Nitheesh NH

Introduction

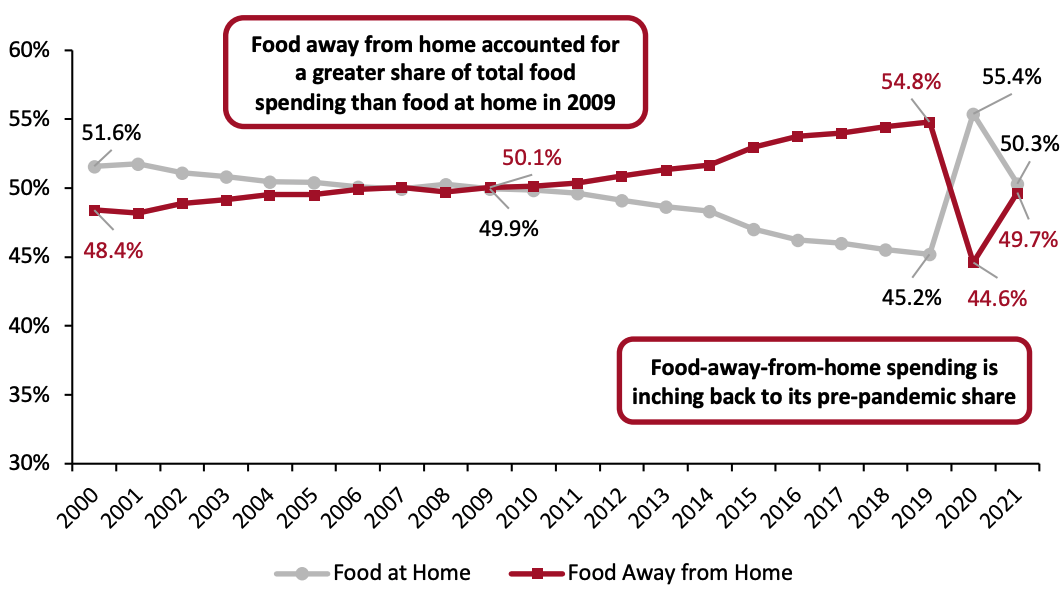

What’s the Story? Retail foodservice is a unique hybrid of grocery retail and traditional away-from-home foodservice. With customer affinity for prepared foods remaining high, the business has strong potential. In this report, we assess key trends in retail foodservice in the US market and consider future prospects of the sector. Why It Matters The Covid-19 pandemic reversed a decade-long trend of market share gravitating from retail to foodservice, boosting grocery store sales. In Figure 1, we show the bifurcation of food-at-home and foodservice spending since 2000; the pandemic flipped the market share in favor of food retail in 2020.Figure 1. US: Food-at-Home Spending Versus Food-Away-from-Home Spending: (% of Total Food Expenditure) [caption id="attachment_144826" align="aligncenter" width="700"]

Source: USDA/Coresight Research[/caption]

However, in 2022, we anticipate that the foodservice sector will regain full strength, with more consumers shifting back to eating and socializing outside of their homes, supported by restaurants adjusting their business practices and finding innovative solutions to serve their customers. This will likely depress traditional food retail sales, representing a significant headwind for grocers in 2022 and beyond. Retailers offering fresh meals and exciting dining experiences will compete for a larger slice of the total foodservice pie going forward.

Source: USDA/Coresight Research[/caption]

However, in 2022, we anticipate that the foodservice sector will regain full strength, with more consumers shifting back to eating and socializing outside of their homes, supported by restaurants adjusting their business practices and finding innovative solutions to serve their customers. This will likely depress traditional food retail sales, representing a significant headwind for grocers in 2022 and beyond. Retailers offering fresh meals and exciting dining experiences will compete for a larger slice of the total foodservice pie going forward.

Three US Retail Foodservice Trends: Coresight Research Analysis

1. Grocers Tap Ghost Kitchens as New Revenue Driver Grocery retailers have increasingly focused on offering onsite dining options to entice shoppers to stay in stores longer, resulting in increased spending. With dine-in services severely impacted during Covid-19, some grocers now see an opportunity in ghost kitchens to capitalize on the surge in takeout and meal delivery. Ghost kitchens are food preparation facilities purpose-built to produce food exclusively for pickup or delivery. They can also allow multiple restaurants to share a single commercial kitchen space to prepare pickup- and delivery-optimized meals. Ghost kitchens tend to have slimmed-down menus from their respective restaurant brands but use the same ingredients and training as the restaurants’ actual locations. In August 2021, Kroger partnered with Kitchen United to offer shoppers freshly prepared, on-demand restaurant-quality food. These kitchens inside participating Kroger locations will feature a mix of six local, regional or national restaurant brands. Consumers can order via the Kitchen United website or app or onsite using the in-store kiosks. The first kitchen center was debuted at a Los Angeles Ralphs store (a subsidiary of Kroger) in January 2022, with more locations in the pipeline. Kroger previously partnered with ghost kitchen company ClusterTruck in October 2020 to open two in-store ghost kitchens in Indianapolis and Columbus, Ohio. ClusterTruck locations offer online and walk-up ordering for pickup, as well as delivery options.- For more on Kroger’s 2022 plans, see our separate report, Kroger 2022 Business Update.

ClusterTruck ghost kitchen at a Kroger store in Fishers, Indiana

ClusterTruck ghost kitchen at a Kroger store in Fishers, IndianaSource: Kroger[/caption] Walmart opened its first ghost-kitchen service location in partnership with Ghost Kitchen Brands in New York in September 2021, as part of the multi-state US expansion. The service enables Walmart shoppers to select meal items from 25 national and regional restaurants and combine them into a single order for pickup or delivery. Customers can also place their orders via in-store touchscreen kiosks and receive a text when their order is ready, enabling them to shop while their meal is prepared. Walmart expects to open similar ghost kitchens in Texas, California, Illinois and Georgia in 2022. The ghost-kitchen venture came just five months after McDonald’s announced it would close hundreds of Walmart locations. Benefits and Potential of Ghost Kitchens As consumers cut back on grocery spending in favor of prepared food, ghost-kitchen partnerships will allow retailers to partially retain their audience, reducing the overall impact on topline performance. Additionally, customers coming into stores for food pickup will increase foot traffic, creating a sales opportunity for grocers. Ghost kitchens are also less expensive than traditional dining establishments, as they do not require the same back-of-house facilities or dining/reception area. As a result, they present a more cost-optimized approach for grocers/restaurants to enter new markets and reach a larger customer base. According to real estate firm CBRE, around 111 million Americans used an online ordering app for food in 2020, up 17% year over year. The company said that pre-pandemic, ghost kitchens were expected to account for 10%–¬15% of the US restaurant industry by 2025. Now, the market share is expected to climb to 20%–25% by 2025 due to increased consumer adoption of online ordering. 2. Grocery Retailers Are Expanding Pre-Packaged Meals Assortment Grocery retailers are expanding their meal-kit line to include meal offerings that require little or no preparation, to appeal to time-strapped consumers seeking convenient and healthy mealtime options.

- In 2020, Kroger-owned Home Chef expanded its meal-kit offerings to include ready-to-eat products, heat-and-eat meals and seasonal fare. Home Chef meals and kits are sold at more than 2,200 locations in the Kroger Family of Stores, as well as through a home-delivery subscription from HomeChef.com. In October 2021, Kroger announced that Home Chef reached $1 billion in annual sales. Kroger said Home Chef will continue to expand its menu to provide consumers with more “fresh mealtime shortcuts.”

- Ahold Delhaize-owned The Giant Company extended its meal-kit selection by launching a ready-to-eat meal solution, All Set in a Box, in February 2021, which combines a main course and several sides in a single package. Shoppers can call ahead or order their meal in-store, with the order ready within 15 minutes.

- In October 2020, Wakefern-owned Shoprite launched Fresh to Table, a store-within-a-store concept that features meal solutions in various grab-and-go formats. Fresh to Table offers a one-stop-shopping experience for different meal occasions, including ready-to-cook items, ready-to-heat-and-serve items, and ready-to-eat meals.

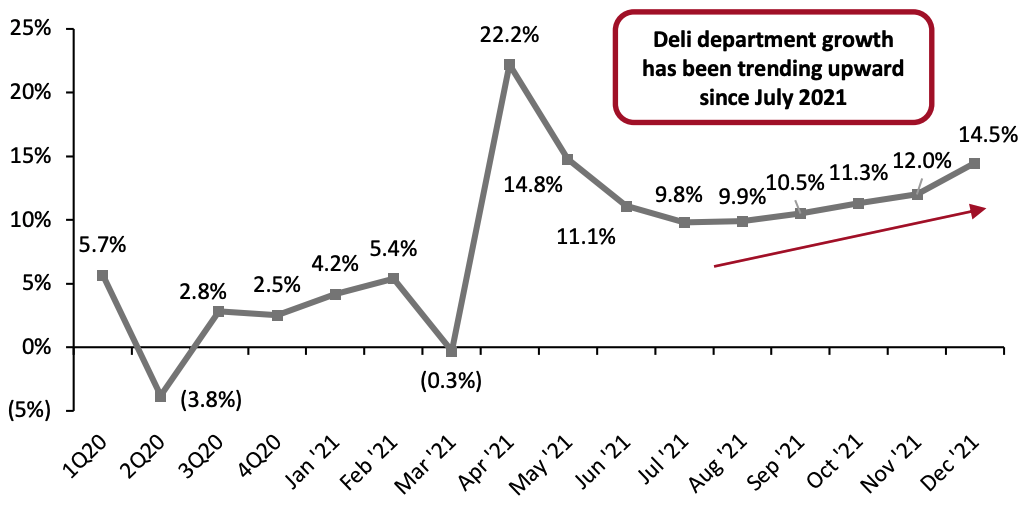

Figure 3. US Deli Department Sales Growth (YoY %) [caption id="attachment_144828" align="aligncenter" width="700"]

Source: Integrated Fresh/IRI/MULO/Total US[/caption]

According to IRI, in 2021, deli department sales increased by 11.1% versus 2020, driven by growth in each of the four main deli sales areas (see Figure 4).

Source: Integrated Fresh/IRI/MULO/Total US[/caption]

According to IRI, in 2021, deli department sales increased by 11.1% versus 2020, driven by growth in each of the four main deli sales areas (see Figure 4).

Figure 4. US Deli Department Sales and 2021 Sales Growth [wpdatatable id=1864]

Source: IRI

The “deli prepared” category not only saw the highest sales but the highest sales growth, year over year, in 2021—and the $20.9 billion in 2021 sales also reflects a 9.7% increase versus the pre-pandemic level. With sales recovering, the deli prepared category has once again become an area of growth, supporting busy consumers with their everyday meal needs, from full entrees to side dishes that complement meals cooked at home.Figure 5. US Deli Prepared Category: Sales Growth (YoY %) [wpdatatable id=1865]

Source: IRI

What We Think

Although food-away-from-home sales are increasing, restaurants will face high prices and service costs in the inflationary environment of 2022. Grocery retailers have the opportunity to develop affordable meal solutions and shopping experiences designed to match the convenience of out-of-home eating. Grocers can also target shoppers who are already using grocery pickup services with increased frequency to grow their food-to-go order volume. Implications for Retailers- Shoppers typically do not view grocers as a foodservice option. Grocery retailers can increase their marketing and merchandising strategies (via in-store signage, inclusion in e-mail newsletters and social media posts) by acknowledging the growing time constraints and cooking fatigue among shoppers. To further promote engagement, retailers can emphasize highlighting convenience, nutrient facts and meal ingredients.

- Although retail inflation is growing, the cost for eating out is rising much faster. Restaurant inflation will potentially result in more at-home preparation as many consumers realize the potential savings and other benefits of cooking at home. Retailers should look to capitalize on this scenario by ramping up foodservice options that amplify convenience, affordability, nutrition and culinary experience.

- Retailers should ensure that their delivery and prepared meal options are listed and amply visible in their apps as well as third-party delivery platforms. This will allow grocers to remain in front of customers with a variety of prepared meal offerings, making it convenient for them to combine those orders with their usual grocery shopping.

The information contained herein is based in part on data reported by IRI through its Market Advantage service for the retail foodservice industry as interpreted solely by Coresight Research, Inc. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinions expressed herein reflect the judgment of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.