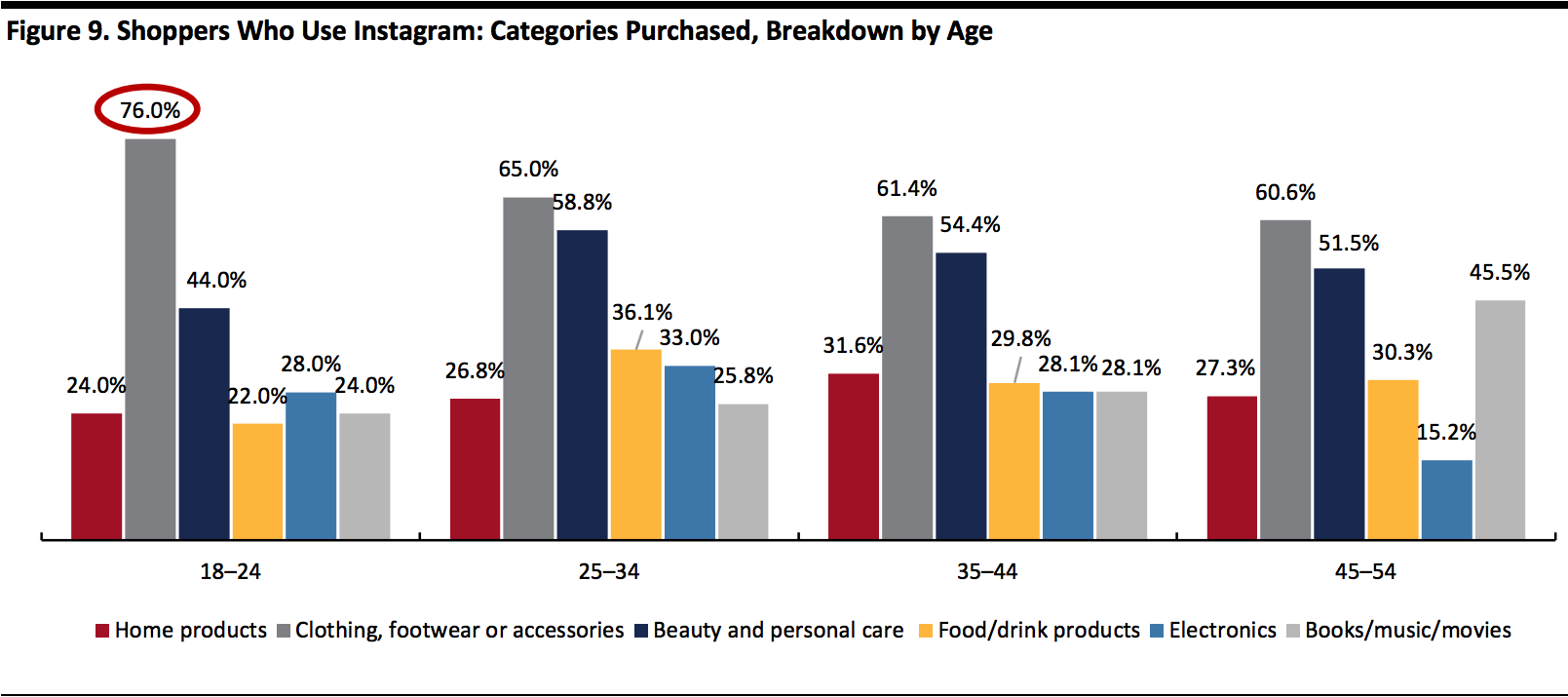

Source: Coresight Research[/caption] Aligning with the high conversion rate in the apparel category (shown in Figure 7) and the popularity of clothing in the 18–24 age group, purchasing of clothing was also highest among the youngest adult age group: Just over three-quarters of respondents who use Instagram as part of the shopping process aged 18–24 purchased clothing, footwear and accessories on Instagram. Of Instagram shoppers aged 25–34, 58.8% purchased beauty and personal care products, higher than their younger peer’s 44.0%, and mirroring the 25-34 age group being more likely to browse or research this category on Instagram (see above). [caption id="attachment_105254" align="aligncenter" width="700"]

