DIpil Das

Introduction

In our fourth annual US online grocery survey, we explore how many shoppers are buying food and essentials online, how much they purchase online, which retailers they are buying from and whether they expect to retain crisis-driven habits—among other findings. The consistency of many of the questions we asked has enabled us to build up trend data from when we first ran this survey in 2018. The health crisis was a significant catalyst in accelerating online grocery adoption and transformation in 2020 and into 2021. With the pandemic keeping consumers at home and away from stores (and restaurants), we estimate that total US food and beverage e-commerce sales grew to $55.5 billion in 2020, up 81.1% year over year—a vastly greater increase than any recent year. As discussed later in the report, we believe that the pandemic-induced channel stickiness will support further online growth among retailers. Grocers have a unique opportunity to capitalize on shifting trends and the still-evolving e-commerce consumer experience. The basis of this report is our survey conducted on April 1, 2021, of 1,652 US consumers, of which 59% had purchased groceries online in the 12 months preceding the survey. We provide comparisons to our 2020, 2019 and 2018 surveys. We discuss our four key insights from the survey, before covering our survey questions in detail.Four Top Insights from Our Online Grocery Survey

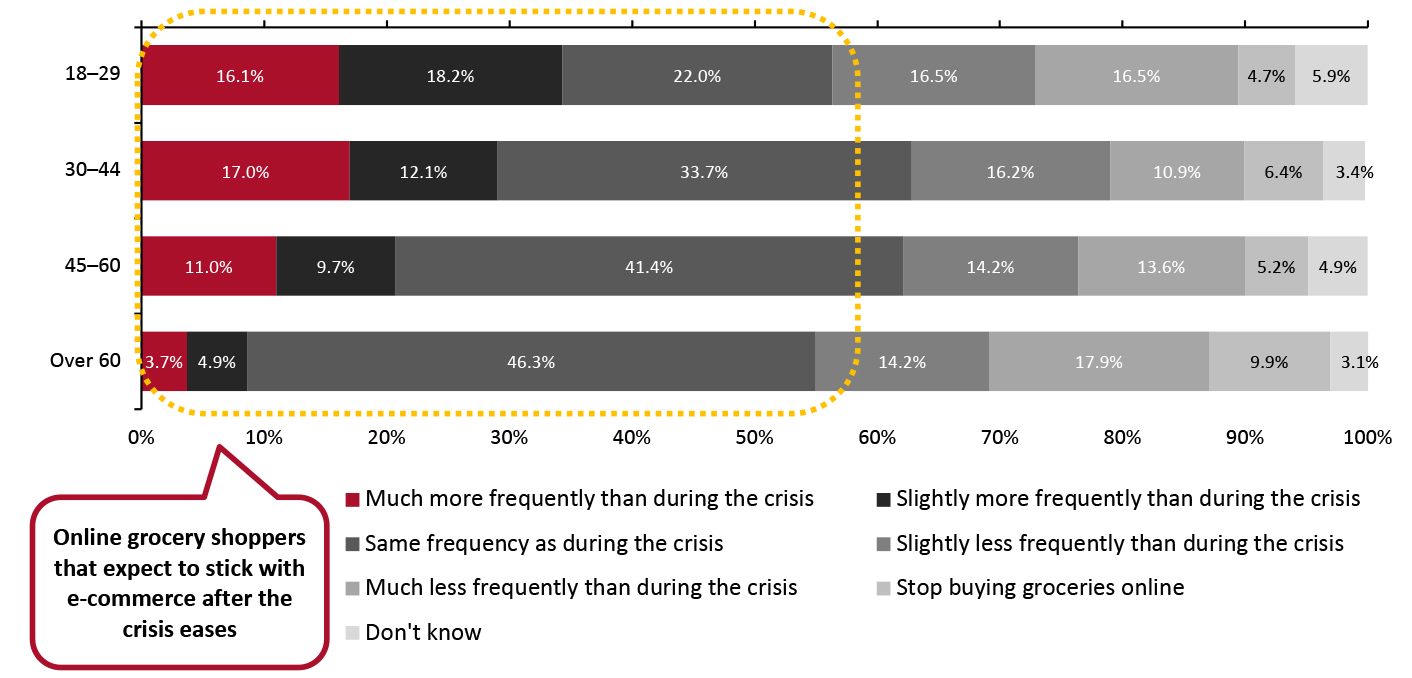

1. Most Online Grocery Shoppers To Stick with E-Commerce Post Crisis A key question that grocery retailers are trying to answer is—to what extent will crisis-driven shopping habits be retained once consumers get vaccinated and return to more traditional ways of living and spending? Our survey suggests that the prolonged crisis has reinforced online buying behaviors in a high proportion of online shoppers.- Over one-third of online grocery shoppers do not expect to change their online grocery shopping habits once the crisis eases or ends. Additionally, over one-quarter of shoppers said that they plan to buy groceries online after the crisis subsides more frequently than they did during.

- Around 29.5% of online shoppers plan to shop “slightly less frequently” or “much less frequently” once the pandemic subsides. Some 6.3% of respondents said that they will stop buying groceries online.

- Online grocery shoppers aged 30–44 are the most likely to continue buying groceries online, with almost 63% reporting that they expect to continue at the “same” frequency or “more” frequently once the pandemic subsides.

Figure 1. Online Grocery Shoppers: How Frequently They Expect To Buy Groceries Online Once the Coronavirus Crisis Subsides, by Age Group (% of Respondents) [caption id="attachment_127472" align="aligncenter" width="725"]

Base: 975 US Internet users aged 18+ who have purchased groceries online in the past 12 months

