Nitheesh NH

Introduction

In 2022, consumers are shifting away from the popular pandemic categories, such as casual and activewear, into more occasion-based apparel, leaving retailers such as American Eagle Outfitters, Gap and Macy’s stocked with excess inventories. In this report, we analyze the US menswear market and identify key drivers and trends. We offer implications for apparel and footwear brands and retailers on how they could better capture the opportunities in the menswear market and respond to changing consumer needs. Our coverage of menswear includes men’s (aged 15+) clothing, footwear and apparel accessories, excluding jewelry, watches and eyewear.US Menswear Retailing: Performance and Outlook

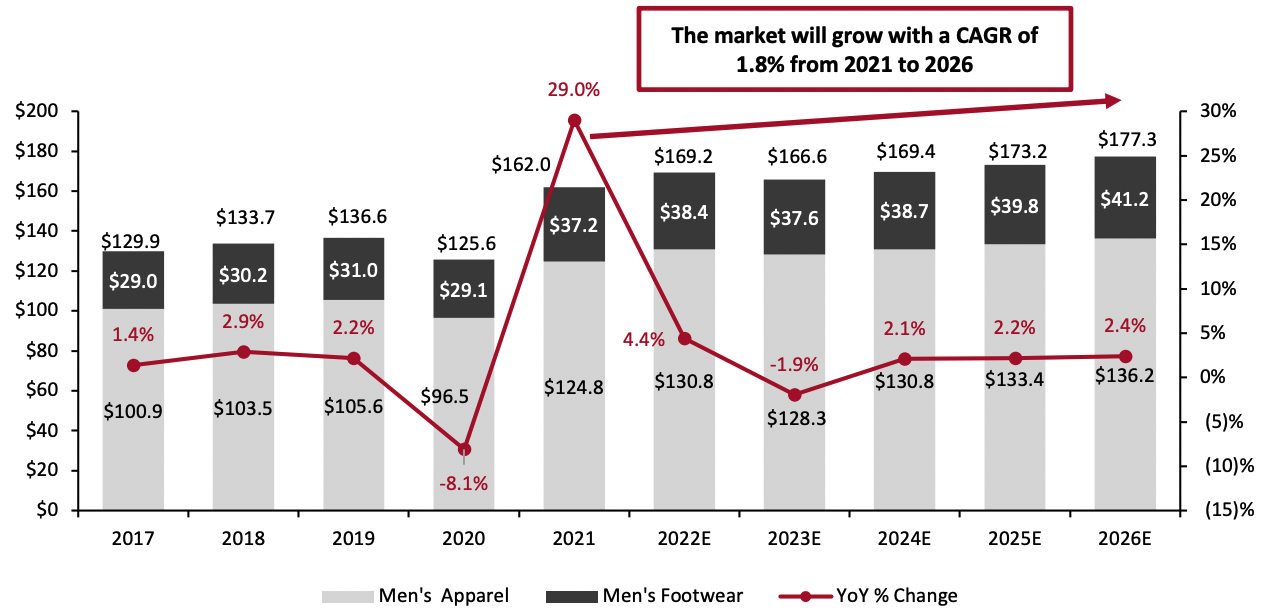

The US Menswear Market Overview Propelled by rising prices, we estimate that the US menswear market will grow 4.4% in 2022, marginally slower than the growth of the total apparel and footwear market, reaching $169.2 billion and accounting for 35% of the total market. By category, we expect men’s apparel to continue to dominate the menswear market, with an estimated scale of $130.8 billion in 2022, capturing 77.3% of the total menswear market. We estimate the men’s footwear market will reach $38.4 billion in 2022, capturing 22.7% of the total menswear market. More and more consumers are returning to offices and are able to participate in in-person activities. When we take into account other market drivers, which we discuss below, such as pandemic weight gain, the hype in sneaker culture and inflation, we believe the momentum of consumer spending growth on men’s apparel and footwear will continue in 2022. We are seeing brands and retailers such as Madewell and Lululemon actively expanding their menswear assortment to capture opportunities in the growing market. Consumer spending on clothing and footwear remained solid from January to April 2022 (latest), according to the Bureau of Economic Analysis (BEA), albeit with growth accounted for by inflation in the latest two reported months. We expect price rises to be the driver of spending growth for apparel and footwear at a total level for the second half of 2022, with total market volumes down slightly, year over year. We expect the market to see a low-single-digit percentage decline in 2023 as consumers will have already updated their wardrobes in 2021 and 2022, and the pent-up demand and effect of stimulus checks will have faded away. We estimate that the market will fully normalize in 2024 and return to low-single-digit percentage annual growth rates, similar to those seen before the crisis. The market will grow with a CAGR of 1.8% from 2021 to 2026. We estimate that the US menswear market totaled $162.0 billion in 2021—up 29.0% year over year. This growth was primarily driven by the rollout of vaccinations and consumers’ return to more normal living habits. The market saw a strong recovery in 2021, at 18.6% higher than pre-crisis level. The market totaled $125.6 billion and $136.6 billion in 2020 and 2019, respectively.Figure 1. US Menswear Sector Size (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_150059" align="aligncenter" width="700"]