Not all age groups shown due to small sub-samples for some age groups

Not all age groups shown due to small sub-samples for some age groupsBase: 252 US Internet respondents aged 18+ who use Instagram to purchase products, surveyed in November 2019

Source: Coresight Research[/caption]

The Power of Influencers

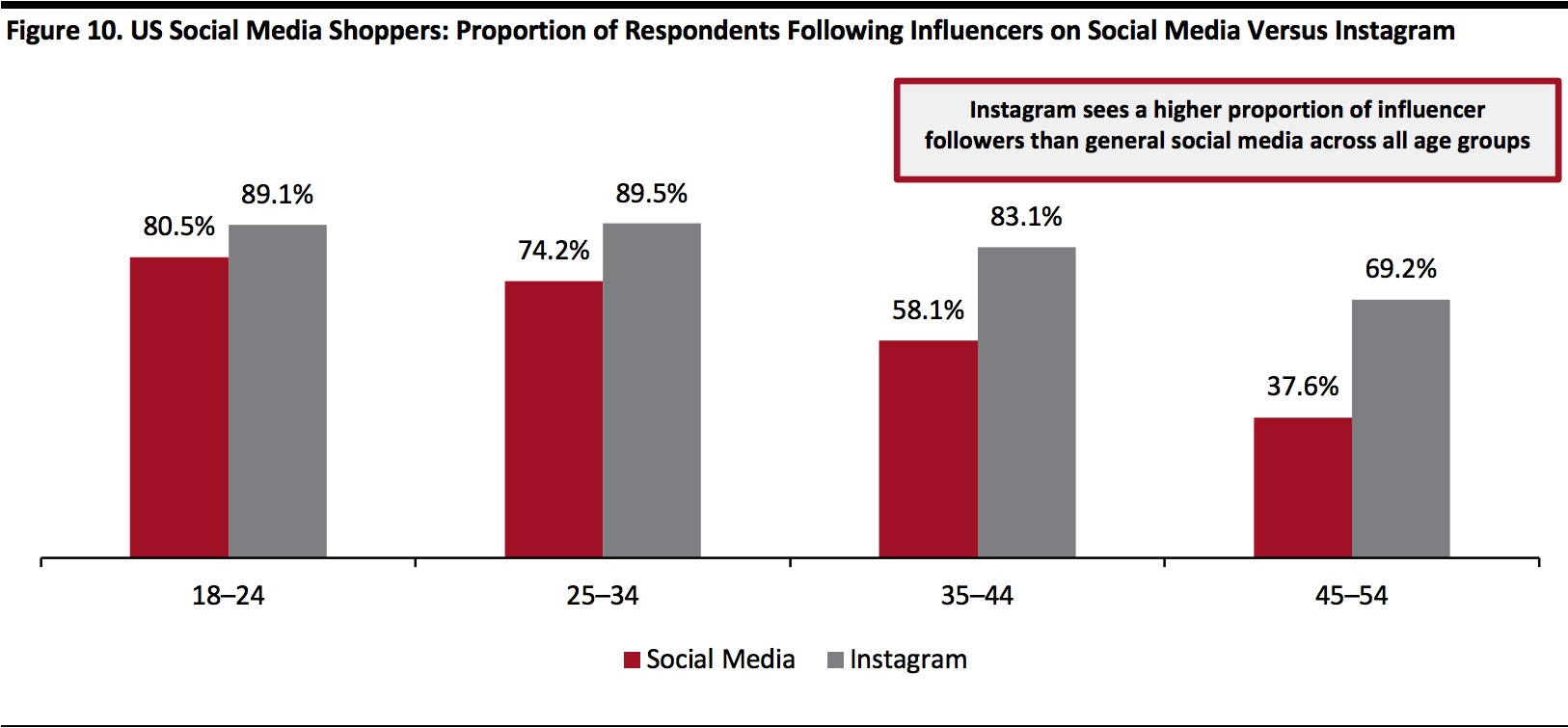

Our survey revealed that 51.6% of respondents who use social media as part of the shopping process follow influencers or celebrities on social media. The proportion decreases as age increases: Respondents aged 18–24 have the highest rate across all age groups, with 85% following influencers or celebrities on social media. The proportion of Instagram shoppers following influencers or celebrities is 82.6%, which is much higher than overall social media shoppers. As could be expected due to the trend mentioned above, the highest proportion of respondents that follow Instagram influencers are aged 25–34, followed by the 18–24 age group. However, it is interesting to note that the percentages only slightly drop off for the more mature age groups, compared to the low proportions of older respondents that follow influencers on social media in general (shown in Figure 10). A potential reason for Instagram achieving higher proportions of influencer followers than general social media could be that the platform is based around visual content—images and videos—which users may find more engaging and personable than the text-based nature of other social media. [caption id="attachment_105255" align="aligncenter" width="700"] Not all age groups shown due to small sub-samples for some age groups

Not all age groups shown due to small sub-samples for some age groupsBase: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019. Of those, 282 are Instagram shoppers who follow Instagram influencers.