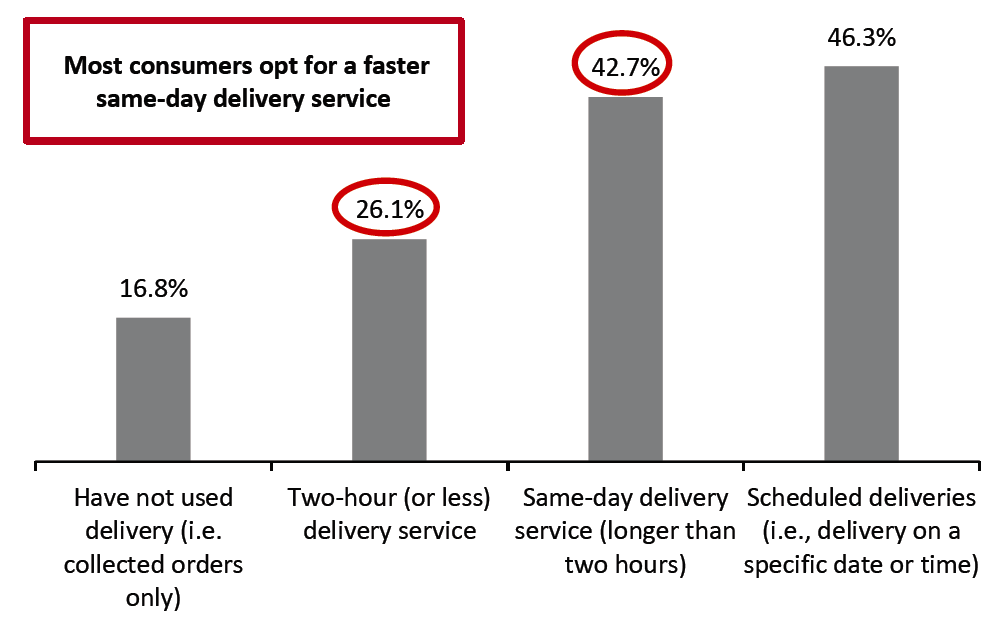

Base: 975 US Internet users aged 18+ who have purchased groceries online in the past 12 months Source: Coresight Research [/caption] 2. Consumers Prefer Rapid Delivery Our survey indicates that the US market is advancing toward home delivery as the default for online grocery purchases, with this fulfillment option enjoying a clear lead over collection. Over 56% of respondents who had purchased groceries online in the prior 12 months had their orders delivered, while 43% said that they opted for pick up. Retailers must continue to focus their resources on delivery despite the increased profile of collection services amid the pandemic. Delivery time is critical for online grocery shopping experiences. Our survey found that 42.7% of online grocery shoppers used same-day shipping services, while more than one-quarter used rapid two-hour delivery services. Grocery retailers—large and small—should seek to meet consumers’ delivery expectations to avoid losing business to competitors that can deliver more quickly. Automation of fulfillment processes, along with a reevaluation of last-mile shipping practices will prove beneficial for retailers in meeting consumer demand for faster delivery. 3. New York Consumers Are Most Interested in Buying Groceries Online While the pandemic has boosted online grocery shopping in the US, our survey results reveal that this trend is not evenly distributed. To find out which US states are most interested in buying grocery products online and likely present significant opportunities for retailers, we asked respondents if they had bought groceries online in the prior 12 months and if they expect to do so in the next 12 months, and looked at the responses at state level.

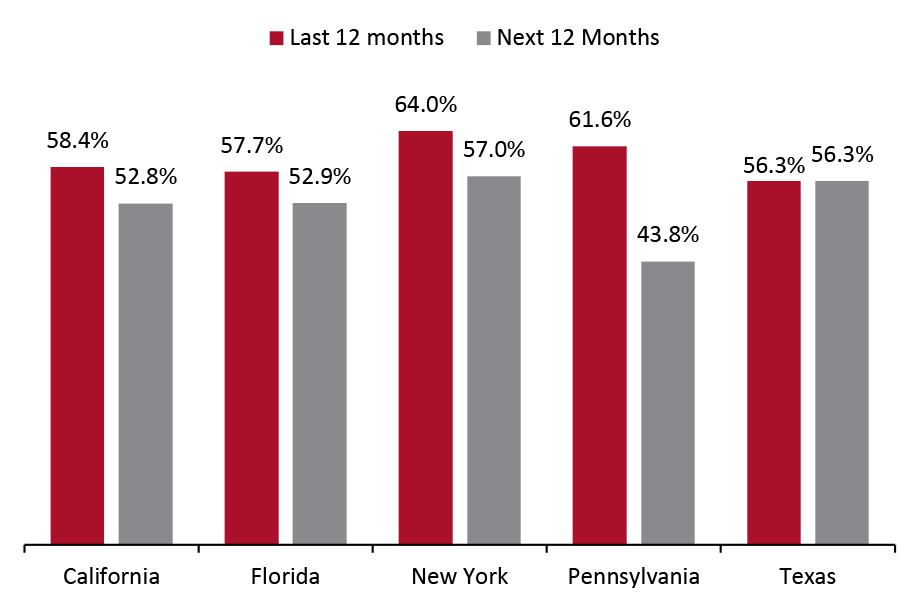

- Comparing the top five states by population (California, Florida, New York, Pennsylvania and Texas), consumers in New York and Pennsylvania are more likely than the average online shopper to use e-commerce for grocery purchases, with 64.0% of respondents in New York and 61.6% in Pennsylvania reporting that they bought groceries online in the 12 months prior to the survey (against the national average of 59%).

- Consumers in the four abovementioned states except Pennsylvania are more likely than the average shopper to buy groceries online in the next 12 months, coming in at 57% in New York, 56.3% in Texas, 52.9% in Florida and 52.8% in California versus the national average of 49.5%.

- New York reported the highest proportion of respondents that had bought groceries online, at 62.1%—likely linked to the state seeing the most coronavirus-induced lockdowns. Shoppers in New York also stated a higher expectation of shopping via e-commerce, with around 57% of respondents expecting to buy groceries online in the next 12 months.

Survey Findings in Detail

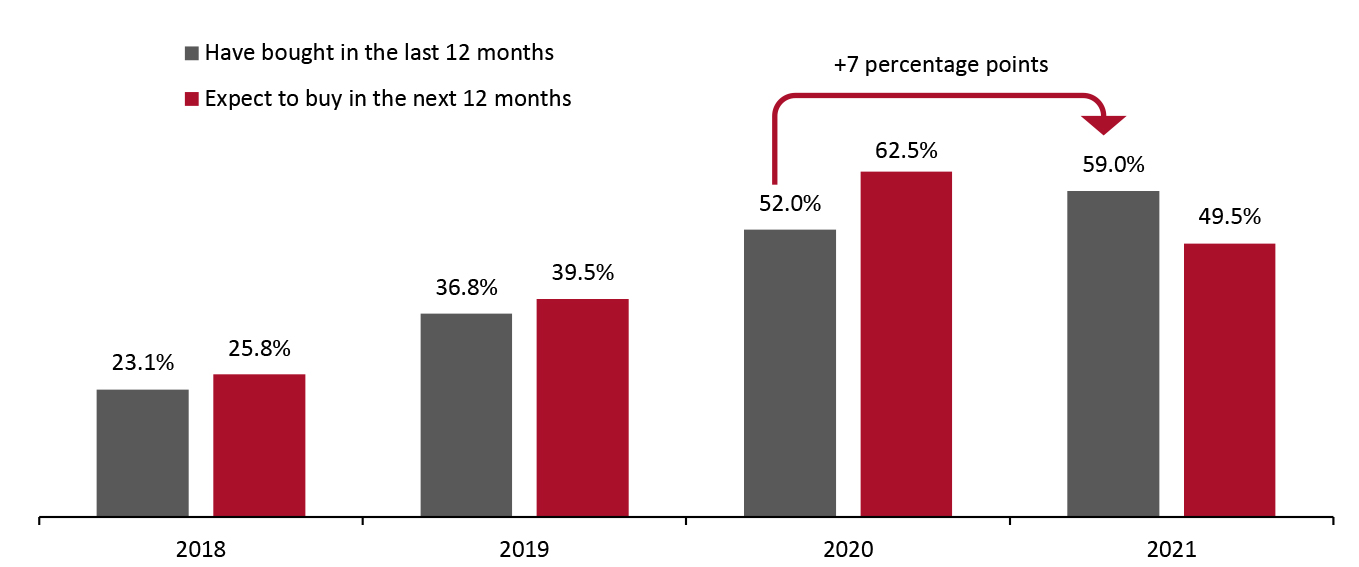

Three in Five Consumers Now Buy Groceries Online Each year, we ask respondents if they had bought groceries online in the past 12 months and if they expect to do so in the next 12 months.- This year, our survey found that over 59% of all respondents had bought groceries online in the past 12 months—the highest level we have recorded. However, this is still 3.5 percentage points lower than last year’s findings on the proportion of consumers that expected to buy online in the next 12 months—indicating that respondents in March 2020, who we surveyed as the pandemic’s impact began to hit, slightly overestimated their expectation to buy online compared to actual behavior.

