DIpil Das

Introduction

This is our first quarterly US Retail Inventory Tracker and in it we review inventories held by US retailers in our Coresight 100, a global list of retailers, brands and non-retail companies. In this report, we focus on US retailers in the Coresight 100. We look at inventory levels, why inventory levels changed and inventory turnover. The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in particular period calculated as the cost of sales (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may spell challenges in inventory management. Inventory turnover rates tend to fluctuate by season, so year-over-year changes are often more significant than quarter-over-quarter changes. Different retailers have different fiscal year-ends so the quarters under review in this report may not be identical.Overview: Apparel Specialty Retailers and Department Stores

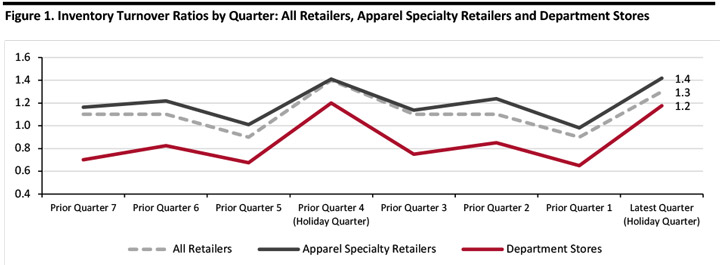

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes or simply making misjudgments about selection and designs of products. The consequent need to make profit-denting markdowns to clear stock is an ever-present threat. As the 2018 holiday season ended, we saw retailers planning for the next fiscal quarter by optimizing inventory levels.- Specialty retailers’ inventory turnover was stable compared to the year ago period and improved sequentially due to the holiday season.

- Department store retailers also saw inventory turnover rates remain constant compared to same quarter in the previous year, while showing sequential improvement versus the prior quarter.

Segment inventory turnovers are non-weighted (arithmetic) averages of selected companies. “All Retailers” represents all retailers covered in this report.

Segment inventory turnovers are non-weighted (arithmetic) averages of selected companies. “All Retailers” represents all retailers covered in this report. Source: S&P Capital IQ/company reports [/caption]

Potential Tariff Hike Led to Inventory Build Up

US tariff hikes had a significant impact on retailers’ inventory levels. In September 2018, the US imposed tariffs of 10% on $200 billion worth of Chinese goods, including handbags, cotton, sports accessories, beauty products, jams, dried fruits, frozen meat and vegetables. Retailers anticipated US tariffs on imports from China would rise from 10% to 25%, effective January 1, 2019. This prompted many US retailers to boost imports during October and November, especially specialty retailers, food and drug retailers, mass merchants, apparel and footwear brands. According to the National Retail Federation’s (NRF) monthly Global Port Tracker, US ports handled a record 2.04 million twenty-foot equivalent units (TEUs) of imports in October 2018, up 9% month over month and 13.6% year over year. A TEU is one 20-foot container or its equivalent. Imports stayed high in November, December and January, with 1.81 million TEUs handled in November, up 2.5% year over year; 1.97 million TEUs in December, up 13.9% year over year; and, 1.89 TEUs in January, up 7.4% year over year.How Retailers Turned Over their Inventories

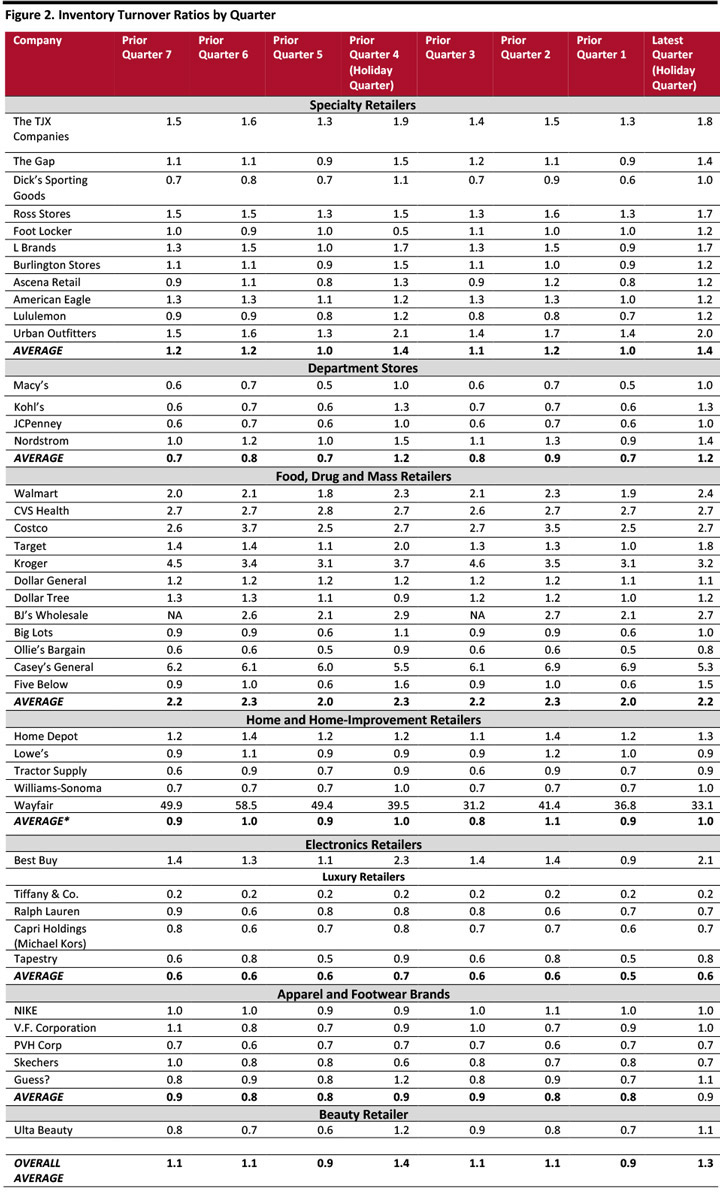

Many retailers, including specialty retailers, luxury retailers, food and drug retailers, mass merchants and department store retailers, showed sequential improvements in inventory turnover, led by holiday season sales and investments in supply-chain efficiency. Inventory turnover for these retailers remained broadly constant over the same quarter in the previous year, even though most built up inventory due to tariff concerns as sales increased (on an average basis) at the same rate as inventory on the back of the holiday season, leading to stable year-over-year inventory turnover ratios. On a quarter-over-quarter basis, inventory turnover rates picked up due to holiday-season demand. [caption id="attachment_83675" align="alignnone" width="720"] Inventory turnover = cost of sales for the quarter/ending inventory for the quarter; Averages are non-weighted (arithmetic);

Inventory turnover = cost of sales for the quarter/ending inventory for the quarter; Averages are non-weighted (arithmetic); *Excludes Wayfair, an outlier

Source: S&P Capital IQ/company reports [/caption]

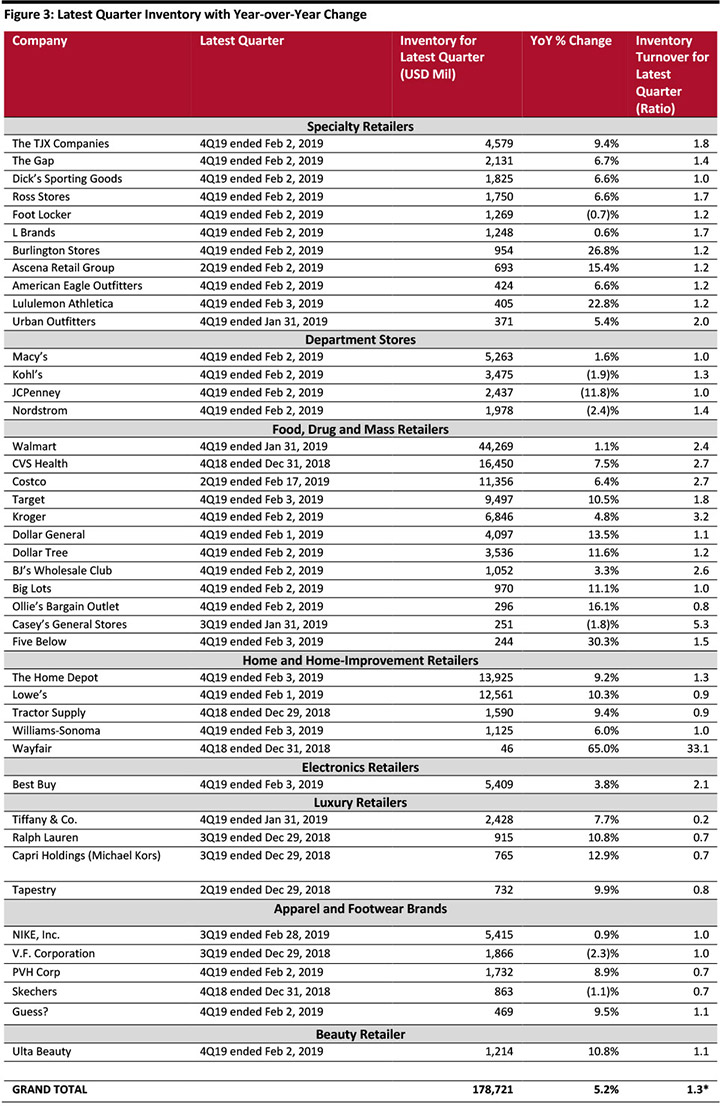

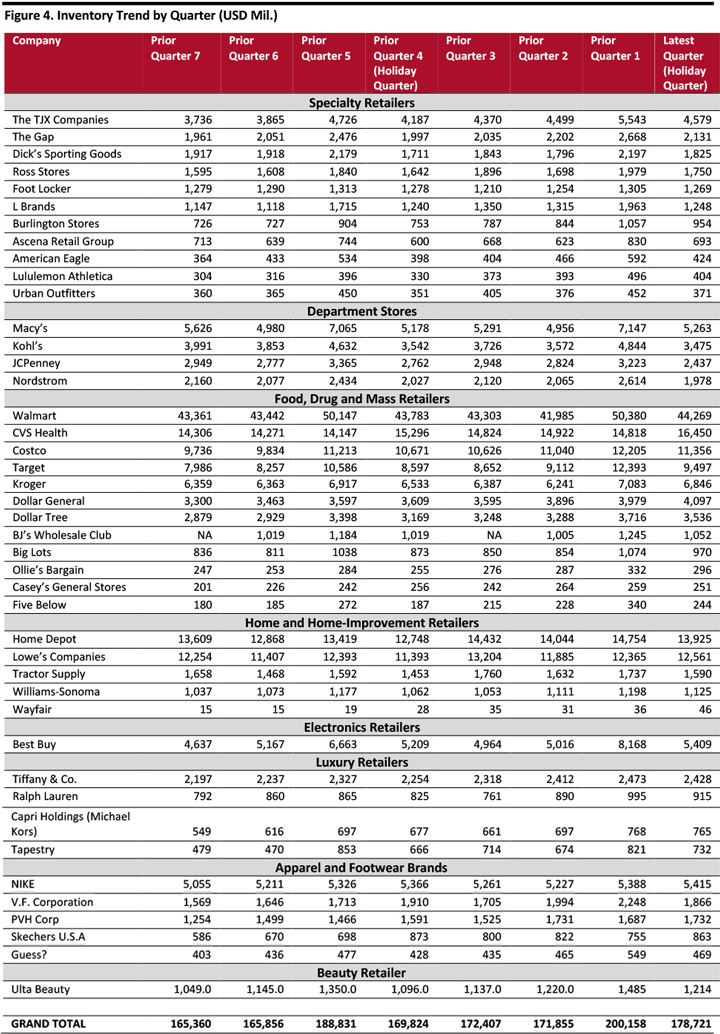

Retailers’ Inventory Increased Despite Holiday Season

In addition to building up inventory to minimize the impact from potential tariff increases, many retailers increased inventory to support expansion plans that involved opening new stores and distribution centers. Weaker-than-expected holiday sales also contributed to inventory pile-ups for some retailers. [caption id="attachment_83676" align="alignnone" width="720"] Inventory turnover = cost of sales for the quarter/ending inventory for the quarter; *Nonweighted overall average

Inventory turnover = cost of sales for the quarter/ending inventory for the quarter; *Nonweighted overall average Source: S&P Capital IQ/company reports [/caption] [caption id="attachment_83677" align="alignnone" width="720"]

Source: S&P Capital IQ/company reports[/caption]

Source: S&P Capital IQ/company reports[/caption]

Segment and Company Overview

While most retailers increased inventory ahead of tariff increases or to prepare for the holiday season, some correctly anticipated strong holiday turnover: Home and home improvement, food, drug, mass retail and convenience store turned over inventory at a faster rate than retailers in luxury, beauty and apparel.Specialty Retailers

Specialty retailers such as Dick’s Sporting Goods and Burlington Stores accumulated inventory in anticipation of demand. TJX Companies- The company grew inventory 9.4% year over year. Consolidated inventories on a per-store basis as of February 2, 2019, were up 3% on a constant currency basis (up 1% on a reported basis), including distribution centers but excluding inventory in transit and the company’s e-commerce businesses.

- TJX noted it had an excellent inventory base, rising 9.4% year on year at the start of the new fiscal year and is well positioned to continue shipping new spring merchandise to stores.

- The company’s inventory growth reflected strategic investments to support key growth categories.

- Management said in its earnings call that inventory will continue to grow throughout the year as the company plans to invest in “non-toxic” inventory such as Nike running shorts and Adidas’ running shoes and training shoes – products with longer shelf life.

- Foot Locker’s inventory was down 0.7% year over year, but increased 1.3% at constant currencies, while inventory turnover was the highest in eight quarters.

- The company says it will expand its breadth of product and brand offering across various price points.

- Burlington Stores posted a strong increase in the inventory levels, driven by a higher “pack and hold” inventory on the back of a strong buying environment (reflected in higher turnover), which was 30% of total inventory at the end of the fourth quarter of fiscal 2018, compared to 25% in the same period previous year.

- Inventory also increased ahead of tariff rises and to stock 46 net new stores opened during fiscal 2018.

Department Stores

Department stores kept inventory low. While Macy’s merchandise inventory was impacted by a fire, Kohl’s initiatives to optimize the inventory levels reduced stock and increased turnover. Macy’s- Macy’s reported a fire in its West Virginia mega center on November 24 made a portion of merchandise inventory unavailable for its online store during Cyber Week.

- The company noted it entered fiscal 2019 with clean inventory and lower levels of aged inventory. However, in the first quarter, it expects inventory to be on the higher side on the back of spring transition receipts. The company hopes its supply chain transformation initiatives will improve inventory levels and turnover.

- Kohl’s reported a decline in inventory, with strong improvements in turnover, which it attributed to investments in technology and predictive analysis.

Food, Drug and Mass Retailers

Food and drug retailers and mass merchants also bought ahead of expected tariff increases. Walmart- Walmart reported a marginal increase in inventory compared to the previous year but noted it stocked up to hedge against worst-case scenario tariff increases.

- The company’s effort to rationalize inventory is reflected in the inventory position and turnover. The inventory turnover ratio in the current quarter improved to 2.4, compared to 1.9 in the previous quarter and 2.3 in the same quarter previous year.

- Dollar General’s inventory increased as the company stocked its new Longview, Texas, distribution center, in addition to buying to beat the tariffs.

- In 2019, the company plans to update its inventory replenishment cycle to boost on-shelf availability, driving inventory to be in line with or below sales growth.

- Dollar Tree also built up inventory for certain imported goods to beat the tariffs.

- In 2019, the company plans to close about 390 stores, and also plans to re-banner 200 Family Dollar stores to Dollar Tree, which resulted in $40 million in markdown reserves during the current quarter.

Home and Home-Improvement

Home and home-improvement retailers increased investment in inventory without negatively impacting turnover. Home Depot- The company grew inventory 9.2% year over year in the latest quarter, but its turnover ratio improved, reflecting strong sales.

- Home Depot noted higher merchandising investment drove higher inventory levels.

- The company increased inventory for its Pro brand by investing in job-lot quantities. Lowe’s sells some products through its Contractor Pack's Program, under which customers can buy in bulk at discounted price. Lowe’s says it has optimal inventory to meet spring demand.

- During the third quarter of fiscal 2018, the company planned to exit certain non-core activities within its US home improvement business, including Alacrity Renovation Services and Iris Smart Home, but ended up having to write down inventory and fixed assets. As a result, the company recorded a third-quarter pre-tax charge of $14 million related to long-lived asset impairment and inventory write-down. During the fourth quarter (latest), the company recorded an additional pre-tax charge of $32 million.

- Lowe’s plans to move slow-moving SKUs from store to online to improve turnover as online comps are growing at more than six times the rate of in-store comps.

Luxury Retailers

Luxury retailers increased inventory levels due to planned investments in store expansion and in certain categories to optimize the product mix. Tiffany & Co- Tiffany & Co grew inventory 7.7% year over year, driven by strong investments in jewelry inventory, as the company wants to offer high-end assortments at all major locations across the world.

- Ralph Lauren grew inventory 11% year over year to $914 million, led by investments to support global store expansion.

- Ralph Lauren noted that inventory growth in the third quarter reflected strategic actions to support the following: earlier receipt of goods to maximize full-price selling buoyed by demand; comp growth; new retail distribution; and, improving the depth and breadth of product assortments in Europe.

- It expects to reduce inventories through the end of the fiscal year to be better aligned with its sales outlook.

- Inventory for the Michael Kors brand at the end of the quarter was $606.2 million, up 8.2% year over year. The company entered the quarter with lower inventory levels in its signature products and later made adjustments to have sufficient inventory for the next quarter.

- Fashion segment inventories ended as a higher percentage of total inventory, which resulted in higher markdowns. The company looks to have a more balanced mix of inventory with higher levels of signature and core assortments in the fourth quarter to reduce markdowns.

- Inventory for the Jimmy Choo brand was $158.5 million, up 35.3% year over year, led by rapid new store expansion and the consolidation of inventory from two joint ventures in Asia and the Middle East.

Apparel and Footwear Brands

Apparel and footwear brands such as Guess? and brand owners such as PVH ended the quarter reporting a strong increase in inventories. NIKE- NIKE grew inventory by 1%, driven by demand for key franchises.

- The company said it had “healthy” inventory levels across all geographies.

- The company’s inventory decreased 2.3% year over year. Excluding the impact of acquisitions net of divestitures, inventories were up 7%.

- Company CFO Scott A. Roe noted that the Sears bankruptcy added to inventory as Sears was a major jeans customer.

- The company will focus on reducing inventory by the end of the year. It noted that looking forward it will have a clean inventory position.

- PVH increased inventory levels, mainly due to an expected increase in demand in the next quarter and also to beat the tariff increase.

- It also plans to increase investment in basic and core products, primarily Tommy Hilfiger, on the back of strong demand for the brand.

- The company recorded $2 million of inventory markdown as a part of “Calvin Klein Restructuring” in the latest quarter.

- Skechers’ overall inventory decreased year over year due to strong turnover in the retail and international wholesale segment.

- In the US wholesale business, the company noted that performance was weaker than expected, so inventory destocking was slower than expected.

- CFO John M. Vandemore noted the “decrease in the inventory reflects our diligent management of inventory levels globally, while fulfilling requirements for our growth expectations and expanded retail store base.”

- The company reported a strong increase in inventory due to elevated inventory levels in Europe and China.

- It liquidated some aged inventory in these regions.

- Guess? plans to liquidate excess inventory through third party channels, liquidators and its own channels.

Beauty Retailers

Ulta Beauty- The company’s year-over-year increase in inventory was due to a net opening of 100 new stores and the opening of a distribution center in Fresno, California, partially offset by inventory productivity benefits backed by supply chain investment initiatives.