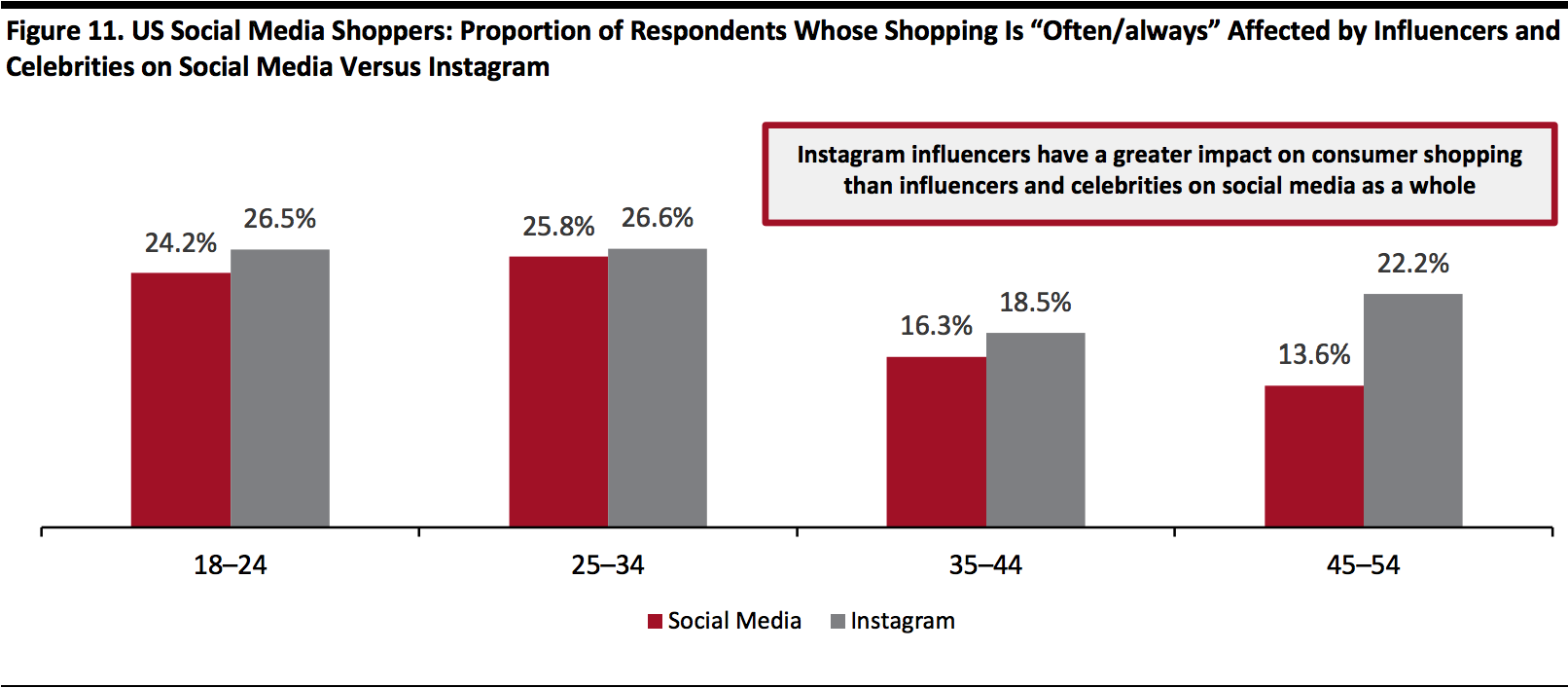

Source: Coresight Research[/caption] Social media influencers are shown to have an impact on consumer purchasing decisions. In addition to harnessing a higher proportion of followers than general social media, Instagram is outperforming other platforms in terms of its influencers driving consumer shopping behaviors: 23.6% of Instagram shoppers who follow influencers on the platform stated their shopping is “often/always” affected by influencers or celebrities on Instagram, which is more than the 19.7% of general social media shoppers who follow influencers. In terms of age groups, 26.5% of Instagram shoppers aged 18-24 stated that their shopping is “often/always” affected by influencers and celebrities, versus 24.2% of general social media shoppers. However, consumers aged 25–34 are most affected by influencers and celebrities, with 26.6% stating that influencers and celebrities “often/always” influence their shopping, versus 25.8% of them influenced by social media influencers. [caption id="attachment_105257" align="aligncenter" width="700"]

Not all age groups shown due to small sub-samples for some age groups

Not all age groups shown due to small sub-samples for some age groupsBase: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019. Of those, 282 are Instagram shoppers who follow Instagram influencers.

