Nitheesh NH

What’s the Story?

While gift cards carry many benefits for retailers, they have unique and distinct accounting requirements under FASB’s updated revenue recognition model, known as ASC 606 (Accounting Standards Codification), Revenue from Contracts with Customers. The ASC 606 guidance aims at bringing uniformity to breakage calculations and recordings in financial statements, where retailers previously took varying approaches.

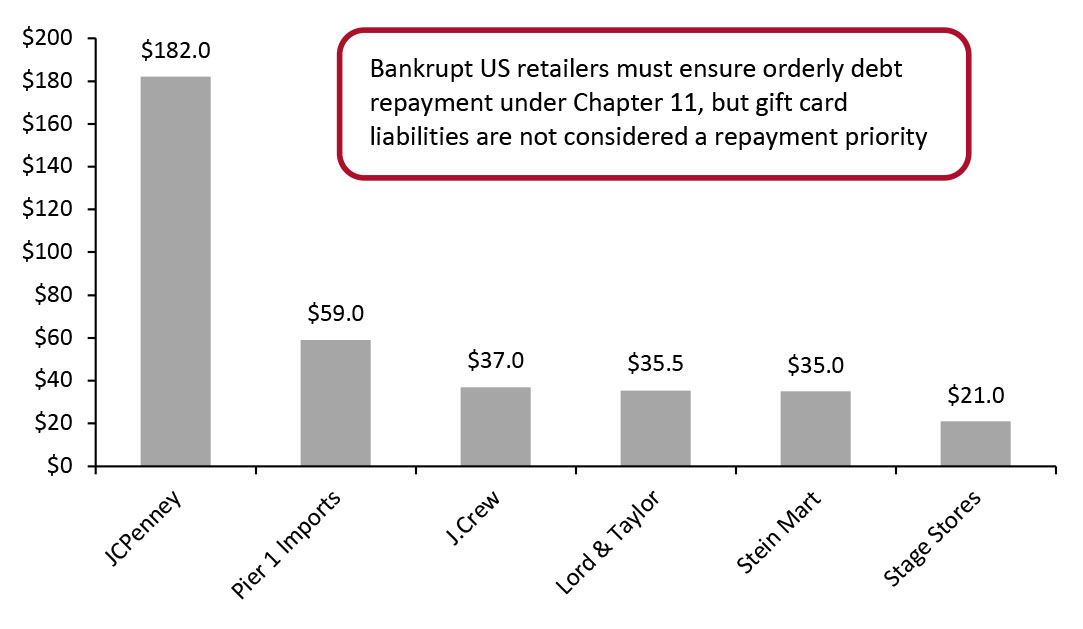

Understanding gift card accounting is increasingly important owing to the recent surge in retail bankruptcies—bankrupt retailers JCPenney, J.Crew and Pier 1 Imports individually held tens of millions of dollars as outstanding gift card liabilities when they filed.

This report assesses how US retailers account for gift cards under the updated FASB revenue recognition model in detail. We also discuss unclaimed state property or “escheat” laws, which may require retailers to hand over unredeemed balances to the government in instances where customers do not demand gift card redemption.

