DIpil Das

What’s the Story?

The Covid-19 pandemic has amplified the ongoing digital disruption in the retail industry. As online demand has exploded, so too have the pressures on the last mile—i.e., the delivery process of getting the product into the hands, or onto the doorstep, of the consumer. We expect raised levels of e-commerce adoption to be a lingering effect of the crisis and that heightened consumer expectations around fulfillment will compound the need for retailers to invest in last-mile capabilities. Coresight Research has identified last-mile evolution as one of the key trends to watch in 2021. In this report, we discuss four technological innovations that US retailers are implementing to increase the efficiency of their last-mile logistics operations and thus gain a competitive advantage.Why It Matters

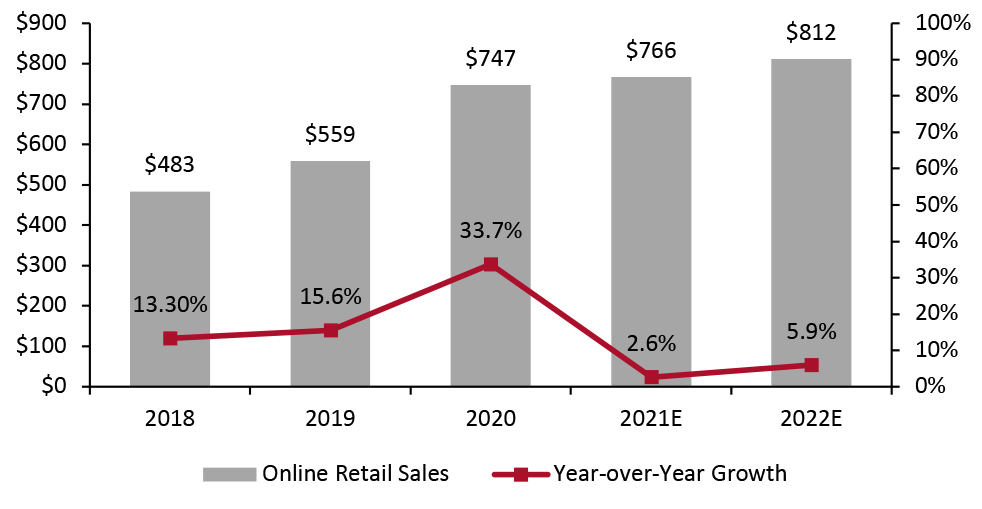

The pandemic has rapidly accelerated the e-commerce pivot. US online retail sales surged 33.7% year over year in 2020, and Coresight Research estimates that sales will see low-single-digit growth in 2021, taking the market to around $766 billion (see Figure 1).Figure 1. US Online Retail Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_125218" align="aligncenter" width="725"]

Total data exclude online sales by automobile dealers

Total data exclude online sales by automobile dealers Source: US Census Bureau/Coresight Research [/caption] We believe that the online channel will hold permanent gains as consumer habits of shopping online become embedded beyond the pandemic: The Coresight Research US Consumer Tracker consistently finds that over one-third of survey respondents expect to buy more online and less in stores once the crisis ends. This shift in consumer shopping behavior will galvanize retailers to enhance their last-mile capabilities will technological innovations in order to thrive in a post-pandemic future.

Technological Innovations in the Last Mile: A Deep Dive

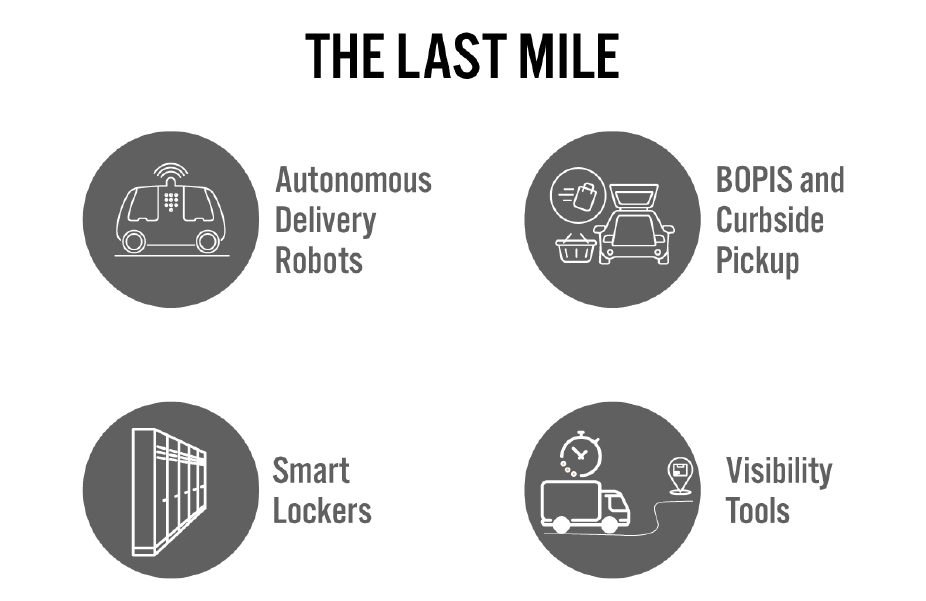

We identify four key innovations that are changing the face of retail’s last-mile ecosystem (summarized in Figure 2). We present an overview of each technology, recent developments and case studies, highlighting relevant retailers and technology vendors. We also discuss an outlook for the future adoption of each innovation.Figure 2. Key Innovations in Retail’s Last-Mile Ecosystem, 2021 and Beyond [caption id="attachment_125219" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

1. Autonomous Delivery Robots

We see a number of reasons why autonomous delivery robots are posed for widespread adoption:

In the US, online sales of prepared food for delivery are expected to total $28.49 billion in 2021, up 7.4% year over year, according to Statista.

According to a study published by the World Economic Forum in January 2020, urban last-mile delivery emissions are set to rise by 32% in 100 cities by 2030. Introducing autonomous delivery robots can significantly help retailers and logistics firms to drive down their carbon footprint and achieve their corporate sustainability targets.

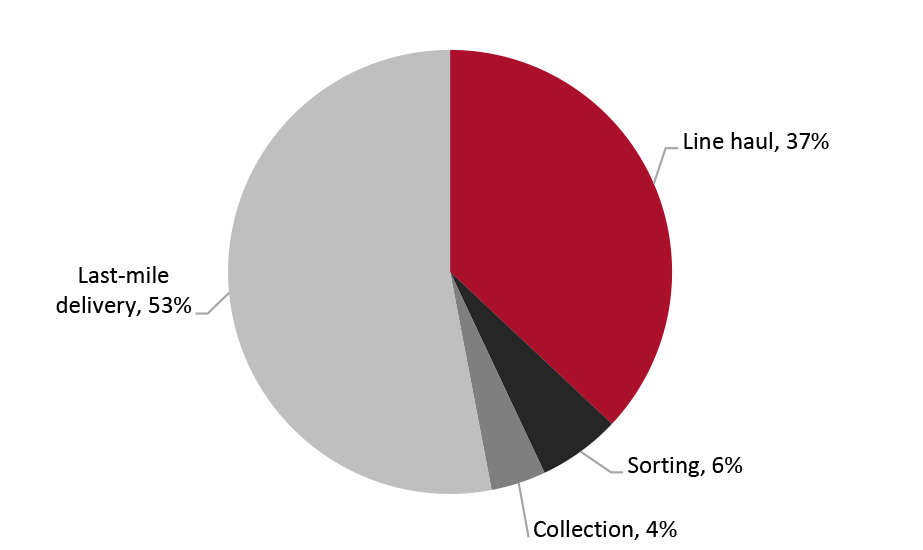

Last-mile delivery is the most expensive part of the supply chain. According to automation solutions provider Honeywell, last-mile delivery costs account for 53% of total shipping costs (see Figure 3). Adopting autonomous robots can slash the cost of last-mile deliveries, from $1.60 per delivery (via human drivers) to $0.06 per delivery, according to Robotics Business Review.

Source: Coresight Research[/caption]

1. Autonomous Delivery Robots

We see a number of reasons why autonomous delivery robots are posed for widespread adoption:

In the US, online sales of prepared food for delivery are expected to total $28.49 billion in 2021, up 7.4% year over year, according to Statista.

According to a study published by the World Economic Forum in January 2020, urban last-mile delivery emissions are set to rise by 32% in 100 cities by 2030. Introducing autonomous delivery robots can significantly help retailers and logistics firms to drive down their carbon footprint and achieve their corporate sustainability targets.

Last-mile delivery is the most expensive part of the supply chain. According to automation solutions provider Honeywell, last-mile delivery costs account for 53% of total shipping costs (see Figure 3). Adopting autonomous robots can slash the cost of last-mile deliveries, from $1.60 per delivery (via human drivers) to $0.06 per delivery, according to Robotics Business Review.

Figure 3. Breakdown of Average Logistics Costs of a Shipment [caption id="attachment_125220" align="aligncenter" width="725"]

Source: Honeywell[/caption]

Recent Developments

Many large retailers are already testing some form of autonomous ground-delivery solutions.

Source: Honeywell[/caption]

Recent Developments

Many large retailers are already testing some form of autonomous ground-delivery solutions.

- On July 21, 2020, Amazon announced that it had rolled out Amazon Scout, an autonomous delivery robot vehicle, to two new markets in the US: Atlanta, Georgia and Franklin, Tennessee. Amazon Scout is a watertight, six-wheeled, cooler-sized vehicle built to deliver small packages. Amazon has already been testing the Scout in two other locations: Irvine, California and Snohomish, Washington. The company said that it used the service to help meet high customer demand in the test areas during the pandemic, in conjunction with its existing fleet of delivery vehicles.

- Kroger and Walmart have been testing a self-driving robot by robotics startup Nuro, delivering groceries and other small goods—and Nuro tested its second-generation delivery robot, R2, with the two retailers in 2020. Nuro also partnered with CVS in June 2020 to test prescription delivery in Houston. Nuro’s compact vehicles operate as small driverless cars with four cargo holds and can transport groceries, food and other retail products.

- Starship Technologies partnered with Save Mart Companies in September 2020, its first grocery partner in the US, to autonomously deliver from its flagship store in Modesto, California.

Starship’s autonomous delivery robots

Starship’s autonomous delivery robots Source: Starship Technologies [/caption] Although it is not autonomous technology, one notable example of the adoption of robots in last-mile delivery is the March 2021 partnership between Albertsons and technology startup Tortoise. The retailer has launched a pilot program at three Safeway stores in North Carolina, which will see remote-controlled delivery carts make scheduled drop-offs to customers within an approximately five-kilometer radius. The retailer plans to scale up the use of the robots to more stores if the pilot is successful. Retailers are also testing drones/aerial robots. Large technology companies such as Alphabet, Amazon and UPS and have been investing significantly in drone delivery projects in recent years and are among the first companies to secure FAA approval as official drone airlines, allowing them to commence trial deliveries under strict guidelines.

- Walgreens, which began a trial drone service with Alphabet’s Wing in September 2019, saw drone deliveries increase five times in April 2020 compared to February 2020, and it expanded the eligible product list for drone deliveries to approximately 100–155 items during lockdowns.

- Walmart launched a pilot program with drone operator Flytrex in September 2020 to deliver select grocery and household items from Walmart stores in Fayetteville, North Carolina.

- In March 2020, Michigan-based robotic startup Refraction AI announced that it had raised $4.2 million in new funding led by venture capital firm Pillar VC. The company said that it will use the capital for customer acquisition, product development and geographic expansion.

- In November 2020, Nuro announced that it has secured $500 million in a Series C funding round led by T. Rowe Price Associates, with participation from new investors, including Baillie Gifford and Fidelity Management & Research Company.

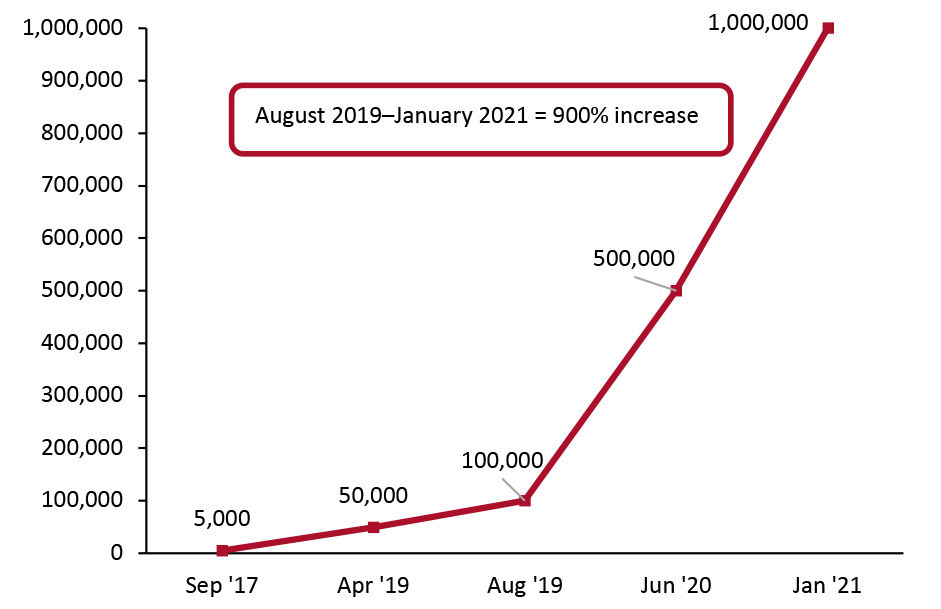

- In January 2021, Starship Technologies announced that it had raised $17 million in funding, led by investors Goodyear Ventures and TDK Ventures. The technology provider was founded in 2014; it took five years to reach 100,000 deliveries. However, the pandemic supercharged its growth: In January 2021, Starship Technologies achieved a milestone of 1 million autonomous deliveries, representing a 900% increase over August 2019. The company has more than doubled its fleet of delivery robots to roughly 1,000 in 2020, with plans to add thousands more over the course of 2021.

Figure 4. Starship Technologies: Cumulative Deliveries by Autonomous Robots, Worldwide [caption id="attachment_125222" align="aligncenter" width="725"]

Source: Starship Technologies[/caption]

Outlook

As the technologies and deep-learning algorithms powering autonomous robots have improved, costs have declined. For example, the average cost of Lidar (light detection and ranging), a primary component in delivery robots, has dropped precipitously in recent years—from approximately $85,000 in 2014 to below $10,000 in 2020. As costs continue to fall, the return on investment is growing more attractive, especially for grocers, where repetitive deliveries could help them achieve economies of scale on their investments. As the technology evolves, delivery robots would be capable of completing multiple deliveries in a single trip.

Although autonomous delivery is poised for growth, challenges remain. Regulators have shown a willingness to cut red tape and allow robot fleets to help consumers who had Covid-19, but there are currently no federal guidelines for autonomous delivery robots, with each US state making their own rules, creating a lot of ambiguity. While some states have formalized regulations for the deployment of autonomous robots in real-world applications, others have not put in place any regulations to test autonomous vehicles, making it difficult for the technologies to be rolled out nationwide.

Autonomous delivery robots promise faster, cheaper and more sustainable deliveries, but their deployment has not typically progressed past the pilot phase. The market is poised to shift quickly as consumer acceptance of robots grows, owing to increased demand for contactless deliveries due to the pandemic.

2. BOPIS and Curbside Pickup

Pickup is fast becoming a preferred mode for customers who place orders online. Retailers of all types have ramped up their BOPIS and curbside-pickup services as a safe and convenient alternative to in-store shopping in the age of social distancing. These services are less margin-erosive for retailers than delivery, and many price-conscious consumers also prefer BOPIS and curbside pickup to delivery as assessed fees are typically lower than those on delivery orders.

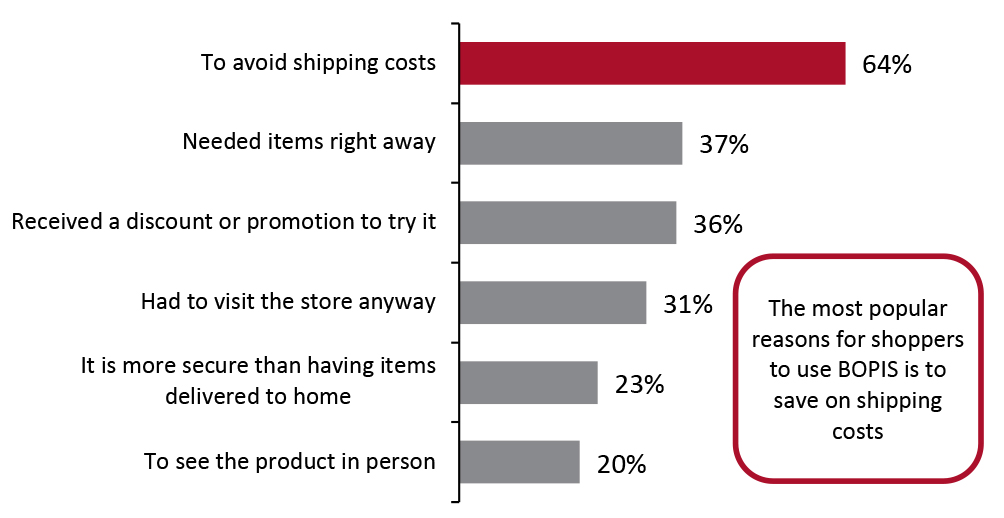

Among US shoppers, the top reason for using BOPIS and curbside-pickup services is to avoid shipping costs, ahead of needing items right away, according to a survey conducted by the National Retail Federation (NRF) in January 2019.

Source: Starship Technologies[/caption]

Outlook

As the technologies and deep-learning algorithms powering autonomous robots have improved, costs have declined. For example, the average cost of Lidar (light detection and ranging), a primary component in delivery robots, has dropped precipitously in recent years—from approximately $85,000 in 2014 to below $10,000 in 2020. As costs continue to fall, the return on investment is growing more attractive, especially for grocers, where repetitive deliveries could help them achieve economies of scale on their investments. As the technology evolves, delivery robots would be capable of completing multiple deliveries in a single trip.

Although autonomous delivery is poised for growth, challenges remain. Regulators have shown a willingness to cut red tape and allow robot fleets to help consumers who had Covid-19, but there are currently no federal guidelines for autonomous delivery robots, with each US state making their own rules, creating a lot of ambiguity. While some states have formalized regulations for the deployment of autonomous robots in real-world applications, others have not put in place any regulations to test autonomous vehicles, making it difficult for the technologies to be rolled out nationwide.

Autonomous delivery robots promise faster, cheaper and more sustainable deliveries, but their deployment has not typically progressed past the pilot phase. The market is poised to shift quickly as consumer acceptance of robots grows, owing to increased demand for contactless deliveries due to the pandemic.

2. BOPIS and Curbside Pickup

Pickup is fast becoming a preferred mode for customers who place orders online. Retailers of all types have ramped up their BOPIS and curbside-pickup services as a safe and convenient alternative to in-store shopping in the age of social distancing. These services are less margin-erosive for retailers than delivery, and many price-conscious consumers also prefer BOPIS and curbside pickup to delivery as assessed fees are typically lower than those on delivery orders.

