DIpil Das

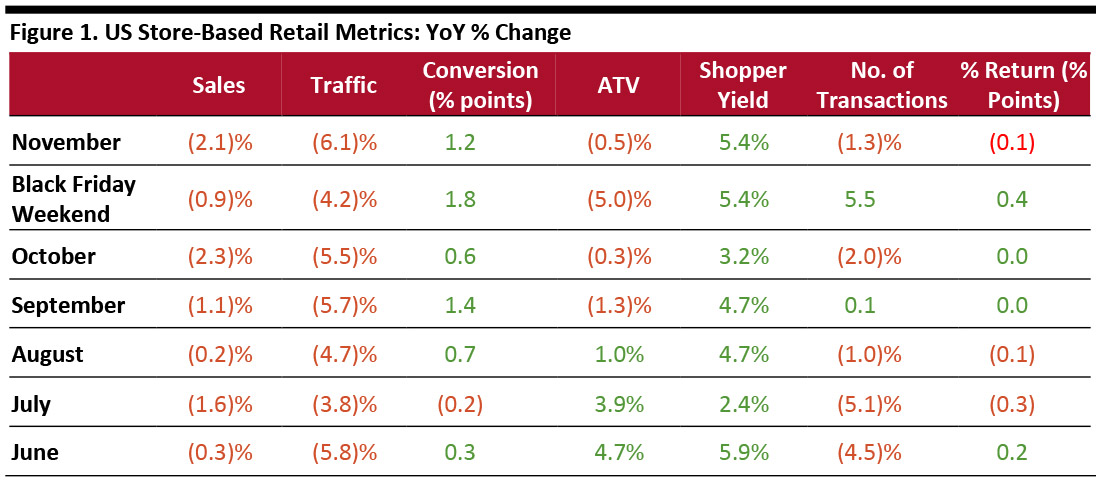

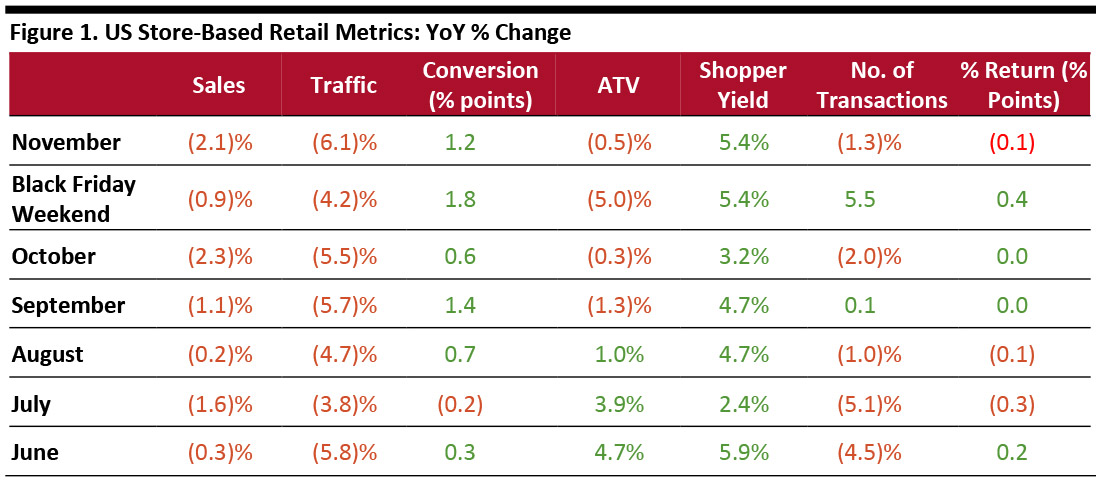

Coresight Research’s US Retail Traffic and In-Store Metrics report reviews year-over-year changes in selected store-based metrics, including sales, traffic and conversion rates.

ATV = average transaction value, % return = percentage of goods returned to stores

ATV = average transaction value, % return = percentage of goods returned to stores

Source: RetailNext [/caption] Data for November shows performance varied over the course of the four weeks:

- US store-based traffic continued to fall in November, according to RetailNext. Retail traffic slid 6.1% year over year in November, versus October’s 5.5% decline. Black Friday accounted for the largest portion of November traffic—but retail traffic was still 4.2% lower than last year.

- The conversion rate (sales transactions as a percentage of traffic) advanced 1.2 percentage points in November, with 1.8-percentage-point growth on the Black Friday weekend, both growing more quickly than the 0.6-percentage-point increase in October.

- Transaction volume slipped 1.3% in November, slowing from October’s 2.0% decline, but transaction volume did increase some 5.5% on the Black Friday weekend.

- The product return rate declined 0.1 percentage points in November, but grew 0.4 percentage points on the Black Friday weekend, compared to flat in October.

- ATV declined 0.5% in November, slightly faster than the 0.3% decline in October. On the Black Friday weekend, ATV contracted 5.0%.

- Shopper yield grew 5.4% year over year in both November and the Black Friday weekend, accelerating from 3.2% growth in October.

ATV = average transaction value, % return = percentage of goods returned to stores

ATV = average transaction value, % return = percentage of goods returned to stores Source: RetailNext [/caption] Data for November shows performance varied over the course of the four weeks:

- The first week performed the best for traffic, while the second week performed the best for sales and ATV.

- The third and fourth weeks saw the largest traffic declines, but the highest increase in conversion rates.

- Black Friday (November 29) performed the best for sales, traffic and transactions, while November 22 performed best for conversion rate.

- Sales, traffic, ATV and transactions were lowest on November 21. CVR and shopper yield were lowest on Thanksgiving Day, November 28.