Why It Matters

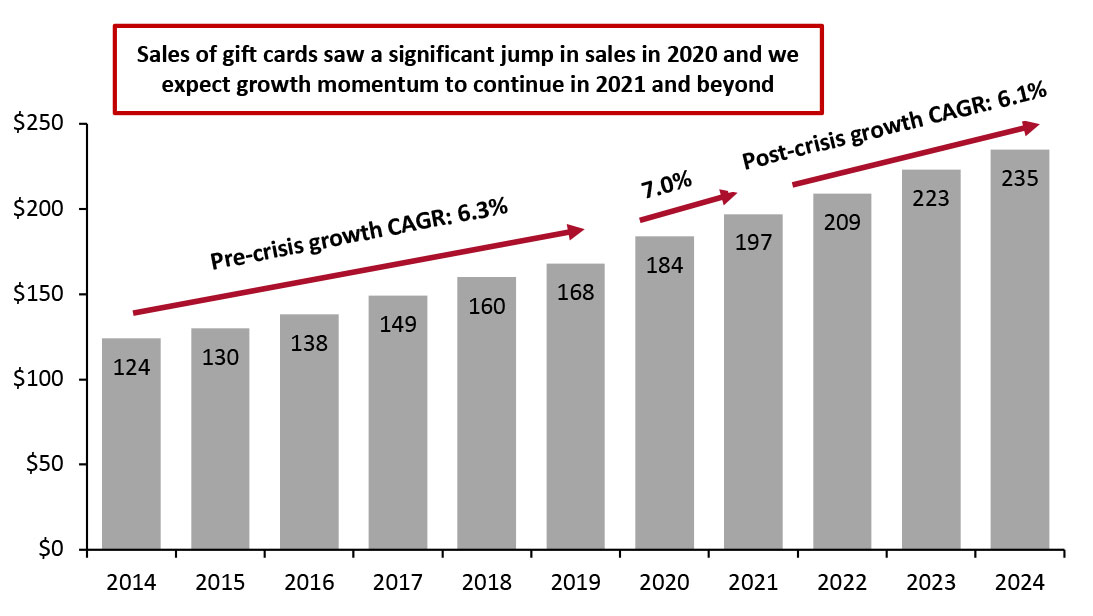

Coresight Research estimates that the US gift cards market grew 9.5% year over year in 2020 to $184 billion. The surge in gift card sales in 2020 was led by a rise in sales of gift cards purchased online, which can be attributed to consumers shifting to e-commerce amid the pandemic and their suitability as “virtual” gifts. In 2021, against strong comparatives, growth will remain robust at 7.0% as we expect online shopping momentum to continue and the demand for gift cards to remain solid. We expect gift card sales to grow consistently to reach $235 billion by the end of 2024, at a CAGR of 6.1% between 2021 and 2024.

Gift cards are therefore becoming a more significant source of revenue for retailers and a strong catalyst for bolstering consumer spending on items, with many consumers prepared to pay the difference between the gift card value and the product price in cash. Furthermore, gift cards provide strong opportunities for new retailers to introduce themselves to consumers.

Retailers should be familiar with the accounting process for gift cards and evaluate potential impacts, including tax implications, before offering them to consumers. While accounting for sale and redemption of gift cards is typically simple, accounting for unredeemed gift cards, as we discuss in detail in the next section, can be challenging.

Figure 1. Estimated US Gift Cards Market Size (USD Bil.) [caption id="attachment_123698" align="aligncenter" width="725"] Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Gift Card Accounting: In Detail

Accounting Entries for Sales and Redemption of Gift Cards Under FASB’s Updated Guidance