Among US shoppers, the top reason for using BOPIS and curbside-pickup services is to avoid shipping costs, ahead of needing items right away, according to a survey conducted by the National Retail Federation (NRF) in January 2019.

Figure 5. US Consumers: Top Reasons To Use BOPIS and Curbside Pickup [caption id="attachment_125223" align="aligncenter" width="725"]

Base: 3,002 US shoppers aged 18+, surveyed in January 2019

Base: 3,002 US shoppers aged 18+, surveyed in January 2019 Source: NRF [/caption] Recent Developments According to financial services provider Comprar Acciones, retailers offering BOPIS and curbside options increased their digital revenue by an average of 49%, year over year, in 2020. Comparatively, those that did not offer the services saw a sales increase of only 28% on average. However, BOPIS and curbside-pickup services are not without flaws, including long wait times, vague pickup instructions and poorly timed rendezvous plans to connect with customers and staff. Position Imaging is a technology innovator that is disrupting the industry its “iPickup” platform, an order-fulfillment solution that leverages computer vision and laser- and audio-guidance technologies to help customers and/or staff locate the exact items for retrieval, thus allowing retailers to simplify and expedite the fulfillment of BOPIS and curbside-pickup orders for both staff and customers. The iPickup platform solution also provides a quick and easy way for shoppers to buy online and return or even exchange items in stores without having to wait in line, as the new item is ready within 15 seconds of a customer dropping off the original item at the store, according to Position Imaging. Several retailers are now turning to such technologies to readjust and refine their approaches to smoothen out the process, such as solving queuing and overcrowding issues, decreasing wait times and further enhancing the customer experience with click-and-collect services.

- American Eagle Outfitters launched BOPIS and curbside-pickup options in May 2020 as part of its store-reopening strategy following pandemic-led lockdowns. However, the retailer faced several operational challenges, including customers having difficulty finding curbside-pickup locations and depending on associates to provide parking directions and pickup instructions. The retailer partnered with locations technology provider Radar in September 2020, which provided flexible geofencing functionality to support trip tracking for curbside pickup.

- Lululemon launched a virtual waitlist technology in September 2020 that notifies consumers via text when it is their turn to enter the store or perform pickup, returns and exchanges outside the store. Customers can also use the waitlist service to schedule shopping appointments that can be scheduled even before or after the store’s normal operating hours.

- Target and Walmart have been using location-based technology for a while, paving the way for others to follow suit. In September 2020, Giant Eagle partnered with Radius Network to use its FlyBuy Pickup location technology to optimize curbside and in-store pickup. The FlyBuy platform is directly integrated into the Giant Eagle mobile application; it predicts customer’s estimated time of arrival in the parking lot and sends supermarkets live alerts, enabling the store associate to properly prioritize order fulfillment. Similarly, Lowe’s Foods, SpartanNash and Albertsons-owned United Supermarkets implemented Radius Network’s FlyBy system in 2020 to reduce the time it takes to fulfill orders.

- Ulta Beauty, which launched curbside pickup in April 2020, has implemented a curbside notification system integrated with GPS and geofencing technology. It automatically alerts the store associate when a customer is on the way to the store, allowing them to deliver the orders as soon as the customer arrives at the pickup zone.

- Amazon launched parcel solutions in 2011, and as of September 2019, it had more 10,000 lockers installed in retail stores, college campuses and apartment buildings.

- Albertsons has launched two different takes on unattended pickup in recent months. In October 2020, the company launched Bell and Howell’s temperature-controlled locker pickup service at select Chicago Jewel-Osco locations and Bay Area Safeway stores. In January 2021, the company debuted the Cleveron 501 robotic pickup kiosk at a Jewel-Osco store in Chicago.

Albertsons’ Automated Grocery Pickup Kiosk

Albertsons’ Automated Grocery Pickup Kiosk Source: Cleveron [/caption]

- Lowe’s announced in September 2020 that it will roll out parcel lockers at more than 1,700 US stores by the end of March 2021. The company highlighted that more than 60% of its online orders are picked up in-store.

Lowe’s pickup locker

Lowe’s pickup locker Source: Lowe’s [/caption]

- Ahold Delhaize banner Stop & Shop announced on February 4, 2021 that it is trialing pickup lockers at one of its Boston Stores. The lockers are available in three temperature settings—refrigerated, frozen and ambient—and are located in the store’s main entrance.

- Since July 2017, Walmart has rolled out more than 900 vertical pickup towers in its Supercenters to enable shoppers to retrieve online orders in the style of a vending machine rather than wait in a customer service line.

- Cleveron offers automated pickup kiosks that robotically serve grocery orders to consumers.

- Parcel locker suppliers such as Mobikey and Parcel Pending use Bluetooth Low Energy (wireless personal area network technology) to provide the capability for lockers to opened via consumers’ smartphones.

- Retail Robotics’ pickup grocery robot, known as Arctan, houses 200 bins and another 28 frozen bins. The unmanned setup dispenses orders through any four drawers, allowing it to serve multiple customers at a time.

- Bell and Howell’s QuickCollect XL grocery kiosk offers an automated curbside-pickup service. The kiosk has seven drive-up stations with a dedicated parking space for each station, enhancing the ease and efficiency of pickup for consumers.

- Amazon now provides a visual MapTracker showing how many stops a delivery driver has to make before reaching a drop-off destination. Customers are notified via text message or email when a package is delivered at their residence or alternative pickup location, such as an Amazon locker.

- FedEx tracking tool InSight utilizes reference numbers to give customers a complete view of the delivery process.

- FourKites, a provider of real-time tracking and visibility solutions, provides all types of in-transit data, including location, estimated time of arrival, temperature and light exposure and shipper load locations.

- Pitney Bowes, a shipping technology company, enables customers to track the delivery and receipt of their mail in real time and in detail.

What We Think

The need to deliver parcels rapidly and efficiently to meet consumer expectations is pushing retailers to focus on making improvements to their last-mile delivery capabilities. Innovative technology can reshape last-mile delivery to be more agile, efficient and responsive to consumer demand. Implications for Retailers- The upswing in online orders during the pandemic is placing a significant strain on retailers as they struggle to find delivery methods that do not eat into their profits. Autonomous robots have the potential to significantly trim end-to-end costs involved in last-mile delivery. Retailers must theoretically compare costs and return on investment of their existing delivery options with that of robotic deliveries to see if they should be adopted. They must conduct trials in the localities to determine consumers’ feeling and acceptance level of robotic deliveries and which SKUs (stock-keeping units) are most suitable for this shipping method.

- Environmentally conscious shoppers may look to shop with retailers that offer them delivery options that would not involve large carbon dioxide emissions. Incorporating a robotic delivery option—which would not have CO2 emissions—would allow a retailer to promote itself as committed to sustainability while simultaneously expanding delivery capacity.

- Employing robots for deliveries can be an effective branding tool for retailers, offering a competitive differentiator.

- With all of the major grocers offering some form of pickup service, location-tracking and geo-fencing technology that optimizes BOPIS and curbside pickup and simplifies the overall process can offer a competitive advantage to retailers.

- Smart lockers have the potential to become a more prominent last-mile delivery method due to the convenience and labor-cost benefits the format has over other last-mile options. As with automation in logistics and fulfillment, retailers must weigh those advantages against the investments required.

- As contactless delivery is the need of the hour, technology vendors will likely see higher engagement with retailers through partnerships, likely moving beyond pilot phases toward wider implementation in the coming months. Technology firms will have to ramp up the manufacturing of robots and add more units to their robotic fleet to increase delivery capacity.