DIpil Das

What’s the Story?

Returns are an integral part of the digital customer experience and with the spike in e-commerce in 2020, managing reverse logistics is putting increasing pressure on brands and retailers. In this report, we discuss key metrics within e-commerce product returns in the US and four strategies that retailers can implement to improve the online returns process.Why It Matters

Returns are an ongoing challenge for retailers and area of potential customer dissatisfaction, as well as a cost center. Consumer experiences during the return process can make or break a retailer relationship. Consumers consider product returns as equally significant to delivery and payment within their overall e-commerce experience, according to a US survey conducted by consumer fulfillment and returns technology provider Doddle in May 2020, with 84% of respondents stating that a positive returns experience makes them more likely to purchase from a retailer. Moreover, high levels of returns eat into profitability on a product, store channel and organizational level while simultaneously impeding efforts related to environmental sustainability. As such, retailers have come to recognize that they cannot manage returns logistics in the same way as forward logistics operations.Retail Returns: A Deep Dive

Retail Returns Key Metrics · Top Product Categories for Returns Coresight Research survey findings from March 2021 reveal that 42.4% of US consumers returned unwanted products in the prior 12 months. Clothing ranked as the most returned product category at almost double the rate of electronics, which came in second place, as shown in Figure 1. Consumers tend to buy apparel much more frequently than products such as electronics and therefore are more likely to return those items in a given period. Product characteristics such as size, fit and color not matching the shopper expectations also drives return rates in apparel. Moreover, higher return rates in this category are likely exacerbated by first-time online apparel shoppers amid a greater shift to online shopping during the pandemic.Figure 1. Product Categories Returned by US Consumers in the Past 12 Months, as of March 2021 (% of Respondents That Reported Making a Return) [wpdatatable id=1055 table_view=regular]

Base: 170 US Internet users aged 18+, who had made a return in the prior 12 months Source: Coresight Research · Top Causes of Retail Returns According to the 2021 Retail Returns report by Incisiv (sponsored by Newmine), the top cause of returns among US omnichannel shoppers is product quality. Of the top 10 causes of retail returns identified, only two are out of the retailer’s control: “bought to try” and “no longer needed.” The other, controllable reasons—as listed in Figure 2—present opportunities for retailers to reduce returns and thus improve sales, profits, customer satisfaction and lifetime value.

Figure 2. Top Causes of Online Retail Returns [wpdatatable id=1056 table_view=regular]

Source: Incisive/Newmine · Top States and Cities by Return Rate According to Returnly’s 2020 US Returns report, cities have higher return rates than suburban and rural areas. Cities on the US East Coast, such as New York City and San Jose, have a much higher rate of store and postal returns in the evening. West coast cities such as Carlsbad, Newport Beach, Santa Barbara and Scottsdale rank higher in terms of returns made during the daytime.

Figure 3. Top Cities and States with Highest Return Rates [wpdatatable id=1057 table_view=regular]

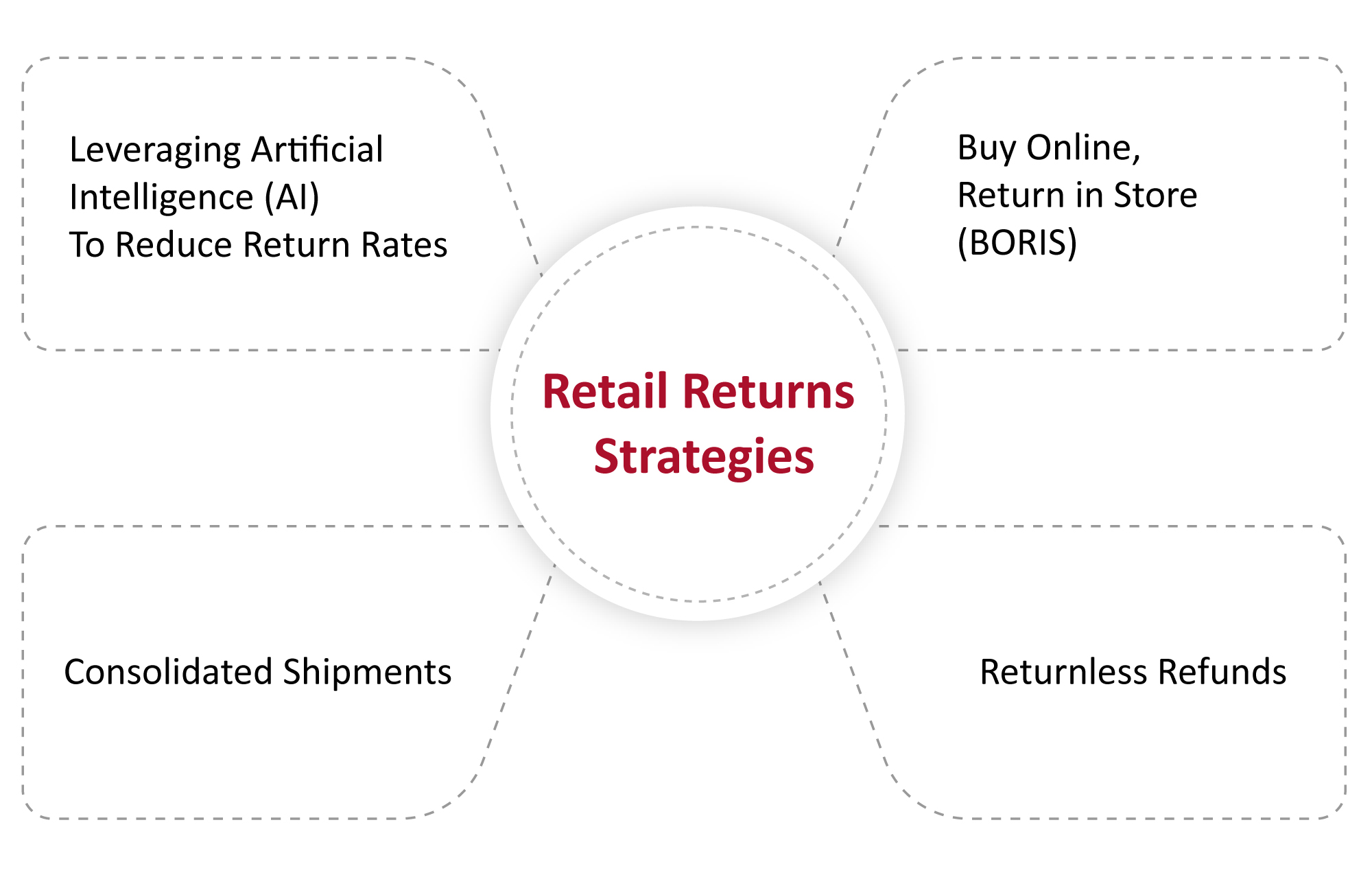

Source: Returnly Retail Returns Strategies We discuss four strategies for managing returns that are gaining traction in the US retail market.

Figure 4. Key Returns Strategies [caption id="attachment_129241" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

1. Buy Online, Return in Store (BORIS)

Many US retailers offer an in-store return option for online orders as it facilitates faster returns and offer upselling opportunities. The service requires retailers to invest in technologies such as order management systems that align online and offline channels.

Retailers have the option to send returned items to a distribution store for subsequent online purchases or add them to store inventory for sale in physical locations. We explore three advantages for retailers of shifting a share of returns to stores.

Reduced Shipping Costs and Timeframe

Source: Coresight Research[/caption]

1. Buy Online, Return in Store (BORIS)

Many US retailers offer an in-store return option for online orders as it facilitates faster returns and offer upselling opportunities. The service requires retailers to invest in technologies such as order management systems that align online and offline channels.

Retailers have the option to send returned items to a distribution store for subsequent online purchases or add them to store inventory for sale in physical locations. We explore three advantages for retailers of shifting a share of returns to stores.

Reduced Shipping Costs and Timeframe

- Remerchandising returns in-store avoids shipping costs altogether.

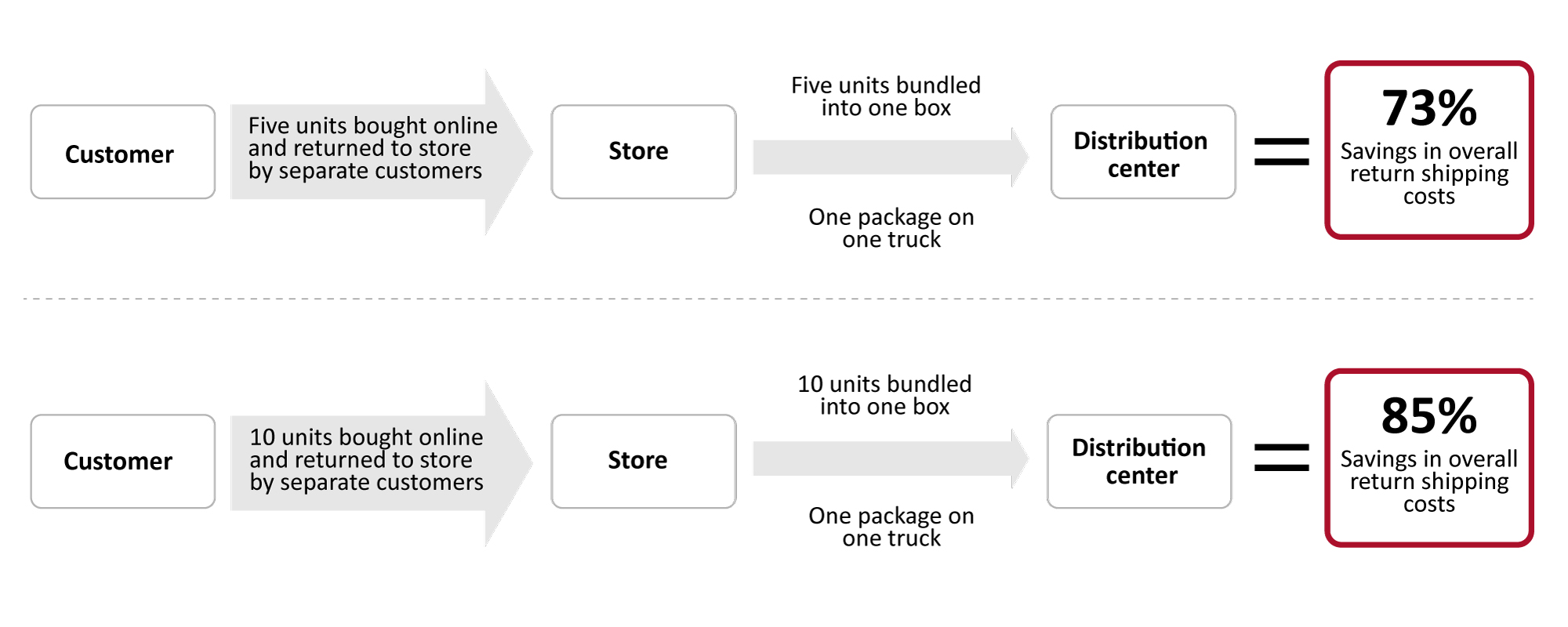

- Items purchased online and returned to store by different customers can be processed and bundled in-store prior to a return shipment to the distribution center, lowering the overall shipping costs, as shown in Figure 5.

Figure 5. BORIS: Savings in Overall Return Shipping Costs [caption id="attachment_129242" align="aligncenter" width="725"]

Source: Simon Property Group[/caption]

Source: Simon Property Group[/caption]

- According to McKinsey, in-store returns that are reshelved in the store are processed 12 to 16 times faster, on average, as compared to returns by mail. This translates to a higher likelihood of full-price sell-through and a longer time frame for a product to sell in-season.

- Shipping cost savings are particularly high for expensive or bulky items, such as electronics or furniture. BORIS also reduces the risk of an expensive returned item getting delayed or lost.

- Encouraging customers to return to store also gives brands better opportunities to save sales or up-sell. Instead of shipping an item back for refunds, shoppers returning items in a store may exchange items for others or buy additional products, which in turn, may drive incremental purchases. According to a National Retail Federation survey conducted in October and November 2020, around 71% of respondents made a new purchase when they returned a product to a store.

- The main reason shoppers use BORIS is to avoid paying to return something. According to a survey by Simon Property Group in February 2021, 76% of US shoppers said that if they are required to pay for return shipping then they prefer to return items in a store to avoid the additional cost.

- Moreover, consumer preferences for in-store returns are driven by the speed and convenience of returning items quickly and receiving an immediate refund.

- Actively encourage store-based returns to customers by promoting the benefits such as saving money, time and reducing environmental impacts.

- Elevate the in-store return option in after-sales and return-related communication materials.

- Proactively remind shoppers of the proximity of their nearest stores by providing the distances on return slips and other return-related communications.

- Returnless refunds can be a more beneficial financial option for a retailer—avoiding the time and cost drains of managing return shipping and processing for items that would be hard to resell. According to B-Stock, an online marketplace for returned merchandise, processing certain returned items costs twice as much as their sales price. Hence, it is more cost-effective for retailers to let customers keep the items, especially when the price and margin is very low.

- Consumers may face significant delays in receiving refunds since payment is only processed once an item purchased online arrives back at the distribution center. While having funds tied up with a retailer for an extensive time period will likely frustrate customers, a returnless refund releases the refund almost instantly, thus eliminating any negative refund experience.

- Returnless refunds remove the hassles of going through the returns process for customers, including printing out a shipping label, finding a suitable package for the product, packing it and then taking it to a drop-off location or post-office to send it back.

- As a third-party returns specialist, Happy Returns provides “Return Bars” or physical locations for shoppers to return items for an immediate refund. Products are shipped in bulk back to the e-commerce retailers, decreasing overall shipping costs. The company has a network of over 500 locations nationwide, including in malls, campus bookstores and office buildings. In October 2020, Happy Returns partnered with FedEx to add Return Bars to more than 2,000 FedEx locations. Happy Returns claims to provide 10% guaranteed savings on reverse logistics costs to retailers in the first year of business.

- Narvar teamed up with Simon Property Group in November 2020 to enable customers to drop off returns from about two dozen retail brands (which are clients of Narvar) at a participating Simon location. In the same month, Narvar partnered with UPS to enable no-label and boxless returns at nearly 5,000 UPS store locations.

- In October 2020, Optoro partnered with Staples to enable customers looking to return a product from a retailer using the Optoro platform, to drop the item at a nearby Staple’s outlet. Optoro manages returns for Best Buy, Target, Bed Bath & Beyond, IKEA, Under Armour as well as Staples and many smaller online sites.

- ZigZag helps retailers to manage their returns domestically and globally. The company’s platform connects retailers to a global network of 220 warehouses and 26 global online marketplaces from a single integration. It uses AI and predictive analytics to grade the returned products and work out the most cost-effective and energy-efficient route for returned products to either go back to the retailer via consolidation or be locally distributed, recycled or resold internationally.

- Newmine’s AI-powered Chief Return’s Officer mines a retailer’s data, identifies returns- reduction opportunities and presents improved feedback and corrective actions. By monitoring returns, identifying their root causes, collaborating across organizational silos and directing in- season action, Chief Returns Officer’s AI and automation can improve assortment planning, inventory positioning, supplier performance and marketing decisions. The solution also empowers retail employees because they are better informed with a comprehensive view of how products are performing, from inception to point of sale. In sum, returns decline, sales and profits increase, efficiencies are captured, and a virtuous business cycle is created.

- Optoro uses AI and proprietary algorithms to determine which channel will yield the highest value for a product by considering the predicted selling price and shipping costs for the item to reach the proposed destination. It then helps to divert returned items to the channel that will get retailers the most money back. Possible dispositions include selling directly to consumers, reselling to wholesalers, returning to vendors for repair, donation or recycling.

What We Think

Retailers must account for product returns as an essential part of the customer journey. They should focus on eliminating consumer friction when opting to return unwanted merchandise as well as reducing the cost to the supply chain. Implications for Retailers- Retailers should place greater emphasis on making the online returns experience less time-consuming and easier to navigate, for instance, by offering exchanges with alternative product suggestions, multiple drop-off locations and easy returns to stores.

- Retailers should implement reliable returns technology with strong physical infrastructure to accept returns and handle disposal. That comprises inspecting an item, determining how quickly it can be restocked, assessing what to do with items that cannot be restocked and deciding which secondary channels to use to dispense with those.

- Technology vendors should devise analytical solutions to harness the data generated from returns and help retailers to uncover opportunities to reduce returns and increase sales, profits, efficiencies and customer satisfaction.

- We recommend that technology vendors look to partner with traditional third-party logistics providers that are keen to embrace technology to improve their returns management solutions. For instance, they can help transportation providers to grow their capabilities such as visibility, tracking and alternative drop-off locations, which will subsequently help them to serve their clients (retailers) more effectively.