albert Chan

US Off-Price Retail Insights

Burlington Stores, Ross Stores and The TJX Companies (which includes US banners T.J. Maxx, Marshalls, HomeGoods, and Homesense) are the major off-price retailers in the US.

Off-price retail is focused on value, concentrated on physical stores in off-mall locations. Off-price retail models work with thousands of merchants and vendors in their supply chain with deliveries multiple times a week, so the product replenishment model is unique.

The off-price sector has been growing steadily in recent years, with the three major companies reporting positive revenue and comparable sales growth for each of the five years prior to the Covid-19 pandemic. Despite temporary store closures and accelerating consumer shifts to digital channels during the pandemic last year, off-price retailers remain committed to physical retail.

Coresight Research’s new US Off-Price Retail Insights quarterly series covers the recent performance of these three companies, highlighting trends in comparable sales, revenue, trending categories and areas of note by management.

In this report, we look at the performance of the three retailers in their most recently reported quarter (the fourth quarter of the fiscal year ended January 30, 2021, which we refer to throughout as 4Q20, although please note that this period was 4Q21 for TJX) and discuss relevant fiscal-year highlights. As this is the first report in our new series, we provide an overview of the companies and their retail banners in the appendix.

4Q20: In Detail

As with other retail sectors, off-price was impacted by the Covid-19 pandemic last year: The combined revenue of Burlington, Ross and TJX totaled $43.8 billion In fiscal 2020, down 20.8% year over year from $55.3 billion in fiscal 2019.

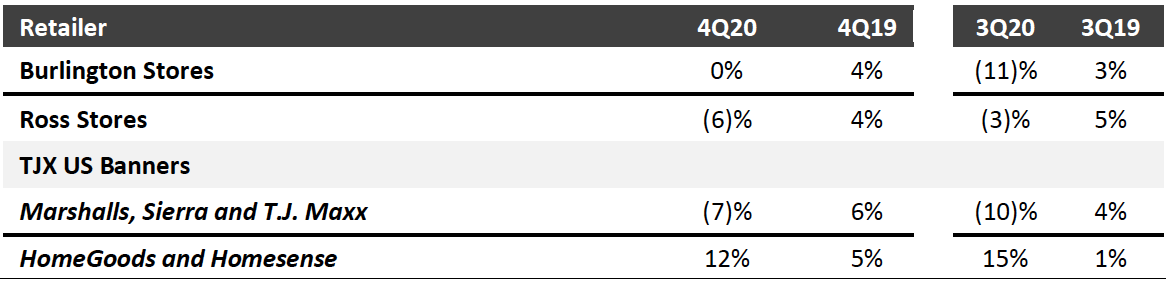

Comparable Sales: Sequential 4Q20 Comp Improvements and Stimulus-Driven Sales in January

For 4Q20, the TJX HomeGoods and Homesense banners were the standout performers of the off-price banners, reporting 12% growth in comparable sales. Burlington reported flat comps, noting a boost from January stimulus checks; this represents an increase from the company’s 3Q20 comp sales decline of 11%. Ross reported a comp sales decline of 6% in the fourth quarter, down from a decline of 3% in 3Q20, impacted by California occupancy restrictions due to the pandemic. Marshalls, Sierra and T.J. Maxx (TJX banners) saw comp sales growth of (7)%, a sequential improvement from (10)% in 3Q20.

Burlington provided more color on its comp sales for 4Q20. The company’s strength is outerwear, so it was impacted by unusually warm weather in the fall. Comp sales growth was down 10% in November 2020, flat in December 2020 and up 17% in January 2021. Management believes that the strong January 2021 comps were primarily driven by stimulus checks.

Ross reported that in terms of month-to-month progress over the quarter, the biggest decline in comp growth was in November 2020 (by mid-single digits) before stimulus payments were issued and shelter-in-place orders were lifted in California, resulting in improvements later in the quarter. In terms of geography, California, Florida and Texas locations significantly underperformed.

