DIpil Das

What’s the Story?

In the US, major off-price retailers Burlington Stores, Ross Stores (Ross Dress for Less and dd’s Discounts) and The TJX Companies (which includes US banners T.J. Maxx, Marshalls, Sierra, HomeGoods and Homesense) have been aggressively growing their physical store footprints and show no signs of slowing. Most recently, off-price has begun to enter the digital channel, with Nordstrom and HomeGoods creating an online presence. In this report, we discuss the physical and digital strategies in the off-price sector, considering brick-and-mortar expansion over the past 10 years, store productivity, trends in physical retail and digital growth.Why It Matters

Off-price retail is focused on value pricing and off-mall physical locations, and the sector has been growing steadily. Although the Covid-19 pandemic negatively impacted total revenues across the three major off-price retailers in the US (Burlington Stores, Ross Stores and The TJX Companies)—with a combined year-over-year decline of 20.9% in fiscal 2020 (ended January 30, 2021)—the 10-year revenue CAGR from fiscal 2010 was still positive, at 4.7%, with all retailers having seen positive revenue growth every year between fiscal 2010 and fiscal 2019. In addition, all three retailers reported positive comparable sales growth between fiscal 2011 and fiscal 2019. However, the off-price market is becoming increasingly competitive, with more retailers offering value pricing online and in stores in the apparel, home and beauty categories—including big-box retailers, value discounters, warehouse clubs and resale retailers. It may become more challenging for off-price retailers to remain a physical-only channel as consumers shop both online and in-store. To remain competitive moving forward, off-pricers must carefully strategize around digital and physical retail. We are seeing some remain committed to the brick-and-mortar channel, while others are making efforts to launch and improve their e-commerce presence.Physical and Digital Strategies in Off-Price Retail: Coresight Research Analysis

Market Overview In Figure 1, we provide an overview of the major off-price companies and US retail banners that are the focus of this report.Figure 1. US Off-Price Retail Sector: Overview of Major Retailers [wpdatatable id=1252 table_view=regular]

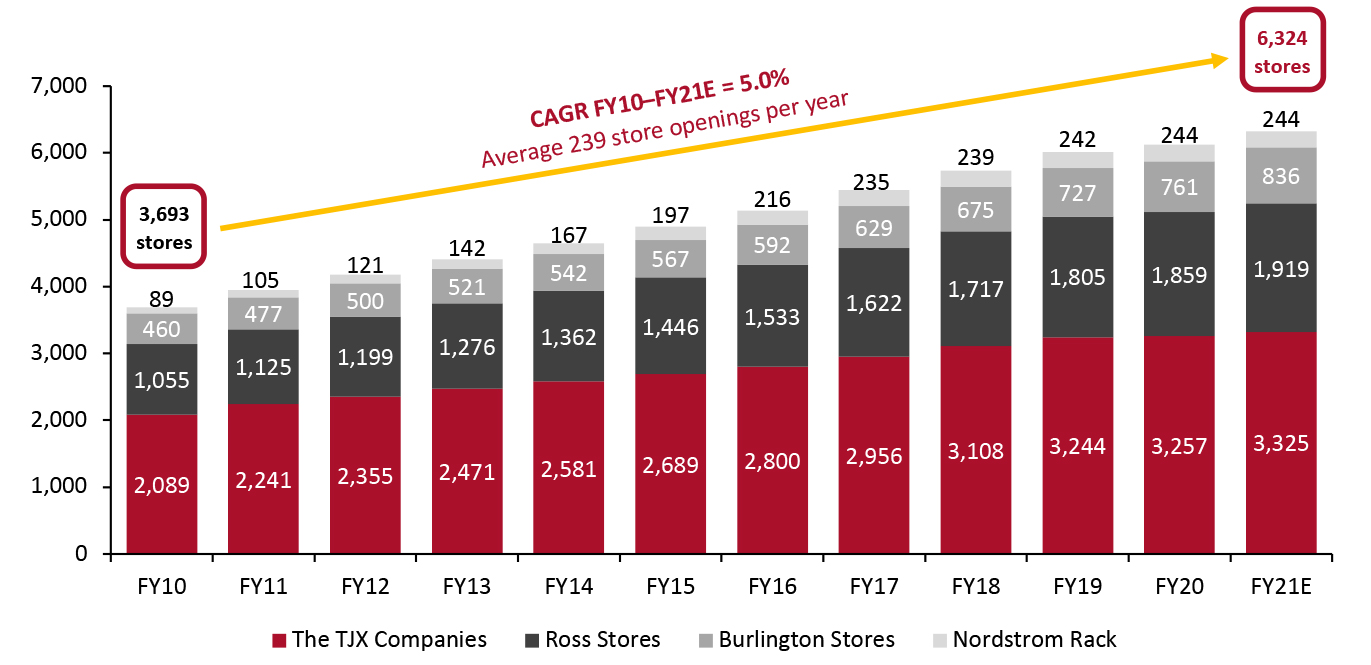

For the purposes of comparison in this report, we refer to FY20 (fiscal 2020) as the year ended January 30, 2021, although The TJX Companies refers to this year as FY21 in its reports. Macy’s Backstage, a major US off-price banner, is not included for comparison in this report, as the retailer currently operates its off-price segment within its own Macy’s banner stores and so does not report comparable metrics on its Backstage stores. Macy’s reported in February 2021 that it has over 200 Backstage stores and plans to open 35 Backstage stores in fiscal 2021. Source: Company reports Bullish Brick-and-Mortar Expansion The off-price sector is bullish on physical store expansion. We explore the store portfolios of each major retailer and banner since fiscal 2010 below, presenting the data in Figures 2 and 3. In fiscal 2021, the four major retailers plan to open a combined total of 203 stores, with the largest increase at Burlington. Each retailer has expanded its store portfolios consistently in recent years, at a combined CAGR of 5.0% since fiscal 2010—from 3,693 stores to an expected 6,324 in fiscal 2021 (see Figure 2). This is notable given physical store closures over the past 10 years in other retail sectors such as department stores and specialty stores.

Figure 2. US Off-Price Retailers: Total Store Counts [caption id="attachment_132509" align="aligncenter" width="726"]

Source: Company reports[/caption]

Major Retailers

Source: Company reports[/caption]

Major Retailers

- The TJX Companies will have grown its store portfolio by 1,236 stores by the end of fiscal 2021, from 2,089 in fiscal 2010, representing a 4.3% CAGR. The company has opened an average 112 stores per year over that timeframe across its four banners. Its most recent focus on store openings has been under its HomeGoods and Homesense banners, which have accounted for nearly 60% of the company’s store openings since fiscal 2017.

- Ross Stores had 1,055 stores in fiscal 2010 across its Ross Dress for Less (“Ross”) and dd’s Discounts banners; the expected total of 1,919 in fiscal 2021 represents a CAGR of 5.6%. The new stores comprise 637 stores under the Ross banner and 227 dd’s Discounts stores. The company has consistently grown its portfolio across the two banners, opening an average of 40 Ross Dress for Less stores and 20 dd’s Discount stores every year since fiscal 2010. In fiscal 2020, Ross banner stores comprised 85.3% of the company’s store portfolio. The 60 planned store openings in fiscal 2021 (40 Ross stores and 20 dd's Discounts locations) represent a total increase of 3.2% from Ross Stores’ fiscal 2020 store count.

- Burlington will have grown its store base by 376 stores by the end of fiscal 2021—a 5.6% CAGR from fiscal 2010. The company averaged 30 new stores per year over that timeframe and has been steadily increasing its store openings since fiscal 2017. Burlington plans to open 75 new stores in fiscal 2021, one-third of which will be in a new, smaller 25,000-square-foot format, according to the company. At the end of fiscal 2021, Burlington will have 836 total stores, 9.9% more than in fiscal 2020—the most aggressive store growth plan of the off-price retailers this year.

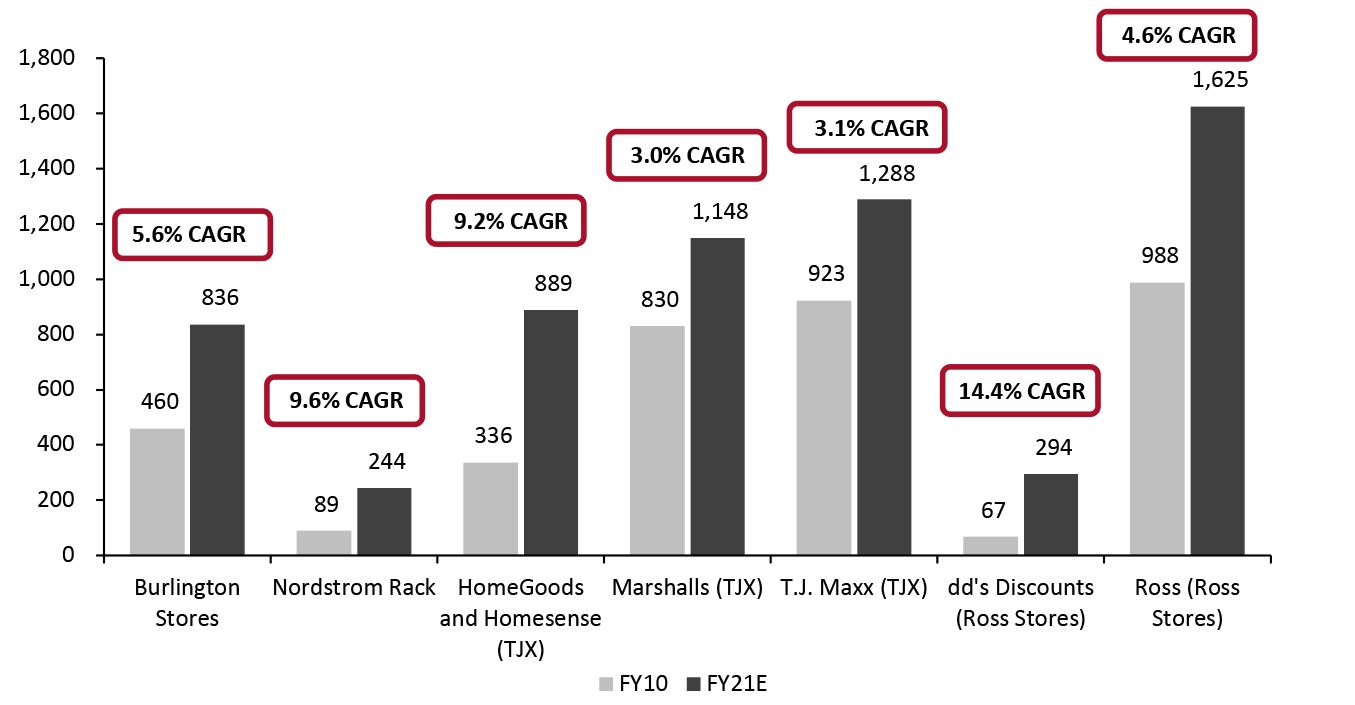

- dd’s Discounts (Ross Stores) was the smallest off-price banner in fiscal 2010 but will have grown its brick-and-mortar portfolio by a 14.4% CAGR by the end of fiscal 2021—overtaking Nordstrom Rack. The banner’s store-opening strategy has been consistent and steady, opening around 20 stores per year.

- Nordstrom Rack has not announced plans to open new stores in fiscal 2021. Since fiscal 2010, the banner has grown its physical store portfolio from 89 stores to 244—a 9.6% CAGR. However, growth has not been consistent: store openings peaked in fiscal 2016 at 30 stores, and have averaged only three per year since fiscal 2018.

- The TJX Companies has announced plans for its HomeGoods and Homesense banners to have 1,500 stores in the long term—up from 889 in fiscal 2021 and continuing its accelerated store-opening trend since fiscal 2016. The company has 34 new store openings planned under the two home banners in fiscal 2021. By the end of the fiscal year, the banners will have opened 553 new stores combined since fiscal 2010—a 9.2% CAGR.

Figure 3. US Off-Price Retailers: Stores by Banner [caption id="attachment_132508" align="aligncenter" width="725"]

Source: Company reports [/caption]

Store Productivity: Retail Sales per Square Foot in Fiscal 2020

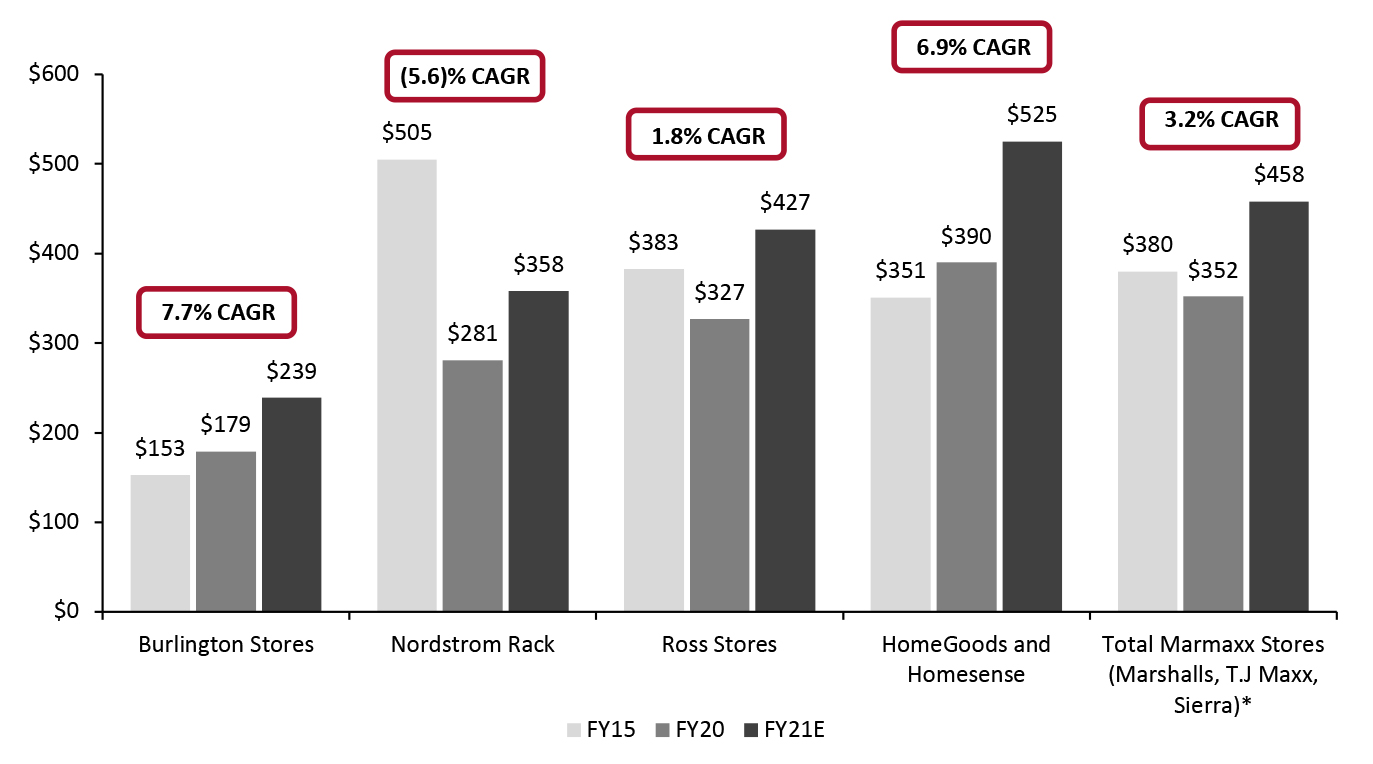

According to Coresight Research analysis of retail sales per square feet in the off-price sector, the TJX HomeGoods and Homesense banners have the highest store productivity, at an estimated $525 in sales per square foot in fiscal 2021. We present the data in Figure 4 below and discuss each company in detail below.

Source: Company reports [/caption]

Store Productivity: Retail Sales per Square Foot in Fiscal 2020

According to Coresight Research analysis of retail sales per square feet in the off-price sector, the TJX HomeGoods and Homesense banners have the highest store productivity, at an estimated $525 in sales per square foot in fiscal 2021. We present the data in Figure 4 below and discuss each company in detail below.

Figure 4. US Off-Price Retailers: Sales per Square Foot [caption id="attachment_132533" align="aligncenter" width="724"]

Estimates for 2021 based upon company announcements on store openings; revenue estimates based upon S&P Capital IQ estimates; all estimates exclude digital sales

Estimates for 2021 based upon company announcements on store openings; revenue estimates based upon S&P Capital IQ estimates; all estimates exclude digital sales *The TJX Companies includes its Sierra stores under the Marmaxx business unit, of which there were just 48 in fiscal 2020

Source: Company reports/Coresight Research [/caption] The TJX Companies HomeGoods and Homesense had the highest combined retail sales per square foot in fiscal 2020 ($390), and we estimate that this sales density will increase to $525 in fiscal 2021—representing a CAGR of 6.9% since fiscal 2015. The average store size under the two banners is approximately 23,000 square feet; this smaller format, a relatively higher home ticket price and increased consumer interest in the home category amid the Covid-19 pandemic have contributed to the productivity of TJX’s off-price home banners. The Marmaxx US banner stores—T.J. Maxx, Marshalls and Sierra–collectively had the second-highest productivity by sales per square foot in fiscal 2020, at $358. We expect the sales density across the three banners to total $458 in fiscal 2021. One of the major contributing factors to the business unit’s high productivity is the small average store size of the T.J. Maxx and Marshalls banners—23,000 square feet and 29,000, square feet, respectively. Ross Stores We estimate that Ross Stores’ sales per square feet averaged $327 in fiscal 2020. Across its Ross and dd’s Discounts banners, the retailer operates a large number of stores (second only to TJX, as we saw earlier), ranging from 18,000 square feet to 30,000 square feet in size. Burlington Stores Burlington has seen the highest CAGR in retail sales per square foot between fiscal 2015 and fiscal 2021, at 7.7%. However, the retailer’s productivity remains the lowest of the off-price banners—averaging $179 in fiscal 2020 and increasing to $239 in fiscal 2021, we estimate. Burlington’s average unit retail is similar to Ross Stores, at $10–$12 in fiscal 2020, and its total selling space is similar: Burlington has over 32 million retail square feet in its portfolio, and Ross Stores has over 38 million retail square feet in its portfolio. Although Burlington has half the stores of Ross and its stores are much larger (averaging 40,000 square feet in fiscal 2020), one-third of the stores that Burlington plans to open in fiscal 2021 are set to be a small-format prototype, measuring 25,000 square feet. Nordstrom Rack According to our analysis, Nordstrom Rack had the most productive stores in fiscal 2015, with a sales density of $505 per square foot, but the retailer fell behind Ross Stores and The TJX Companies’ banners by fiscal 2020. Nordstrom Rack is the only off-price retailer to have experienced a CAGR decline in the six-year period (to the end of fiscal 2021), we estimate. However, it is one of the few off-price retailers that operates online, through Nordstromrack.com and its HauteLook business: In fiscal 2019, the company reported that 25% of Nordstrom Rack sales were from the digital channel (equating to $1.3 billion). Key Insights into Store Productivity

- There is a positive correlation between smaller store size and higher retail sales per square feet in off-price retail.

- The banners that have the smallest store formats, on average, were comparatively the most productive in fiscal 2020, and we expect this trend to stick in fiscal 2021: HomeGoods (23,000-square-foot average store size) and Homesense (27,000 square feet).

- Although it is set to have the lowest sales productivity in fiscal 2021, Burlington has improved this metric since fiscal 2015 by lowering its average store size (from 60,000 square feet in fiscal 2015 to 40,000 square feet in fiscal 2020), and we expect retail sales per square feet to further improve with Burlington’s launch of its smaller store format (25,000 square feet) moving forward.

- Digital sales at Nordstrom Rack impact physical retail sales per square foot. If the retailer’s online sales had remained in-store, we estimate that its brick-and-mortar sales density would have been 33% higher in fiscal 2019 (at $598 per square foot) and 37% higher in fiscal 2020 (at $385). As consumers increasingly shift spending from physical retail channels to e-commerce, driving physical retail foot traffic while also engaging the digital consumer will be a key consideration for off-price retailers’ strategies through the remainder of fiscal 2021 and beyond.

- The off-price retailers with comparatively higher average unit retail price points had higher retail sales per square feet—namely, HomeGoods and Homesense, Nordstrom Rack and T.J. Maxx.

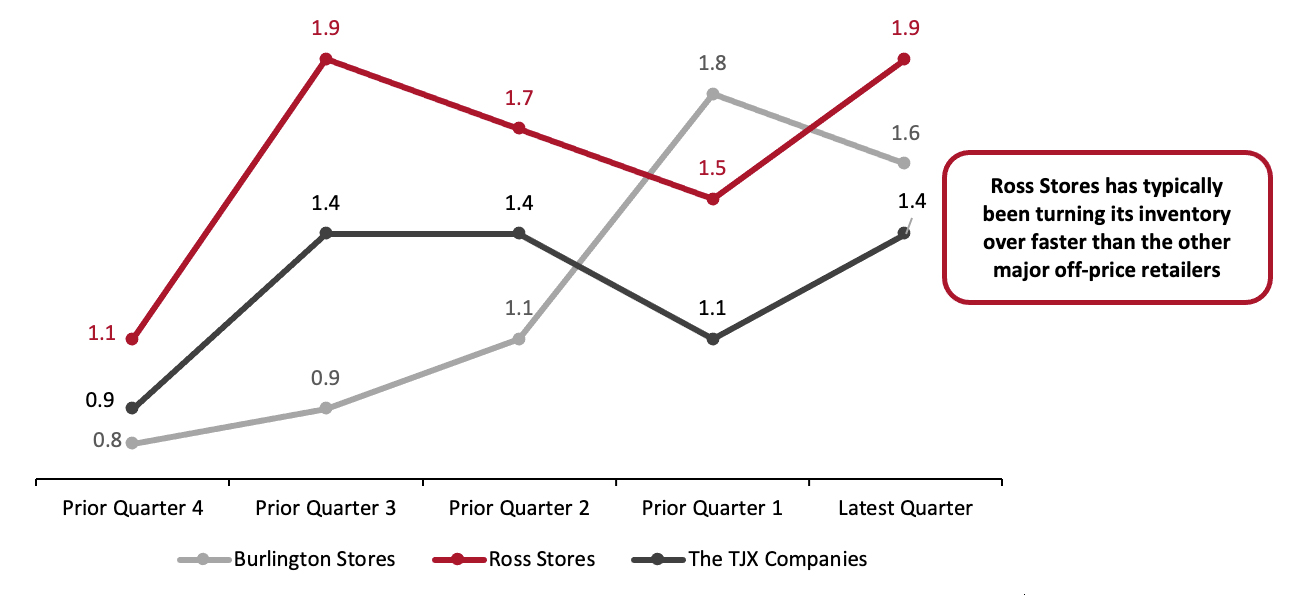

- Ross Stores has the lowest average unit retail but the highest inventory turn. The retailer’s high inventory turn is boosting its average retail sales per square foot. Figure 5 provides an overview of the off-price retailers’ inventory turns for the past five retail quarters.

Figure 5. US Off-Price Retailers: Inventory Turns [caption id="attachment_132506" align="aligncenter" width="726"]

Source: Company reports/Coresight Research [/caption]

Trends in Brick-and-Mortar Retail

In terms of the physical channel, we are seeing two main trends in the US off-price sector. We provide examples from across the major retailers under each of these trends below.

Stores Are Becoming Smaller

Burlington reported on its earnings call for the fourth quarter of fiscal 2020, in March 2021, over time, most of its new store openings will be in the smaller, 25,000-square-foot format, following one-third of new store openings being in this format in fiscal 2021. Management said that the company will operate with leaner in-store inventory levels, lower occupancy costs and higher operating margins. Burlington sees opportunity to operate more profitable stores in the long term with more locations; the company increased its long-term growth potential goal with this new smaller-format prototype, from 1,000 stores to 2,000 stores. On the company’s earnings call for the second quarter of fiscal 2021, in August 2021, management said that Burlington had opened 16 smaller-format stores in the spring and that initial consumer response has been very favorable; the stores are performing well ahead of targets.

The Backstage banner has typically been located within Macy’s stores, but Macy’s is opening smaller stores in off-mall locations. While this report has not covered the Macy’s Backstage banner elsewhere (because the retailer does not disclose financials, exact store numbers or results on its Backstage locations), it is notable that the company is experimenting with a new, smaller, off-mall format for its off-price business. Macy’s reported that it is testing three market locations in fiscal 2021.

Retailers Are Experimenting with Store Segmentation

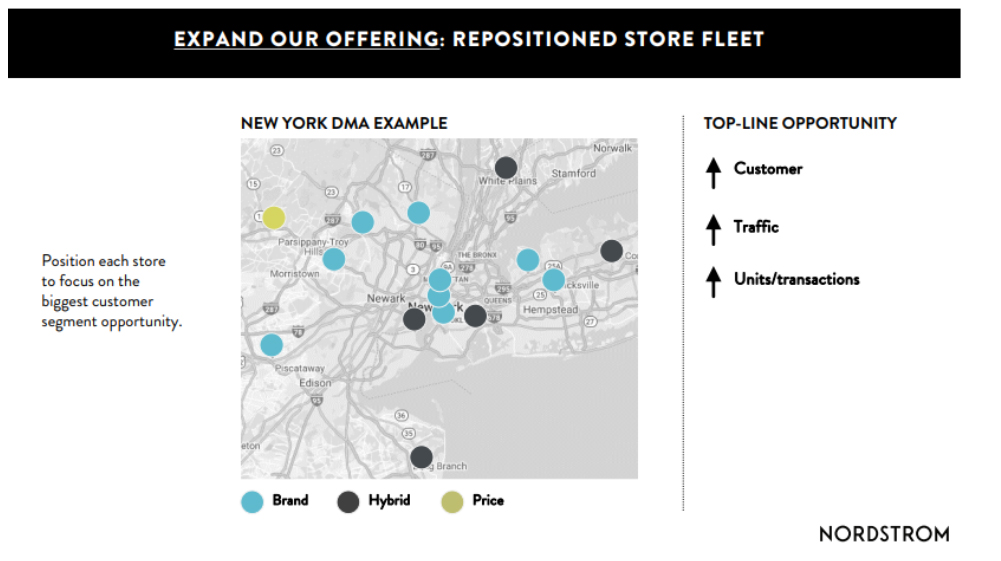

Nordstrom Rack reported at its Investor Day in February 2021 that the company is segmenting its Nordstrom Rack locations by “price,” “brand” and “hybrid,” stores across its geographic base to better serve its customers. Management said that 26% of Nordstrom Rack shoppers are seeking bold and trendy brands and aspire to afford designers, while 13% are seeking “price” and are smart, savvy spenders that are looking for traditional and practical value-oriented deals.

As shown in the image below, Nordstrom provided an example of how the company is repositioning its store fleet in New York to better serve customer segments: Its “price” stores will be more sensitive to the prices that the store offers; the “brand” stores will be more attuned to fashion-conscious customers seeking trends; and the “hybrid” stores will mix the two—similar to its stores today. The company reported that it has repositioned 70% of its North American stores to “price” stores. On its earnings call for the second quarter of fiscal year 2021, in August 2021, management said that among “the 70 Rack stores that have been repositioned for a price-oriented offering, new-to-Nordstrom customer counts increased 16% over 2019.”

[caption id="attachment_132507" align="aligncenter" width="724"]

Source: Company reports/Coresight Research [/caption]

Trends in Brick-and-Mortar Retail

In terms of the physical channel, we are seeing two main trends in the US off-price sector. We provide examples from across the major retailers under each of these trends below.

Stores Are Becoming Smaller

Burlington reported on its earnings call for the fourth quarter of fiscal 2020, in March 2021, over time, most of its new store openings will be in the smaller, 25,000-square-foot format, following one-third of new store openings being in this format in fiscal 2021. Management said that the company will operate with leaner in-store inventory levels, lower occupancy costs and higher operating margins. Burlington sees opportunity to operate more profitable stores in the long term with more locations; the company increased its long-term growth potential goal with this new smaller-format prototype, from 1,000 stores to 2,000 stores. On the company’s earnings call for the second quarter of fiscal 2021, in August 2021, management said that Burlington had opened 16 smaller-format stores in the spring and that initial consumer response has been very favorable; the stores are performing well ahead of targets.

The Backstage banner has typically been located within Macy’s stores, but Macy’s is opening smaller stores in off-mall locations. While this report has not covered the Macy’s Backstage banner elsewhere (because the retailer does not disclose financials, exact store numbers or results on its Backstage locations), it is notable that the company is experimenting with a new, smaller, off-mall format for its off-price business. Macy’s reported that it is testing three market locations in fiscal 2021.

Retailers Are Experimenting with Store Segmentation

Nordstrom Rack reported at its Investor Day in February 2021 that the company is segmenting its Nordstrom Rack locations by “price,” “brand” and “hybrid,” stores across its geographic base to better serve its customers. Management said that 26% of Nordstrom Rack shoppers are seeking bold and trendy brands and aspire to afford designers, while 13% are seeking “price” and are smart, savvy spenders that are looking for traditional and practical value-oriented deals.

As shown in the image below, Nordstrom provided an example of how the company is repositioning its store fleet in New York to better serve customer segments: Its “price” stores will be more sensitive to the prices that the store offers; the “brand” stores will be more attuned to fashion-conscious customers seeking trends; and the “hybrid” stores will mix the two—similar to its stores today. The company reported that it has repositioned 70% of its North American stores to “price” stores. On its earnings call for the second quarter of fiscal year 2021, in August 2021, management said that among “the 70 Rack stores that have been repositioned for a price-oriented offering, new-to-Nordstrom customer counts increased 16% over 2019.”

[caption id="attachment_132507" align="aligncenter" width="724"] Nordstrom is repositioning its Rack store fleet in New York Source: Nordstrom [/caption]

Digital Growth

The off-price market remains bifurcated on physical store growth versus digital growth.

Burlington and Ross Stores have reported that they remain focused on physical growth channels. Both have iterated that at an average unit retail between $10 and $12, having a digital presence is not economically viable, particularly with increasing consumer expectations for free shipping and returns.

On the other hand, Nordstrom Rack has been aggressively pursuing its digital capabilities for over two years. At its Investor Day presentation in February 2021, management reported that it is more cost-effective for the retailer when customers use its BOPIS (buy online, pick up in store) services, and that BOPIS and ship from store help Nordstrom Rack to further the services it offers to customers while also increasing its supply chain capabilities. In the third quarter of fiscal year 2020 dated November 2020, Nordstrom reported in November 2020 that online represented 40% of Nordstrom Rack sales in the third quarter of fiscal 2020. Nordstrom is seeking to eventually put all of its Nordstrom Rack assets online and create a “synergistic relationship” between its full-line stores and Nordstrom Rack stores, according to the company.

We noted above that digital sales decreased the average retail sales density of Nordstrom Rack physical stores, because online sales replace, rather than add to, its brick-and-mortar sales. However, Nordstrom would see greater benefits if it could maintain its physical store sales while also increasing its digital sales.

The TJX Companies launched tjmaxx.com in 2013, marshalls.com in 2019 and sierra.com in 1999 (The TJX Companies acquired Sierra Trading Post in 2012). The retailer reported that e-commerce sales were approximately 5% of TJX International’s net sales for fiscal 2020, totaling $192 million, and 3% for fiscal 2019, totaling $169 million. Performance was impacted in fiscal 2020 due to the Covid-19 pandemic, as the company temporarily closed its online business for a portion of the year, in addition to closing stores.

The TJX Companies plans to launch homegoods.com in the third quarter of fiscal 2021. Management reported that it believes the retailer can capture a greater share of the home sector through an online presence. The company reported that its comps and average unit retail are very strong, with its Homesense business even stronger than its HomeGoods business. Management is confident about taking the business online amid current consumer product discovery and buying behaviors and delivery preferences.

Nordstrom is repositioning its Rack store fleet in New York Source: Nordstrom [/caption]

Digital Growth

The off-price market remains bifurcated on physical store growth versus digital growth.

Burlington and Ross Stores have reported that they remain focused on physical growth channels. Both have iterated that at an average unit retail between $10 and $12, having a digital presence is not economically viable, particularly with increasing consumer expectations for free shipping and returns.

On the other hand, Nordstrom Rack has been aggressively pursuing its digital capabilities for over two years. At its Investor Day presentation in February 2021, management reported that it is more cost-effective for the retailer when customers use its BOPIS (buy online, pick up in store) services, and that BOPIS and ship from store help Nordstrom Rack to further the services it offers to customers while also increasing its supply chain capabilities. In the third quarter of fiscal year 2020 dated November 2020, Nordstrom reported in November 2020 that online represented 40% of Nordstrom Rack sales in the third quarter of fiscal 2020. Nordstrom is seeking to eventually put all of its Nordstrom Rack assets online and create a “synergistic relationship” between its full-line stores and Nordstrom Rack stores, according to the company.

We noted above that digital sales decreased the average retail sales density of Nordstrom Rack physical stores, because online sales replace, rather than add to, its brick-and-mortar sales. However, Nordstrom would see greater benefits if it could maintain its physical store sales while also increasing its digital sales.

The TJX Companies launched tjmaxx.com in 2013, marshalls.com in 2019 and sierra.com in 1999 (The TJX Companies acquired Sierra Trading Post in 2012). The retailer reported that e-commerce sales were approximately 5% of TJX International’s net sales for fiscal 2020, totaling $192 million, and 3% for fiscal 2019, totaling $169 million. Performance was impacted in fiscal 2020 due to the Covid-19 pandemic, as the company temporarily closed its online business for a portion of the year, in addition to closing stores.

The TJX Companies plans to launch homegoods.com in the third quarter of fiscal 2021. Management reported that it believes the retailer can capture a greater share of the home sector through an online presence. The company reported that its comps and average unit retail are very strong, with its Homesense business even stronger than its HomeGoods business. Management is confident about taking the business online amid current consumer product discovery and buying behaviors and delivery preferences.