Nitheesh NH

Executive Summary

M&A activity has risen in the US retail sector over the past 10 years, in terms of deal value and number of deals, and the same trend applies somewhat to deals within the mass-merchandiser sector. Mass merchandiser deals are generally a trickle interspersed with a flood of blockbuster deals, such as Walmart’s $3.3 billion acquisition of Jet.com, Dollar Tree’s $9.4 billion takeover of Family Dollar, and Walmart’s $16 billion acquisition of a majority stake in Flipkart. While not a mass merchandiser, Amazon acquisitions of companies such as Kiva, Whole Foods, and PillPack have sparked fear and dealmaking activity within several retail sectors. There are various reasons behind mass-merchandiser M&A. Other than basic strategy of entering adjacent markets, acquiring key technology and increasing scale, many of these acquisitions were likely designed to help the company remain competitive in e-commerce, to compete with Amazon either directly or indirectly, on a global basis. These include acquisitions to expand and enhance an existing e-commerce platform (such as Jet.com), to improve delivery capabilities (such as Shipt, acquired by Target) or to establish a presence in a fast-growing market (such as Flipkart in India). This report also discusses Amazon’s acquisitions, as they provide an indicator of Amazon’s direction, and the likely direction of the retail industry. Target’s acquisitions historically comprised undisclosed, small acquisitions for technology or products. However, its most recent purchase – of Shipt for $550 million – has also been its largest, bringing faster delivery times underpinning its strategy to move delivery to its physical stores to reduce distance to the customer, and therefore, delivery times. Walmart completed its transformative acquisition of Jet.com in September 2016, which preceded a series of product-related acquisitions such as ModCloth and Bonobos, which give the company unique products to sell on its online marketplaces. Already present in China for two decades, the company sensed and acted on the high-growth opportunity in India and acquired a majority stake in the country’s leading e-commerce marketplace, Flipkart, in August 2018. This report also outlines product assortments and selected private-label businesses, whose strengths and gaps have likely motivated many transactions, as these offerings are unique and draw traffic to e-commerce sites. There are several factors that act as catalysis for M&A. First, interest rates remain relatively low and stock values, though volatile, remain at high levels, providing cheap currency for acquisitions. Second, the relentless pressure from e-commerce continues to encroach on physical retail, and this pressure is causing tremendous disruption in the industry and is likely causing the upswing in M&A. Third, competition is expanding globally, and Walmart and Amazon are squaring off and competing in high-growth countries such as China and India. Fourth, technology has become a differentiating factor: Many of the acquired companies highlighted in this report are small companies, offering a new technology for e-commerce or executing delivery. Acquisitions in mass merchandising are likely to continue and even accelerate as retail giants seek to fill gaps in their offerings and enhance global competitiveness.Industry Overview

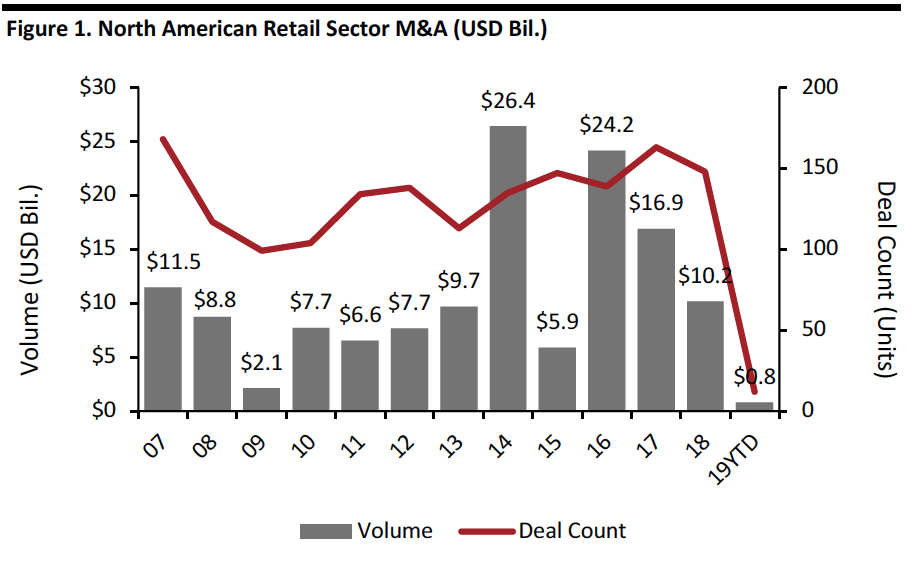

North American retail M&A activity has been steady during 2007-2018 in terms of the number of deals; however the total deal value picked up substantially in 2014. There were 148 deals valued at a total of more than $10.2 billion in 2018, according to Bloomberg data. Annual deal value averaged $7.7 billion during 2007-2013, more than doubling to an average of $16.7 during 2014-2018. [caption id="attachment_82273" align="aligncenter" width="640"] Note: Year-to-date through March 4, 2019

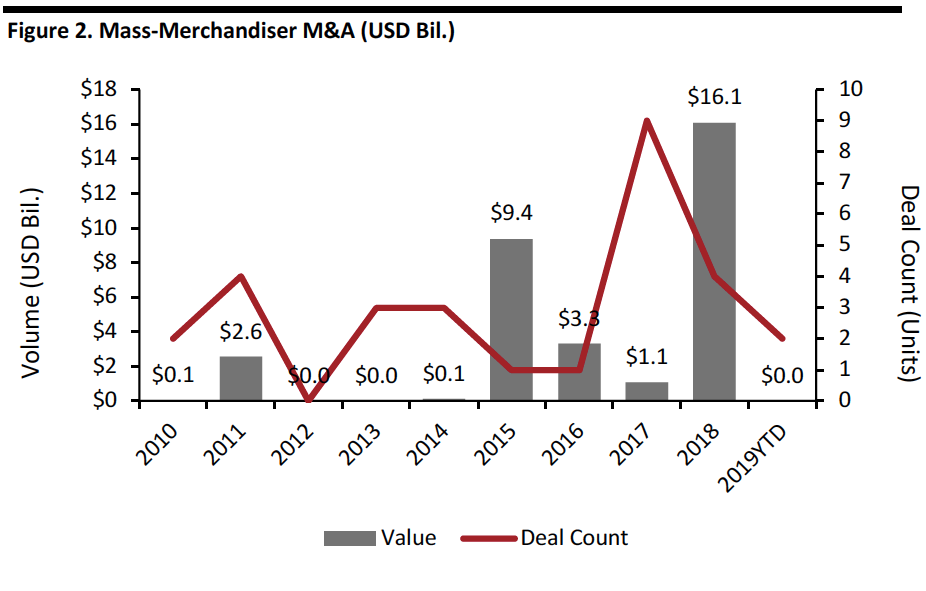

Note: Year-to-date through March 4, 2019 Source: Bloomberg[/caption] M&A in the mass merchandiser sector has been lumpy and generally at a low level. However, deal value dramatically picked up starting in 2015. These figures, though, are dominated by a few large deals, in particular, Walmart’s $16 billion acquisition of Flipkart in 2018, Dollar Tree acquiring Family Dollar for $9.4 billion in 2015 and Walmart’s acquisition of Jet.com for $3.3 billion in 2016. [caption id="attachment_82274" align="aligncenter" width="640"]

Note: Year-to-date through March 4, 2019

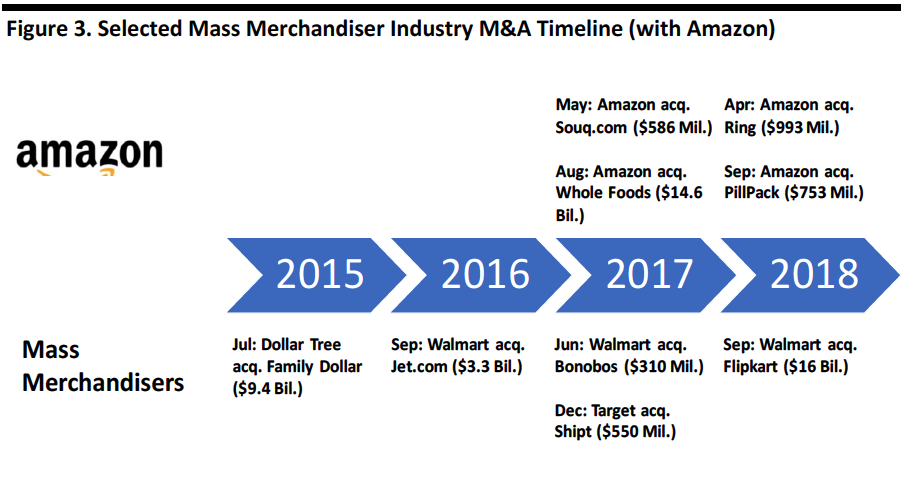

Note: Year-to-date through March 4, 2019 Source: Bloomberg[/caption] The figure below shows a timeline of M&A activity, with Amazon top of the timeline, and selected M&A activity for mass merchandisers below. [caption id="attachment_82275" align="aligncenter" width="640"]

Source: S&P Capital IQ/company reports[/caption]

Source: S&P Capital IQ/company reports[/caption]

Company Analysis

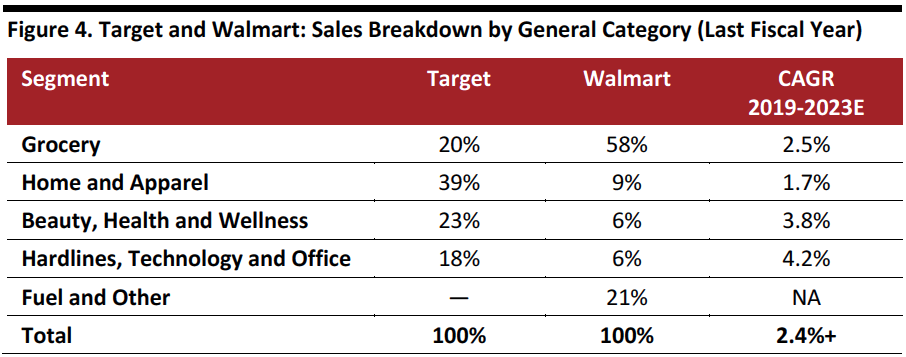

The table below provides a comparison of Target and Walmart sales data by segment to highlight relative strengths and concentrations, which could point to future M&A activity. The table shows Walmart’s high concentration (nearly 60% of FY18 sales) in grocery, whereas Target’s revenue mix is more balanced. Target’s largest acquisition, of Shipt, provided speedy delivery technology, which will likely boost the appeal of its grocery offerings. The table also provides market compound growth rate estimates and shows that hardlines, technology and office is expected to be the highest-growth segment during 2019-2023E, followed by beauty and then grocery, according to data from Euromonitor International. The data supports Amazon’s acquisition to date (of Whole Foods) in the grocery space, as well as acquisitions and investments in delivery companies in technology, necessary to get perishable items to consumers in short order. Walmart has publicly announced its interest in acquiring unique product companies to expand its presence in that area, in addition to recently announcing a private-label furniture and furnishings line. [caption id="attachment_82276" align="aligncenter" width="640"] Note: CAGR calculated for specified categories

Note: CAGR calculated for specified categories Source: Company reports/Euromonitor International/Coresight Research[/caption]

Target

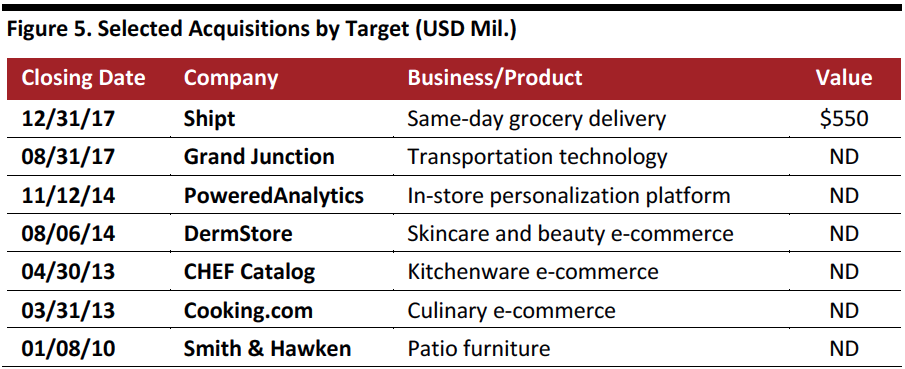

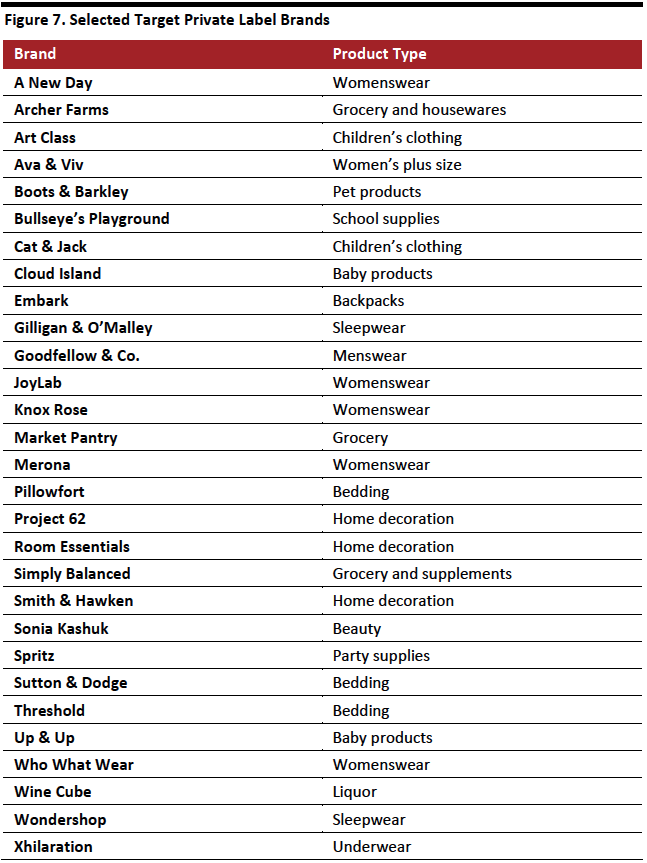

Overview In addition to earlier acquisitions of product companies, the company has aggressively refreshed and expanded its private-label assortment and used acquisitions to bolster its delivery and e-commerce capabilities. In addition, Target is works with startups by offering their products, investing in them, and working with emerging companies through accelerator programs. Aquisitions Target’s acquisitions prior to 2017 were primarily focused on products and building out the company’s e-commerce operations. The Shipt acquisition in 2017 highlighted that Target had redirected its focus on delivery, leveraging its broad network of physical stores. [caption id="attachment_82277" align="aligncenter" width="640"] ND = Not disclosed

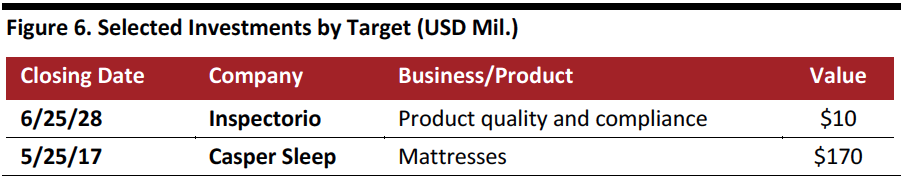

ND = Not disclosed Source: S&P Capital IQ/company reports[/caption] Partnerships/Investments In addition to carrying national and private-label brands, Target features products from several partners, including the following:

- Bark: Pet toys and treats.

- Casper: Mattresses (see below).

- GIR: Cookware.

- Harry’s: Men’s shaving products.

- Hello: Health and beauty.

- Hidrate Spark: Water bottles.

- Native: Personal care.

- Quip: Electric toothbrushes.

- Primal Kitchen: Health supplements and nutrition bars.

- Rocketbook:

Source: S&P Capital IQ/company reports/CrunchBase[/caption]

Finally, Target is also engaged with startups through the following programs:

Source: S&P Capital IQ/company reports/CrunchBase[/caption]

Finally, Target is also engaged with startups through the following programs:

- The Target + Techstars

- Target Takeoff: a mini retail boot camp.

- The Target Accelerator program in India.

- The Target Incubator.

Source: Company reports[/caption]

Source: Company reports[/caption]

Walmart

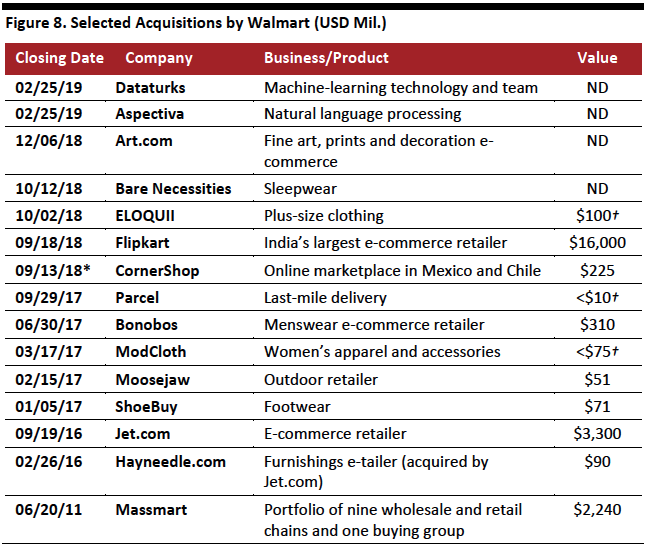

Overview Walmart’s M&A activity picked up speed with the acquisition of Jet.com in September 2016, and the company followed up with acquisitions of product companies, such as MooseJaw, Bonobos, ModCloth, and several others as part of its public strategy to offer unique, differentiated products on its online platforms. Walmart has been present in China for more than 20 years, and this business has evolved over time with the addition of e-commerce. The company expanded into another emerging, fast-growing market, India, with its largest acquisition ever, a majority stake in e-commerce marketplace Flipkart for $16 billion. Walmart has publicly articulated its acquisition strategy as comprising two thrusts:- Acquiring companies that strengthen Walmart.com and Jet.com by enhancing both their category expertise and assortment (e.g., Shoes.com and Moosejaw).

- Acquiring digital brands that are unique and differentiated, offering products and experiences that customers cannot find anywhere else (e.g., ELOQUII).

ND = Not disclosed

ND = Not disclosed *Not yet closed

†Reported

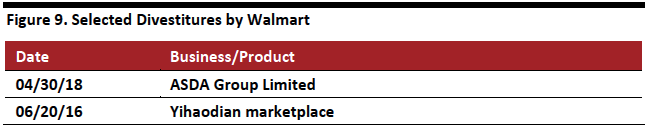

Source: S&P Capital IQ/company reports[/caption] Investments Walmart’s engagement with JD.com began with a June 2016 announcement that it would acquire a 5% stake in JD.com, transferring Walmart’s ownership of Yihaodian to JD, and opening a store on JD.com for Sam’s Club. Walmart announced its initial investment in Yihaodian in May 2011 and took full ownership in July 2015. In October 2016, Walmart stated in that it had increased its stake in JD to 10.8%. Divestitures Walmart has been unwinding selected foreign investments, including plans, announced in April 2018, to combine its Asda Group with UK-based grocer Sainsbury and the announcement of a sale of a majority stake in its Brazil unit in June 2018. As noted above, in June 2016, Walmart transferred ownership of its Yihaodian e-commerce platform as part of a larger transaction with JD.com. In May 2018, Walmart announced an agreement to sell its Brazilian subsidiary, which has not yet closed. [caption id="attachment_82281" align="aligncenter" width="640"]

Source: S&P Capital IQ/company reports[/caption]

Private Label

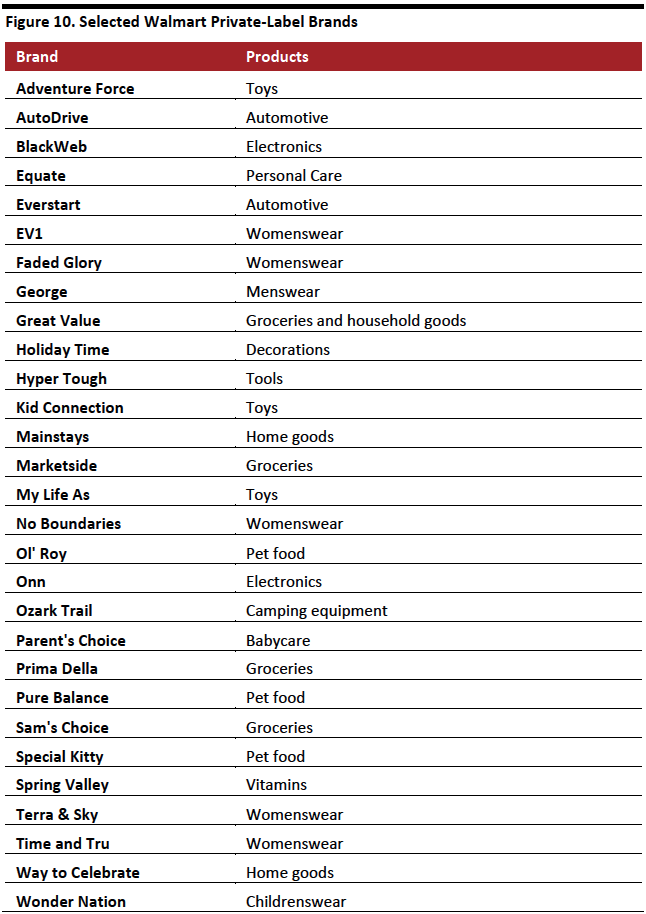

Walmart’s portfolio of private-label brands comprises the numerous traditional Walmart brands listed in the table below, the Jet.com brands such as Uniquely J, and brands it has acquired.

In February 2019, Walmart announced a new furniture brand called MoDRN that offers 650 brands with items priced at $20-899 and available on Walmart.com, Jet.com and Hayneedle.com.

[caption id="attachment_82282" align="aligncenter" width="640"]

Source: S&P Capital IQ/company reports[/caption]

Private Label

Walmart’s portfolio of private-label brands comprises the numerous traditional Walmart brands listed in the table below, the Jet.com brands such as Uniquely J, and brands it has acquired.

In February 2019, Walmart announced a new furniture brand called MoDRN that offers 650 brands with items priced at $20-899 and available on Walmart.com, Jet.com and Hayneedle.com.

[caption id="attachment_82282" align="aligncenter" width="640"] Source: Company reports[/caption]

Four of the above brands are new — Time and Tru, Terra & Sky, Wonder Nation and the reinvigorated George — and were launched in February 2018.

Source: Company reports[/caption]

Four of the above brands are new — Time and Tru, Terra & Sky, Wonder Nation and the reinvigorated George — and were launched in February 2018.

Amazon

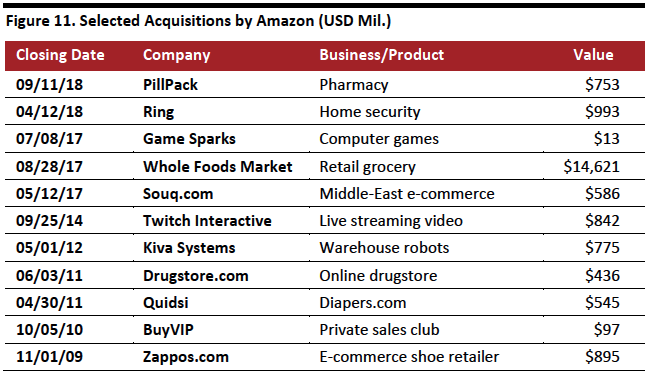

Overview Amazon has been a somewhat acquisitive company, making 11 acquisitions in nine years. Excluding the Whole Foods acquisition, its acquisitions averaged $560 million. Amazon’s acquisitions reveal new markets that the company wants to conquer, from consumer products, to grocery (with the Whole Foods acquisition), to medicine to home security. The Kiva acquisition notably showed Amazon’s interest in warehouse automation and likely sparked retailer interest in the robotics industry. Amazon appears to have taken the intervening year to digest its Whole Foods acquisition, and the media has recently reported that Amazon is planning to expand in the grocery sector by opening its own grocery stores (with a larger, more traditional assortment than health-oriented Whole Foods) or by acquiring small regional chains. Acquisitions The table below lists selected Amazon key acquisitions: 11 deals in 10 years. [caption id="attachment_82283" align="aligncenter" width="640"] Source: S&P Capital IQ/company reports[/caption]

Private Label

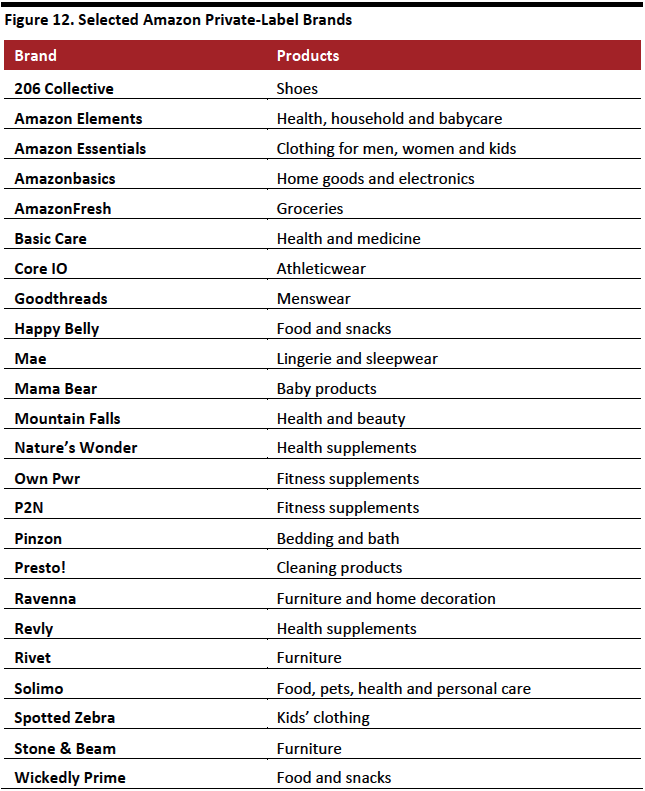

Amazon reportedly offers more than 150 private-label and more than 325 exclusive brands, respectively, and a selection is included in the table below. Our June 2018 report Slicing and Dicing Amazon’s Private Label Offering provides detailed analysis of the company’s private-label offering.

[caption id="attachment_82284" align="aligncenter" width="640"]

Source: S&P Capital IQ/company reports[/caption]

Private Label

Amazon reportedly offers more than 150 private-label and more than 325 exclusive brands, respectively, and a selection is included in the table below. Our June 2018 report Slicing and Dicing Amazon’s Private Label Offering provides detailed analysis of the company’s private-label offering.

[caption id="attachment_82284" align="aligncenter" width="640"] Source: Company reports[/caption]

Source: Company reports[/caption]