DIpil Das

What’s the Story?

As 2021 progresses, the US will continue to face a crisis with intersecting economic and public health challenges. However, retail in the US has faced severe economic crises before, most recently in 2008 when the collapse of the housing market and financial system paralyzed the economy. In this report, we examine lessons to be learned for retail from that crisis. One key distinction is that the Covid-19 crisis has not dented retail sales in total. In 2020, total US retail sales rose 6.8%, but gains were highly uneven: While home-improvement retailers enjoyed a 13.3% rise in sales, department stores faced an 18.2% slump, according to US Census Bureau data. Such was the strength of total demand that, even while e-commerce sales grew by 33.7% in the year and shoppers obeyed stay-at-home orders, offline sales increased in 2020, by 2.0%Why It Matters

Studying previous recessions and the shape of retail’s performance in recovery periods is a powerful tool for predicting the state of the industry as it moves beyond the current disruption.US Retail amid Economic Recovery: A Deep Dive

In Figure 1, we compare select major retail sales indicators from early 2009, in the wake of the 2008 GFC, with those of early 2021, along with their expected impact on retail in the US.Figure 1. Macroeconomic Indicators: GFC (Early 2009) vs. Early 2021 [wpdatatable id=774 table_view=regular]

Source: BEA/BLS/S&P/US Census Bureau/Coresight Research Differences Needless to say, the most significant difference between the two crises is that while the GFC was purely economic, retailers and consumers have had to contend with both economic and health issues during the coronavirus pandemic. The pandemic has also reshaped everyday life—consumers are working from home in many instances, changing the way they socialize, and spending record amounts of time and money on digital channels. While the long-term impact of the current crisis remains unclear, it will certainly extend beyond the metrics of economic recovery. Despite the havoc wreaked by the pandemic on the lives and livelihoods of countless Americans, the fact that the current economic crisis was sparked by a public health emergency, and not underlying economic issues, bodes well for a recovery uninhibited by the structural financial factors that the country had to deal with in the aftermath of the GFC. Moreover, as we noted earlier, retail in total performed solidly during the crisis period of 2020, with a near-7% rise in total retail sales during the year. As vaccinations proceed, the health impact on retail is likely to lessen. We identify four differences between the current situation and the GFC, two that impact consumer behavior and two that affect sectoral outlooks. We expect to see these differences reflected in retail in 2021 once health concerns begin to subside. Consumer Behavior

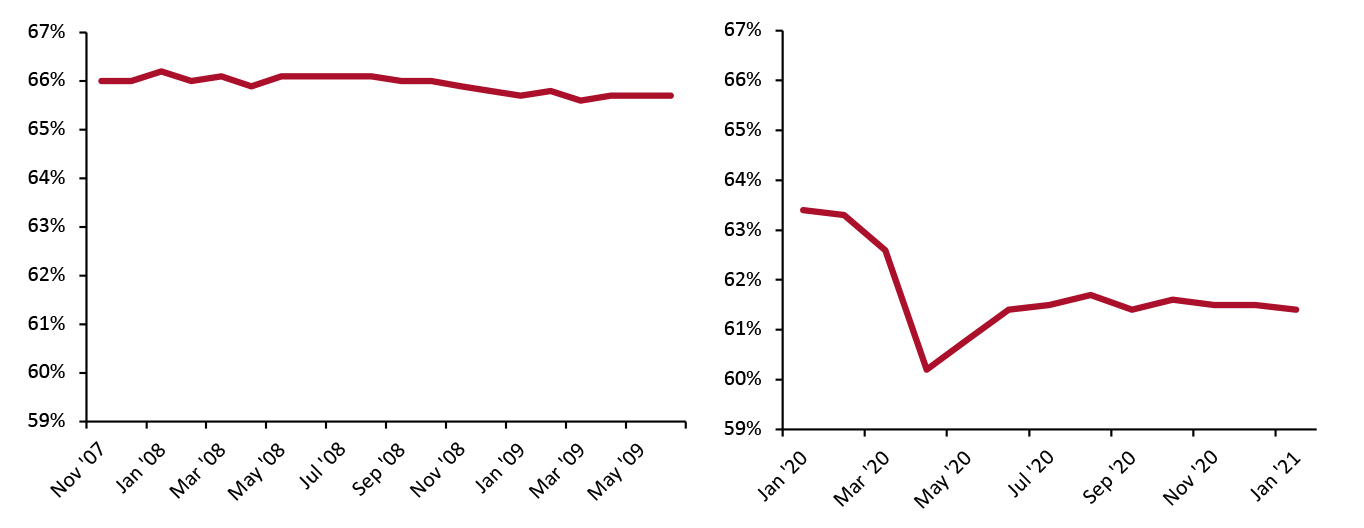

- Labor Force Participation: During the GFC, US labor force participation dropped by just 0.3 percentage points. However, labor force participation dropped by more than 3 percentage points at the height of the coronavirus pandemic. As of January this year, the rate remains 2 percentage points down from January 2020, indicating that out-of-work consumers will remain cost-conscious for the foreseeable future.

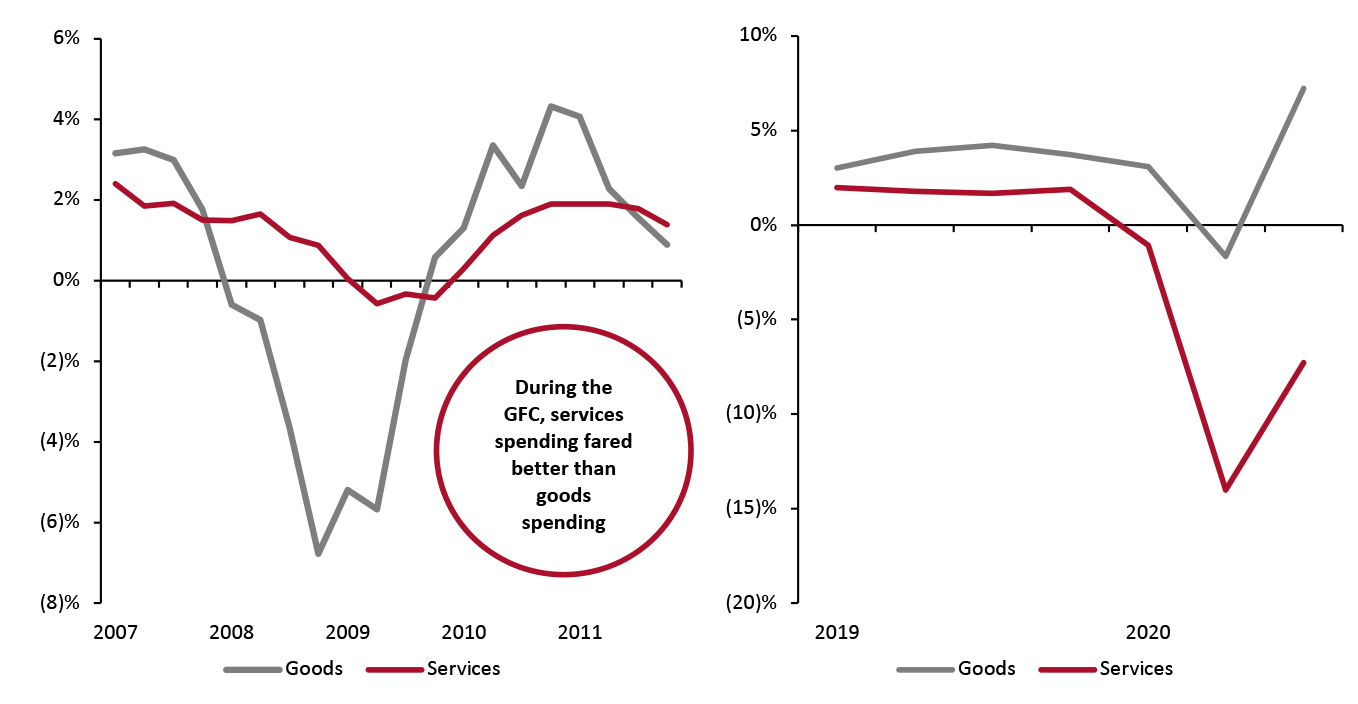

- Goods vs. Services: While overall spending on services remained high during the GFC—with a drop in spending on goods—during the current crisis consumers have been artificially pushed toward spending on goods due to restricted access to many services. Once widespread inoculation is achieved, we expect this behavior to revert, potentially to the detriment of retail spending.

- Stimulus: Consumers will likely have increased disposable incomes for the time being as stimulus checks keep many Americans afloat, while the GFC recovery saw no such direct payments to consumers. This will likely help categories such as apparel and personal care to recover more quickly than in the aftermath of the 2008 crisis.

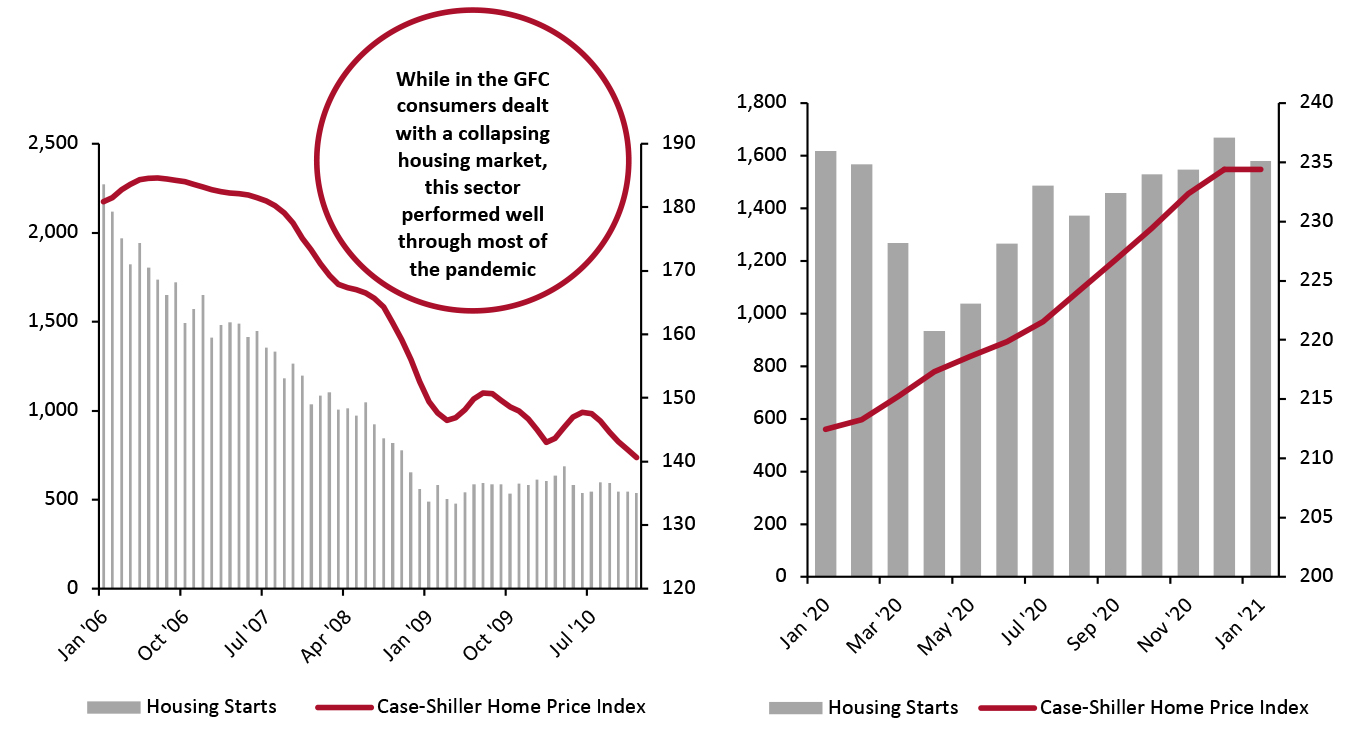

- Housing: While housing starts and prices dropped dramatically during the GFC, the housing market in 2021 is likely to remain strong, buoyed by a low interest rate. This should help home-improvement and sports equipment sales to also remain strong, and help to boost the furniture and electronics sectors in 2021—both of which struggled due to restrictions on physical retail in 2020.

Figure 2. US Labor Force Participation Rate, GFC (Left) vs. 2020–21 (Right, %) [caption id="attachment_123897" align="aligncenter" width="725"]

Source: BLS[/caption]

Coupled with a higher unemployment rate, the significant drop in labor force participation during the pandemic has resulted in the loss of more than 22 million jobs, which may not return until 2024, according to financial intelligence firm Moody’s Analytics. Most of these sustained job losses have been in low-wage industries, and the substantial shrinkage of the labor force renders employment projections slightly less optimistic than the overall unemployment numbers would indicate.

The lack of a rebound in the labor force participation rate since summer 2020 supports the expectation of a drawn-out recovery. While many US workers who left the workforce at the height of the lockdowns in April returned to work when the country partially reopened in May and June, a general lack of progress on containing the virus over the rest of the year caused participation to plateau. The rate is virtually unchanged since June.

Labor force participation is usually seen as a leading indicator of how strong retail sales will be in the US. Looking back to 1993, when data on year-over-year growth of retail sales was first made available, and controlling for a variety of other indicators, a 1% increase in labor force participation generally correlates with an increase of more than 1% increase in year-over-year retail sales growth.

The drop in labor force participation during the current crisis will likely result in the same slow-to-recover unemployment rates as witnessed with the GFC. Moreover, low employment will make low-income consumers—those hit hardest by job losses—increasingly cost-conscious in their purchases.

Goods vs. Services: A Service Rebound Is Likely

The redirection of spending from services to goods during the pandemic has given retail something of a “Covid bump,” even as overall output has struggled. Conversely, during the GFC retail goods spending was hit hardest—dropping by more than 5% year over year for three straight quarters spanning the end of 2008 and the beginning of 2009, while service spending did not drop by more than 6% year over year through the entire recession. We illustrate the divergent trends in spending on goods versus services across the two crises in Figure 3.

Source: BLS[/caption]

Coupled with a higher unemployment rate, the significant drop in labor force participation during the pandemic has resulted in the loss of more than 22 million jobs, which may not return until 2024, according to financial intelligence firm Moody’s Analytics. Most of these sustained job losses have been in low-wage industries, and the substantial shrinkage of the labor force renders employment projections slightly less optimistic than the overall unemployment numbers would indicate.

The lack of a rebound in the labor force participation rate since summer 2020 supports the expectation of a drawn-out recovery. While many US workers who left the workforce at the height of the lockdowns in April returned to work when the country partially reopened in May and June, a general lack of progress on containing the virus over the rest of the year caused participation to plateau. The rate is virtually unchanged since June.

Labor force participation is usually seen as a leading indicator of how strong retail sales will be in the US. Looking back to 1993, when data on year-over-year growth of retail sales was first made available, and controlling for a variety of other indicators, a 1% increase in labor force participation generally correlates with an increase of more than 1% increase in year-over-year retail sales growth.

The drop in labor force participation during the current crisis will likely result in the same slow-to-recover unemployment rates as witnessed with the GFC. Moreover, low employment will make low-income consumers—those hit hardest by job losses—increasingly cost-conscious in their purchases.

Goods vs. Services: A Service Rebound Is Likely

The redirection of spending from services to goods during the pandemic has given retail something of a “Covid bump,” even as overall output has struggled. Conversely, during the GFC retail goods spending was hit hardest—dropping by more than 5% year over year for three straight quarters spanning the end of 2008 and the beginning of 2009, while service spending did not drop by more than 6% year over year through the entire recession. We illustrate the divergent trends in spending on goods versus services across the two crises in Figure 3.

Figure 3. Consumer Spending on Goods vs. Services, 2007–2011 and 2019–2020 [caption id="attachment_123898" align="aligncenter" width="725"]

Source: BEA[/caption]

The shift toward spending on goods rather than services in 2020 is unlikely to be permanent—it is almost certain that the dramatic reduction in experience-related spending is due to coronavirus restrictions rather than the resulting economic downturn. Once widespread inoculation is achieved, consumers are likely to switch significant spending back to services, to the potential detriment of retail sales.

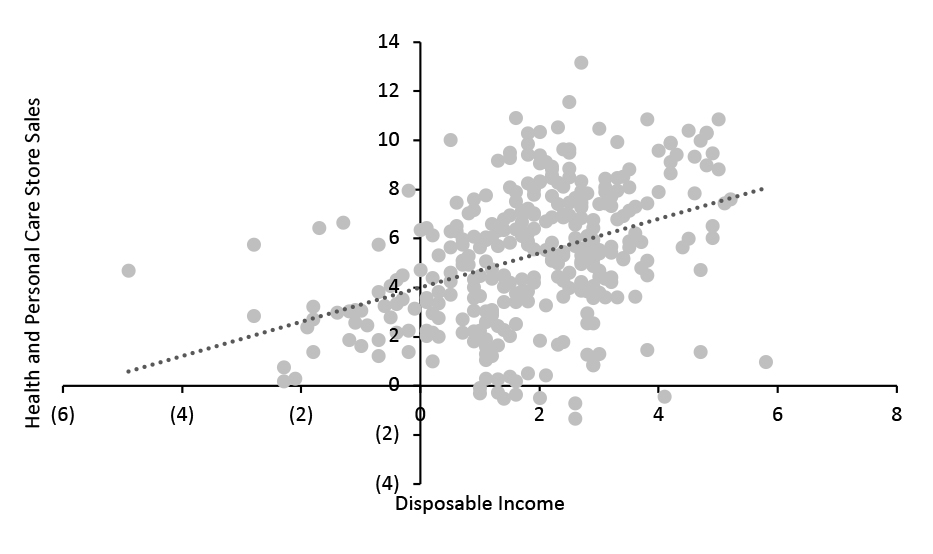

Stimulus: Two Different Approaches

The passage of a second stimulus bill in December by the US government, and a potential third round of checks later this winter, should ensure the continuation of strong disposable income in 2021. This is a distinct departure from the response to the GFC, where bailouts to financial institutions were favored over direct payments to consumers. That stimulus was also much less substantial—5% of GDP as opposed to 18% to date during the pandemic, according to data from the IMF and estimates from news outlet TIME.

Predictably, while disposable income growth stagnated during the GFC, it peaked this year with 16.7% year over year growth following the first round of stimulus in April and remained up 3.3% year over year in November 2020. This number is likely to climb again with the receipt of an additional stimulus check by many Americans in January and the resumption of enhanced unemployment benefits. Analyzing US retail sales data from 1993 to present, we identified that health and personal care, and apparel and accessories tend to benefit most from a rise in disposable income.

As shown in Figure 4, changes in health and personal care sales are generally correlated relatively closely to changes in disposable income. The sector performed well through 2020 as consumers prioritized health and wellness, and historical data suggests that it will likely continue to thrive throughout the recovery.

Source: BEA[/caption]

The shift toward spending on goods rather than services in 2020 is unlikely to be permanent—it is almost certain that the dramatic reduction in experience-related spending is due to coronavirus restrictions rather than the resulting economic downturn. Once widespread inoculation is achieved, consumers are likely to switch significant spending back to services, to the potential detriment of retail sales.

Stimulus: Two Different Approaches

The passage of a second stimulus bill in December by the US government, and a potential third round of checks later this winter, should ensure the continuation of strong disposable income in 2021. This is a distinct departure from the response to the GFC, where bailouts to financial institutions were favored over direct payments to consumers. That stimulus was also much less substantial—5% of GDP as opposed to 18% to date during the pandemic, according to data from the IMF and estimates from news outlet TIME.

Predictably, while disposable income growth stagnated during the GFC, it peaked this year with 16.7% year over year growth following the first round of stimulus in April and remained up 3.3% year over year in November 2020. This number is likely to climb again with the receipt of an additional stimulus check by many Americans in January and the resumption of enhanced unemployment benefits. Analyzing US retail sales data from 1993 to present, we identified that health and personal care, and apparel and accessories tend to benefit most from a rise in disposable income.

As shown in Figure 4, changes in health and personal care sales are generally correlated relatively closely to changes in disposable income. The sector performed well through 2020 as consumers prioritized health and wellness, and historical data suggests that it will likely continue to thrive throughout the recovery.

Figure 4. Correlation Between US Disposable Income and Health and Personal Care Store Sales (YoY % Change) [caption id="attachment_123899" align="aligncenter" width="725"]

Note: Based on data from 1993–2020

Note: Based on data from 1993–2020 Source: FRED/US Census Bureau/Coresight Research [/caption] Once consumers begin to feel more comfortable shopping in stores and returning to their workplaces and social activities, we expect apparel to rebound somewhat from a weak 2020. The category is historically responsive to changes in disposable income, and while it did not recover quickly during the GFC recovery, consumers did not experience a comparable influx of money at that time. Earlier this year, we predicted that the US clothing and footwear market will grow by around 7% in 2021—taking total spending to a level that is still below that of 2019—with growth concentrated in the second half of the year. Inflation is a concern whenever cash is injected into the economy, and record government spending in response to the pandemic is no exception. However, it is not a given that the present stimulus is a cause for concern. US inflation and inflationary expectations, while rising, remain far lower than they were during the last major period of harmful inflation in the late 1970s. Furthermore, a spike in inflationary expectations is not unexpected during recovery from an economic downturn—following the GFC, inflationary expectations rose at a pace similar to the last three quarters of 2020 and so far in 2021, as illustrated in Figure 5.

Figure 5. 10-Year Break-Even Inflation Rate: GFC (Left) vs. 2020–2021 (Right), % [caption id="attachment_123900" align="aligncenter" width="725"]

Source: FRED[/caption]

Housing: Boom Rather than Bust

While the GFC was partly caused by and perpetuated a once-in-a-generation housing crisis, the coronavirus pandemic has seen housing starts and home prices remain strong, as shown in Figure 6.

Source: FRED[/caption]

Housing: Boom Rather than Bust

While the GFC was partly caused by and perpetuated a once-in-a-generation housing crisis, the coronavirus pandemic has seen housing starts and home prices remain strong, as shown in Figure 6.

Figure 6. Housing Starts (Left Axis, Thousands) and Case-Shiller Home Price Index (Right Axis); During the GFC (Left) and the Pandemic (Right) [caption id="attachment_123901" align="aligncenter" width="725"]

Note: January home price index data not yet released[/caption]

Housing starts and home prices tend to disproportionately impact the spending habits of middle-to-higher income consumers—but for the 32.3% of the country that does not own their home, which disproportionately consists of low-income consumers, changes in home prices do not have the same effect on spending habits.

Certain retail sectors are particularly well-poised to capitalize on higher spending by the 67.7% of the population that does own their residence. Home improvement is an obvious category and has done well through the pandemic. A high correlation between housing starts and home-improvement sales should help this sector continue to thrive in 2021. This should especially hold true in the wake of the pandemic, when consumers will have not only started new homes at higher rates, but, as indicated in Figure 7 below, have also moved to stand-alone houses, contrasting with GFC trends.

Note: January home price index data not yet released[/caption]

Housing starts and home prices tend to disproportionately impact the spending habits of middle-to-higher income consumers—but for the 32.3% of the country that does not own their home, which disproportionately consists of low-income consumers, changes in home prices do not have the same effect on spending habits.

Certain retail sectors are particularly well-poised to capitalize on higher spending by the 67.7% of the population that does own their residence. Home improvement is an obvious category and has done well through the pandemic. A high correlation between housing starts and home-improvement sales should help this sector continue to thrive in 2021. This should especially hold true in the wake of the pandemic, when consumers will have not only started new homes at higher rates, but, as indicated in Figure 7 below, have also moved to stand-alone houses, contrasting with GFC trends.

Figure 7. Single vs. Multiple Unit Housing Starts in the US (YoY % Change) [caption id="attachment_123902" align="aligncenter" width="725"]

Source: HUD/US Census Bureau[/caption]

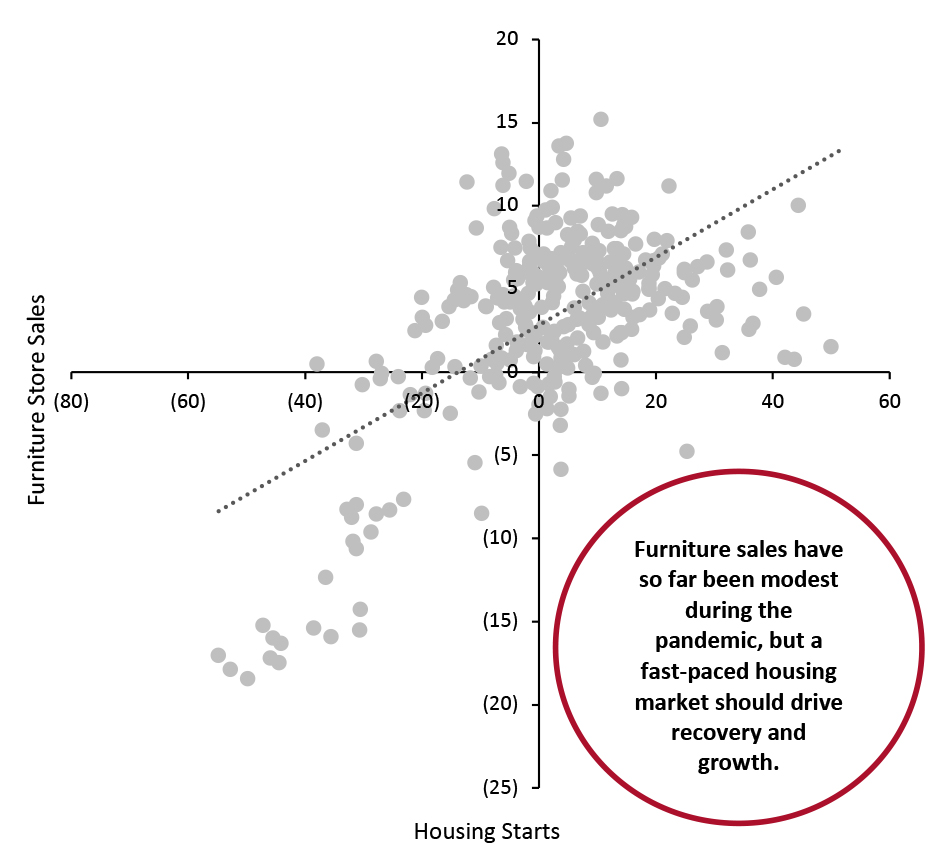

Consumers living in single-unit housing starts will likely require more home goods and maintenance than their apartment and multi-unit counterparts. Sales of furniture typically benefit from a strong housing market, as illustrated in Figure 8, and should do especially well as consumers move to larger single-unit homes.

Source: HUD/US Census Bureau[/caption]

Consumers living in single-unit housing starts will likely require more home goods and maintenance than their apartment and multi-unit counterparts. Sales of furniture typically benefit from a strong housing market, as illustrated in Figure 8, and should do especially well as consumers move to larger single-unit homes.

Figure 8. Correlation Between Housing Starts and Furniture Store Sales (YoY % Change) [caption id="attachment_123903" align="aligncenter" width="725"]

Based on data from 1993–2020

Based on data from 1993–2020 Source: FRED/US Census Bureau/Coresight Research [/caption] Online furniture sales are already booming, and growth in digital sales may slow in 2021, ceding ground to brick-and-mortar retailers as consumers become more comfortable visiting physical locations. Similarities While the previously discussed indicators suggest marked differences between the recovery from the GFC and the pandemic, lessons from retail in the wake of the GFC are useful in informing expectations on recovery once the current health crisis is brought under control. We discuss a lesson in consumer behavior as well as two sectoral predictions for 2021 and beyond, through the lens of GFC recovery analysis. Consumer Behavior

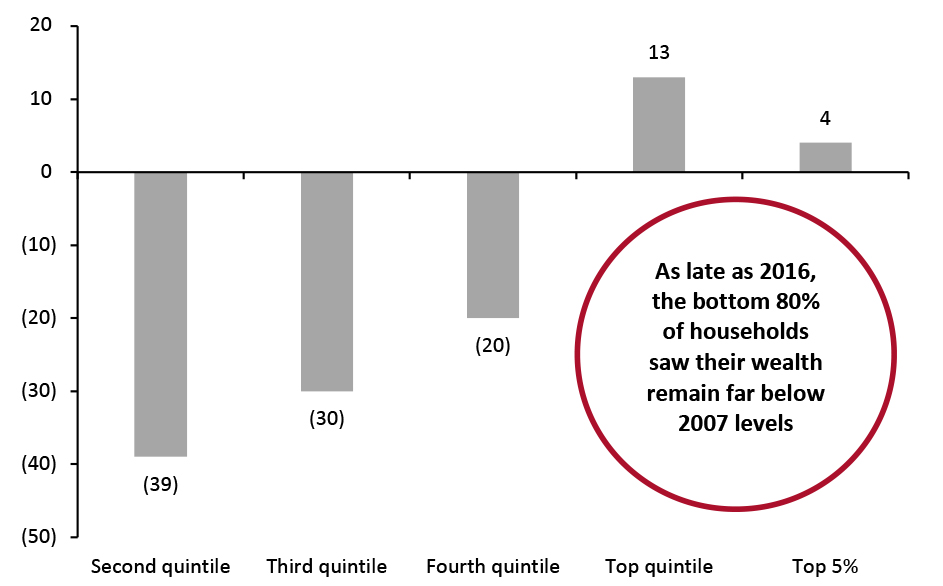

- Squeezed Middle Class: Mirroring the effects of the GFC, the middle class will be squeezed financially, despite rising wealth among high earners. This aligns with the Coresight Research hourglass model of retail, which anticipates high-end and value formats outperforming retail strategies targeting the middle of the income spectrum given the divergent fates of high and low-income consumers combined with a shrinking middle class in the US.

- Electronics: This category will likely perform well as the US moves out of the crisis period.

- Grocery Growth: Historically, grocery is one of the retail sectors that is least responsive to economic downturns and recovery. Strong growth in 2020 suggests that grocery growth will be underwhelming in 2021.

Figure 9. US Median Family Wealth (% Change 2007–2016) by Wealth Quintile [caption id="attachment_123904" align="aligncenter" width="725"]

Source: Pew Research[/caption]

In the wake of the pandemic, we are seeing signs of a similar phenomenon. According to data from Morning Consult Economic Intelligence, as of December 2020, more than 40% of low-income US consumers and around 30% of middle-income consumers reported being in a worse financial situation than a year ago, while just slightly more than 20% of high-income consumers reported the same.

Another parallel trend between the GFC and the current crisis is reflected in struggles among small businesses, many of which are owned by middle-class consumers. Between 2007 and 2012, small businesses (those with less than 50 employees) accounted for more than 60% of US job losses. In 2020, the number of active business owners in the US decreased by 3.3 million from February to April, according to data from the National Bureau of Economic Research.

Fortunately, the outlook for small businesses appears to be more positive. In January 2021, new business applications rose by 73% year over year. However, until these businesses scale to a point that counteracts the catastrophic decline in business ownership at the outset of the pandemic, this will continue to contribute to a squeezed middle class.

Electronics

Electronic retailers have generally struggled during the pandemic, and the specialists sector saw sales decline also in 2015, 2016, 2017 and 2019, according to the US Census Bureau. However, consumer spending in electronics categories (which includes spending through any channel or store format) jumped by over 10% in 2020.

During the GFC, the electronics retail sector saw year-over-year declines for 19 straight months from August 2008. Once the economy started to recovery, however, electronics retailers’ sales saw a sustained bounce-back and enjoyed one of the larger swings in fortune among all retail sectors.

As consumers spend more time working from flexible locations and consumer confidence recovers, we expect an improvement in electronics retailers’ sales following a difficult 2020. Large players in the industry have already proven that with the right kinds of innovation, the sector can thrive in the most difficult times. For instance, through its pivot toward e-commerce and buy online, pick up in store (BOPIS) services, Best Buy grew its comparable sales by 23% year over year in its most recent quarter, ended October 31.

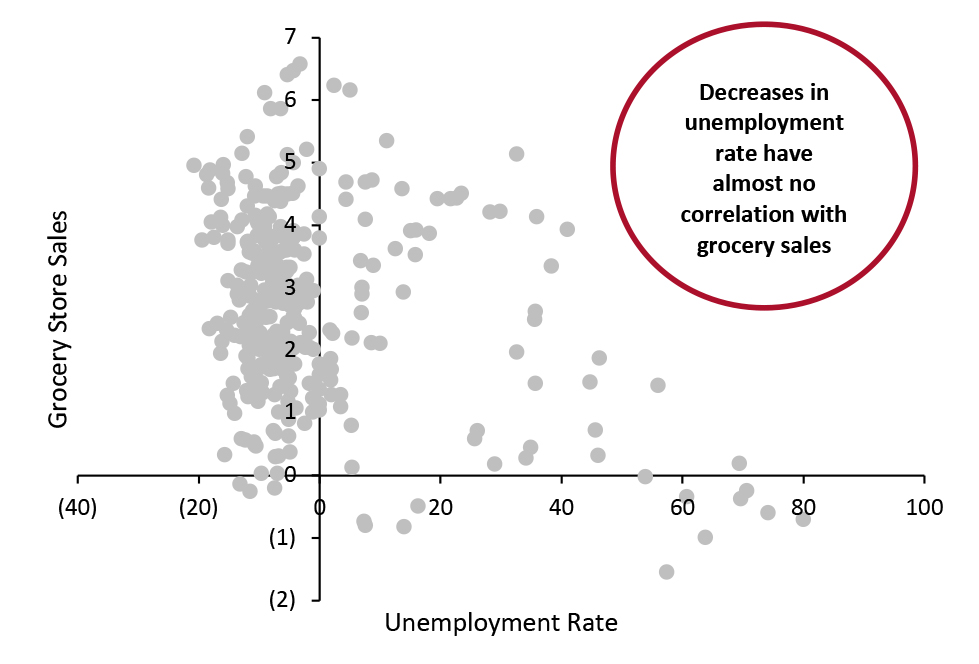

Grocery Growth: Likely To Underwhelm

Looking back to the GFC, grocery sales were far less responsive to negative economic indicators than most other retail categories. From an analysis of historical data, it becomes clear that changes in the economic indicators set out in Figure 1 have a much more modest effect on grocery sales compared to other retail categories. Figure 10 indicates that the unemployment rate indicator has virtually no correlation with grocery sales.

Source: Pew Research[/caption]

In the wake of the pandemic, we are seeing signs of a similar phenomenon. According to data from Morning Consult Economic Intelligence, as of December 2020, more than 40% of low-income US consumers and around 30% of middle-income consumers reported being in a worse financial situation than a year ago, while just slightly more than 20% of high-income consumers reported the same.

Another parallel trend between the GFC and the current crisis is reflected in struggles among small businesses, many of which are owned by middle-class consumers. Between 2007 and 2012, small businesses (those with less than 50 employees) accounted for more than 60% of US job losses. In 2020, the number of active business owners in the US decreased by 3.3 million from February to April, according to data from the National Bureau of Economic Research.

Fortunately, the outlook for small businesses appears to be more positive. In January 2021, new business applications rose by 73% year over year. However, until these businesses scale to a point that counteracts the catastrophic decline in business ownership at the outset of the pandemic, this will continue to contribute to a squeezed middle class.

Electronics

Electronic retailers have generally struggled during the pandemic, and the specialists sector saw sales decline also in 2015, 2016, 2017 and 2019, according to the US Census Bureau. However, consumer spending in electronics categories (which includes spending through any channel or store format) jumped by over 10% in 2020.

During the GFC, the electronics retail sector saw year-over-year declines for 19 straight months from August 2008. Once the economy started to recovery, however, electronics retailers’ sales saw a sustained bounce-back and enjoyed one of the larger swings in fortune among all retail sectors.

As consumers spend more time working from flexible locations and consumer confidence recovers, we expect an improvement in electronics retailers’ sales following a difficult 2020. Large players in the industry have already proven that with the right kinds of innovation, the sector can thrive in the most difficult times. For instance, through its pivot toward e-commerce and buy online, pick up in store (BOPIS) services, Best Buy grew its comparable sales by 23% year over year in its most recent quarter, ended October 31.

Grocery Growth: Likely To Underwhelm

Looking back to the GFC, grocery sales were far less responsive to negative economic indicators than most other retail categories. From an analysis of historical data, it becomes clear that changes in the economic indicators set out in Figure 1 have a much more modest effect on grocery sales compared to other retail categories. Figure 10 indicates that the unemployment rate indicator has virtually no correlation with grocery sales.

Figure 10. Correlation Between Change in Unemployment Rate and Grocery Store Sales (YoY % Change) [caption id="attachment_123905" align="aligncenter" width="725"]

Note: Based on data from 1993–2020

Note: Based on data from 1993–2020 Source: FRED/US Census Bureau/Coresight Research [/caption] Grocery has consistently been a top-performing sector since the start of the pandemic. In 2021, we expect grocery to annualize strong growth rates from last year and suffer slightly as consumers return to restaurants in greater numbers. This pattern held true in the GFC recovery and should be doubly replicated this year as consumers with more money in their pockets get more comfortable going out to eat.