DIpil Das

Introduction: Gauging the Expansion of Grocery E-Commerce

In our third annual US online grocery survey, we explore how many shoppers are buying food and essentials online, how much they purchase online and which retailers they are buying from—among many other findings. The consistency of many of the questions we asked has enabled us to build up trend data from when we first ran this survey in 2018. We estimate that e-commerce accounted for only around 2.6% of US food and beverage retail sales in 2019. However, online sales are growing fast—by an estimated 22% in 2019—and we see the market growing by approximately 40% this year, supported by much higher growth during lockdowns. That would equate to almost $38 billion of online food and beverage sales in 2020, or around 3.5% of the total market. The basis of this report is our mid-March 2020 online survey of 1,152 US consumers, of which just over half had purchased groceries online during the prior 12 months. This report forms part of our How the US Shops series, in which we share insights into shopper behavior from original consumer research. Before we examine our survey findings question by question, we bring together data points from various questions in our survey as we discuss key insights from our research.Our Top Insights

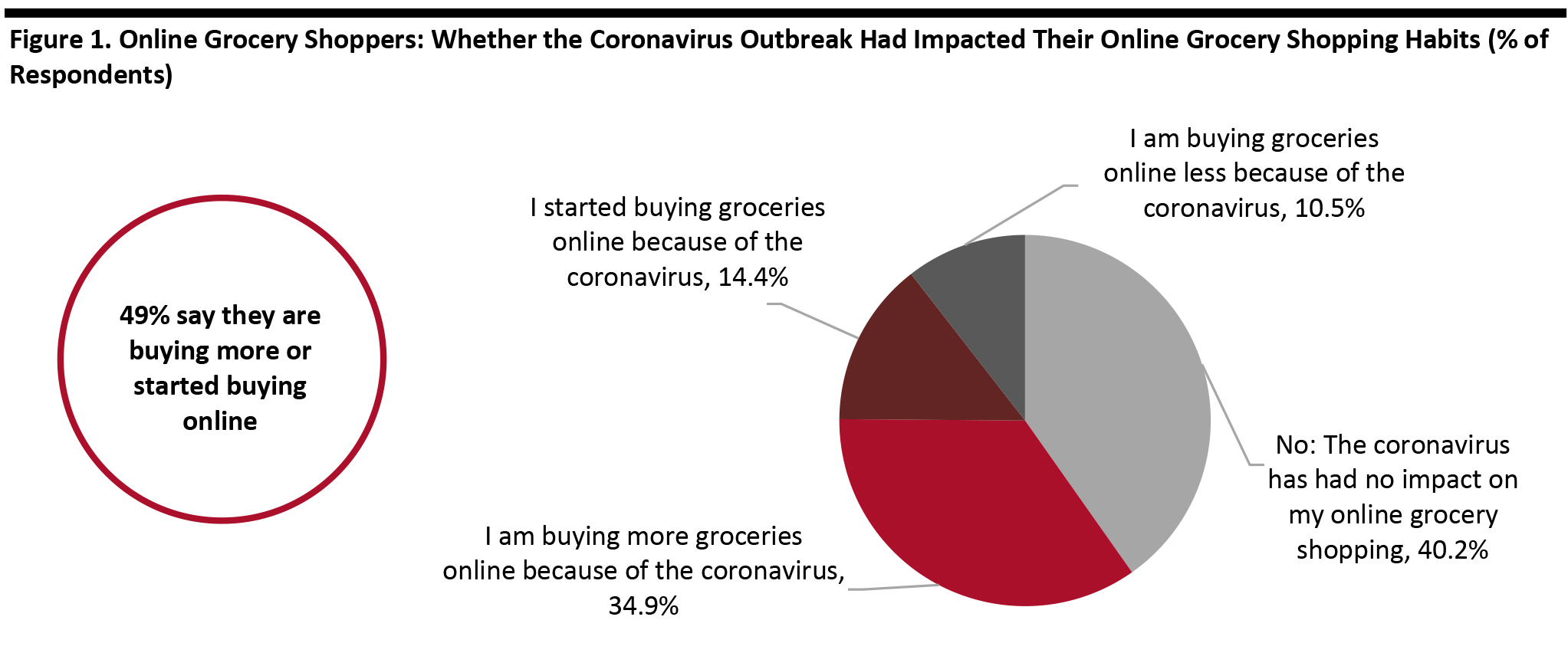

Coroanvirus Drives Jump in Online Shopping The coronavirus outbreak has prompted shoppers to buy food and essentials online in greater numbers and more frequently: By the time of our survey in mid-March, the outbreak had already encouraged just under half of online grocery shoppers to buy more groceries online or driven them to start buying online. As we show later, this year’s survey results saw a big increase in expectations to buy groceries online in the coming 12 months—and we suspect much of that is due to the impact of the coronavirus. [caption id="attachment_109024" align="aligncenter" width="700"] Base: 599 US Internet users aged 18+ who have bought groceries online in the past 12 months

Base: 599 US Internet users aged 18+ who have bought groceries online in the past 12 months Source: Coresight Research [/caption] More, More, More! As well as registering many more online shoppers, this year’s survey found that these shoppers bought more product categories from more retailers. The following findings reflect how the online channel is maturing to become more frequently used for more regular, larger-basket grocery shops:

- This year, respondents bought an average of 5.0 grocery categories online, versus last year’s 4.4 average. This not only implies greater cross-category shopping but also signals the market moving away from occasional one-off or specialty purchases to a greater focus on full-basket grocery shops.

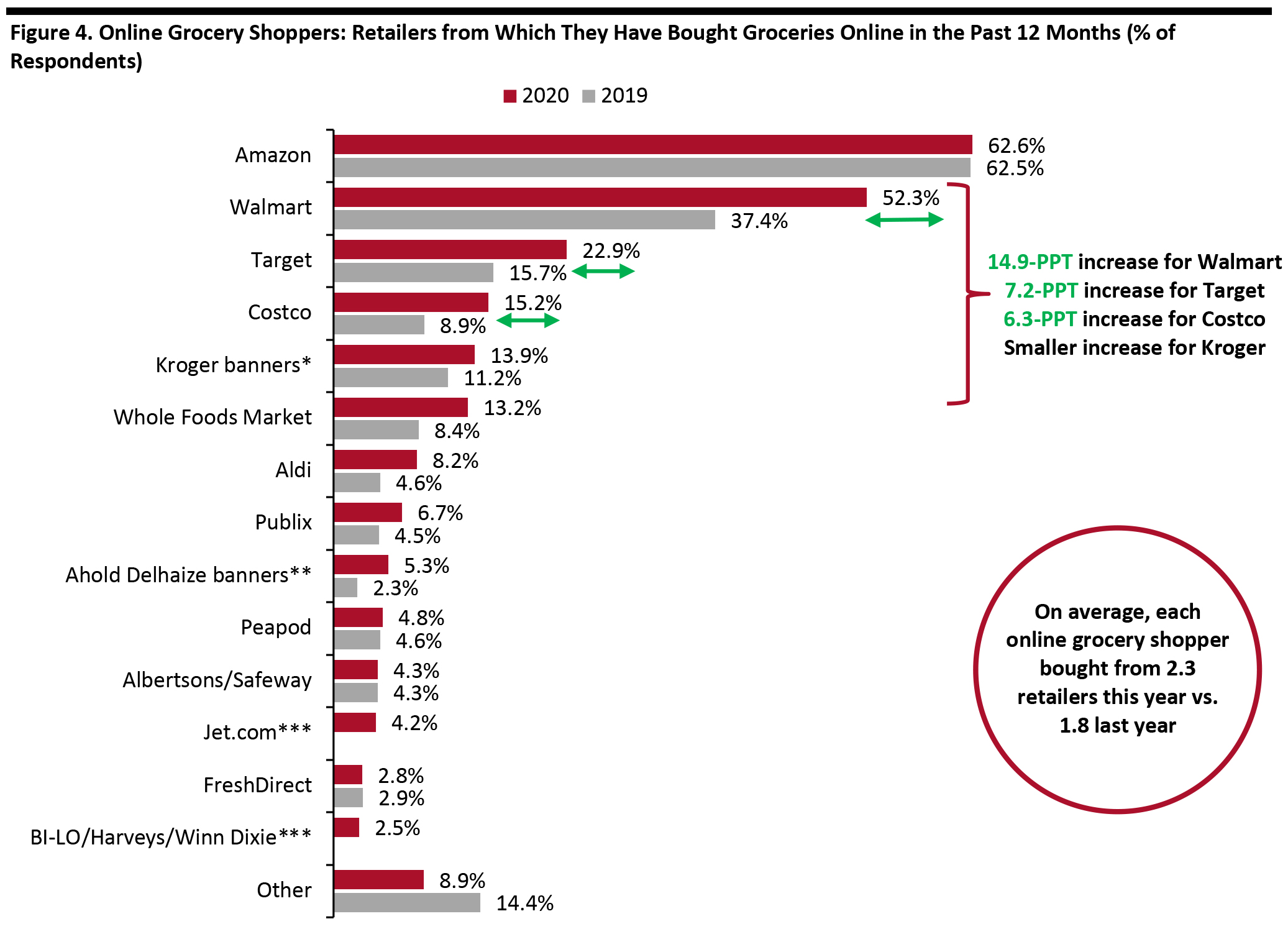

- Similarly, respondents to our survey purchased from an average 2.3 retailers online in the past 12 months, versus 1.8 last year—which we think is a function of more frequent online shopping. It could indicate that the grocery e-commerce market remains partly up for grabs as shoppers continue to test the waters and have not yet settled on one online “favorite.”

- The use of Amazon for grocery shopping is nudging consumers further away from the main Amazon.com site (which is not equipped to handle fresh grocery orders) and toward the “full-shop” Amazon Fresh and Prime Now services.

- We saw significant increases in the proportion of online shoppers buying fresh dairy, meat, fish or eggs and bakery products, further suggesting that consumers are adopting e-commerce as a channel for regular grocery shops and not just for ambient or nonfood store-cupboard goods.

- The market appears to be inching toward home delivery as the default, with our survey finding that this model now enjoys a clear lead over collection.

Survey Findings in Detail

Over Half of Respondents Now Buy Some Groceries Online; Almost Two-Thirds Expect To Buy Online

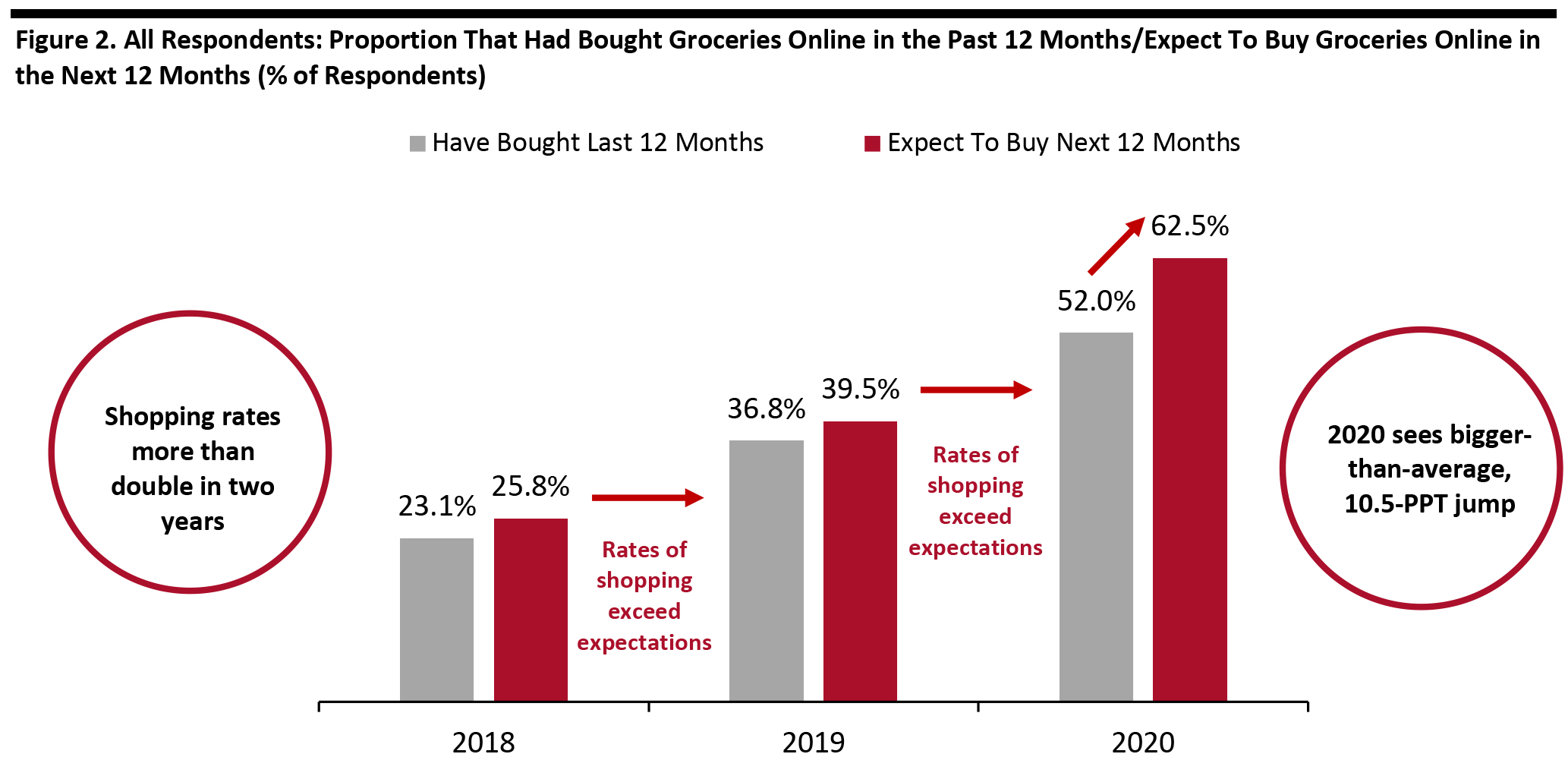

Each year, we ask respondents if they had bought groceries online in the past 12 months and if they expect to do so in the next 12 months.- This year, for the first time, over half (52.0%) had bought groceries online—more than double the shopper numbers from two years ago.

- In the prior two years, respondents underestimated their tendency to shop online in the next 12 months—i.e., the following years’ surveys recorded shopping rates that well exceeded the expectations of the previous year.

- Previous years’ trends imply that the actual rate of shopping online in the next 12 months will exceed the already substantial 62.5% of respondents that expect to do so.

- In the prior two years, expectations of buying online in the next 12 months exceeded the proportion of respondents that had bought online in the past 12 months by only a couple of percentage points or so. This year, we saw a major 10.5-percentage-point difference between “had bought” and “expect to buy,” with the latter jumping to 62.5%.

- The coronavirus outbreak likely fueled this jump in expectations, as we discuss further below.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Reflecting the impact of the coronavirusare Coresight Research’s separate consumer surveys. In our coronavirus-tracker surveys, we asked US shoppers if they are purchasing more online than they used to. On April 29, around two-thirds of all consumers were buying more products online, and 40.5% of those consumers were buying food more online than they used to.

E-Commerce Is Complementary to Stores

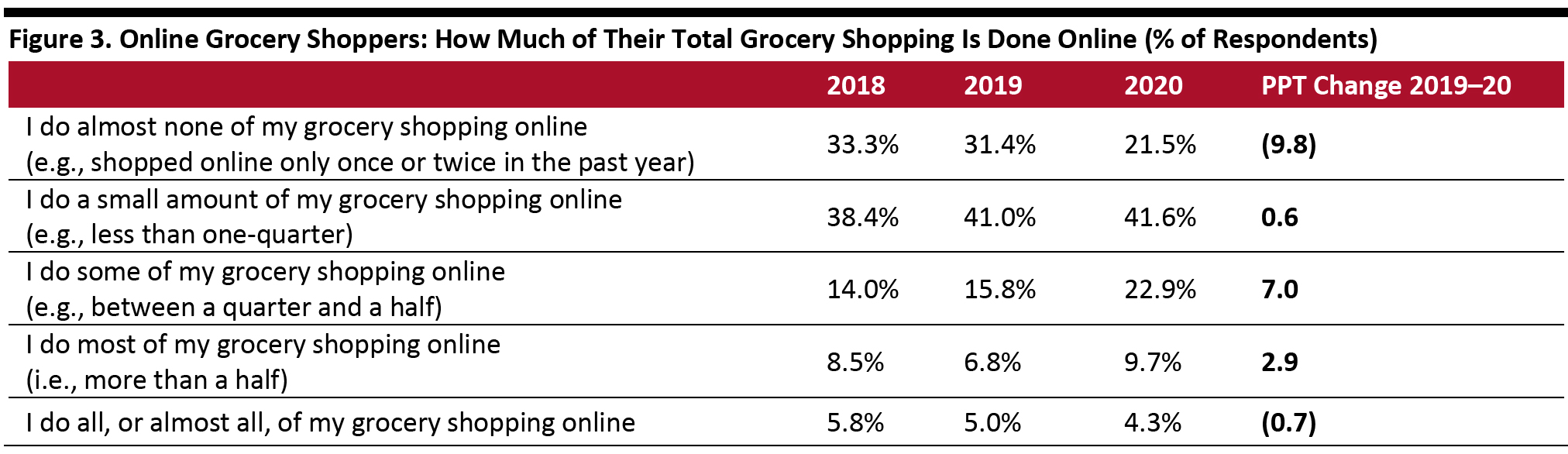

Counterbalancing the substantial number of shoppers is the small proportion of grocery shopping that most of these consumers undertake online. Nevertheless, the trend is that respondents are undertaking a more sizeable proportion of their shopping online over time.- A little: This year, a total of 63.1% said they did “almost none” or “a small amount” of their grocery shopping online—down markedly from 72.4% last year.

- A lot: This year, a total of 14.0% did “most” or “all or almost all” of their grocery shopping online—versus 11.8% last year.

Base: US Internet users aged 18+ who have bought groceries online in the past 12 months (435 in 2018, 695 in 2019 and 599 in 2020)

Base: US Internet users aged 18+ who have bought groceries online in the past 12 months (435 in 2018, 695 in 2019 and 599 in 2020) Source: Coresight Research [/caption]

Which Retailer Shoppers Bought from Online

Among respondents who bought groceries online, Amazon remains the most-shopped retailer. However, unlike all major rivals, the proportion of online grocery shoppers buying on Amazon.com remained flat year over year. In contrast, the proportion buying from Walmart jumped by nearly 15 percentage points, to just over half of online grocery shoppers. We saw major jumps at other multichannel retailers too. We recorded a more modest increase for Kroger, with a 2.7-percentage-point increase taking the proportion of online shoppers buying from its banners to just under 14%. With the exception of Amazon, the landscape is dominated by multichannel retailers rather than Internet pure plays—albeit often with the assistance of service providers such as Instacart. Our repertoire analysis found that respondents to our survey purchased from an average 2.3 retailers online this year, versus 1.8 last year. We interpret this as a function of more frequent online shopping, but it implies a market that remains partly up for grabs among promiscuous shoppers.- Note that the figures below are a percentage of online grocery shoppers—and this is a base that is increasing. So, even flat percentages represent growth in absolute terms.

Base: US Internet users aged 18+ who had purchased groceries online in the past 12 months (695 in 2019 and 599 in 2020)

Base: US Internet users aged 18+ who had purchased groceries online in the past 12 months (695 in 2019 and 599 in 2020) *In 2020, we specified City Market, Fred Meyer, Harris Teeter, King Soopers, Kroger, Ralphs and Smith’s Food & Drug. This was a slightly expanded list versus 2019, when we specified Fred Meyer, Harris Teeter, Kroger and Smith’s Food & Drug.

**In 2020, we specified Food Lion, Giant, Hannaford and Stop & Shop. This was an expanded list versus 2019, when we specified Food Lion and Hannaford—due to Ahold Delhaize rolling out online grocery services to more of its banners.

***Not provided as an option in 2019.

Source: Coresight Research [/caption]

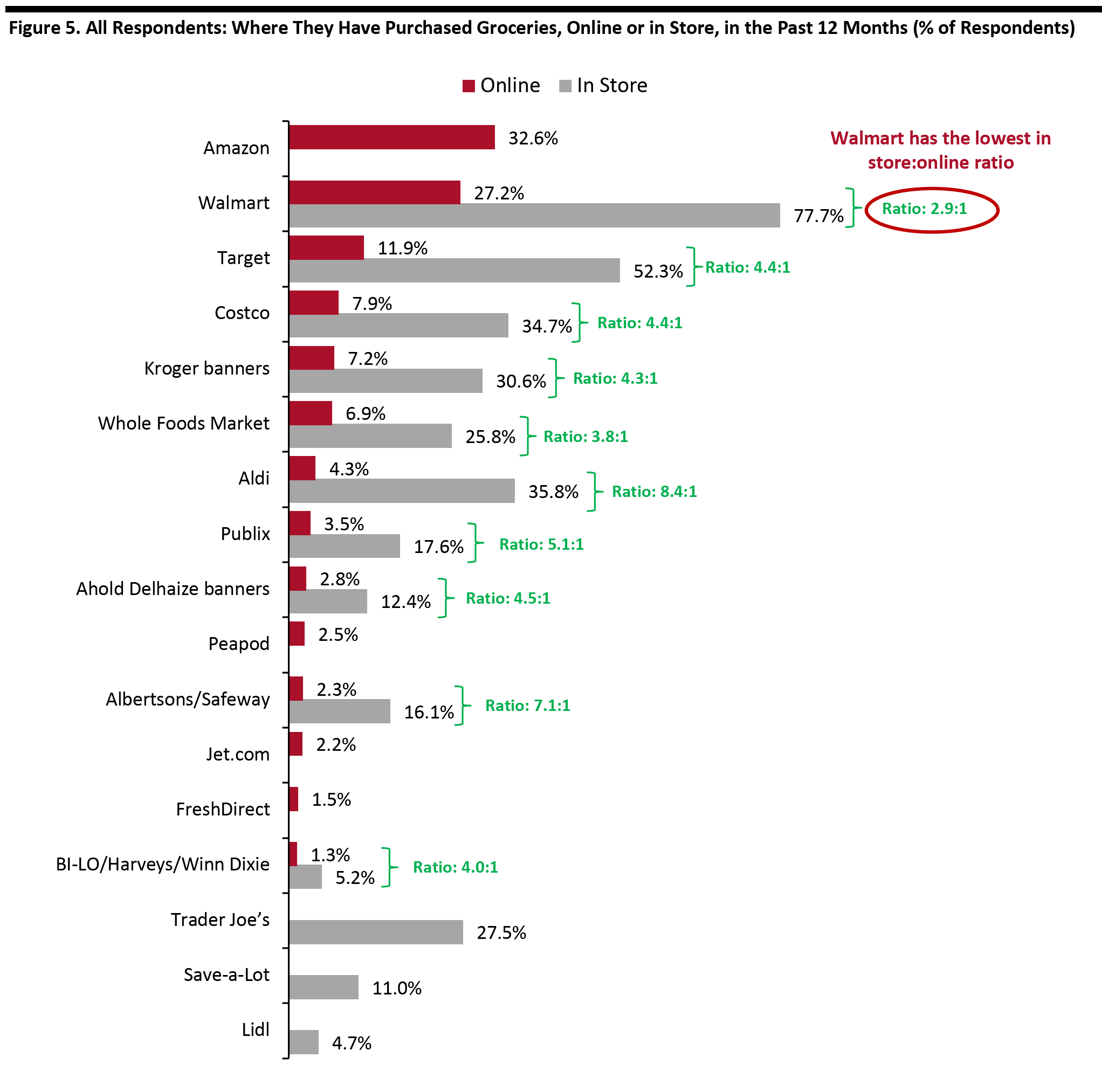

Comparing Online and In-Store Shopper Numbers

Below, we chart where consumers shop in store and online, represented as percentages of all respondents. The ranking of the most popular retailers online broadly reflects their in-store ranking. Aldi is the exception: It sees disproportionately few online grocery shoppers, reflecting its relatively limited online offering that matches its no-frills approach. The ratio of in-store shoppers to online shoppers clusters around the four-to-one mark for the major multichannel retailers (albeit with Aldi and Albertsons being exceptions). Walmart is an outperformer online, with a ratio of just 2.9 in-store shoppers for every one online shopper.- For comparability between channels, the figures below are a percentage of all respondents, which is a different base from the chart above.

Base: 1,152 US Internet users aged 18+

Base: 1,152 US Internet users aged 18+ Source: Coresight Research [/caption]

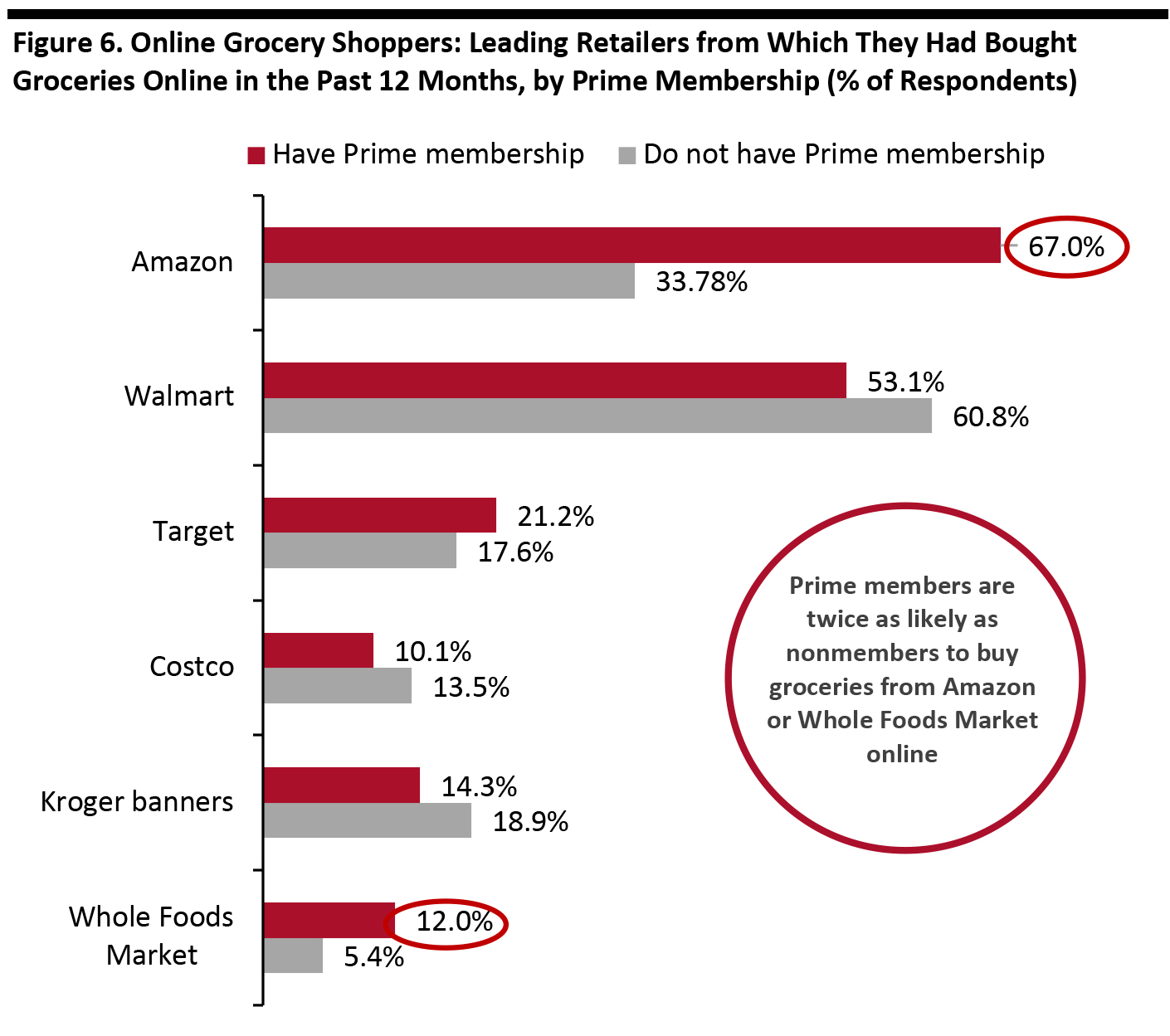

Prime Members Twice as Likely To Shop at Whole Foods

Prime members drive shopping on Amazon.com. As we show below, two-thirds of shoppers who had bought groceries online and who had Prime membership bought groceries from Amazon in the past 12 months—versus around one-third of online grocery shoppers without Prime membership. Amazon-owned Whole Foods Market also sees an approximate doubling rate of shopping among Prime members, suggesting that gains are trickling through to this subsidiary. [caption id="attachment_109029" align="aligncenter" width="700"] Chart shows only those who personally have a Prime membership and those without access to Prime benefits. A third group is not charted: Those who have access to Amazon Prime membership benefits through someone else in their household, but who do not have Amazon Prime membership themselves.

Chart shows only those who personally have a Prime membership and those without access to Prime benefits. A third group is not charted: Those who have access to Amazon Prime membership benefits through someone else in their household, but who do not have Amazon Prime membership themselves. Base: 1,152 US Internet users aged 18+ who have bought groceries online in the past 12 months

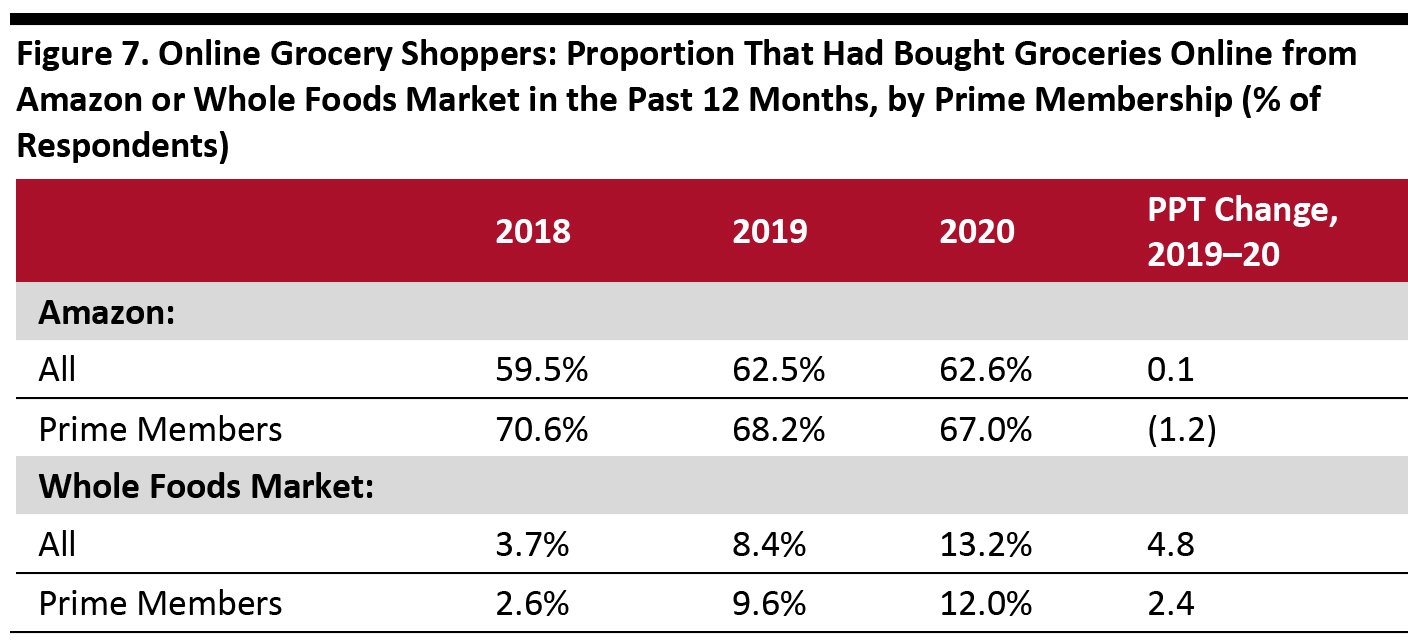

Source: Coresight Research [/caption] However, our trend data suggests that Amazon is gradually losing share of online grocery shoppers who are Prime members. Although the year-over-year change is too small to be statistically significant, the pattern of declining percentages has been consistent in the past two years. Whole Foods seems to have been a beneficiary of the Amazon acquisition, with big jumps in the proportion of online shoppers buying from the retailer—whether they have Prime or not.

- Remember, the figures below are a percentage of online grocery shoppers—and this is a base that is increasing. So, even flat percentages represent growth in absolute terms.

Table shows only those who personally have a Prime membership and those without access to Prime benefits. A third group is not charted: Those who have access to Amazon Prime membership benefits through someone else in their household, but who do not have Amazon Prime membership themselves.

Table shows only those who personally have a Prime membership and those without access to Prime benefits. A third group is not charted: Those who have access to Amazon Prime membership benefits through someone else in their household, but who do not have Amazon Prime membership themselves. Base: US Internet users aged 18+ who have bought groceries online in the past 12 months (435 in 2018, 695 in 2019 and 599 in 2020)

Source: Coresight Research [/caption] This year, 54.3% of all respondents personally had an Amazon Prime membership (versus 48.6% in 2019); 18.4% did not have a membership or any access to Prime benefits (versus 24.5% in 2019); and the remaining 27.3% did not have a Prime membership themselves but had access to Prime benefits through someone else in their household (versus 26.9% in 2019).

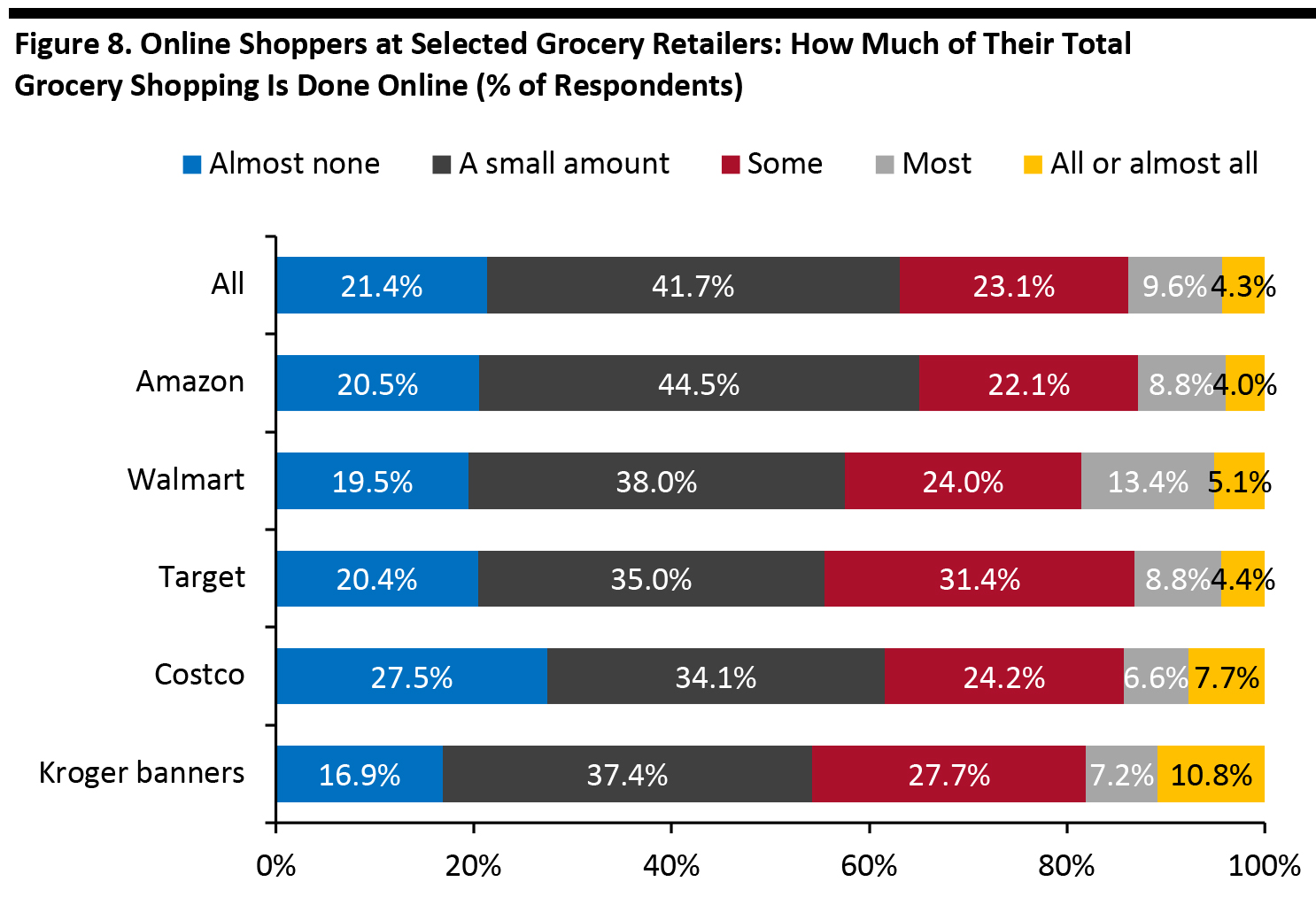

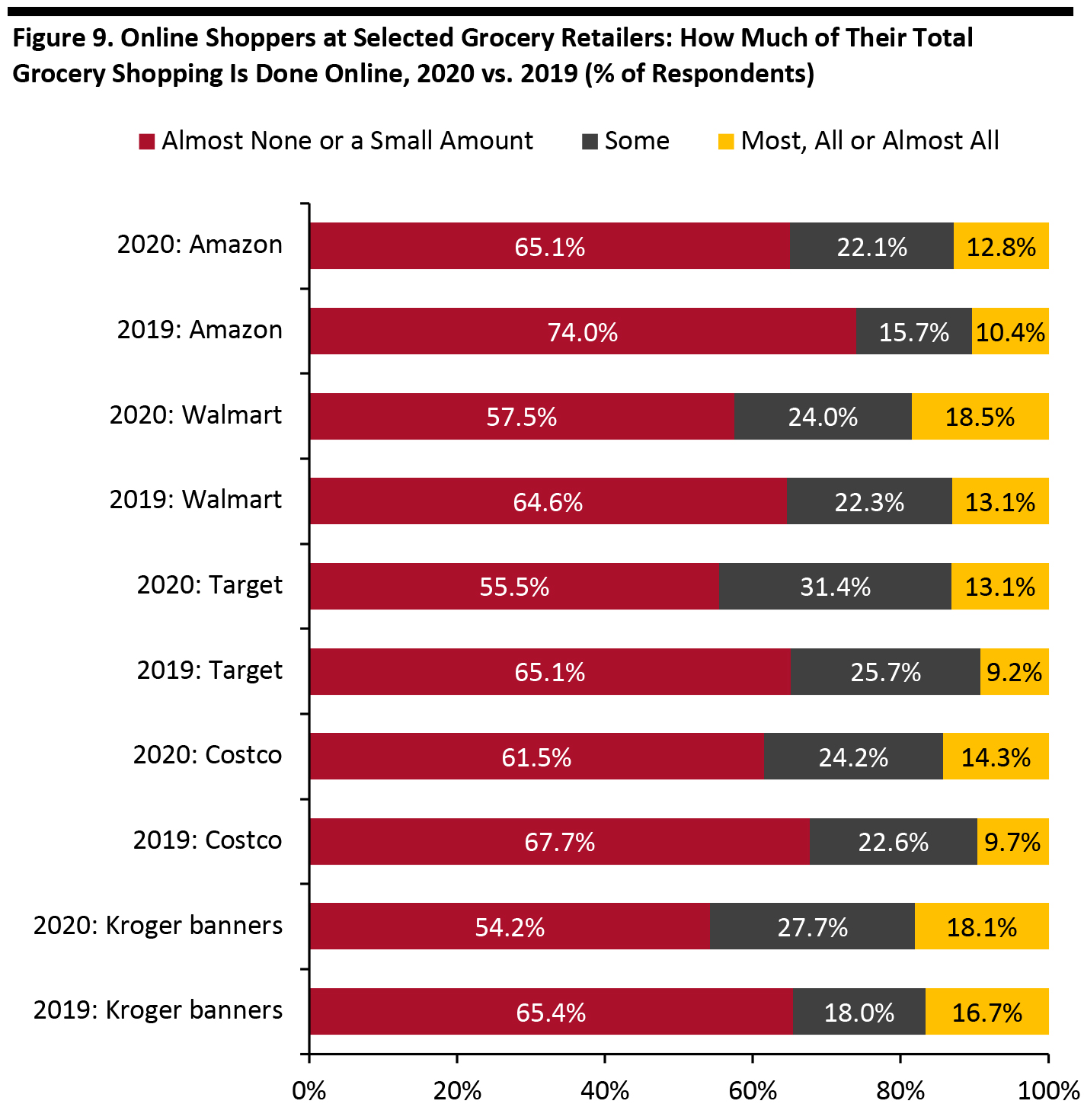

How Much Shoppers Buy Online, by Where They Shop

Among shoppers at the major retailers, those who buy groceries online from Walmart are the most likely to be doing all of their grocery shopping online. Those buying from Target.com are most likely to be doing some of their total grocery shopping online. [caption id="attachment_109031" align="aligncenter" width="700"] Base: 599 US Internet users aged 18+ who had purchased groceries online in the past 12 months

Base: 599 US Internet users aged 18+ who had purchased groceries online in the past 12 months Source: Coresight Research [/caption] Below, we provide year-over-year comparisons for these retailers, based on grouping the “almost none” and “a small amount” options and the “most” and “all or almost all” options. As identified above, among shoppers at the major retailers, those who buy groceries online from Walmart are the most likely to be doing all of their grocery shopping online, and those buying from Target.com are most likely to be doing some of their total grocery shopping online. Those who had bought from Kroger registered the biggest year-over-year decline (11.2 percentage points) in saying they bought only a little online, as well as the biggest increase (9.7 percentage points) in buying some online. Shoppers who had bought from Amazon and Target registered substantial declines in saying they bought only a little online and significant increases in buying some of their groceries online. [caption id="attachment_109032" align="aligncenter" width="700"]

Base: 599 US Internet users aged 18+ who had purchased groceries online in the past 12 months

Base: 599 US Internet users aged 18+ who had purchased groceries online in the past 12 months Source: Coresight Research [/caption]

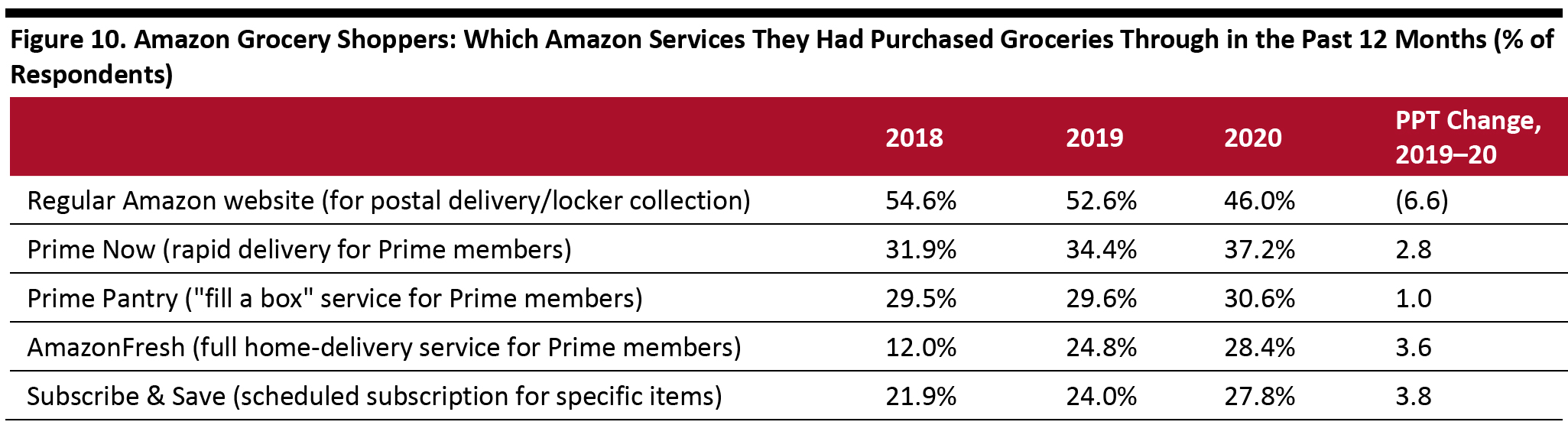

Which Amazon Grocery Services Shoppers Use

We asked Amazon grocery shoppers which Amazon service they had used. While the regular website remains the most used, its relative popularity is declining. Shifting grocery shoppers away from its regular site could be a positive for Amazon as that site is not set up to fulfill regular grocery orders: It is limited to nonperishable products that can be shipped through the mail, which limits its ability to offer a full, conventional basket of groceries. We recorded upticks in the use of Amazon’s grocery-focused Prime Now and AmazonFresh platforms—which suggest that Amazon is more successfully capturing conventional grocery shops—as well as a further increase in the use of Subscribe & Save. [caption id="attachment_109033" align="aligncenter" width="700"] Base: US Internet users aged 18+ who had purchased groceries on Amazon.com in the past 12 months

Base: US Internet users aged 18+ who had purchased groceries on Amazon.com in the past 12 months Source: Coresight Research [/caption]

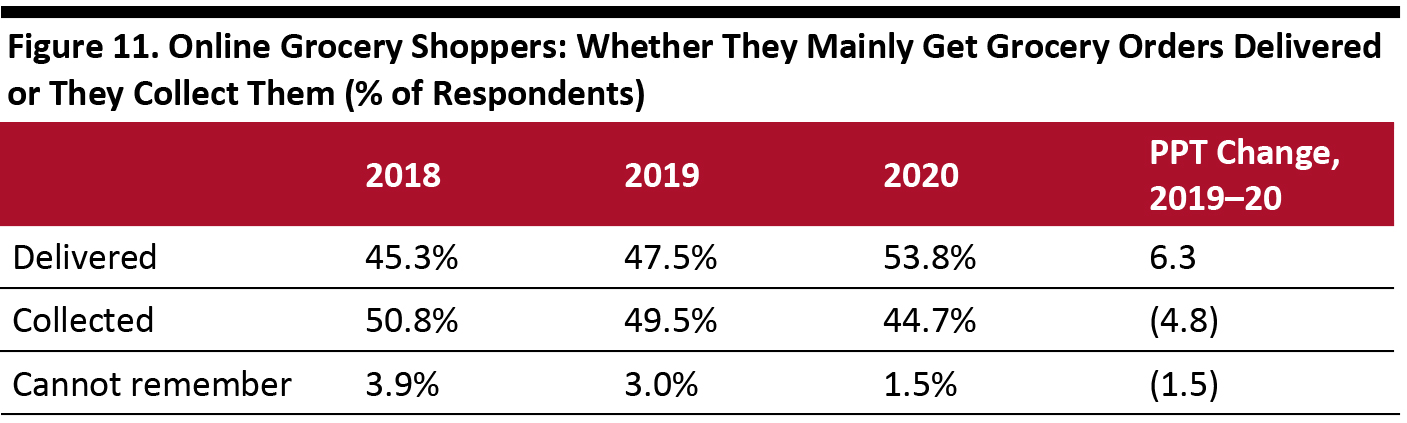

Delivery Gains Ground over Collection

In the past two years, home delivery has steadily crept ahead of collection, as measured by shopper numbers. Delivery now has a clear lead, helped by retailers rolling out capacity in their own right and through partners such as Instacart. [caption id="attachment_109034" align="aligncenter" width="700"] Base: US Internet users aged 18+ who had purchased groceries online in the past 12 months (435 in 2018, 695 in 2019 and 599 in 2020)

Base: US Internet users aged 18+ who had purchased groceries online in the past 12 months (435 in 2018, 695 in 2019 and 599 in 2020) Source: Coresight Research [/caption]

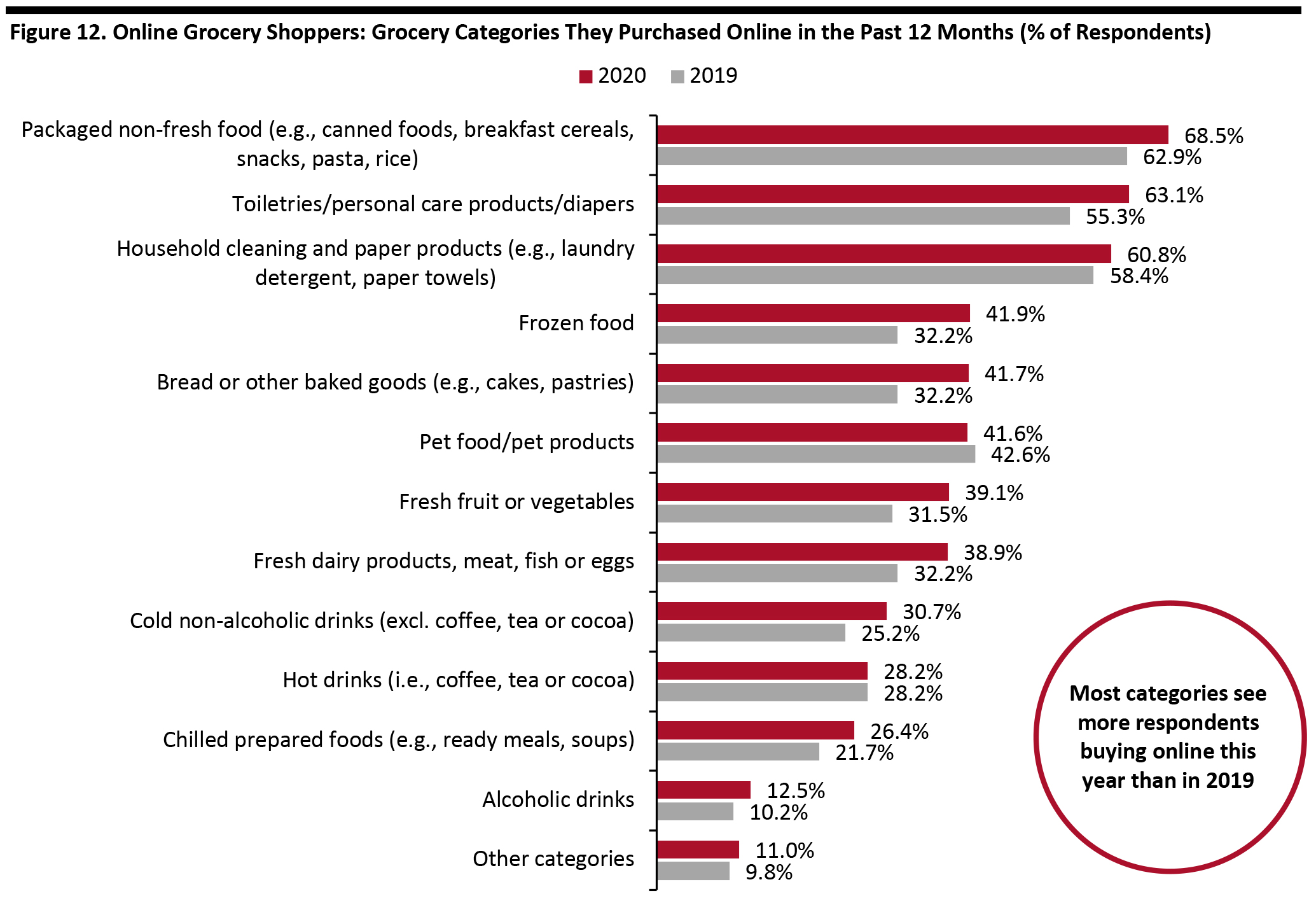

Grocery Categories Shoppers Buy Online

Respondents bought an average of 5.0 grocery categories online this year, versus 4.4 categories in last year’s survey. This increase in cross-category shopping implies a greater frequency and/or basket size in online shopping. We think it also reflects the market rebalancing away from more limited food purchases online—such as buying chocolate gifts or specialty health foods—and toward a focus on full-basket grocery shops of the kind that are undertaken in supermarkets. We saw meaningful increases for fresh dairy, meat, fish or eggs and baked goods. This indicates that consumers are adopting e-commerce as a channel for regular grocery shops and not just for ambient and nonfood store-cupboard goods, although those kinds of products constitute the three most-bought categories. [caption id="attachment_109035" align="aligncenter" width="700"] Base: US Internet users aged 18+ who had purchased groceries online in the past 12 months (695 in 2019 and 599 in 2020)

Base: US Internet users aged 18+ who had purchased groceries online in the past 12 months (695 in 2019 and 599 in 2020) Source: Coresight Research [/caption]

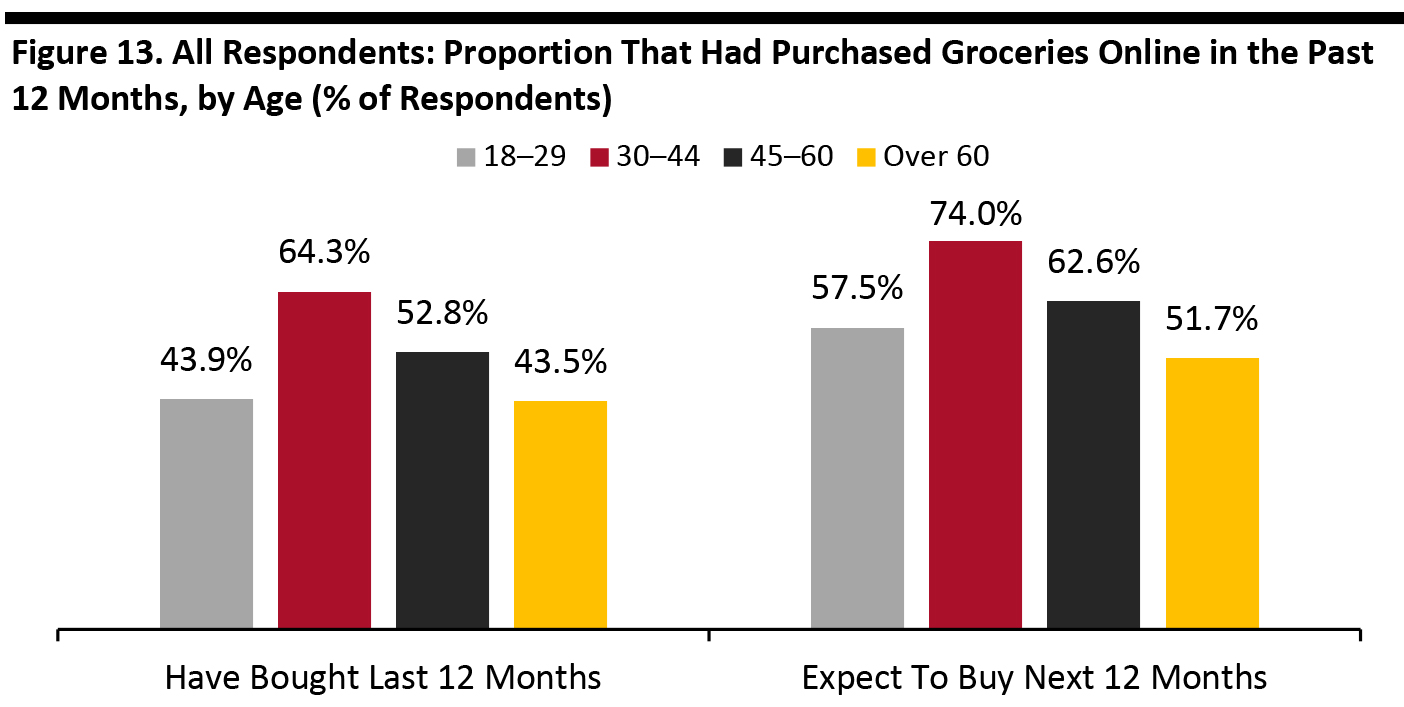

Who Is Buying Groceries Online?

By age, buying groceries online, and expectations to buy online, peak among the 30–44-year-old age group. Consumers in this demographic are more likely to have relatively settled family lives, and so larger households, than their younger counterparts, as well as being more digitally familiar than their older peers. [caption id="attachment_109036" align="aligncenter" width="700"] Base: 1,152 US Internet users aged 18+

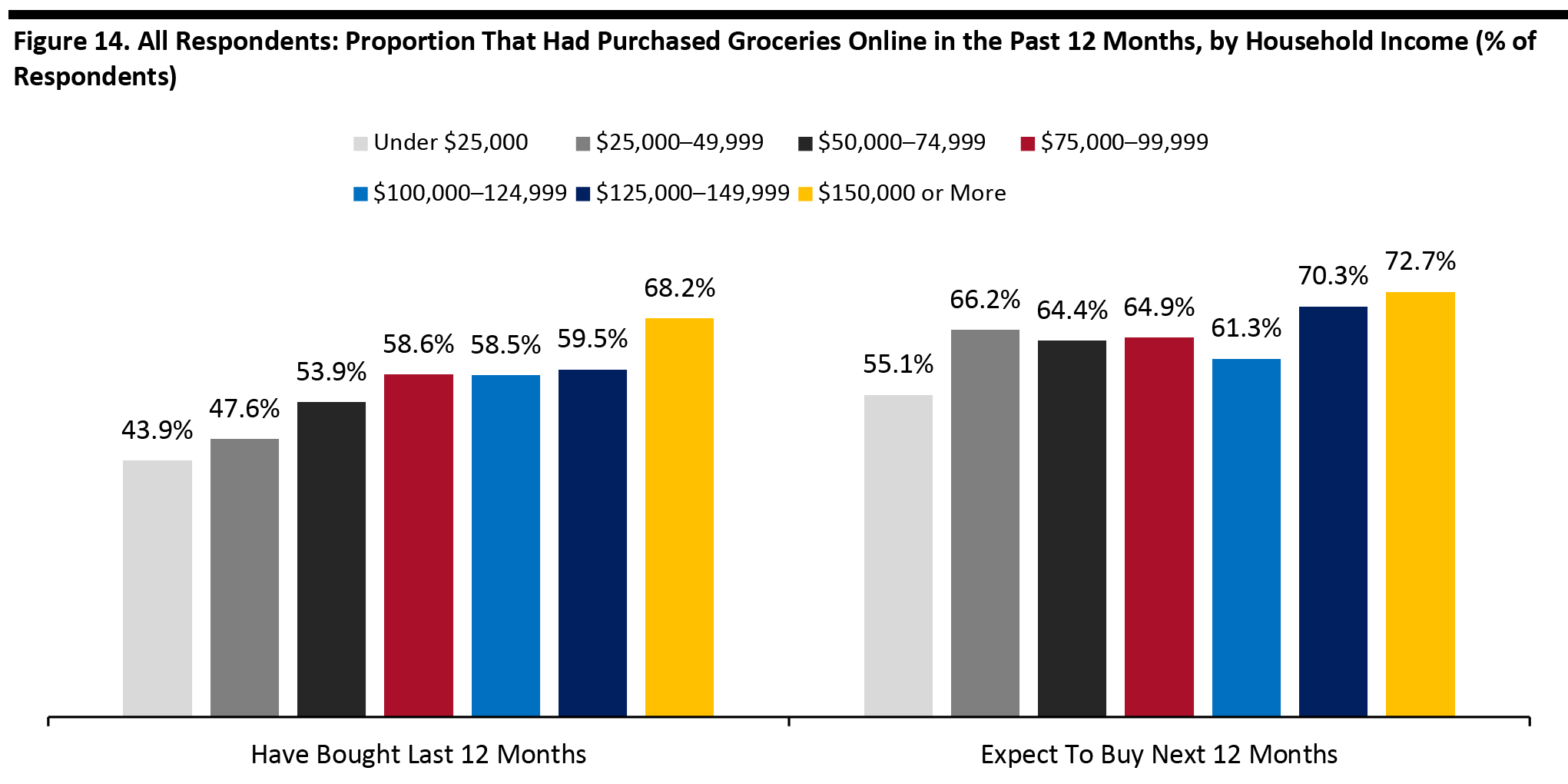

Base: 1,152 US Internet users aged 18+ Source: Coresight Research [/caption] The tendency to have bought groceries online broadly increases with income, albeit with a plateau partway through the income scale. The pattern for expectation to buy is less consistent—and, as we noted earlier, the coronavirus crisis may have pushed up expectations to buy versus had-bought. [caption id="attachment_109037" align="aligncenter" width="700"]

Base: 1,152 US Internet users aged 18+

Base: 1,152 US Internet users aged 18+ Source: Coresight Research [/caption]