- In our three prior surveys, we saw expectations of buying online in the next 12 months exceed the proportion of respondents that had bought online in the past 12. However, this year, for the first time, we saw a 10.5-percentage-point difference between the “had bought” and “expect to buy” proportions, with the latter dropping to 49.5%. The drop in spending intent through the online channel signifies that the unprecedented online grocery growth rate of 2020 will be hard to sustain as consumers are set to return (partially) to prior ways of living and spending.

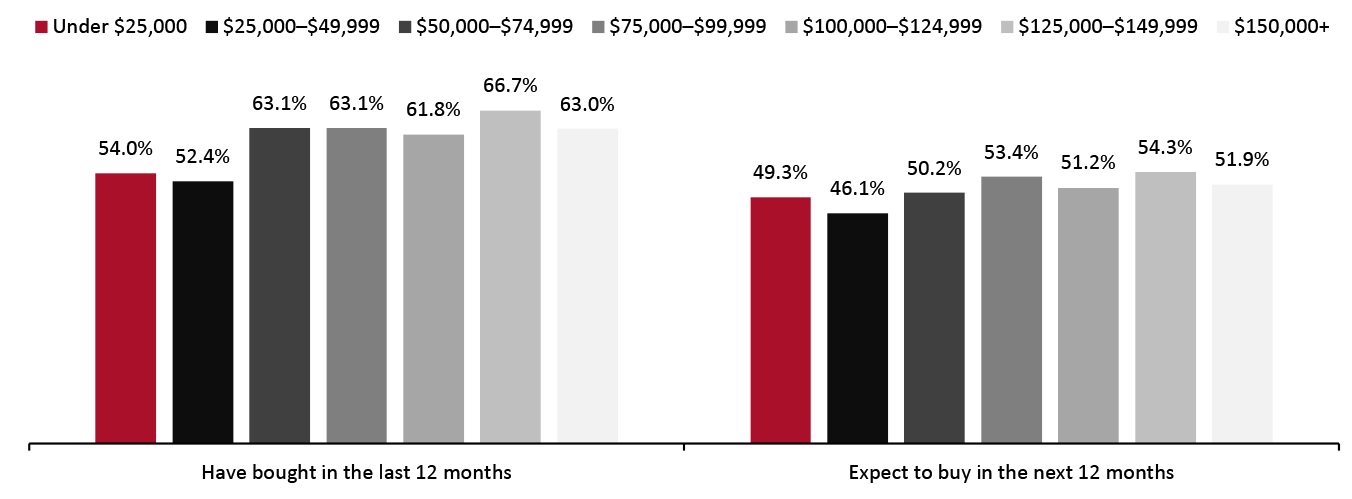

- The proportion for “expect to buy” online compared to the “had bought” online proportion declined by nine to 10 percentage points for all age groups. By income, those who earned $50,000–$74,999 showed the largest decline, of 12.9 percentage points.

Figure 2. All Respondents: Proportion That Had Bought Groceries Online in the Past 12 Months/Expect To Buy Groceries Online in the Next 12 Months (% of Respondents) [caption id="attachment_127473" align="aligncenter" width="725"]

Base: US Internet users aged 18+

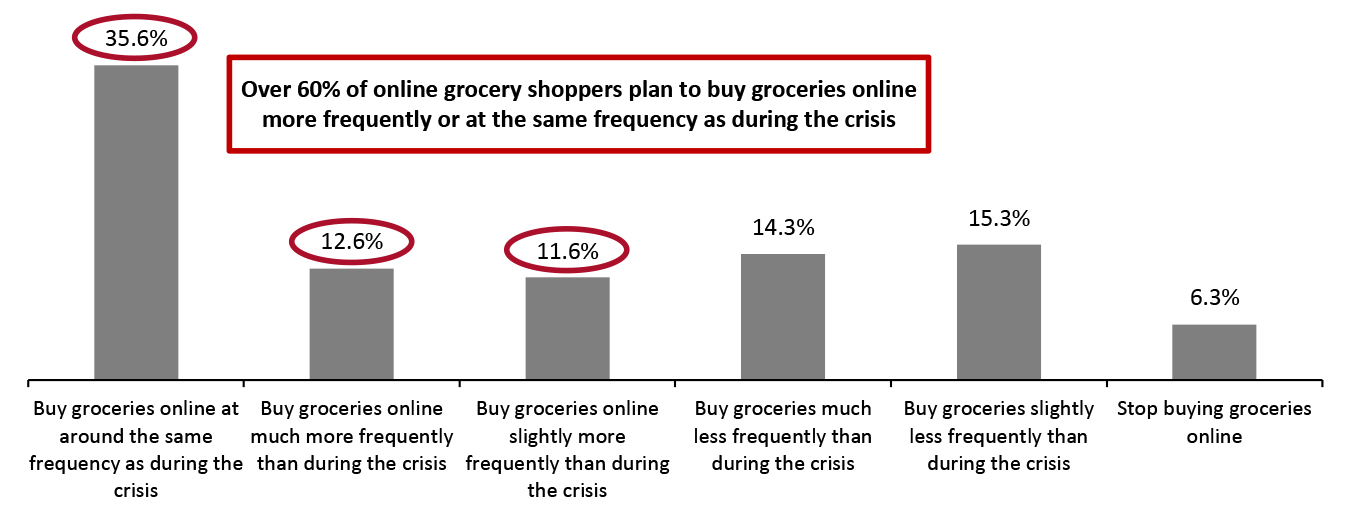

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Pandemic Reinforces Online Grocery Shopping Behavior This year, we asked respondents about their expectations to buy groceries online once the crisis eases up. As reflected in Figure 3, online shopping will certainly dip somewhat as the pandemic subsides, but the overall shift toward online grocery shopping is likely to remain.

- Over one-third of online grocery shoppers do not expect to change their online grocery shopping habits once the crisis eases or ends. Additionally, over one-quarter of shoppers said that they plan to buy groceries online more than their current purchase frequency.