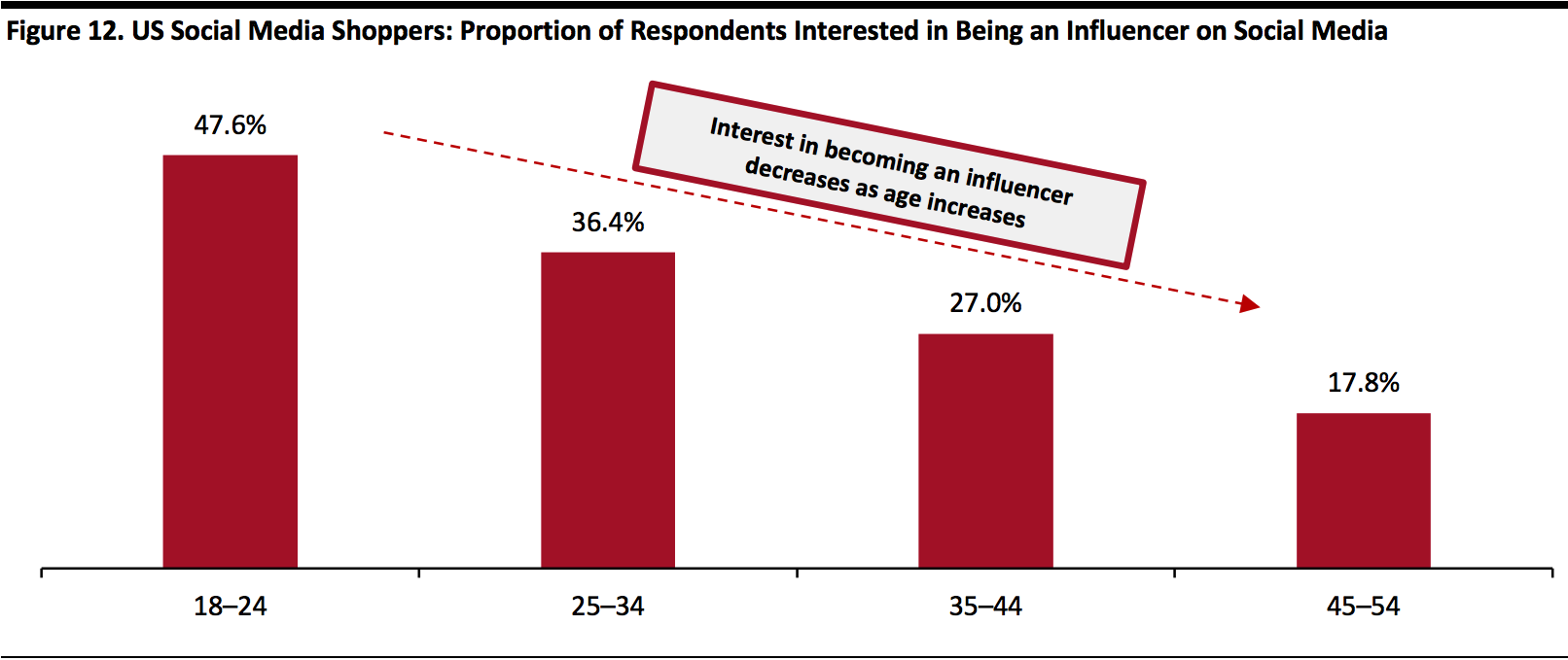

Source: Coresight Research[/caption] Because of the significant impact and popularity of influencers and celebrities, many people—especially younger generations—aspire to be influencers themselves. One-quarter of survey respondents who use social media as part of the shopping process confirmed that they want to be an influencer on social media, with interest peaking among younger social media shoppers—possibly more surprising is the scale of the peak: Almost half of 18–24 year olds would like to be an influencer. [caption id="attachment_105258" align="aligncenter" width="700"]

Not all age groups shown due to small sub-samples for some age groups

Not all age groups shown due to small sub-samples for some age groupsBase: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019.

