Introduction

Major names in US grocery are piling into e-commerce. These companies are rolling out delivery points, partnering with rapid delivery firms and acquiring fulfillment providers. At the same time, Amazon appears to be recognizing how hard it is to gain traction in grocery with an online-only operation. The company has moved into brick-and-mortar formats and pared back its AmazonFresh coverage over the past year.

- Walmart and Kroger have raced to establish hundreds of new grocery collection points, and many regional grocers have joined them by trialing or rolling out grocery pickup services.

- In recent months, Target acquired delivery provider Shipt and Walmart bought logistics startup Parcel. In addition, a number of grocery retailers signed agreements in 2017 to offer delivery via Instacart: these include Kroger, Publix, Albertsons, Food Lion and Stop & Shop (both owned by Ahold Delhaize) as well as regional chains Superior Grocers, Stew Leonard’s and Best Market.

- Amazon has merged its AmazonFresh and Prime Now operations and reduced the number of regions in which it offers AmazonFresh. Offline, it has acquired Whole Foods Market and launched the Amazon Go convenience store format.

In this report, we take a deep dive into the fast-moving online grocery segment and present the findings of our latest consumer survey, conducted in March of 2018. This report forms part of our How the US Shops series of reports, each of which is based on proprietary consumer research. The main body of the report features analysis of our survey findings, question by question. First, though, we bring together data points from various questions that we asked respondents as we discuss four top takeaways from our survey.

Four Top Takeaways from Our Online Grocery Survey

1. Online Shopper Numbers Do Not Reflect Market Size

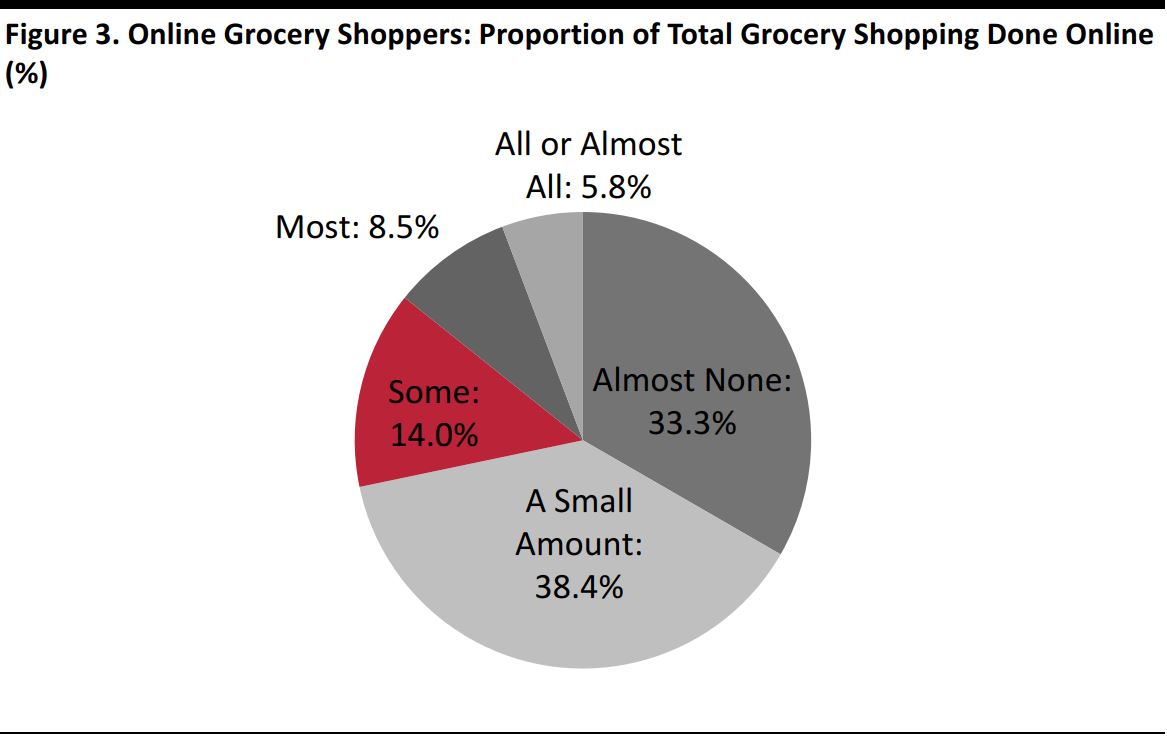

The online grocery market is disproportionately small relative to the number of consumers who say they shop for groceries online. Some 23.1% of all shoppers we surveyed said that they had bought groceries online in the past year, but most online grocery shoppers actually spend very little of their grocery budgets online:

- Approximately one-third of respondents said that they had purchased “almost none” of their groceries online in the past 12 months—i.e., they made just one or two online grocery purchases over the period.

- A further 38% said that they had purchased only “a small amount” online—which we defined in our survey as less than one-quarter of all their groceries.

- Only 14.3% of online grocery shoppers said that they had bought more than half of their groceries online in the past 12 months.

We estimate that e-commerce will account for only about 2.4% of total food and drink retail sales this year. This is equivalent to sales of around $23 billion in a market approaching $1 trillion in value.

Those retailers interested in growing the online grocery market must do more than simply boost participation; they must also convert occasional and small-basket shoppers into regular, full-shop customers.

2. Amazon Is the Most-Shopped Online Grocery Retailer, but Few Use It Like a Regular Grocery Retailer

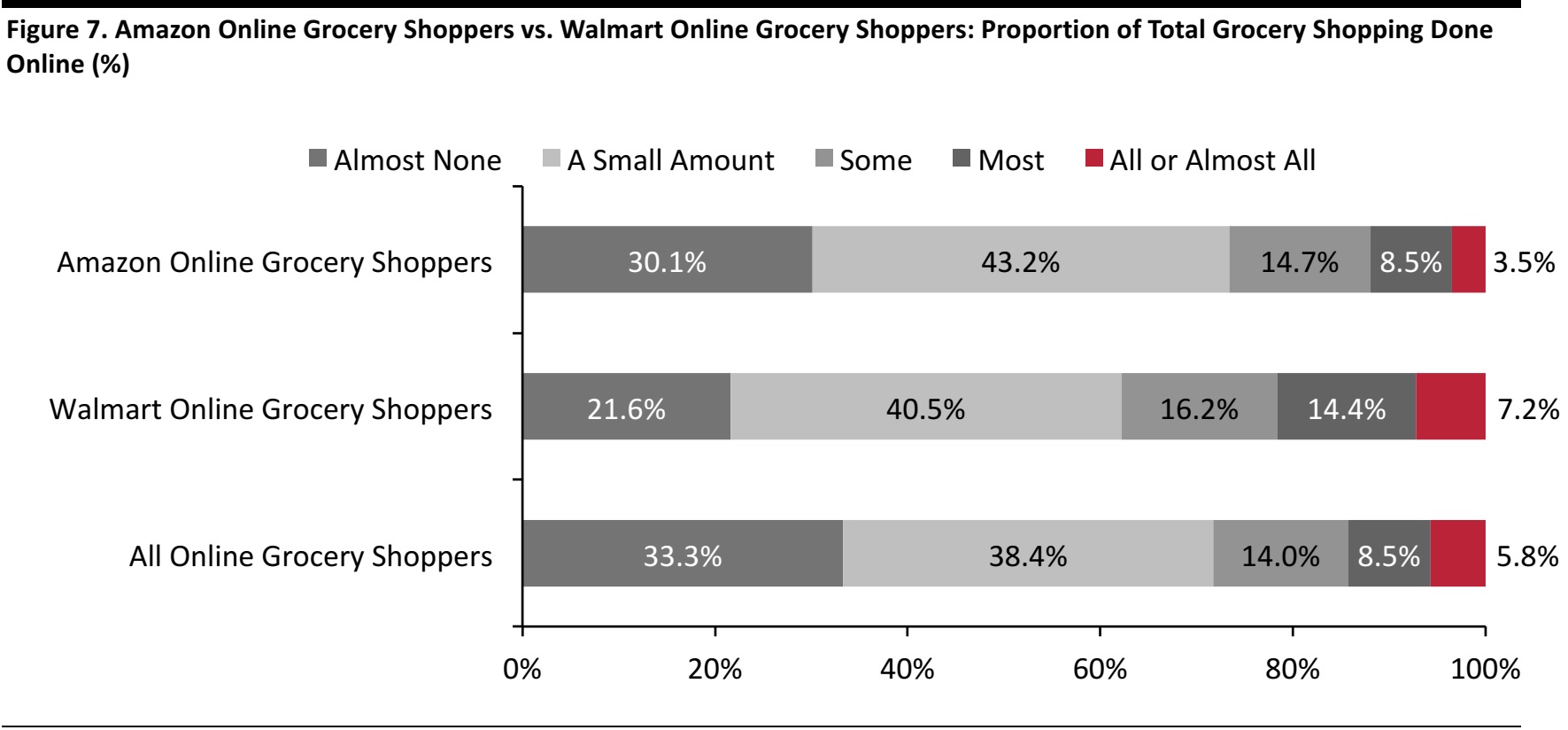

Amazon is by far the most-shopped retailer for online groceries. Some 59% of online grocery shoppers surveyed said they had bought from Amazon in the past year, versus 26% for second-place Walmart. However, that does not mean that shoppers turn to the site for their regular grocery shops. In fact, a number of data points suggest that shoppers tend not to use Amazon for conventional, full-basket grocery shops, while they do tend to visit Walmart.com for such shops.

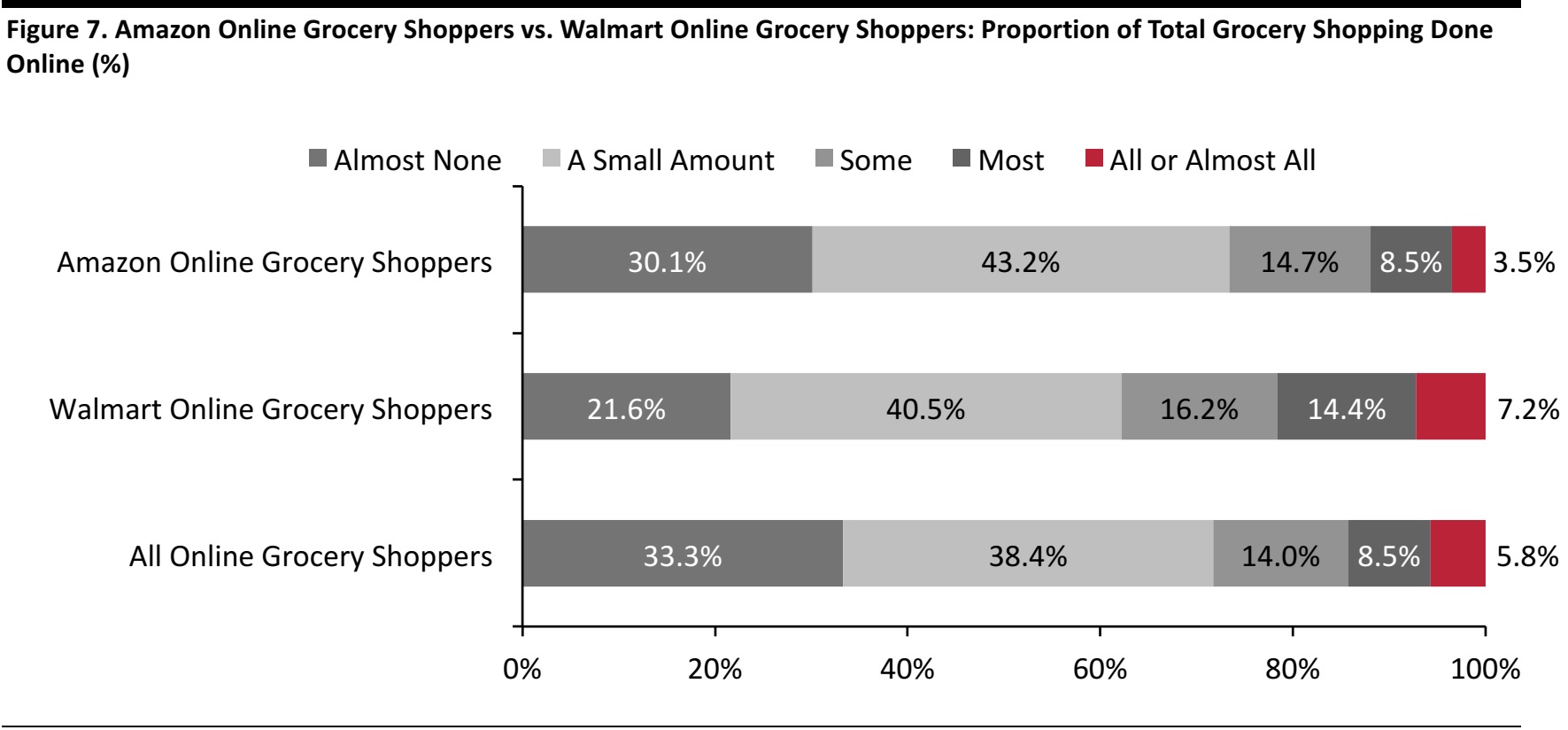

- Our survey found that those who have bought groceries online from Amazon are more likely than the average shopper to have done only a small amount of their grocery shopping online. By contrast, those who have bought groceries online from Walmart are more likely than the average shopper to have done most or all of their grocery shopping online—implying that grocery orders at Walmart.com are bigger than at Amazon.com.

- Amazon’s regular website is by far the most-used of the retailer’s online grocery services: it is used by more Amazon shoppers than the company’s Prime Now (rapid delivery) and AmazonFresh (full grocery delivery) services. The regular Amazon site is limited to ambient grocery products that are sent through the mail one or a few items at a time, so it is not a viable option for a conventional grocery shop. AmazonFresh is by far the retailer’s least popular online grocery service: just 12% of Amazon grocery shoppers surveyed said they had used it in the past year.

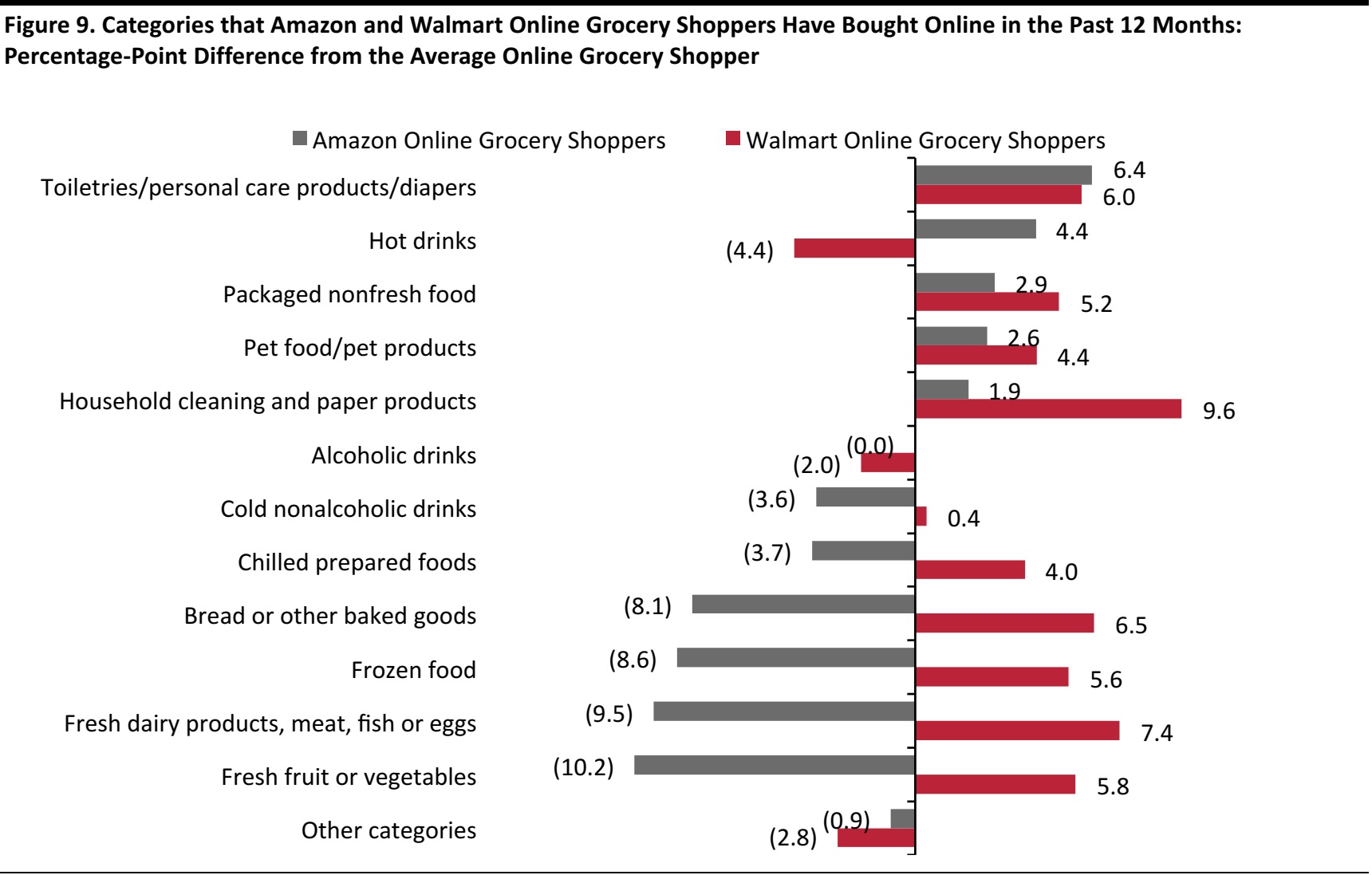

- In addition, Amazon grocery shoppers are much less likely than the average shopper to have purchased fresh and frozen food categories online. Instead, Amazon shoppers tend to stick to brand-heavy nonperishables such as ambient food products and toiletries. By contrast, Walmart online grocery shoppers are significantly more likely than the average to have bought fresh and frozen food categories online, reflecting Walmart.com’s ability to meet shoppers’ full-basket grocery shopping needs.

So, although Amazon has the most online grocery shoppers, it is established grocery retailers such as Walmart that are pulling in consumers looking to complete bigger-basket, full-assortment grocery shops

3. Cross-Channel Grocery Retailing Looks Set to Beat Pure-Play Formats

Our long-standing view is that it is much more difficult to make pure-play Internet retailing work in the grocery category than in nonfood categories, and Amazon’s recent history supports our conclusion. The company has ventured into brick-and-mortar retail by acquiring Whole Foods and launching Amazon Go stores. It has also withdrawn AmazonFresh from some US regions and recently merged its Prime Now and AmazonFresh operations.

Meanwhile, other major grocery retailers have been rapidly expanding their collection services, enabling more shoppers to pick up their grocery orders from stores. This reflects the strength of cross-channel shopping in the grocery sector.

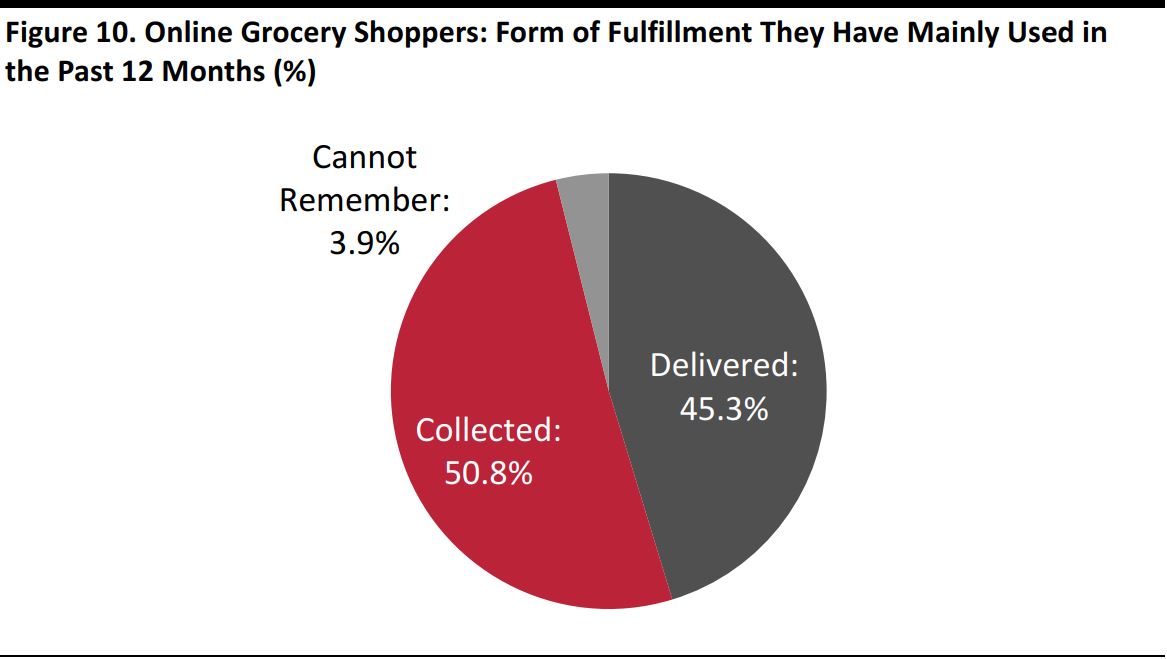

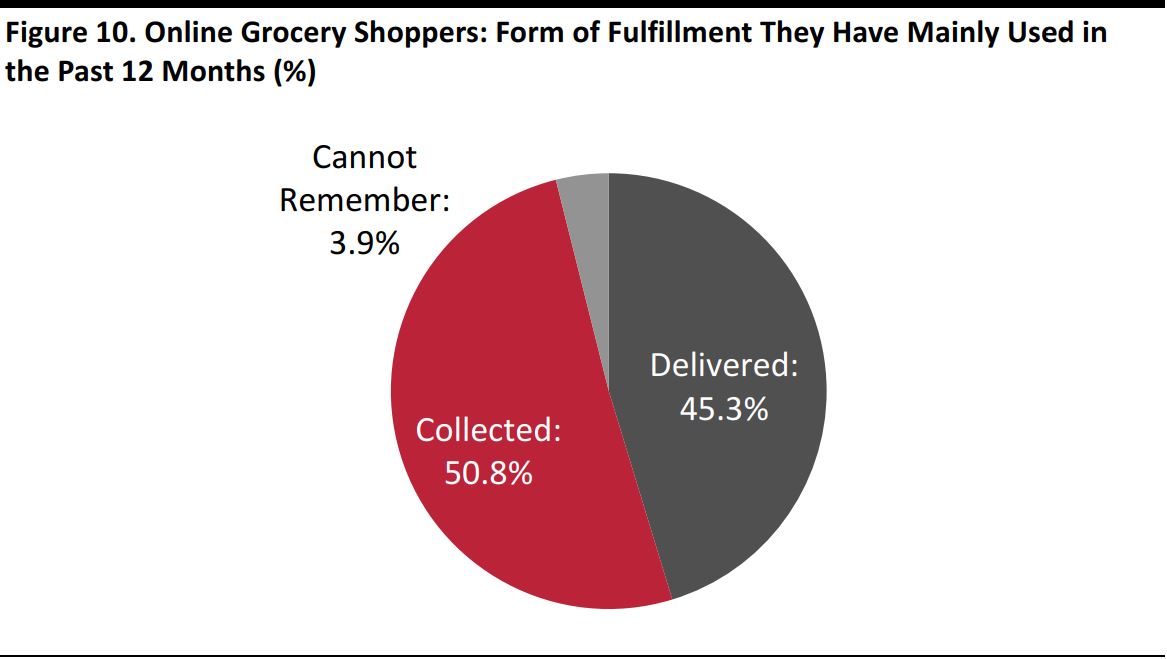

- Our survey confirmed that collection is the majority fulfillment method in US online grocery. Some 51% of respondents said that they mostly opt to collect their online grocery orders, while 45% mostly opt to have their orders delivered (the remainder could not remember which service they used the most).

- Amazon, which focuses on delivery, pushes up the average delivery rate. Some 60% of those surveyed who had bought groceries online from Walmart in the past 12 months mainly collected their orders. Among Kroger online shoppers, that rate leaped to 74% (although the Kroger subsample was admittedly small).

We think that the mature online grocery markets of the UK and France, where multichannel retailers dominate, further indicate that it is not pure plays that tend to lead in online grocery. We expect to see Amazon innovate further to avoid facing a similar situation in the US as online pure plays have faced in mature European markets.

The popularity of grocery pickup services and the extension of same-day delivery by retailers such as Target seem to foretell a polarization in online grocery: we expect to see lower-cost, collection-based services fulfilling the majority of large, family-type orders and premium services such as Amazon Prime Now and Shipt fulfilling smaller orders via same-day delivery.

4. Walmart Is in a Strong Position Online

Walmart has a confident lead over its brick-and-mortar rivals in online grocery and one indication of Walmart’s online strength is that it sees a narrower gap between online and in-store shopper penetration rates than its major rivals do. However, because Amazon captures so many online purchases, Walmart’s share of online grocery shoppers is still much lower than its share of in-store grocery shoppers. Just over one-quarter of online grocery shoppers we surveyed had bought from Walmart.com in the past 12 months.

Relative to competitors such as Target and Costo, Kroger also shows strength in online grocery. In our survey, Kroger ranked second in terms of online shopper numbers, with 8% of those polled saying they had bought groceries online from Kroger in the past 12 months. In terms of in-store shopper numbers, Kroger ranked third among major grocers. And, like Walmart, Kroger sees a narrower gap between online and in-store shopper penetration rates than most of its major competitors do.

Like Walmart, Kroger has been rolling out hundreds more grocery collection points.But, unlike Walmart, Kroger charges customers to pick up their order—typically, $4.95 per collection. Among those who expect to buy groceries online in the next 12 months, we found that in-store and online Kroger shoppers were more willing than Amazon or Walmart grocery shoppers to pay for delivery and were more willing to pay delivery charges at higher levels. These shoppers’ willingness to pay to collect their orders is supporting Kroger’s strong position in online grocery.

One-Quarter of Consumers Buy Groceries Online, Led by Shoppers in the 30–44 Age Group

Almost a quarter of all shoppers buy groceries online, although that does not necessarily mean they shop online regularly.

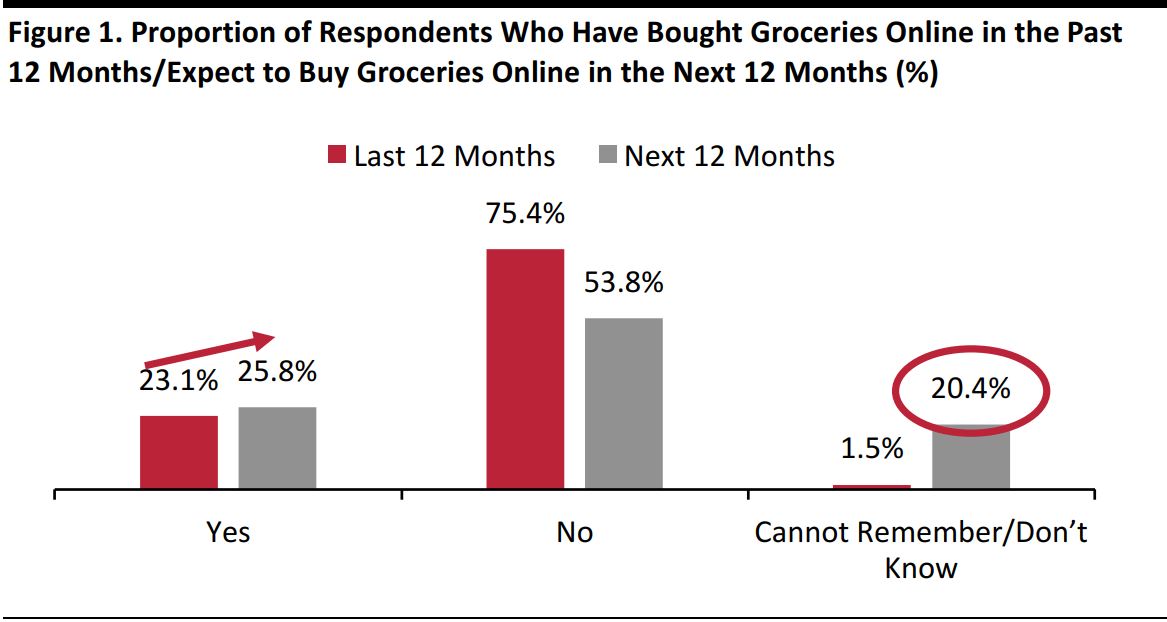

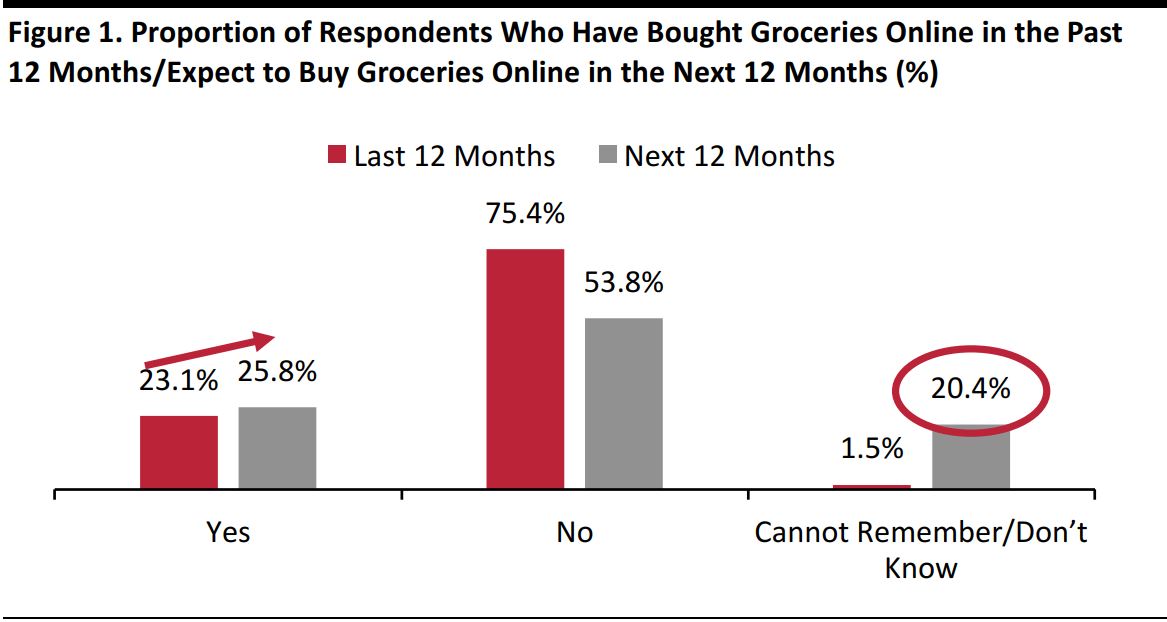

- As we chart below, 23.1% of survey respondents said that they had bought groceries online in the past 12 months, and 25.8% said that they expect to buy them online in the next 12 months.

- However, it is the 20.4% of respondents who said that they do not yet know whether they will buy groceries online that represent a substantial pocket of opportunity for retailers seeking to convert grocery shoppers to e-commerce.

Base: 1,885 US Internet users ages 18+

Survey questions: Have you bought groceries online in the past 12 months?/Looking ahead, do you expect to buy groceries online in the next 12 months?

Source: Coresight Research

Base: 1,885 US Internet users ages 18+

Survey questions: Have you bought groceries online in the past 12 months?/Looking ahead, do you expect to buy groceries online in the next 12 months?

Source: Coresight Research

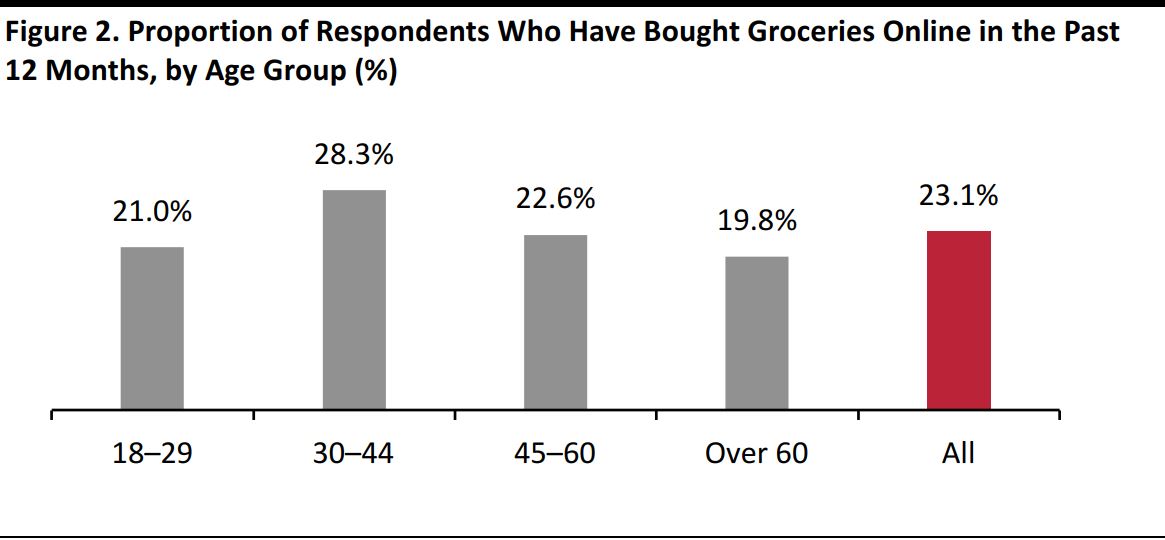

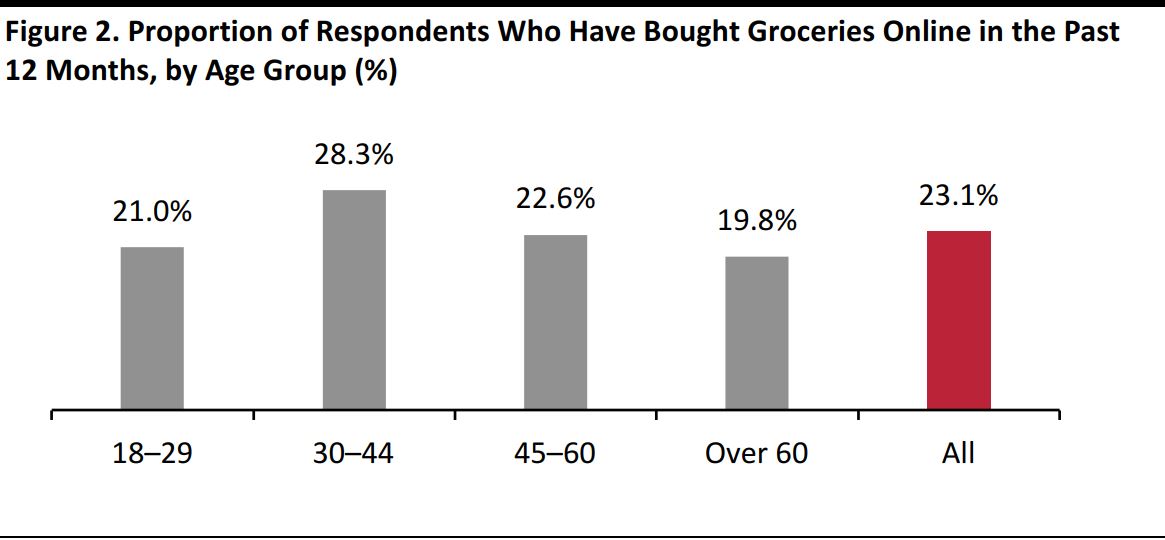

All age groups we surveyed registered strong levels of online grocery shopping. It is not a market led by the very youngest shoppers, however, as these consumers’ busy lifestyles and smaller households typically result in more last-minute, small-basket shops. It is shoppers ages 30–44who buy groceries online most often. Consumers in this group are likely to be more settled and, in many cases,to have young families, which drives up basket sizes and willingness to plan grocery shops ahead of time.

Base: 1,885 US Internet users ages 18+

Source: Coresight Research

Base: 1,885 US Internet users ages 18+

Source: Coresight Research

Our survey found that shopper penetration across US regions was fairly even, suggesting that online grocery shopping is not confined to a few large urban centers. One regional exception was the West North Central region, which was the only area where the proportion of consumers buying groceries online was less than 20%.

Online Grocery Shoppers: How Much They Spend Online

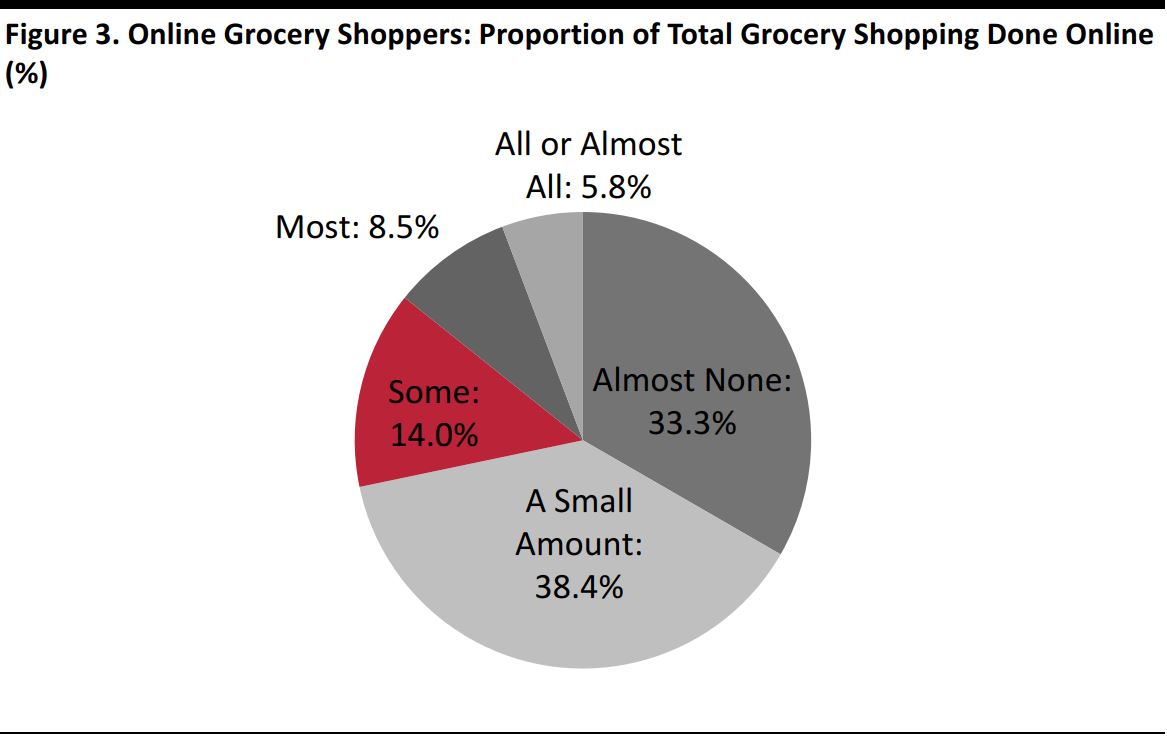

While almost one-quarter of consumers have bought groceries online, most online grocery shoppers buy only a very small share of all their groceries on the Internet.

- More than 70% of those surveyed who had bought groceries online in the past year said that they had purchased “almost none” oronly “a small amount” of their groceries online—i.e., they made just one or two online grocery purchases over the year (almost none) or purchased less than one-quarter of all their groceries online (a small amount).

- In total, only 14.3% of online grocery shoppers said that they had purchased “most” or “all or almost all” of their groceries online in the past 12 months.

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Thinking about how much of your total grocery shopping is done online, which of the following best describes your use of online grocery services? Please select one option.Respondents were given fuller descriptors as follows: I do almost none of my grocery shopping online (e.g., once or twice in the past year); I do a small amount of my grocery shopping online (e.g., less than one-quarter);I do some of my grocery shopping online (e.g., between a quarter and a half); I do most of my grocery shopping online (i.e., more than a half); I do all, or almost all, of my grocery shopping online.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Thinking about how much of your total grocery shopping is done online, which of the following best describes your use of online grocery services? Please select one option.Respondents were given fuller descriptors as follows: I do almost none of my grocery shopping online (e.g., once or twice in the past year); I do a small amount of my grocery shopping online (e.g., less than one-quarter);I do some of my grocery shopping online (e.g., between a quarter and a half); I do most of my grocery shopping online (i.e., more than a half); I do all, or almost all, of my grocery shopping online.

Source: Coresight Research

Online Grocery Shoppers: Where They Shop

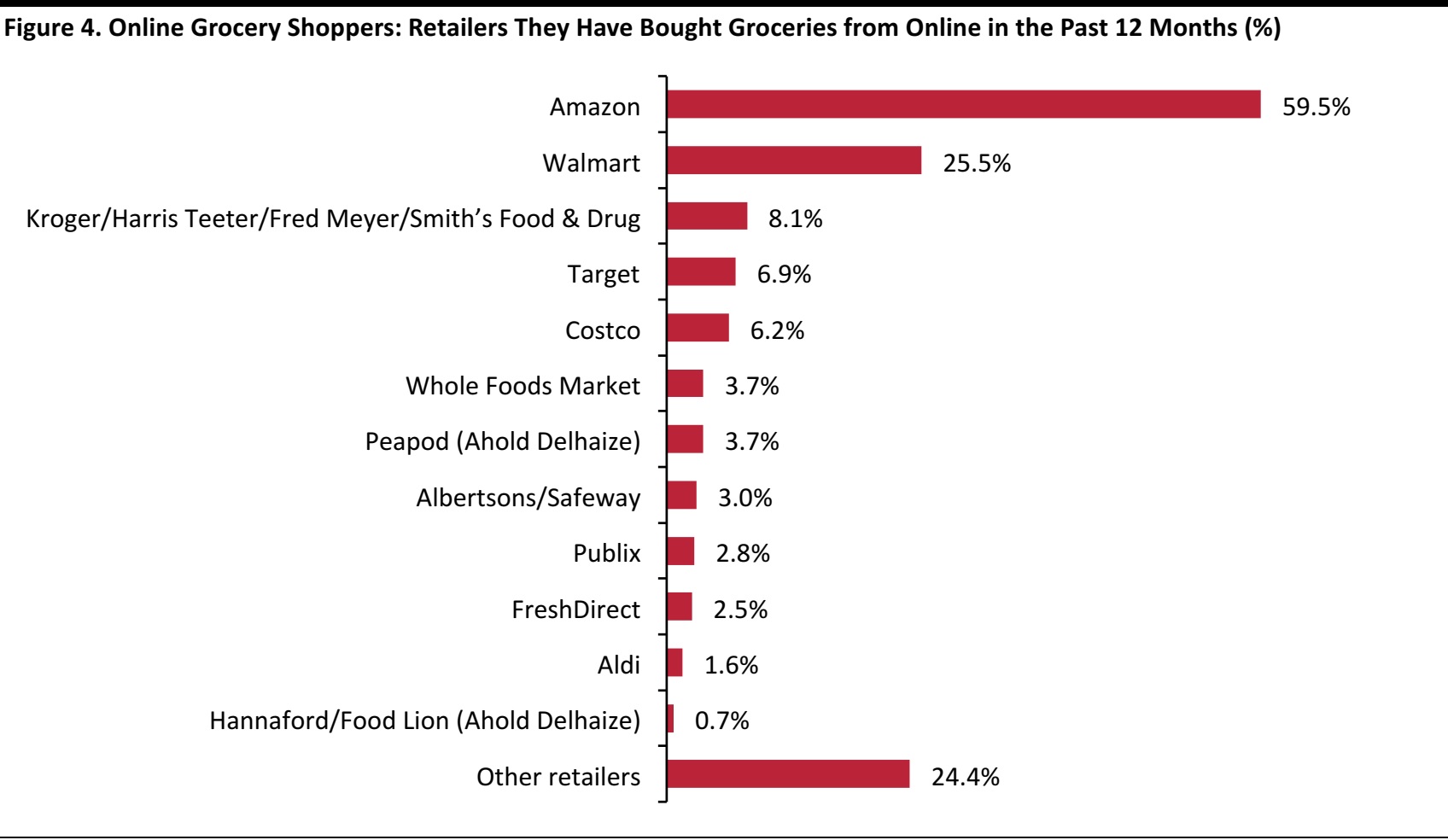

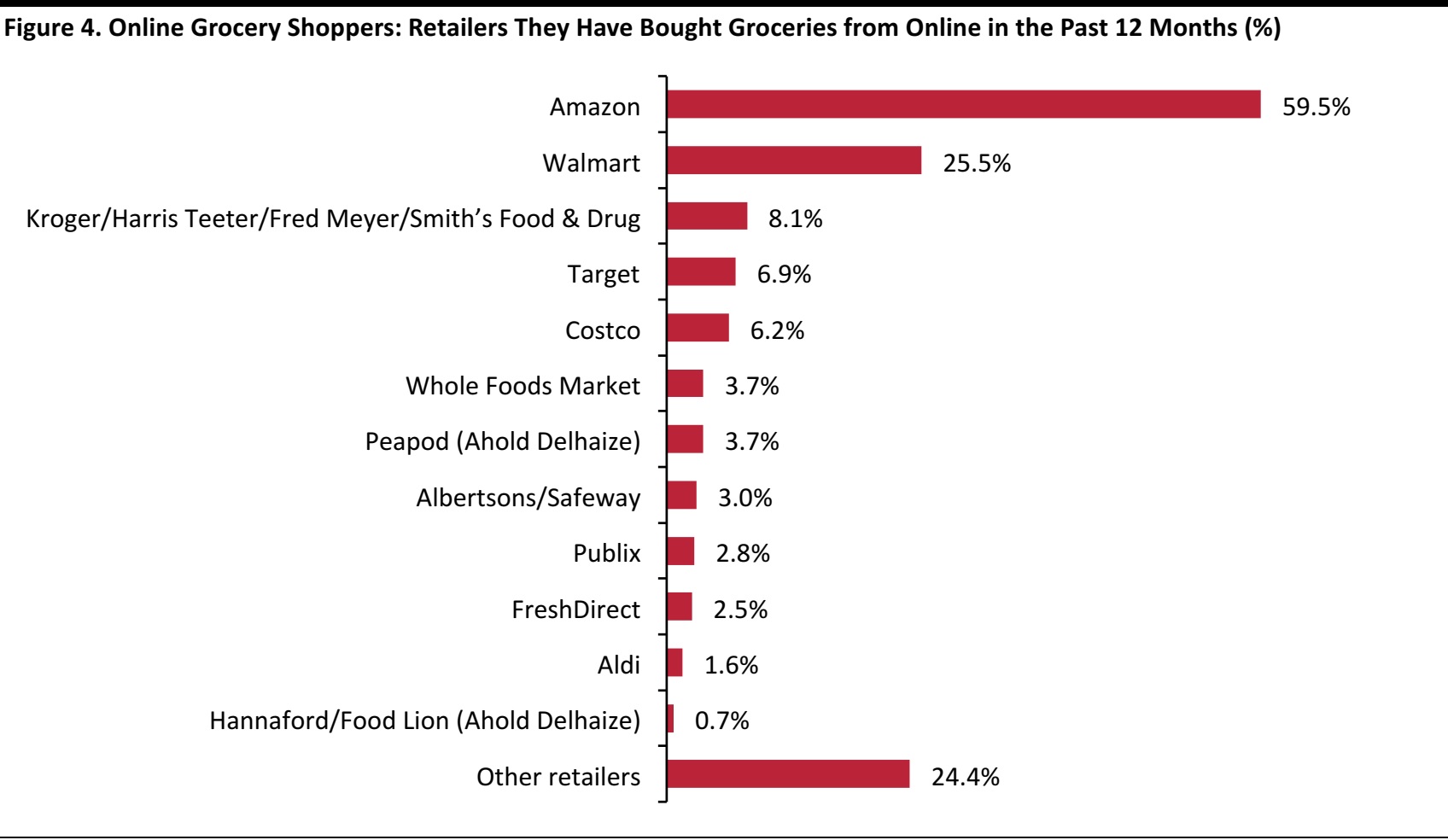

Amazon is by far the most popular retailer for online grocery purchases. Otherwise, Walmart, Kroger, Target and Costco are the only retailers with meaningful numbers of online grocery shoppers—and Walmart has a big lead among those retailers.

Amazon’s retreat from online-only grocery leaves Peapod and FreshDirect as the main pure plays in the space, although visitors to the websites of Giant and Stop & Shop (both of which, like Peapod, are owned by Ahold Delhaize) are directed to Peapod.com for online purchases, which enhances Peapod’s scale.

Only a very small number of consumers we surveyed said they shop at Peapod and FreshDirect. This may be attributable to the two pure plays’ limited geographic coverage: Peapod covers only 24 markets in eastern US states while FreshDirect delivers in only six states. These retailers see the highest penetration rates in the Mid-Atlantic region:a sizable 21% of online grocery shoppers in the region said that they had bought from Peapod in the past 12 months and 14% said that they had bought from FreshDirect.

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart? Select all that apply.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart? Select all that apply.

Source: Coresight Research

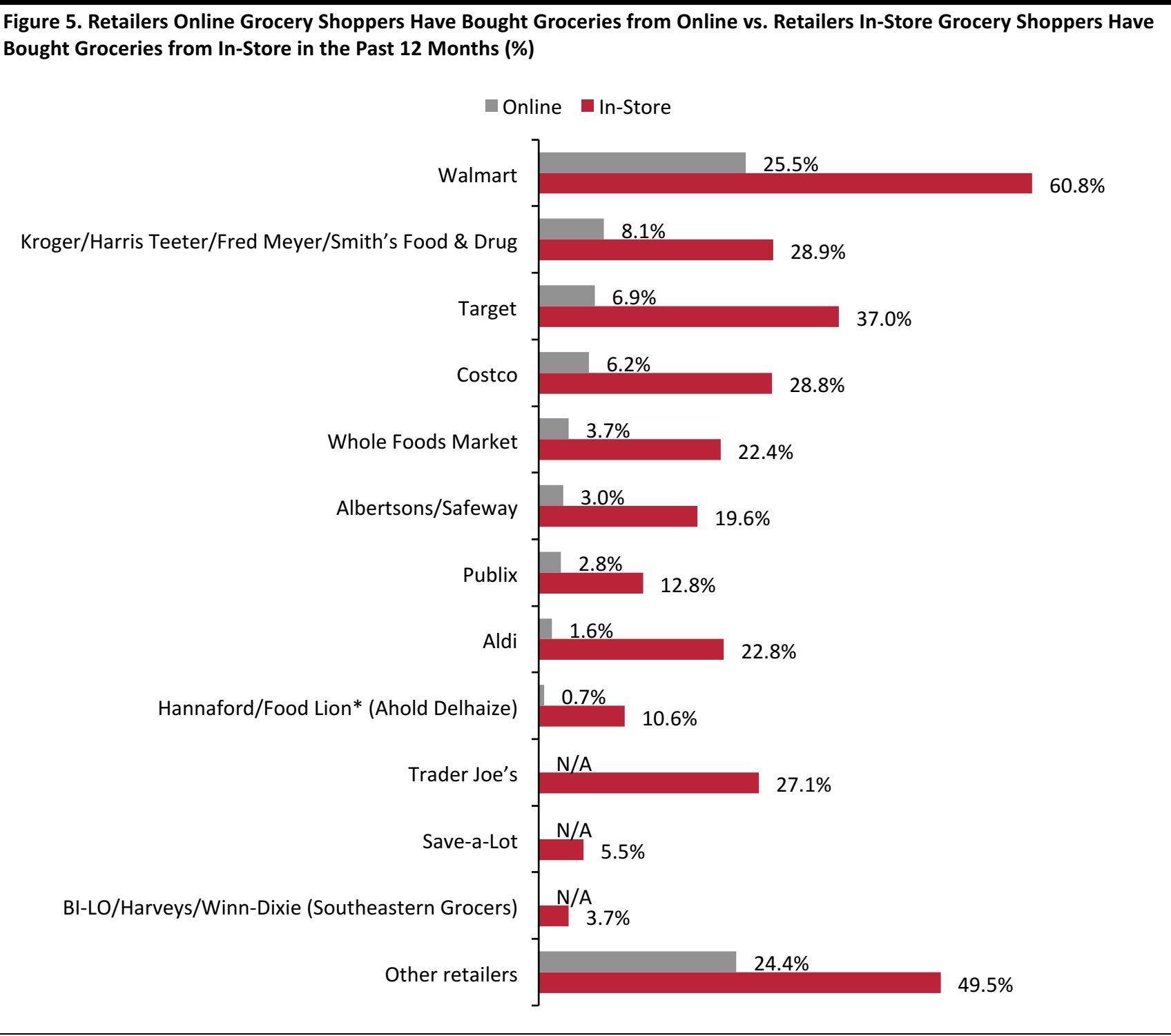

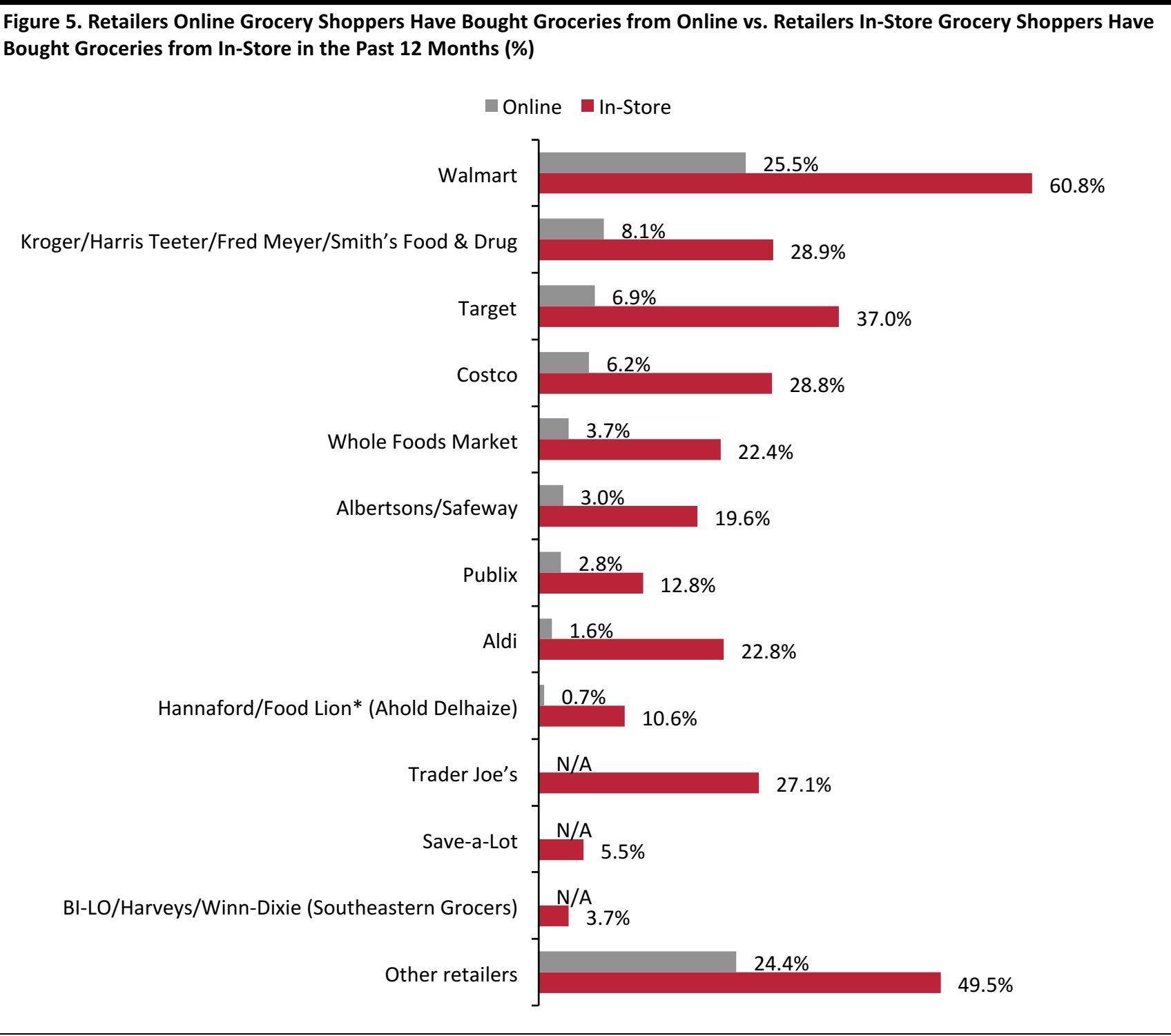

Online vs. Offline

We also asked respondents where they bought groceries in-store, and we provide an online/offline comparison for multichannel retailers below. These data confirm that, in online grocery, Walmart is outperforming key multichannel competitors:

- Walmart’s in-store shopper penetration rate is more than twice its online shopper penetration rate.

- Kroger’s in-store/online ratio is above three times. Kroger is in third place in terms of number of in-store shoppers, but in second place in terms of number of online shoppers.

- The in-store/online ratio is well above three times at Target, Costco and others, suggesting that these retailers punch below their weight online.

Notably fewer online grocery shoppers buy from Walmart.com (some 25.5%) than in-store grocery shoppers buy from Walmart stores (fully 60.8%). However, this is likely due to the very large share of shoppers that Amazon captures online, and we think that the most meaningful comparisons are between Walmart and its multichannel rivals.

Base: 1,815 US Internet users ages 18+ who have bought groceries in-store in the past 12 months and 435 who have bought groceries online in the past 12 months

Figures are respective percentages of all those who have bought groceries in-store and all those who have bought groceries online. Online-only retailers Amazon, Peapod and FreshDirect have been excluded from this chart.

*In-store option included Giant and Stop & Shop, which are also owned by Ahold Delhaize but which do not sell under their own banners online.

Survey questions: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart?/Which retailers have you bought any groceries from in-store in the past 12 months?

Source: Coresight Research

Base: 1,815 US Internet users ages 18+ who have bought groceries in-store in the past 12 months and 435 who have bought groceries online in the past 12 months

Figures are respective percentages of all those who have bought groceries in-store and all those who have bought groceries online. Online-only retailers Amazon, Peapod and FreshDirect have been excluded from this chart.

*In-store option included Giant and Stop & Shop, which are also owned by Ahold Delhaize but which do not sell under their own banners online.

Survey questions: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart?/Which retailers have you bought any groceries from in-store in the past 12 months?

Source: Coresight Research

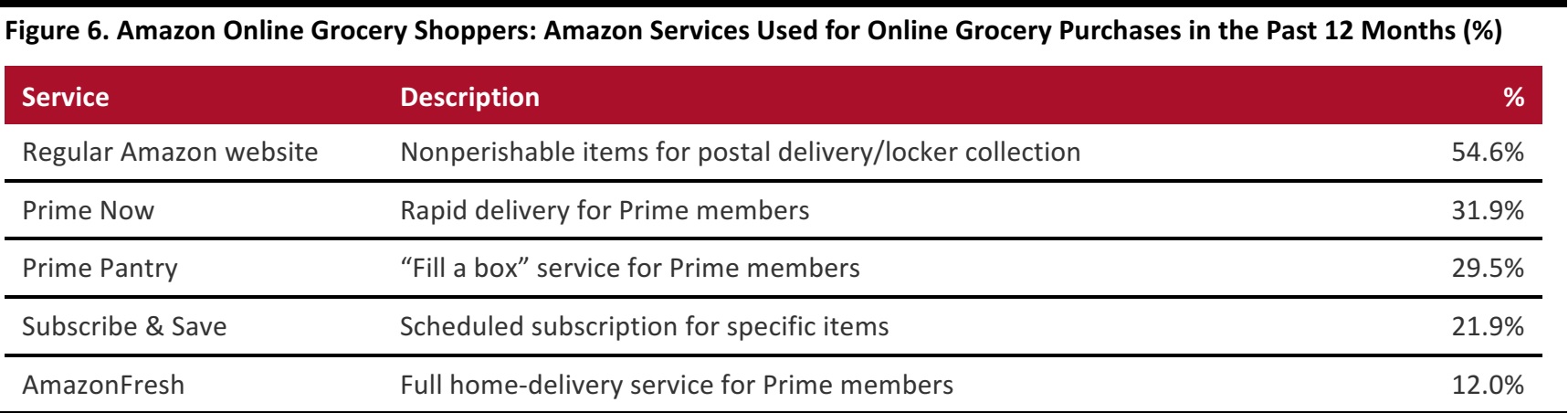

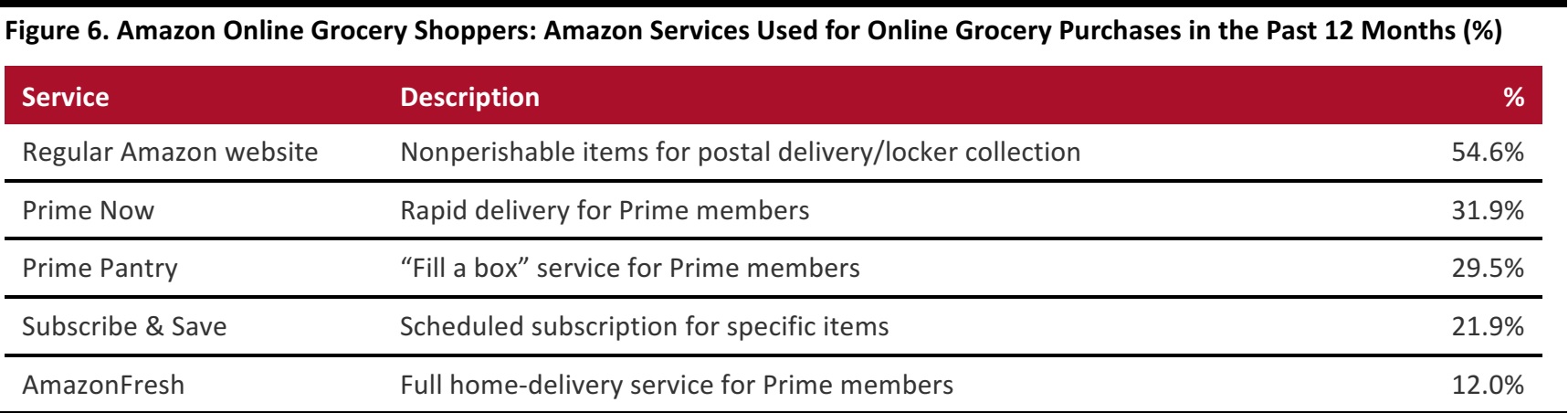

Amazon Grocery Shoppers: Full-Range AmazonFresh Is Amazon’s Least-Popular Grocery Service

Amazon may be the top choice among consumers buying grocery items online, but few shoppers appear to be using the site for regular, full-basket food orders. Amazon sells groceries through a number of services, so we asked those shoppers who had bought groceries on the site in the past 12 months which of its services they had used.

- Amazon’s regular website is by far its most-used grocery service. This is significant because the regular site is limited to ambient grocery products that are shipped, one or a few items at a time, through the mail, which makes it all but impossible to shop for a basket of conventional groceries on the site.

- AmazonFreshis Amazon’s only full-range grocery service, but it is the company’s least-popular option, according to our survey, with just 12% of Amazon grocery shoppers saying they had used this service. The limited regional coverage of AmazonFresh depresses the national average: the service now offers delivery only to certain areas of New York City, Boston, Chicago, Philadelphia and Los Angeles.

- Moreover, survey respodents use Subscribe & Save—through which Amazon mails out individual, nonperishable items on a scheduled basis(such as once a month)—much more heavily than AmazonFresh.

Base: 251 US Internet users ages 18+ who have bought groceries online on Amazon in the past 12 months

Survey question: You have indicated that you have bought groceries on Amazon. Which of the following Amazon services have you used for grocery purchases in the past 12 months? Select all that apply.

Source: Coresight Research

Base: 251 US Internet users ages 18+ who have bought groceries online on Amazon in the past 12 months

Survey question: You have indicated that you have bought groceries on Amazon. Which of the following Amazon services have you used for grocery purchases in the past 12 months? Select all that apply.

Source: Coresight Research

Our data also show that Amazon shoppers are more likely than average to use the Internet for only a small portion of their grocery purchases. By contrast, those who have bought groceries online from Walmart in the past 12 months are more likely than average to do most or all of their grocery shopping online.

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months, including 259 Amazon online grocery shoppers and 111 Walmart online grocery shoppers

Numbers may not sum to 100 due to rounding.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months, including 259 Amazon online grocery shoppers and 111 Walmart online grocery shoppers

Numbers may not sum to 100 due to rounding.

Source: Coresight Research

As we show in the next section, shoppers’ irregular usage of Amazon is also reflected in the types of grocery categories they buy on the site.

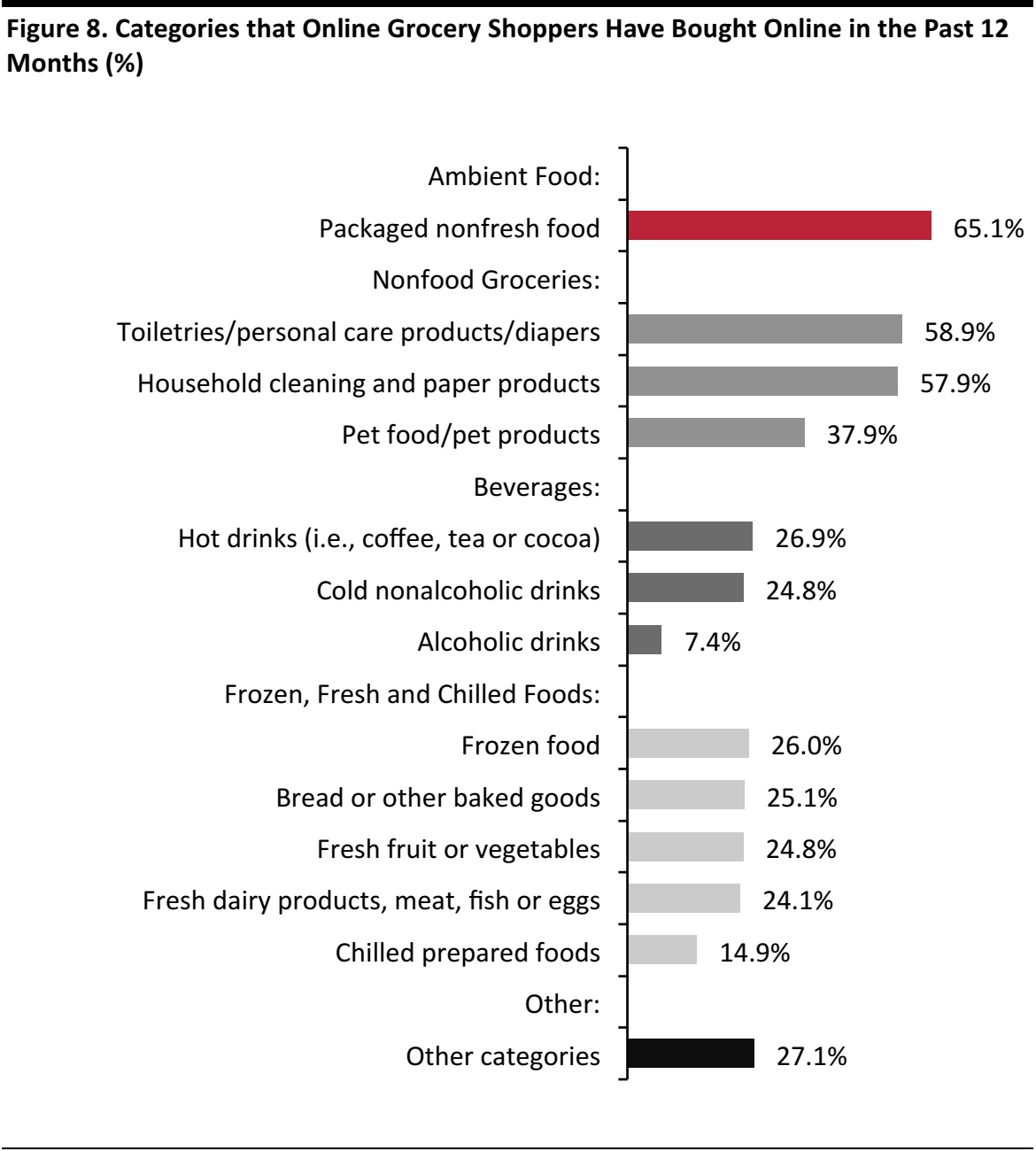

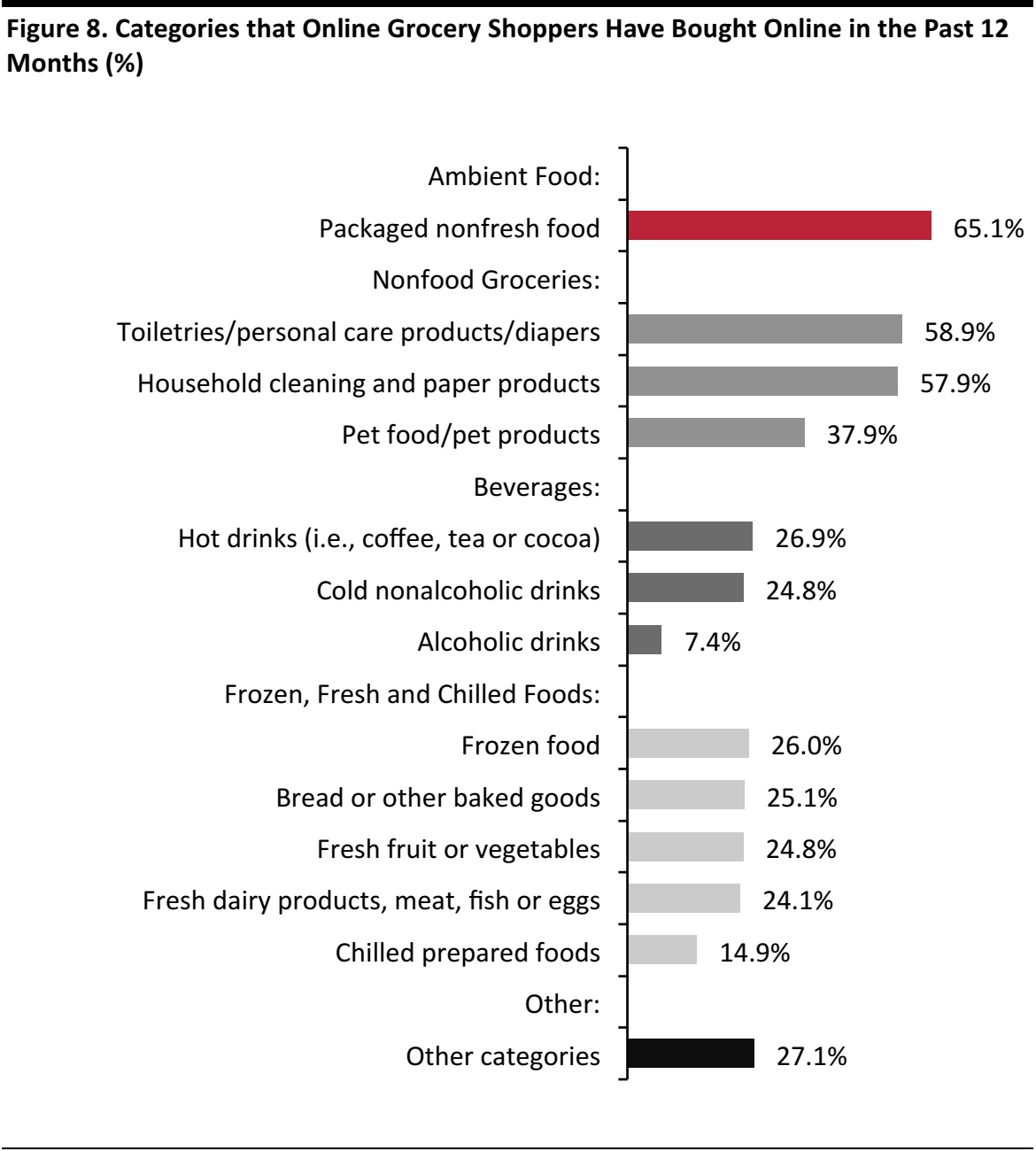

Online Grocery Shoppers: What They Buy

We asked shoppers what grocery products they had bought online in the past year, and the survey results confirm that consumers remain reluctant to buy fresh food online. Apart from alcoholic drinks, the categories shoppers said they bought the least often online were chilled prepared foods and fresh dairy products, meat, fish or eggs. Fresh fruit or vegetables also ranked relatively low in terms of online purchase frequency.

While packaged nonfresh food ranked highest, the category’s popularity is somewhat skewed by its breadth.Reflecting this breadth, our survey question defined the category as encompassing“chocolate, canned foods, breakfast cereals, snacks, pasta, rice, prepared sauces, etc.”

The survey results showed that nonfood groceries, such as toiletries, household cleaning products and pet food, are very popular categories for online purchase.Such nonperishables are well suited for e-commerce and shoppers frequently buy them from trusted brands, and so do not feel a need to see or choose the products in person.

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Which of the following grocery categories have you purchased online in the past 12 months? Select all that apply.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Which of the following grocery categories have you purchased online in the past 12 months? Select all that apply.

Source: Coresight Research

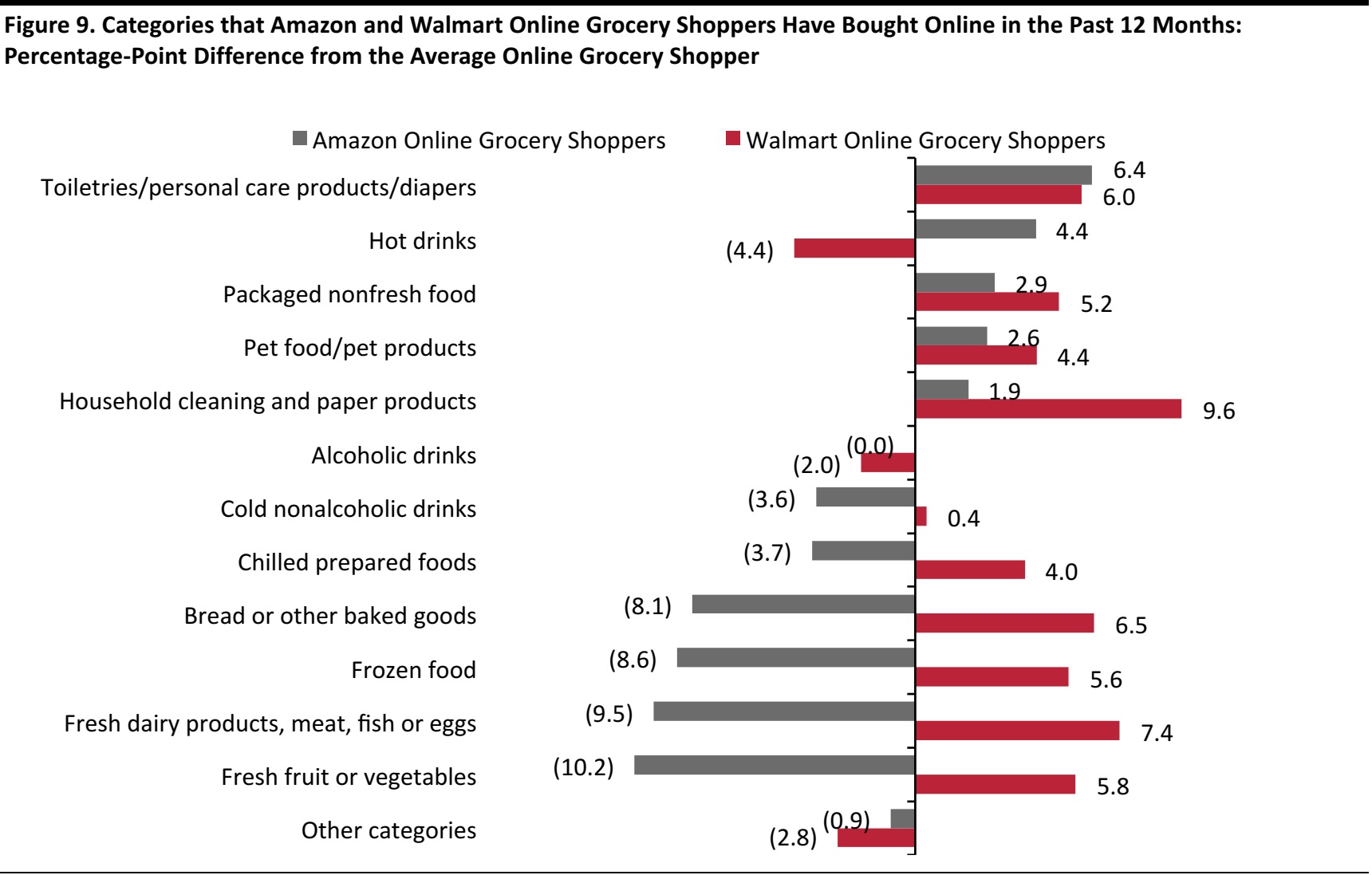

Notably, Amazon grocery shoppers are much less likely than the average shopper to purchase fresh and frozen categories online. As we chart below, Amazon online grocery shoppers were approximately 10 percentage points

less likely than average to have bought fresh dairy, meat, fish or eggs, or fresh fruit or vegetables, online. These figures further support the conclusion that shoppers look to Amazon less often than other online grocery retailers when they need to undertake a regular, full-basket grocery shop.

Walmart online grocery shoppers are significantly

more likely than the average shopper to buy fresh and frozen food categories online. This supports the perception that shoppers are turning to Walmart for full-basket grocery shops.

Base: 259Internet users ages 18+ who have bought groceries online from Amazon in the past 12 months and 111 US Internet users ages 18+ who have bought groceries online from Walmart in the past 12 months

Source: Coresight Research

Base: 259Internet users ages 18+ who have bought groceries online from Amazon in the past 12 months and 111 US Internet users ages 18+ who have bought groceries online from Walmart in the past 12 months

Source: Coresight Research

Delivery or Collection?

Reflecting the wide scale rollout of collection services by a number of grocery retailers that sell online and somewhat patchy home-delivery coverage, online grocery shoppers are slightly more likely to pick up their orders than to have them delivered.

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: In the past 12 months, have you mainly had online grocery orders delivered to you or have you mainly collected them (e.g., from a store)? Select one option.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: In the past 12 months, have you mainly had online grocery orders delivered to you or have you mainly collected them (e.g., from a store)? Select one option.

Source: Coresight Research

- Survey respondents who had bought groceries on Amazon in the past 12 months were more likely to have had their grocery orders delivered than to have collected them. This reflects the fact that Amazon’s collection offerings are limited: the company does not have stores that serve as regular collection points, so shoppers who want to pickup their Amazon.com orders must have their items shipped to a location that has pickup lockers (some Whole Foods stores have these lockers). The company has also operated two AmazonFresh Pickup centers in Seattle since March 2017.

- Conversely, those who have shopped online at Walmart and Kroger are much more likely to have collected most of their grocery orders than to have had them delivered.

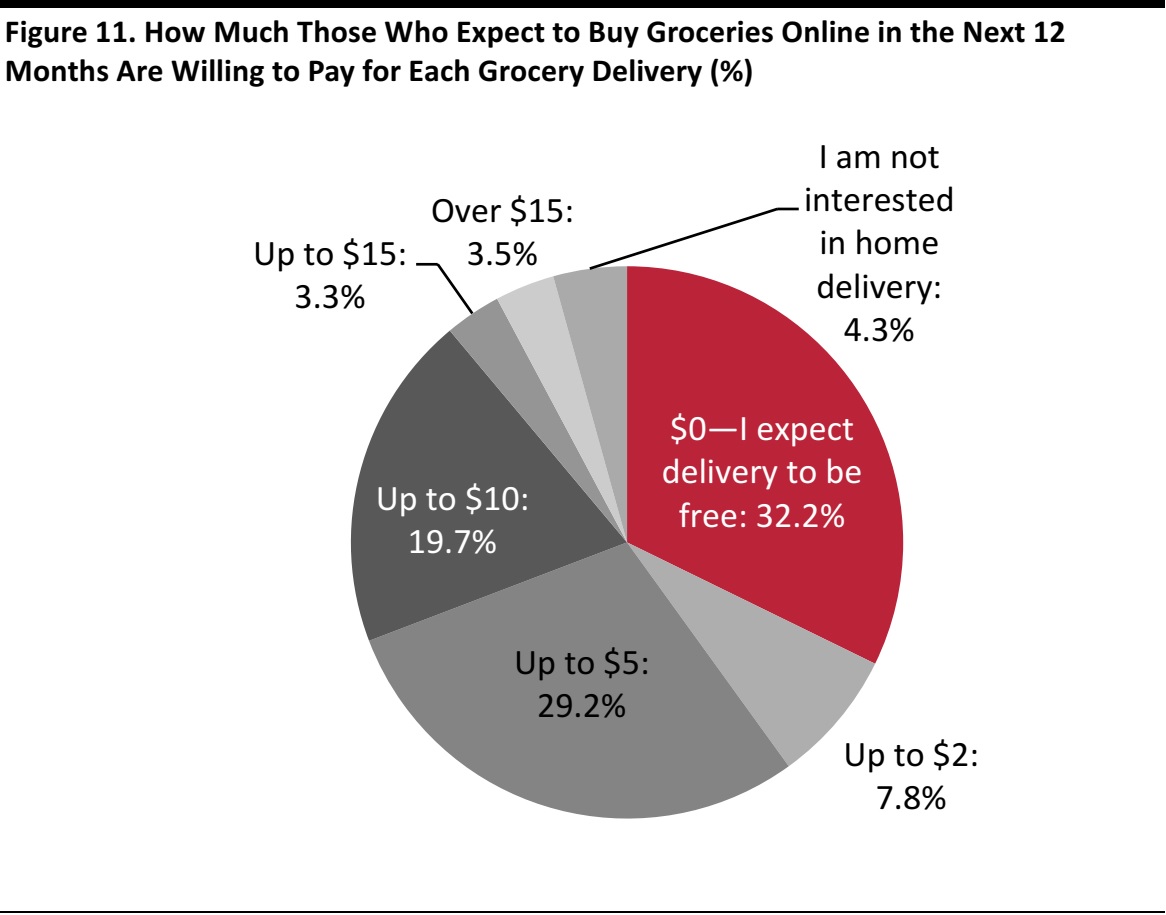

How Much Shoppers Will Pay for Delivery

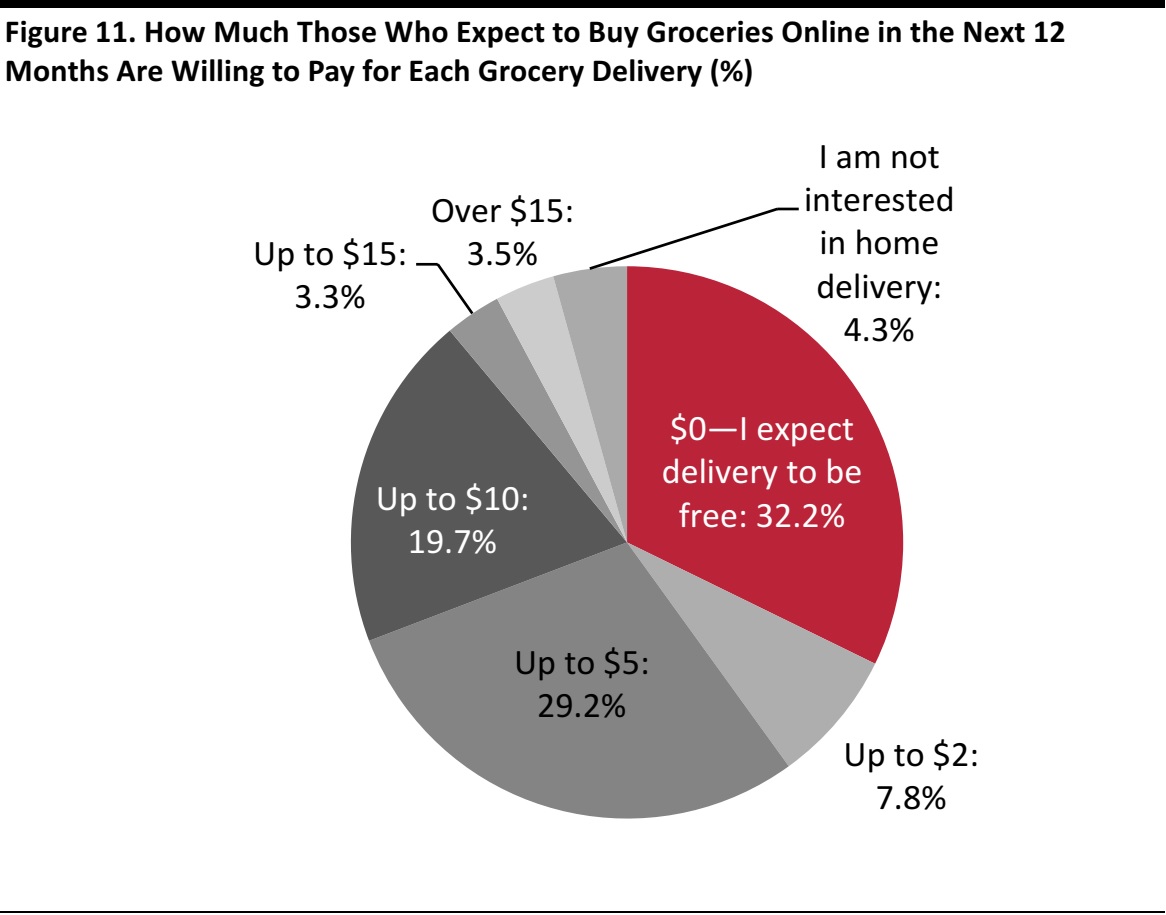

We asked those respondents who expect to buy groceries online in the next 12 months how much they would be willing to pay for delivery. While almost one-third expect delivery to be free, a sizable 29% said they would pay up to $5 and nearly 20% said they would pay up to $10.

For context, Walmart charges $9.95 for each grocery delivery, while Instacart typically charges $5.99 per delivery for those without an annual subscription to Instcart Express.Target-owned Shipt charges $7 for delivery of orders under $35, but users must pay for a membership, too. Peapod charges $6.95–$9.95 for delivery.

Base: 487 US Internet users ages 18+ who expect to buy groceries online in the next 12 months

Survey question:How much would you be willing to pay in delivery charges for each grocery home delivery? Select one option.

Source: Coresight Research

Base: 487 US Internet users ages 18+ who expect to buy groceries online in the next 12 months

Survey question:How much would you be willing to pay in delivery charges for each grocery home delivery? Select one option.

Source: Coresight Research

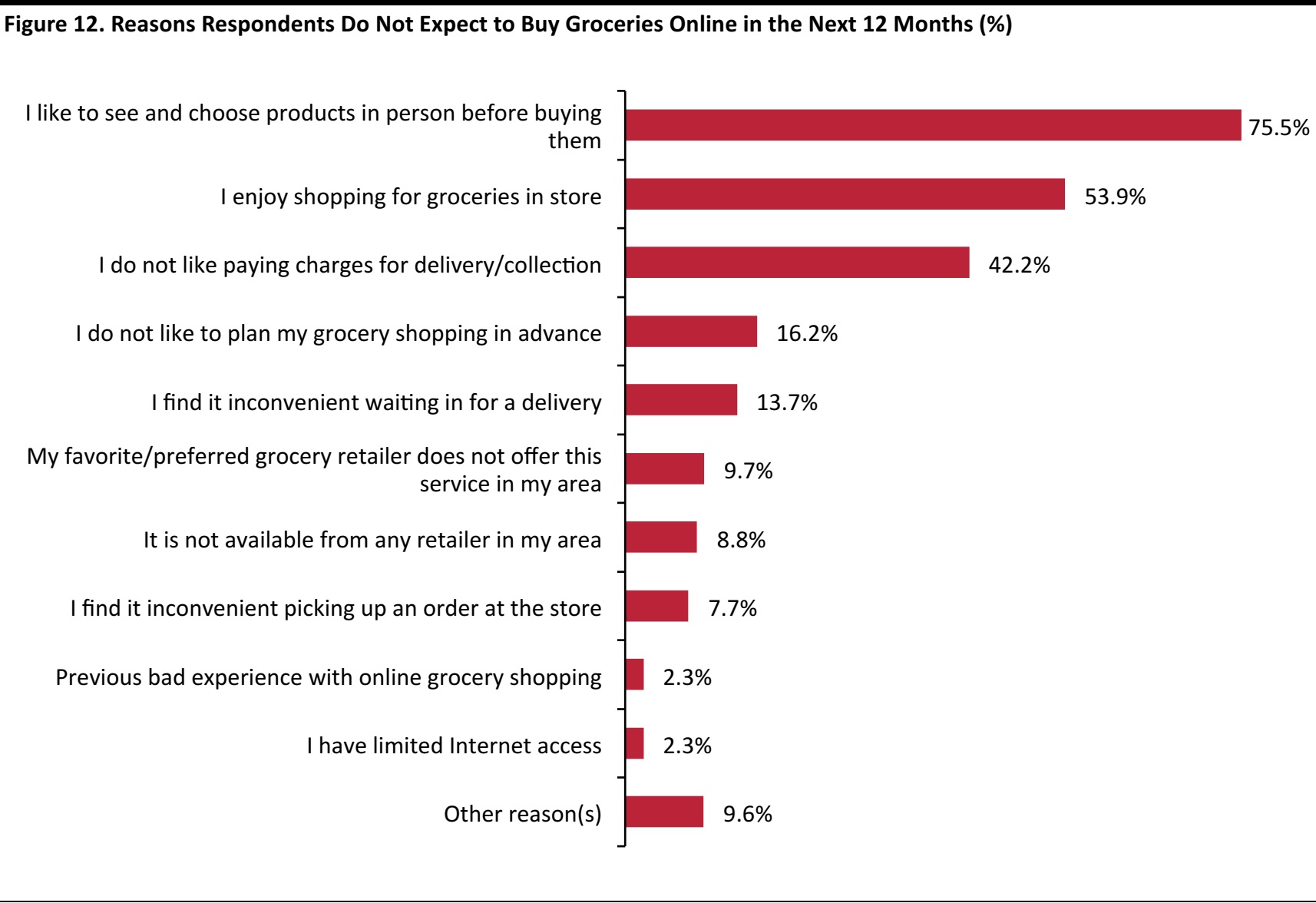

Online Grocery Holdouts: Why They Do Not Shop Online

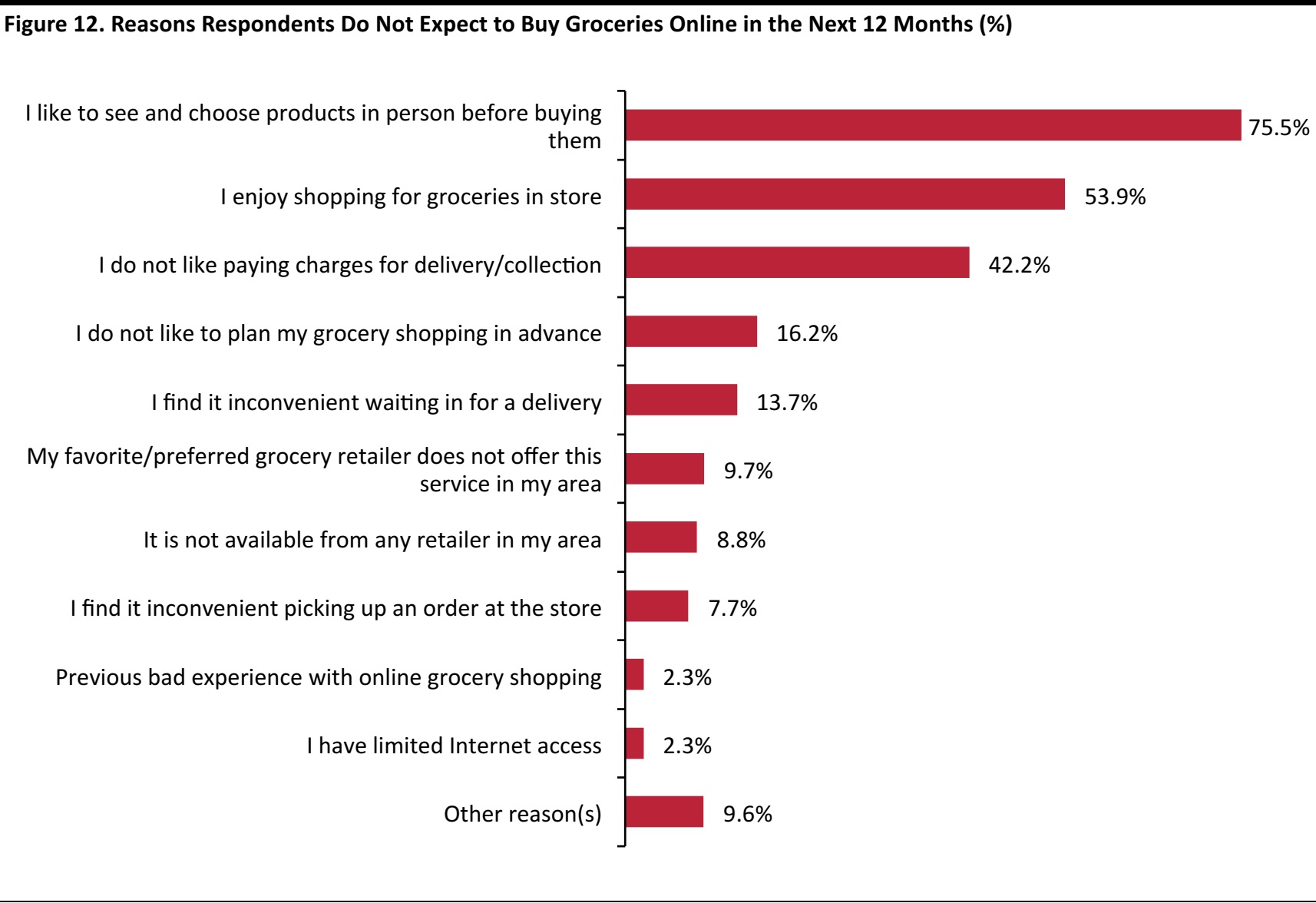

As we noted earlier, just over half of those we surveyed told us that they do not expect to buy groceries online in the next 12 months. We asked them why that is, andthe group cited three particular reasons much more frequently than all the other possible reasons presented in the survey:

- Fully three-quarters of the group indicated that they want to see and choose their own grocery items.

- Over half actually enjoy shopping for groceries in a store.

- More than 40% are resistant to delivery or collection charges—although some retailers, such as Walmart, do not impose collection charges.

Base: 1,014 US Internet users ages 18+ who do not expect to buy groceries online in the next 12 months

Source: Coresight Research

Base: 1,014 US Internet users ages 18+ who do not expect to buy groceries online in the next 12 months

Source: Coresight Research

Key Takeaways

- Some 54% of consumers we surveyed do not expect to buy groceries online in the next 12 months, meaning that approximately half of all consumers are “up for grabs” among online grocery retailers.

- Cross-channel retailing is emerging as the dominant model in the US grocery sector: collection, rather than delivery, is the most popular means of receiving online orders, and Amazon has been paring back its online-only operations while building out its brick-and-mortar capabilities.

- We think online grocery could be polarized in the future, with low-cost, collection-based services fulfilling the majority of large, family-type orders and premium services such as Amazon Prime Now and Shipt fulfilling smaller orders via same-day delivery.

Survey Methodology

For this report, we conducted an online survey of 1,885 demographically representative, Internet-using American adults between March 15 and March 24, 2018. Online surveys represent Internet users and, according to the Pew Research Center’s latest published data, 88% of Americans were Internet users in 2016. The proportion of the total US population using the Internet has been climbing by around two percentage points per year, according to Pew data. So, in March 2018, when we undertook our survey, it is likely that approximately 90%–91% of Americans were Internet users.

The groceries category covers more than food, and respondents were given the following definition: “By groceries, we mean the kind of food and nonfood products that you regularly buy from a grocery store, including food, drink, pet food, household cleaning products (e.g., laundry detergent) and personal care products (e.g., shampoo, diapers).”

Base: 1,885 US Internet users ages 18+

Survey questions: Have you bought groceries online in the past 12 months?/Looking ahead, do you expect to buy groceries online in the next 12 months?

Source: Coresight Research

Base: 1,885 US Internet users ages 18+

Survey questions: Have you bought groceries online in the past 12 months?/Looking ahead, do you expect to buy groceries online in the next 12 months?

Source: Coresight Research Base: 1,885 US Internet users ages 18+

Source: Coresight Research

Base: 1,885 US Internet users ages 18+

Source: Coresight Research Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Thinking about how much of your total grocery shopping is done online, which of the following best describes your use of online grocery services? Please select one option.Respondents were given fuller descriptors as follows: I do almost none of my grocery shopping online (e.g., once or twice in the past year); I do a small amount of my grocery shopping online (e.g., less than one-quarter);I do some of my grocery shopping online (e.g., between a quarter and a half); I do most of my grocery shopping online (i.e., more than a half); I do all, or almost all, of my grocery shopping online.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Thinking about how much of your total grocery shopping is done online, which of the following best describes your use of online grocery services? Please select one option.Respondents were given fuller descriptors as follows: I do almost none of my grocery shopping online (e.g., once or twice in the past year); I do a small amount of my grocery shopping online (e.g., less than one-quarter);I do some of my grocery shopping online (e.g., between a quarter and a half); I do most of my grocery shopping online (i.e., more than a half); I do all, or almost all, of my grocery shopping online.

Source: Coresight Research Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart? Select all that apply.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart? Select all that apply.

Source: Coresight Research Base: 1,815 US Internet users ages 18+ who have bought groceries in-store in the past 12 months and 435 who have bought groceries online in the past 12 months

Figures are respective percentages of all those who have bought groceries in-store and all those who have bought groceries online. Online-only retailers Amazon, Peapod and FreshDirect have been excluded from this chart.

*In-store option included Giant and Stop & Shop, which are also owned by Ahold Delhaize but which do not sell under their own banners online.

Survey questions: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart?/Which retailers have you bought any groceries from in-store in the past 12 months?

Source: Coresight Research

Base: 1,815 US Internet users ages 18+ who have bought groceries in-store in the past 12 months and 435 who have bought groceries online in the past 12 months

Figures are respective percentages of all those who have bought groceries in-store and all those who have bought groceries online. Online-only retailers Amazon, Peapod and FreshDirect have been excluded from this chart.

*In-store option included Giant and Stop & Shop, which are also owned by Ahold Delhaize but which do not sell under their own banners online.

Survey questions: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart?/Which retailers have you bought any groceries from in-store in the past 12 months?

Source: Coresight Research Base: 251 US Internet users ages 18+ who have bought groceries online on Amazon in the past 12 months

Survey question: You have indicated that you have bought groceries on Amazon. Which of the following Amazon services have you used for grocery purchases in the past 12 months? Select all that apply.

Source: Coresight Research

Base: 251 US Internet users ages 18+ who have bought groceries online on Amazon in the past 12 months

Survey question: You have indicated that you have bought groceries on Amazon. Which of the following Amazon services have you used for grocery purchases in the past 12 months? Select all that apply.

Source: Coresight Research Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months, including 259 Amazon online grocery shoppers and 111 Walmart online grocery shoppers

Numbers may not sum to 100 due to rounding.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months, including 259 Amazon online grocery shoppers and 111 Walmart online grocery shoppers

Numbers may not sum to 100 due to rounding.

Source: Coresight Research Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Which of the following grocery categories have you purchased online in the past 12 months? Select all that apply.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: Which of the following grocery categories have you purchased online in the past 12 months? Select all that apply.

Source: Coresight Research Base: 259Internet users ages 18+ who have bought groceries online from Amazon in the past 12 months and 111 US Internet users ages 18+ who have bought groceries online from Walmart in the past 12 months

Source: Coresight Research

Base: 259Internet users ages 18+ who have bought groceries online from Amazon in the past 12 months and 111 US Internet users ages 18+ who have bought groceries online from Walmart in the past 12 months

Source: Coresight Research Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: In the past 12 months, have you mainly had online grocery orders delivered to you or have you mainly collected them (e.g., from a store)? Select one option.

Source: Coresight Research

Base: 435 US Internet users ages 18+ who have bought groceries online in the past 12 months

Survey question: In the past 12 months, have you mainly had online grocery orders delivered to you or have you mainly collected them (e.g., from a store)? Select one option.

Source: Coresight Research Base: 487 US Internet users ages 18+ who expect to buy groceries online in the next 12 months

Survey question:How much would you be willing to pay in delivery charges for each grocery home delivery? Select one option.

Source: Coresight Research

Base: 487 US Internet users ages 18+ who expect to buy groceries online in the next 12 months

Survey question:How much would you be willing to pay in delivery charges for each grocery home delivery? Select one option.

Source: Coresight Research Base: 1,014 US Internet users ages 18+ who do not expect to buy groceries online in the next 12 months

Source: Coresight Research

Base: 1,014 US Internet users ages 18+ who do not expect to buy groceries online in the next 12 months

Source: Coresight Research