Source: BEA/Coresight Research[/caption]

Men’s Apparel by Categories

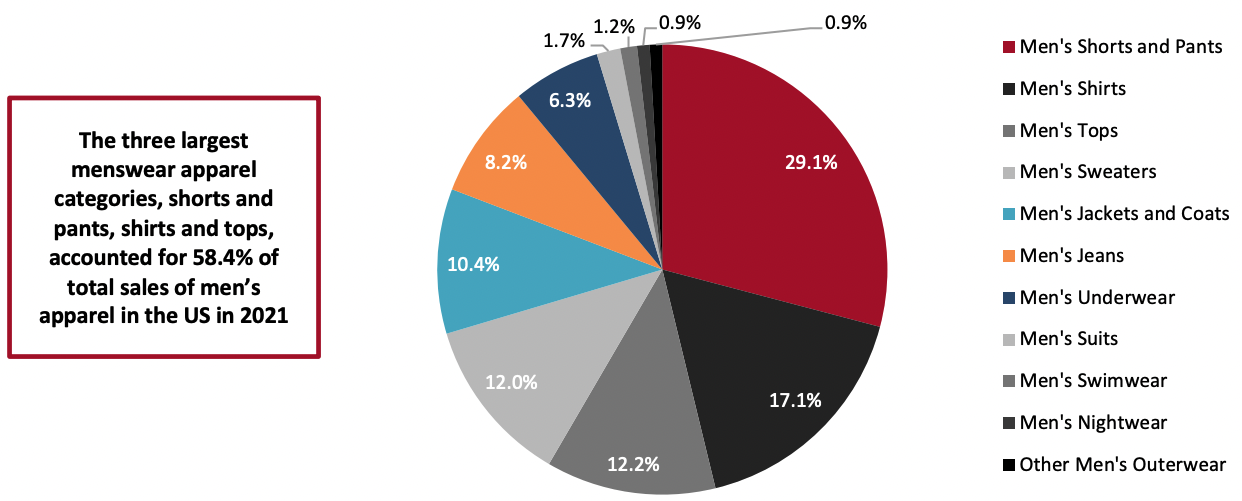

In 2021, the three largest menswear apparel categories accounted for 58.4% of total sales on men’s clothing in the US, according to Euromonitor International: Shorts and pants comprise the largest category, with a 29.1% share of total sales, followed by shirts (17.1%) and tops (12.2%). Suits saw less than $1.5 billion in revenue in 2021, representing less than 2% of the total market. This category was therefore one of the four smallest (men’s nightwear, suits, swimwear and other men’s outerwear) in the menswear market, which together totaled $4.2 billion, or 4.7% of total sales.

Source: BEA/Coresight Research[/caption]

Men’s Apparel by Categories

In 2021, the three largest menswear apparel categories accounted for 58.4% of total sales on men’s clothing in the US, according to Euromonitor International: Shorts and pants comprise the largest category, with a 29.1% share of total sales, followed by shirts (17.1%) and tops (12.2%). Suits saw less than $1.5 billion in revenue in 2021, representing less than 2% of the total market. This category was therefore one of the four smallest (men’s nightwear, suits, swimwear and other men’s outerwear) in the menswear market, which together totaled $4.2 billion, or 4.7% of total sales.

Figure 2. Men’s Clothing by Share of Category, 2021 (%) [caption id="attachment_150060" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

In 2022, we are seeing consumers shifting away from the popular pandemic categories, such as casual and activewear, into more occasion-based apparel. We expect categories in the occasion wear (apparel and footwear that consumers wear for special occasions such as weddings, social occasions such as parties, and work), including suits, shirts, tuxedos, ties, and leather shoes will gain shares in the total men’s apparel and footwear market, versus the casual wear and activewear market, as people are returning to the office or dining out with friends. We are seeing signs of men’s occasion wear sales recovery and a revival of consumer demand in the market.

For example, Express reported on its first quarter of fiscal year 2023 earnings call on May 25, 2022 that men’s suits were up 78% year over year and men’s knit polos increased 78%. Modern tailoring in both men’s and women’s has seen an incredible resurgence.

Nordstrom reported on May 24, 2022 that core categories including men's and women's apparel, shoes and designer had the strongest growth against 2021 as customers refreshed their wardrobes for occasions such as social events, travel and return to office. Strength in men's and women's apparel was driven especially by suiting and dresses.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

In 2022, we are seeing consumers shifting away from the popular pandemic categories, such as casual and activewear, into more occasion-based apparel. We expect categories in the occasion wear (apparel and footwear that consumers wear for special occasions such as weddings, social occasions such as parties, and work), including suits, shirts, tuxedos, ties, and leather shoes will gain shares in the total men’s apparel and footwear market, versus the casual wear and activewear market, as people are returning to the office or dining out with friends. We are seeing signs of men’s occasion wear sales recovery and a revival of consumer demand in the market.