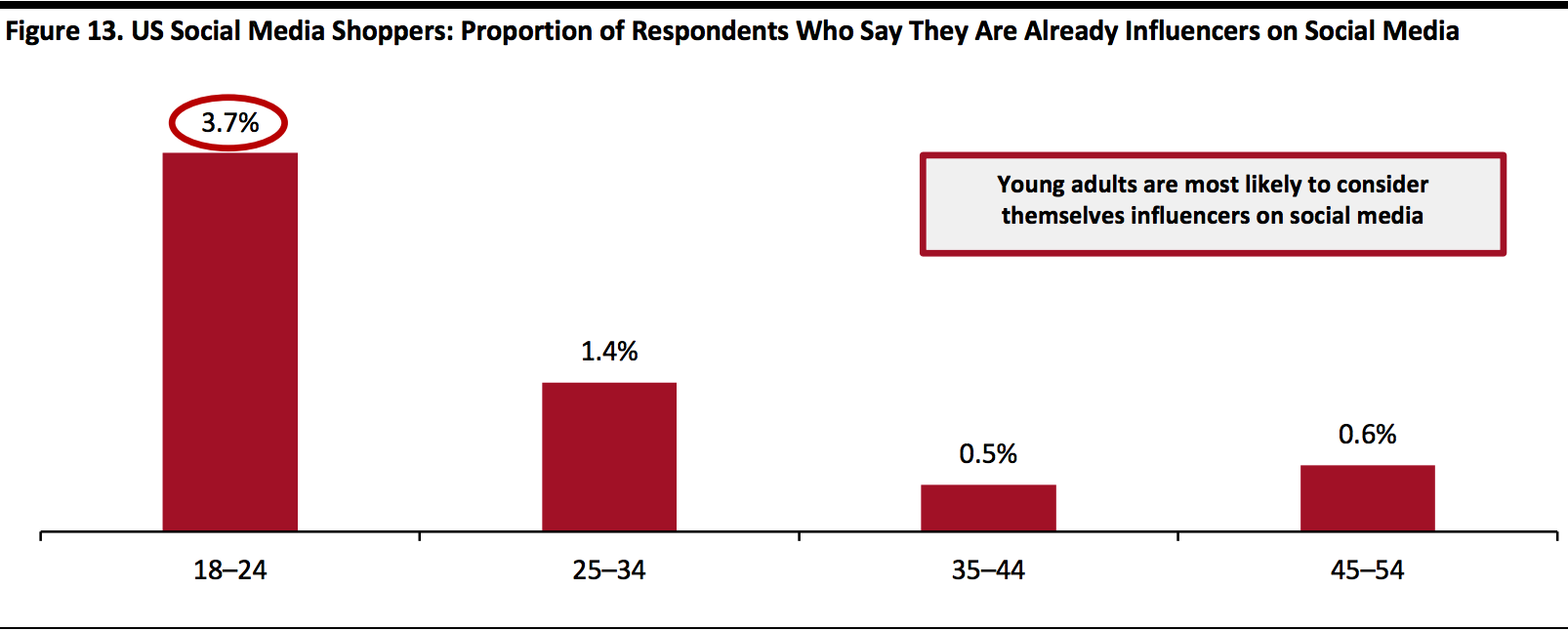

Source: Coresight Research[/caption] However, the distribution of respondents who say they are already influencers looks quite different to Figure 12. In total, 1.2% of respondents who use social media as part of the shopping process identify as influencers. Respondents aged 35–44 have the lowest proportion of influencers, while respondents age 65+ claimed the third-highest percentage, after the 25–34 age group. While 47.6% of the youngest adults are interested in becoming influencers, only 3.7% stated that they actually are. [caption id="attachment_105259" align="aligncenter" width="700"]

Not all age groups shown due to small sub-samples for some age groups

Not all age groups shown due to small sub-samples for some age groupsBase: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019

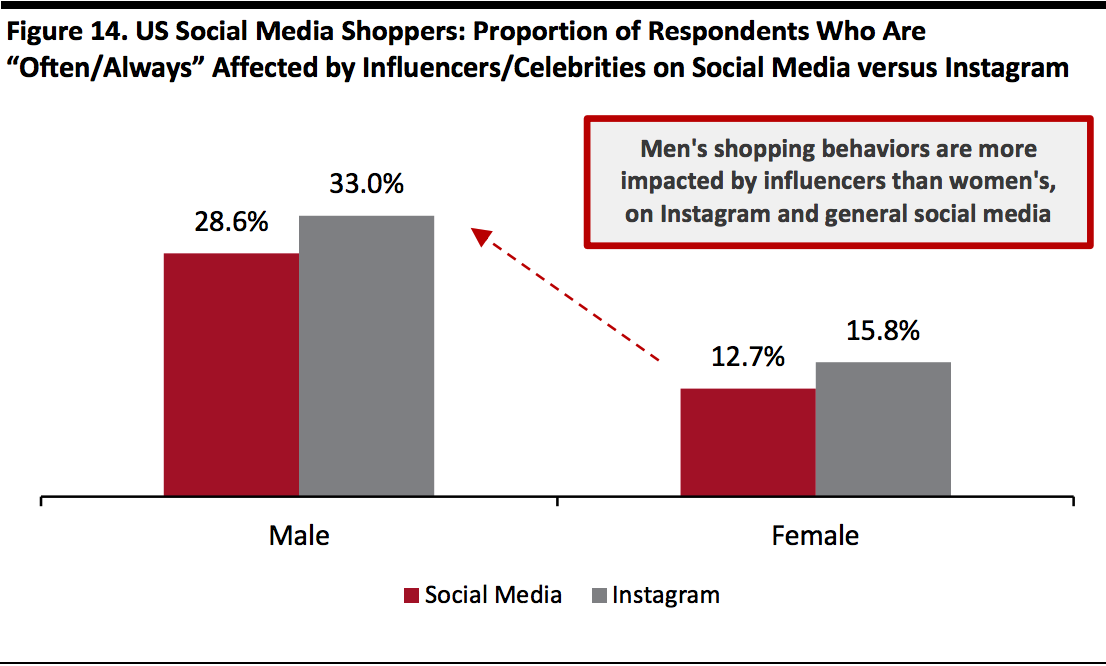

Source: Coresight Research[/caption] Men versus Women There’s a disparity between the impact of influencers on male and female social media shoppers. Male respondents seem to be more engaged with influencers, as a higher proportion of them stated that their shopping is “often/always” affected by influencers or celebrities compared to female respondents (shown in Figure 14). The rising casualization trend in workplace attire is resulting in new apparel categories, often called “workleisure” or “performance professional”. Driven by this casualization, men are venturing beyond suits and looking to social media influencers for fashion advice. Men are also more likely to engage with their peers on social media and Instagram for gaming and fitness advice. It is therefore not unexpected that Instagram influencers were shown in the survey results to have a higher impact on male respondents than female respondents. In addition, 33.0% of male Instagram shoppers say their shopping is “often/always” affected by Instagram influencers or celebrities, which is higher than the 28.6% of male social media shoppers who follow influencers. The same trend was observed in female respondents. [caption id="attachment_105260" align="aligncenter" width="580"]

Base: 441 US Internet respondents aged 18+ who use social media as part of the shopping process and follow influencers/celebrities, surveyed in 2019. Of those, 233 are Instagram shoppers who follow Instagram influencers.

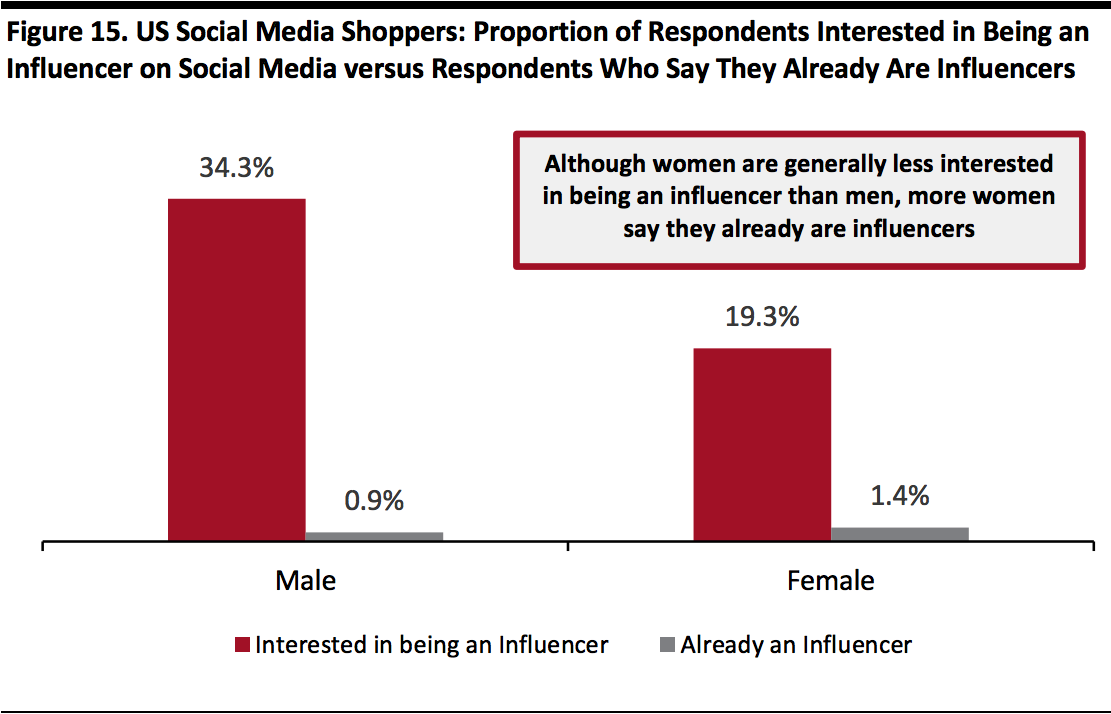

Base: 441 US Internet respondents aged 18+ who use social media as part of the shopping process and follow influencers/celebrities, surveyed in 2019. Of those, 233 are Instagram shoppers who follow Instagram influencers.Source: Coresight Research[/caption] In addition, 34.3% of male respondents stated that they are interested in being an influencer on social media, which is a much higher proportion than the 19.3% of female respondents. However, only 0.9% of male respondents claimed to be influencers already, versus 1.4% of female respondents. It may be that fewer male influencers have a larger influence individually than the higher proportion of female influencers. However, these numbers could suggest that it is more difficult for men to be recognized as influencers on social media than it is for women. [caption id="attachment_105261" align="aligncenter" width="580"]

Base: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019

Base: 854 US Internet respondents aged 18+ who use social media as part of the shopping process, surveyed in November 2019Source: Coresight Research[/caption]