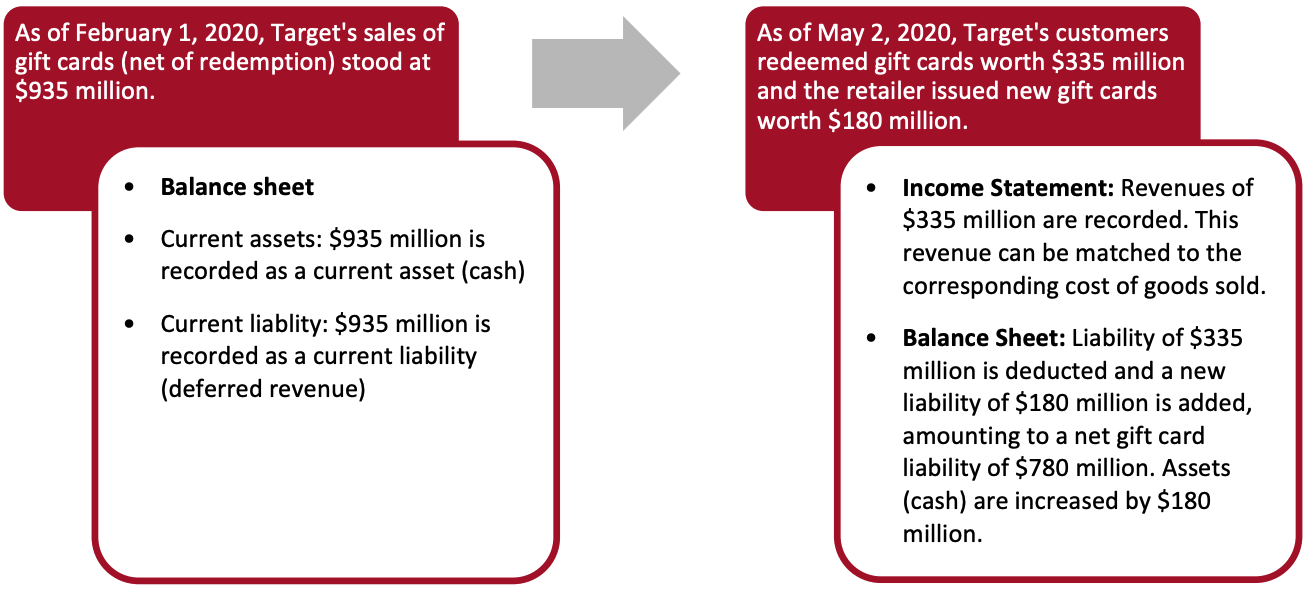

While there are changes to accounting for unredeemed gift cards under FASB’s ASC 606 guidance—as we discuss below—the guidance on sales and redemptions of gift cards remains consistent with legacy US Generally Accepted Accounting Principles (GAAP), which are the guiding rules and standards that have been set by the FASB and adopted by accounting professional across the US:

• Sale of a gift card: This is a debit to cash (increase in asset) and credit to deferred revenue (increase in liability) in the retailer’s balance sheet as the retailer has an obligation to provide goods or service at a later date.

• Redemption of a gift card: The revenue from redeemed gift cards is recorded in the retailer’s income statement and liability is decreased by the redeemed amount in the balance sheet.

Figure 2. Sale and Redemption of Gift Cards: Example of Target

[caption id="attachment_123651" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Accounting Entries for Unredeemed Gift Cards