For example, Express reported on its first quarter of fiscal year 2023 earnings call on May 25, 2022 that men’s suits were up 78% year over year and men’s knit polos increased 78%. Modern tailoring in both men’s and women’s has seen an incredible resurgence.

Nordstrom reported on May 24, 2022 that core categories including men's and women's apparel, shoes and designer had the strongest growth against 2021 as customers refreshed their wardrobes for occasions such as social events, travel and return to office. Strength in men's and women's apparel was driven especially by suiting and dresses.

Market Factors

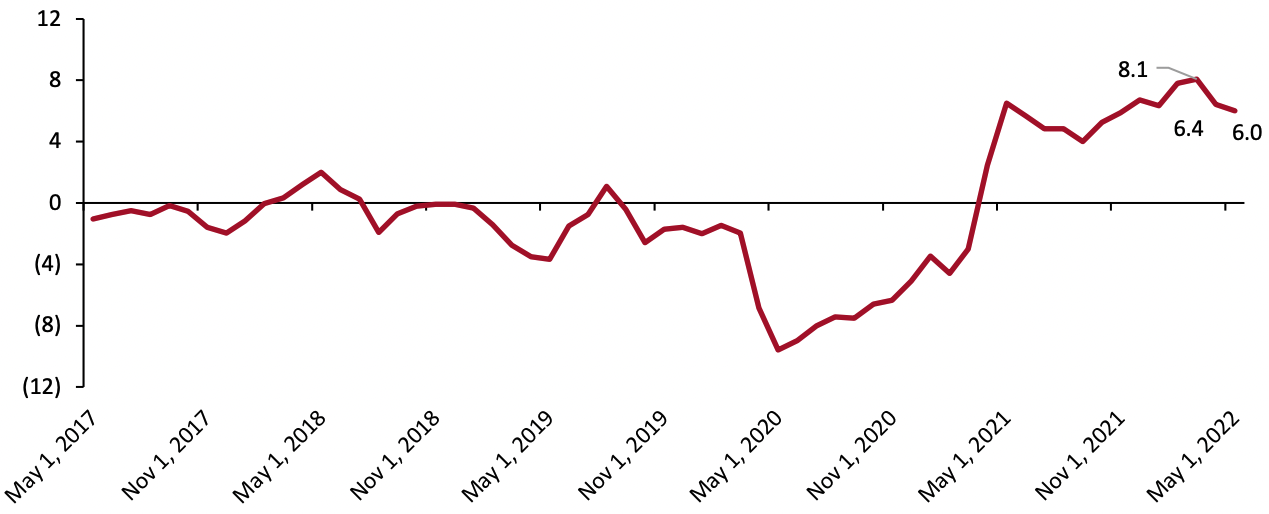

A Return of Demand for Occasion Wear What drives the US menswear market is a return to in-person events such as dining out, office work and parties, and therefore, the demand for occasion wear categories. Offices in the US’s ten largest cities are about 40% occupied, up 15% from a year earlier, as of April 22, 2022, according to Kastle, an office security firm that tracks key card swipes in thousands of commercial buildings. Companies such as Apple and Google began requiring most employees to return to offices on a hybrid schedule in April 2022. Formal events such as weddings will drive occasion wear categories. There will be an estimated 2.5 million weddings in 2022, which is the most the US has seen since 1984, according to The Wedding Report, a market research firm. Many people postponed their celebrations during the pandemic and are planning to book venues and celebrate the weddings in 2022, which will drive menswear businesses. Pandemic Weight Gain We expect brands and retailers in the plus-size market to see increased demand for extended sizes as a result of the Covid-19 pandemic: 61% of Americans reported that they have gained weight since the start of the pandemic (with 42% stating that they had gained more weight than they had intended), according to The Harris Poll for the American Psychological Association conducted in February 2021. According to the survey, 39% of male respondents reported an average weight gain of 37 pounds since the start of the pandemic. Extrapolating the data to the total population, approximately 51 million US men will be shopping for larger clothing sizes, representing a potential larger men’s plus-size addressable market. The widespread weight gain is a clear market driver for the menswear market overall as consumers are requiring new clothing in larger sizes than they were previously buying. The Continuation of Hype in Sneaker Culture The footwear market is being buoyed by “sneaker culture” across segments, from mass market to luxury. The sneaker trend is one of the most visible manifestations of fashion in footwear. We have seen a proliferation of sneakers sold at regular prices by brands such as Adidas, Louis Vuitton and Nike, which are then valued much higher on resale platforms such as StockX. We expect sneaker mania to continue, driving the men’s footwear market. Inflation We see inflation as an important driver of the US menswear market. The US inflation rate in the apparel and footwear sector rose to 6.0% in May 2022 (seasonally adjusted), according to the Bureau of Labor Statistics. In March and April 2022, these year-over-year price rises exceeded year-over-year spending increases (as reported by the BEA), implying a real-terms erosion of apparel and footwear spend in those months. Higher prices will support the size of the menswear market in 2022, but we expect those price uplifts to conceal a weakness in volumes in the second half of the year as consumers become more selective about fashion purchases.Figure 3. YoY Changes of Consumer Price Index in Apparel and Footwear for All Urban Consumers (%, Seasonally Adjusted) [caption id="attachment_150061" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Competitive Landscape

