DIpil Das

https://youtu.be/pDp3cWtiU1Y

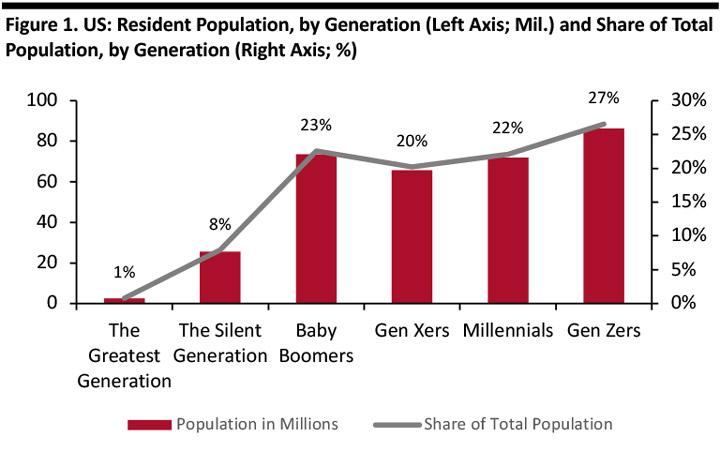

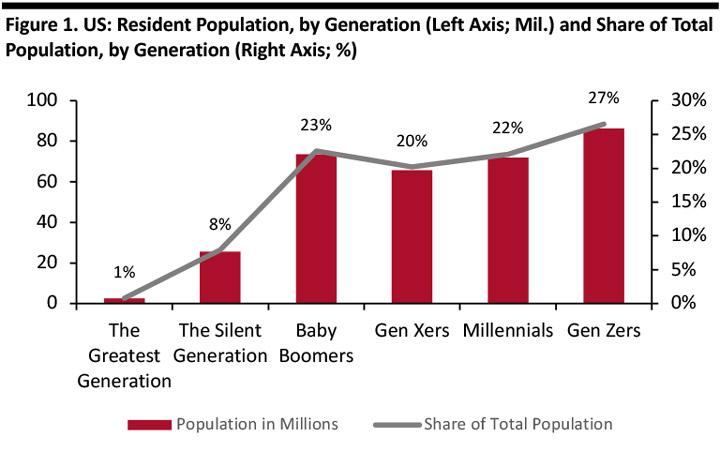

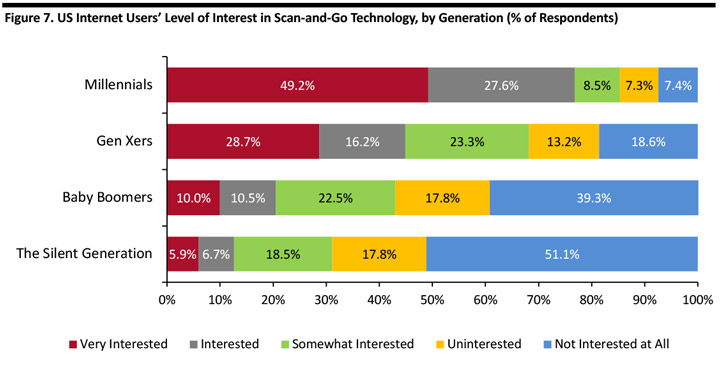

Definitions: The Greatest Generation were born 1910-1924; the Silent Generation were born 1925–1945; Baby Boomers were born 1946–1964; Gen Xers were born 1965–1979; millennials were born 1980–2000; and Gen Zers were born 2000 and later.

Definitions: The Greatest Generation were born 1910-1924; the Silent Generation were born 1925–1945; Baby Boomers were born 1946–1964; Gen Xers were born 1965–1979; millennials were born 1980–2000; and Gen Zers were born 2000 and later.

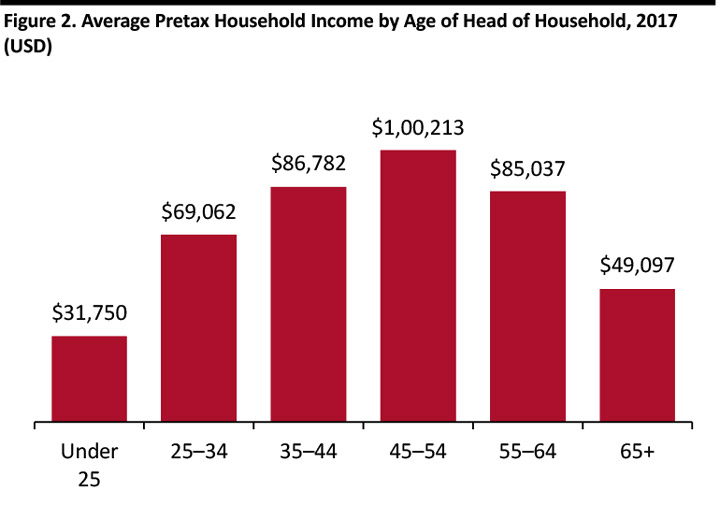

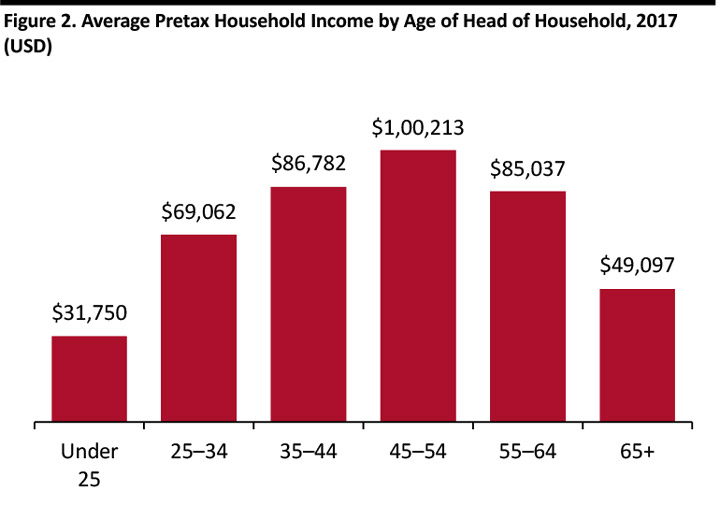

Source: US Census Bureau/Statista/Coresight Research[/caption] Millennials’ Spending Power Will Increase in the Coming Years On average, older millennials already have substantial household incomes, and the average income for younger millennials will increase as they move into their peak earning years. According to the US Bureau of Labor Statistics, the 25–34-year-old group — which effectively represents the midpoint of the millennial demographic — saw an average pretax income of around $69,000 in 2017, making it the fourth-highest-earning age group. Income peaks in the 45–54 age group. As younger millennials enter the workforce and older millennials progress in their careers, there will be a surge in their average household income. And, as their spending power increases, millennials will lay out more on food, be it cooking at home or dining out. [caption id="attachment_83848" align="alignnone" width="720"] Source: US Bureau of Labor Statistics[/caption]

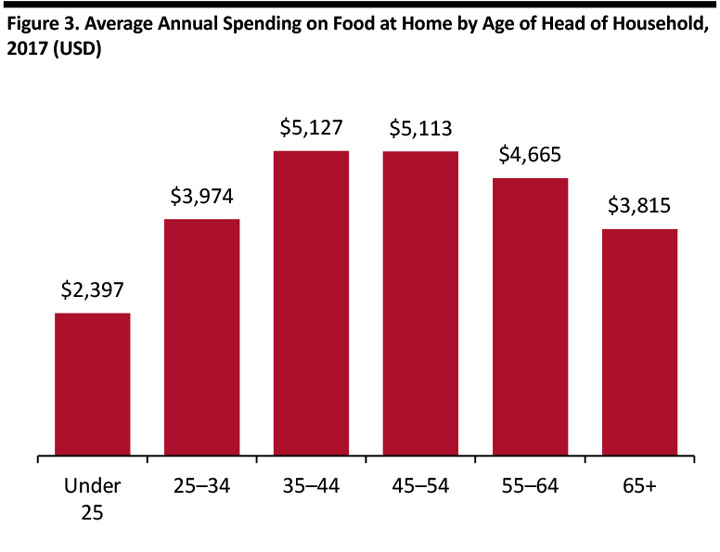

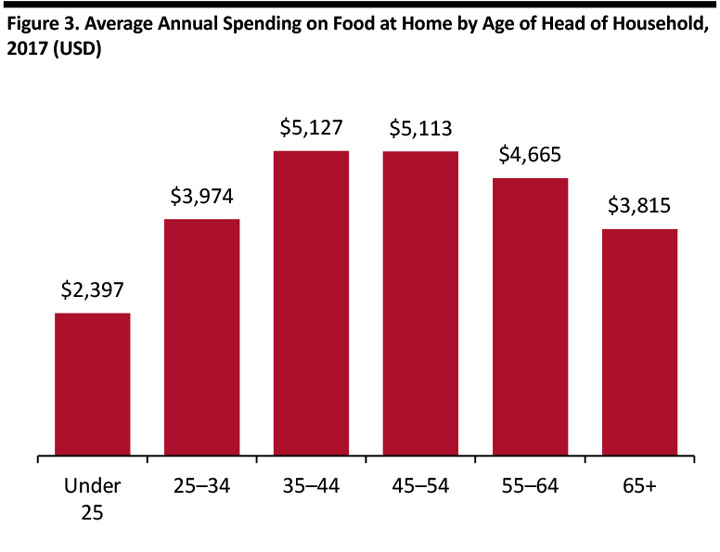

According to the Bureau of Labor Statistics, households headed up by those aged 25–34 spent on average $3,974 on food at home in 2017. Spending on food at home peaks among 35–44 year olds, which includes older millennials.

[caption id="attachment_83849" align="alignnone" width="720"]

Source: US Bureau of Labor Statistics[/caption]

According to the Bureau of Labor Statistics, households headed up by those aged 25–34 spent on average $3,974 on food at home in 2017. Spending on food at home peaks among 35–44 year olds, which includes older millennials.

[caption id="attachment_83849" align="alignnone" width="720"] Source: Bureau of Labor Statistics[/caption]

Source: Bureau of Labor Statistics[/caption]

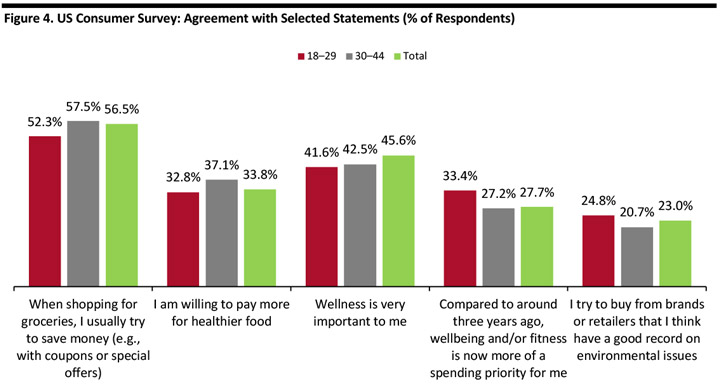

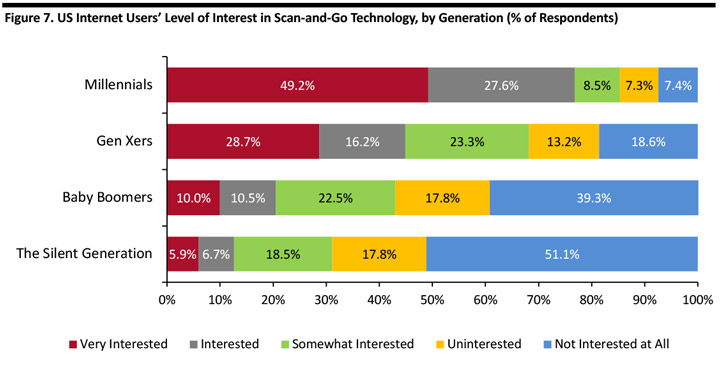

Base: 1,729 US Internet users aged 18+, surveyed in February 2019

Base: 1,729 US Internet users aged 18+, surveyed in February 2019

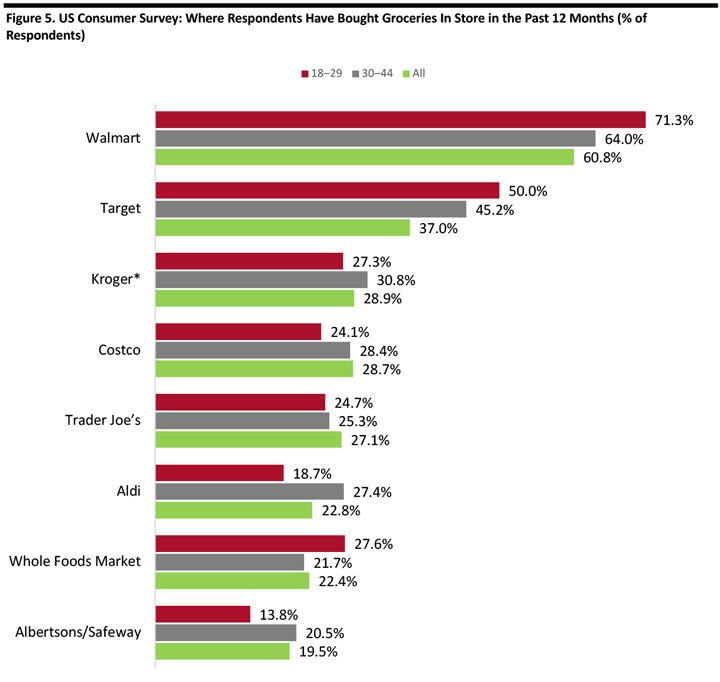

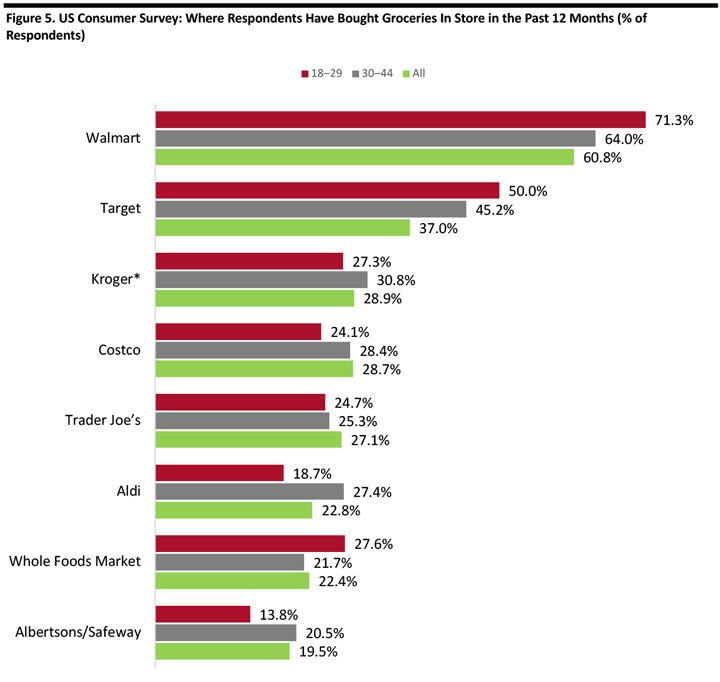

Source: Coresight Research [/caption] Younger millennials may not be avid coupon clippers, but they do exhibit thrifty characteristics when it comes to their choice of grocery store. *Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

*Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 1,813 US Internet users aged 18+ who have bought groceries in store in the past 12 months, surveyed in March 2018

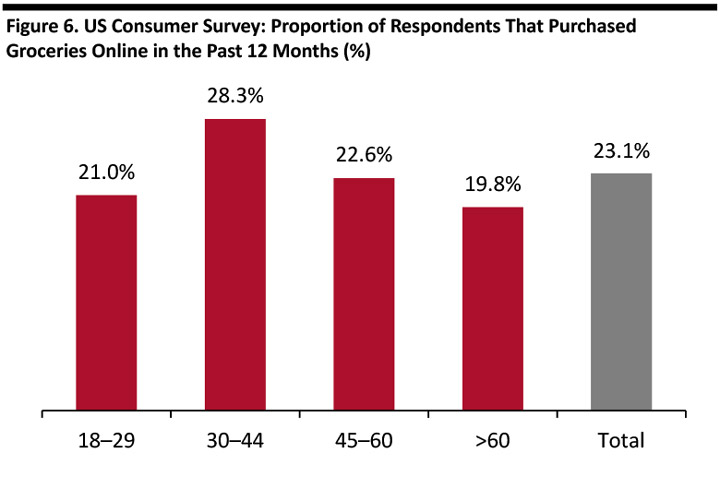

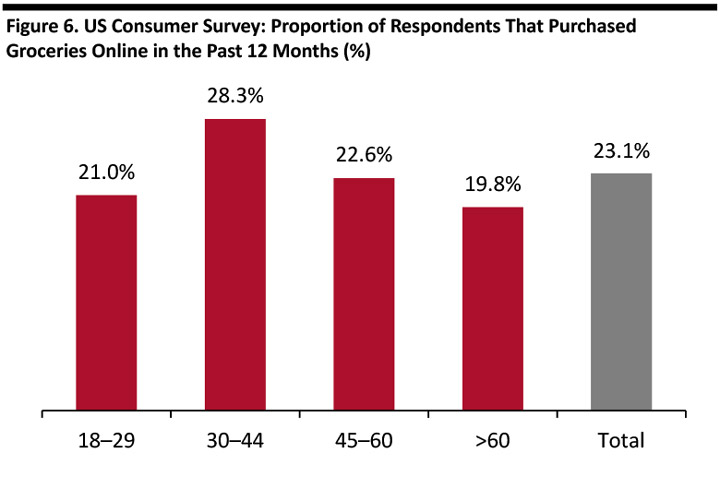

Source: Coresight Research [/caption] Older millennials are the principal demographic for Internet grocery retailers: Our 2018 US online consumer grocery survey found that online grocery shopping peaks in the 30-44 age group, reflecting a combination of time pressure, rising incomes, relatively settled professional and family lives, and familiarity with digital channels. E-commerce still captures a very small share of the total US grocery market. We estimate that online sales will account for around 2.7% of all food and beverage retail sales in the US this year, up from an estimated 2.2% last year. As younger millennials continue to establish households, build families and grow incomes, they are joining their older counterparts in driving growth in the e-commerce channel. [caption id="attachment_83852" align="alignnone" width="720"] Base: 1,883 US Internet users aged 18+, surveyed in March 2018

Base: 1,883 US Internet users aged 18+, surveyed in March 2018

Source: Coresight Research [/caption] Survey conducted July 5, 2017

Survey conducted July 5, 2017

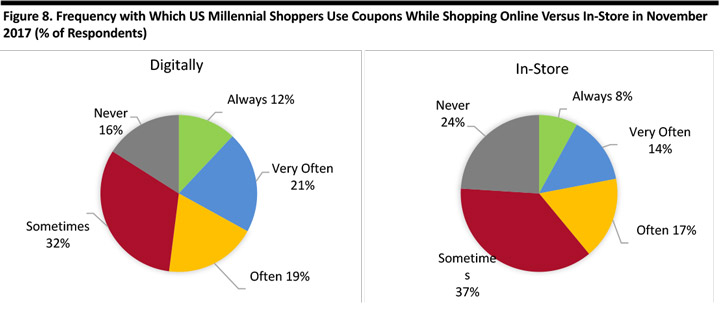

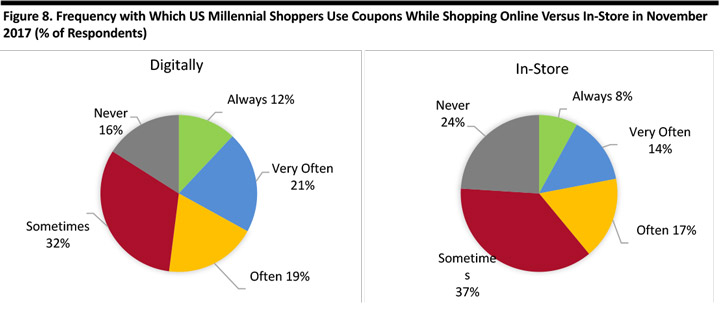

Source: Acosta [/caption] Brand Switching: Acosta noted that 48% of surveyed millennials agreed they are not brand-loyal and switch to any brand when they can find a better deal. The report found 44% of millennials visit three or more stores a week to find a better deal, compared with 29% of all surveyed shoppers. Millennials are also more likely to shop multiple stores to get fresh food. While 37% of all shoppers said they make multiple trips to ensure food is fresh, some 65% of millennials reported making multiple store visits. In contrast, only 47% of Gen Xers, 25% of Baby Boomers and 22% of the Silent Generation said they make multiple trips to find fresh food. Frugal: According to a November 2017 survey conducted by CouponFollow, an online platform that tracks and features coupon codes from online merchants, about 84% of millennials said they use coupon codes while shopping online. [caption id="attachment_83854" align="alignnone" width="720"] Ages 20–35

Ages 20–35

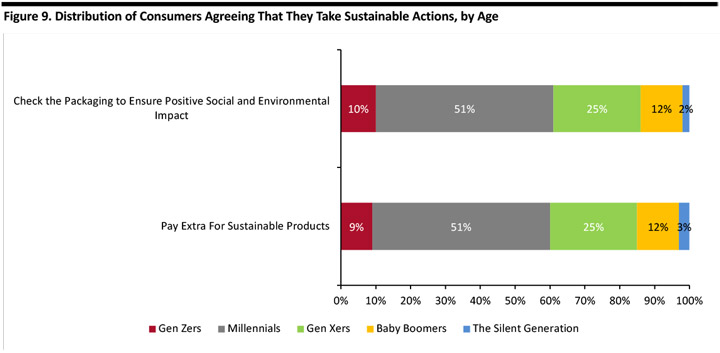

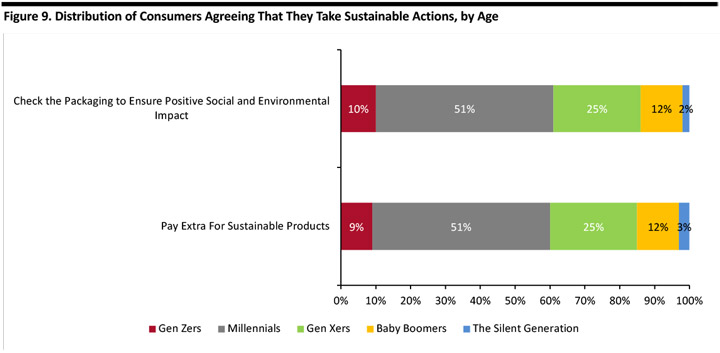

Source: CouponFollow [/caption] Social Responsibility Attracts Millennials Millennials focus more than any other generation on whether a brand aligns itself with a social cause. If a retailer’s values resonate with millennials, the brand will most likely win their trust. According to a Nielsen survey on corporate social responsibility, millennials represented 51% of those who agreed that they pay extra for sustainable products and 51% of those who check the packaging for sustainable labeling. In contrast, Gen Xers constituted 25% of those who said they pay extra for sustainable products and 25% of those who check the packaging for sustainable labeling. [caption id="attachment_83855" align="alignnone" width="720"] Survey conducted during the first quarter of 2014

Survey conducted during the first quarter of 2014

Source: Nielsen [/caption] Many millennials exhibit a preference for buying food from retailers that provide detailed information on where the food was sourced: According to a September 2015 report from market-research firm Mintel, 74% of millennials wished that food companies were more transparent about how they manufacture their products. This compared with 69% of non-millennials. The report also found that 59% of millennials will stop buying a certain brand’s products if they find that the brand is unethical; 58% of millennials agreed that “where you buy your groceries reflects your personal values,” compared with 28% of non-millennials. Retailers are aligning themselves with these kinds of causes. For example, Kroger launched its ambitious “Zero Hunger Zero Waste Plan” in September 2017: It set a goal to eliminate food waste in the company by 2025 through prevention and donation, and to accelerate food donations to provide three billion meals by 2025. The company also created a $10 million innovation fund to address hunger and food waste issues. Base: 2,136 US respondents aged 18+, surveyed February 4–16, 2018

Base: 2,136 US respondents aged 18+, surveyed February 4–16, 2018

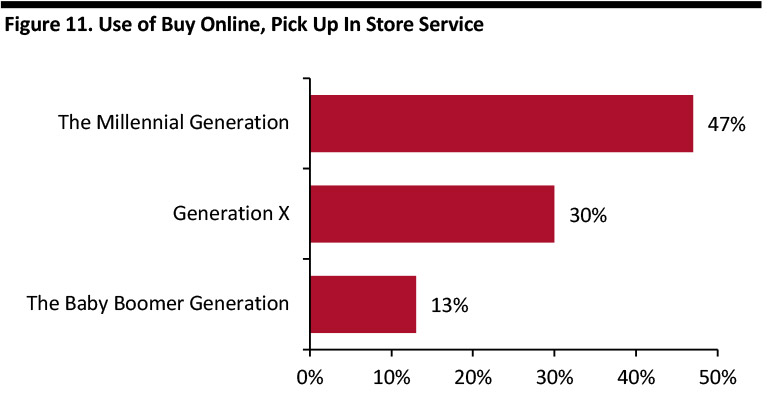

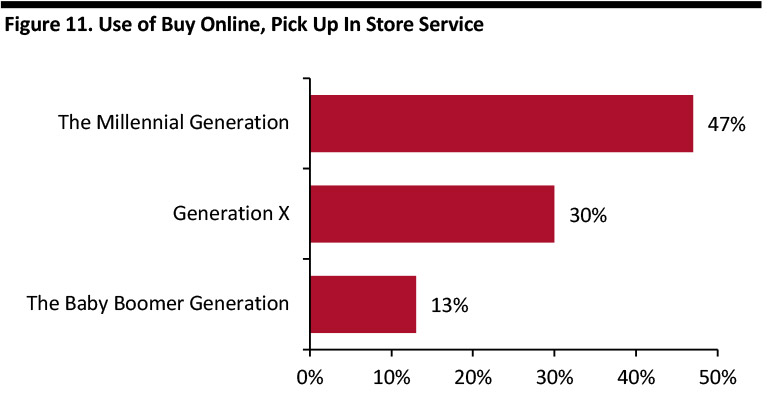

Source: FMI/Hartman Group [/caption] Buy Online, Pick Up In Store Online grocery shopping with two-hour or same-day delivery has become a popular choice for many millennials. However, most of the US online grocery market is served by “buy online, pick up in store” (BOPIS) services. Walmart and Kroger have been among those rolling out hundreds of grocery BOPIS collection points. A March 2018 survey by Euclid, a spatial analytics platform, found that millennials use the BOPIS services more across all categories than does any other generation. [caption id="attachment_83857" align="alignnone" width="720"] Base: 1,500 US respondents, surveyed in March 2018

Base: 1,500 US respondents, surveyed in March 2018

Source: Euclid [/caption] Millennials are Informed Shoppers Digitally savvy, mobile and exposed to a plethora of social media networks, millennials turn online to get product reviews and recommendations. According to a 2018 survey by the Pew Research Center, 81% of users in the 18-29 age group were active on Facebook, compared with 65% of users aged 50–64. Similarly, 91% of users aged 18–29 were active on YouTube, compared with 68% of users aged 50–64. Millennials are the generation most likely to use social networks to connect directly with brands. According to Euclid’s March 2018 survey, 40% of millennials said they used Facebook to communicate with brands, while 28% used Twitter. [caption id="attachment_83858" align="alignnone" width="720"] Base: 1,500 US respondents, surveyed in March 2018

Base: 1,500 US respondents, surveyed in March 2018

Source: Euclid [/caption]

Introduction

Millennials are the third largest living generation in the US by population and form the largest part of the labor force. Unsurprisingly, this demographic plays a leading role in shaping the grocery retail industry. However, as millennials age, the differences between the oldest and youngest in lifestyle, behavior and attitude are becoming more acute: With its oldest members turning 39 this year while its youngest are still filtering into the workforce, this generation is no longer a demographic group united by a youthful nature. In this report, we revisit the impact of millennial habits and demands on the grocery retail sector. We begin by assessing the scale of this demographic in terms of population and spending power.The Scale and Spending Potential of Millennials

Millennials (also referred to as Generation Y) are generally defined as the demographic cohort born between 1980 and 2000, now (as of 2019) aged between 19 and 39. They differ from their preceding, older generation, Gen X, in that they grew up as technology natives, tend to be more educated, often carry student debt, like to travel but also tend to live longer in their parents’ homes, are more likely to shun car ownership, and were the hardest-hit generation during the 2008 Great Recession. Some of these differences can be attributed to underlying preferences, while others are due to different economic conditions when they started their working lives. Millennials represented 22% of the total US population as of July 1, 2017, according to the US Census Bureau, but formed 35% of the US labor force, according to the Pew Research Center. Occupying a large part of the working population, they wield substantial purchasing power. Being relatively young, they are also setting up households, establishing families and bringing up children. As a result, they play a more impactful role in shaping the US grocery market than other generations. [caption id="attachment_83847" align="alignnone" width="720"] Definitions: The Greatest Generation were born 1910-1924; the Silent Generation were born 1925–1945; Baby Boomers were born 1946–1964; Gen Xers were born 1965–1979; millennials were born 1980–2000; and Gen Zers were born 2000 and later.

Definitions: The Greatest Generation were born 1910-1924; the Silent Generation were born 1925–1945; Baby Boomers were born 1946–1964; Gen Xers were born 1965–1979; millennials were born 1980–2000; and Gen Zers were born 2000 and later. Source: US Census Bureau/Statista/Coresight Research[/caption] Millennials’ Spending Power Will Increase in the Coming Years On average, older millennials already have substantial household incomes, and the average income for younger millennials will increase as they move into their peak earning years. According to the US Bureau of Labor Statistics, the 25–34-year-old group — which effectively represents the midpoint of the millennial demographic — saw an average pretax income of around $69,000 in 2017, making it the fourth-highest-earning age group. Income peaks in the 45–54 age group. As younger millennials enter the workforce and older millennials progress in their careers, there will be a surge in their average household income. And, as their spending power increases, millennials will lay out more on food, be it cooking at home or dining out. [caption id="attachment_83848" align="alignnone" width="720"]

Source: US Bureau of Labor Statistics[/caption]

According to the Bureau of Labor Statistics, households headed up by those aged 25–34 spent on average $3,974 on food at home in 2017. Spending on food at home peaks among 35–44 year olds, which includes older millennials.

[caption id="attachment_83849" align="alignnone" width="720"]

Source: US Bureau of Labor Statistics[/caption]

According to the Bureau of Labor Statistics, households headed up by those aged 25–34 spent on average $3,974 on food at home in 2017. Spending on food at home peaks among 35–44 year olds, which includes older millennials.

[caption id="attachment_83849" align="alignnone" width="720"] Source: Bureau of Labor Statistics[/caption]

Source: Bureau of Labor Statistics[/caption]

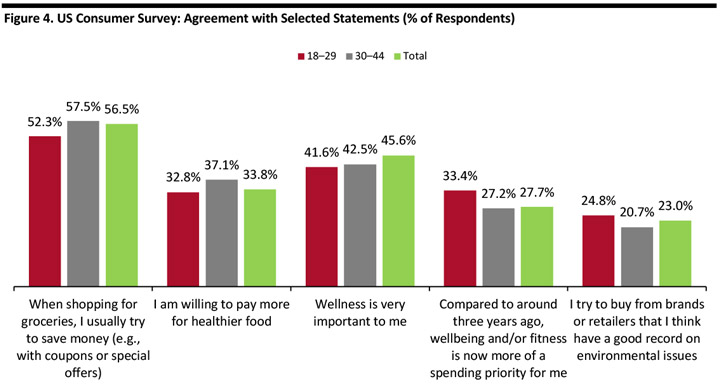

Frugal, Fit and Conscious vs. Sensible, Settled and Digital: Coresight Research Data Suggest a Divide in Behavior and Attitudes Between Younger and Older Millennials

The millennial generation spans a 20-year range that includes those still in college to those who have settled down with families and mortgages. Our recent surveys confirmed a divide in behavior and attitudes between younger millennials (aged under 30) and their older cohorts.- From our survey data, we characterize younger millennials as frugal, fit and conscious shoppers. They shop at mass merchandisers, spend on wellbeing and fitness, and try to buy consciously.

- We characterize older millennials aged 30+ as sensible, settled and digital shoppers. They look for savings, shop at traditional supermarkets and are the peak demographic for online grocery shopping.

- Younger millennials are more likely than their older peers to have prioritized wellbeing now more than they did three years ago as a spending priority, and are more likely to buy from brands with a good record on environmental issues.

- Older millennials are more likely than their younger counterparts to clip coupons and seek deals, even though this 30+ segment is also more willing to pay more for healthier food.

Base: 1,729 US Internet users aged 18+, surveyed in February 2019

Base: 1,729 US Internet users aged 18+, surveyed in February 2019 Source: Coresight Research [/caption] Younger millennials may not be avid coupon clippers, but they do exhibit thrifty characteristics when it comes to their choice of grocery store.

- Millennials aged under 30 are the peak demographic for shopping at mass merchandisers Walmart and Target. The contradiction is that the youngest age group also has the highest rate of shopping at Whole Foods Market, suggesting a polarization between “frugal” and “fit” characteristics.

- Older millennials tend to be the peak demographic for traditional-format supermarkets, such as Kroger and Albertsons, as well as discount supermarkets such as Aldi. Shopping at Costco increases with age: We think this is a retailer that shoppers grow into as they establish larger households.

*Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

*Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug Base: 1,813 US Internet users aged 18+ who have bought groceries in store in the past 12 months, surveyed in March 2018

Source: Coresight Research [/caption] Older millennials are the principal demographic for Internet grocery retailers: Our 2018 US online consumer grocery survey found that online grocery shopping peaks in the 30-44 age group, reflecting a combination of time pressure, rising incomes, relatively settled professional and family lives, and familiarity with digital channels. E-commerce still captures a very small share of the total US grocery market. We estimate that online sales will account for around 2.7% of all food and beverage retail sales in the US this year, up from an estimated 2.2% last year. As younger millennials continue to establish households, build families and grow incomes, they are joining their older counterparts in driving growth in the e-commerce channel. [caption id="attachment_83852" align="alignnone" width="720"]

Base: 1,883 US Internet users aged 18+, surveyed in March 2018

Base: 1,883 US Internet users aged 18+, surveyed in March 2018 Source: Coresight Research [/caption]

Further Notable Characteristics of Millennial Grocery Consumers

To fully understand what influence millennials have on the grocery market, we need to dive into their lifestyles, spending habits, consumption patterns, preferences and priorities. With the caveat that our own data suggest a division in behavior and attitudes between older and younger millennials, in the sections that follow, we examine key third-party data points suggesting preferences and behaviors in relation to grocery retail. Millennials Spend Less Time on Food Preparation Millennials tend to spend less time preparing food at home than any other generation. A December 2017 USDA report found:- Millennials typically spend 88 minutes on food preparation, presentation and cleanup each time they cook, compared with Gen Xers, who spend 143 minutes.

- Instead of cooking food at home, millennials more frequently purchase meal kits, ready-to-eat and “heat-and-eat” foods; according to the USDA report, nearly two-thirds of millennials reported buying some form of prepared food within the prior seven days. Millennials spend a minor share of their at-home food budget on grains, poultry and meat that require cooking.

- The USDA also found an age divide in millennial behaviors similar to our own research: Those millennials who entered the workforce during the 2007–09 Great Recession exhibit more frugal characteristics, such as buying more food for at-home preparation in place of meals away from home.

Survey conducted July 5, 2017

Survey conducted July 5, 2017 Source: Acosta [/caption] Brand Switching: Acosta noted that 48% of surveyed millennials agreed they are not brand-loyal and switch to any brand when they can find a better deal. The report found 44% of millennials visit three or more stores a week to find a better deal, compared with 29% of all surveyed shoppers. Millennials are also more likely to shop multiple stores to get fresh food. While 37% of all shoppers said they make multiple trips to ensure food is fresh, some 65% of millennials reported making multiple store visits. In contrast, only 47% of Gen Xers, 25% of Baby Boomers and 22% of the Silent Generation said they make multiple trips to find fresh food. Frugal: According to a November 2017 survey conducted by CouponFollow, an online platform that tracks and features coupon codes from online merchants, about 84% of millennials said they use coupon codes while shopping online. [caption id="attachment_83854" align="alignnone" width="720"]

Ages 20–35

Ages 20–35 Source: CouponFollow [/caption] Social Responsibility Attracts Millennials Millennials focus more than any other generation on whether a brand aligns itself with a social cause. If a retailer’s values resonate with millennials, the brand will most likely win their trust. According to a Nielsen survey on corporate social responsibility, millennials represented 51% of those who agreed that they pay extra for sustainable products and 51% of those who check the packaging for sustainable labeling. In contrast, Gen Xers constituted 25% of those who said they pay extra for sustainable products and 25% of those who check the packaging for sustainable labeling. [caption id="attachment_83855" align="alignnone" width="720"]

Survey conducted during the first quarter of 2014

Survey conducted during the first quarter of 2014 Source: Nielsen [/caption] Many millennials exhibit a preference for buying food from retailers that provide detailed information on where the food was sourced: According to a September 2015 report from market-research firm Mintel, 74% of millennials wished that food companies were more transparent about how they manufacture their products. This compared with 69% of non-millennials. The report also found that 59% of millennials will stop buying a certain brand’s products if they find that the brand is unethical; 58% of millennials agreed that “where you buy your groceries reflects your personal values,” compared with 28% of non-millennials. Retailers are aligning themselves with these kinds of causes. For example, Kroger launched its ambitious “Zero Hunger Zero Waste Plan” in September 2017: It set a goal to eliminate food waste in the company by 2025 through prevention and donation, and to accelerate food donations to provide three billion meals by 2025. The company also created a $10 million innovation fund to address hunger and food waste issues.

Cross-Channel Trends Catering to Millennial Demands

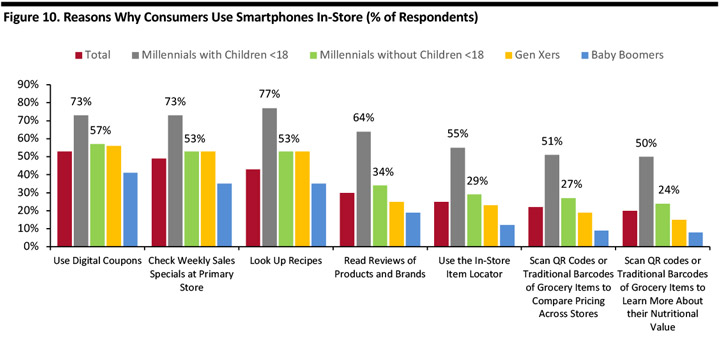

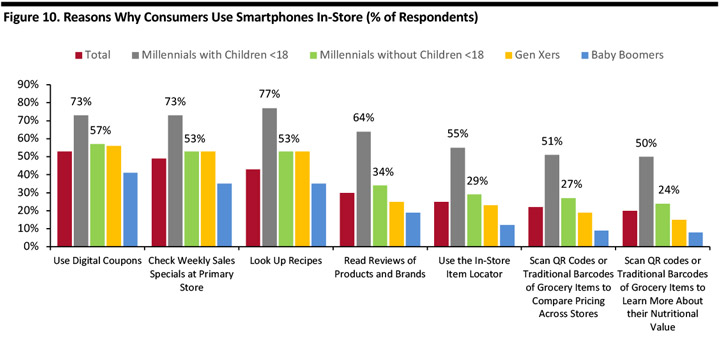

Millennials with Children Most Likely to Use Smartphones While Grocery Shopping Millennials use smartphones to shop for many reasons. While convenience and seamlessness remain the most important factors, rapidly evolving online shopping has enabled consumers to use smartphones to research products, gain detailed product information such as nutritional value and ingredients, compare prices and access digital coupons. A February 2018 survey conducted by the Food Marketing Institute and the Hartman Group, a research firm, showed another type of millennial divide: By presence of children in the house. Across a number of metrics, shown below, millennials with children were much more likely to use smartphones while shopping in store:- Fully 73% of millennials with children under 18 said they used smartphones in-store to access digital coupons, while 77% said they use smartphones to look up recipes.

- In contrast, 57% of millennials without children under 18 used smartphones to access and download digital coupons, while 53% said they use smartphones to look up recipes.

Base: 2,136 US respondents aged 18+, surveyed February 4–16, 2018

Base: 2,136 US respondents aged 18+, surveyed February 4–16, 2018 Source: FMI/Hartman Group [/caption] Buy Online, Pick Up In Store Online grocery shopping with two-hour or same-day delivery has become a popular choice for many millennials. However, most of the US online grocery market is served by “buy online, pick up in store” (BOPIS) services. Walmart and Kroger have been among those rolling out hundreds of grocery BOPIS collection points. A March 2018 survey by Euclid, a spatial analytics platform, found that millennials use the BOPIS services more across all categories than does any other generation. [caption id="attachment_83857" align="alignnone" width="720"]

Base: 1,500 US respondents, surveyed in March 2018

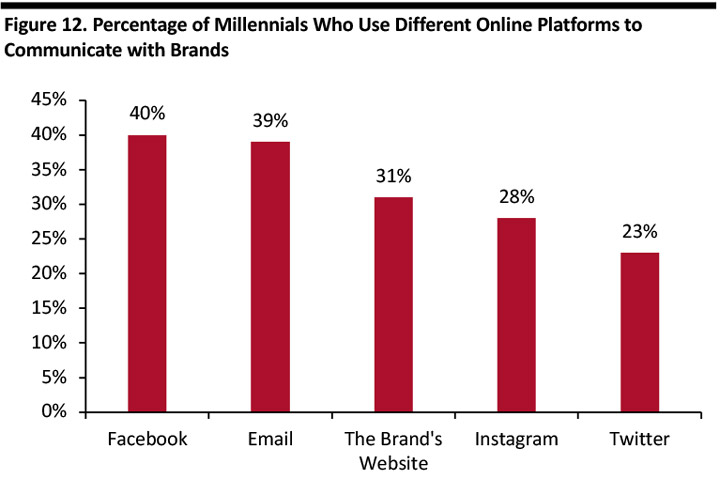

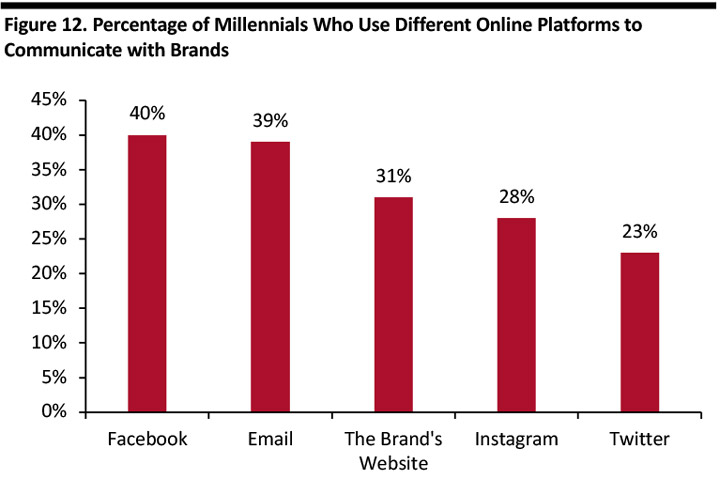

Base: 1,500 US respondents, surveyed in March 2018 Source: Euclid [/caption] Millennials are Informed Shoppers Digitally savvy, mobile and exposed to a plethora of social media networks, millennials turn online to get product reviews and recommendations. According to a 2018 survey by the Pew Research Center, 81% of users in the 18-29 age group were active on Facebook, compared with 65% of users aged 50–64. Similarly, 91% of users aged 18–29 were active on YouTube, compared with 68% of users aged 50–64. Millennials are the generation most likely to use social networks to connect directly with brands. According to Euclid’s March 2018 survey, 40% of millennials said they used Facebook to communicate with brands, while 28% used Twitter. [caption id="attachment_83858" align="alignnone" width="720"]

Base: 1,500 US respondents, surveyed in March 2018

Base: 1,500 US respondents, surveyed in March 2018 Source: Euclid [/caption]

How Are Companies Responding to Millennials’ Demands?

Millennials and Meal Kits A July 2017 study conducted by market research firm Fluent found that almost 24% of US millennials subscribe to a meal kit service, compared with 16% of total grocery shoppers. Key advantages of meal kits for millennials include saving time, reducing wastage, ameliorating cooking skills, creating shared experiences and eating more healthily. We estimate that the US meal-kits category was worth around $3 billion in 2018, though performance in this space is becoming mixed, with former market leader Blue Apron seeing sales decline even as HelloFresh continues to report positive momentum. The meal kit market is currently dominated by the subscription model, but, as traditional players start selling meal kits in stores, we expect the market to consolidate and growth may slow from the current double-digit rate. HelloFresh: HelloFresh is the largest meal-kit provider in the US. It overtook Blue Apron in US revenues in 2018, reporting sales of €733.8 million ($866 million). The company is based in Berlin, and has operations in 10 other countries including Canada, the UK and Australia. The company currently loses money, but expects to reach breakeven at group level at some point in 2019 in adjusted EBITDA terms. Blue Apron: Blue Apron is a New York-based ingredient and recipe meal kit service. In 2018, it reported a 24% fall in revenues, to $667.6 million. The company narrowed its net loss to $122.1 million in 2018, from $210.1 million in 2017. The company’s CEO Brad Dickerson resigned in early April 2019; he was replaced by Etsy’s former Chief Operating Officer Linda Findley Kozlowski. Home Chef: Home Chef was acquired by Kroger in June 2018 (it was formally termed a merger). At the time, the companies stated that Home Chef grew sales by 150% in 2017, saw $250 million in revenue, and had enjoyed two profitable quarters. The brand’s meal kits continue to be rolled out to Kroger stores in 2019, according to a February 2019 press release. Plated: Plated is a subsidiary of Albertsons, having been acquired in September 2017. In 2018, Albertsons rolled out Plated meal kits to hundreds of stores. By March 2019, Albertsons had stopped selling the meal kits in some stores in Idaho, according to local news website BoiseDev. Sun Basket: Sun Basket is a San Francisco-based subscription meal delivery company that provides organic, sustainable ingredients and recipes on a weekly basis. Millennials and Grocery Retailers Many grocery retailers are coming up with innovative strategies that appear designed to cater to the demands of millennials. Whole Foods Expands its Millennial Strategy: Amazon-owned Whole Foods strengthened its appeal to price-conscious millennials with a third round of price cuts in April 2019. Whole Foods said customers would save an average 20% on items reduced in price. In May 2018, Amazon extended Prime member discounts to Whole Foods stores. With this, Prime members enjoy weekly deals and discounts using the Whole Food app at checkout or by typing in their Amazon-linked mobile number. In April 2019, Whole Foods announced that Prime members would enjoy double the number of deals and deeper discounts. Walmart Targets Millennials: Walmart-owned Jet.com launched a private-label brand, Uniquely J, in October 2017, to target urban millennials through product selection, quality, low pricing and bold packaging design. Walmart has ramped up its e-commerce platform and has converted many of its physical stores into distribution centers, where consumers can pick up online grocery orders. As of January 31, 2019, Walmart offered grocery pickup at more than 2,100 locations and grocery delivery at almost 800 locations. At its Supplier Growth Summit in February 2018, Walmart said that 42% of Walmart.com and 65% of Jet.com customers are millennials, versus 38% at Amazon. Kroger’s Edge Technology Appeals to Millennials: In January 2018, Kroger and Microsoft rolled out a technology called Kroger Edge that displays pricing and product information such as nutritional value on digital shelf-edge displays. The displays can also show coupon codes and advertisements. The technology looks designed to cater to digitally equipped millennials looking for greater product and pricing information. In December 2018, Kroger and Nuro, a US company that designs and develops robotic systems, launched autonomous delivery service using automated pods, through which customers can schedule same-day or next day delivery of grocery orders. Albertsons Launches New Store Format: In 2018, Albertsons opened a new millennial-focused store in Boise, Idaho. The store offers exclusive culinary specialties, an in-store bar, unique dishes and in-store culinary events and classes. As noted above, Albertsons also entered the meal-kits market through its 2017 acquisition of Plated. Low Price Strategy From Aldi and Lidl: Aldi and Lidl have been successful in attracting price-conscious customers through lower prices and limited assortments. Our data (shown above) suggest Aldi has attracted older millennials in particular.Key Insights

As the spending power of millennials increases in the coming years, this demographic will become even more important to grocery retailers and brands. However, with the aging of this generation, the gap between the oldest and youngest millennials — in attitudes and behavior — is likely to be wider than it has been in previous years.- Our data suggest younger millennials are shopping at mass merchandisers, spending on fitness and trying to buy consciously.

- Millennials aged 30+ are more likely than their younger peers to look for savings and shop at traditional supermarkets; they are the peak demographic for online grocery shopping.