albert Chan

https://youtu.be/3iZGLq25Ii4

Base: 1,888 US Internet users ages 18+

Base: 1,888 US Internet users ages 18+

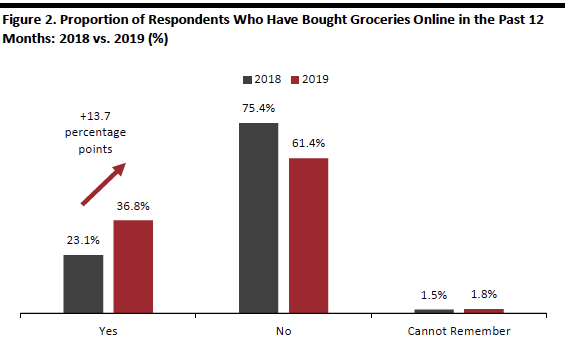

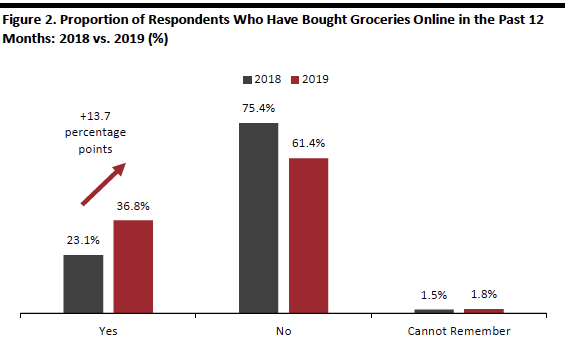

Source: Coresight Research[/caption] However, comparing our latest survey data with last year suggests that non-online shoppers underestimate the extent of their migration. In 2018, our survey found just a 2.8-percentage-point uplift from “had bought” to “expect to buy.” But, as shown in the chart below, we actually saw a near-14-percentage-point increase in online shopping penetration rates between 2018 and 2019, from 23.1% to 36.8%. [caption id="attachment_87605" align="aligncenter" width="566"] Base: US Internet users ages 18+ (1,885 in 2018 and 1,888 in 2019)

Base: US Internet users ages 18+ (1,885 in 2018 and 1,888 in 2019)

Source: Coresight Research[/caption] Base: US Internet users ages 18+ (1,885 in 2018 and 1,888 in 2019)

Base: US Internet users ages 18+ (1,885 in 2018 and 1,888 in 2019)

Source: Coresight Research[/caption] Respondents were given fuller definitions; see next table.

Respondents were given fuller definitions; see next table.

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

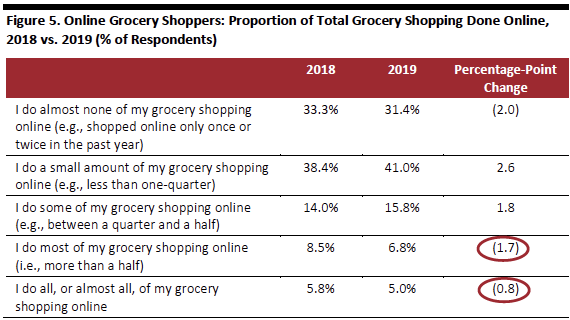

Source: Coresight Research[/caption] As more new shoppers move into online grocery, they appear to be having a dilutive impact on frequency or volume of shop. As we show below, the proportion of online shoppers saying they do “most” or “all or almost all” of their grocery shopping online declined year over year in 2019. The biggest year-over-year uplift was in the proportion doing a small amount of their shopping online, suggesting that the market is primarily adding tentative or occasional shoppers. Base: US Internet users ages 18+ who have bought groceries online in the past 12 months (435 in 2018 and 695 in 2019)

Base: US Internet users ages 18+ who have bought groceries online in the past 12 months (435 in 2018 and 695 in 2019)

Source: Coresight Research[/caption] Not all year-over-year differences are statistically significant.

Not all year-over-year differences are statistically significant.

*Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

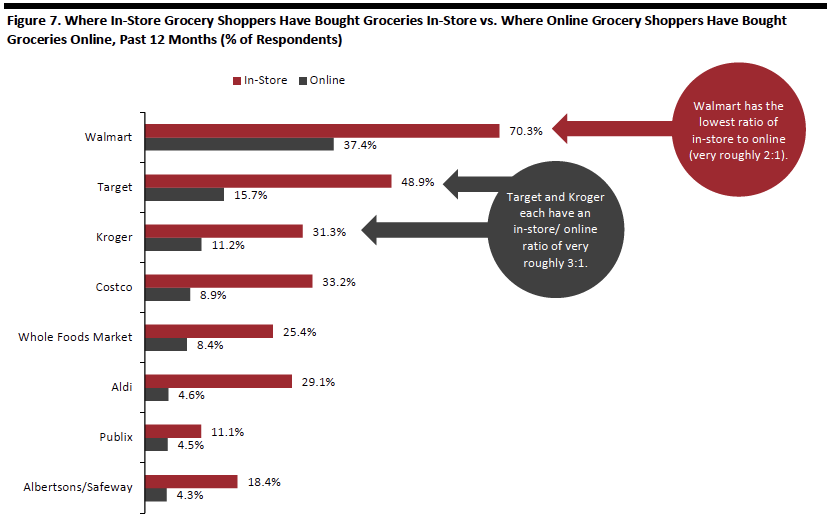

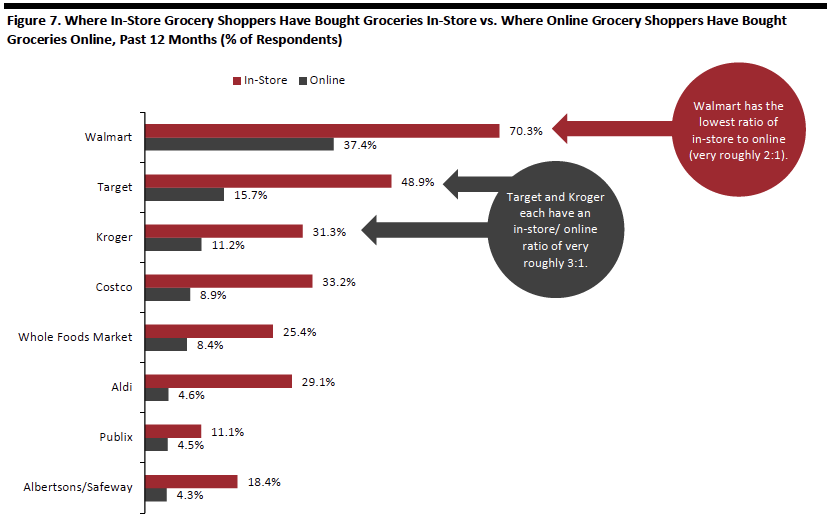

Source: Coresight Research[/caption] Estimating Shopper Numbers in Absolute Terms Using Census Bureau population data and the proportion of respondents shopping for groceries online (a base that is growing rapidly), we can estimate approximate year-over-year changes in absolute shopper numbers. With the caveat that surveys include a margin of error (see the Survey Methodology section), these data suggest the following: Base: US Internet users ages 18+ who have bought groceries in-store/online in the past 12 months (1,803 in-store and 695 online)

Base: US Internet users ages 18+ who have bought groceries in-store/online in the past 12 months (1,803 in-store and 695 online)

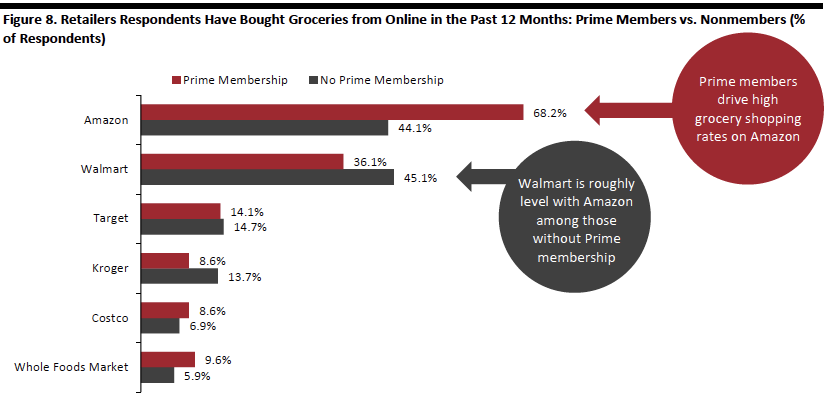

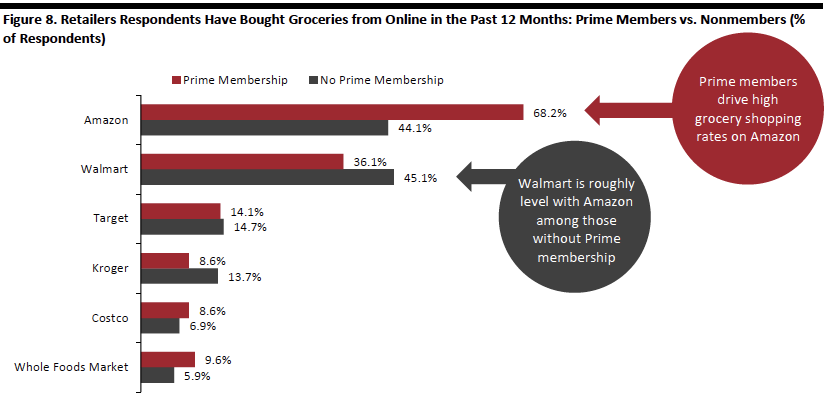

Source: Coresight Research[/caption] Where Do Amazon Prime Members Buy Groceries Online? Amazon Prime members show greater propensity than those without Prime membership to buy groceries on Amazon.com — at 68% versus 44%. Prime members underindex in buying groceries online from Walmart.com, Target.com Kroger.com, but they are more likely than the average to buy groceries online from Amazon-owned Whole Foods Market. [caption id="attachment_89367" align="aligncenter" width="700"] Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Source: Coresight Research[/caption] Totals may not sum due to rounding

Totals may not sum due to rounding

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Source: Coresight Research[/caption] Base: US Internet users ages 18+ who have bought groceries online on Amazon in the past 12 months (251 in 2018 and 416 in 2019)

Base: US Internet users ages 18+ who have bought groceries online on Amazon in the past 12 months (251 in 2018 and 416 in 2019)

Source: Coresight Research[/caption] Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Source: Coresight Research[/caption] Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Source: Coresight Research[/caption] Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Source: Coresight Research[/caption] Looking ahead, we see delivery gaining share of online grocery fulfillment, and we think Kroger’s deal with Ocado, struck in 2018, will be one driver of such a shift. Kroger and Ocado plan to build 20 robot-equipped grocery fulfillment centers in the US over the next three years. The Kroger-Ocado deal suggests that Kroger will move into grocery delivery in a major way, with Ocado’s fulfillment centers traditionally serving home delivery. Base: 746 US Internet users ages 18+ who do not expect to buy groceries online in the next 12 months

Base: 746 US Internet users ages 18+ who do not expect to buy groceries online in the next 12 months

Source: Coresight Research[/caption]

Introduction: Online Grocery Attracts More Shoppers, but a Small Share of Spend

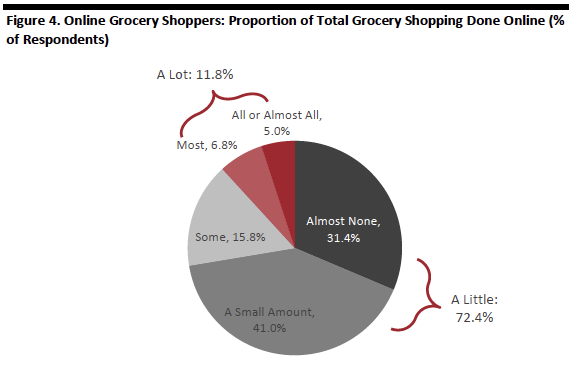

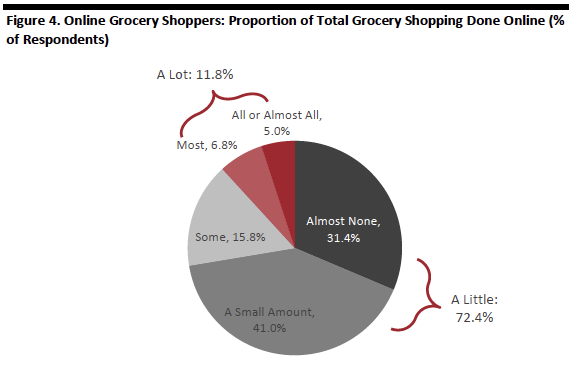

E-commerce accounts for a small fraction of US grocery sales — yet the number of shoppers buying groceries online, even if only occasionally, is substantial and growing rapidly. We estimate just 2.2% of US food and beverage retail sales were online in 2018. We expect this share to rise to around 2.7% in 2019. But, our second annual survey of grocery shopping habits found that while more than one-third of US consumers now buy groceries online, 72% of those shoppers direct only a small amount of their total grocery spend online. In this report, we look at the fast-evolving online grocery segment and present the findings of our latest consumer survey, conducted in April 2019. We provide comparisons to our March 2018 survey, all part of Coresight Research’s How the US Shops series, each based on proprietary consumer research. We begin with five insights from the survey.Five Insights from Our Second Annual Survey of Grocery Shoppers

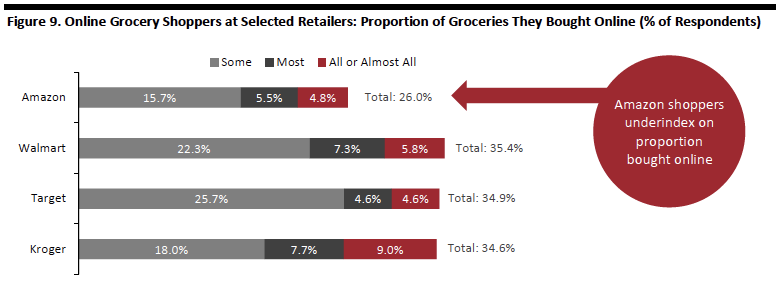

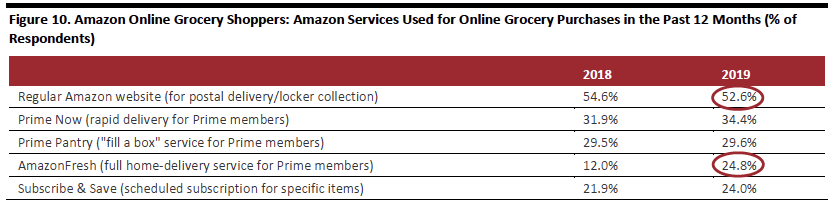

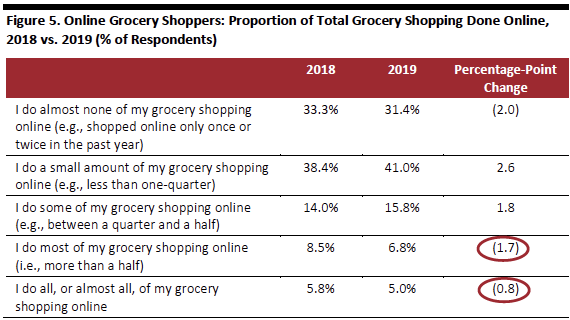

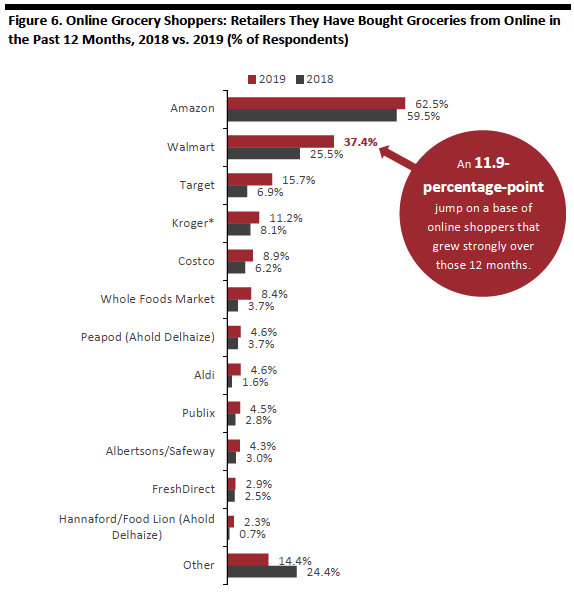

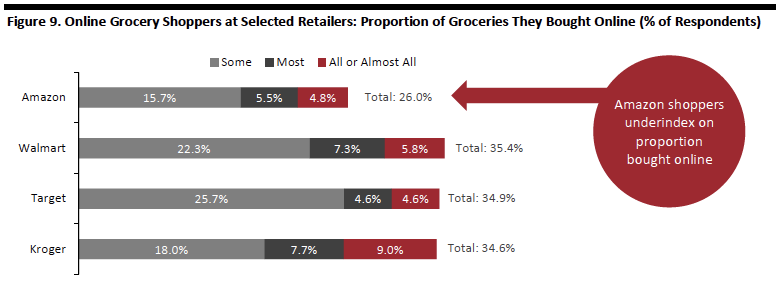

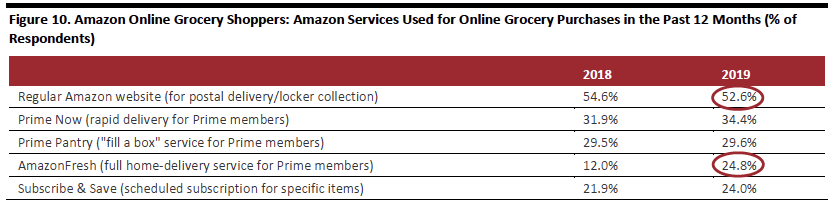

1. We Recorded an Approximate 35-Million Increase in Online Grocery Shoppers Some 36.8% of respondents said they bought groceries online in the past year, up substantially from 23.1% in last year’s survey. Based on Census Bureau adult population data, that equates to roughly 35 million more consumers buying groceries online between 2018 and 2019, taking the total pool of online grocery shoppers to approximately 93 million US adults. 2. But They Are Still Buying Only a Small Amount Online Offsetting this huge number of online shoppers is the small portion of total grocery spend they typically direct online. Of those online shoppers surveyed in 2019, some 72.4% bought only a small portion of their groceries online (the combined total for those saying they bought “almost none” or “a small amount” online). Just 11.8% of online grocery shoppers bought a lot of their groceries online (the combined total of those saying they bought “most” or “all or almost all” of their groceries online). As more new shoppers move into online grocery, they appear to be having a dilutive impact on the proportion of per-shopper grocery spend captured by e-commerce. Tentative or occasional online shoppers seem to be dipping their toes in the water instead of jumping in. The proportion of online shoppers saying they do “most” or “all or almost all” of their grocery shopping online declined from a combined 14.3% in 2018 to 11.8% in 2019. 3. Amazon Continues to Lead in Shopper Numbers, Driven by Prime Members Fully 62.5% of those who bought groceries online bought on Amazon.com in the past year, keeping Amazon in first place. Prime members support this leadership: Some 68% of Prime members bought groceries on Amazon.com in the past 12 months, versus 44% of those without Prime membership. 4. But Amazon Grocery Shoppers Tend to Buy Less of their Groceries Online than Online Shoppers at Walmart, Target or Kroger Amazon shoppers appear to be occasional or small-basket online grocery shoppers. Some 26% of Amazon shoppers said they bought “some,” “most” or “all or almost all” of their groceries online. Among Walmart, Target and Kroger online shoppers, this proportion was around 35%. Amazon may underindex in grocery because the most popular Amazon service is its regular website, used by around 53% of Amazon’s grocery shoppers. Amazon’s regular site is limited to ambient grocery products that can be sent by mail, which makes it all but impossible to shop for a basket of conventional groceries. Apparently offsetting this was a jump in respondents saying they used AmazonFresh, Amazon’s full-service grocery service, from 12% of Amazon grocery shoppers in 2018 to 25% in 2019. 5. Walmart Dramatically Narrowed the Gap in Shopper Numbers Walmart was again in second place by number of shoppers. But, we recorded a leap in the portion of online grocery shoppers buying from Walmart, from 25.5% in 2018 to 37.4% in 2019. Coupled with the portion of respondents shopping for groceries online, our data suggest the absolute number of Walmart online grocery shopper more than doubled in 12 months. Target enjoyed a jump in shoppers, too: Some 15.7% of online grocery shoppers bought from Target.com in the past year, versus 6.9% when we surveyed shoppers in 2018. Measured from a base that is itself growing, this implies a more-than-tripling in the retailer’s online shopper numbers in the last 12 months. And, as we noted above, these shoppers tend to buy more of their groceries online than do Amazon grocery shoppers: With around 35% of Walmart.com shoppers doing “some,” “most” or “all or almost all” of their grocery shopping online, they are more likely to be “full-basket” shoppers of the kind we see in brick-and-mortar grocery stores.Survey Findings in Detail

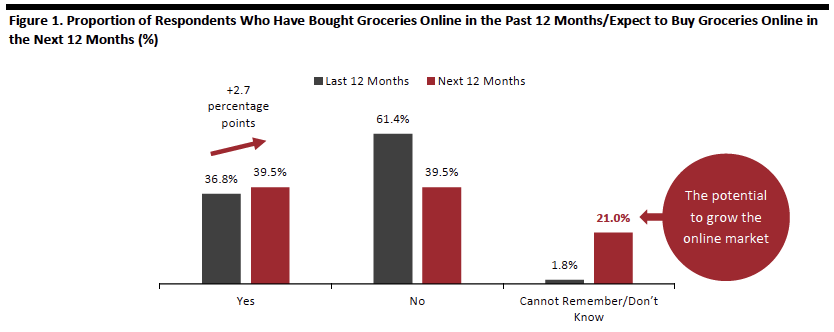

The following sections review our findings in more detail.One in Three Americans Now Buy Groceries Online

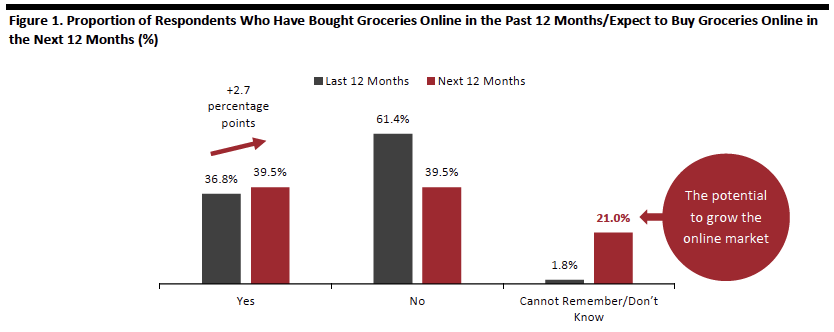

More than one-third of US consumers now buy groceries online: Our survey found 36.8% of respondents had purchased groceries online in the past 12 months, up from 23.1% when we surveyed consumers in April last year. Based on Census Bureau data, we estimate some 93 million US adults bought some groceries online in the 12 months prior to our April 2019 survey, up by almost 35 million from when we surveyed consumers in April 2018. This year, some 39.5% said they expect to shop online for groceries in the next 12 months, representing only a minor uplift from actual shopper numbers (past 12 months). The potential to grow the online market lies in the 21.0% who say they don’t know if they will buy groceries online in the next year. [caption id="attachment_87604" align="aligncenter" width="700"] Base: 1,888 US Internet users ages 18+

Base: 1,888 US Internet users ages 18+Source: Coresight Research[/caption] However, comparing our latest survey data with last year suggests that non-online shoppers underestimate the extent of their migration. In 2018, our survey found just a 2.8-percentage-point uplift from “had bought” to “expect to buy.” But, as shown in the chart below, we actually saw a near-14-percentage-point increase in online shopping penetration rates between 2018 and 2019, from 23.1% to 36.8%. [caption id="attachment_87605" align="aligncenter" width="566"]

Base: US Internet users ages 18+ (1,885 in 2018 and 1,888 in 2019)

Base: US Internet users ages 18+ (1,885 in 2018 and 1,888 in 2019)Source: Coresight Research[/caption]

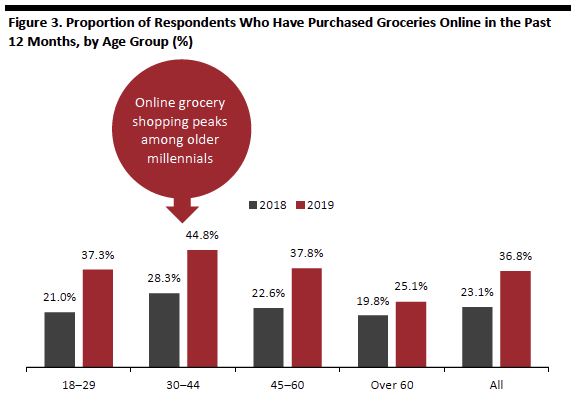

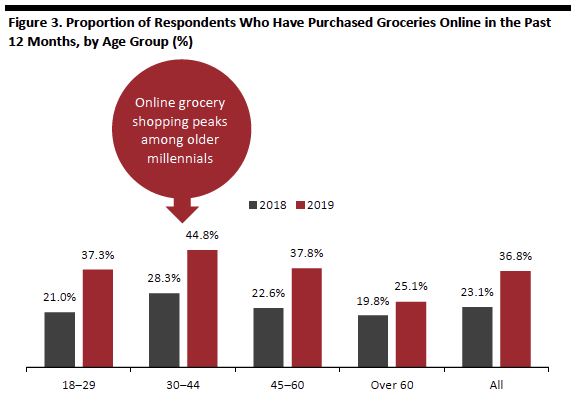

Online Grocery Shopping Peaks Among Older Millennials

The online grocery market continues to be led by those aged 30–44, reflecting a combination of time pressures, rising incomes, relatively settled professional and family lives, and familiarity with digital channels. However, online shopping is used in substantial numbers across all age groups, with one-quarter of over-60s buying groceries online in the past 12 months (up from one in five in 2018). It is not a market led by the very youngest shoppers, as these consumers’ busy lifestyles and smaller households typically result in more last-minute, small-basket shops. [caption id="attachment_89364" align="aligncenter" width="574"] Base: US Internet users ages 18+ (1,885 in 2018 and 1,888 in 2019)

Base: US Internet users ages 18+ (1,885 in 2018 and 1,888 in 2019)Source: Coresight Research[/caption]

Few Consumers Use E-Commerce for the Majority of Their Grocery Shopping

The online grocery market has a sizeable number of shoppers — but they generally buy online infrequently. Almost one-third said they bought “almost none” of their groceries online in the past year and just over 40% said they bought “only a small amount” online.- In total, 72.4% buy only a small proportion of their groceries online while just 11.8% buy a lot.

Respondents were given fuller definitions; see next table.

Respondents were given fuller definitions; see next table.Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Source: Coresight Research[/caption] As more new shoppers move into online grocery, they appear to be having a dilutive impact on frequency or volume of shop. As we show below, the proportion of online shoppers saying they do “most” or “all or almost all” of their grocery shopping online declined year over year in 2019. The biggest year-over-year uplift was in the proportion doing a small amount of their shopping online, suggesting that the market is primarily adding tentative or occasional shoppers.

- In our 2018 survey, 71.7% told us they bought a small proportion (“almost none” or “a small amount”) of their groceries online and 14.3% said they bought a lot (“most” or “all or almost all”) online.

Base: US Internet users ages 18+ who have bought groceries online in the past 12 months (435 in 2018 and 695 in 2019)

Base: US Internet users ages 18+ who have bought groceries online in the past 12 months (435 in 2018 and 695 in 2019)Source: Coresight Research[/caption]

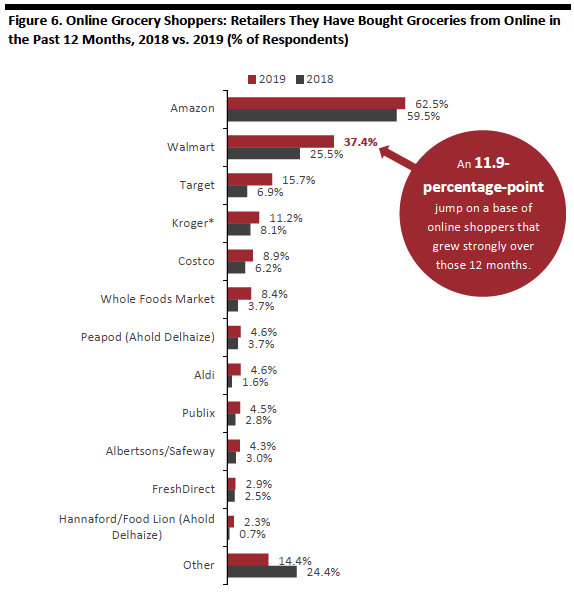

Most-Shopped Retailers: Walmart Narrows the Gap with Amazon

We chart below where online grocery shoppers said they had bought groceries online in the past 12 months in our 2019 and 2018 surveys. Note that these are the percentage of online shoppers, a base which has grown rapidly in the intervening 12 months. By number of shoppers, Amazon remains in first place. However, we note the following:- First, Walmart closed the gap considerably in the past 12 months, with the proportion of online grocery shoppers that had bought from Walmart jumping from 25.5% last year to 37.4% this year — an 11.9-percentage-point jump on a base of online shoppers that grew strongly over those 12 months.

- Second, as we discuss later, a greater proportion of shoppers on Walmart.com (and at other leading multichannel players) do a substantial share of their total grocery shopping online than do Amazon shoppers.

Not all year-over-year differences are statistically significant.

Not all year-over-year differences are statistically significant.*Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Source: Coresight Research[/caption] Estimating Shopper Numbers in Absolute Terms Using Census Bureau population data and the proportion of respondents shopping for groceries online (a base that is growing rapidly), we can estimate approximate year-over-year changes in absolute shopper numbers. With the caveat that surveys include a margin of error (see the Survey Methodology section), these data suggest the following:

- A more than doubling of Walmart’s online grocery shopper numbers in 12 months, with an approximate 20 million uplift in Walmart.com online grocery shoppers.

- A more-than-tripling in Target’s online shopper numbers in the last 12 months, with an approximate 10 million increase in Target.com online grocery shoppers.

- A more than doubling of Kroger’s online grocery shopper numbers, with the retailer adding very roughly 6 million new online grocery shoppers in the past 12 months.

Base: US Internet users ages 18+ who have bought groceries in-store/online in the past 12 months (1,803 in-store and 695 online)

Base: US Internet users ages 18+ who have bought groceries in-store/online in the past 12 months (1,803 in-store and 695 online)Source: Coresight Research[/caption] Where Do Amazon Prime Members Buy Groceries Online? Amazon Prime members show greater propensity than those without Prime membership to buy groceries on Amazon.com — at 68% versus 44%. Prime members underindex in buying groceries online from Walmart.com, Target.com Kroger.com, but they are more likely than the average to buy groceries online from Amazon-owned Whole Foods Market. [caption id="attachment_89367" align="aligncenter" width="700"]

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 monthsSource: Coresight Research[/caption]

Amazon Grocery Shoppers Underindex on Quantity Bought Online

Amazon may be #1 by number of shoppers, but our data suggest it underindexes on regular, full-basket grocery shops. As we show below, only around one-quarter of Amazon online grocery shoppers say they do “some,” “most,” or “all or almost all” of their grocery shopping online (i.e., they purchase a meaningful proportion online). At each of Amazon’s biggest rivals, Walmart, Target and Kroger, these more regular online shoppers account for around 35% of online grocery shoppers. [caption id="attachment_89368" align="aligncenter" width="700"] Totals may not sum due to rounding

Totals may not sum due to roundingBase: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Source: Coresight Research[/caption]

Most Amazon Grocery Shoppers Use Amazon’s Regular Website to Buy Groceries

The finding that Amazon shoppers tend to purchase less online than shoppers at some other retailers can be explained by the kind of Amazon services they use. As we show below, the regular Amazon website is the most-used service for buying groceries. Amazon’s regular site is limited to nonperishable products that can be shipped through the mail, which limits its ability to offer a full, conventional basket of groceries. However, our survey also recorded a jump in shopper numbers for AmazonFresh in the past 12 months, with one-quarter of those surveyed saying they purchased groceries on Amazon using this service. This pushed it ahead of Subscribe & Save. [caption id="attachment_89369" align="aligncenter" width="700"] Base: US Internet users ages 18+ who have bought groceries online on Amazon in the past 12 months (251 in 2018 and 416 in 2019)

Base: US Internet users ages 18+ who have bought groceries online on Amazon in the past 12 months (251 in 2018 and 416 in 2019)Source: Coresight Research[/caption]

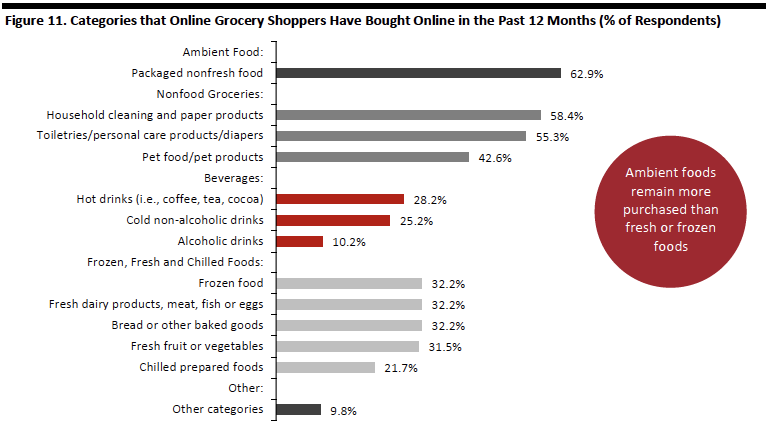

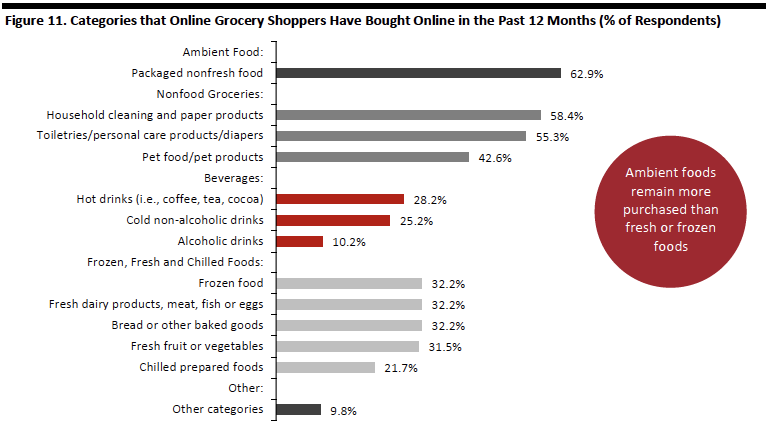

What They Buy Online: Nonfresh Categories Continue to Be Most Popular

We asked online grocery shoppers what they had bought online, and the results suggest some continued resistance to buying fresh-food categories online. Packaged, nonfresh foods (for which we gave respondents the examples of chocolate, canned foods, breakfast cereals, snacks, pasta, rice, prepared sauces) are the most-bought category — the breadth of this category may support its ranking. Nonfood grocery products accounted for the second- and third-most-bought categories, as shown below. These products are suited for e-commerce as shoppers typically buy them on specification (including by brand) and their nonperishable nature supports online bulk buying. [caption id="attachment_89370" align="aligncenter" width="700"] Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 monthsSource: Coresight Research[/caption]

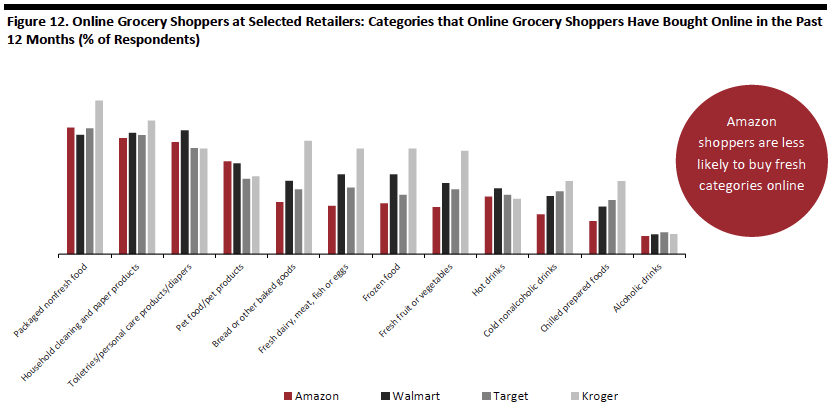

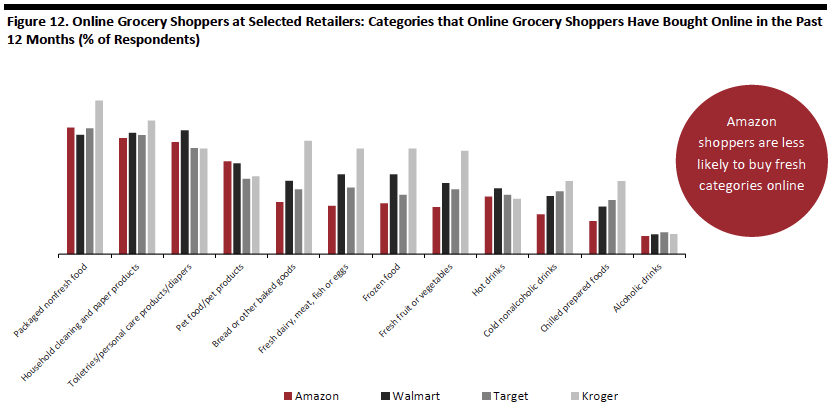

What They Buy, by Where They Shop

Amazon grocery shoppers are much less likely than shoppers at major rivals to buy fresh categories such as dairy, meat, fish or eggs online. [caption id="attachment_89371" align="aligncenter" width="700"] Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 monthsSource: Coresight Research[/caption]

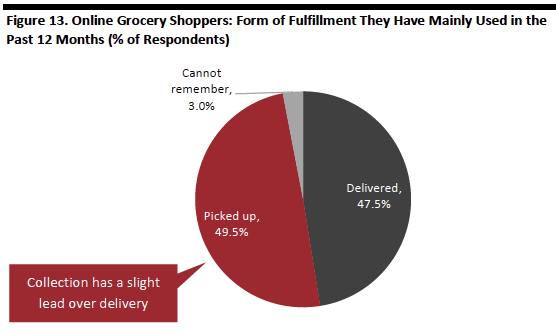

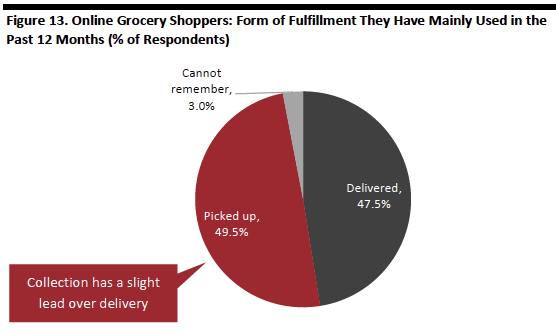

Delivery and Collection are Neck and Neck

We asked online shoppers whether they had mainly had grocery orders delivered or they had mainly picked them up. The findings indicate collection has a slight lead over delivery. Last year, the split was 45.3% for delivered vs 50.8% for collection, suggesting delivery may have made some gains — and this dovetails with the expansion of rapid delivery services, such as Target’s rollout of same-day delivery services in 2018, following its acquisition of Shipt. [caption id="attachment_89372" align="aligncenter" width="556"] Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 months

Base: 695 US Internet users ages 18+ who have bought groceries online in the past 12 monthsSource: Coresight Research[/caption] Looking ahead, we see delivery gaining share of online grocery fulfillment, and we think Kroger’s deal with Ocado, struck in 2018, will be one driver of such a shift. Kroger and Ocado plan to build 20 robot-equipped grocery fulfillment centers in the US over the next three years. The Kroger-Ocado deal suggests that Kroger will move into grocery delivery in a major way, with Ocado’s fulfillment centers traditionally serving home delivery.

- A 2019 Coresight Research survey on US consumers’ usage of buy online, pick up in store (BOPIS) services, found groceries are the third-most-collected category, behind apparel and electronics.

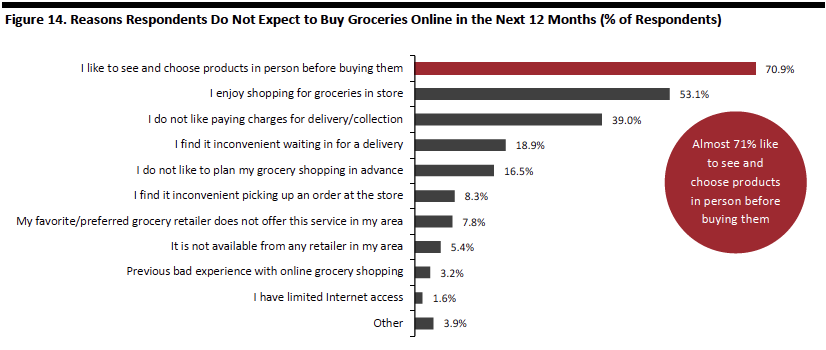

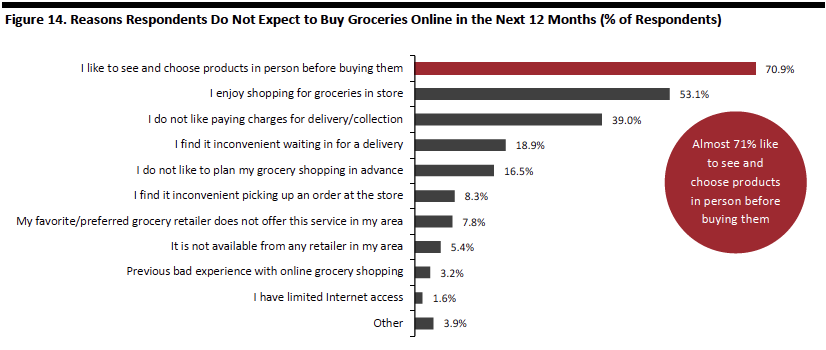

Why Some Shoppers Do Not Buy Groceries Online: Over Half Enjoy In-Store Shopping

We asked those who do not expect to buy groceries online in the next 12 months why not. And over half actually enjoy shopping for groceries in a store. The overall ranking is similar to what we recorded in 2018. However, reflecting the rollout of online services by many grocery retailers, both “My favorite/preferred retail does not offer this service” and “It is not available from any retailer in my area” both slipped in the ranking. [caption id="attachment_87617" align="aligncenter" width="700"] Base: 746 US Internet users ages 18+ who do not expect to buy groceries online in the next 12 months

Base: 746 US Internet users ages 18+ who do not expect to buy groceries online in the next 12 monthsSource: Coresight Research[/caption]