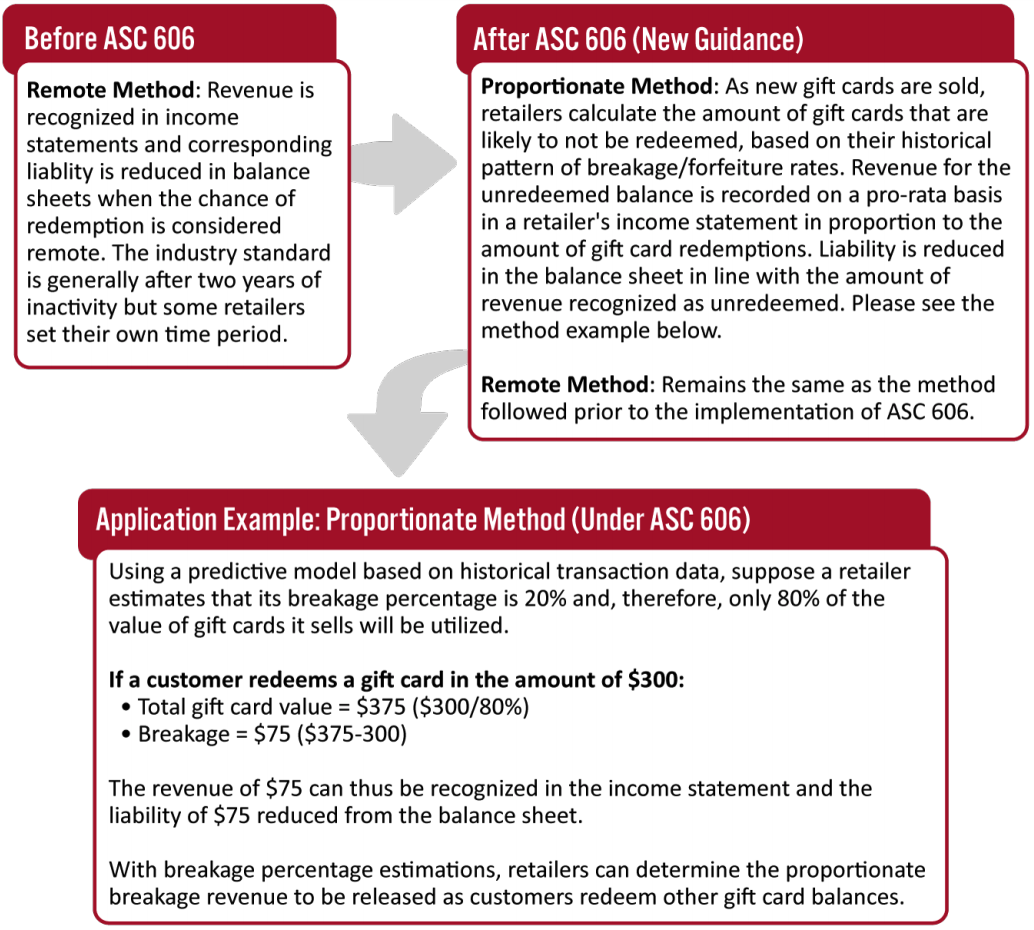

Most US retailers, including Target and Walmart, issue gift cards with no expiration date—meaning that their legal obligation to provide goods and services never expires. Therefore, these retailers must account for the dollar amount of gift cards that are unredeemed, which is generally referred to as breakage. If breakage is not dealt with, gift cards will remain a liability in retailers’ balance sheets indefinitely.

ASC 606 implements two methods for systematically recognizing breakage revenue in income statements: The Proportionate Method and The Remote Method. Both methods are discussed in Figure 3; however, before moving onto our breakage analysis, US retailers should note unclaimed state property or “escheat” laws, which may require them to hand over unredeemed balances to the government in instances where customers do not demand gift card redemption.

Escheat Law

Escheat refers to the right of a government to acquire ownership of unclaimed property or assets. In the US, the government gains escheat rights when assets, such as gift cards, are unclaimed for a prolonged period of time. The escheat law is based on the concept that assets or property always have a recognized owner, which defaults to the government if no other claimants to ownership are identified or exist.

In the US, unclaimed property laws vary across the country’s 50 states as well as in Guam, Puerto Rico, the District of Columbia and the US Virgin Islands. Nearly half of US states require that unused gift card funds be sent to state control after a mandated period—usually three to five years—with the stated purpose of returning the unused money to consumers. While some gift cards are completely exempt from unclaimed property laws in some states, such as Arizona, Arkansas, California and Connecticut, other states—including Alabama, Alaska and Colorado, require a portion of the unredeemed gift card to be escheated. With each state handling escheat laws differently, retailers could face jurisdictional issues. Retailers should be mindful of escheat laws applicable to them and ensure complete compliance.

Figure 3. Before and After ASC 606: Accounting for Unredeemed Gift Card Balances

[caption id="attachment_123652" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

ASC 606 Adoption Timeline

• Public companies: The ASC 606 update became effective for annual reporting periods beginning after December 15, 2017.

For public retailers that have adopted the updated revenue standard, analyzing the domino effects of this guidance on their financial statements is significant. Understanding retailers’ liabilities toward consumers with gift cards is particularly important in the current retail landscape as we are witnessing a surge in retail bankruptcies.

• Non-public companies: The model became effective for annual reporting periods beginning after December 15, 2018, and for interim reporting periods within annual reporting periods beginning after December 15, 2019. Moreover, on June 3, 2020, the FASB issued ASU 2020-05 to amend the ASC 606 guidance and defers the effective date of ASC 606 standard for non-public companies for one year. The deferrals apply to only non-public companies that had not issued their financial statements or not made them available for issuance, as of June 3, 2020.

As such, for private retailers with interim reporting periods within annual reporting periods beginning after December 15, 2020, the application of the ASC 606 update is a fairly recent development—it is important that retailers selling gift cards understand the accounting treatment of this guidance and evaluate the financial and tax implications of their gift card programs.

US retailers can implement the ASC 606 guidance retroactively with two options:

1 Full retroactive transition: Restatement of financial statements from all prior periods

2 Modified retroactive transition: A cumulative-effect adjustment to the opening balance of retained earnings (net profit minus dividend), as of the date of initial application

Why Was the Overhaul of Financial Reporting Necessary?

Before ASC 606, gift card accounting methods were designed for a cash-based economy, where payment is made in exchange for products and services in a one-time transaction. There was no revenue standard that recognized or reported recurring revenues for unredeemed gift cards. Recurring revenue is a key metric for the evaluation of a retailer’s financial performance, which helps potential investors to understand a retailer’s business potential.

