DIpil Das

Introduction

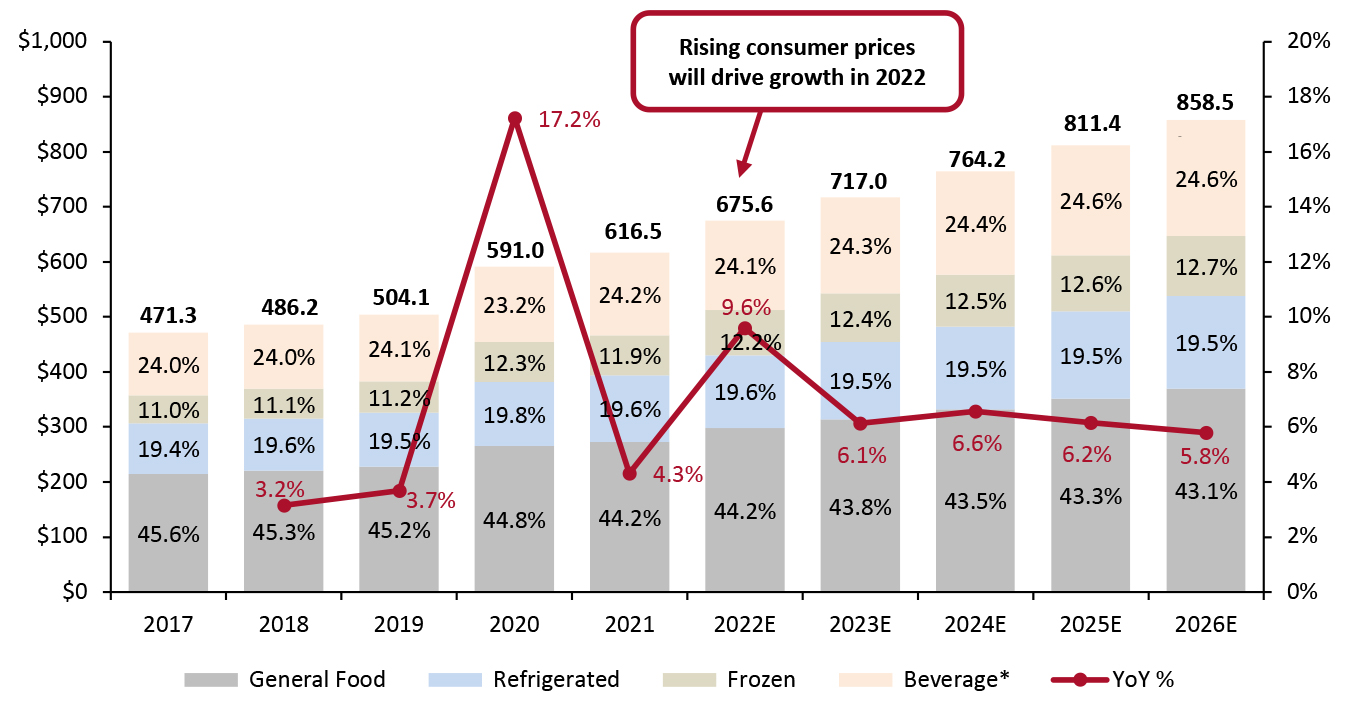

We estimate the US packaged foods category—which includes non-alcoholic beverages, as well as the frozen, general and refrigerated food segments—will reach $675.6 billion in revenue by 2022. With traditional foodservice locations closed and overall grocery retail demand increasing, the category grew substantially during the Covid-19 pandemic. While foodservice locations have slowly reopened, the desire for convenient, packaged food is likely to persist going forward. In this report, we present our expectations for the US packaged foods category through 2026 and discuss the major headwinds to growth. We also explore the competitive landscape of the category and two key themes we are watching.Packaged Foods: Performance and Outlook

Market Size The packaged foods category—which traditionally sees low- to mid-single-digit growth year over year—jumped 17.2% in 2020 as consumers switched spending from dining out to eating at home during the pandemic. While growth slowed in 2021 to 4.3%, that reflected a compounding of the gains of 2020. In 2022, we estimate that revenue from packaged foods will rise to $675.6 billion, representing impressive year-over-year growth of 9.6%. Price increases will drive that growth as brands respond to inflation in input costs—with consumer prices for food at home (FAH) up 10.8% year over year in April (latest), according to the Bureau of Labor Statistics. In 2023 and beyond, we predict that growth rates will slow gradually as pandemic-led consumer behaviors persist—such as increased spending on healthier foods and larger FAH purchases. These consumer behaviors are being further encouraged by high food-away-from-home prices due to retail inflation, making grocery purchases a more budget-friendly option.Figure 1. US Packaged Foods: Market Size (USD Bil.; Left Axis) and YoY Growth (%; Right Axis) [caption id="attachment_147195" align="aligncenter" width="701"]

*Beverage excludes alcoholic beverages

*Beverage excludes alcoholic beverages Source: IRI/Coresight Research [/caption]

Market Factors

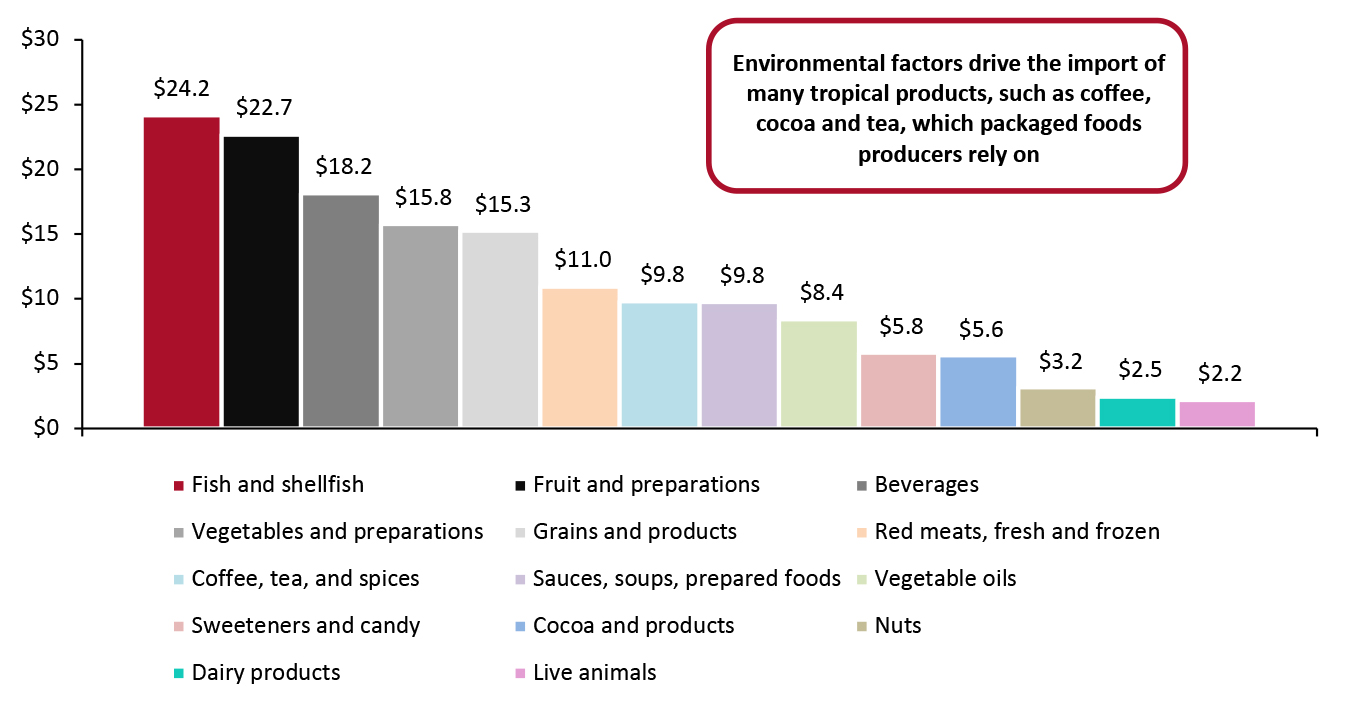

Many top CPG companies reported pressure on their 2021 margins due to the input cost inflation, labor shortages in both US manufacturing and logistics departments, and a shortage of imported raw materials. Moving forward, we believe that these issues, along with socio-economic factors, will continue and strengthen headwinds in the US packaged foods category. Raw Material Shortages Various political and social hurdles are causing raw material shortages in the US. Most notably, the Russia-Ukraine war is disrupting vital Black Sea shipping routes, while critical Chinese ports remain affected by China's latest Shenzhen Covid-19 outbreak. These issues have slowed—or in some cases stopped—US imports. We discuss both of these issues in more detail, below. According to the US Department of Agriculture (USDA), the US only imports 15%–20% of its food—totaling an estimated $154.4 billion. However, these imports include key ingredients in packaged foods production, such as 25% of sugar and coffee, cocoa and tea. In Figure 2 below, we list the top US imports by product, many of which go through the Black Sea or Shenzhen ports.Figure 2. Top US Imports by Product, 2021 (USD Bil.) [caption id="attachment_147111" align="aligncenter" width="700"]

Source: USDA[/caption]

The Russia-Ukraine War

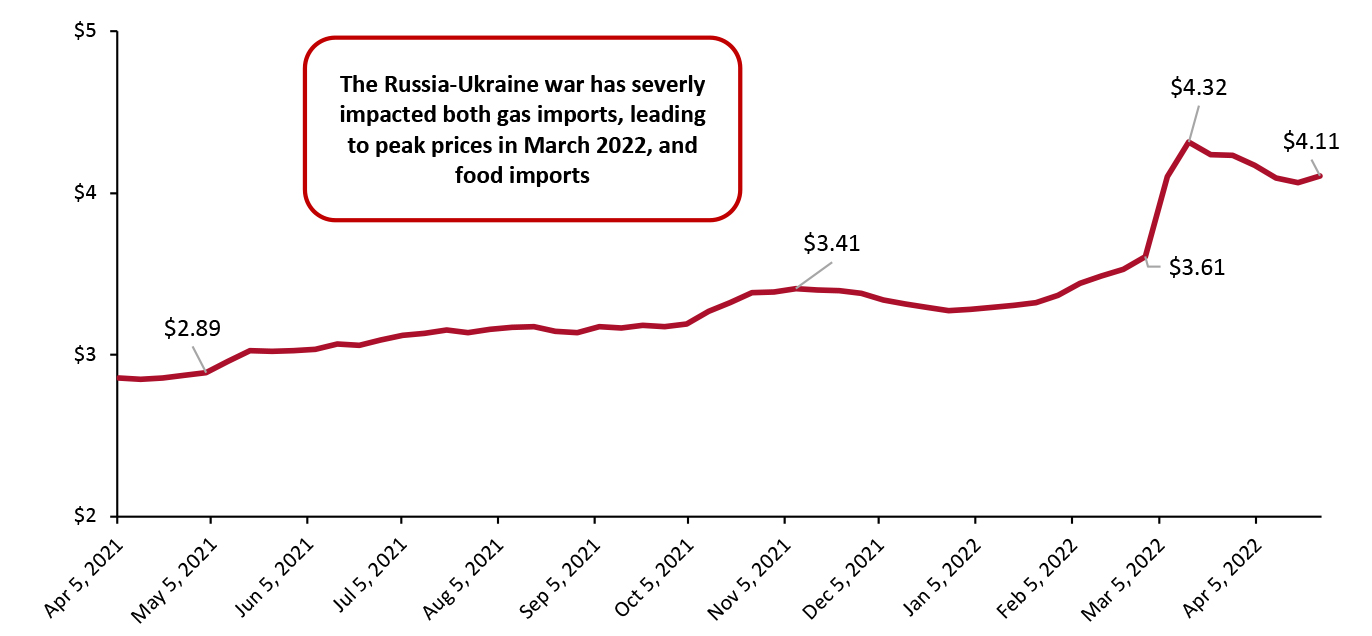

The Russia-Ukraine war has substantially impacted logistics. Russia is the world’s third-largest producer of petroleum, according to the US Energy Information Administration (EIA)—and controls close to 11% of the world’s landmass—making the conflict highly detrimental to energy prices and, therefore, transportation routes and costs. Oil prices have breached $100 per barrel, standing at $101.90 per barrel as of April 25, 2022, according to the Organization of the Petroleum Exporting Countries (OPEC). Air cargo has been doubly impacted by the higher gas prices, as flight lengths have increased due to Russian airspace being closed to Western planes.

However, increased energy prices are not the only issue affecting shipping costs. Increased militarization in the Black Sea—which contains the Bosporus Strait, one of the eight busiest ocean shipping lanes—has sent transportation insurance costs soaring for any who use the route. As a result, ocean carriers are rerouting vessels that typically take Black Sea trade routes, increasing both costs and shipping times. US last-mile delivery—which accounts for at least 40% of supply chain costs according to a June 2021 Coresight Research survey of 150 US-based executives—will also be impacted by rising gas prices.

Source: USDA[/caption]

The Russia-Ukraine War

The Russia-Ukraine war has substantially impacted logistics. Russia is the world’s third-largest producer of petroleum, according to the US Energy Information Administration (EIA)—and controls close to 11% of the world’s landmass—making the conflict highly detrimental to energy prices and, therefore, transportation routes and costs. Oil prices have breached $100 per barrel, standing at $101.90 per barrel as of April 25, 2022, according to the Organization of the Petroleum Exporting Countries (OPEC). Air cargo has been doubly impacted by the higher gas prices, as flight lengths have increased due to Russian airspace being closed to Western planes.

However, increased energy prices are not the only issue affecting shipping costs. Increased militarization in the Black Sea—which contains the Bosporus Strait, one of the eight busiest ocean shipping lanes—has sent transportation insurance costs soaring for any who use the route. As a result, ocean carriers are rerouting vessels that typically take Black Sea trade routes, increasing both costs and shipping times. US last-mile delivery—which accounts for at least 40% of supply chain costs according to a June 2021 Coresight Research survey of 150 US-based executives—will also be impacted by rising gas prices.

Figure 3. US Gas Prices (USD per Gallon) [caption id="attachment_147194" align="aligncenter" width="699"]

Source: Federal Reserve Bank of St. Lawrence (FRED)[/caption]

The Russia-Ukraine war also has significant consequences for the food supply as, combined, Russia and Ukraine produce 14% of the world’s wheat, 19% of its barley and 4% of its corn, amounting to over one-third of the global cereal creation, according to shipping giant Maersk. According to the same source, wheat prices have risen 50% globally since the start of the conflict. As a result, US wheat imports are forecast to decline by five million bushels to 94 million in the 2021–22 season, according to the USDA. High wheat prices are also expected to “price out human consumer[s] of food before livestock,” said Jacqueline Holland, a grain market analyst for Farm Futures, a leading farm business magazine.

The US agriculture market has also seen significant price increases overall, according to the USDA. This is due to increased fertilizer costs—fertilizer requires petroleum in the manufacturing process—in addition to the global rise in agricultural commodity prices.

Covid-19 Outbreak in Shenzhen

The Omicron outbreak in the Chinese port city of Shenzhen will only worsen already intensified logistics issues, as the city imposed a seven-day lockdown lasting from March 14 to March 20, 2022, to stop the spread of the virus. While the lockdown has since ended, some restrictions remain, such as health screenings at border checkpoints, ports and transport hubs, continuing to impact trade in April 2022.

This is the latest in several flare-ups across Chinese cities, including Beijing, Hong Kong, Shanghai and Qingdao. Shenzhen’s port is the preferred hub for cold chain commodities imports and exports in South China and one of the busiest ports in the world, with more than 100 maritime routes connections, according to American Shipper magazine. Given its important port status, Shenzhen’s lockdown led to the cancelation of many ocean carriers’ docking reservations, resulting in vessel delays of up to 16 days, per to a representative from Maersk, a shipping giant. These delays will impact many companies in the US, including packaged foods brands.

Read our May 2022 Supply Chain Briefing report for more on this topic.

Input Cost Inflation and the CPI

CPG companies have started taking pricing actions to offset input cost inflation, resulting in a substantial effect on the US CPI, even though price increases are unlikely to cover the higher costs CPG companies face in 2022.

In February 2022, the US CPI rose 8.6% year over year for the FAH category, according to the US Bureau of Labor Statistics. This increased to 10.0% in March and 10.8% in April. Although the CPI increase is the result of both CPG companies and grocery retailers increasing their prices, we expect input cost inflation to remain a headwind for CPG companies’ margins as they absorb some costs.

Nestlé, in particular, is concerned about higher input cost inflation, which was greater than expected in fiscal 2021, according to the company’s February 2022 earnings call. The company expects inflation to worsen in 2022, especially in the first half, resulting in higher prices for key materials, such as coffee and metals. Nestlé is offsetting inflation-related cost increases through “mitigating actions, including pricing, operating leverage and efficiencies.”

Logistics Challenges

In addition to raw material shortages and price increases, CPG food companies also face continued logistics challenges. To combat these problems, companies are improving their supply chain by investing in labor and digitalization, as well as raising prices and taking cost-cutting actions to protect their margins.

For example, Tyson faces significant headwinds in 2022 due to the increased cost of goods, which increased 18% year over year, and higher labor and transportation costs, per a company earnings call in February 2022. The challenges impacted the company’s beef category the most, leading to a 6.2% decline in total volume. To combat these hurdles, Tyson is spending more on labor—the company has provided hourly workers with over $50 million in bonuses in the first quarter of 2022 alone—and building 12 new plants. Furthermore, the company has invested in a mix of private, dedicated and third-party fleet transportation services to mitigate inflationary pressures and ensure better on-time deliveries to customers.

Additionally, Tyson is striving to digitalize its supply chain and employ advanced analytics to drive better yields, lower costs, maintain consistent quality and increase output. Likewise, in an earnings call earlier this year, packaged foods giant PepsiCo said that it is adopting supply chain digitalization strategies to unlock real-time inventory visibility, split sourcing capabilities and improve overall logistics efficiency.

Source: Federal Reserve Bank of St. Lawrence (FRED)[/caption]

The Russia-Ukraine war also has significant consequences for the food supply as, combined, Russia and Ukraine produce 14% of the world’s wheat, 19% of its barley and 4% of its corn, amounting to over one-third of the global cereal creation, according to shipping giant Maersk. According to the same source, wheat prices have risen 50% globally since the start of the conflict. As a result, US wheat imports are forecast to decline by five million bushels to 94 million in the 2021–22 season, according to the USDA. High wheat prices are also expected to “price out human consumer[s] of food before livestock,” said Jacqueline Holland, a grain market analyst for Farm Futures, a leading farm business magazine.

The US agriculture market has also seen significant price increases overall, according to the USDA. This is due to increased fertilizer costs—fertilizer requires petroleum in the manufacturing process—in addition to the global rise in agricultural commodity prices.

Covid-19 Outbreak in Shenzhen

The Omicron outbreak in the Chinese port city of Shenzhen will only worsen already intensified logistics issues, as the city imposed a seven-day lockdown lasting from March 14 to March 20, 2022, to stop the spread of the virus. While the lockdown has since ended, some restrictions remain, such as health screenings at border checkpoints, ports and transport hubs, continuing to impact trade in April 2022.

This is the latest in several flare-ups across Chinese cities, including Beijing, Hong Kong, Shanghai and Qingdao. Shenzhen’s port is the preferred hub for cold chain commodities imports and exports in South China and one of the busiest ports in the world, with more than 100 maritime routes connections, according to American Shipper magazine. Given its important port status, Shenzhen’s lockdown led to the cancelation of many ocean carriers’ docking reservations, resulting in vessel delays of up to 16 days, per to a representative from Maersk, a shipping giant. These delays will impact many companies in the US, including packaged foods brands.

Read our May 2022 Supply Chain Briefing report for more on this topic.

Input Cost Inflation and the CPI

CPG companies have started taking pricing actions to offset input cost inflation, resulting in a substantial effect on the US CPI, even though price increases are unlikely to cover the higher costs CPG companies face in 2022.

In February 2022, the US CPI rose 8.6% year over year for the FAH category, according to the US Bureau of Labor Statistics. This increased to 10.0% in March and 10.8% in April. Although the CPI increase is the result of both CPG companies and grocery retailers increasing their prices, we expect input cost inflation to remain a headwind for CPG companies’ margins as they absorb some costs.

Nestlé, in particular, is concerned about higher input cost inflation, which was greater than expected in fiscal 2021, according to the company’s February 2022 earnings call. The company expects inflation to worsen in 2022, especially in the first half, resulting in higher prices for key materials, such as coffee and metals. Nestlé is offsetting inflation-related cost increases through “mitigating actions, including pricing, operating leverage and efficiencies.”

Logistics Challenges

In addition to raw material shortages and price increases, CPG food companies also face continued logistics challenges. To combat these problems, companies are improving their supply chain by investing in labor and digitalization, as well as raising prices and taking cost-cutting actions to protect their margins.