Figure 3. Online Grocery Shoppers: How Frequently They Expect to Buy Groceries Online Once the Coronavirus Crisis Subsides (% of Respondents) [caption id="attachment_127474" align="aligncenter" width="725"]

Base: 975 US Internet users aged 18+ who had purchased groceries online in the past 12 months

Base: 975 US Internet users aged 18+ who had purchased groceries online in the past 12 months Source: Coresight Research [/caption] More Consumers Use E-Commerce for the Majority of Their Grocery Shopping Before the pandemic, shoppers generally tended to buy online infrequently and for smaller volumes. However, as shown in Figure 4, more respondents undertook a sizeable proportion of their shopping grocery online last year, as the pandemic led customers to limit physical interactions.

- A lot: We saw the biggest year-over-year uplift in the proportion of shoppers doing a large amount of their shopping online, suggesting that the US grocery e-commerce market now captures a meaningful share of full-basket grocery shoppers. This year, around one-quarter of respondents said they did “all or almost all” or “most” of their grocery shopping online—versus 14% last year.

- A little: This year, 55.3% said that they did “almost none” or “a small amount” of their grocery shopping online—a notable decrease from 63.1% last year.

Figure 4. Online Grocery Shoppers: How Much of Their Total Grocery Shopping Is Done Online (% of Respondents) [wpdatatable id=963 table_view=regular]

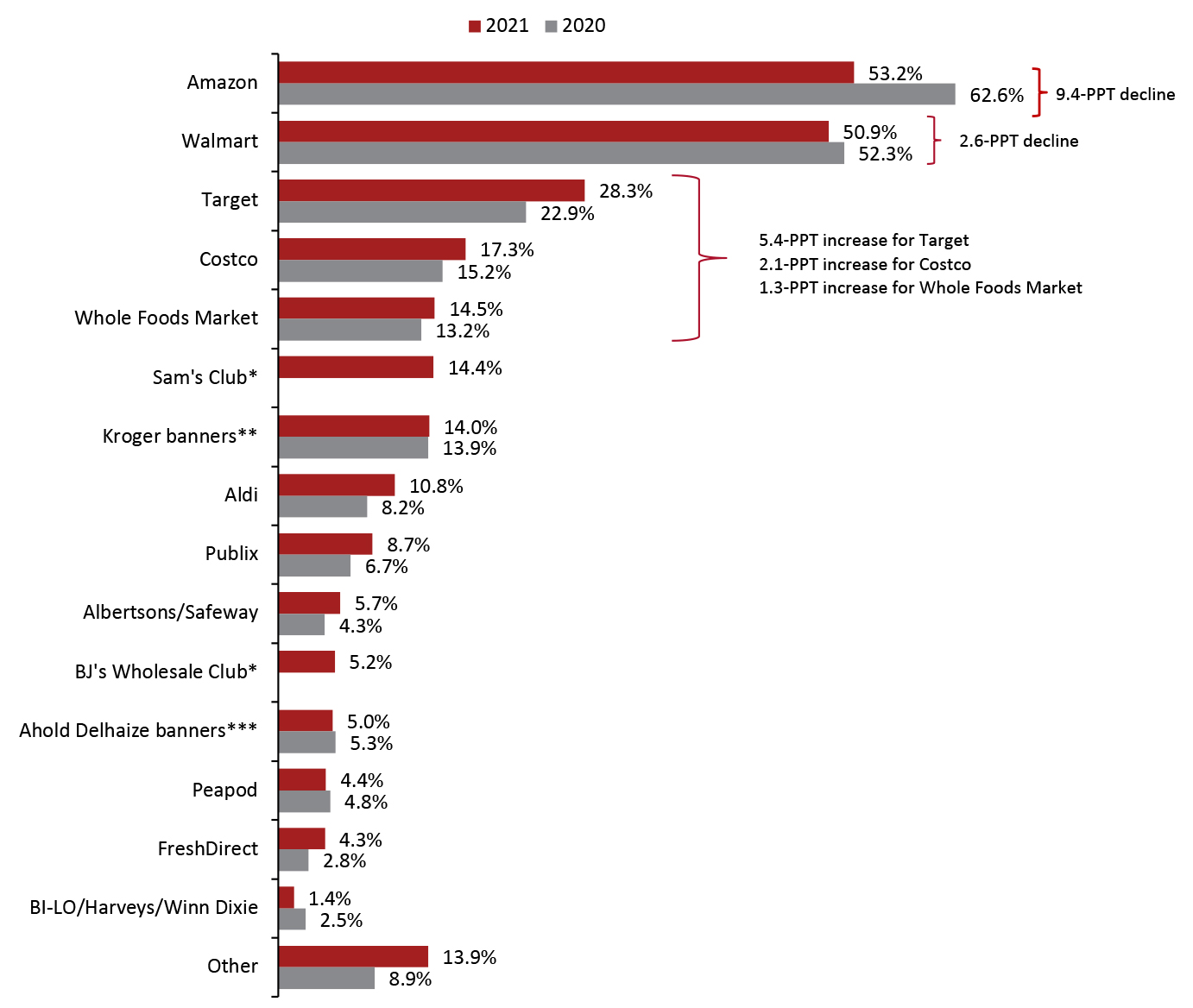

Base: US Internet users aged 18+ who have bought groceries online in the past 12 months (435 in 2018, 695 in 2019, 599 in 2020 and 975 in 2021) Source: Coresight Research Amazon and Walmart Almost Level in Online Race Among respondents who bought groceries online in the last 12 months, Amazon remains the most-shopped retailer. However, the proportion of online grocery shoppers buying on Amazon slid by 9.4 percentage points compared to 2020. The share of Walmart—the second most-shopped grocery retailer—also declined, albeit to a lesser extent. Amazon now has only a marginal lead over Walmart in terms of the proportion of online grocery shoppers buying from the retailer. As discussed later in the report and shown in Figure 9, Amazon’s most-used grocery service is its regular site. However, that site is not built for conventional, full-basket grocery shops as it is limited to ambient grocery products that are shipped, one or a few items at a time, through the mail. This likely worked against Amazon during the pandemic as consumers turned to other traditional grocery retailers to undertake a regular, full-basket grocery shop online. The percentage of online shoppers buying groceries from most other retailers we ask about rose compared to 2020 (except for Ahold Delhaize, Peapod and BI-LO/Harveys/Winn Dixie), suggesting that they stepped up their efforts to serve customers online and build out omnichannel models to deliver groceries, thus capturing a greater share of online shoppers at the expense of Amazon and Walmart. With the exception of Amazon, the landscape is dominated by multichannel retailers rather than online pure plays—albeit often with the assistance of service providers such as Instacart.

Figure 5. Online Grocery Shoppers: Retailers from Which They Have Bought Groceries Online in the Past 12 Months (% of Respondents) [caption id="attachment_127475" align="aligncenter" width="725"]

Base: US Internet users aged 18+ who have purchased groceries online in the past 12 months (599 in 2020 and 975 in 2021) *Not provided as an option in 2020

Base: US Internet users aged 18+ who have purchased groceries online in the past 12 months (599 in 2020 and 975 in 2021) *Not provided as an option in 2020 **Includes City Market, Fred Meyer, Harris Teeter, King Soopers, Smith’s Food & Drug, and Ralphs

***Includes Food Lion, Giant/Hannaford, and Stop & Shop

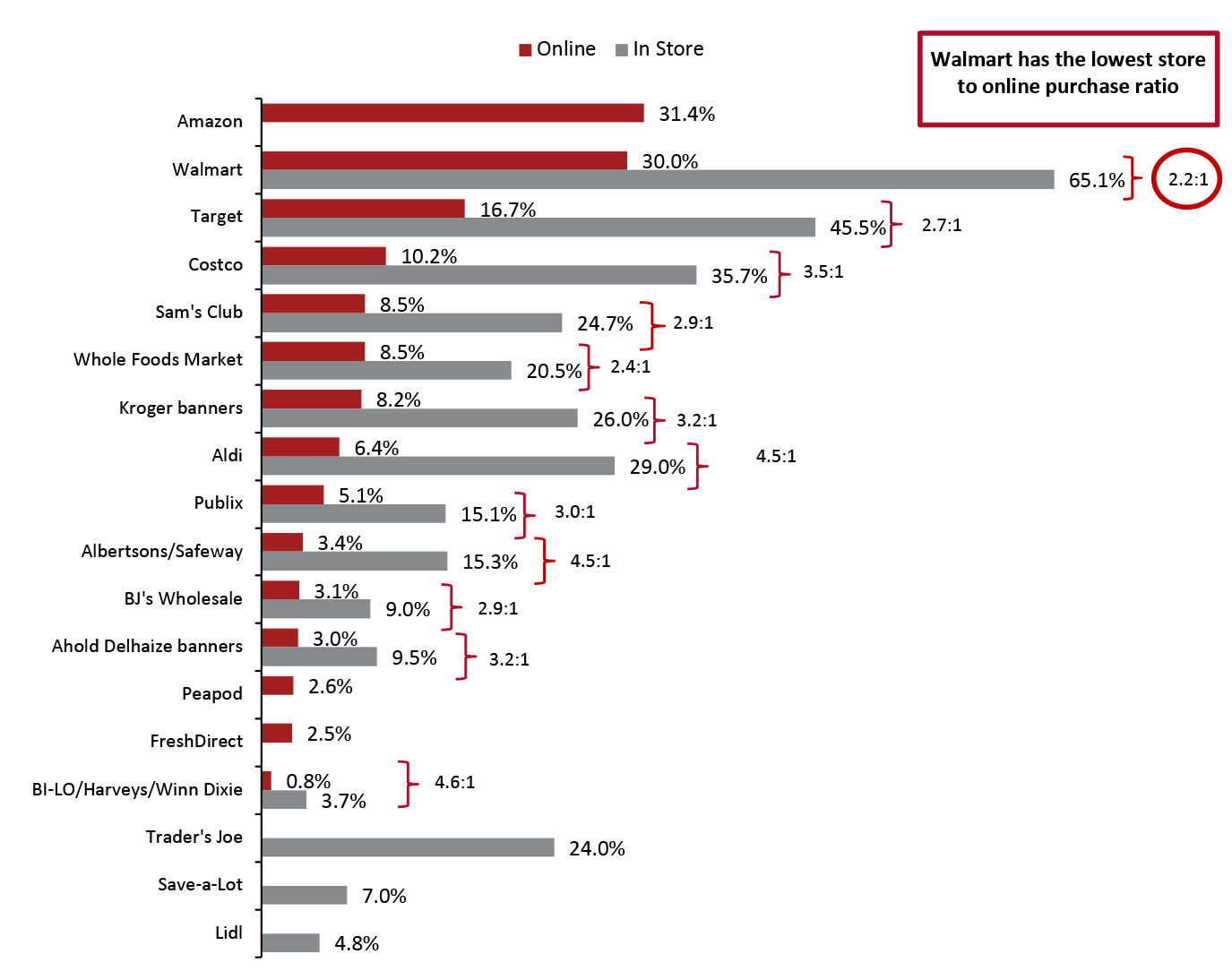

Source: Coresight Research [/caption] Walmart Converts Store Shoppers To Online Faster Than Competitors Walmart’s in-store/offline purchase ratio outperforms its rivals, including key multichannel operators, with a ratio of just 2.2 in-store shoppers for each online shopper. This suggests that it is attracting shoppers toward its e-commerce service faster than its rivals. Whole Foods Market has the next best in-store/online ratio of 2.4:1 We asked respondents where they bought groceries for in-store purchases to provide an offline/online comparison for multichannel retailers, as shown in Figure 6. For comparability between channels, the data below are a percentage of all respondents, which is a different base from the chart above.

Figure 6. All Respondents: Where They Have Purchased Groceries, Online or In-Store, in the Past 12 Months (% of Respondents) [caption id="attachment_127476" align="aligncenter" width="725"]

Base: 1,652 Internet users aged 18+

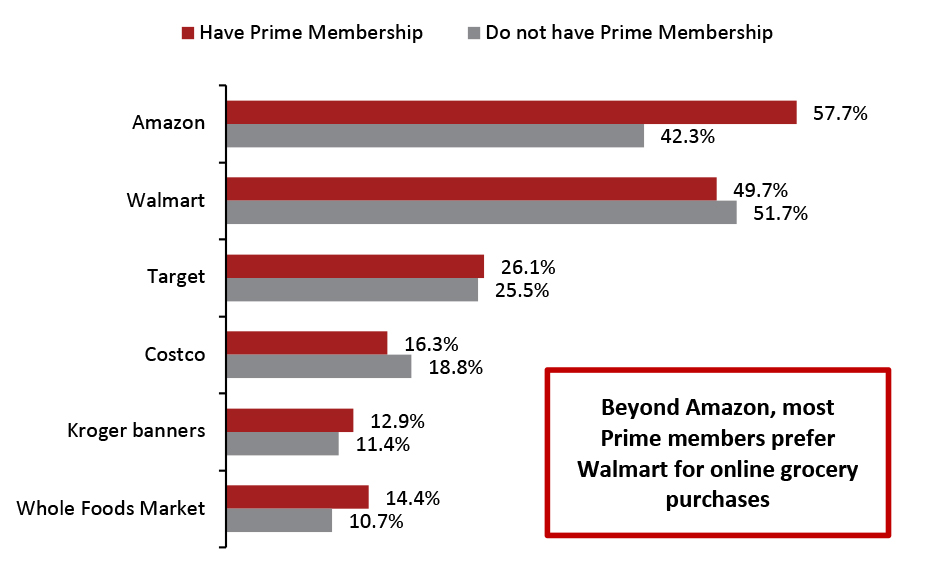

Base: 1,652 Internet users aged 18+ Source: Coresight Research [/caption] Prime Members Prefer Amazon’s Regular Website for Grocery Purchases Unsurprisingly, Amazon Prime members show a greater propensity for buying groceries on Amazon.com than those without Prime membership—at 58% versus 42%. Prime members underindex in buying groceries online from Costco and Walmart but are more likely than the average to buy groceries from Amazon-owned Whole Foods Market.

Figure 7. Online Grocery Shoppers: Leading Retailers from Which They Bought Groceries Online in the Past 12 Months, by Prime Membership (% of Respondents) [caption id="attachment_127477" align="aligncenter" width="725"]

Chart shows only those who personally have a Prime membership and those without access to Prime benefits. A third group is not charted: Those who have access to Amazon Prime membership benefits through someone else in their household, but who do not have Amazon Prime membership themselves

Chart shows only those who personally have a Prime membership and those without access to Prime benefits. A third group is not charted: Those who have access to Amazon Prime membership benefits through someone else in their household, but who do not have Amazon Prime membership themselves Base: US Internet users aged 18+ who have bought groceries online in the past 12 months

Source: Coresight Research [/caption] However, Amazon’s share of online grocery shoppers who are prime members has been trending downward, with a 9.3-percentage-point drop in the latest survey period, suggesting that Prime members are increasingly drifting away from purchasing groceries from Amazon. Whole Foods seems to have benefited from its acquisition by Amazon. Our trend data suggests that gains are trickling through to the subsidiary, with the proportion of online shoppers—whether they have Prime or not—buying from the retailer trending upward.

Figure 8. Online Grocery Shoppers: Proportion That had Bought Groceries Online from Amazon or Whole Foods Market in the Past 12 Months, by Prime Membership (% of Respondents) [wpdatatable id=964 table_view=regular]

Table shows only those who personally have a Prime membership and those without access to Prime benefits. A third group is not charted: Those who have access to Amazon Prime membership benefits through someone else in their household, but who do not have Amazon Prime membership themselves. Base: US Internet users aged 18+ who have bought groceries online in the past 12 months (435 in 2018, 695 in 2019, 599 in 2020 and 975 in 2021) Source: Coresight Research Amazon Services Amazon’s regular website is the most-used service for buying groceries, with its relative popularity increasing in the past year after declining for three consecutive years. However, Amazon’s regular site is not set up to fulfill regular grocery orders and is restricted to non-perishable products that can be shipped via conventional mail, limiting its ability to offer a full, conventional basket of groceries. Filling that gap, AmazonFresh, the company’s full-range grocery service, has steadily gained popularity among Amazon shoppers, with 3.4-percentage-point growth in the proportion of respondents using the service in 2021. Amazon closed its Prime Pantry service in early 2021, but the service was available for most of the 12-month period that we asked respondents about.

Figure 9. Amazon Grocery Shoppers: Which Amazon Services They Had Used To Purchase Groceries in the Past 12 Months (% of Respondents) [wpdatatable id=965 table_view=regular]

Base: US Internet users aged 18+ who had purchased groceries on Amazon.com in the past 12 months Source: Coresight Research This year, 54.3% of all respondents personally had an Amazon Prime membership (flat with 2020), some 20.6% did not have a membership or any access to Prime benefits (versus 18.4% in 2020), and the remaining 25.1% did not have a Prime membership themselves but had access to Prime benefits through someone else in their household (versus 27.3% in 2020). Delivery Moves Ahead of Collection We asked online shoppers whether they mainly had grocery orders delivered to their homes or picked them up from stores in the past 12 months. The survey results found that shoppers have a much stronger preference for grocer delivery—over the past three years, home delivery has steadily crept ahead of collection, as measured by shopper numbers. This indicates that retailers must continue to focus their resources on delivery despite the increase in popularity for pickup during the pandemic.

Figure 10. Online Grocery Shoppers: Whether They Mainly Get Grocery Orders Delivered or They Collect Them (% of Respondents) [wpdatatable id=966 table_view=regular]

Base: US Internet users aged 18+ who had purchased groceries online in the past 12 months (435 in 2018, 695 in 2019, 599 in 2020 and 975 in 2021) Source: Coresight Research Consumers Favor Faster Delivery Speed is of the essence when it comes to online grocery delivery. Around 26% of respondents who shopped online in the last 12 months opted for a rapid two-hour delivery service, while 42.7% opted for a service longer than two hours but still delivered on the same day. Retailers should leverage their store networks efficiently, automate fulfillment processes and improve last-mile operations to keep pace with consumers’ demand for increased speed in home delivery.

Figure 11. Online Grocery Shoppers: Delivery Service They Had Used in the Past 12 Months (% of Respondents) [caption id="attachment_127515" align="aligncenter" width="720"]

Base: 975 US Internet users aged 18+ who had purchased groceries online in the past 12 months

Base: 975 US Internet users aged 18+ who had purchased groceries online in the past 12 months Source: Coresight Research [/caption] Consumers in New York Most Interested in Shopping for Groceries Online We asked respondents across US states if they had bought groceries online in the past 12 months and if they expect to do in the next 12 months. A higher proportion of respondents based in New York, the state most impacted by coronavirus-induced lockdowns, said that they bought groceries online in the last 12 months compared to other states. Among the top five US states by population (California, Florida, New York, Pennsylvania and Texas), New York also indicates a greater interest in grocery e-commerce, with around 57% of respondents in the state expecting to buy groceries online in the next 12 months. Although New York leads in the proportion of shoppers buying groceries online, Texas has a higher number of full-basket online shoppers, at 24% compared to 20.6% in New York, 16.7% in Florida, 13% in California and 8.9% in Pennsylvania. Moreover, 22.4% of respondents based in Texas said that they do all, or almost all of their grocery shopping online, which comes in significantly higher than 15.6% in Pennsylvania, 10% in Florida, 9.6% in New York and 7% in California.

Figure 12. All Respondents: Proportion That Had Bought Groceries Online in the Past 12 Months/Expect to Buy Groceries Online in the Next 12 Months (% of Respondents) [caption id="attachment_127479" align="aligncenter" width="725"]