Furthermore, the ASC 606 Standard creates uniformity across gift card accounting through the convergence between the US GAAP and the International Financial Reporting Standards (IFRS). The International Accounting Standards Board (IASB) issues the IFRS to create common accounting rules and guidelines that increase transparency in the presentation of financial information.

Gift Card Accounting by Leading US Retailers

Amazon, Target and Walmart are leading issuers of gift cards in the US and have successfully adopted the updated ASC 606 guidance. All of these retailers use proportionate method under the updated guidance (see Figure 3 above) to account for unredeemed gift cards.

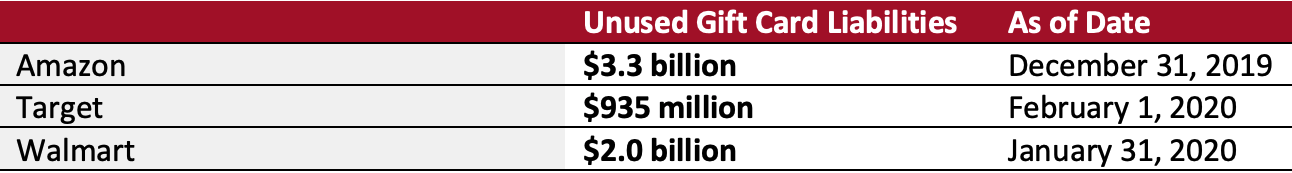

In the US, around 3% of gift card money goes unused every year, translating to billions of dollars, according to Coresight Research’s estimates. Amazon, Target and Walmart combined held over $6 billion in unused gift cards in their balance sheets as of each of their last reported fiscal year.

Figure 4. Unused Gift Card Liabilities of Amazon, Target and Walmart

[caption id="attachment_123653" align="aligncenter" width="720"] Source: Company reports[/caption]

Source: Company reports[/caption]

Retailers’ Liabilities: Bankruptcies and Liquidations

In the US, 2020 saw a surge in pandemic-induced retail bankruptcies. Many bankrupt US retailers had tens of millions of dollars in gift card balances, or outstanding liabilities, when they filed in bankruptcy court. Nevertheless, US retailers are not legally liable to honor gift cards on demand, as the payment of most pre-bankruptcy debts is put on hold by the US bankruptcy court to ensure orderly debt repayment through liquidation or a Chapter 11 plan.

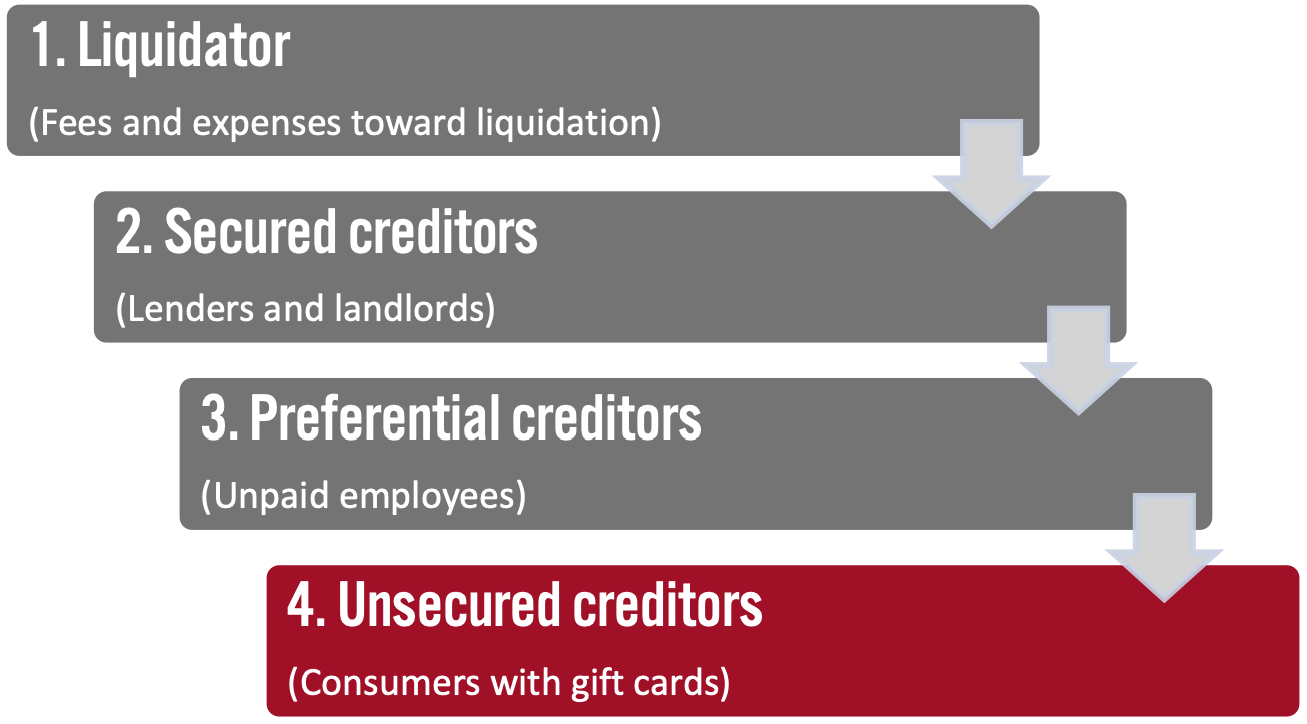

In cases of retailer liquidations, the gift card issue becomes more contentious. Consumers with gift cards are considered unsecured creditors and are a low priority for creditor payment.

Figure 5. Creditor Payments in US Retailers’ Liquidation, by Priority

[caption id="attachment_123654" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Despite the absence of legal liability, many bankrupt retailers seek the court’s approval to honor gift cards as a gesture of goodwill—JCPenney, J.Crew and Pier 1 Imports are among the bankrupt retailers that filed such notions in 2020.

Some liquidating retailers may put a time limit on redeeming gift cards. For example, as a part of its liquidation process following filing for bankruptcy protection in January 2020, stationery and greeting card retailer Papyrus gave customers 30 days to redeem their gift cards.

Figure 6. Selected US Retailers’ Outstanding Gift Cards Liabilities, as of Bankruptcy Filing (USD Mil.)

[caption id="attachment_123700" align="aligncenter" width="725"] Source: US Bankruptcy Court[/caption]

Source: US Bankruptcy Court[/caption]

What We Think

The updated FASB guidance has changed the way that retailers must account for revenue from gift cards. Non-public companies must ensure compliance with the standard for their next interim reporting period, in respect of the December 15, 2020 implementation deadline.

Implications for Brands/Retailers

• Retailers and brand owners should ensure that the key attributes and objectives of internal controls are revised to address the financial reporting and tax implications of the updated guidance.

• Retailers that use third-party service providers to maintain gift card records must ensure that they have access to all necessary details and historical information for each gift card transaction to successfully implement the proportionate method of ASC 606 guidance.

• Retailers and brands should review and make changes to their existing gift card programs and practices to ensure compliance with state escheat laws. Furthermore, a better understanding of business operations that result in the sale of gift cards can help retailers to ensure correct implementation of the updated guidance. Retailers would benefit from enabling automation of front-end systems that eliminate conflicts of interest among reporting departments throughout the quote-to-cash process, which encompasses accounts receivable, account management, billing, order fulfillment and sales functions.

• Retailers should use a predictive model to forecast the value of gift cards likely to go unused and how much of that unused value may be escheated. To build a reliable model, retailers need access to complete and accurate historical information, and the mathematical modeling capabilities to design a training process and feed in the new results. The model needs to be updated on a regular basis, ideally quarterly and annually at least.

• Best practice for retailers is to compute the breakage/forfeiture rate separately for each type of gift card, owing to differences in the redemption rate. For example, a regular direct-to-consumer sale of a gift card in a store will have different redemption rates to bulk sales to warehouse retailers.

• For new retailers, where historical data are not available, management can forecast the gift card forfeiture rate based on industry data or public financial statements for retailers in the same market.

• Retailers should implement a suitable gift card monitoring system to continuously track redemptions and analyze actual forfeitures on gift cards to ensure appropriate breakage estimation. Furthermore, having a reliable monitoring system helps to provide a full picture of outstanding amounts, ensure compliance with accounting rules and lighten end-of-year financial reporting stress.