Nitheesh NH

Introduction

What’s the Story? The pet products market (focused on cats and dogs) primarily comprises four categories, according to the American Pet Products Association (APPA): pet food and treats, veterinary care, other supplies and other pet services. Numerous CPG companies are entering the pet products market as they see tremendous potential for growth and innovation. In this report, we explore the size of the market, its key players and three key trends we are seeing in the space. Why It Matters In 2021, the pet products market comfortably exceeded $100 billion, bolstered by an increased interest in pets and pet adoption during the pandemic. Trends in human products such as wellness and fashion have followed consumers in their purchase of pet products, which is driving innovation through the creation of new pet segments. In this report, we examine the current breakdown of the market as well as identify key players and growth drivers.US Pet Products Market: Coresight Research Analysis

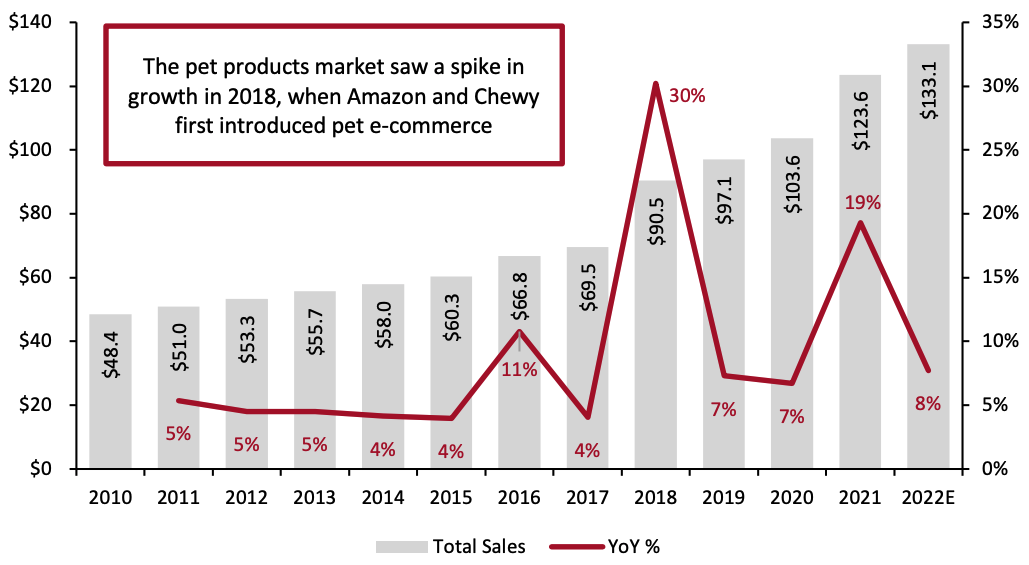

Market Overview The US pet products market totaled $123.6 billion in 2021, up from $97.1 billion in 2019, according to the APPA. This is likely due to growth in the number of pet owners during the Covid-19 pandemic, with 70% of US households being pet owners in 2021—an all-time high and up from 67% in 2019—according to the 2021–2022 APPA National Pet Owners Survey. Based on historical CAGR rates, we expect the pet products market to grow by around 8% to $133.1 billion in 2022. Although the growth rate for pet ownership will likely slow following the pandemic, we expect positive growth to continue and demand for pet products to increase. As a share of total sales, e-commerce penetration in the pet products market is significant, as 42% of US pet owners buy their pet food online, according to the APPA. E-commerce comprises 20% of the global pet products market and this share is set to increase to around 33% by 2026, according to Euromonitor International. Coresight Research weekly US Consumer Tracker surveys routinely record around one-quarter of consumers buying pet products online in the two weeks preceding each survey, versus around one-third buying in-store.Figure 1. Pet Products: US Market Size (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_146665" align="aligncenter" width="700"]

Source: APPA/Coresight Research[/caption]

Pet retail is especially lucrative as 95% of consumers view their pets as part of their family, according to a survey by pet products retailer Spots, and so they are more willing to purchase items to increase their furry companion’s quality of life. Spending in the market is on a positive trajectory, as shown by the APPA’s survey findings: 30% of pet owners reported that they spent more on pet products in the past year than they did previously, versus 10% that spent less.

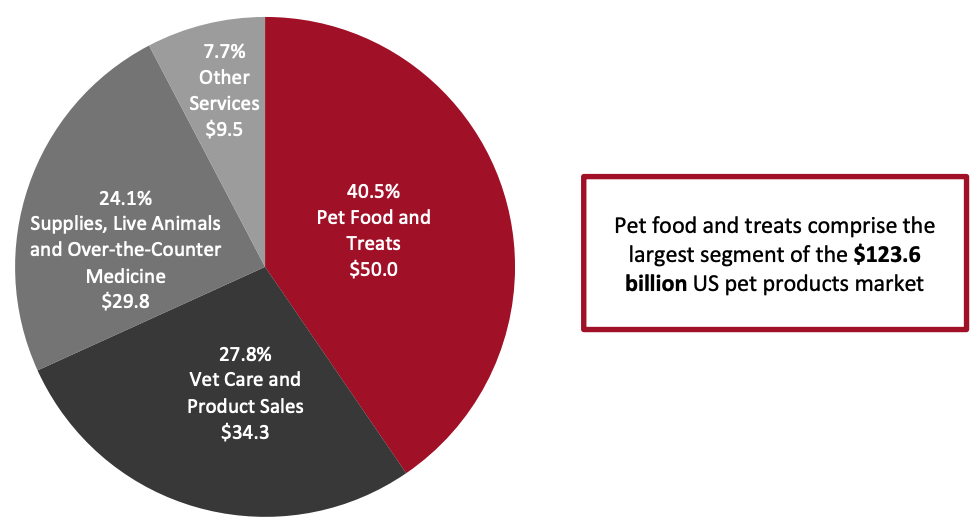

Pet food and treats comprise the largest segment of the pet products market (40.5% share), totaling an estimated $50.0 billion, according to the APPA.

Source: APPA/Coresight Research[/caption]

Pet retail is especially lucrative as 95% of consumers view their pets as part of their family, according to a survey by pet products retailer Spots, and so they are more willing to purchase items to increase their furry companion’s quality of life. Spending in the market is on a positive trajectory, as shown by the APPA’s survey findings: 30% of pet owners reported that they spent more on pet products in the past year than they did previously, versus 10% that spent less.

Pet food and treats comprise the largest segment of the pet products market (40.5% share), totaling an estimated $50.0 billion, according to the APPA.

Figure 2. US Pet Products Market: Sales (USD Bil.) and Share of Total Market (%), by Segment, 2021 [caption id="attachment_146666" align="aligncenter" width="700"]

Segment values may not sum exactly to total due to rounding

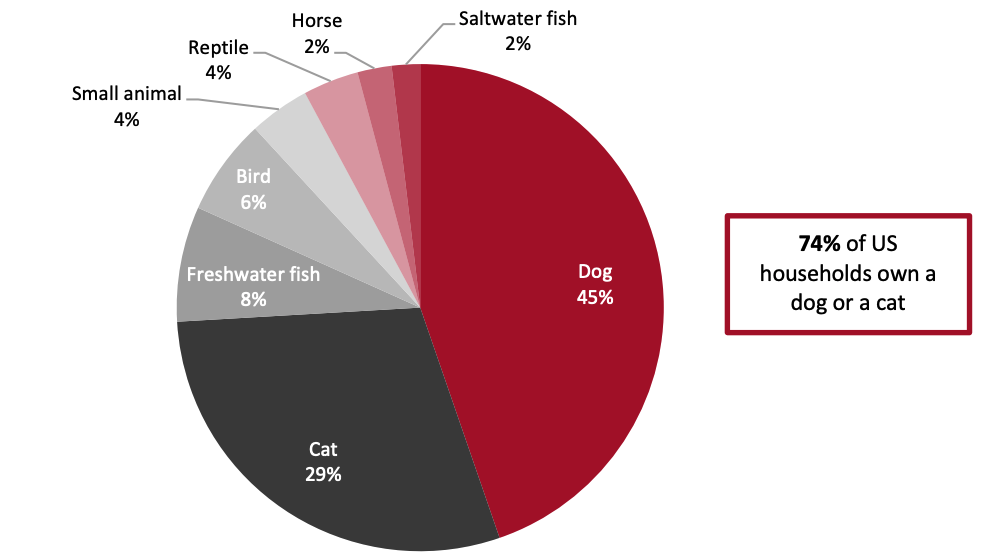

Segment values may not sum exactly to total due to roundingSource: APPA[/caption] The most popular pets in the US are dogs and cats, as shown in Figure 4 (this report focuses on products for these two types of pets).

Figure 3. Top Pet Species as % of Ownership by US Households, 2021 [caption id="attachment_146667" align="aligncenter" width="700"]

Source: APPA[/caption]

Market Leaders

As the pet food and treats segment is the largest in the US pet products market, we identify and discuss the major players below. In addition, we look at the top online retailers in the overall pet products market.

Source: APPA[/caption]

Market Leaders

As the pet food and treats segment is the largest in the US pet products market, we identify and discuss the major players below. In addition, we look at the top online retailers in the overall pet products market.

Figure 4. Key Players in the Pet Products Market

| Top Pet Food Brands |

| 1. Mars’ Mars Petcare |

| 2. Nestlé’s Purina Petcare |

| 3. Colgate’s Hill’s Pet Nutrition |

| 4. J.M. Smucker’s Big Heart Pet Brands |

| 5. Schell & Kampeter’s Diamond Pet Foods |

| 6. General Mill’s Blue Buffalo |

Source: Coresight Research

Pet Food: Top Brands We see pet food brands catering to the wellness trend through product innovation, and many are also actively engaging in an e-commerce strategy.- For Mars Petcare, the pet products business of Mars, “care and treats” is the company’s top-performing segment, comprising nearly 24% of the pet care category in 2021. According to Mars, the company’s combined global sales of dog and cat treats grew 8.2% year over year in 2021. Its Crave brand is leading the way with 257.2% year-over-year growth, Mars reported.

- Nestlé’s Purina Petcare saw double-digit growth in the North American market in 2021, according to the company, driven by e-commerce sales and demand for premium products. For example, Pro Plan LiveClear, the first allergen-reducing cat food, saw growth of near-triple digits in 2021, Nestlé reported.

- Colgate’s Hill’s Pet Nutrition continued to lead sales in the CPG company’s US segment, with organic sales growth in the teens in percentage terms—marking the second year of double-digit growth for Colgate’s pet category. Hill’s uses veterinary recommendations and approvals to cement the health credentials of its competitive pet food products, Prescription Diet and Science Diet, thereby increasing consumer loyalty. Colgate continues to invest in Hill’s advertising and e-commerce, and management expects another year of strong growth in 2022.

- Under its subsidiary Big Heart Pet Brands, J.M. Smucker plans to accelerate the growth of its pet snack portfolio, maintain momentum in cat food sales and improve its dog food portfolio. The CPG company projects that its pet segment will grow 4% annually over the next five years, with the historically fast-growing and high-margin pet snacks segment driving this growth.

- Schell & Kampeter’s Diamond Pet Foods produces wet and dry cat and dog food and is known for its high-end food brands Diamond Performance, Diamond Naturals, NutraGold and Taste of the Wild.

- General Mills has entered the pet products market through its acquisition of Blue Buffalo in 2018. General Mills has launched mobile app platform “Buddies by Blue Buffalo” to connect with, educate and reward consumers.

- Given its focus on convenience and price-competitiveness, Amazon is understandably a major retailer of online pet care products and launched its Wag pet products brand in 2018. Coresight Research US consumer survey data from March 2022 show that pet products are the seventh-most-purchased category on Amazon.com, by number of shoppers, after apparel and footwear, books, health products, beauty and personal care, toys and games, and electronics. That survey found 32.6% of all respondents had bought pet products on Amazon in the prior 12 months.

- Chewy is the leader among specialized pure-play e-commerce retailers. The company reported revenues of $7.15 billion in 2021, a 47.4% increase from 2020.

- Walmart launched its private-label pet food brand PRO+, which offers tailored diet products to promote pet health.

- Petco is supplementing its brick-and-mortar presence with a complete online resource for pet health and wellness through its Petco.com website and Petco app. In the fourth quarter of 2021, the company grew revenues by 13.0%, with digital revenues up 25%.

- Petco has recently refreshed its layout to include a pet care center, robust nutrition center and digital signage to facilitate navigation and ensure a seamless shopping experience. The pet care center includes integrated veterinary services and grooming as well as dedicated areas for BOPIS (buy online, pick up in-store) and curbside pickup, which attracts consumers and provides a one-stop shop for customers to purchase multiple goods and services for their pets. Additional pet-friendly features include varied floor surfaces to prevent pets from slipping and in-store lighting that simulates natural sunlight. Petco drives customer loyalty through a membership program that offers discounts and rewards.

- Chewy has expanded its services as an online retailer to offer “Connect with Vet” veterinary telehealth services in October 2020, and it launched the “Practice Hub” online pharmacy platform for veterinarians in September 2021. The “Connect with Vet” services are free for subscribers of Chewy’s Autoship service. The company added a new video feature in 2021.

- Amazon’s Wag Labs is developing one-stop shop capabilities for pet care. The Wag Labs app offers an array of services, covering dog walking, pet sitting, expert pet advice and training. Most recently, Wag Labs expanded its premium membership benefits in 2021 to include “24/7 Live Expert Advice” from veterinarians or veterinary technicians.

- Walmart is launching Walmart Pet Care to offer a variety of pet products and services, such as dog walking and insurance. The company offers discounts and perks to its customers, such as 10% discounts on insurance policies.

- The Tractor Supply Company opened 36 new Petsense stores in the fourth quarter of 2021, and plans to add 10 more in 2022. Petsense offers services on its My Pet mobile app, which provides owners with easy access to pet prescriptions and vet services, as well as pet food that can be delivered to consumers’ homes or picked up in-store. The company hopes to become the omnichannel one-stop shop for pet products and services.

- Mars has established itself as a leader in the pet health-tracker business through its 2018 Pet Insight Project, which used the company’s Whistle Fit wearable activity monitor in one of the largest tech-enabled pet health studies. Mars expects that there will soon be an explosion of AI tools in the pet industry to track pet behaviors and form the basis of preventative care, according to a professor at the company’s Waltham Petcare Science institute.

- Pet treats containing safe doses of CBD oil rose in popularity in 2021, reaching $624 million in sales, up from $426 million in 2020, according to a report from Brightfield Group. This product has a wide variety of benefits, such as relief from inflammatory problems, seizures, pain and anxiety. It may also boost mood.

- Amazon’s Furbo Pet Camera allows owners to view and interact with their pets via a smart monitoring and treat-dispensing device. This device may help ease a pet’s loneliness while its owners are at work.

Source: Amazon[/caption]

Source: Amazon[/caption]

- The iCalm Speaker is another digital device that can help ease pet anxiety in chaotic or unsettling environments by playing a “suite of sound solutions.”

Source: Amazon[/caption]

The Entrance of Luxury Brands in the Pet Fashion Space

Luxury brands are eager to enter the pet space as many consumers appear keen to confer the same luxuries they enjoy on their pets. Pet fashionwear is a fast-growing category; designer multibrand retailer and e-commerce platform Ssense saw sales in the pet category increase by 95% year over year in 2021.

Source: Amazon[/caption]

The Entrance of Luxury Brands in the Pet Fashion Space

Luxury brands are eager to enter the pet space as many consumers appear keen to confer the same luxuries they enjoy on their pets. Pet fashionwear is a fast-growing category; designer multibrand retailer and e-commerce platform Ssense saw sales in the pet category increase by 95% year over year in 2021.

- Versace’s Black Barocco Medusa Dog T-shirt, available on Ssense.com, features the brand’s signature Medusa print, which allows the user to match outfits with their dog.

Source: Ssense.com[/caption]

Source: Ssense.com[/caption]

- Hermes offers a dog bowl that features the same Chaine d'Ancre motif the brand uses in its jewelry collection.

Source: Hermes[/caption]

Source: Hermes[/caption]

- Prada has also joined the pet products category. Its leather dog collar prominently features the brand’s logo.

Source: Prada[/caption]

Source: Prada[/caption]

What We Think

The pet products market is growing rapidly due to high consumer demand, which has been supported by the pandemic. Many players have entered this market, including top CPG companies, e-commerce giants and luxury brands, which have benefited from the category’s high growth rates. We also see an expansion of pet services by Amazon and Chewy and an emphasis on omnichannel shopping by Walmart and Petco, which are vying to become pet owners’ one-stop shop for all their pets’ needs and to increase consumer loyalty through high-value memberships. Finally, there is huge demand for innovation to improve pet physical and mental wellbeing as well as in pet fashion. Implications for CPG Companies The relatively new pet products market is growing quickly compared to traditional CPG categories such as food and beverages, driven by demand for innovation to meet new needs. We encourage CPG companies to branch out into the space to capitalize on the ever-expanding needs of pet owners, particularly in the food and technology categories. Pet food today often uses the same ingredients used in the edible categories for humans (particularly as pet owners look for organic and health-centered products), and so for many established CPG food companies, little change would be needed to procure the raw materials for pet food.Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved