DIpil Das

What’s the Story?

The off-price model has traditionally been unchallenged. It is largely based on a physical retail model of frequently changing inventory or unique items sourced from a multitude of buyers, creating a diverse product portfolio. Due to low average unit retail (AUR) combined with a high number of different product SKUs (stock-keeping units), off-price retailers report that it is not cost-effective to replicate the shopping experience online, and it would be challenging to do so. However, retailers in the US off-price sector are now under pressure from heightened competition and consumer demand, particularly amid pandemic-led shifts to e-commerce. In this report, we explore how retailers both within and outside the off-price sector are challenging the value-retail landscape by expanding their assortments, channels and offerings. We discuss the increasing competition for the major US off-price retailers—namely, Burlington Stores, Nordstrom Rack, Ross Stores and The TJX Companies.Why It Matters

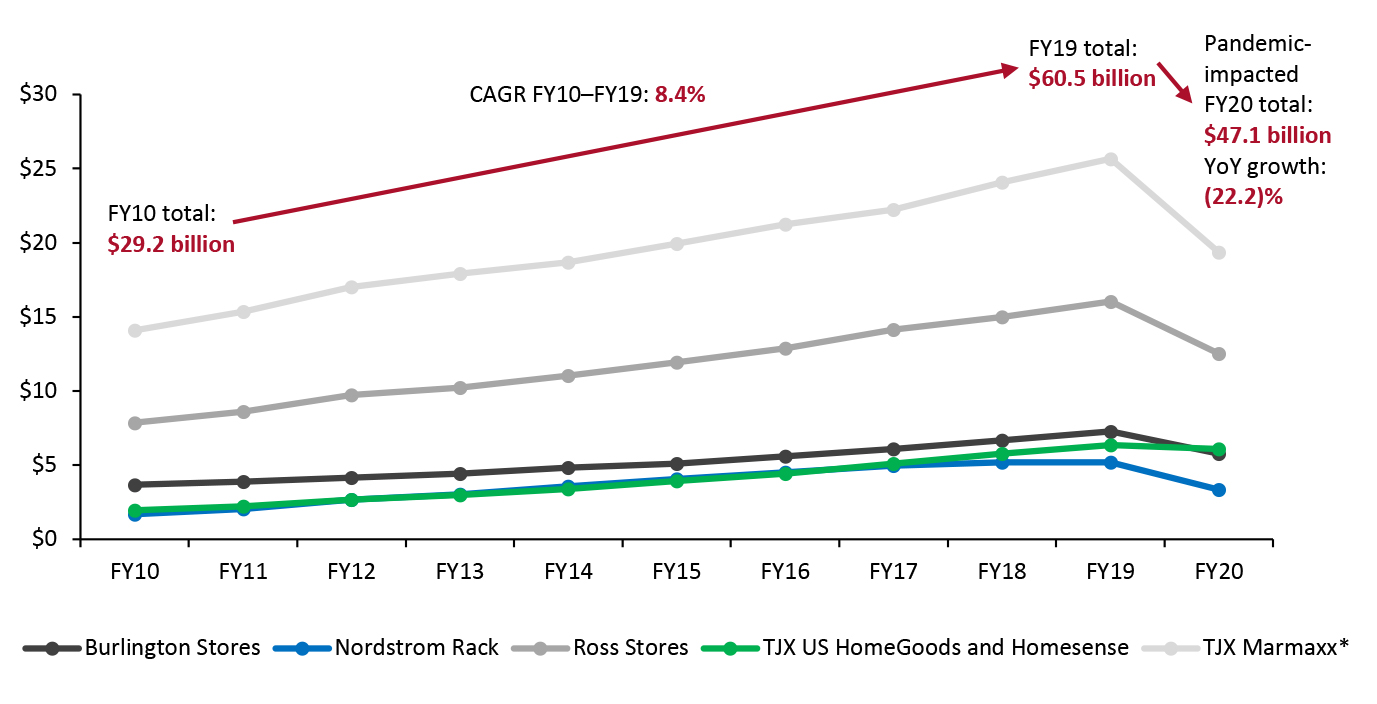

The off-price retail sector was growing steadily prior to the Covid-19 pandemic, with the five major retail banners in the sector posting positive year-over-year revenue growth between fiscal 2010 and fiscal 2019, as shown in Figure 1. However, fiscal 2020 saw overall revenue across the major off-price banners decline by 22.2%, to $47.1 billion, Coresight Research estimates.Figure 1. US Off-Price Retail Sector: Revenue by Major Retail Banner (USD Bil.) [caption id="attachment_135888" align="aligncenter" width="726"]

For the purposes of comparison in this report, we refer to FY20 (fiscal 2020) as the year ended January 30, 2021, although The TJX Companies refers to this year as FY21 in its reports.

For the purposes of comparison in this report, we refer to FY20 (fiscal 2020) as the year ended January 30, 2021, although The TJX Companies refers to this year as FY21 in its reports. *TJX Marmaxx includes Marshalls, T.J. Maxx and Sierra banners

Source: Company reports/Coresight Research [/caption] The pandemic-impacted retail environment gave rise to the omnichannel shopper, with more consumers turning to the online channel as they prioritized convenience and speed in the shopping journey, as much as product uniqueness. Retailers in other sectors are encroaching on the value territory by offering consumers compelling combinations of convenience and fast delivery while growing the number of product options through private labels and exclusive designer collaborations, particularly in the apparel, home and beauty categories. In order to remain competitive moving forward, off-price retailers must be aware of new competitors and developments by existing players in the market, and strategize effectively to differentiate their brands and offerings, both online and offline.

US Off-Pricers Face Heightened Competition: Coresight Research Analysis

We identify four defining characteristics of the off-price sector, which we detail below to provide context for the retail competition that we explore in the following sections of this report.- A variety of unique, different merchandise usually sourced from multiple suppliers—Off-price retailers often refer to their assortment as a “treasure hunt” for the consumer. Usually there very few items per style and varied styles dependent upon the selection that buyers find in the market.

- Deeply discounted prices, generally 20%–70% below full-price retailers’ prices—The AUR is $11–$12 at Burlington Stores, $10–$11 at Ross Stores and $14–$15 at The TJX Companies, according to the companies’ latest available data.

- Frequent inventory deliveries—Off-price retailers report that store inventories are replenished often, sometimes two to three times per week, which helps to drive traffic.

- Physical retail presence—Off-price retailers are invested heavily in physical locations with few having an online presence.

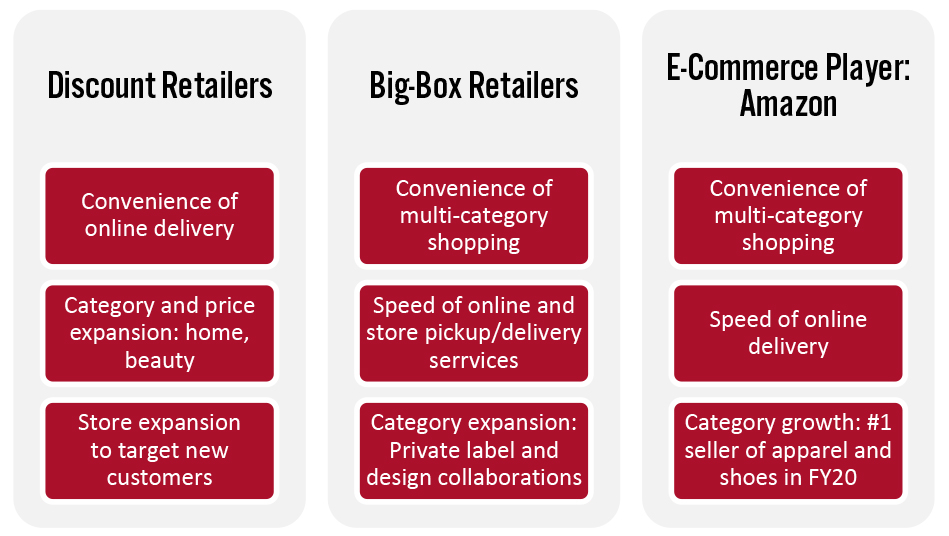

Figure 2. Competition for the Off-Price Sector from Three Types of Retailers [caption id="attachment_135889" align="aligncenter" width="724"]

Source: Coresight Research[/caption]

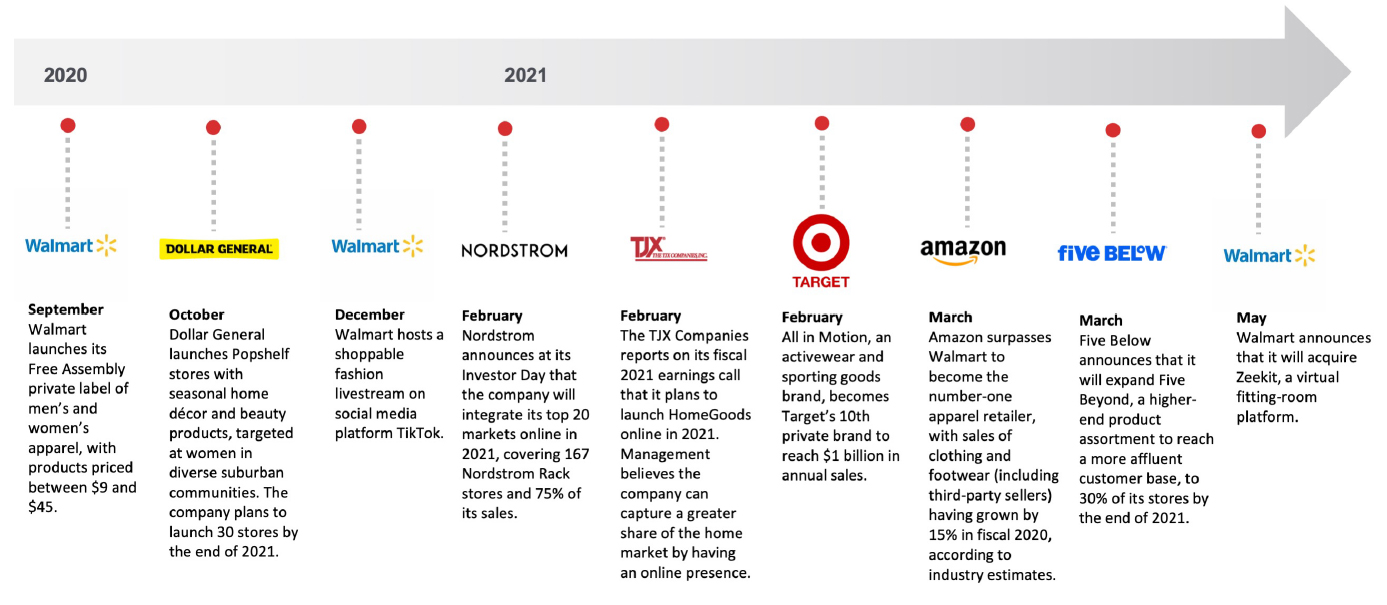

In Figure 3, we highlighted recent developments in the off-price sector that demonstrate the emerging competition from major US retailers.

Source: Coresight Research[/caption]

In Figure 3, we highlighted recent developments in the off-price sector that demonstrate the emerging competition from major US retailers.

Figure 3. Timeline of Recent Developments Related to Off-Price Retail Competition [caption id="attachment_135890" align="aligncenter" width="724"]

Source: Coresight Research [/caption]

Discount Retailers: Expanded Categories, Price Points and Physical Store Portfolios

Discount retailers are expanding price points, allowing them to offer a broader range of products across the home, pet products, small electronics and beauty categories. While discount retailers offer very limited competition in the apparel space, the retailers are providing competition for off-price retailers across other categories including home and beauty. Discount retailers are also offering consumers online options and partnering with Instacart for at home delivery, a competitive advantage over off-price retail as the majority do not have an online presence.

Discounters Dollar General and Five Below launched expanded price and category concepts last year, and due to their success, both are planning aggressive expansions with a combined 350 new locations in 2021, according to company reports.

Source: Coresight Research [/caption]

Discount Retailers: Expanded Categories, Price Points and Physical Store Portfolios

Discount retailers are expanding price points, allowing them to offer a broader range of products across the home, pet products, small electronics and beauty categories. While discount retailers offer very limited competition in the apparel space, the retailers are providing competition for off-price retailers across other categories including home and beauty. Discount retailers are also offering consumers online options and partnering with Instacart for at home delivery, a competitive advantage over off-price retail as the majority do not have an online presence.

Discounters Dollar General and Five Below launched expanded price and category concepts last year, and due to their success, both are planning aggressive expansions with a combined 350 new locations in 2021, according to company reports.

- Five Below launched Five Beyond, a higher-end product assortment priced above $5, as a permanent section to 140 stores in fiscal 2020. The company plans to add Five Beyond stores to 30% of its stores (approximately 300) in 2021. In terms of providing off-price competition by offering convenience, Five Below is using associate assisted self-checkout (ACO) in most Five Beyond stores and plans to add the technology to over 250 stores, to feature in over 60% of its store portfolio by the end of 2021. ACO enables store associates to assist customers with their shopping and checkout process. Five Below products are available online. The company partnered with Instacart for same-day delivery, and reported on its second-quarter earnings call of fiscal year 2021 that it has expanded Instacart to all of its stores.

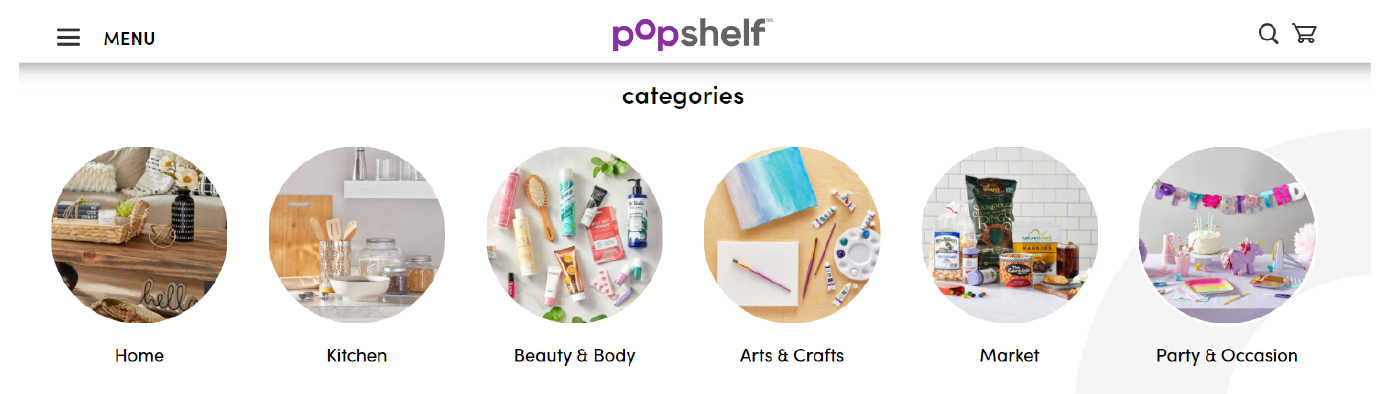

- Dollar General launched Popshelf in the third quarter of fiscal 2020, a concept store that targets more affluent consumers and “aims to engage customers by offering a fun, affordable and differentiated treasure hunt experience,” according to the company. The concept covers a variety of product categories, including home and beauty both in store and online (see the image below). Dollar General plans to add 50 Popshelf stores and 25 shop-in-shops in total in 2021, with long-term expansion opportunities of 3,000 stores in the US, according to company reports. The company sees Popshelf stores as a lucrative opportunity: On its May 2021 earnings call for the first quarter of fiscal 2021, Dollar General reported that annualized sales volumes for its first eight Popshelf locations were trending between $1.7 million and $2 million per store, with an average gross margin rate of about 40%, compared to sales volume of around $1.4 million for a traditional Dollar General store and a gross margin rate of 32% for the overall chain in 2020. The company expects to improve its gross margin as its scales Popshelf.

Source: Popshelf.com [/caption]

We expect off-price retailers to see competition from discounters in the beauty and home categories as they expand price points and grow online and offline.

Amazon, Target and Walmart: Top Destinations for Apparel and Home

Amazon, Target and Walmart are presenting competition in the off-price sector as they gain share of wallet across various categories by offering convenience to consumers. These companies have also been launching private-label brands and exclusive brand collaborations that are challenging off-price in the home and furnishings, apparel, and beauty categories.

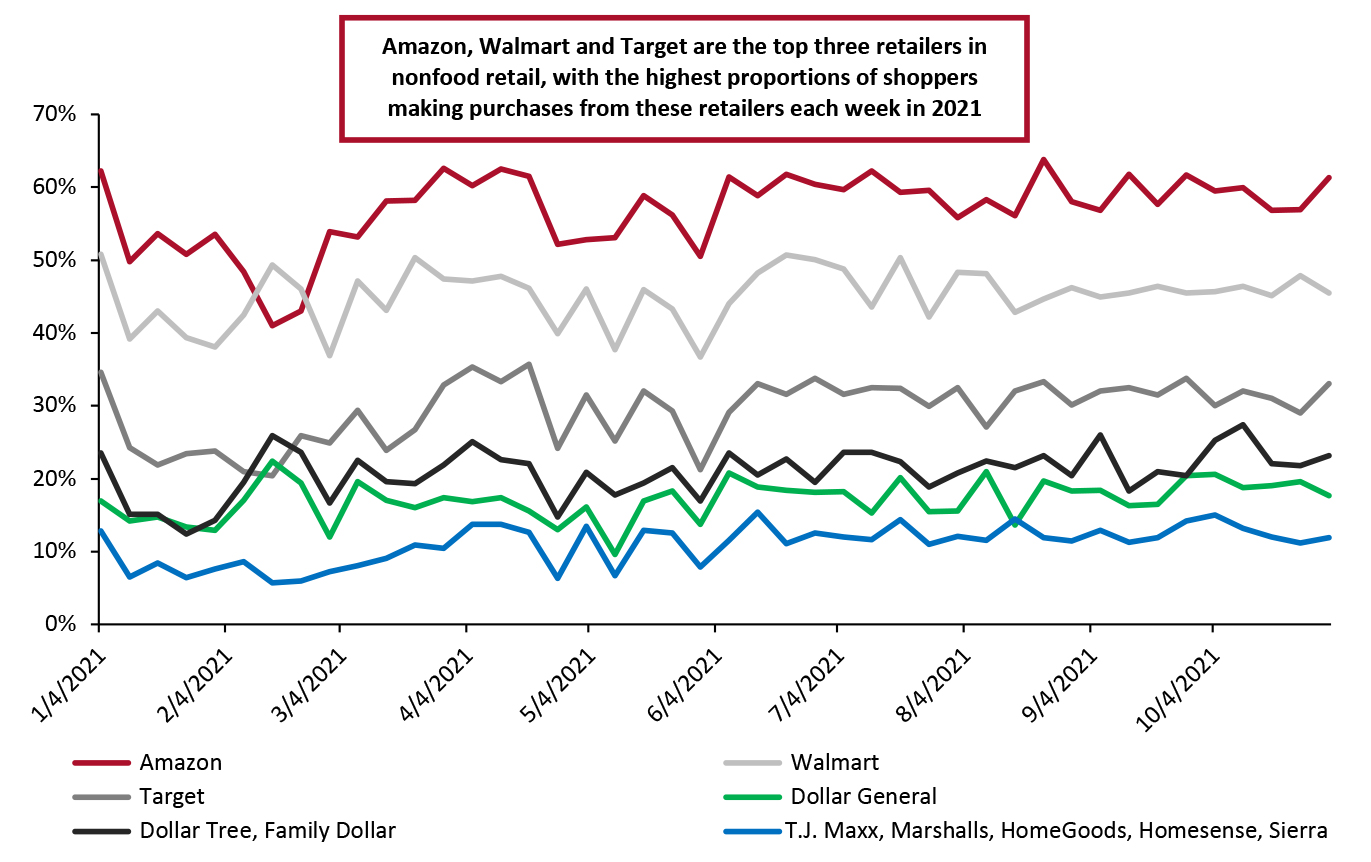

Coresight Research’s weekly US Consumer Tracker surveys consistently find that Amazon, Walmart and Target are the top three retailers in nonfood retail, with the highest shares of nonfood shoppers through year-to-date 2021 (see Figure 4).

Source: Popshelf.com [/caption]

We expect off-price retailers to see competition from discounters in the beauty and home categories as they expand price points and grow online and offline.

Amazon, Target and Walmart: Top Destinations for Apparel and Home

Amazon, Target and Walmart are presenting competition in the off-price sector as they gain share of wallet across various categories by offering convenience to consumers. These companies have also been launching private-label brands and exclusive brand collaborations that are challenging off-price in the home and furnishings, apparel, and beauty categories.

Coresight Research’s weekly US Consumer Tracker surveys consistently find that Amazon, Walmart and Target are the top three retailers in nonfood retail, with the highest shares of nonfood shoppers through year-to-date 2021 (see Figure 4).

Figure 4. Selected Retailers from Which US Consumers Have Bought Nonfood Products in the Past Two Weeks (% of Respondents) [caption id="attachment_135892" align="aligncenter" width="725"]

Base: US respondents

Base: US respondents Source: Coresight Research [/caption] Amazon Amazon is the number-one apparel retailer in the US, with sales of clothing, footwear and accessories totaling $39 billion in 2020, Coresight Research estimates—40% above its closest competitor, Walmart. Amazon is competition for off-price apparel for three main reasons:

- Amazon has a range of value offerings across all categories.

- Consumers are shopping Amazon as a multi-category destination due to its convenience and speed of delivery. Shoppers can simply “add to cart” as they order.

- Consumers can search for any product in almost any specification. Using Amazon’s filtering function, they can narrow their search by price, brand or type of product. The level of detail in the search functionality may be competition for the in-store “treasure hunt” discovery of finding unique products.

- Walmart is targeting a younger consumer with its digital engagement on social media and livestreaming.

- Walmart’s acquisition of Zeekit suggests that it will be investing more in its fashion apparel space, providing a social shopping experience.

- The company is already the number-two apparel retailer in the US, and its work to increase its apparel assortment will support its dominance in the space.

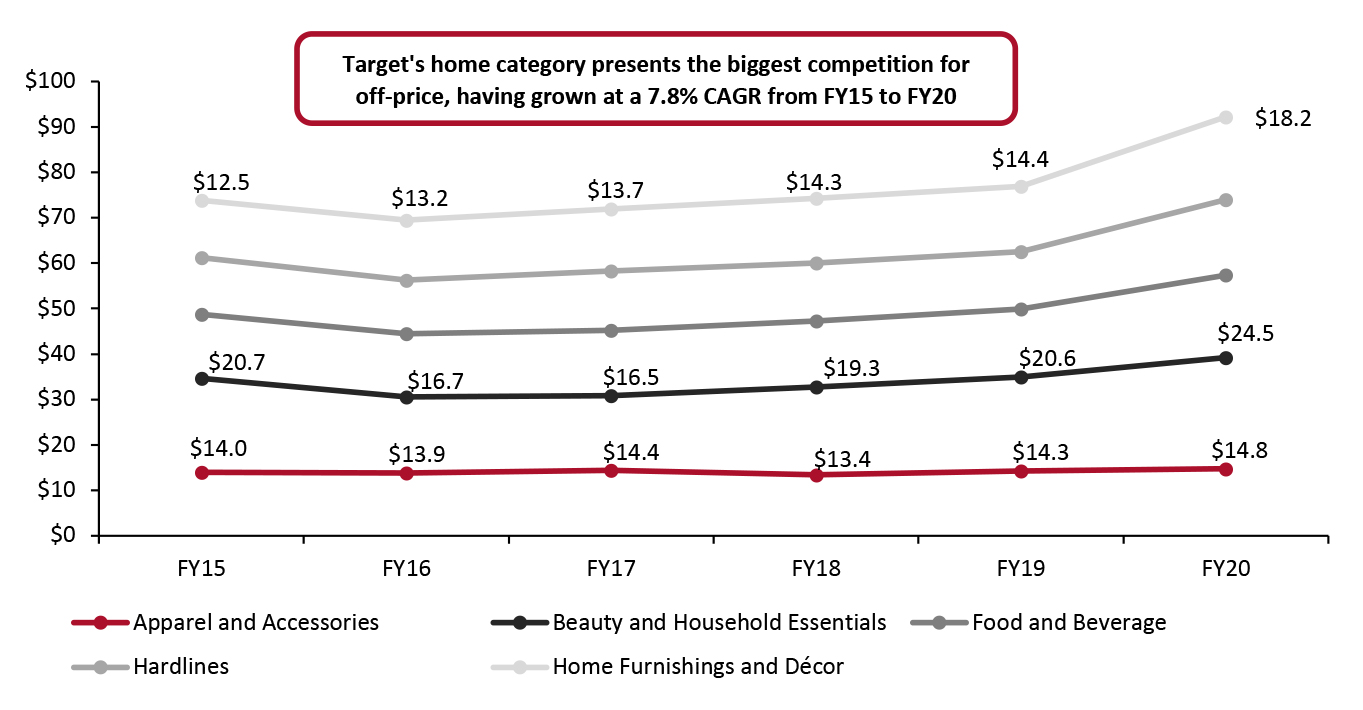

Figure 5. Target: Revenue by Product Category (USD Bil.) [caption id="attachment_135893" align="aligncenter" width="726"]

Source: Company reports [/caption]

Target also continues to innovate and stay relevant with consumers in its apparel and accessories category, which saw a year-over-year sales increase of 3.3% in fiscal 2020, according to company reports.

Source: Company reports [/caption]

Target also continues to innovate and stay relevant with consumers in its apparel and accessories category, which saw a year-over-year sales increase of 3.3% in fiscal 2020, according to company reports.

- The company’s All in Motion private-label activewear and sporting goods brand was the retailer’s 10th owned brand to reach $1 billion in annual revenue in February 2021.

- Target collaborates with top designers to create exclusive collections that are sold at lower price points than the retailer’s traditional prices. Examples of past exclusive design collaborations include Anna Sui, Christopher John Roberts, Hunter, Levi’s, LoveShackFancy and Missoni. The LoveShackFancy x Target collaboration launched at 2.00 a.m. online on June 6, 2020; the items were so popular they sold out online in under 15 minutes.

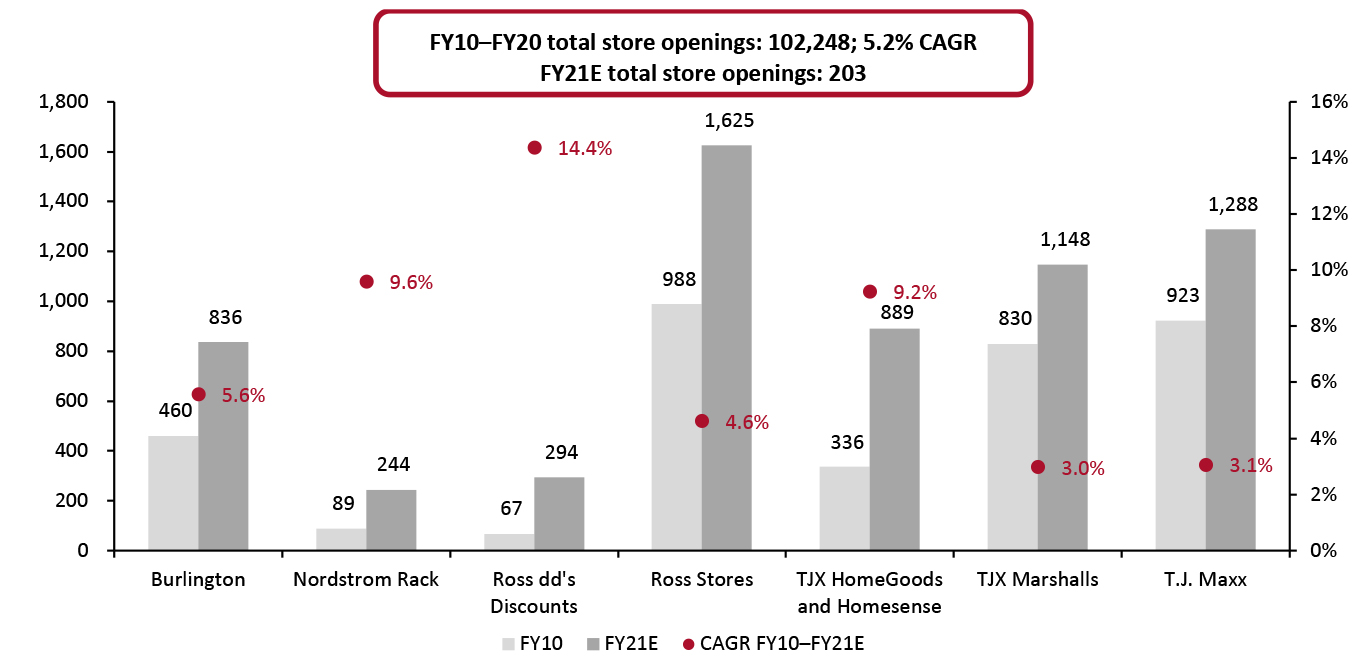

Figure 6. The US Off-Price Sector: Total Stores (Left Axis) and Store Portfolio Growth (%; Right Axis), by Banner [caption id="attachment_135894" align="aligncenter" width="725"]

Source: Company reports [/caption]

Retailers in the off-price sector, including Burlington Stores and Ross Stores, maintain that the economics of online retailing is not realistic due to their low AUR; these players plan to continue to aggressively expand physical stores rather than pursue an e-commerce presence.

However, Nordstrom Rack and The TJX Companies are pursuing online opportunities as a point of differentiation and a way to gain market share among their off-price competitors. Figure 7 is a breakdown of the traditional off-price retailers and their online presence.

Source: Company reports [/caption]

Retailers in the off-price sector, including Burlington Stores and Ross Stores, maintain that the economics of online retailing is not realistic due to their low AUR; these players plan to continue to aggressively expand physical stores rather than pursue an e-commerce presence.

However, Nordstrom Rack and The TJX Companies are pursuing online opportunities as a point of differentiation and a way to gain market share among their off-price competitors. Figure 7 is a breakdown of the traditional off-price retailers and their online presence.

Figure 7. Off-Price Retailer High-Level Overview [wpdatatable id=1432]

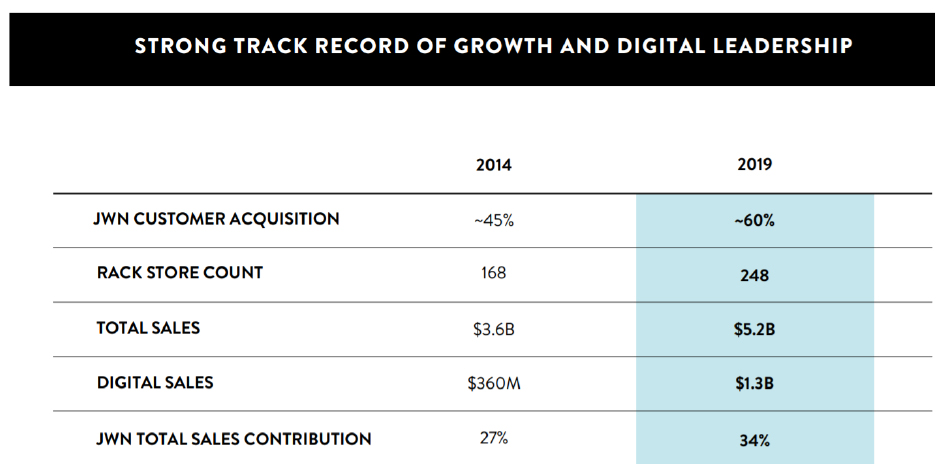

Source: Company reports Online Initiatives Nordstrom Rack is aggressively pursuing its digital capabilities and has been adding assets online for over two years. The company has integrated Nordstrom Rack into its top 10 markets, which represent over half of its total sales. According to Nordstrom, it aims to have integrated Nordstrom Rack into its top 20 markets (which represent 75% of its sales) by the end of 2021. At its Investor Day presentation in February 2021, management reported that having Nordstrom Rack online provides consumers another channel to shop, as well as offering BOPIS (buy online, pick up in store) and ship-from-store services, which help meet consumer demand while enhancing the company’s supply chain capabilities; BOPIS is more cost-effective for the retailer than home delivery. Nordstrom is seeking to eventually put all of its Nordstrom Rack assets online and create a synergistic relationship between its full-line stores and Nordstrom Rack stores. The company reported that in fiscal 2019, Nordstrom Rack’s digital sales totaled $1.3 billion, representing 24.5% of the banner’s total sales. In the third quarter of fiscal 2020, Nordstrom reported that online represented 40% of Nordstrom Rack sales, and since 2019, nearly 3.5 million consumers have downloaded its Nordstrom Rack app. Coresight Research expects that Nordstrom Rack’s online capability will provide competition for T.J. Maxx in particular, as both retailers are known for offering consumers unique and trending fashion apparel and accessories. [caption id="attachment_135895" align="aligncenter" width="726"]

Nordstrom Rack overview from Nordstrom Investor Day, February 2021

Nordstrom Rack overview from Nordstrom Investor Day, February 2021 Source: Nordstrom [/caption] The TJX Companies planned to launch HomeGoods and Homesense online in 2021; management reported in February 2021 that the company believes it can capture a greater share of the home market by having an online presence. The HomeGoods and Homesense banners have seen the fastest revenue growth of the off-price banners over the past 10 years, at a 14.0% CAGR, we calculate. These banners also were most resilient during the pandemic in fiscal 2020, with a year-over-year revenue decline of only 4.1%. Management reported on its earnings call in February 2021 that comps and AUR are very strong, with its Homesense business even stronger than its HomeGoods business. The TJX Companies is confident about taking its business online, with how consumers are shopping and discovering products, and wanting products delivered. Coresight Research expects that HomeGoods and Homesense online capabilities will further advance The TJX Companies’ advantage in the home category, providing further competition to Burlington Stores and Ross Stores.