Base: 607 US Internet users aged 18+

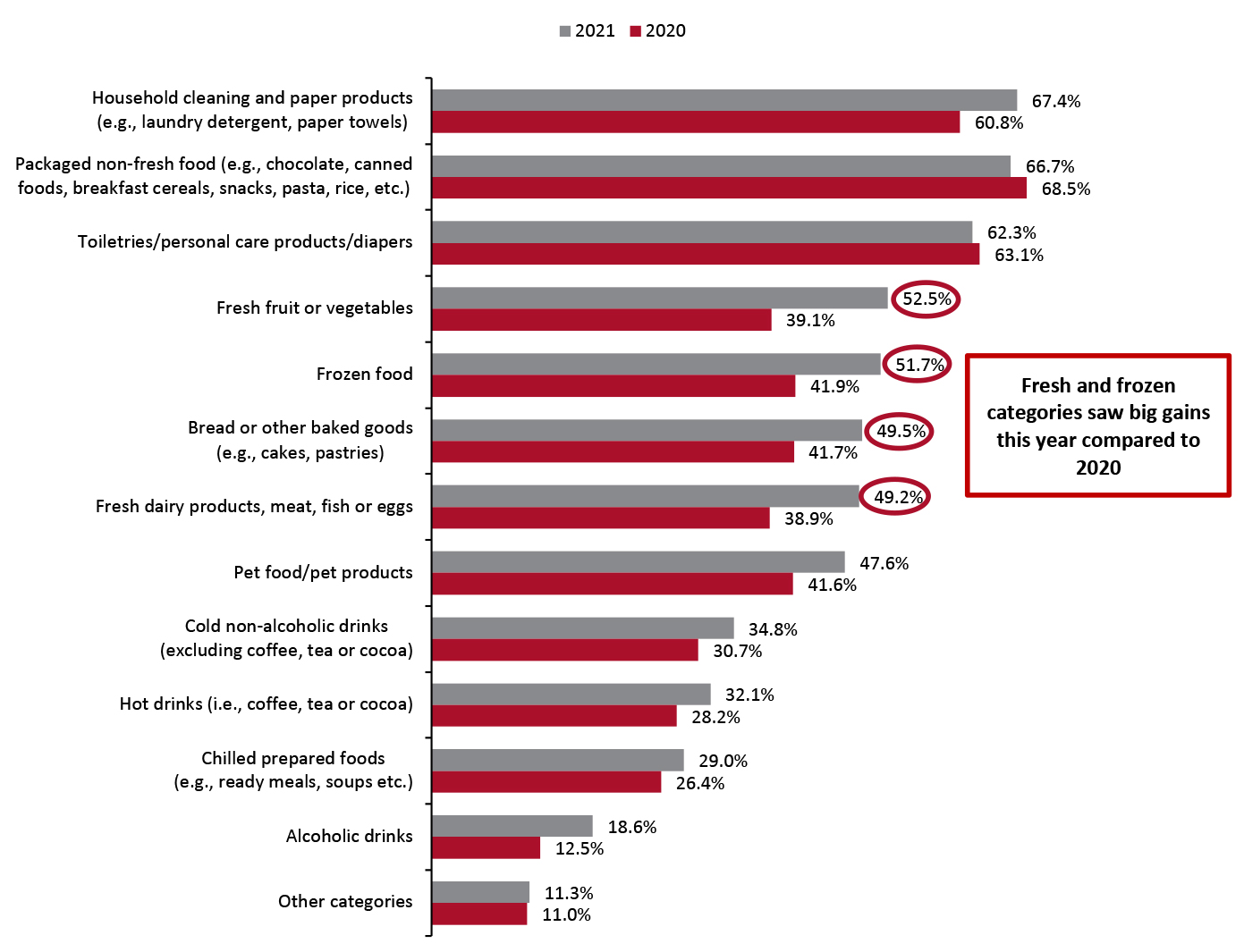

Base: 607 US Internet users aged 18+ Source: Coresight Research [/caption] Fresh Food Categories Go Mainstream We asked shoppers what grocery products they had bought online in the past year, and unsurprisingly, household cleaning products ranked highest as consumers have become increasingly focused on home hygiene amid the pandemic. Our past surveys indicated some resistance to buying fresh food categories online. This year, however, social distancing and stay-at-home measures induced many consumers to increase their use of e-commerce to buy fresh foods. Our survey shows meaningful gains in the percentage of respondents buying fresh products online compared to last year, including fresh fruits and vegetables (up 13.4 percentage points), fresh dairy, meat, fish or eggs (up 10.3 percentage points), and baked goods (up 7.8 percentage points). The increase across almost all categories indicates that consumers were, on average, buying more categories online as they increasingly adopted e-commerce as a channel for regular grocery shops and not just for ambient and nonfood store goods, although those kinds of products constitute the three most-bought categories.

Figure 13. Online Grocery Shoppers: Grocery Categories They Purchased Online in the Past 12 Months (% of Respondents) [caption id="attachment_127480" align="aligncenter" width="725"]

Base: US Internet users 18+ who had purchased groceries online in the past 12 months (975 in 2021 and 599 in 2020)

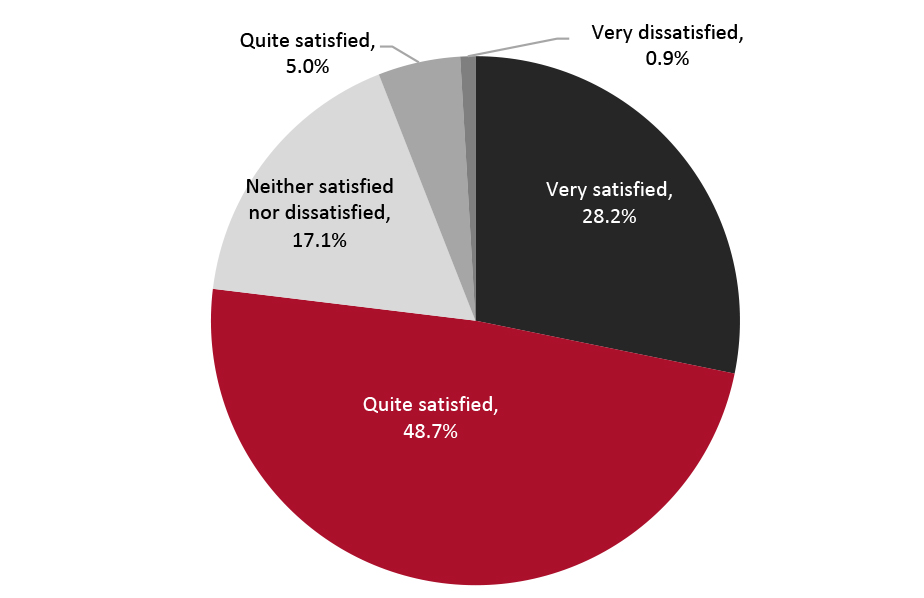

Base: US Internet users 18+ who had purchased groceries online in the past 12 months (975 in 2021 and 599 in 2020) Source: Coresight Research [/caption] First-Time Online Customers are Overall Satisfied with E-Commerce Services We asked online grocery shoppers how satisfied they are with the overall quality of the services provided such as delivery/collection services, availability of delivery slots and product availability. Around 77% of the respondents said that they were “very satisfied” or “quite satisfied” with online services.

Figure 14. Online Grocery Shoppers: Whether They Have Been Satisfied with the Overall Quality of the Services Provided, e.g. Delivery/Collection Services, Availability of Delivery Slots, Product Availability, etc. (% of Respondents) [caption id="attachment_127481" align="aligncenter" width="725"]

Base: 975 US Internet users aged 18+ who had bought groceries online in the past 12 months

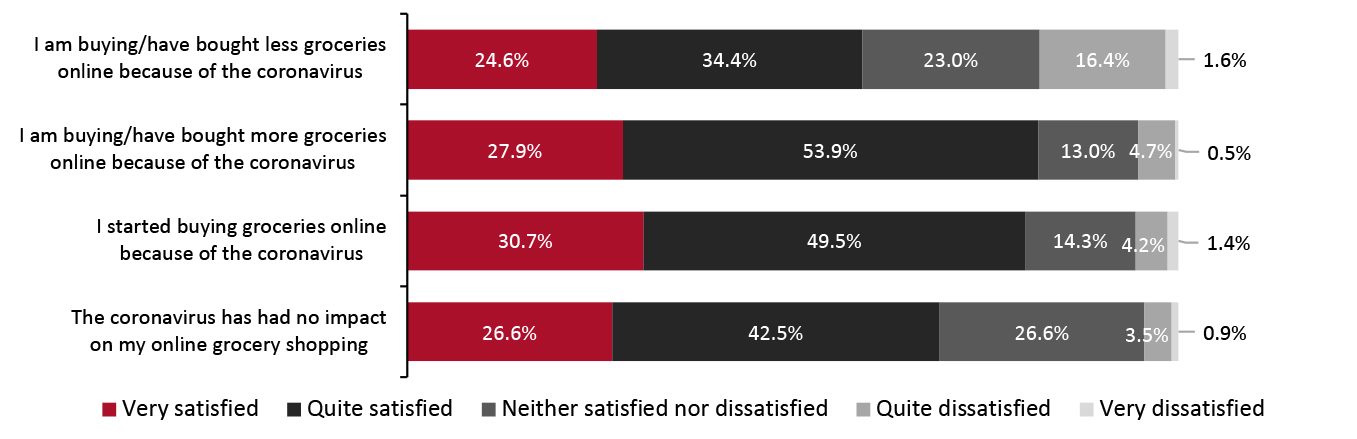

Base: 975 US Internet users aged 18+ who had bought groceries online in the past 12 months Source: Coresight Research [/caption] The satisfaction levels among new online buyers or those who increased their online purchases due to the pandemic exceed those of the average online shopper.

- A greater proportion of shoppers who started to buy online in the past 12 months because of coronavirus (30.7%) said that they are “very satisfied” with the quality of online services—coming in higher than the average of 28.21%.

- Around 54% of respondents who bought more online because of the coronavirus are “quite satisfied” with online services, compared to the average of 48.7%.

Figure 15. Online Grocery Shoppers: Whether They Have Been Satisfied with the Overall Quality of the Services Provided, e.g. Delivery/Collection Services, Availability of Delivery Slots, Product Availability, etc. (% of Respondents) [caption id="attachment_127482" align="aligncenter" width="725"]

Base: US Internet users 18+ who had purchased groceries online in the past 12 months

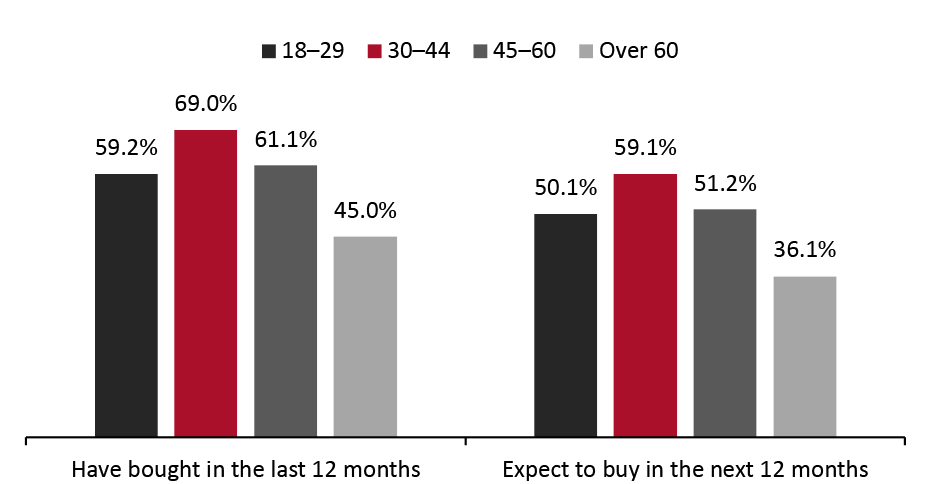

Base: US Internet users 18+ who had purchased groceries online in the past 12 months Source: Coresight Research [/caption] Older Millennials and Higher-Income Shoppers Are Key Demographics for Online Grocery Shopping All age groups we surveyed recorded a strong disposition for online grocery shopping. Broken down by age group, consumers aged 30–44 continue to lead in online grocery purchases, likely because they are familiar with digital channels and, in many cases, will have young families, which drives up basket sizes and often encourages grocery planning ahead of time.

Figure 16. All Respondents: Proportion That Had Purchased Groceries Online in the Past 12 Months, by Age Group (% of Respondents) [caption id="attachment_127483" align="aligncenter" width="725"]

Base: 1,649 US Internet users aged 18+

Base: 1,649 US Internet users aged 18+ Source: Coresight Research [/caption] More than 60% of respondents across income groups above $25,000 said that they bought groceries online in the past 12 months. Buying groceries online and expectations to buy online peak among our second-highest income group. Middle and high-income shoppers are more likely to have access to Internet, which increases their propensity to buy online.

Figure 17. All Respondents: Proportion That Had Purchased Groceries Online in the Past 12 Months, by Household Income (% of Respondents) [caption id="attachment_127490" align="aligncenter" width="725"]

Base: 1,649 US Internet users aged 18+

Base: 1,649 US Internet users aged 18+ Source: Coresight Research [/caption]

What We Think

Covid-19 has amplified the ongoing digital disruption in the grocery industry. The penetration of e-commerce in the grocery space has lagged behind most other retail sectors; however, the pandemic shook up this status quo by fueling a rapid collapse of consumer uptake barriers and a dramatic acceleration in online grocery growth.- Although more respondents who shopped online last year did a significant proportion of their shopping online, 38.4% said that they did “a small amount”of their grocery shopping online—representing a significant pocket of opportunity for retailers seeking to convert grocery shoppers to e-commerce. Retailers interested in growing in the online grocery market should do more than simply boost customer participation; they should focus on converting occasional and small-basket shoppers into regular, full-shop customers.

- Moving forward, we expect to see higher levels of competition in the online grocery market among small and mid-size players, following on from intensified efforts amid the pandemic. We expect to see these players pull in consumers carrying out big-basket, full-assortment grocery shops and maintaining pressure on the market leaders Amazon and Walmart.

- Our survey found that customers prefer delivery over pickup options, with delivery speed being a key factor. Although retailers pivoted quickly to manual models to facilitate increased online orders during the pandemic, current pickup options need further adaptation to be a viable model going forward. Grocery retailers must stem the cycle of negative operating margins by moving toward more automated fulfillment methods that serve consumer demand for increasingly smaller delivery windows.