For example, Tyson faces significant headwinds in 2022 due to the increased cost of goods, which increased 18% year over year, and higher labor and transportation costs, per a company earnings call in February 2022. The challenges impacted the company’s beef category the most, leading to a 6.2% decline in total volume. To combat these hurdles, Tyson is spending more on labor—the company has provided hourly workers with over $50 million in bonuses in the first quarter of 2022 alone—and building 12 new plants. Furthermore, the company has invested in a mix of private, dedicated and third-party fleet transportation services to mitigate inflationary pressures and ensure better on-time deliveries to customers.

Additionally, Tyson is striving to digitalize its supply chain and employ advanced analytics to drive better yields, lower costs, maintain consistent quality and increase output. Likewise, in an earnings call earlier this year, packaged foods giant PepsiCo said that it is adopting supply chain digitalization strategies to unlock real-time inventory visibility, split sourcing capabilities and improve overall logistics efficiency.

Competitive Landscape

Several CPG companies dominate the packaged food competitive landscape, with Nestlé and PepsiCo taking the top two spots. The top 10 companies generated a combined global revenue of $475.8 billion in 2021, according to data from S&P Capital IQ.Figure 4. Leading Public Packaged Goods Companies’ Global Net Revenue (USD Bil.)* [wpdatatable id=1968 table_view=regular]

*Private companies such as Mars were not included, due to a lack of data, nor were liquor companies; Fiscal year-end varies by company Source: S&P Capital IQ Nestlé Based in Switzerland, Nestlé is a food and beverage producer. While the company is Swiss, the US is its largest market by far, earning it CHF 26.3 billion ($29.3 billion) in 2021 (30.1% of global revenue), per its annual report. Its high-growth channels include coffee, Nestlé Health Science (its nutrition and supplement channel) and Purina PetCare. In addition to producing vitamins, minerals and supplements, Nestlé Health Science also improves the health benefits of Nestlé’s other packaged foods products, giving them added value in a more health-conscious age. Likewise, Nestlé has also made several important portfolio changes and acquisitions, focusing on fast-growing segments like health and wellness. Most recently, Nestlé Health Science acquired Orgain, a leader in plant-based nutrition, in April 2022. PepsiCo PepsiCo is one of the largest CPG companies in the world and North America, which accounts for 60% of its global revenue, is its largest market, according to its annual report. PepsiCo company primarily produces beverages and convenient foods, with its portfolio emphasizing hydration and nutrition (see Wellness Trend section below). Recently, it has invested in various brands to participate in fast-growing new consumer segments, such as its acquisition of Rockstar Energy in 2020 to increase its competitiveness in the sports drink category. Due to its continued growth, the company has bolstered its advertising and marketing spend, as well as investments in automation and its manufacturing processes according to the company. Tyson Foods Tyson is a US packaged foods producer that primarily focuses on beef, pork, chicken and prepared foods. Its products are sold fresh, frozen or refrigerated and brought in $47.0 billion in total revenue in 2021 of which the US made up 99.6%, according to its annual report. While the company recently struggled with labor shortages in both manufacturing and logistics, it said in its February 2022 earnings call that it is investing in automation, supply chain digitalization and advanced analytics to mitigate these issues in the future.

Themes We Are Watching

Wellness The pandemic boosted the growing wellness trend as it drew more attention to consumer health. In its latest estimate, the non-profit organization Global Wellness Institute expects the global wellness market to reach $7.0 trillion by the end of 2025, growing at an average of 9.9% year over year. More than ever, consumers are willing to spend extra on organic and natural foods, as well as low-calorie, low-fat, low-sugar and additive-free options. As a result, many food CPG companies are shifting their food and beverage portfolios to incorporate more sustainable and nutritious ingredients.- Nestlé has acquired collagen business Vital Proteins in its expansion of nutritional products in its portfolio.

- PepsiCo began prioritizing chickpeas, plant-based proteins, whole grains, nuts and seeds in its food offerings, according to a recent company presentation at the Consumer Analyst Group of New York 2022 Conference. The brand will also continue reducing the amount of added sugars and sodium in products across its portfolio. Recently, PepsiCo introduced more nutritious, sustainable convenience foods that use little or no single-use packaging and are cooked with healthier oils.

- Tyson has invested more heavily into Raised & Rooted, its environmentally-friendly, plant-based protein brand. As a result, in 2021, Raised & Rooted expanded its plant-based protein line from just plant-based chicken nuggets and tenders to include hamburger patties and grounds, and bratwurst and Italian sausages. Tyson’s step toward plant-based meat alternatives signals the importance of this burgeoning market.

- Nestlé acquired electrolyte hydration brand Nuun to increase its edge in the sports drink category.

- PepsiCo has started selling its Gatorade Gx Sweat Patch—a wearable patch that sends fluid loss, sweat rate and sodium loss information to the wearer’s smartphone—to help develop personal consumers’ hydration profiles, offering customized drink recommendations. The company also acquired other nutritional drink brands, including Propel, Muscle Milk and EVOLVE, which help consumers build muscle and stay fit.

The Gatorade Gx Sweat Patch

The Gatorade Gx Sweat Patch Source: PepsiCo [/caption] For more information on wellness in CPG, see our 10 Trends in US CPG report. Vegan Products The rise in popularity of the flexitarian diet—a primarily vegetarian diet with the occasional meat or fish meal—has bolstered the demand for vegan products. In the US alone, meat alternatives reached $1.4 billion in revenue in June 2021 and grew 14% year over year, according to IRI. Globally, 23% of consumers are limiting their meat intake—a slight increase from 21% in 2020—while 16% are trying to follow an entirely plant-based diet, according to Euromonitor. Meanwhile, the number is even larger in the US: 34% of the population wants to eat less meat, according to IRI. The innovations of vegan startups like Impossible Foods and Beyond Meat have opened up possibilities for vegan meat, with many top CPG companies—including Danone S.A, Nestlé and PepsiCo—entering the plant-based market. There are numerous reasons for choosing plant-based meat alternatives: 37% pursue the diet for health benefits, 21% due to environmental concerns and 19% for animal welfare, per Euromonitor. Apart from these primary reasons, plant-based alternatives allow people to enjoy a greater variety of food and beverage alternatives, especially those with food allergies or intolerances. CPG companies have identified plant-based dairy alternatives as an area of potential growth, as there are 30 million lactose intolerant consumers in the US, according to the US Department of Health and Human Services.

- Danone is investing in its Essential Dairy and Plant-Based beverage brand and aims to increase its plant-based sales from $2.2 billion worldwide in 2019 to $5.4 billion by 2025 via its Plant-Based Acceleration Unit, according to the company.

- Nestlé is also developing plant-based food. However, rather than focusing on the more “plain, straightforward products” such as burger patties or chicken pieces, the company is interested in developing specialty vegan foods such as tuna or shrimp plant-based alternatives, according to an earnings call on February 17, 2022.

- PepsiCo has formed a joint venture with Beyond Meat in 2021 and hopes to release new plant-based snacks and drinks in 2022.

A collection of products from Silk, a plant-based brand owned by Danone

A collection of products from Silk, a plant-based brand owned by Danone Source: Danone [/caption]

What We Think

In 2022, we expect that inflation, continued FAH consumption habits and increased focus on wellness and plant-based trends will drive growth in the packaged foods category. However, we expect brands and retailers to struggle to protect their margins due to unfortunate external factors—such as the Russia-Ukraine war and unstable port situations in China—creating supply chain disruptions and raw material shortages. Implications for Brands and Retailers- Brands and retailers should invest in automation in both manufacturing and logistics, as an efficient supply chain has a significant impact on the competitive edge one brand has over another.

- Brands should move manufacturing plants closer to the markets the products are sold in, especially when a high percentage of revenue is derived from a single market.

- The wellness trend grew significantly during the pandemic and will stick around in the post-pandemic world. Packaged foods retailers and brands should look into offering organic, natural, low-fat, low-sugar or additive-free options to their customers.

- There is a growing market for plant-based meat, meaning brands and retailers are keen to establish a foothold. Companies in the packaged food space need to familiarize themselves with the latest innovations in vegan meat to offer consumers a wide variety of options.

The information contained herein is based in part on data reported by IRI through its Market Advantage service for the Packaged Food category as interpreted solely by Coresight Research, Inc. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinions expressed herein reflect the judgment of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information. Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved