DIpil Das

Executive Summary

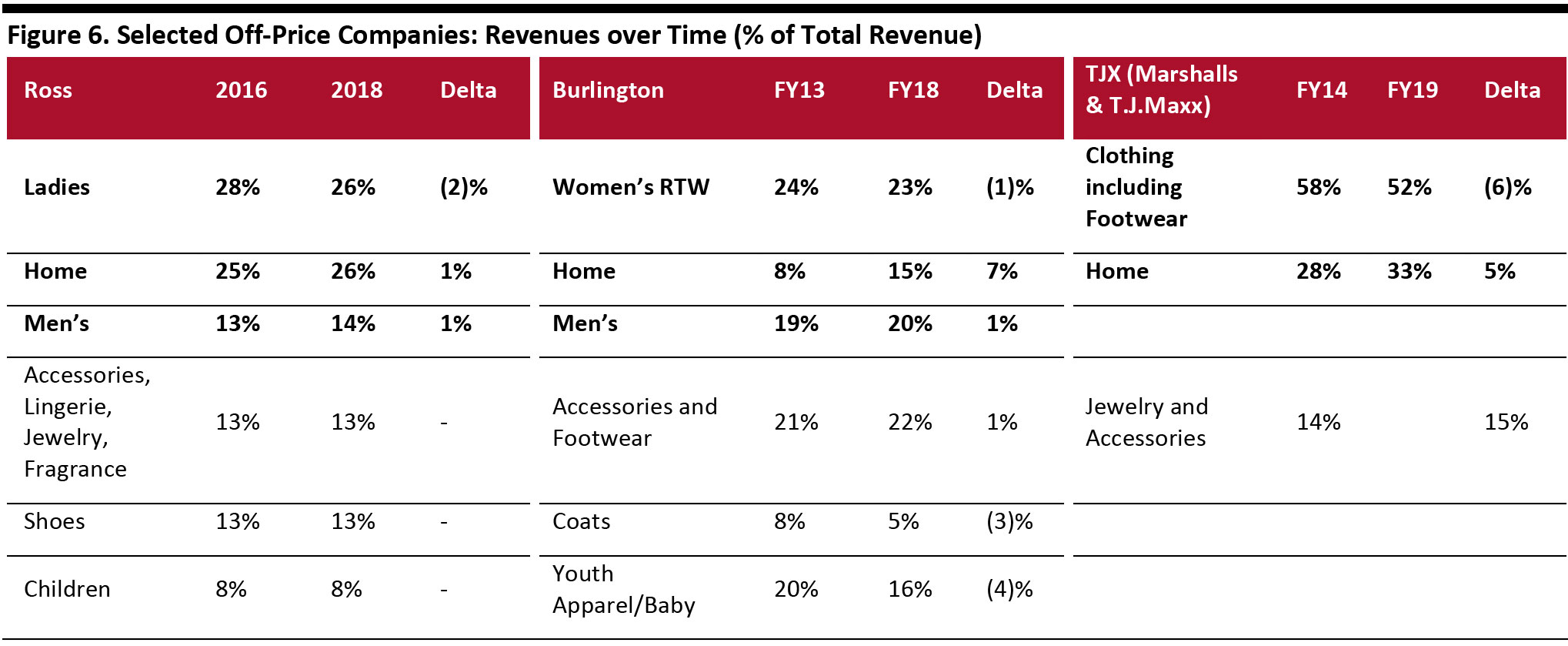

Off-price retail, a segment defined by value product offerings, is a lucrative $55.1 billion market. This is equivalent to 13.3% of the total $415 billion in sales the US Census Bureau recorded for apparel, footwear and accessories stores, home-furnishing retailers and discount department stores in the same year. Top retailers in the sector are continuing to gain dominance. The two market leaders, Ross Stores and TJX, together held a 72.3% share of the off-price market in 2019, up from 68.3% in 2014. The off-price segment defies the notion that today’s consumer primarily wants to shop online or experience innovative retail in physical stores. Off-price typically has a brick-and-mortar nature—requiring consumers to visit stores to discover products instead of researching and ordering online—but there is no emphasis on experiential retail. In fiscal year 2020, a total of 306 off-price stores were opened by US companies Burlington, Ross Stores and TJX, and these retailers currently plan to open 254 new stores in fiscal year 2021. E-commerce is not a lucrative market for many off-price retailers: During its latest earnings call for the fourth quarter 2020 on March 5, Burlington announced that it would discontinue its e-commerce operations, which represented only 0.5% of its total business. Ross Stores does not have plans to enter the e-commerce marketplace. The “home” and “men’s” categories have been growing in the off-price sector over the past few years. Burlington, Ross Stores and TJX have all reported growth in these two categories. TJX plans to open 50 HomeGoods stores in fiscal year 2021, and Burlington reported that its home business grew steadily over five years—from 8% of the company’s total sales in fiscal year 2013 to 20% in fiscal year 2018. Burlington’s men’s business also increased, from 19% of total business to 20% over the same period. Traditional department stores are leveraging off-price channels to complement their full-price stores and attract a younger, more diverse demographic. Macy’s reported that its Backstage store-within-store locations that have been open for at least one year grew on a comparable basis by more than 5% in 2019. Approximately 20% of Backstage customers are under the age of 40; they shop across channels and visit the stores an average of six times per year, spending about $78 per visit. We expect that the off-price trend will continue to gain traction as consumers increasingly demand on-trend, value products that are delivered to the store quickly and merchandised in their “true form.”Introduction: Off-Price Success Confirms that Traditional Brick-and-Mortar Retail Is Alive

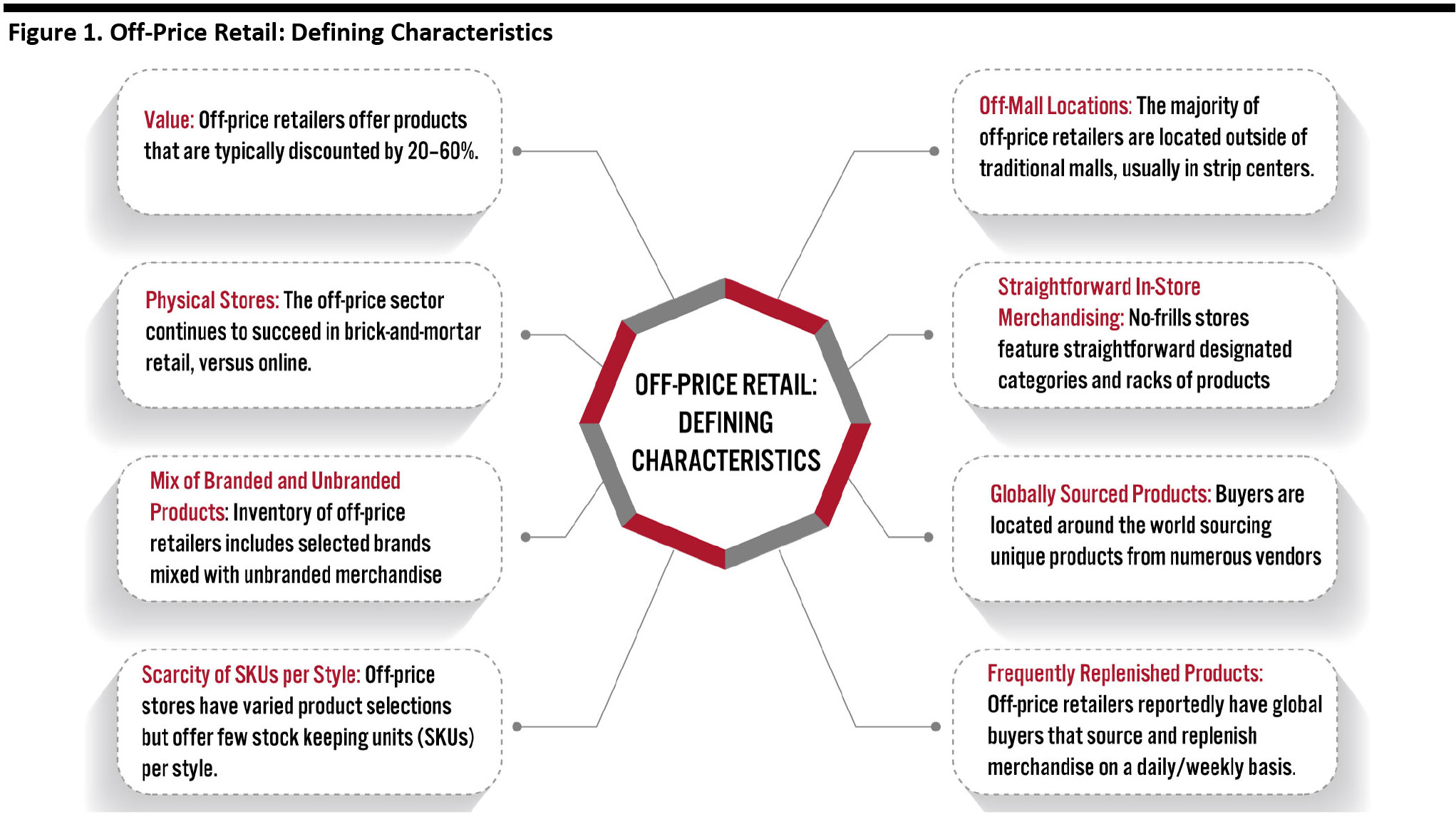

Consumer demand remains consistently high for off-price retail, although the brick-and-mortar nature of this market defies the notion that today’s consumer primarily wants to shop online. Furthermore, while customer experience is a key focus for most retailers that have a physical presence—which can be achieved through visual displays and merchandising—the off-price sector does not place emphasis on experiential retail and instead comprises “no-frills” stores that offer a wide variety of products displayed in a straightforward way. This is one of the defining characteristics of off-price retail, as shown in Figure 1. [caption id="attachment_105481" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The US Off-Price Retail Market

The US off-price retail market was worth $55.1 billion in 2019 according to Euromonitor International, representing approximately 13.3% of the total $415 billion in sales for apparel, footwear and accessories stores, home-furnishing retailers and discount department stores in the same year. The off-price sector grew faster than the total apparel and footwear market from 2014 to 2019, at a 5.3% CAGR compared to 2.2%, respectively, according to Euromonitor International. Top retailers in the off-price sector are continuing to gain dominance: The top five companies held a combined 91.1% market share in 2019, up from 86.5% in 2014. The biggest player in the US, Ross Stores (parent company of Ross Dress for Less and dd’s Discounts), gained the most market share over the same five-year period, from 25.4% to 28.0% (as shown in Figure 2). TJX—the parent company of specialty retailers T.J. Maxx, Marshalls and Sierra (and specialty home stores HomeGoods and Homesense)—held a 44.3% share of the US off-price market in 2019, up from 43.0% in 2014. Both Ross Stores and TJX are moving forward with aggressive fleet-expansion plans, as described in more detail in the following sections. Figure 2. Top US Off-Price Retailers, by US Market Share, 2014 and 2019 (%) [wpdatachart id=26] Source: Euromonitor International TJX is the largest off-price retail company with $41.7 billion in revenues followed by Ross at $16 billion in revenues, and Burlington at 7.2 billion. In terms of revenue growth, Burlington led with average revenue growth CAGR of 8.5% over the past five years, followed by Ross Stores with a CAGR of 7.9% and TJX with a 7.3% CAGR. Figure 3. Revenue Growth of Top US Off-Price Companies versus Retail Sales Growth at Clothing, Footwear and Accessories Stores, Home-Furnishing Retailers and Discount Department Stores (YoY, %) [wpdatachart id=29] Source: Company reports/US Census BureauOff-Price Specialty Retailers Continue To Expand Their Physical Footprint

Brick-and-mortar retail is more conducive for off-price shopping, as it encourages consumers to discover products in a “no two items are alike” environment; as we highlighted in Figure 1, scarcity of SKUs per style is a defining characteristic of the market, making it difficult for shoppers for search for similar, alternative product options online, particularly as they would not know what is available. The steady influx of discrete SKUs from vendors around the globe would also create a challenge for off-price retailers in catagaloging products on, and maintaining, e-commerce sites. The US off-price industry has been steadily growing in recent years through store openings. This is particularly noteworthy because the overall US footwear and apparel industry has been closing stores at an increasing pace. In 2019, there were 9,532 total store closures, up from 6,897 store closures in 2018, according to Coresight Research’s Weekly Store Tracker. (See the Coresight Research Retail Store Databank to access openings and closures data from 2012 to 2020 year to date, filterable by sector and year.) As shown in Figure 4, major off-price companies have grown their physical footprints in fiscal year 2020, amounting to 306 new store openings overall and with a planned 254 stores set to open in fiscal year 2021.- Ross Stores’ dd’s Discounts has nearly doubled its fleet since 2015, growing from 152 stores to 284 at the end of fiscal year 2020, representing a CAGR of 13.3%.

- TJX’s HomeGoods, launched in 1992, has been rapidly expanding its brick-and-mortar presence at a 12.5% CAGR over the past five years, expanding from 450 stores to 809 stores. The retailer has plans to open 50 new stores in FY21.

- Burlington management said that in its off-price business growth is driven by physical retail. The company plans to grow its store network, stating on its earnings call for the fourth quarter 2020, “The data shows that over the last several years, as e-commerce in general has grown, brick-and-mortar moderate off-price retail has continued to power ahead and to gain share. You can see that just in our own results. Our top line growth in the last three years has averaged about 8% per year, driven by our brick-and-mortar stores.”

E-Commerce Is Not a Lucrative Channel for Some Off-Price Retailers

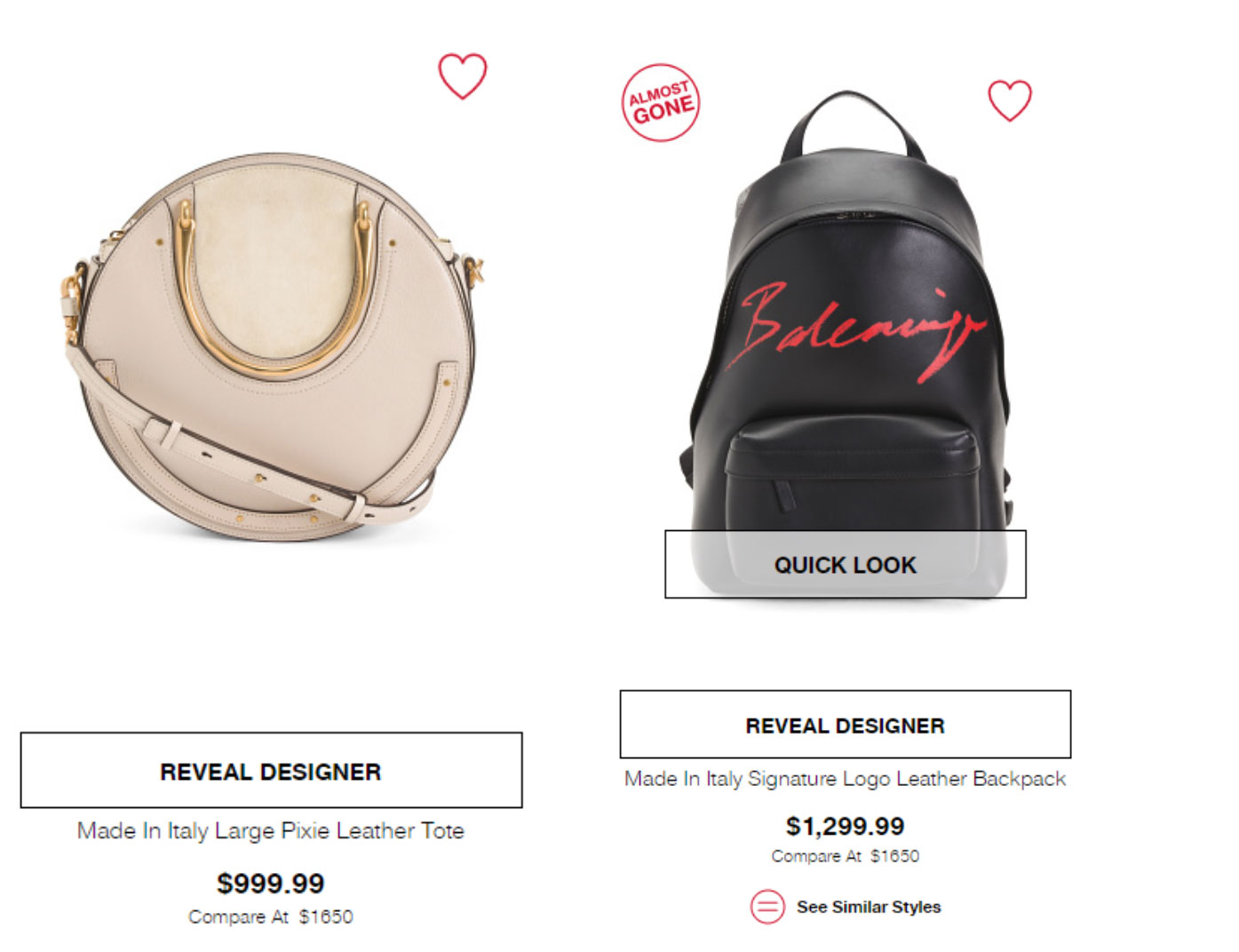

Physical product discovery plays an important role in the off-price sector, as the “treasure-hunt” experience of discovering unique products is difficult to replicate online. In addition, the lure of off-price retail is value products—consumers may therefore be unwillingly to pay for delivery services or to return items, but it would not be financially lucrative for off-price retailers to offer this for free or at reduced rates. On its most recent earnings call, dated March 5, 2020, Burlington announced that it is discontinuing its ecommerce business. The retailer’s e-commerce model represented only 0.5% of its total sales, and management said that brick-and-mortar stores offer a significant competitive and economic advantage over e-commerce. The average unit selling price of Burlington’s products is approximately $12 in physical stores; accounting for the costs of merchandising, processing, shipping and accepting returns, it would be difficult for the retailer to make a profit in e-commerce at those price points. Ross Stores’ management said on its earnings call for the third quarter of fiscal year 2020 that the company is not planning to launch an e-commerce business; as above, with a $10–11 average unit price, online operations would be unlikely to make a profit. Ross Stores is currently focused on growing its physical presence in the Midwest of the US. TJX launched Marshalls.com in September 2019, where prices range from under $10 to $2,000. TJMaxx.com was first launched in 2004, but was taken down one year later due to poor consumer response. TJX relaunched TJMaxx.com in September 2013. The website now includes “The Runway,” which features designer brands including Balenciaga, Chloe, Fendi and Philip Lim, to name a few. Prices range from $20 to over $3,000. The company has attempted to recreate elements of the in-store search and discovery experience by adding “reveal designer” functionality under some of the product thumbnails. In its fourth-quarter 2020 earnings report, TJX management stated that the company has seen double-digit sales growth in e-commerce across its banners, as it continues to add more categories and brands to its websites. [caption id="attachment_105487" align="aligncenter" width="700"] The Runway designer products

The Runway designer products Source: TJMaxx.com [/caption]

Home and Men’s Categories Are Growing within Off-Price

Reflecting a trend in the overall apparel market, the “home” and “men’s” categories are growing in the off-price sector.- Burlington reported during its third-quarter 2020 earnings call (on November 26, 2019) that “Home” was one of its top-performing businesses.

- On its November 21, 2019 earnings call for the third quarter 2020, Ross Stores reported that its men’s segment had the strongest performance, and the company then made progress on developing its “key underpentrated categories” such as “home” and “beauty” in the following quarter.

- At its T.J. Maxx and Marshalls stores, TJX reported its home category grew from 28% in FY14 to 33% in FY19 whereas its clothing and footwear decreased from 58% in FY14 to 52% in FY19

Source: Company reports [/caption]

Source: Company reports [/caption]

Traditional Department Stores Are Leveraging Off-Price Channels

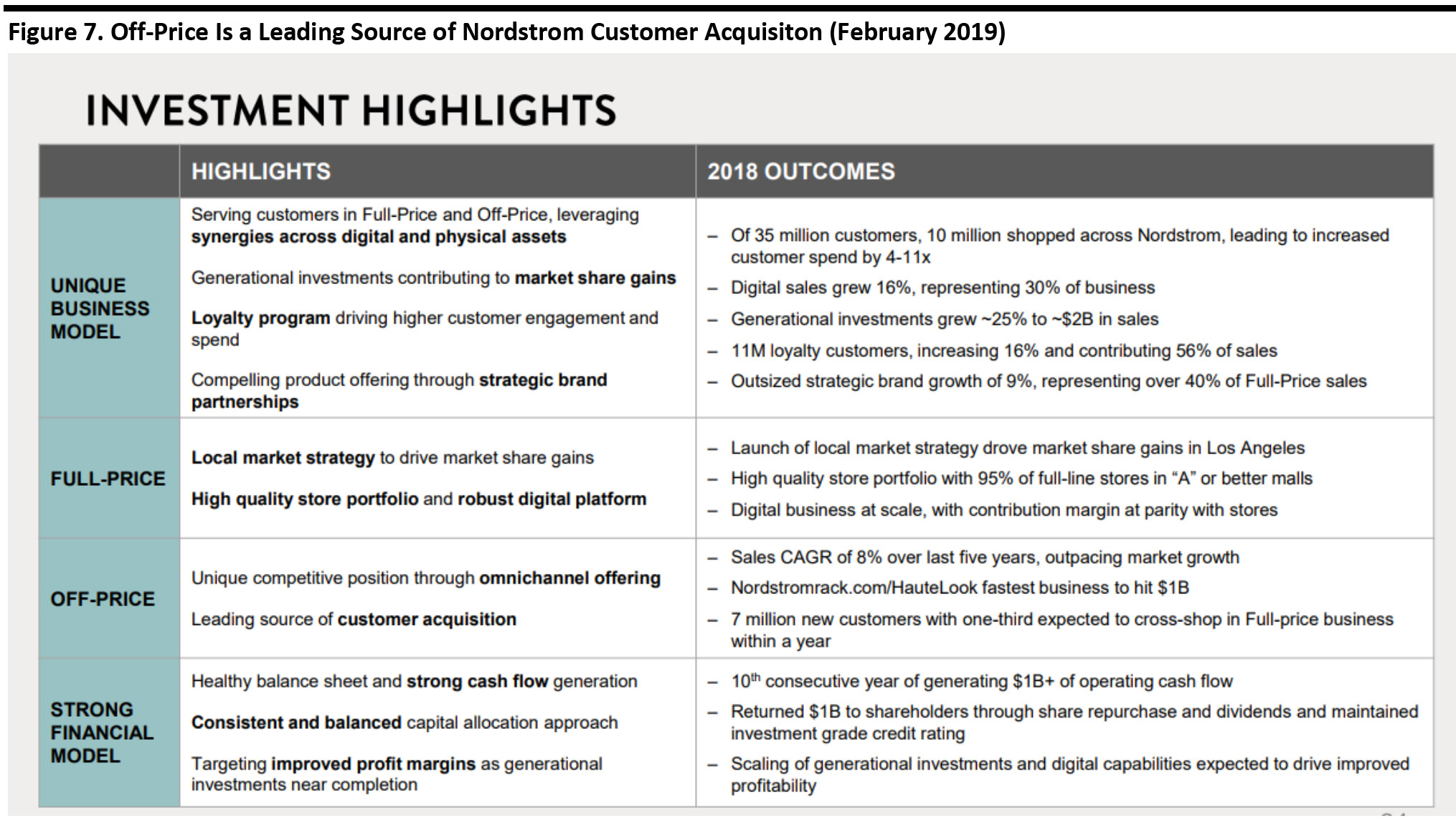

During its investor day on February 5, 2020, Macy’sreported that due to the success of its Backstage stores, it plans to expand the store-within-store concept to another 50 locations in 2020, bringing the total count to 261 plus seven freestanding stores. Macy’s launched Backstage in 2015 with six freestanding locations. Backstage store-within-store locations that have been open for at least one year grew on a comparable basis by 5% in 2019. Approximately 20% of Macy’s Backstage store-within-store customers are under the age of 40; they shop across channels and visit the stores an average of six times per year, spending about $78 per visit. Nordstrom reported in its third-quarter 2019 earnings call that the Nordstrom Rack business helped to increase inventory turnover for eight consecutive quarters. The company reported in its fourth-quarter 2018 earnings call on February 28, 2019 that off-price is a leading source of customer acquisition: Of Nordstrom’s 7 million new off-price customers, one-third were expected to cross-shop into its full-price business within one year. Company CEO Erik Nordstrom reiterated this point at the NRF 2020 event in January 2020. He said that the company’s “best customers” shop across full-price and off-price channels, and the more that Nordstrom can engage the two brands, the better the business is. Looking forward, the retailer plans to launch express services at its Nordstrom Rack stores, where it will process full-price returns and provide alterations, increasing the synergy between channels. [caption id="attachment_105489" align="aligncenter" width="700"] Source: Company reports[/caption]

Luxury retailer Neimain Marcus has been an exception to traditional off-price department store leveraging its off price channel. The retailer announced in March 2020 that it will focus on its full-price luxury customer base and will close the majority of its off-price Last Call stores by first quarter of its fiscal year, 2021. The company intends to keep selected last call stores open as a selling channel for residual Neiman Marcus inventory. Through the downsizing the company will eliminate approximately 500-750 positions.

Source: Company reports[/caption]

Luxury retailer Neimain Marcus has been an exception to traditional off-price department store leveraging its off price channel. The retailer announced in March 2020 that it will focus on its full-price luxury customer base and will close the majority of its off-price Last Call stores by first quarter of its fiscal year, 2021. The company intends to keep selected last call stores open as a selling channel for residual Neiman Marcus inventory. Through the downsizing the company will eliminate approximately 500-750 positions.