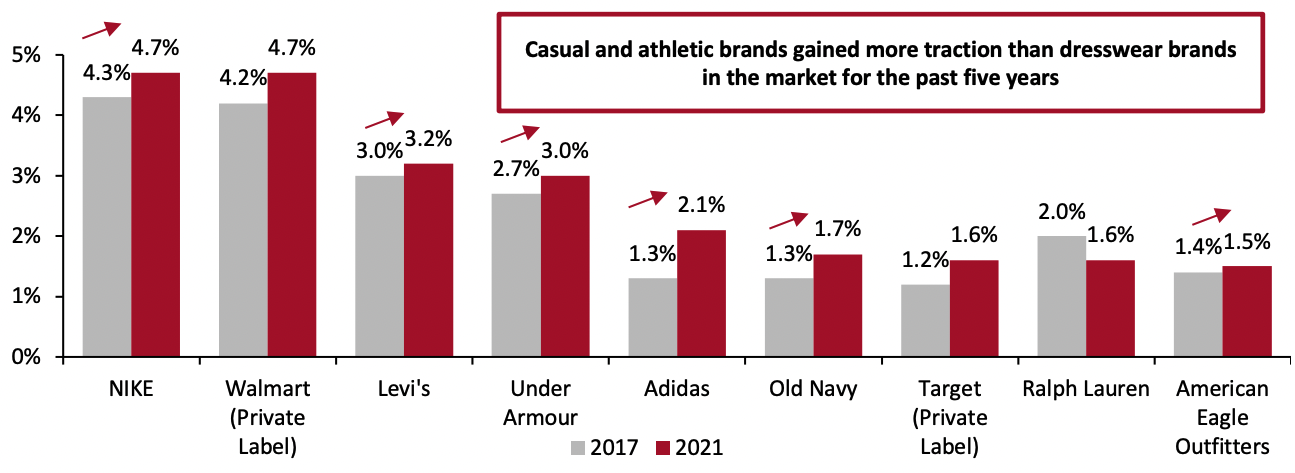

The US Men’s Apparel Market Is Fragmented Within the US men’s apparel market, the top 10 brands comprised 26.4% of the market in 2021, according to Euromonitor International. NIKE is the leading brand, with a market share of 4.7% in 2021. NIKE brand men’s revenues increased 11% in fiscal 2021 (ended May 31, 2021), mainly driven by growth in the Jordan brand. We can see category trends by looking at the five-year market share growth of the top 10 men’s apparel brands: The athletic wear category is the largest, and the top three athletic brands—Adidas, NIKE and Under Armour—have seen the largest gains over the past five years, from a combined market share of 8.3% in 2017 to 9.8% in 2021. Casual brands American Eagle Outfitters and Old Navy have collectively grown from 2.7% of the market to 3.2%. Denim brand Levi’s has seen 20 basis points of share growth, while dress attire brand Ralph Lauren has declined by 40 basis points. Levi’s reported that its men's bottoms business was up 6% in the fiscal year ended November 28, 2021 compared to pre-crisis level, reaching the highest revenue level since the fourth quarter of fiscal year 2015.Figure 4. Top Menswear Brands by Market Share, (%) [caption id="attachment_150062" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