TJX reported that comp sales growth improved each month of the quarter and were positive in January 2021—exceeding expectations across each of its divisions, including HomeGoods, which experienced a double-digit increase in comp sales. Management said that its Homesense banner is even “up at notch” in terms of its home business, and comps were even higher at Homesense than at HomeGoods for the fourth quarter.

Figure 1. US Off-Price Retailers: Comparable Sales*

[caption id="attachment_125885" align="aligncenter" width="550"] *We refer to fiscal 2020 as the year ended January 30, 2021 and fiscal 2019 as the year ended January 31, 2020

*We refer to fiscal 2020 as the year ended January 30, 2021 and fiscal 2019 as the year ended January 31, 2020Source: Company reports/S&P Capital IQ[/caption]

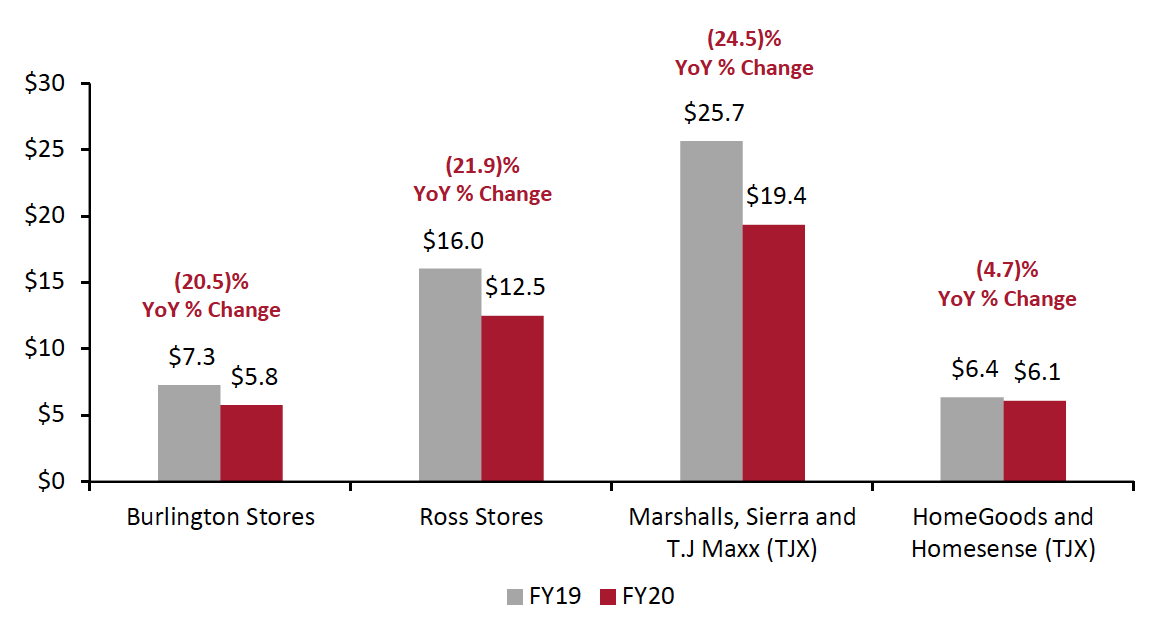

Revenue: Year-over-Year Declines but a More Positive Second Half of 2020

With the end of the fourth quarter also bringing the end to the fiscal year, we consider the full-year revenue performance of the three major off-price retailers below.

- Burlington saw a revenue decline of 20.5%, from $7.3 billion in fiscal 2019 to $5.8 billion in fiscal 2020.

- Ross, the second largest off-price retailer with 1,859 stores (1,585 Ross Dress for Less stores and 274 dd’s Discount stores), declined by 21.9% from fiscal 2019 to 2020—$3.5 billion in revenue—from $16.0 billion to $12.5 billion.

- TJX’s Marshalls, Sierra and T.J. Maxx banners saw the greatest revenue impacts from the pandemic in the latest fiscal year, with combined revenue declining by 24.5% year over year, from $25.7 billion to $19.4 billion. The company’s HomeGoods and Homesense banners performed relatively better, with a 4.7% year-over-year decline in revenues from $6.4 billion to $6.1 billion.

Figure 2. US Off-Price Retailers: Revenue (USD Bil.), FY19 vs. FY20

[caption id="attachment_125886" align="aligncenter" width="700"] *We refer to fiscal 2020 as the year ended January 30, 2021 and fiscal 2019 as the year ended January 31, 2020

*We refer to fiscal 2020 as the year ended January 30, 2021 and fiscal 2019 as the year ended January 31, 2020Source: Company reports/Coresight Research[/caption]

We posit that the sharper decline in Marshalls, Sierra and T.J. Maxx banners as compared to Burlington and Ross is down to the company’s focus on fashion-forward apparel that TJX (particularly the T.J. Maxx banner) is known for. At the onset of the pandemic, consumers’ shopping priorities were focused more on essentials, before shifting to casual and comfort wear as most consumers worked from home and had little reason to shop for “fun” apparel or work apparel: Total apparel and footwear sales in the US declined by 12.2% in 2020, according to the Bureau of Economic Analysis. If consumers were shopping for apparel essentials based on value pricing, Burlington and Ross may have held the advantage, as they reported average unit retail prices of $10–$12 and $10–$11, respectively, while average unit retail prices at TJX are at least $14 (as last reported by analysts in 2016).

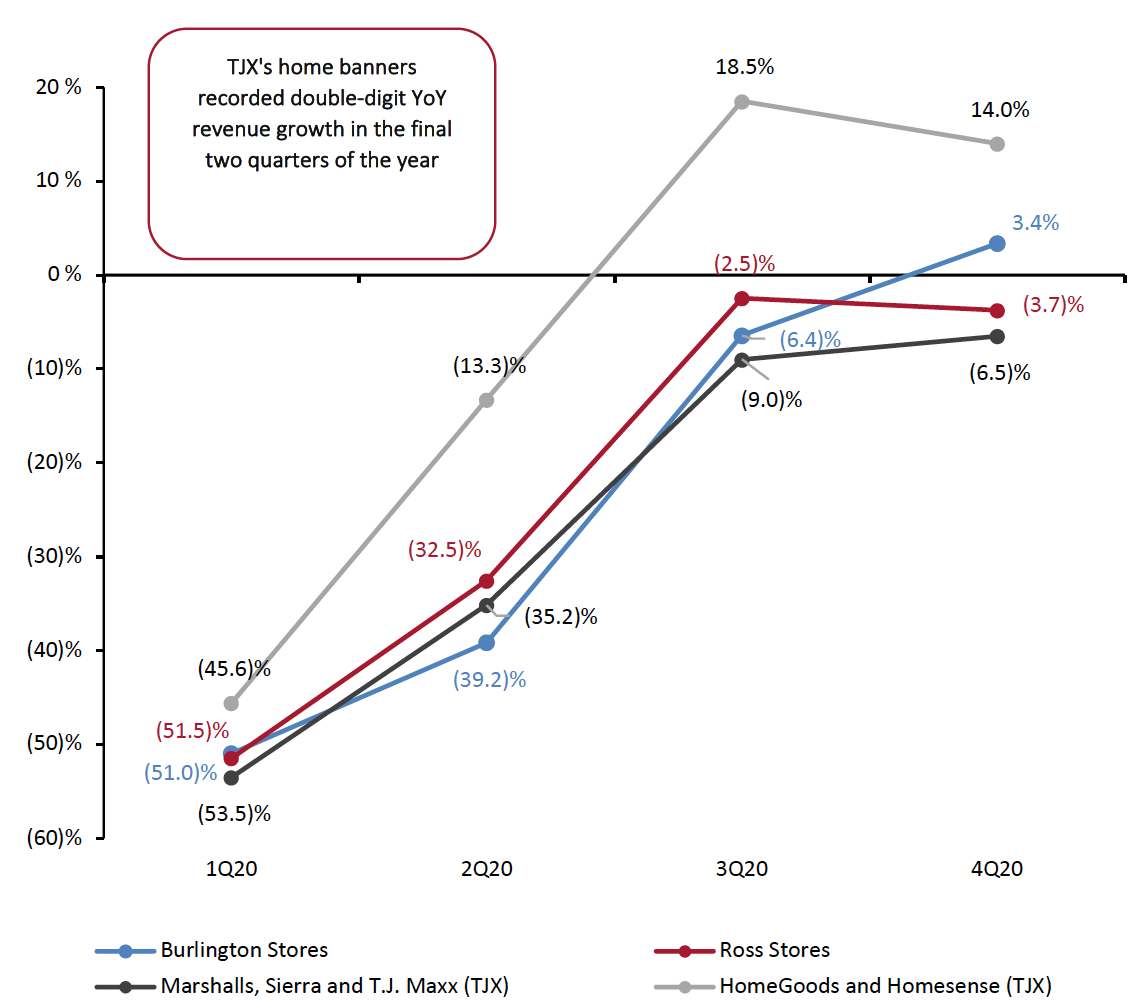

We outline the sequential performance of the retailers by quarter below.

- Burlington’s revenue growth has continued to improve quarter over quarter since the pandemic-impacted deep decline in 1Q20, with 3.4% year-over-year growth in 4Q20.

- At Ross, year-over-year revenue growth increased steadily from 1Q20 to 3Q20 but then declined in 4Q20. Management highlighted that geographically, its California, Florida and Texas locations significantly underperformed in the fourth quarter; these three states represent 49% (919 stores) of the company’s total stores as of November 2020, according to Ross. The retailer has 434 stores in California alone, so the stay-at-home mandates and restrictions on store operating hours in the state were likely key contributors to the poor performance.

- TJX’s HomeGoods and Homesense banners recorded the most notable recovery through the year: The home banners saw 19% year-over-year revenue growth in 3Q21 and 14% growth in 4Q21 (equivalent to the other retailers’ 3Q20 and 4Q20), which the retailers attributes to consumers’ overwhelming focus on the home category amid stay-at-home measures.

Figure 3. Off-Price Retailers: Revenue by Quarter, FY20* (YoY % Change)

[caption id="attachment_125887" align="aligncenter" width="700"] *The year ended January 30, 2021, which was fiscal 2020 for Burlington and Ross but fiscal 2021 for TJX

*The year ended January 30, 2021, which was fiscal 2020 for Burlington and Ross but fiscal 2021 for TJXSource: Company reports/Coresight Research[/caption]

