DIpil Das

What’s the Story?

“Resale” constitutes buying and selling previously owned goods, which may be new, but are more often gently used. In this report, we provide an overview of the US resale market, with a focus on fashion retail. We discuss business models and major players, as well as opportunities and challenges in the market. We cover six resale models that represent the majority of resale businesses today: consignment-based resale, e-commerce native resale, resale-as-a-service, resale programs launched by retailers and brands, social commerce-based resale, and thrift stores.Why It Matters

Resale is becoming increasingly mainstream as consumers seek out value options, both in terms of price and sustainability. According to Coresight Research’s weekly survey, US consumers have become more focused on sustainability following the Covid-19 crisis: Some 29.0% of respondents said that the pandemic has made environmental sustainability more of a factor in their shopping choices, which indicates demand opportunities for the resale market in the near future. A number of digitally native resale companies have emerged to make the process easier for buyers and sellers, and we are seeing more retailers jump onto the bandwagon to launch resale services.The US Resale Market: In Detail

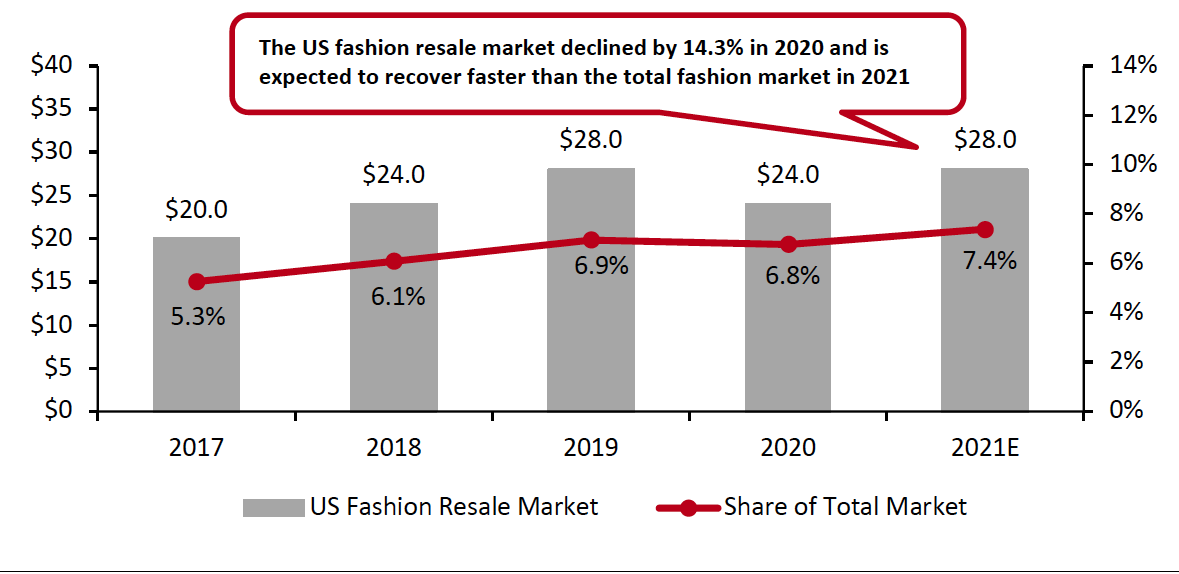

The Fashion Resale Market Gains Momentum in the US The growth of the US resale market is mainly driven by fashion resale. The US fashion resale market has evolved from a high-single-billion-dollar market in 2008 to a $28 billion market in 2019, according to ThredUP. According to the company, the market grew 40% from 2017 to 2019, faster than the 5.8% growth of the total fashion market in the same period. The US fashion resale market declined by 14.3% in 2020, according to ThredUP, driven largely by reduced need for apparel amid the pandemic. Though the market size declined in 2020, we expect US fashion resale to recover to a pre-crisis level in 2021, implying mid-teens-percent growth, which is more than double the anticipated recovery of 7% for the total US fashion market. This further implies that fashion resale will capture a 7.4% share of the total US fashion market in 2021, as shown in Figure 1. Fashion resale platforms have a positive outlook on development and anticipated revenue recovery in 2021, which supports our market growth expectations. For example, The RealReal expects its metrics to normalize in 2021 and to see growth in all of its categories again, according to its third-quarter earnings call on November 9, 2020. Despite the overall fashion resale market decline, some fashion resale platforms saw growth in 2020. Poshmark launched on the stock market in January 2021, following strong revenue of $193 million in the nine months ended September 30, 2020, which was up by 28% compared to the same period in 2019.Figure 1. The US Fashion Resale Market (Accessories, Apparel and Footwear) (Left Axis; USD Bil.) and Share of Total Market (Right Axis; %) 2017–2021E [caption id="attachment_123116" align="aligncenter" width="725"]

Source: ThredUP/US Bureau of Economic Analysis/Coresight Research[/caption]

Major Resale Business Models and Key Players

In recent years, we have seen a rise of the number of online resale marketplaces, such as Poshmark, The RealReal and ThredUP, as well as e-commerce websites such as Etsy that offer resale products. These marketplaces enjoyed higher traffic during the pandemic than before as consumers browsed more resale products online. We estimate that online penetration in the US resale market was around 50% in 2020. With the extended influence of the pandemic, online resale momentum will likely continue in 2021.

Traditional resale channels, such as the thrift stores run by Goodwill Industries, continue to sell offline, with many also developing an online presence. We identify six resale models that represent the majority of resale businesses today:

Source: ThredUP/US Bureau of Economic Analysis/Coresight Research[/caption]

Major Resale Business Models and Key Players

In recent years, we have seen a rise of the number of online resale marketplaces, such as Poshmark, The RealReal and ThredUP, as well as e-commerce websites such as Etsy that offer resale products. These marketplaces enjoyed higher traffic during the pandemic than before as consumers browsed more resale products online. We estimate that online penetration in the US resale market was around 50% in 2020. With the extended influence of the pandemic, online resale momentum will likely continue in 2021.

Traditional resale channels, such as the thrift stores run by Goodwill Industries, continue to sell offline, with many also developing an online presence. We identify six resale models that represent the majority of resale businesses today:

Figure 2. Six Models That Are Fueling The US Resale Economy [wpdatatable id=751 table_view=regular]

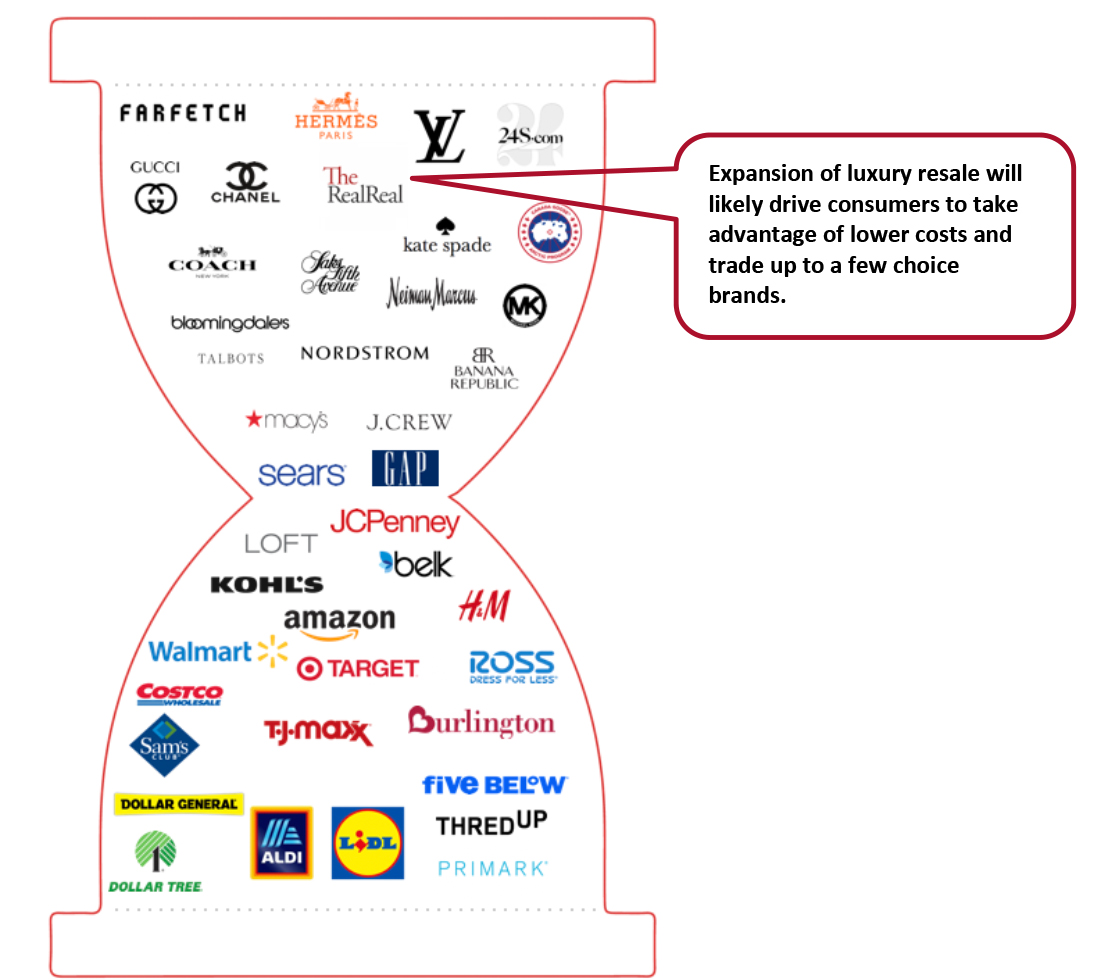

Source: Coresight Research Opportunities in the US Luxury Resale Market Customers stocked up on used high-end shoes, jewelry and handbags during holiday 2020, indicating opportunities for luxury resale to grow in 2021. For example, peer-to-peer online luxury consignment shop Tradesy reported that sales of rings increased by 92% year over year in December 2020 on its site, sales of Saint Laurent boots sales increased by 36% year over year and the Louis Vuitton Pochette purse sold for an average of $1,300 (more than double its retail price). Sales of premium and designer brands on ThredUP increased by 22% during the 2020 holiday shopping season, compared to the period from January 1 to October 31 2020, according to the company. The Coresight Research hourglass model of retail points to the bifurcation of demand in the US consumer market: Retailers and brands in the middle lack meaningful differentiators and are losing share to retailers with sharper value and price offerings. Customers may take advantage of lower resale prices and trade up to a few choice brands.

Figure 3. The Coresight Research Hourglass Model of Retail [caption id="attachment_123080" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

Capital Funding or Acquisition

Venture capital funds demonstrated strong interest in the resale market in 2020. Resale platforms including Goat, Letgo and StockX attracted funding or acquisition deals last year, despite the pandemic, while other resale platforms such as AptDeco (a furniture resale marketplace) and Kaito (a consignment-based furniture resale market) are still seeking funding from investors.

We detail investments and acquisitions in Figure 4indicate that marketplaces that focus on fashion or local resale services are more likely to attract funding, likely a reflection of their correspondence to consumer demand, easier handling of products and more manageable supply chains.

Source: Coresight Research[/caption]

Capital Funding or Acquisition

Venture capital funds demonstrated strong interest in the resale market in 2020. Resale platforms including Goat, Letgo and StockX attracted funding or acquisition deals last year, despite the pandemic, while other resale platforms such as AptDeco (a furniture resale marketplace) and Kaito (a consignment-based furniture resale market) are still seeking funding from investors.

We detail investments and acquisitions in Figure 4indicate that marketplaces that focus on fashion or local resale services are more likely to attract funding, likely a reflection of their correspondence to consumer demand, easier handling of products and more manageable supply chains.

Figure 4. Funding Raising of US Resale Platforms in 2020 [wpdatatable id=752 table_view=regular]

Source: Crunchbase/Coresight Research Headwinds Faced by US Resale Platforms Resale platforms need to tackle challenges to stand out in the increasingly competitive landscape. We outline three potential headwinds below:

- Unpredictable buyer retention: Resale businesses should ensure that they generate a sufficient amount of new and recurring supplies of pre-owned goods, to cater to buyers’ preferences and increase loyalty and retention. Investing in targeted advertising and building consumer trust can support customer retention customers. For example, The RealReal has invested in paid advertising on social media platforms such as Instagram and TikTok, as well as referral programs to boost consumer loyalty. It has also invested in methods of discovery such as press exposure and brand partnerships with Burberry and Stella McCartney. Collaboration is also a good way to attract traffic—The RealReal unveiled a partnership with Gucci in November 2020 to roll out an e-commerce store showcasing pre-owned Gucci products to foster circularity for high-end fashion. Technologies companies such as Recurate can also help resale platforms, especially small-to-medium sized companies, to promote used products online.

- Complex supply chain operations:For resale platforms, especially consignment-based business models, a smooth supply chain is critical as resale platforms have to communicate with customers to have merchandise safely delivered to warehouses, and then examine the quality and dispatch them to buyers once purchased. Technology investments can help to improve supply chain operations, such as building automation and machine learning capabilities to drive efficiencies in merchandising and increase fulfillment capacity.

- The promotional retail environment: US retailers and brands set their own retail prices and promotional discounts on goods, which could adversely affect the value proposition of resale platforms to consumers. The prices of goods sold through online marketplaces may need to be lowered in order to compete with these pricing strategies, which could negatively affect gross merchandise value and revenues.

What We Think

Implications for Brands/Retailers- The US fashion resale market declined in 2020 but we expect it to grow more than twice as fast as the US total fashion market in 2021, driven by consumers’ demand for sustainability and affordability.To capitalize on this growing trend, improve the utilization of materials and fabrics, and turnover outdated or extra inventories efficiently, we see opportunities for brands and retailers to launch resale services or work with resale platforms. For example, Nordstrom, Gap, H&M launched resale services in 2020 and can leverage their established reputations to improve consumer trust in resale items.

- We recommend that technology vendors focus on enabling resale platforms to run smoothly in operations, logistics and merchandising. For example, in terms of logistics, automation technology will allow authentication teams to process more products, while also improving overall quality control procedures.

- It is important for resale platforms toconsider headwinds including unpredictable buyer retention, complex supply chain operations, and competition from the promotional retail environment. For example, resale platforms can invest in advertising and acquire more active users to generate a sufficient amount of new supply of pre-owned goods and build trust with both consumers and consigners. Collaboration is also a good way to attract traffic.