The US Men’s Footwear Market Is Relatively More Brand-Prominent

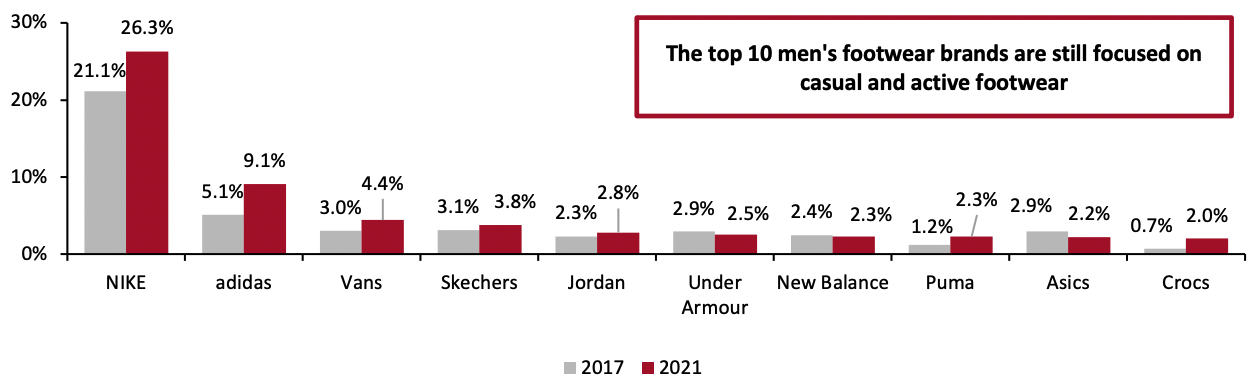

The leading 10 men’s footwear brands are still focused on casual and activewear footwear, indicating the dominance of the category. Within the US men’s footwear market, the top 10 brands comprised 57.7% of the market in 2021, according to Euromonitor International, showing that the market is more brand-prominent than the men’s apparel market. NIKE is the leading brand, with a market share of 26.3% in 2021. The market has become more concentrated over the past five years; in 2017 the top ten US men’s footwear brands accounted for 44.7% of total sales. We expect the market to be more concentrated in the next three years with leading brands NIKE, Adidas and Vans gaining more shares from smaller brands.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

The US Men’s Footwear Market Is Relatively More Brand-Prominent

The leading 10 men’s footwear brands are still focused on casual and activewear footwear, indicating the dominance of the category. Within the US men’s footwear market, the top 10 brands comprised 57.7% of the market in 2021, according to Euromonitor International, showing that the market is more brand-prominent than the men’s apparel market. NIKE is the leading brand, with a market share of 26.3% in 2021. The market has become more concentrated over the past five years; in 2017 the top ten US men’s footwear brands accounted for 44.7% of total sales. We expect the market to be more concentrated in the next three years with leading brands NIKE, Adidas and Vans gaining more shares from smaller brands.

Figure 5. Top Men’s Footwear Brands by Market Share, (%) [caption id="attachment_150063" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Where Consumers Are Shopping and What They Are Buying

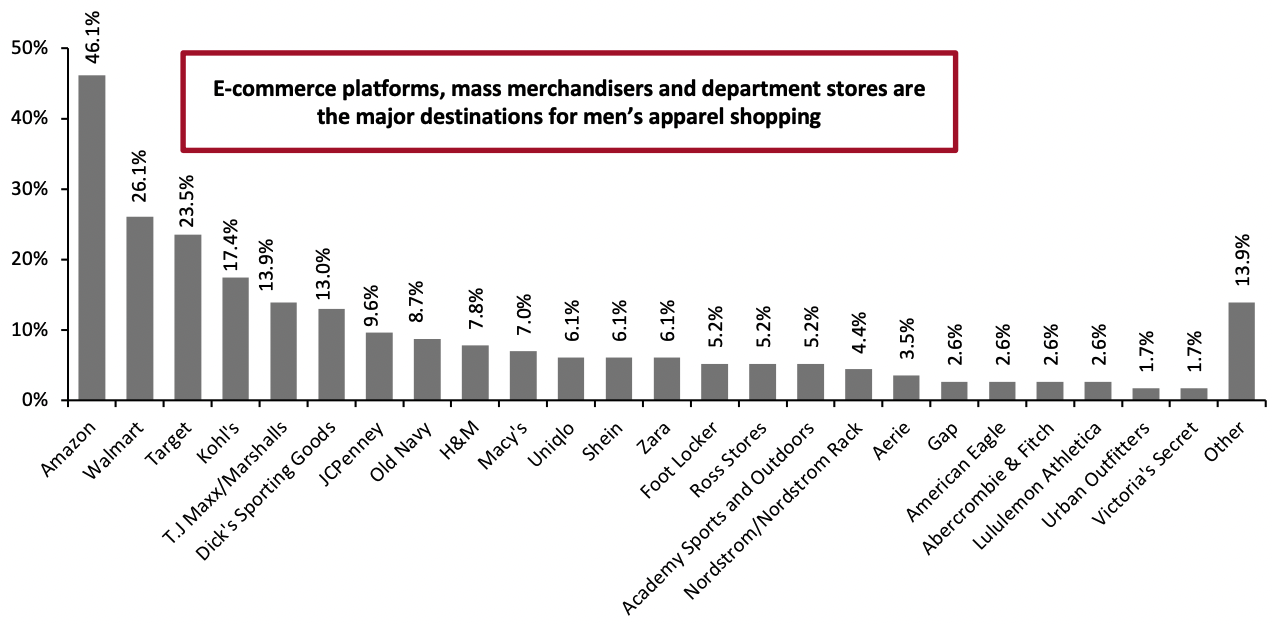

Amazon, Walmart, and Target are the top three retailers US male shoppers bought clothing or apparel accessories from in the past three months ended May 3, 2022, according to Coresight Research survey data.

Our findings indicate that compared to specialty retailers such as American Eagle and Gap, e-commerce platforms, mass merchandisers and department stores are major destinations for male consumers’ apparel shopping—mainly due to larger product assortments, more convenient services such as buy online, pick up in-store (BOPIS), fast delivery and easy inventory requests, according to our analysis.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Where Consumers Are Shopping and What They Are Buying

Amazon, Walmart, and Target are the top three retailers US male shoppers bought clothing or apparel accessories from in the past three months ended May 3, 2022, according to Coresight Research survey data.

Our findings indicate that compared to specialty retailers such as American Eagle and Gap, e-commerce platforms, mass merchandisers and department stores are major destinations for male consumers’ apparel shopping—mainly due to larger product assortments, more convenient services such as buy online, pick up in-store (BOPIS), fast delivery and easy inventory requests, according to our analysis.

Figure 6. Male Respondents Who Purchased Clothing or Apparel Accessories in The Past Three Months: Retailers That Consumers Purchased From (%), May 2022 [caption id="attachment_150064" align="aligncenter" width="700"]

Base: 115 US male consumers aged 18+ who purchased clothing or apparel accessories in the past three months ended May 3, 2022

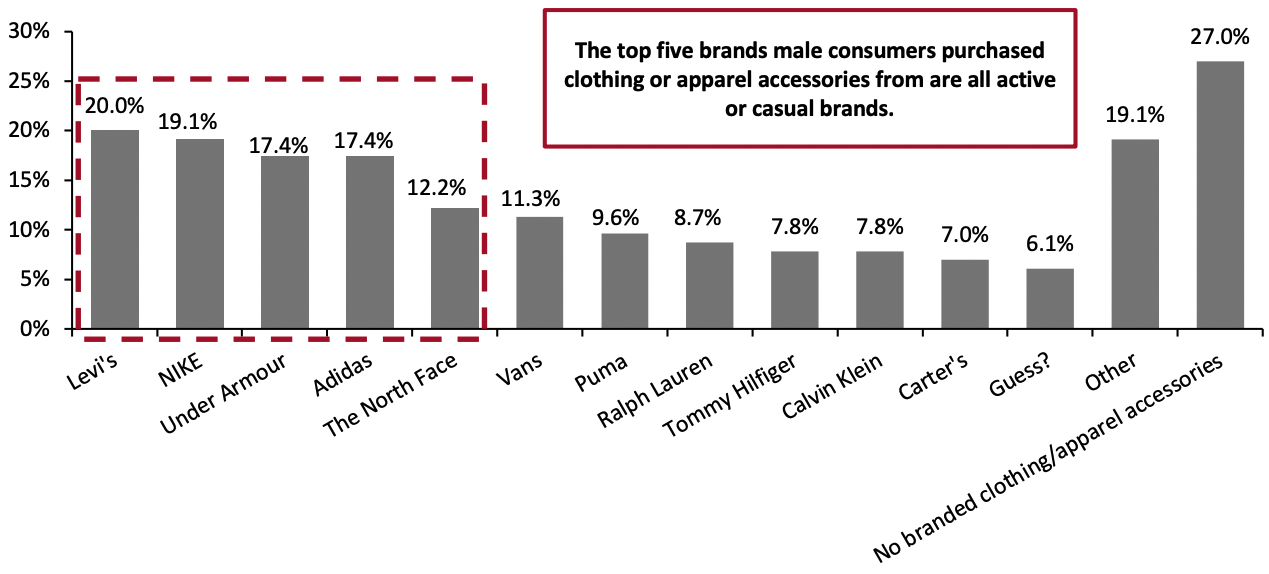

Base: 115 US male consumers aged 18+ who purchased clothing or apparel accessories in the past three months ended May 3, 2022Source: Coresight Research[/caption] By brand, Levi’s, NIKE, and Under Armour are the top three brands that US male shoppers bought clothing or apparel accessories from in the last three months, ended May 3, 2022, followed by Adidas, The North Face, and Vans, according to our survey. No occasion wear brands pop up on the top five of the list, and we believe there is potential bias existing in the survey results due to a mix of reasons including small sample size, occasion wear’s low wardrobe refreshment frequency and seasonality. We also found that a significant portion (27.0%) of male consumers had not bought branded clothing or apparel accessories.

Figure 7. Male Respondents Who Purchased Clothing or Apparel Accessories in The Past Three Months: Brands That Consumers Purchased from, (%), May 2022 [caption id="attachment_150067" align="aligncenter" width="700"]

Base: 115 US male consumers aged 18+ who purchased clothing or apparel accessories in the past three months ended May 3, 2022

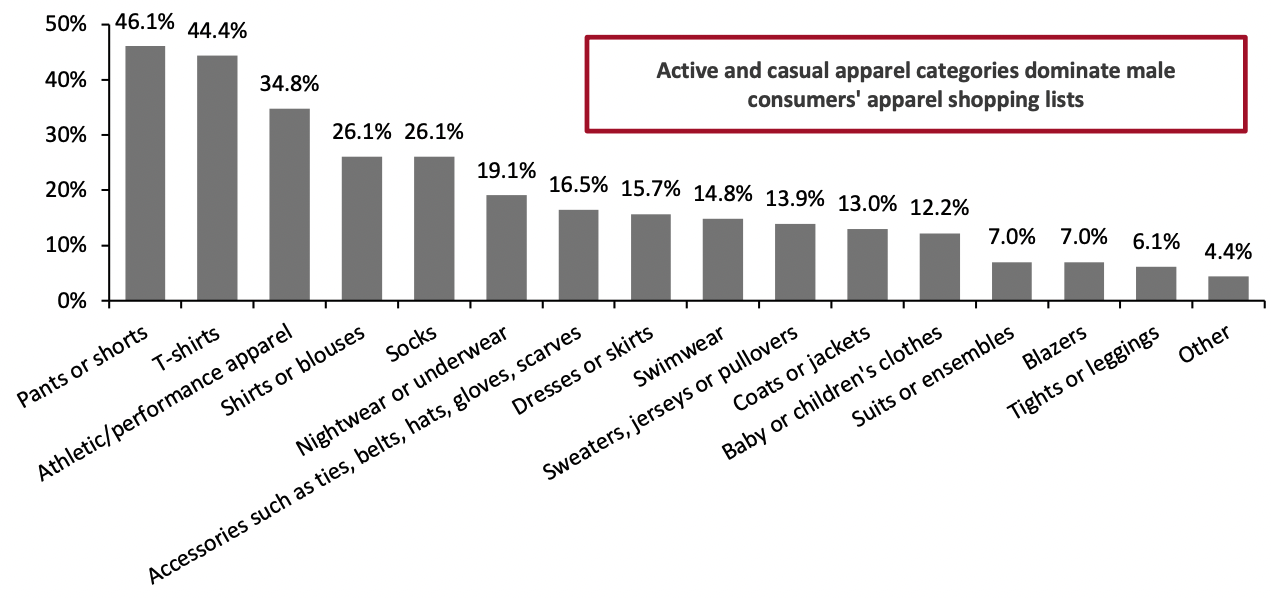

Base: 115 US male consumers aged 18+ who purchased clothing or apparel accessories in the past three months ended May 3, 2022Source: Coresight Research[/caption] By categories, pants or shorts, T-shirts and athletic or performance apparel are the top three clothing or apparel accessories categories US male shoppers bought in the past three months ended May 3, 2022, according to our survey. Although the majority of male consumers are still buying casual and active wear, we believe the occasion wear categories such as suits or ensembles will grow faster, due to weak comparatives in 2021 and relatively smaller market scale.

Figure 8. Male Respondents Who Purchased Clothing or Apparel Accessories in The Past Three Months: Categories That Consumers Purchased (%), May 2022 [caption id="attachment_150068" align="aligncenter" width="700"]

Base: 115 US male consumers aged 18+ who purchased clothing or apparel accessories in the past three months ended May 3, 2022

Base: 115 US male consumers aged 18+ who purchased clothing or apparel accessories in the past three months ended May 3, 2022Source: Coresight Research[/caption]

Themes We Are Watching

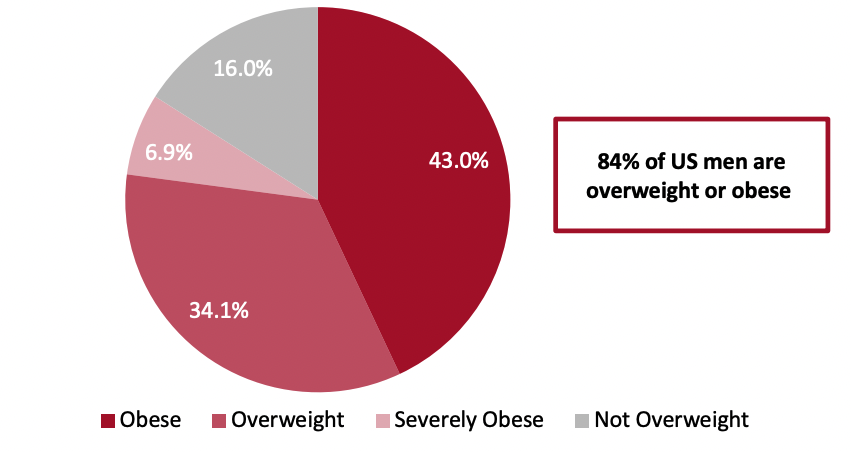

Changing Fashion Silhouettes in Men’s Apparel We are seeing changing fashion silhouettes in men’s occasion apparel, impacted by the casualization trend for the past few years. Men are trading stiff suits for more comfortable suits and buying more “workleisure” (professionalism mixed with relaxed comfort) items. We recommend brands and retailers respond to the changing needs and offer more comfortable office wear. Companies such as Banana Republic and Ministry of Supply are adapting their products. Ministry of Supply now features a “kinetic blazer” (using fabrics that offer stretch styles for casual everyday use) and “velocity suit jacket” (offers a classic look and feel of wool) in its blazer category on its website. Banana Republic also offers men’s apparel items at the intersection of comfort and formal, such as athletic-fit pants, linen-blend blazers, and relaxed tapered pants. Outperformance in Luxury Apparel and Footwear Reflecting the resilience of higher-income consumers, we are seeing outperformance in high-end apparel and footwear, while retailers catering to consumers on low or moderate incomes are tending to report weakened demand amid soaring inflation for essentials. We expect to see continued strong demand in luxury men’s apparel and footwear. On the high end, companies such as Capri Holdings, Hermès, Kering, Nordstrom, and Ralph Lauren reported strong apparel and footwear sales growth. Capri Holdings reported on February 2, 2022 that the company saw strength in luxury footwear. In the third quarter of its fiscal year 2022, men's and women's sneakers continued to perform well. Nordstrom reported on May 24, 2022 that its men’s apparel had double-digit year-over-year growth in the first quarter of its fiscal year 2023. However, the outperformance of high-end menswear will have a limited impact on the total market: Luxury men’s clothing and footwear accounted for around 8.5% of total US men’s clothing and footwear sales, by value, in 2021, according to our analysis of Euromonitor data. Meanwhile, we are seeing price-sensitive consumers cutting discretionary spending as high inflation persists, including in essentials such as food and gasoline. Ross Stores, for example, reported in May 2022 that with higher fuel and food prices, discretionary spending for the lower-income customer is being squeezed. Kohl’s, which is positioned as a middle to value market player, reported in May 2022 that it is seeing average spend per transaction and units per transaction decline. Inclusivity in Menswear The proportion of US adults that are overweight has been increasing in recent years, according to the Centers for Disease Control and Prevention. Approximately 84.0% of men in the US are overweight or obese, according to the organization’s latest estimates in 2018 (see Figure 7). This highlights the tremendous opportunity for brands and retailers to provide extended sizes in the men’s apparel market.Figure 9. US Men: Classification by Body Mass Index, 2017-2018* (% of Population) [caption id="attachment_150071" align="aligncenter" width="520"]

* Latest available data

* Latest available dataSource: Centers for Disease Control and Prevention[/caption] Furthermore, as discussed in this report, the Covid-19 pandemic has brought about weight gain among male consumers, which will impact apparel sales in the wider market and likely present opportunity in the plus-size sector. More brands and retailers are entering the market or broadening their offerings to take advantage of the plus-size opportunity.

Figure 10. US Men’s Plus-Size Apparel Market: Offerings by Major Brands and Retailers

| Company | Offerings |

| ASOS (US) | Plus-size apparel, available in sizes up to 6XL |

| boohooMan.com | Plus-size apparel, available in sizes XXL to 5XL |

| Champion | Plus-size apparel, available in sizes XL to 6XL |

| JCPenney | Plus-size apparel, available in sizes XXL to 5XL |

| Kohl’s | Plus-size apparel, available in sizes 3XL to 6XL |

| Levi’s | Plus-size apparel, available in sizes XL to 6XL |

| Nautica | Plus-size apparel, available in sizes XL to 6XL (Pants up to 50X32) |

| Old Navy | Plus-size apparel, available 3XL (Pants up to 54X32) |

| Target | Plus-size apparel through its own private-label brands such as All in Motion and third-party brands such as Anchorman, available in sizes up to 6XL (Pants up to 66X32) |

| Walmart | Plus-size apparel mostly through its third-party brands such as Fruit of the Loom, available in sizes up to 5XL |

Source: Company reports

Collaborations Cross-brand and celebrity collaborations in men’s apparel will continue to drive consumer engagement and increase brand awareness. We expect to see continued collaborations in denim, leisurewear, sneakers and sportswear in 2022, which will help brands retailers to expand into complementary markets and attract new customers. We discussed brand collaborations in-depth in our report, Brand Mashups in Fashion.What We Think

Although activewear and casual wear continue to dominate the US menswear market and top the male consumer’s shopping list, according to our survey on May 3, 2022, we believe that occasion wear is seeing strong recovery in 2022. Brand and retailers need to re-examine their apparel portfolios and provide relevant options in 2022. In the long term, we still believe that the casualization trend will likely stay, as many consumers will continue to work remotely or will dress more casually onsite. Implications for Brands/Retailers- With the shift in consumer need toward occasion wear, we recommend menswear brands and retailers adapt their category focus to stay relevant.

- Men are trading stiff suits for more comfortable suits and buying more “workleisure” items. We recommend brands and retailers respond to the changing needs and offer more comfortable office wear.

- We are seeing outperformance in high-end apparel and footwear, while companies targeting consumers on low and moderate incomes are becoming squeezed. However, given luxury’s sub-10% share of the overall market, the outperformance of high-end menswear will have a limited uplift effect on the total market.

- We recommend brands and retailers broaden their apparel size offerings to take advantage of the plus-size opportunity.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved