DIpil Das

Introduction

Our quarterly US Retail Inventory Tracker reports review inventories held by US retailers in the Coresight 100, looking at inventory levels, why inventory levels changed and inventory turnover.

The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in a particular period calculated as the cost of sales (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may spell challenges.

Inventory turnover rates tend to fluctuate by season, so year-over-year changes are often more significant than quarter-over-quarter changes. Also, different retailers have different fiscal year-ends so the quarters under review in this report may not be identical. For most retailers tracked in this report, 1Q ended May 4, 2019 (see figure 3, later in this report, for details).

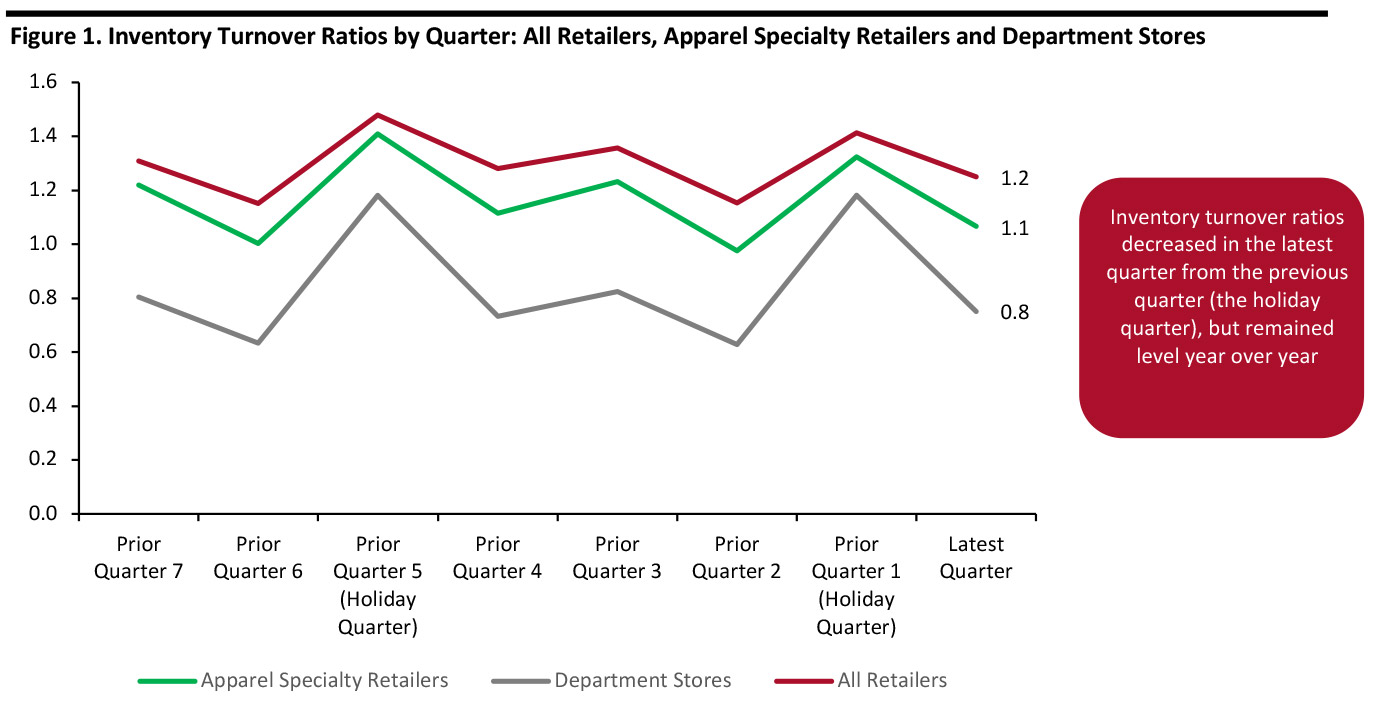

Overview: Apparel Specialty Retailers and Department Stores

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of unpredictable weather, changing consumer tastes or simply making misjudgments about product selection and design. And, with the seasonal nature of apparel sales, there is an ever-present threat of profit-denting markdowns to clear unsold stock.

Most apparel specialty and department store retailers saw subdued consumer demand in the current quarter, which translated into poor sales and inventory buildup compared to the same quarter last year. Other factors such as tariffs and strategic investments also impacted inventory levels.

- Apparel specialty retailers reported a marginal drop in inventory turnover ratio compared to the year-ago period as well as sequential declines after the holiday season. Early buying ahead of tariffs, strategic investments in store expansion or product categories led to higher inventory and lower turnover ratio.

- Department store retailers saw inventory turnover rates slightly improve compared to same quarter in the previous year, while showing a sequential (quarter-over-quarter) decline.

Segment inventory turnovers are non-weighted (arithmetic) averages of selected companies. “All Retailers” represents all retailers covered in this report.

Segment inventory turnovers are non-weighted (arithmetic) averages of selected companies. “All Retailers” represents all retailers covered in this report. Source: S&P Capital IQ/company reports [/caption]

Uncertainty Around Tariffs Continues to Impact Retailers

Data from the National Retail Federation’s (NRF) monthly Global Port Tracker suggests that imports have declined from the peak levels seen at the end of the previous year and the beginning of the current year when retailers were aggressively stocking up ahead of potential tariff hikes. However, imports are still elevated, indicating retailers are still worried about possible further tariff hikes.

Compared to record high imports of over two million twenty-foot equivalents (TEU, one 20-foot shipping container or its equivalent contents) seen in October 2018, imports slowed in the beginning of 2019, with 1.62 million TEUs in February and 1.61 million in March 2019, declining steadily from October’s high, from 1.97 million TEUs in December and 1.89 million in January 2019. However, imports picked up again to 1.75 million TEUs in April and are estimated to be 1.88 million TEUs in May 2019 as uncertainty remains over a possible trade deal between the US and China.

On September 24, 2018, the US implemented tariffs on $200 billion worth of Chinese goods (List 3), bringing the total value of goods subject to additional tariffs to $250 billion. The tariffs had an initial rate of 10%, but that was hiked to 25% on May 10, 2019. Even though some retailers say the tariffs have minimal impact, most also started stocking up before the next list of goods subject to tariffs is announced. Retailers looking to mitigate the impact through negotiations with vendors, shifting sourcing to other countries of origin, increasing prices and cost-saving initiatives.

How Retailers Turned Over their Inventories

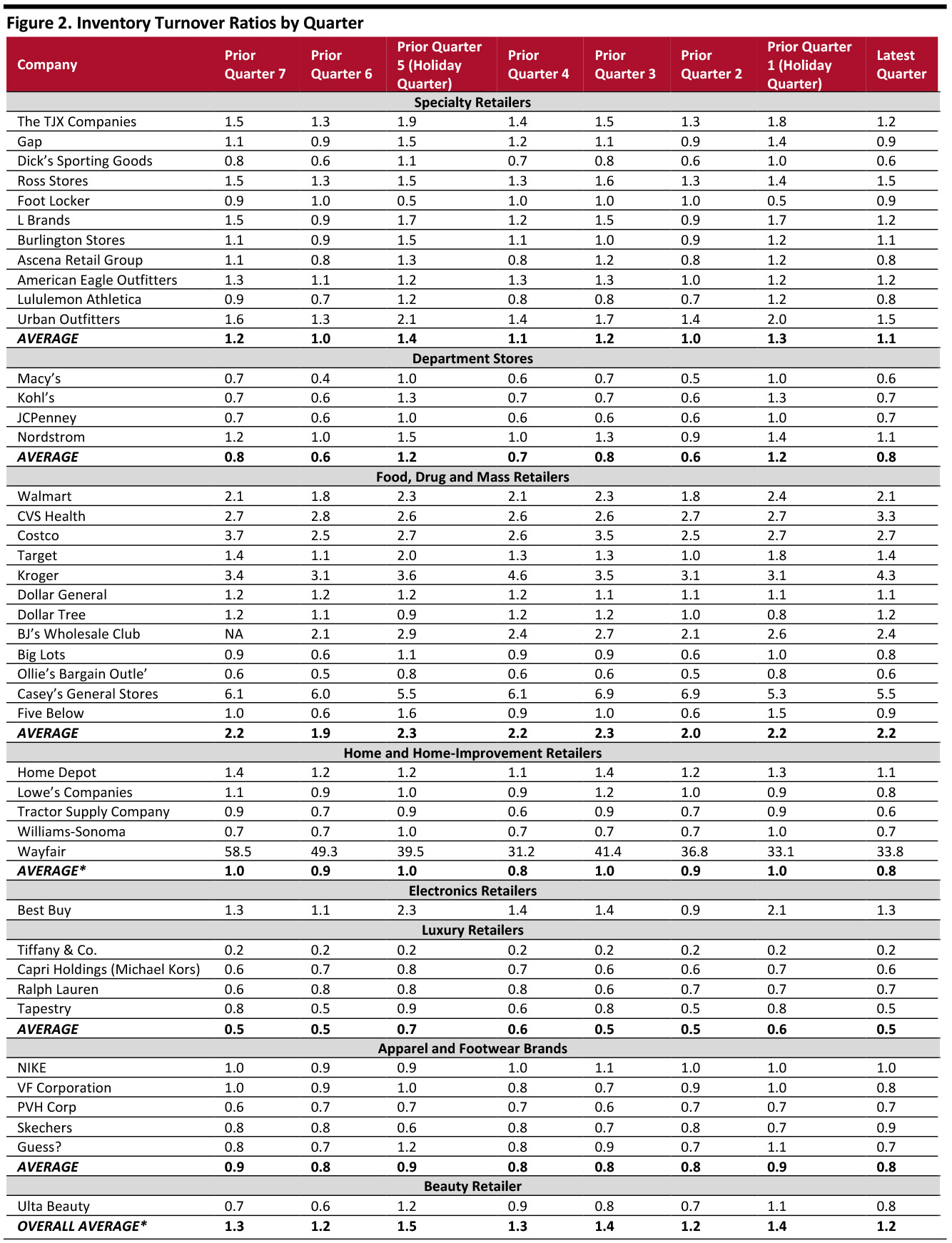

Retailers showed a marginal decline in the inventory turnover rate in the current quarter compared to the same quarter last year.

- The specialty retailer inventory turnover ratio marginally declined, while the ratio improved slightly for department stores due to increased sell-through rates, compared to the same quarter last year.

- The inventory turnover ratio was flat, year over year, for food retailers, drugstores and mass merchants as inventory growth was in-line with sales growth.

- Luxury retailers turned over inventory at a slower pace compared to the previous year quarter due to strategic investments in inventory.

- Home and home-improvement retailers turned over inventories at the same rate as in the year-ago quarter.

Inventory turnover = cost of sales for the quarter/ending inventory for the quarter; Averages are non-weighted (arithmetic);

Inventory turnover = cost of sales for the quarter/ending inventory for the quarter; Averages are non-weighted (arithmetic); *Excludes Wayfair, an outlier

Source: S&P Capital IQ/company reports [/caption]

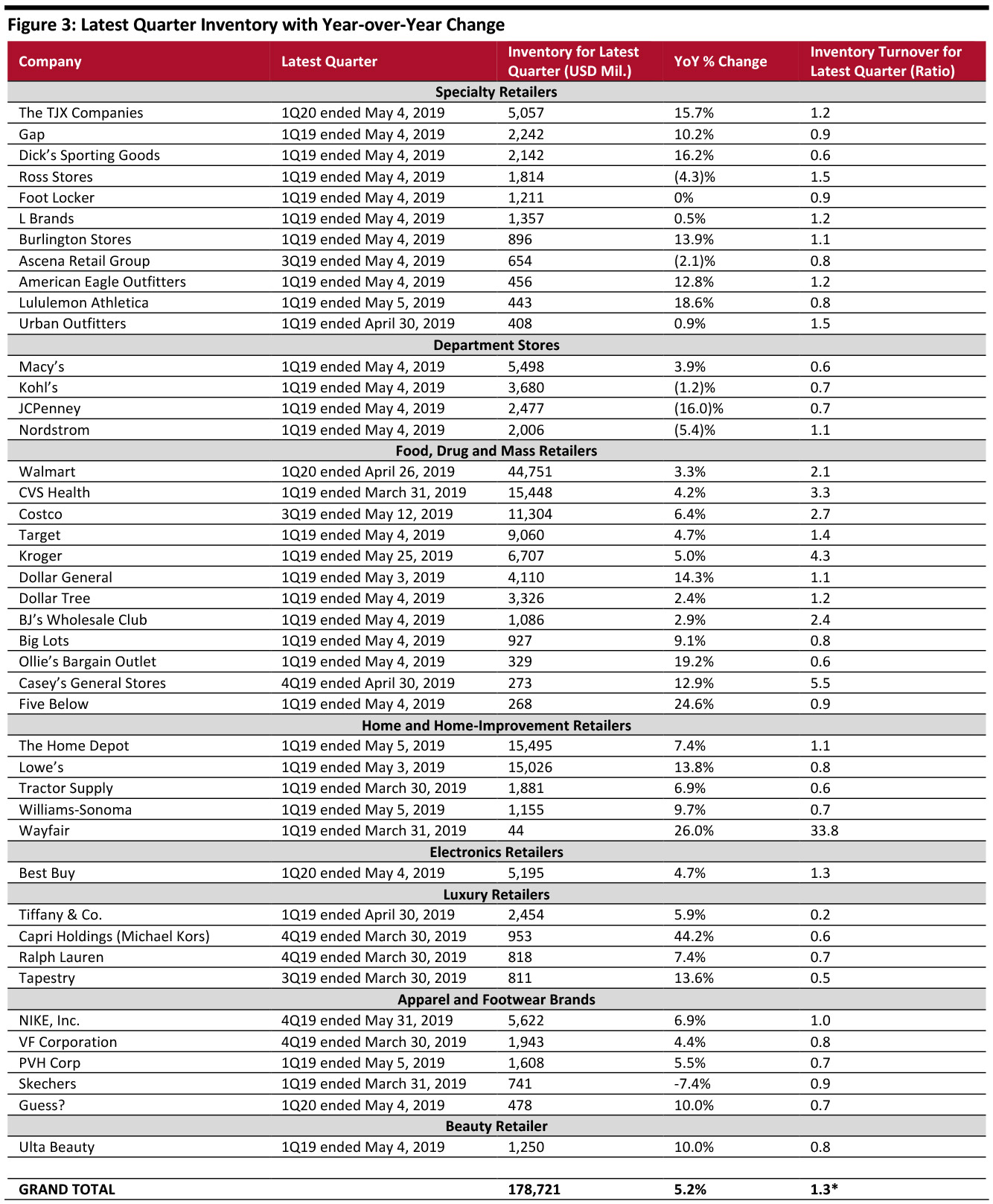

Retailers’ Inventory Increased Despite Holiday Season

A number of retailers continued investment in expansion plans by opening new stores and fulfillment centers, which resulted in higher inventory on their balance sheet. Poor sales, especially for specialty retailers, department stores, electronics retailers and luxury retailers, also resulted in higher stock at the end of the quarter. Pre-tariff buying added to the higher than usual inventory levels.

[caption id="attachment_94018" align="aligncenter" width="700"] Inventory turnover = cost of sales for the quarter/ending inventory for the quarter *Nonweighted overall average

Inventory turnover = cost of sales for the quarter/ending inventory for the quarter *Nonweighted overall average Source: S&P Capital IQ/company reports [/caption] [caption id="attachment_94019" align="aligncenter" width="700"]

Source: S&P Capital IQ/company reports[/caption]

Source: S&P Capital IQ/company reports[/caption]

Segment and Company Overview

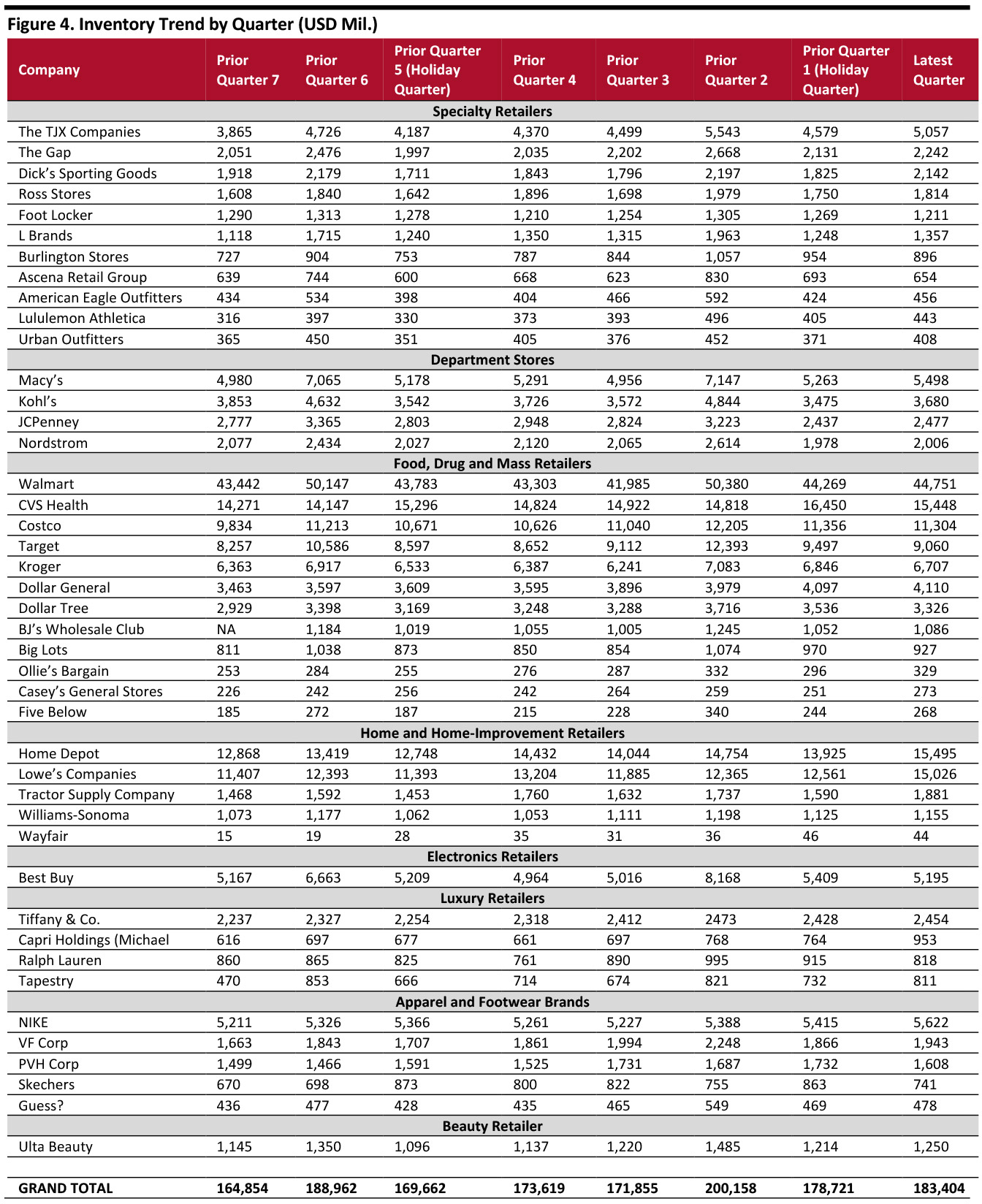

Most retailers continue to accumulate inventory post the holiday season, ahead of an anticipated tariff increase and due to strategic investments in new product line and store expansion. Some retailers turned over inventory at lower rate which also led to higher inventory levels.

Specialty Retailers

Specialty retailers such as TJX Companies and Burlington Stores reported inventory increases due to new store openings. TJX Companies and Dick’s Sporting Goods turned over inventory at a slower pace compared to the same period last year, leading to higher inventory.

TJX Companies

- The company grew inventory 15.7% year over year. Consolidated inventories on a per-store basis as of May 4, 2019, were up 7% on a constant currency basis (up 6% on a reported basis), including distribution centers but excluding inventory in transit and the company’s e-commerce businesses.

- TJX attributed the higher inventory levels to an increase in store count, early buying of certain inventories and late arrival of in-transit inventory.

- Lower inventory turnover also contributed to the inventory buildup.

Dick’s Sporting Goods

- The company’s inventory growth reflected strategic investments to support key growth categories. However, the company also turned over inventory at a slower rate compared to same period year ago.

- Management said in its earnings call that it has invested more in “non-toxic” inventory, products with a longer shelf life, which has increased inventory.

- The company also noted the May 2019 tariff increase will impact its hardlines category and that it is still negotiating with vendors to bring in new pricing strategies to mitigate tariffs.

Foot Locker

- Foot Locker inventory was up 0.1% year over year and 1.7% at constant currencies.

- The company is rolling out RFID technology in its Foot Locker Europe stores. The technology will help associates better track inventory and free them up to spend more time with customers instead of restocking floor inventory or in backrooms.

Burlington Stores

- Burlington Stores continued to report a strong increase in inventory levels, driven by a higher “pack and hold” inventory, which was 28% of total inventory at the end of the first quarter of fiscal 2019, compared to 27% in the same period previous year. Inventories expected to be shipped to customers are packed and stored to be retrieved later on the actual shipping day are known as pack and hold shipments.

- The increase was also due to opening 37 net new stores since the end of the first quarter of fiscal 2018. The company noted that comparable store inventory increased 5% at the end of the reported quarter.

- Burlington Stores’ direct imports represent only 6% of its total orders and 15% of this 6% are impacted by current tariffs, including Baby Depot, luggage and handbags. The company noted that the recent increase to 25% on these categories will not have a material financial impact.

Department Stores

Department stores saw a decline in inventory levels with Macy’s the exception. While Macy’s inventory increased year over year, JCPenney reported a decline in inventory levels due to increased sell-through rates.

Macy’s

- Macy’s inventory was slightly higher due to slower turnover in spring products during the quarter.

- Macy’s said it began the year with clean inventory and looks to expand its merchandise margin.

JCPenney

- The company reported a 16% decline in inventory, with strong improvement in turnover, due to increased sell-through rates in all divisions.

Food, Drug and Mass Retailers

Most of the food and drug retailers and mass merchants grew inventory levels in line with or above sales growth.

Walmart

- Walmart’s increase in inventory was led by accelerated buying in certain categories, timing of sales for summer seasonal merchandise, and increased mirroring of inventory in its e-commerce fulfillment centers.

- Walmart expects inventory to normalize in the coming quarters.

Dollar General

- Dollar General’s inventory increased due to a change in the company’s replenishment process focused on enhancing on-shelf availability.

- Over time, the company targets inventory growth in line with or below sales growth.

Dollar Tree

- Inventory for the Dollar Tree segment increased 10.6% year over year, while sales per square foot increased 5.7%. Inventory per selling square foot increased 4.6%. The company believes current inventory levels are appropriate to support scheduled new store openings, re-banners and sales initiatives for the second quarter.

- Inventory for the Family Dollar segment decreased 3.8% year over year and increased 3% on a selling square-foot basis.

Home and Home-Improvement

Home and home-improvement retailers saw a significant increase in inventory as they stocked up to support anticipated seasonal demand.

Home Depot

- The company grew inventory 7.4% year over year in the latest quarter, slightly higher than its sales growth. The inventory increase was due to merchandising resets and early buy-in for spring sales.

- Home Depot turned over inventory at a rate of 1.12 times compared to 1.13 times in same quarter last year. For fiscal 2019, it expects the inventory turnover rate to remain flat compared to the previous fiscal year.

Lowe’s

- The company increased inventory by investing in job-lot quantities. Lowe’s sells some products through its Contractor Pack’s Program, under which customers can buy in bulk at discounted prices known as job-lot quantities.

- The company also stocked warehouses and stores to support anticipated seasonal demand. It noted in its earnings call that a significant increase in inventory was an important “strategic investment” to drive sales performance in the coming months.

Luxury Retailers

Luxury retailers increased inventory levels due to planned investments in store expansion. Ralph Lauren guided for next quarter inventory to grow in higher single digits. The consolidation of Versace with Capri Holdings led to higher inventory in the quarter for Capri Holdings.

Tiffany & Co

- Tiffany & Co grew inventory 5.9% year over year, driven by strategic investments in jewelry inventory, due to higher finished goods and poor sales in the current and previous (holiday) quarter.

- The company guided for inventory growth to be flat year over year for the current fiscal.

Ralph Lauren

- Ralph Lauren grew inventory 7.4% year over year to $818 million, led by investments to support global store expansion, stocking inventory to align with demand and increased inventory to normalized levels in European factory stores.

- For next quarter, the company guided for inventory to grow in high single digits.

Capri Holdings

- Inventory for the Michael Kors brand at the end of the quarter was $953 million, up 44.2% year over year.

- Inventory increases were driven by the addition of $193 million in Versace inventory. Jimmy Choo inventory increased 22% year over year, reflecting revenue growth. Michael Kors inventory increased 13% as the company stocked up on signature and core accessories products in strong demand.

Apparel and Footwear Brands

Apparel and footwear brands increased inventories in line with sales growth in the reported quarter. Nike and PVH had stable inventory turnover rates, while Skechers improved its inventory turnover rate compared to the previous year.

Nike

- Nike grew inventory by 6.9%, with healthy inventory levels across all geographies.

- The company also noted it will launch RFID across all footwear and apparel beginning in the fall 2019 season, which will significantly improve inventory visibility and accuracy throughout the supply chain. In fiscal 2020, the company will expand RFID technology globally in distribution centers and factories.

PVH

- PVH expects to incur incremental tariffs of $0.05 per share on existing product categories from the 25% tariffs imposed in May on accessory and handbags, to which company has a relatively small overall exposure.

- The company recorded a $1.7 million inventory markdown as a part of Calvin Klein restructuring in the latest quarter.

Skechers

- Skechers’ overall inventory decreased year over year due to strong turnover in domestic and international markets.

- Due to a lean inventory position, the company expects not to be able to deliver all off-price bulk orders at once.

Guess?

- Inventories were up 10% as reported and 15% in constant currency year over year.

- The company said in its earnings call it has some excess inventory from the end of last year but will continue to make progress on its plans to clear the inventory through its own retail outlet stores as well as stock liquidation channels.

- The company noted in its earnings call that if “List 4” tariffs (the next round of threatened tariff increases) are implemented, it would have a meaningful impact on its business. The company will mitigate this through cost sharing with suppliers, shifting sourcing to other countries, raising prices and offsetting increased costs with cost-saving initiatives.

Beauty Retailers

Ulta Beauty

- The company’s year-over-year increase in inventory was due to a net opening of 89 new stores and the opening of a distribution center in Fresno, California, partially offset by inventory productivity benefits backed by supply chain investment initiatives.

- Average inventory per store increased 1.8% compared to the first quarter of fiscal 2018.

- The company expects a minimal impact from tariffs as most cosmetics, fragrance, haircare and liquids are made in North America and Europe. The company plans to manage tariff impacts through supplier relations and pricing.

Outlook

The first quarter was a cool-off period for retailers after a busy holiday season. The NRF Global Port Tracker also showed that imports slowed in February and March 2019, as tariff increases were placed on hold. However, imports surged in April and May due to an expected tariff hike from the then prevailing 10% rate to 25%. Imports are estimated to remain at higher levels for the coming months as retailers try to balance the need to get products in before potential new tariffs hit against the concern of growing inventory levels.

Apart from tariff uncertainty, retailers will also see higher inventory levels as they increase store fleets and test new products ahead of the peak holiday season.