Executive Summary

The US remains a nascent market for online grocery retailing, but we expect grocery e-commerce to grow very rapidly in the near term and in the coming years.

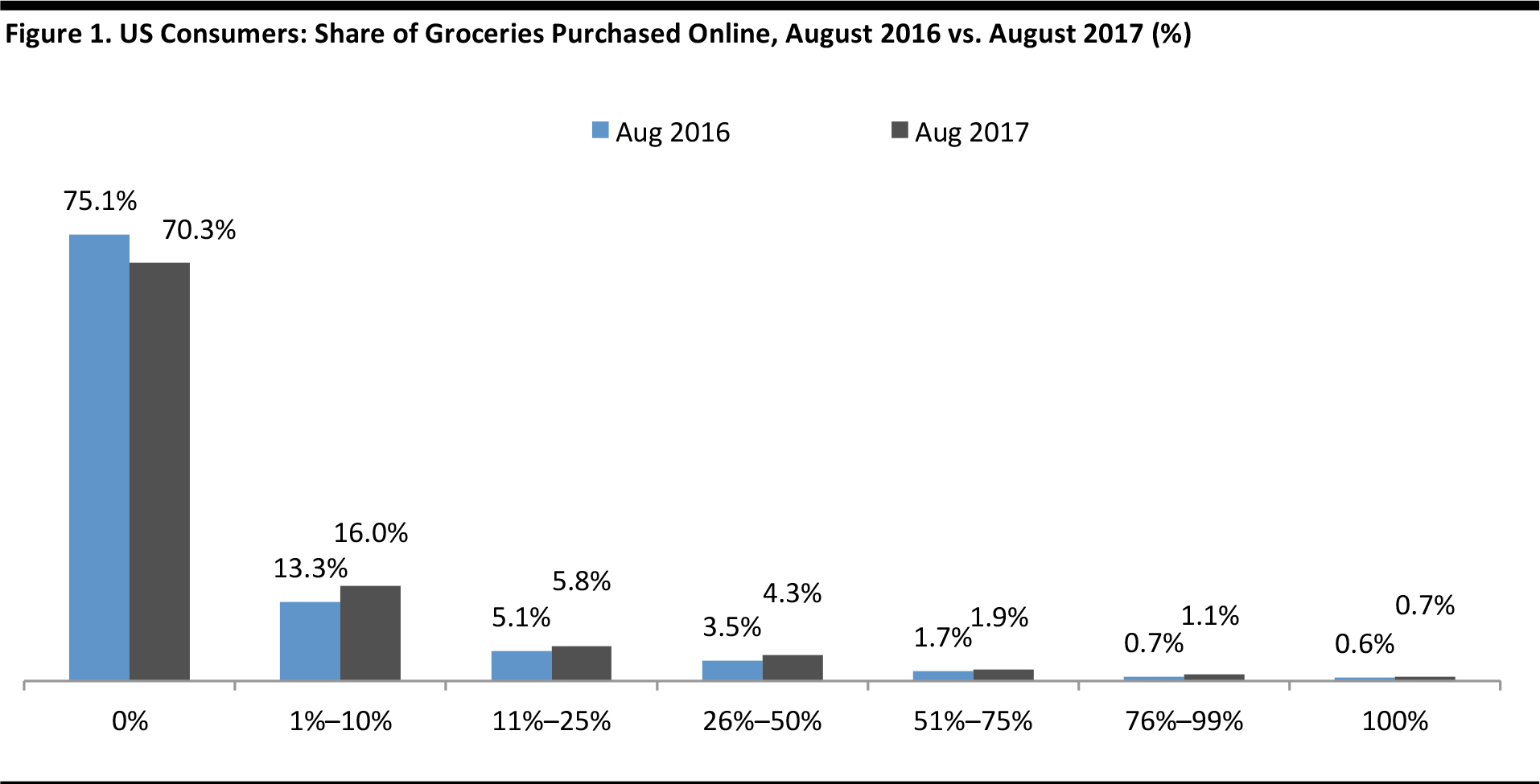

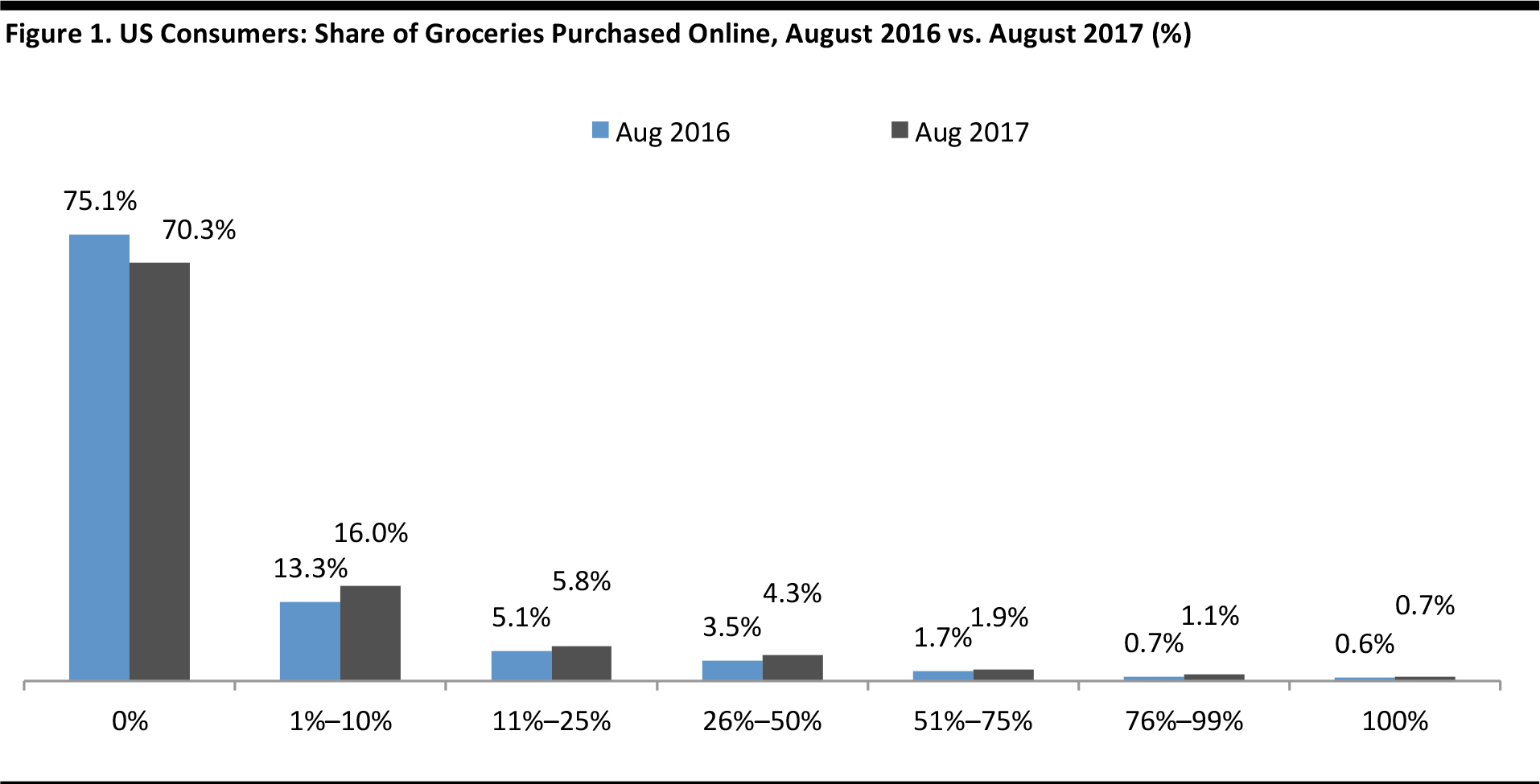

- Consumer participation in online grocery shopping is increasing, and around 30% of US shoppers are now purchasing some groceries online, up from 25% one year earlier, according to a Prosper Insights & Analytics survey conducted in August 2017.

- American consumers will spend around $1 trillion on groceries in 2017, we estimate from Bureau of Economic Analysis (BEA) data. We estimate that e-commerce will capture close to 2% of total US grocery-category sales this year, up from 1.4% in 2016.

- US shoppers will spend $9.3 billion on food and drink online this year, according to Euromonitor International. This excludes other grocery categories and equates to roughly 1% of total food and drink retail sales, we estimate from BEA data. This is lower than the 2% for all grocery categories, as recorded by Kantar, likely because nonfood grocery categories, such as household supplies, tend to over-index online, while certain food categories, such as fresh produce, under-index.

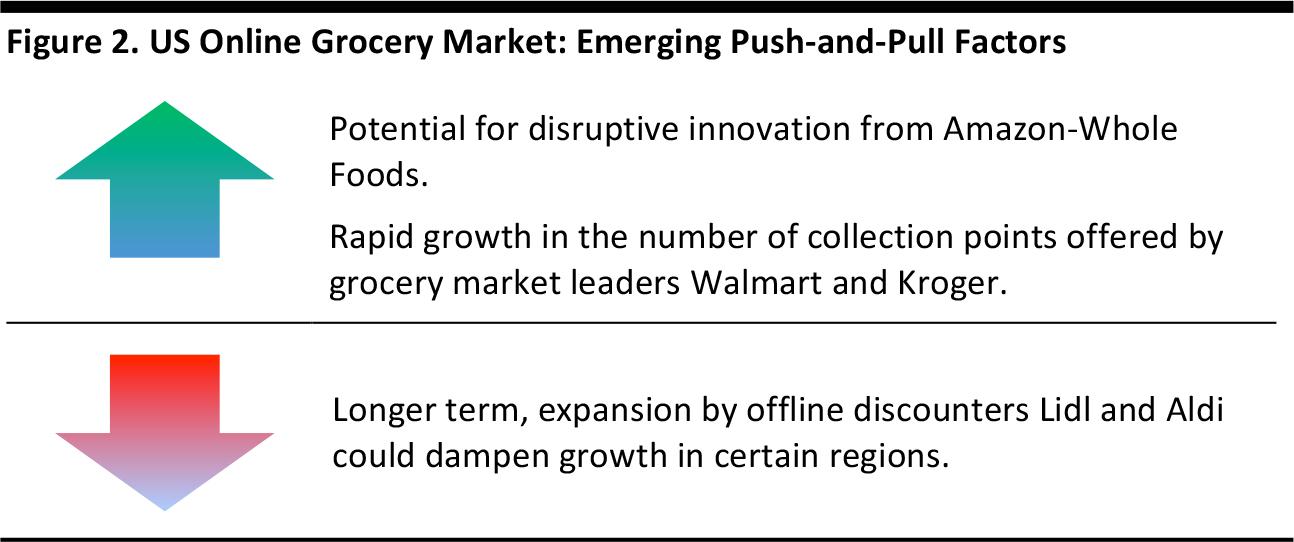

- Euromonitor forecasts that US online grocery sales will grow by 11% in 2017 and at a compound annual growth rate (CAGR) of 10% over the next five years. However, we believe growth is likely to be higher than these estimates, given the current rapid expansion of collection services by grocery market leaders Walmart and Kroger, and the potential for innovative disruption to emerge from Amazon’s acquisition of Whole Foods Market.

Amazon will likely leverage the Whole Foods acquisition to drive its ambitious food-delivery plans, and its options include rolling out collection services at Whole Foods stores or using those stores as picking stations for local grocery deliveries. As we wrote this report, Amazon announced its initial plans for Whole Foods, which includes lowering prices, integrating Prime as Whole Foods’ customer rewards program and installing Amazon Lockers in Whole Foods stores. We expect any further meaningful innovations from Amazon to prompt a response from competitors, consequently accelerating the development of the online grocery market.

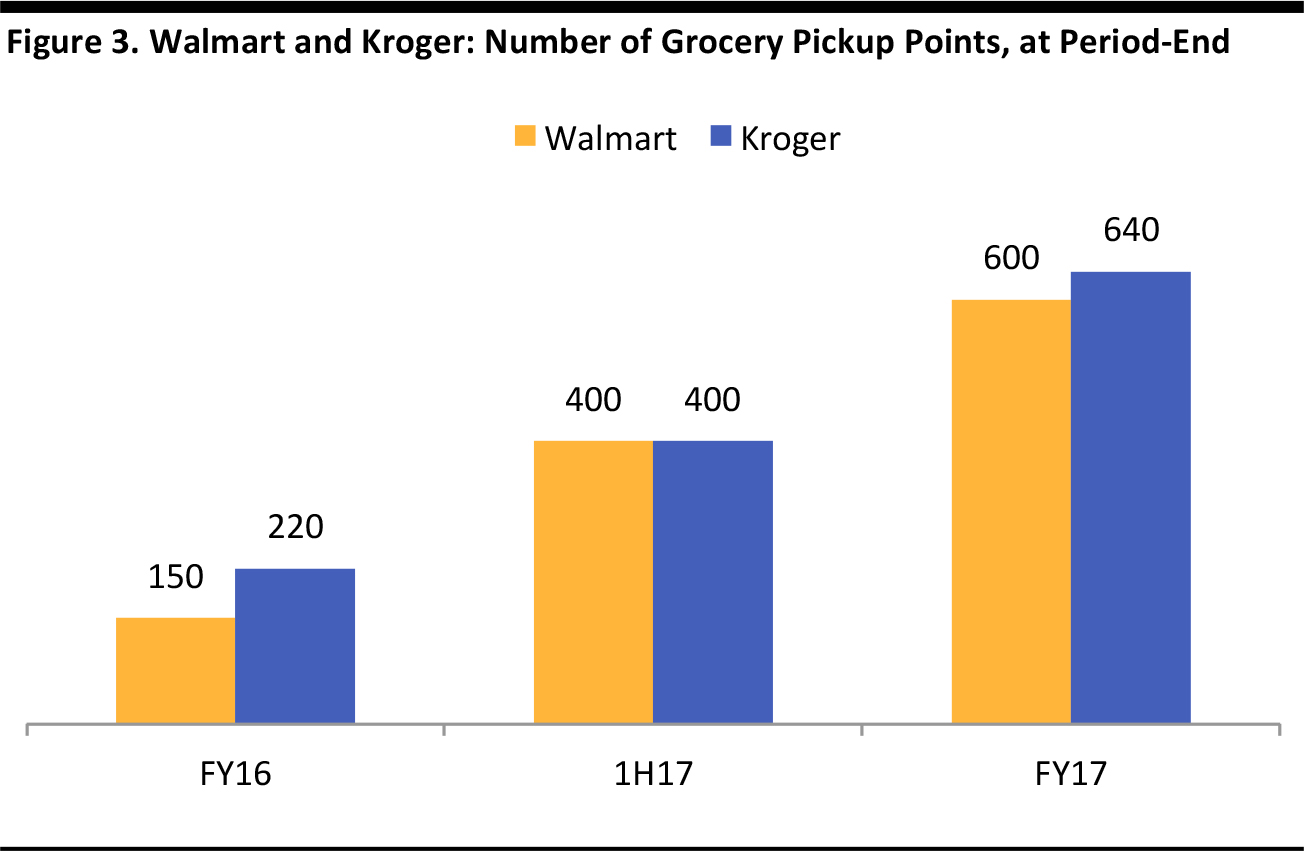

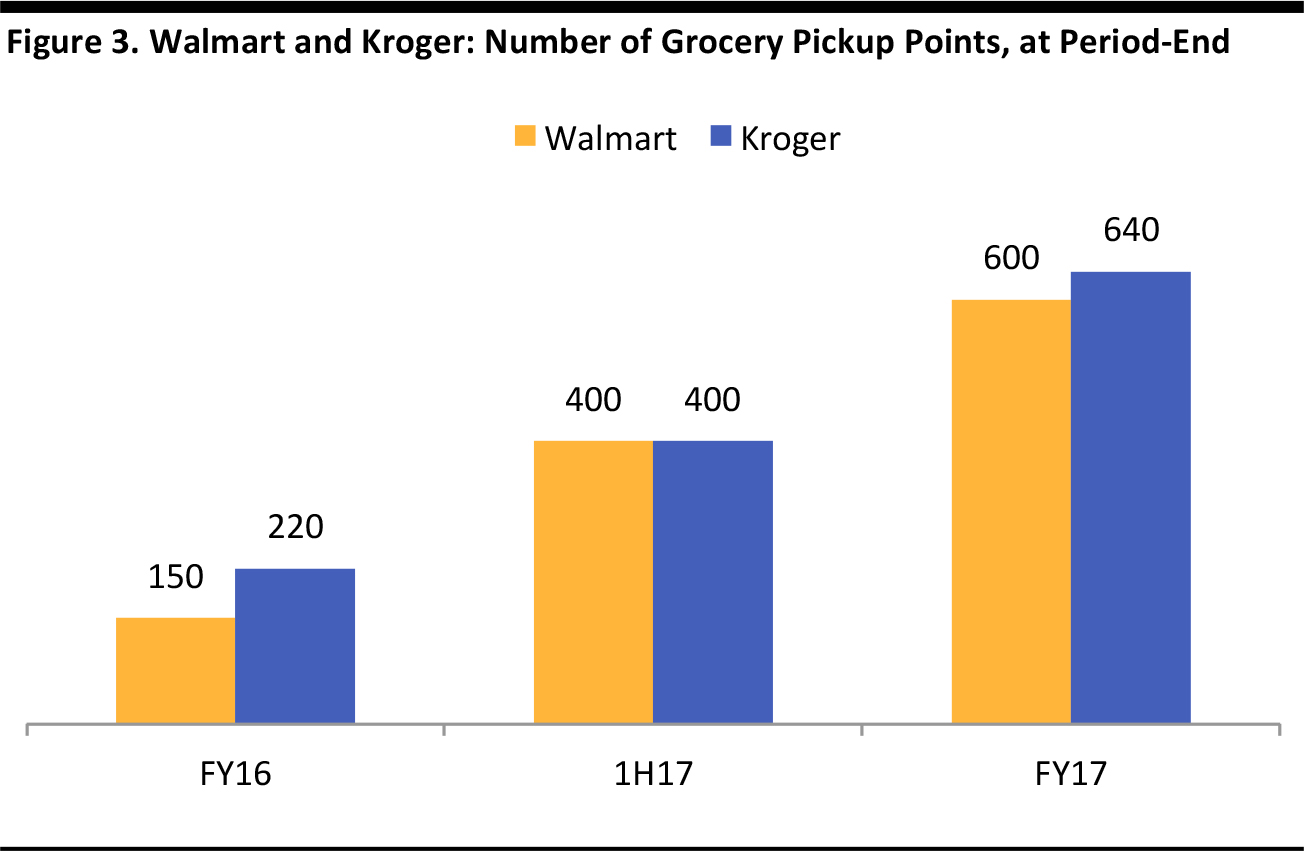

Walmart and Kroger have been growing the number of stores offering grocery collection very rapidly. In the fiscal year ended January 2017, Kroger almost tripled its number of grocery pickup points, while Walmart quadrupled its collection point numbers. In this context, we expect these grocery market leaders to be seeing very strong growth in online grocery sales.

At the same time, the US expansion plans of German low-cost discounters Aldi and Lidl—which remain predominantly offline retailers—could soften growth in selected US regions.

US grocers will also face competition from startup takeout food and food-subscription, meal-kit delivery services that provide the convenience and healthy and fresh options that consumers increasingly demand.

Two key online grocery fulfillment models have emerged in the US market: the click-and-collect model, whereby shoppers pick up groceries at stores or parking lots, and the home-delivery model, which uses third-party delivery providers. Grocery collection is less margin-erosive than home delivery and thus offers a good fit with the US market, which sees a preponderance of large stores and high car usage.

Introduction

The US is one of the least mature online grocery markets among major Western economies, with several major grocery retailers and mass merchants only recently pushing into grocery e-commerce.

This is the fifth report in our Online Grocery series, updating our initial

US online grocery report published in October 2016. In that report, we noted several characteristics of the US online grocery landscape:

- US consumers are mostly buying specific grocery items online, and those, on an occasional basis only. Most US online grocery shoppers are not using the channel for their regular, big-basket shopping trips.

- Amazon is the most popular online retailer for groceries, according to a number of surveys. But its most-used service is Amazon Prime, not its full-service AmazonFresh grocery offering, according to a Cowen and Company survey. For Prime purchases, Amazon sends items through the regular mail, making the service unsuitable for a conventional grocery shop.

- US online grocery retail looks set to boom, as average basket sizes get pushed up by the offerings of conventional grocers such as Walmart and Kroger.

Source: Amazon.com

In this update, we look at:

- The current situation and forecasts for online grocery retailing in the US.

- Amazon’s recent acquisition of Whole Foods Market, the possible rationale behind the deal and the implications it has for the industry.

- Sector challenges and recent developments, such as the entrance of Lidl and the expansion of Aldi in the US market.

- Recent activity from major brick-and-mortar chains and which e-commerce fulfillment options they are pursuing.

The US: An Immature E-Grocery Market with Great Potential

US grocery retailers have tended to be slow to roll out online shopping, and US shoppers have, in turn, lagged their peers in some other countries in terms of uptake.

However, consumer participation in online grocery shopping is increasing, and around 30% of US shoppers are now purchasing some groceries online. According to a Prosper Insights & Analytics survey conducted in August 2017:

- Some 70% of US adults do not make any grocery purchases online, down from 75% one year earlier.

- A total of 26.1% of US adults make up to half of their grocery purchases online, compared to 21.8% one year earlier.

Source: Prosper Insights & Analytics

Outlook: Amazon Could Accelerate its Expansion into Grocery

This year, US consumers will spend just over $1 trillion on groceries, including food, beverages and household supplies, we estimate from BEA figures. However, only a very small share of this total will be spent online.

- In 2016, US online grocery shopping accounted for 1.4% of total grocery category sales, according to Kantar Worldpanel. We estimate this figure will rise to almost 2% of total grocery category sales in 2017, boosted by the continued rollout of collection services by brick-and-mortar retailers such as Walmart and by Amazon’s ongoing push into the grocery space.

- US consumers spent $8.4 billion on food and drink online in 2016, according to Euromonitor International estimates. This equates to 0.9% of total food and drink retail sales, recorded by the BEA. This is a lower share than that for grocery categories overall, as recorded by Kantar, likely because nonfood FMCG categories, such as household supplies, tend to over-index online, while certain food categories, such as fresh produce, under-index.

- Euromonitor forecasts that US shoppers will spend $9.3 billion on food and drink online in 2017, up almost 11% year over year. This equates to roughly 1% of total food and drink retail sales, we estimate from BEA data. Euromonitor forecasts that US online grocery sales will increase by a CAGR of 10% over the next five years.

- However, we think these estimates look conservative, given the pace at which Walmart and Kroger are increasing the number of collection points they offer, and given the potential for disruption from Amazon-Whole Foods synergies.

Source: FGRT

Amazon’s acquisition of Whole Foods could prompt a wave of innovation and renewed competition in the online grocery segment. The Whole Foods store network provides Amazon with hundreds of locations that could be used as picking points for quick, local grocery deliveries, or as collection points for online orders placed with either Whole Foods or Amazon. We expect major grocery rivals to respond to any meaningful innovations launched by Amazon with their own e-commerce initiatives—and this would likely prompt an acceleration in market growth.

Walmart and

Kroger have been growing the number of stores offering grocery collection very rapidly. In the fiscal year ended January 2017, Kroger almost tripled its number of pickup points, while Walmart quadrupled its collection point numbers. These retailers have continued to increase the number of such points into the current year, as we discuss in our company profiles later in the report. Walmart reported total online net sales up 60% year over year in 2Q18 (this includes nongrocery sales and commission from third-party sellers). In this context, it is not hard to envisage these grocery market leaders growing their online grocery sales very strongly, from a small base.

January fiscal year-ends. Kroger includes Harris Teeter and Fred Meyer. Some figures are approximate. Source: Company reports

At the same time, omnichannel grocers and pure plays alike will be facing a fiercely competitive grocery space, which includes the brick-and-mortar US expansion of German discounters

Aldi and

Lidl. Aldi US recently announced a trial grocery delivery operation in partnership with Instacart, but, globally, the discounters remain predominantly offline players, and we expect them to remain so. The added costs of grocery e-commerce do not align with the low-overheads, no-frills business models of Aldi and Lidl.

As a result, we believe that the German discounters’ foray into the US market could have a dampening effect on the growth of online adoption in those regions in the US in which they have a meaningful presence.

A Challenging Sector Landscape

The US grocery retailing sector continues to experience challenges on multiple fronts, with subdued growth of sales and profit margins. The market is saturated and highly competitive, with many players and a variety of retail formats—such as supermarkets, mass merchants, convenience stores, dollar stores, drugstore chains and online meal kit providers—offering food and beverage categories.

We believe that the prevalence of food options sold at such a variety of retail formats hampers the adoption of online grocery shopping to a certain extent, as they provide numerous convenient alternatives for busy consumers.

To add to this, the US has also been experiencing sharp food price deflation and a cutthroat price war in the grocery industry.

- Walmart, Kroger and Ahold Delhaize have been slashing grocery prices in recent years to compete with Amazon and other players.

- The entrance of Lidl and the expansion of Aldi in the US market, combined with the Amazon and Whole Foods merger, will surely accentuate the grocery price war in the US. After all, Amazon is famous for lowering prices and costs through technology.

Fresh Groceries the New Frontier

Consumer preferences have shifted toward healthy and fresh eating and away from packaged, frozen and manufactured foods. Fresh staple items such as produce and meat drive consumers’ decisions of where to shop, as fresh food is the heart of grocery, according to Bain Consulting. We believe that consumers’ preference for fresh and natural food options has also stifled the adoption of grocery e-commerce in the US, as quick delivery of fresh food is complex and capital-intensive for retailers.

As fresh food is a key traffic driver for retailers, the category has become more of a focus for retailers in brick-and-mortar locations. However, the grocery industry has been struggling to figure out how to sell fresh food online, due to the more complicated and costlier nature of the supply chain for perishable groceries than for non-perishable goods. Fresh food delivery is typically unprofitable.

Expansion of Offline Grocery Discounters Aldi and Lidl

Expansion of Offline Grocery Discounters Aldi and Lidl

The US deep discount segment is estimated to grow by 8%–10% annually through 2020, five times more than for traditional grocers, according to Bain.

Globally, German discounters Aldi and Lidl remain predominantly offline retailers, as their low-cost, no-frills formats do not fit naturally with the high overheads associated with grocery e-commerce. Nevertheless, they have dipped their toes into the online grocery waters in selected markets. This included Aldi US announcing in August 2017 that it would trial a delivery service in partnership with Instacart.

We believe the aggressive expansion plans of the two German discounters could slow the adoption of online grocery shopping in certain US regions, given the excellent value proposition these retailers offer.

Aldi and Lidl are focusing their expansion plans on key e-commerce markets such as the Northeast, Southeast, Midwest, Texas and California.

- Aldi stated in early 2017 that it plans to invest $5.0 billion over the next five years to increase its US store count to 2,500 and to remodel its existing 1,600 US stores. The company will add 400 US stores by the end of 2018. These expansion plans will rank Aldi as the third-largest US grocer following Walmart and Kroger.

- Lidl: German discount chain Lidl opened its first 10 US stores in June 2017, with plans to open 10 more stores in 2017 and 80 stores on the US East Coast by summer 2018. The company plans to expand to over 500 locations in the next five years.

Companies in the Online Grocery Space

Amazon and Whole Foods Market

Amazon and Whole Foods Market

Amazon has been trying to penetrate the grocery segment for nearly a decade, when it first launched AmazonFresh in 2007. Its current online grocery offering includes AmazonFresh, Amazon Pantry and Prime Now, as well as a subscription service called Subscribe & Save and Wi-Fi-connected Dash replenishment buttons. The services are available in different geographic locations, at varying prices, with different items available.

In the past few months, Amazon looks to have stepped up the pace of its grocery expansion ambitions.

- In early 2017, Amazon began testing small-size, brick-and-mortar store formats in Seattle. The Amazon Go checkout-free convenience store allows customers to check in with smartphones, pick up desired items and leave without paying at a cash register, as they are billed automatically using artificial intelligence (AI) technology and virtual payment systems.

- In July 2017, Amazon filed a trademark for prepared cook-it-yourself meal kits. The company is also exploring a technology focused on producing tasty, prepared meals that require refrigeration, which was first developed for the US military. The ready-to-eat dishes may be launched as early as 2018.

- According to research firm MWPVL, Amazon has 18 distribution centers for its Pantry and fresh-food offerings in the US, with a further five such centers in the pipeline, as of August 2017. In addition, MWPVL says Amazon has 99 US general fulfilment and redistribution centers and 51 Prime Now hubs for rapid delivery.

Despite its various investments, Amazon held only a 0.2% share of the US grocery market in 2016, according to GlobalData Retail. We believe it will leverage its tie-up with Whole Foods to aggressively build out its online fresh food grocery business and intensify the grocery wars.

Whole Foods Market

Whole Foods Market

On August 23, Amazon gained approval from Whole Foods shareholders to acquire the grocery chain; on the same day, the US Federal Trade Commission confirmed that it would not investigate the acquisition on competition grounds.

Whole Foods operates 444 stores in the US, including 11 distribution centers focused on perishable foods, seafood processing plants, and kitchens and bakeries focused on prepared foods.

- Whole Foods sells a large variety of popular private-label goods.

- The company has tested both direct shipping and click-and-collect formats, and has a partnership with Instacart to deliver perishables. Management stated that online is one of the fastest-growing sales areas and that more customers are seeking grocery deliveries.

- Whole Foods reported eight consecutive quarters of comparable sales declines, as conventional grocers and mass merchants started offering organic products and launching their own healthy private-label brands. In response, Whole Foods was forced to cut prices and margins have suffered as a result.

Will Amazon’s Acquisition of Whole Foods Disrupt the US Grocery Industry?

Amazon’s acquisition of Whole Foods has dramatically shaken up the US grocery industry. Following the announcement in June, the share prices of several US grocers and mass merchants dived, revealing that the analyst and investor community expects the merger to intensify competition in the grocery sector.

On August 24, Amazon announced the following:

- Whole Foods will lower prices on selected best-selling grocery staples from August 28.

- Amazon Prime will be integrated into Whole Foods’ point-of-sale system and Prime members will enjoy special savings and in-store benefits. Prime will become the customer rewards program for Whole Foods.

- Whole Foods’ private label products will be offered through Amazon’s various online grocery services.

- Amazon Lockers will be installed in selected Whole Foods stores, for pick up and return of Amazon orders.

Amazon also said that the companies plan to offer more “in-store benefits” and lower prices for customers as they integrate. In the medium term, we see potential for the following:

- Overcome Amazon’s last-mile logistics hurdle: Whole Foods could provide at least a partial remedy to Amazon’s fresh food, last-mile delivery logistics hurdle. Whole Foods’ 444 US stores will provide Amazon with access to hundreds of local distribution points that could be used to fulfill grocery deliveries, including rapid, one-hour or same-day orders.

- Launch a grocery click-and-collect service: Although Whole Foods has tested click-and-collect, Amazon could launch a comprehensive click-and-collect service under either the AmazonFresh or Whole Foods banners. This would bring Amazon’s grocery offering to multiple new locations across the US.

- Improve data analytics: Amazon will acquire valuable customer data through the Whole Foods deal, and the duo can apply Amazon’s data analytics technology to better predict what goods to carry in stores and online and to develop and build better private-label products.

We could ultimately see Amazon operating a hybrid online/brick-and-mortar grocery model, including a mix of pickup and home delivery. Amazon has already demonstrated that it is willing to incur lower profits for years in order to establish a footprint and build market share in a given sector, meaning we could see it invest in innovative services to build share in the grocery sector.

The tie-up will certainly act as a catalyst for other food retailers to accelerate and improve their e-commerce initiatives—and these rivals could be prompted to invest further should Amazon unveil further initiatives on the back of the Whole Foods acquisition.

Source: iStockphoto

Delivery Partners

Delivery services companies, such as San Francisco-based Instacart, do not own refrigerated warehouses, but instead send third-party couriers to supermarkets and convenience stores to pick up goods and deliver to customers’ homes.

Google Express

Google Express

- Google Express lets online shoppers order health and beauty items and dry good groceries; it no longer delivers fresh groceries. As of September 2016, Google Express had a presence in around 75% of the US.

Instacart

Instacart

- Instacart is a grocery-delivery startup valued at around $3.4 billion, as of March 2017. Instacart charges a flat fee of $14.99 a month for unlimited grocery deliveries. The company is currently unprofitable, but is expected to be cash-flow positive in 2017. Instacart has been growing rapidly and aims to double the number of cities it covers by the end of 2017.

- Aldi is set to trial grocery deliveries via Instacart in three US cities.

Uber

Uber

- Walmart is among those offering home delivery via Uber in selected areas. Uber began partnering with retailers in 2015, and launched UberEATS for restaurant deliveries in the US in 2016.

Walmart

Walmart

Walmart is the largest food seller in the US, with nearly half of its $308 billion in annual US revenues from grocery sales in the fiscal year ended January 2017.

Approximately 90% of the US population lives within a 10-mile radius of a Walmart store, so leveraging the vast store base for online pickup or delivery is not only convenient, but makes sense logistically.

In 2016, Walmart acquired e-commerce retailer Jet.com, which offers a technology based on algorithms that helps shoppers save money through a variety of fulfillment options. Jet.com also sells fresh groceries online in select US cities.

Walmart has slowed plans to build physical stores, with 55 supercenters and smaller-format stores slated for fiscal 2018, down from 132 in fiscal 2017. When deciding to open new stores, Walmart takes its e-commerce strategy into consideration.

Online grocery is a focus for Walmart:

- As of August 2017, approximately 900 stores offer same-day car pickup of fresh food, up from close to 400 locations at the end of the second quarter of fiscal 2017 (see our previous online grocery report). The company plans to expand this to over 1,100 stores by the end of the current year.

- Walmart reported total online net sales up 60% year over year in the second quarter of fiscal 2018; this includes nongrocery sales and commission from third-party sellers. Gross merchandise volume (GMV)—which is the total value of sales, whether made by Walmart or third-party sellers on its site—grew by 67% in the second quarter of fiscal 2018.

- On its second quarter earnings call for fiscal 2018, management stated that online grocery has grown quickly. It has been able to apply the 15 years of ASDA food delivery experience it amassed in the UK to build out its online grocery pickup business in the US.

- The company is currently testing automated drive-through pickup kiosks that allow shoppers to enter a pickup code while they wait for the kiosk to fetch the order from bins inside.

- Because the costs and logistics make it essentially impossible to perform same-day delivery of fresh and frozen food from a central warehouse, Walmart is testing same-day delivery at 10 stores, which are performing solidly, according to management.

- In July 2017, Walmart unveiled Easy Reorder, a mobile app similar to Amazon’s Dash button, to reorder frequently purchased items and to collect customer data.

- In August 2017, Walmart announced an expansion of its trial partnership with Uber to offer grocery home delivery. The trial was launched in Phoenix in 2016 and the recent expansion takes the service to Orlando and Dallas.

Kroger

Kroger

Kroger is the largest supermarket chain in the US and the second-largest retailer in terms of grocery revenues in 2016 behind Walmart, according to company financial statements.

- The company continues to roll out click-and-collect or curb-pickup services. As of the first quarter of fiscal 2018, it offered this service at over 660 of its 2,778 stores, up from nearly 400 stores at the end of the second quarter of fiscal 2017.

- In the first quarter of fiscal 2018, the company reported 30% year-over-year growth in new digital customers and an over 30% rise in digital visits.

- Kroger is testing delivery partnerships with Uber, Shipt and Instacart in selected markets. According to the company, it does not make sound economic sense to own trucks, so it prefers to use third-party partners for delivery.

- Kroger continues to focus on natural and organic products and ready-to-eat meal solutions, two of the highest growth areas. In 2016, its natural and organic sales reached $19 billion. Kroger has also launched its own meal kit service.

Peapod

Peapod

- Peapod is owned by Netherlands-based food retailer Ahold Delhaize, which has a leading position on the US East Coast. Founded in 1989, Peapod was one of the first US grocery delivery companies.

- Peapod increased the capacity of its New Jersey warehouse by 25% year over year in the second quarter of 2017, and currently delivers 20,000 orders weekly. It is also building a new home-delivery center in Chicago to add capacity to the Chicago market.

- The company rolled out an annual subscription service, the Peapod Pod Pass, which charges a fee for unlimited home-delivery or pickup services. The Pod Pass customer base grew by 14% year over year in the second quarter of 2017.

- Peapod recently launched its own brand line of fresh meal kits.

- Management stated that sales are growing in the high single digits.

Target

Target

Target, ranked the 11th-largest retailer in the US, has less fresh food grocery exposure than competitor mass-merchant retailer Walmart. Since a new CEO joined in 2014, Target has made efforts to revamp its grocery business, which accounts for 22% of total annual sales of almost $70 billion in fiscal 2016.

- To help expand its same-day delivery service, in August, Target acquired Grand Junction, a delivery technology company based in San Francisco that manages local delivery for retailers through a network of more than 700 carriers. Target had already been working with Grand Junction on a small, same-day delivery pilot out of its Tribeca store in Manhattan. The service will be expanded to other New York-area stores in fall 2017, and to other cities in 2018.

- Target’s grocery offering is currently limited to shelf staples, although the company is testing Target Restock, a next-day, home-delivery service of household items for Target REDcard holders.

- The company has made an aggressive push to add organic and gluten-free brands and expanded its private-label organic brand Simply Balanced.

- Target scrapped its trial curbside (drive-thru) pickup service in June 2016. However, in July 2017, the company launched a new trial of curbside pickup in Minneapolis. Target customers can also pick up selected grocery items in-store.

Costco

Costco

Costco is the largest membership-only warehouse club in North America. According to the company, online sales amounted to less than 3.5% of total sales, representing over $4 billion in revenues as of the third quarter of fiscal 2017.

- Online sales increased 11% year over year in the third quarter of fiscal 2017, the latest reported earnings quarter.

- Online delivery services used by Costco allow the retailer to reach incremental, primarily urban, customers, who do not generally visit Costco warehouses. It does not offer fresh food online other than through third parties such as Instacart, Shipt and Google Express. Instacart, in particular, has continued to grow dramatically—it operates in 40 Costco cities, up from 26 a year ago, and utilizes 240 Costco warehouses, up from 132 a year ago.

- Costco does not operate a click-and-collect offering.

Sprouts Farmers Market

Sprouts Farmers Market

Specialty natural foods retailer Sprouts Farmers Market operates 268 stores in 15 states. It also has a partnership with Amazon Prime Now—Sprouts products are delivered through the Prime Now service to over 20 markets.

- In terms of basket size and product mix, Amazon Prime Now baskets are roughly twice that of an in-store basket, with a higher penetration of heavier items such as dairy and frozen products.

Smart & Final

Smart & Final

Smart & Final (S&F) is a value-focused grocery chain serving both household and business customers. Its stores are located primarily in the Western US. S&F reported annual sales of $4.3 billion in fiscal 2016.

- S&F currently offers delivery or online pickup options in over 150 stores across seven states, representing over 50% of the store base.

- Online orders tend to be slightly higher-margin and more natural and organic in nature than in-store orders.

- S&F has slowed its store expansion plans, with 19 stores slated in 2017, down from 37 in 2016, lowering new store growth to 6.5% in fiscal 2017 from 15% in fiscal 2016.

What Does the Future Hold for Online Grocery?

We expect US grocers and mass merchants to continue to expand both click-and-collect and home-delivery services. However, due to the cost and difficulties of last-mile logistics, margin generation in the grocery industry will be even more challenging, especially as US grocers are already dealing with low margins in the face of price wars and rising labor costs.

Grocery collection looks to be the obvious choice, as it is less margin-erosive than home delivery and offers a good fit with the US market, which sees a preponderance of very large stores and high car usage.

Although third-party, home-delivery players have been gaining momentum in the US, some food-delivery startups have struggled to make their business models work. At some point, delivery players will have to post profits, otherwise they will soon run out of investment funding.

Competition from Takeout Food and Food Subscription Delivery Services

US grocers are also facing some competition from takeout food and food subscription-box delivery services that provide the convenience that consumers demand.

Source: Blueapron.com

- New York subscription service Blue Apron offers weekly meal kits, ingredients and recipes for make-at-home meals. Blue Apron recently completed an IPO in June 2015, valuing the company at about $1.9 billion. The company posted sales of $795 million in 2016.

- Other meal-kit companies include HelloFresh and Sun Basket, which has received investment funding from Unilever’s venture arm.

- GrubMarket and San Francisco-based Good Eggs deliver products to consumers from local farmers, fisheries, food makers and restaurants.

- According to a UPS/comScore survey conducted in early 2016, 9% of millennials and 4% of non-millennials have signed up for a meal delivery service.

Competition from Online Retail Startups

New online retail startups are also vying for online food share, and we could see an even greater proliferation of these in the future.

San Francisco-based Brandless started selling organic, health and environmentally-friendly food and cosmetics. Brandless offers nearly 200 products, and all items are priced at $3. The company plans to double its merchandise offering by mid-September 2017 and eventually broaden the price range. The company manages to keep prices low, as it created only one product per category to keep costs down compared to large grocery chains that offer numerous product options. The company has received investment funding of $50 million from New Enterprise Associates and Google Ventures.

Key Takeaways

- Online grocery in the US is still an emerging channel. We estimate that e-commerce’s share of the category will approach 2% in 2017, boosted by the continued rollout of collection services by brick-and-mortar retailers and by Amazon’s ongoing push into the grocery space.

- The US grocery retailing industry is changing rapidly. Both traditional and omnichannel grocers will have to compete in the fiercely competitive space.

- Amazon’s acquisition of Whole Foods has brought a renewed focus on US online grocery shopping, as Amazon will likely leverage the Whole Foods acquisition to drive its ambitious food-delivery plans.

�

Walmart and Kroger have been growing the number of stores offering grocery collection very rapidly. In the fiscal year ended January 2017, Kroger almost tripled its number of grocery pickup points, while Walmart quadrupled its collection point numbers. In this context, we expect these grocery market leaders to be seeing very strong growth in online grocery sales.

At the same time, the US expansion plans of German low-cost discounters Aldi and Lidl—which remain predominantly offline retailers—could soften growth in selected US regions.

US grocers will also face competition from startup takeout food and food-subscription, meal-kit delivery services that provide the convenience and healthy and fresh options that consumers increasingly demand.

Two key online grocery fulfillment models have emerged in the US market: the click-and-collect model, whereby shoppers pick up groceries at stores or parking lots, and the home-delivery model, which uses third-party delivery providers. Grocery collection is less margin-erosive than home delivery and thus offers a good fit with the US market, which sees a preponderance of large stores and high car usage.

Walmart and Kroger have been growing the number of stores offering grocery collection very rapidly. In the fiscal year ended January 2017, Kroger almost tripled its number of grocery pickup points, while Walmart quadrupled its collection point numbers. In this context, we expect these grocery market leaders to be seeing very strong growth in online grocery sales.

At the same time, the US expansion plans of German low-cost discounters Aldi and Lidl—which remain predominantly offline retailers—could soften growth in selected US regions.

US grocers will also face competition from startup takeout food and food-subscription, meal-kit delivery services that provide the convenience and healthy and fresh options that consumers increasingly demand.

Two key online grocery fulfillment models have emerged in the US market: the click-and-collect model, whereby shoppers pick up groceries at stores or parking lots, and the home-delivery model, which uses third-party delivery providers. Grocery collection is less margin-erosive than home delivery and thus offers a good fit with the US market, which sees a preponderance of large stores and high car usage.

Expansion of Offline Grocery Discounters Aldi and Lidl

Expansion of Offline Grocery Discounters Aldi and Lidl Amazon and Whole Foods Market

Amazon and Whole Foods Market Whole Foods Market

Whole Foods Market Google Express

Google Express Instacart

Instacart Uber

Uber Walmart

Walmart Kroger

Kroger Peapod

Peapod Target

Target Costco

Costco Sprouts Farmers Market

Sprouts Farmers Market Smart & Final

Smart & Final