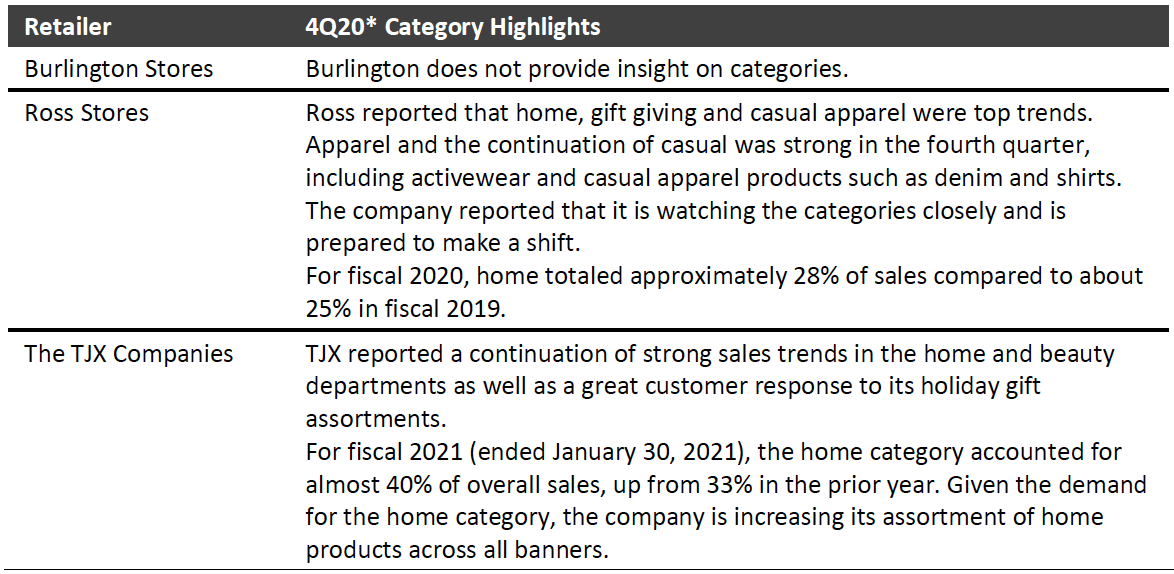

Product Categories: Home and Gifts Are Trending

As we previously noted, the off-price model is based on a fast-moving assortment of trending categories with shipments arriving two to three times per week. The three covered off-price retailers remain tight-lipped on which categories performed well in 2020 and those they are pursuing moving forward. However, each company has noted that they are carefully watching customer trends and are ready to adapt quickly as consumer preferences change.

Figure 4. US Off-Price Retailers: Category Highlights

[caption id="attachment_125888" align="aligncenter" width="700"] *The quarter ended January 30, 2021, which was 4Q20 for Burlington and Ross but 4Q21 for TJX

*The quarter ended January 30, 2021, which was 4Q20 for Burlington and Ross but 4Q21 for TJXSource: Company reports/Coresight Research[/caption]

Areas of Note by Management

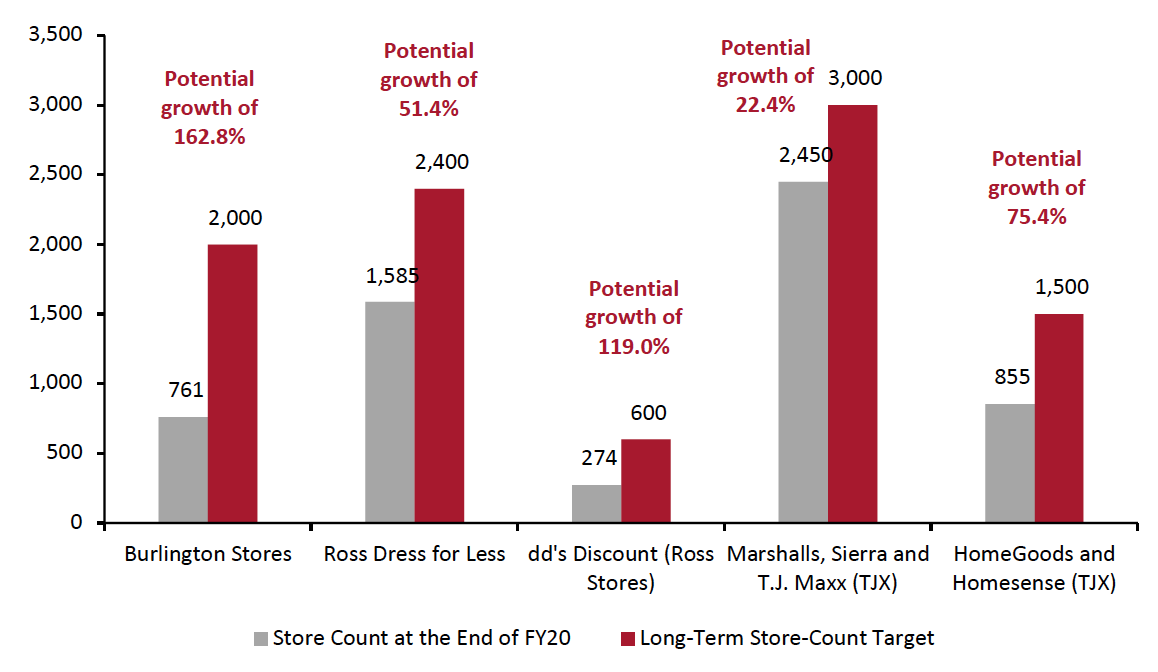

Physical Store Outlook

Despite the pandemic boosting e-commerce and causing disruption in the brick-and-mortar channel, all three of the off-price retailers have expressed confidence in physical retail and confirmed plans to expand their store portfolios in fiscal 2021 and beyond.

Burlington operates 761 stores, as of the end of 4Q20. The retailer provided an update to its retail strategy by announcing a long-term target of 2,000 stores—representing 163% portfolio growth—up from its previous goal of 1,000 stores. Burlington plans to open approximately 100 new stores in 2021 while closing or relocating around 25 stores, for a total increase of 75 net new stores. One-third of the retailer’s new store openings this year will be of a new format that Burlington has been developing over the past year, measuring 25,000 square feet each—smaller than its current 40,000-square-foot stores. Over time, Burlington plans that the smaller format will represent the majority of new store openings due to the economic benefits it provides, such as lower occupancy costs and higher operating margins.

Ross plans to add about 60 stores in fiscal 2021—40 under the Ross Dress for Less banner and 20 dd's Discounts stores—taking its total count to 1,919 stores. In terms of long-term store potential, the company estimates that it will operate 2,400 Ross stores and 600 dd's Discounts stores, growing Ross’ overall store base by 61.4% from 1,859 stores in fiscal year 2020 to 3.000 stores.

TJX is planning to add 78 new stores in the US in 2021, with 34 across Marshalls and T.J. Maxx, 34 across HomeGoods and Homesense, and 12 under the Sierra banner. According to the company (as of February 1, 2020), its long-term store-count target for Marshalls, Sierra and T.J. Maxx is 3,000, representing 22.4% growth from its 2,450 stores today. In its 4Q21 earnings call, TJX estimated that the HomeGoods and Homesense banners could total 1,500 stores in the long term, up from 855 stores at the end of fiscal 2021 (ended January 30, 2021).

Figure 5. US Off-Price Retailers: Store Portfolios as of FY20 and Long-Term Targets

[caption id="attachment_125889" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Higher Supply Chain Costs

All three off-price retailers cited higher supply chain costs during 4Q20, driven by higher domestic freight costs, higher wages and costs associated with the Covid-19 pandemic. The retailers did not provide overall financial outlooks but stated that they expect the higher supply chain costs to persist into 2021.

Burlington reported a significant year-over-year increase of 70 basis points in freight expenses in 4Q20. Product sourcing costs—associated with buying and processing goods through the supply chain—also increased to $143 million compared to $89 million in 4Q19, representing an increase of 230 basis points as a percentage of sales versus last year. According to the company, the major drivers of the higher supply chain costs were higher wage rates, higher wage incentives, the impact of lower average unit retail and product mix, and inefficiencies caused by safety protocols and the general disruption in the flow of receipts through the global retail supply chain.

Management expects higher freight costs to continue to pressure gross margin in fiscal 2021. Burlington expects that the industry-wide supply chain issues are going to continue, putting pressure on freight and supply chain expenses, and the various pandemic-related safety measures in stores and distribution centers will likely need to remain in place for some time.

Ross reported its domestic freight and ocean freight costs were significantly higher in 4Q20 compared to the year-ago period: Freight costs increased by 100 basis points, year over year, due to ongoing industry-wide supply chain congestion. Buying costs were higher by 50 basis points and distribution costs grew 15 basis points; distribution cost increases were primarily due to higher wages in the distribution centers. Beyond these specific costs, management identified that the Covid-19 pandemic has been driving higher costs in the supply chain. Ross expects freight costs and wage pressures to continue through 2021.

TJX reported that the headwinds of freight, wage and supply chain costs that existed pre-pandemic have not gone away but have instead gotten worse due to the current environment. On freight specifically, the company continues to see capacity constraints and driver shortages, resulting in higher costs. TJX also reported that it is experiencing incremental freight costs due to lower average ticket value and moving more units through the supply chain.

What We Think

Given that 1Q21 will be annualizing the deepest declines of 2020 (as seen in Figure 3), we are likely to see a marked jump in year-over-year comparable sales. However, even comparing to fiscal 2019 (pre-pandemic), we expect to see improvements in 1Q21 comparable sales trends due to the impact of March stimulus checks (given the sales improvements exhibited during 4Q20 with January’s stimulus checks) and increased consumer confidence due to vaccinations, which should boost store traffic. We expect this to positively impact TJX banners Marshalls and T.J. Maxx in particular, which offer fashion-oriented styles, as there is likely to be a resurgence in consumers wanting to shop for spring fashion due to more opportunities to go out.

We expect the supply chain to pressure the off-price sector in 2021 and will be watching this closely. The sector’s wide distribution network of thousands of vendors and suppliers globally has been a differentiator for sourcing and unique product selection; however, with the current port congestion situation and increasing freight and product sourcing costs, it remains to be seen if the impact of cost pressures outweigh the benefits of the off-price model.

Appendix: Overview of the Off-Price Companies and Retail Banners

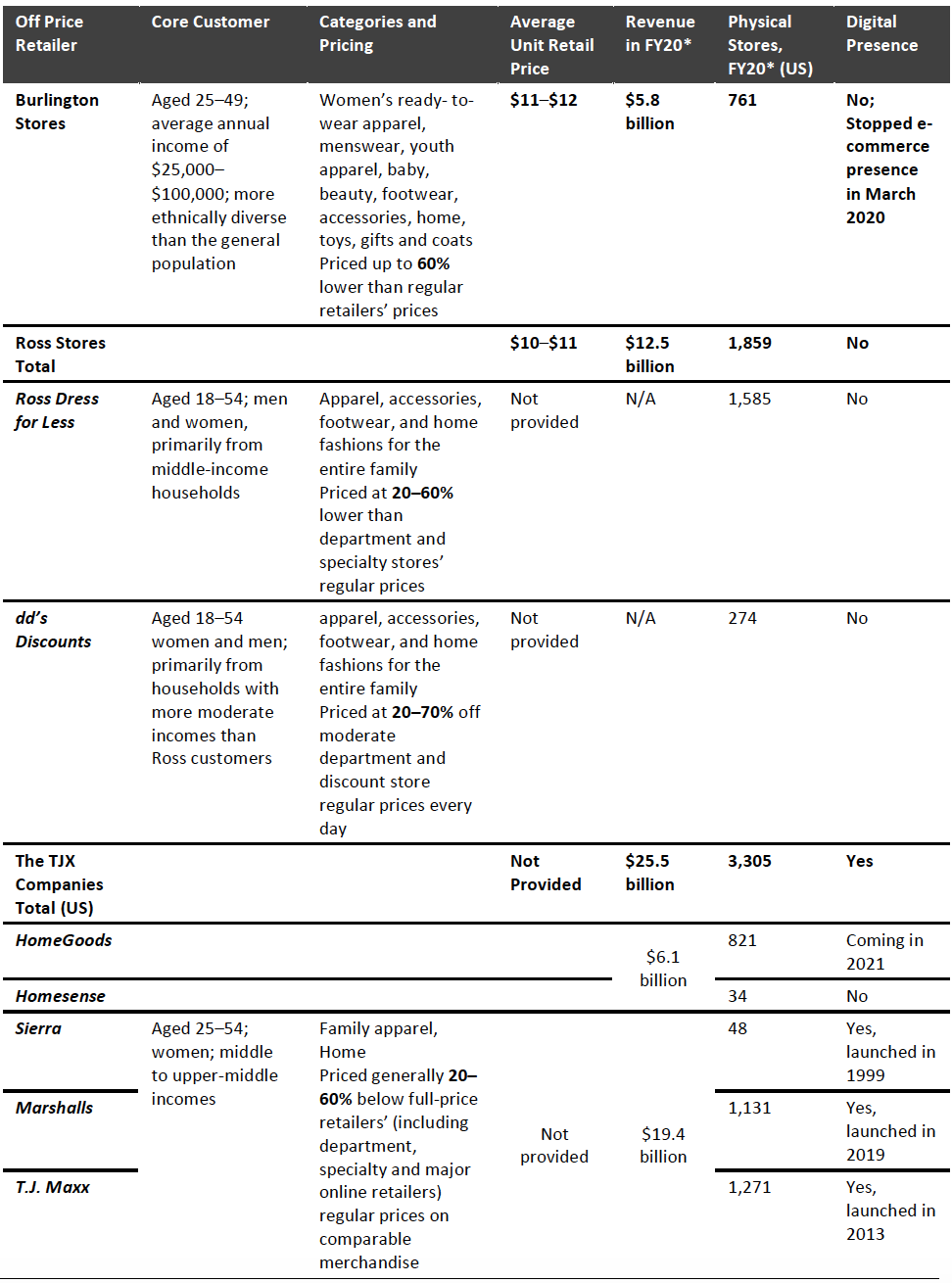

The TJX Companies is the largest off-price retailer, with five banners in the US: HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx. Total revenue across its US banners totaled $25.5 billion and the company had 3,305 stores, as of the end of fiscal 2021 (ended January 30, 2021). Its US operations comprised 79.2% of total revenues and 72.3% of total store locations in fiscal 2021 (TJX has stores in Canada and international locations too).

TJX defines its core customer as female, aged 25–54, and with a middle- to upper-middle income, according to company reports dated February 2020. The company describes its core consumer as fashion- and value-conscious, shopping from a range of different retailers including department stores, specialty stores and mass merchants, both online and in-store.

TJX’s prices are 20–60% below full-price retailers. The retailer is the only off-price company with e-commerce sites: marshalls.com launched in 2019; tjmaxx.com launched in 2013; and sierra.com launched in 1999 (TJX acquired Sierra Trading Post in 2012). TJX plans to launch homegoods.com in 2021.

Ross Stores is the second-largest off-price company, operating under the Ross Dress for Less and dd’s Discounts banners. Combined revenue totaled $12.5 billion in fiscal 2020. Ross Dress for Less is the biggest off-price banner among the covered companies, with 1,585 stores as of the end of fiscal 2020 (85.3% of Ross Stores’ total portfolio). By comparison, the second largest is TJX’s T.J. Maxx banner, which has 1,271 stores. The dd’s Discounts banner has only 274 stores.

In its 10-K report for fiscal 2020, Ross detailed that both its Ross Dress for Less and dd’s Discounts banners target value-conscious men and women between the ages of 18 and 54. In an Investor Presentation dated November 2020, Ross described its typical Ross Dress for Less customer as female (70–75% of its shoppers), with the core customer visiting stores two to three times per month. The dd’s Discount customer is younger, more ethnically diverse and from lower to moderate household incomes. Prices at Ross Dress for Less are 20–60% lower, and prices at dd’s Discounts 20–70% lower, than department and specialty store regular prices.

The company does not operate online and reported on its 3Q19 earnings call that e-commerce would not be financially sustainable since the online environment offers free shipping and returns, and the company operates with an average unit retail price of $10–$11.

Burlington Stores is the smallest of the three off-price companies, with fiscal 2020 revenue of $5.8 billion. The retailer operates 761 stores as of the end of 4Q20.

Burlington’s core customer as described in the company’s 10-K for fiscal 2020 as aged 25–49 with an average household income of $25,000–$100,0000 and more ethnically diverse than the general population. The core customer is educated, resides in mid-sized to large metropolitan areas and is a brand-conscious fashion enthusiast. The retailer’s prices are up to 60% lower than regular retailers’ prices.

Burlington does not operate online. Management reported on its 3Q20 earnings call that with an average unit retail price of $11–$12, covering a broad fashion assortment, it is economically and strategically difficult for e-commerce businesses to compete with Burlington at the price points in the categories where they compete.

Appendix Figure 1. US Off-Price Retailers: Overview

[caption id="attachment_125890" align="aligncenter" width="700"] *The year ended January 30, 2021, which was fiscal 2020 for Burlington and Ross but fiscal 2021 for TJX

*The year ended January 30, 2021, which was fiscal 2020 for Burlington and Ross but fiscal 2021 for TJXSource: Company reports/Coresight Research[/caption]