DIpil Das

What’s the Story?

The US retail industry has seen a spate of bankruptcies year to date in 2020 already, with July alone seeing eight major bankruptcies, and the signs indicate that we will see an acceleration in bankruptcies in the second half of the year.Why It Matters

Coresight Research estimates that the US retail industry will see 20,000–25,000 store closures in 2020, and a number of these will be on account of retailers filing for bankruptcy. Here are four reasons why these bankruptcies have a significant bearing on the retail industry:- More bankruptcies translate to more store closures.

- Mall owners will face a challenge in finding new tenants to occupy space vacated by stores closed by bankrupt retailers.

- Mall owners may acquire some struggling and bankrupt retailers.

- There will be opportunities for stronger retailers to gain market share and thus consolidation in the department-store and apparel retail sectors.

Many Major Retailers Have Filed for Bankruptcy

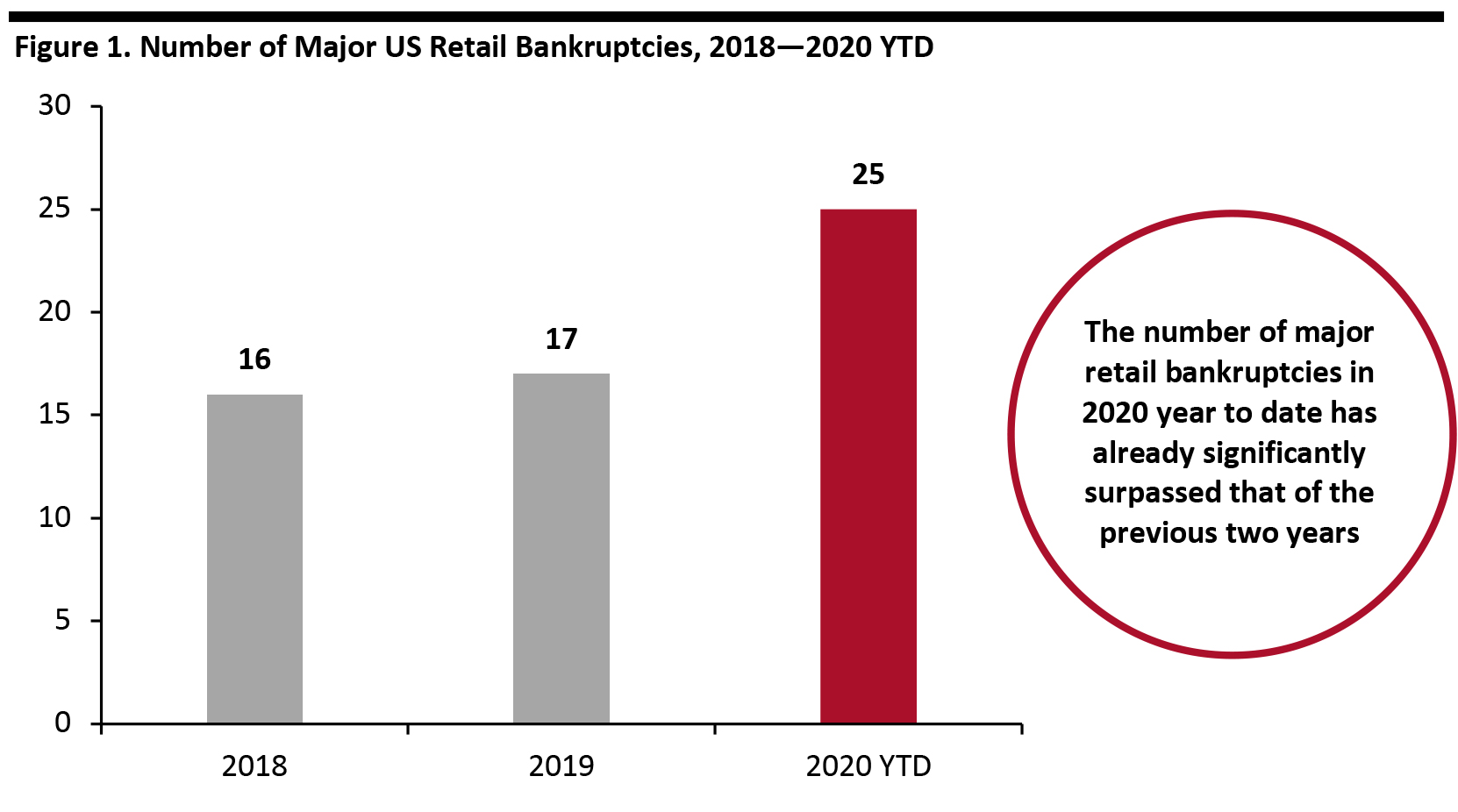

Coresight Research has tracked 25 major US retail bankruptcies year to date in 2020, already significantly more than the full-year tallies in the previous two years, as can be seen in Figure 1. The impact amounts to over $34 billion, taking into account the revenues of 12 retailers for which data was available. [caption id="attachment_113522" align="aligncenter" width="700"] Source: Coresight Research [/caption]

Of the 25 bankrupt retailers, eight filed between January and March—including Art Van Furniture, Modell’s Sporting Goods, Papyrus and Pier 1 Imports—and eight filed in the month of July alone.

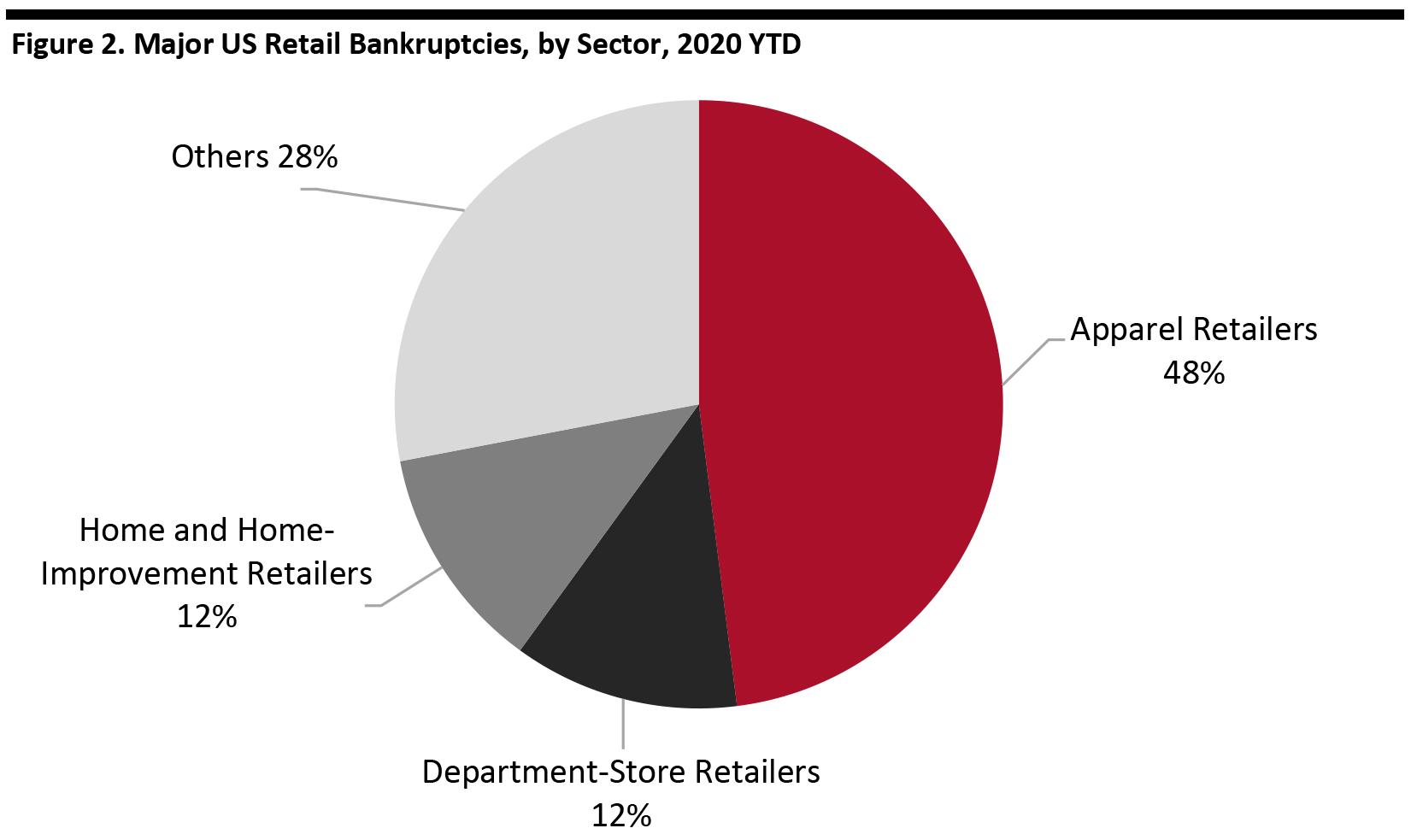

As the coronavirus pandemic wreaked havoc on retail, department stores and apparel retail have proven to be the hardest-hit sectors, as they have seen the most bankruptcies since April (see Figure 2).

[caption id="attachment_113501" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

Of the 25 bankrupt retailers, eight filed between January and March—including Art Van Furniture, Modell’s Sporting Goods, Papyrus and Pier 1 Imports—and eight filed in the month of July alone.

As the coronavirus pandemic wreaked havoc on retail, department stores and apparel retail have proven to be the hardest-hit sectors, as they have seen the most bankruptcies since April (see Figure 2).

[caption id="attachment_113501" align="aligncenter" width="700"] “Apparel” includes retailers such as Ascena Retail Group and Muji; “Others” includes health and nutrition products retailer GNC and grocery, gift and stationery retailers.

“Apparel” includes retailers such as Ascena Retail Group and Muji; “Others” includes health and nutrition products retailer GNC and grocery, gift and stationery retailers. Source: Coresight Research [/caption] We discuss some of the major retailers that have filed in the department-store and apparel sectors below. Department Stores Three major department-store retailers have filed for bankruptcy year to date, and there could be more over the rest of the year given the underwhelming outlook for the sector. Neiman Marcus filed for Chapter 11 bankruptcy protection on May 7. The company entered into an agreement with a majority of its creditors to substantially reduce its debt and provide financing; it expects to emerge from bankruptcy in the fall, at which point its creditors will become majority owners in the business. The company had 43 department stores at the time of filing. While the company has not confirmed how many of these will close permanently, it provided an update last week that it may close four Neiman Marcus stores on July 27. The company will also close the majority of its 22 Last Call (Neiman Marcus’ discount chain subsidiary) stores, according to its press release. Stage Stores filed for Chapter 11 bankruptcy protection on May 10 and announced plans to liquidate its business. The retailer is pursuing a sale of its business while simultaneously initiating a wind-down of its operations. Stage Stores stated that it would terminate the wind-down of operations at certain locations if it receives a suitable going-concern bid. It has planned a phased approach to reopen its stores in order to commence the liquidation of its inventory. Stage Stores operated 738 stores in the US at the time of filing. JCPenney filed a voluntary reorganization petition under Chapter 11 bankruptcy protection on May 15. The retailer had entered into a restructuring support agreement with its lenders to implement a financial restructuring plan in order to reduce its debt. JCPenney announced plans to rationalize its store portfolio by closing 242 stores—192 stores in fiscal year 2020, ending January 30, 2021, and 50 stores by the end of the second quarter of fiscal year 2021, ending July 31, 2022. Combined, the three chains (JCPenney, Neiman Marcus and Stage stores) operated 1,862 stores and $17.3 billion in revenue as of the last reporting period—totaling 12.8% of total FY20 sector revenue from selected major department store retailers. Apparel Retailers Of the 25 major US retailers that have filed for bankruptcy so far in 2020, 12 have been apparel retailers, highlighting the significant struggles that the sector has been facing. In a separate report, we discuss the apparel sector’s outlookfor the rest of the year, on the back of the devastating impact of the coronavirus pandemic. Denim retailer True Religion Apparel filed for Chapter 11 bankruptcy protection on April 13 for the second time in less than three years. True Religion’s CEO Michael Buckley said that the retailer’s major lenders, ABL and Term Loan, were providing additional funding to reorganize its business under Chapter 11. True Religion operated 87 stores at the time of filing for bankruptcy. Chinos Holdings, parent company of specialty retailer J.Crew Group, filed for Chapter 11 bankruptcy protection on May 4. According to a company release, J.Crew stated that it had reached an agreement with its lenders whereby the lenders will convert approximately $1.65 billion of the retailer’s debt into equity. The retailer intends to restructure its debt and position its J.Crew and Madewell brands for long-term profitable growth. As a part of the agreement, Madewell will remain part of the J.Crew Group, although the retailer had previously planned to spin off the former as a public company. Lifestyle brands collective Centric Brands filed for Chapter 11 bankruptcy protection in May, with plans to restructure its business. The company entered into an agreement with its lenders to secure $435 million debtor-in-possession financing so that it can operate during the restructuring process. Centric Brands also revealed that it intends to emerge from Chapter 11 as a private company. As of September 30, 2019, Centric Brands operated 97 retail stores and 337 partner shop-in-shops. Lucky Brand filed for Chapter 11 bankruptcy protection on July 3, with plans to close at least 13 stores. The retailer is also pursuing a sale of its business to reduce its debt. Lucky Brand will continue to operate its e-commerce platform, the majority of its stores and wholesale business during the bankruptcy proceedings. It has received financial commitments from a few of its existing lenders that will enable the retailer to operate during the bankruptcy process. As of May 2020, Lucky Brand operated 112 specialty stores and 98 outlet stores in North America. Brooks Brothers filed for Chapter 11 bankruptcy protection on July 8, 2020 and plans to close at least 51 stores. The retailer operates over 200 stores in North America and 500 stores globally. Specialty apparel retailer RTW Retailwinds filed for Chapter 11 bankruptcy protection on July 13 and expects to close a significant portion, if not all, of its 378 stores. The company will continue to operate its business in the short term by reopening certain stores that were closed due to the coronavirus lockdown, but it is evaluating all strategic alternatives, including the potential sale of its e-commerce business and related intellectual property. Ascena Retail Group, owner of apparel brands Ann Taylor, Justice, Lane Bryant, LOFT and Lou & Grey chains, filed for Chapter 11 bankruptcy on July 23 and has entered a restructuring support agreement with over 68% of its secured term lenders. As part of the restructuring agreement, the company will strategically reduce its footprint by closing all 320 Catherines stores, more than 150 Lane Bryant stores and a select number of Ann Taylor, LOFT and Lou & Grey stores. Combined, six (Ascena Retail Group, Centric Brands, G-Star Raw, J.Crew Group, Tuesday Morning and RTW Retailwinds) of the 12 apparel retailers that filed for bankruptcy operate over 4,300 stores and $11.5 billion in revenue as of the last reporting period.

Figure 3. Major US Retail Bankruptcies, 2020 YTD [wpdatatable id=345] Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. N/A – Not Available Source: Company reports/Coresight Research

Bankruptcies Are Likely to Accelerate

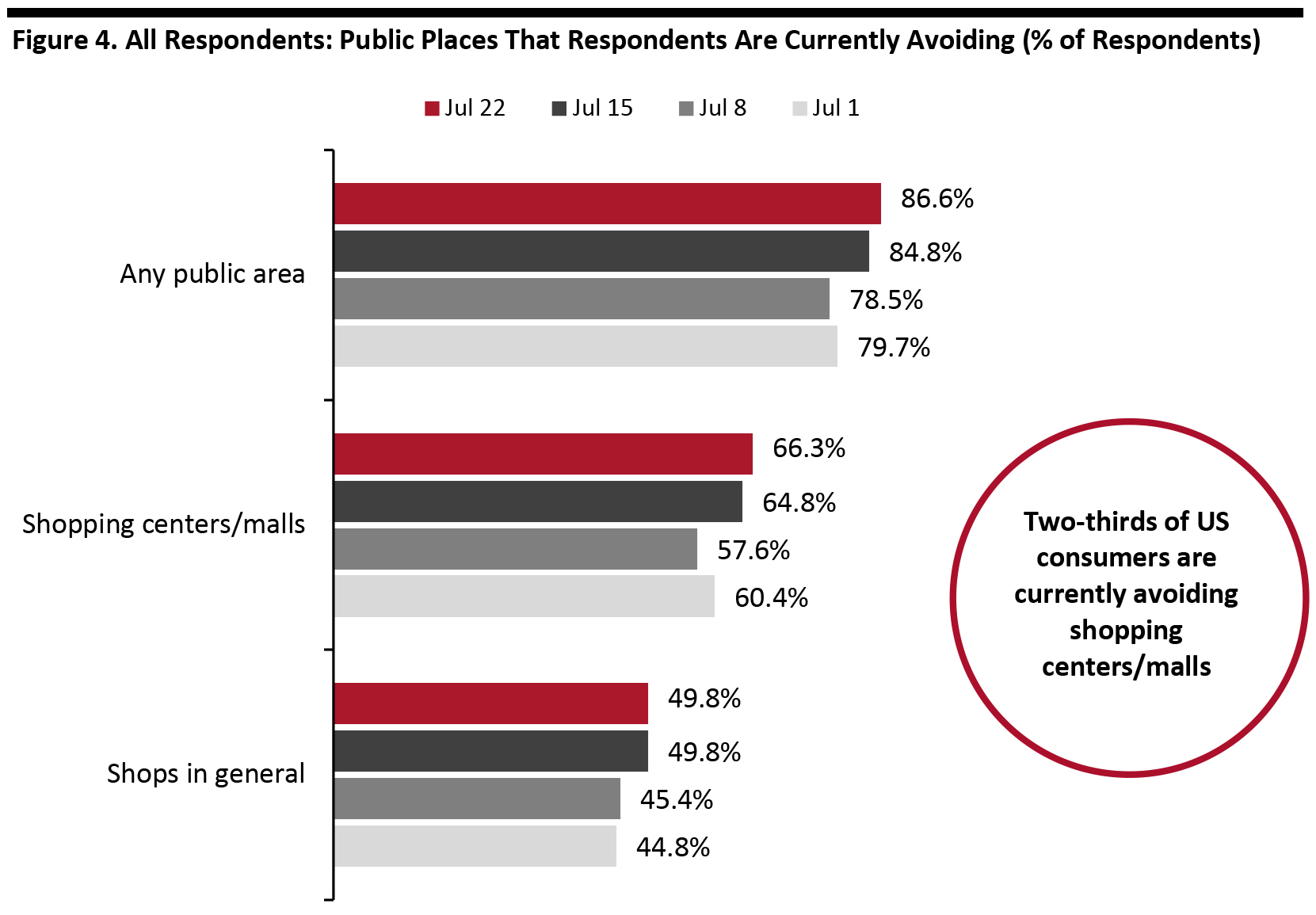

Besides retailers who have already filed for bankruptcy, some others including apparel retailers such as Francesca’s, Tailored Brands and department store chains Lord & Taylor and Saks Fifth Avenue are currently under bankruptcy watch. We expect to see many more bankruptcies over the course of the rest of the year as consumers continue to remain reluctant to visit public places, including malls and stores, and plan to shift more spending from discretionary to staple categories. Our latest weekly consumer survey, undertaken on July 22, includes insights into current consumer avoidance behavior for different types of public places. The proportion of respondents who said they are avoiding shopping centers/malls rose to 66.3%, versus 64.8% the prior week. In addition, half of all respondents are avoiding shops in general—a worrying sign for retail. [caption id="attachment_113502" align="aligncenter" width="700"] Respondents could select multiple options Base: US Internet users aged 18+

Respondents could select multiple options Base: US Internet users aged 18+ Source: Coresight Research [/caption] The debilitating impact of the coronavirus on sales will likely quell hopes of survival for many struggling retailers—especially debt-laden retailers. This will likely result in an acceleration in the number of store closures.

Mall Owners Are Looking To Acquire Bankrupt Retailers

The wave of retailer bankruptcies that have been taking place, along with the ominous signs for an acceleration in these filings for the future, will further complicate the challenges that mall owners continue to face. Department stores such as JCPenney and other large-format retailers have traditionally played the role of anchor tenants in malls, generating strong foot traffic that attracts other retailers to set up shop in the malls. When the anchor tenants shutter their stores in the mall, other tenants are likely to follow suit. Some of these tenants often enter into co-tenancy clauses that enable them to pay lower rent or break their leases when an anchor tenant leaves. Department-store and large apparel-chain bankruptcies and resultant store closures in malls will therefore create a ripple effect that will impact malls significantly. It is in this context that some leading mall owners are considering acquiring bankrupt and struggling retailers:- Simon Property Group, one of the largest US mall owners, is mulling a joint venture with Brookfield Property Partners, a unit of Brookfield Asset Management, and brand management company Authentic Brands (primarily known for acquiring brands with licensing potential) to bid for department-store chain JCPenney, as reported by Bloomberg on June 15, 2020.

- Simon Property Group and Authentic Brands are also considering a partnership to acquire Brooks Brothers, as reported by TheStreet on July 10, 2020, and are looking to buy assets in Lucky Brand Dungarees.

What We Think

As the coronavirus pandemic continues to take a heavy toll on the business of various struggling retailers, we expect to see many more bankruptcies over the rest of the year. This will be driven by consumers continuing to avoid public places, including malls and stores, and plans to shift more spending from discretionary to staple categories. While some retailers are under bankruptcy watch, mall-based department stores and other large-format retailer bankruptcies will weigh heavy on mall owners. To address this challenge, some mall owners may acquire struggling retailers. From another perspective, the bankruptcies and resultant closures represent an opportunity for stronger and established retailers to gain some market share. Implications for Brands/Retailers- More retailers filing for bankruptcy imply more store closures.

- There is opportunity for stronger retailers to gain market share.

- A rise in the number of retail bankruptcies will create significant challenges for malls to find new occupants for vacant spaces on account of store closures.

- Department-store chain and other large-format store retailer bankruptcies will impact malls significantly, given that they operate as anchors.

- Mall owners may consider acquiring struggling and bankrupt retailers, particularly anchor retailers, that have the potential to survive.