DIpil Das

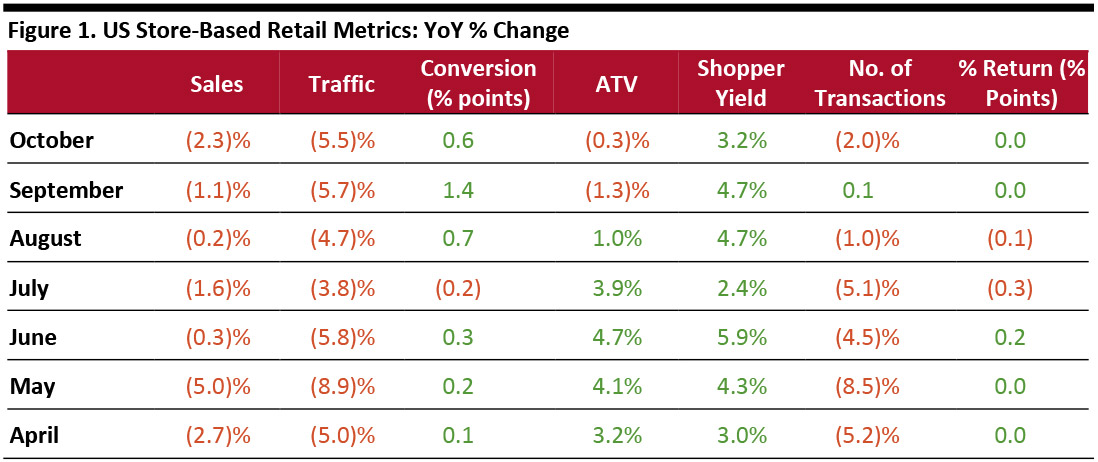

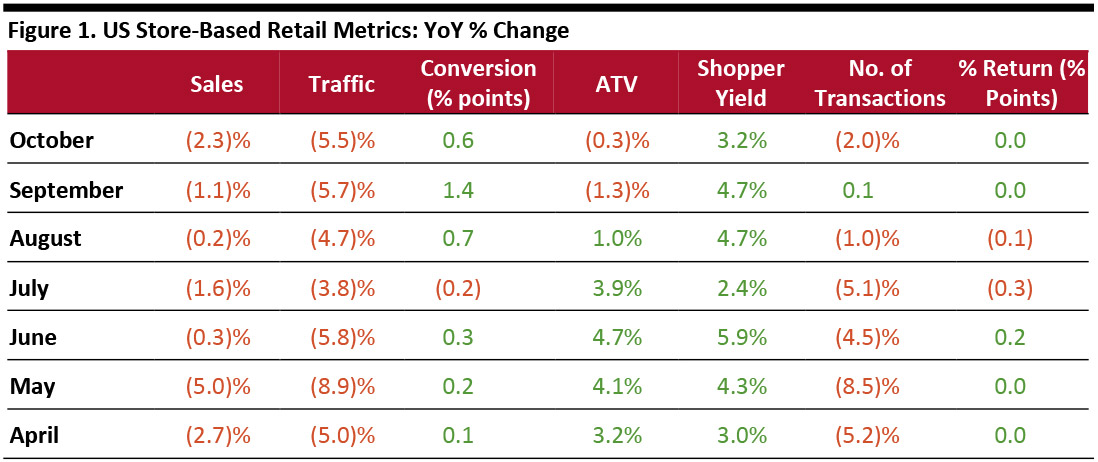

Coresight Research’s US Retail Traffic and In-Store Metrics report reviews year-over-year changes in selected store-based metrics, including sales, traffic and conversion rates.

ATV = average transaction value, % Return = percentage of goods returned to stores

ATV = average transaction value, % Return = percentage of goods returned to stores

Source: RetailNext [/caption] Data for October showed that performance varied over the course of the four weeks:

- US store-based traffic continued to fall in October, according to RetailNext. Retail traffic slid 5.5% year over year in October, slightly slower than the 5.7% decline in September.

- The conversion rate (sales transactions as a percentage of traffic) advanced 0.6 percentage points in October, slower than the 1.4-percentage-point growth in September.

- Transaction volume decreased 2.0% in October after increasing 0.1% in September.

- The product return rate was flat in October, the same as the previous month.

- ATV declined 0.3% in October, easing from a 1.3% decline in September.

- Shopper yield grew 3.2% year over year in October, decelerating from the 4.7% growth in September.

ATV = average transaction value, % Return = percentage of goods returned to stores

ATV = average transaction value, % Return = percentage of goods returned to stores Source: RetailNext [/caption] Data for October showed that performance varied over the course of the four weeks:

- The third week of October performed the best for sales, transactions, conversion rate, shopper yield and ATV.

- The fourth week saw the largest declines in traffic, sales and transactions, particularly in the northeast as powerful wind storms caused power cuts in many parts of the region.

- October 26 performed the best for sales, while November 2 performed the best for traffic and transactions.

- Sales and traffic were the lowest on October 8. CVR and SY were the lowest on October 6.