Nitheesh NH

Introduction

What’s the Story? A typical meal kit (also known as recipe box) offering is a subscription-based service whereby companies send customers pre-portioned and sometimes partially prepared food ingredients and recipes for them to cook at home. Customers typically pick a plan depending on their dietary preferences, schedule and household size. In this report, we examine the size and trajectory of the US meal-kit market, its competitive landscape, key target demographics, factors shaping consumer demand, recurrent challenges for the meal-kit subscription model and meal-kit companies’ strategies for 2022 and beyond. Why It Matters The meal-kit industry is at a crossroads. Meal-kit companies have experienced tremendous growth over the course of the pandemic, fueled by a combination of limited dining-out options and consumer demand for easy-to-make, balanced meals instead of takeouts. Despite strong sales in 2020, consumers’ return to more normal eating habits has led to fewer meals eaten at home, prompting a growth slowdown among meal-kit companies in late 2021. The US meal-kit industry saw numerous mergers and acquisitions and bankruptcies in the years leading up to the pandemic. We believe consolidation will resume from 2022 onward as unprofitable meal-kit providers find it difficult to acquire and retain new customers, leading to further insolvencies. Major players such as HelloFresh and retailer-backed meal-kit providers such as Home Chef have achieved strong competitive positions and are well placed from a procurement and funding perspective; this will allow them to gain economies of scale and pass on favorable pricing to consumers and expand their recipe ranges. Nonetheless, we believe meal-kit companies have strong potential for topline growth. Underlying market drivers, such as the shift toward healthy eating and convenience, as well as pandemic-induced online grocery shopping stickiness, will likely support strong demand.US Meal Kits: Coresight Research Analysis

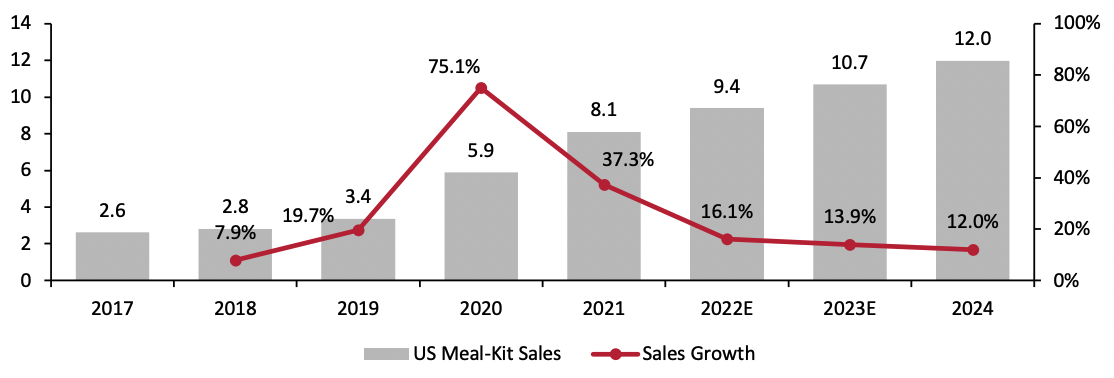

1. US Meal-Kit Market Performance and Outlook Coresight Research estimates that the US meal-kit market reached $8.1 billion in 2021, with growth slowing to 37.3% year over year. In 2022, we expect year-over-year growth to taper off further to 16.1%, likely impacted by on-premise consumption regaining its full strength as more consumers shift back to eating and socializing outside of their homes, partly offset by some retention of online food spending.Figure 1. US Meal-Kit Market: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_149046" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2. Competitive Landscape

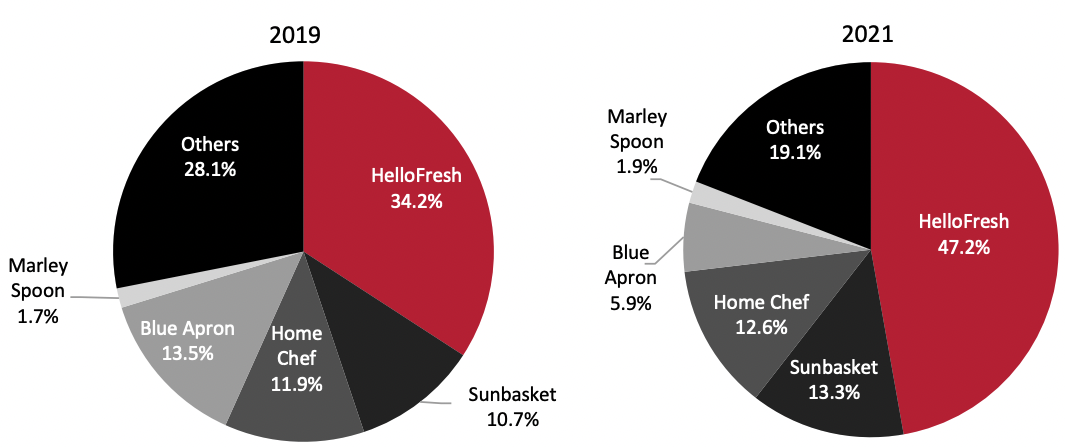

HelloFresh is the leader in the US meal-kit market, accounting for almost half of all meal-kit sales in 2021. Although its competitors Blue Apron, Home Chef and Marley Spoon have seen sales rise since the onset of the pandemic, HelloFresh’s sales growth outpaced them, giving it an increased market share.

HelloFresh’s market share growth can also be attributed to its multi-brand positioning: it offers value meals via its EveryPlate band, affordable premium meals via HelloFresh, premium meals via Green Chef and fully prepared meals via Factor 75. This enables the company to cater to more customers and appeal to different demographics. Interestingly, HelloFresh disproportionately attracts younger shoppers: the majority of meal-kit subscribers aged 18–29 have used the service. We discuss key demographics for meal-kit shoppers in more detail in the next section.

Source: Coresight Research[/caption]

2. Competitive Landscape

HelloFresh is the leader in the US meal-kit market, accounting for almost half of all meal-kit sales in 2021. Although its competitors Blue Apron, Home Chef and Marley Spoon have seen sales rise since the onset of the pandemic, HelloFresh’s sales growth outpaced them, giving it an increased market share.

HelloFresh’s market share growth can also be attributed to its multi-brand positioning: it offers value meals via its EveryPlate band, affordable premium meals via HelloFresh, premium meals via Green Chef and fully prepared meals via Factor 75. This enables the company to cater to more customers and appeal to different demographics. Interestingly, HelloFresh disproportionately attracts younger shoppers: the majority of meal-kit subscribers aged 18–29 have used the service. We discuss key demographics for meal-kit shoppers in more detail in the next section.

Figure 2. US Meal-Kit Market Share (%) [caption id="attachment_149047" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

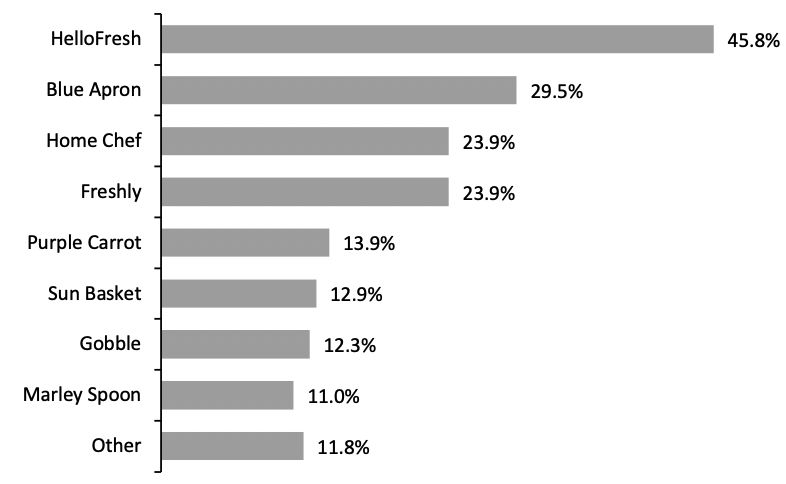

Almost half of meal-kit subscribers have used HelloFresh in the last 12 months. Blue Apron is ranked second, having been used by almost three in 10 meal-kit subscribers, suggesting that while the company has high brand awareness, it has a low average revenue per user (ARPU) and higher churn rates, resulting in a shrinking market share, as shown in Figure 2 above.

Source: Company reports/Coresight Research[/caption]

Almost half of meal-kit subscribers have used HelloFresh in the last 12 months. Blue Apron is ranked second, having been used by almost three in 10 meal-kit subscribers, suggesting that while the company has high brand awareness, it has a low average revenue per user (ARPU) and higher churn rates, resulting in a shrinking market share, as shown in Figure 2 above.

Figure 3. US Meal-Kit Subscribers: Services Used in the Past 12 Months (% of Respondents) [caption id="attachment_149049" align="aligncenter" width="600"]

Base: 373 US respondents aged 18+ who have used meal-kit subscriptions in the 12 months prior to March 2022

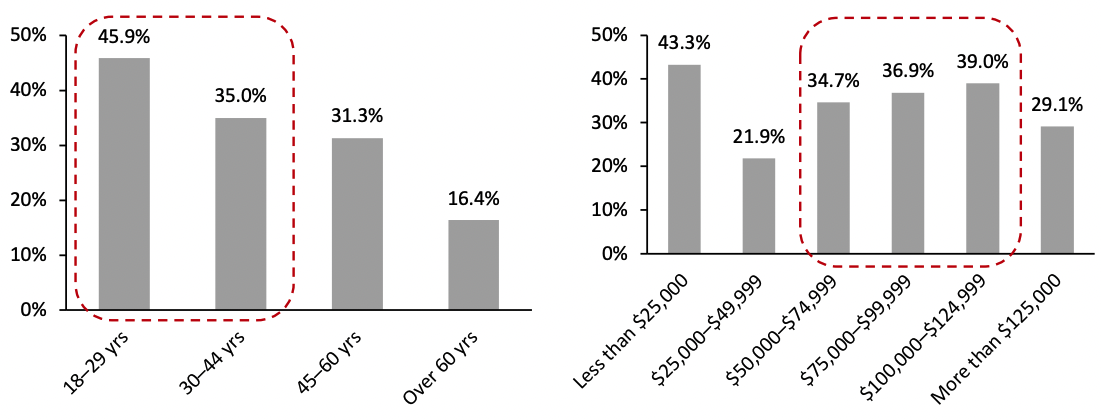

Base: 373 US respondents aged 18+ who have used meal-kit subscriptions in the 12 months prior to March 2022Source: Coresight Research[/caption] 3. Key Demographics Meal-kit subscription services are popular among US online grocery shoppers. According to Coresight Research’s latest annual online grocery survey, conducted in March 2022, one-third of respondents (32.9%) who purchased groceries online in the last 12 months had used an online meal-kit or recipe box subscription service. As shown in Figure 4 below, meal kits are most popular among consumers aged 18–44, likely given that they are a convenient option for parents of young children and busy full-time workers. Unsurprisingly, membership of meal-kit subscriptions is high among high-income consumers, but even among the lowest income group (those with household incomes below $25,000) membership stands at over 43.3% of those who had bought groceries online—indicating that retailers should still prioritize offering affordable products and discounts.

Figure 4. Online Grocery Shoppers: Proportion That Have Used Meal-Kit Subscription Services in the Past 12 Months (% of Respondents) [caption id="attachment_149051" align="aligncenter" width="700"]

Base: 1,135 US respondents aged 18+ who have purchased groceries online in the past 12 months

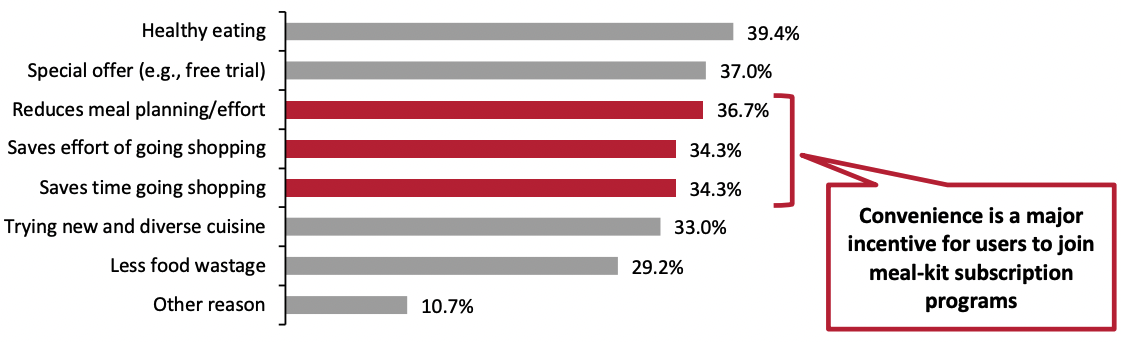

Base: 1,135 US respondents aged 18+ who have purchased groceries online in the past 12 monthsSource: Coresight Research[/caption] 4. Factors Driving Consumer Demand A desire to eat healthily was the most frequently cited reason to use meal-kit programs, demonstrating that meal kits’ target consumers are more conscious about what they eat. Meal-kit companies should therefore clearly present the nutritional value of their meals and provide options for consumers with specific dietary requirements or who are following specialized diet plans. Special offers are the second-most-popular incentive for consumers to join meal-kit subscription programs, which partly explains the subscriber churn challenge for these companies. Consumers are generally enticed to sign up with a discount or trial period, but most do not stay after the offer ends. Convenience is also a significant draw for consumers. Meal kits offer customers a convenient option by reducing time spent on grocery shopping and planning recipes, while still allowing them to eat fresh, home-cooked food.

Figure 5. US Meal-Kit Subscribers: Reasons To Use an Online Meal-Kit Subscription Service (% of Respondents) [caption id="attachment_149052" align="aligncenter" width="700"]

Base: 373 US respondents aged 18+ who have used meal-kit subscriptions in the past 12 months

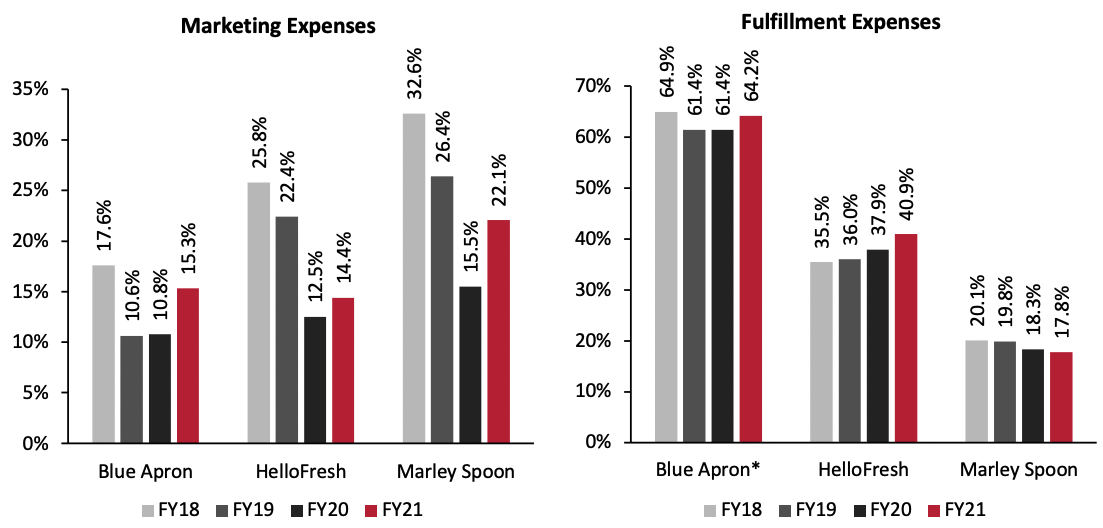

Base: 373 US respondents aged 18+ who have used meal-kit subscriptions in the past 12 monthsSource: Coresight Research[/caption] 5. Challenges for the Meal-Kit Model Marketing Expenses While the pandemic boosted the prospects of the meal-kit market, the challenges associated with the subscription business remain. The meal-kit subscription model comes with high customer acquisition and retention costs, as convincing shoppers to switch to unfamiliar purchasing models and preventing existing customers from returning to traditional channels is challenging. Moreover, the lack of the marketing visibility that the physical retail format enjoys and competition from rivals seeking to tempt shoppers with introductory offers, leading to high subscriber churn rates, requires strong marketing investment. Meal-kit retailers Blue Apron, HelloFresh and Marley Spoon saw their marketing expenditure as a percentage of revenue tick up in their latest fiscal years. We expect this to continue to rise as companies invest in attracting and retaining customers amid renewed competition with in-store shopping and dining out. In its annual report for its fiscal year ended December 31, 2022, Blue Apron stated that it would significantly increase its marketing spend throughout 2022 as part of its accelerated growth strategy for customer retention and acquisition. Fulfillment Expenses Meal-kit companies also incur high fulfillment expenses, including shipping costs to deliver customer orders and payment-related expenses. Fulfillment expenses for Blue Apron and HelloFresh increased meaningfully as a percentage of revenue in 2021. We expect fulfillment costs to continue to comprise a significant portion of meal-kit companies’ operating expenses due to rise in labor, fuel and logistics costs.

Figure 6. Blue Apron, HelloFresh and Marley Spoon: Marketing and Fulfillment Expenses (% of Revenue) [caption id="attachment_149053" align="aligncenter" width="700"]

*Figures are for cost of goods sold, which consists of product and fulfillment costs

*Figures are for cost of goods sold, which consists of product and fulfillment costsBlue Apron, HelloFresh and Marley Spoon’s financial years end on December 31

Source: Company Reports/Coresight Research[/caption] Given the headwinds described above, we expect consolidation to accelerate in the medium term, as small and less differentiated players find it impossible to cope with the growing margin pressure and either drop out of the market or get acquired by more prominent companies. Additionally, we expect more meal-kit companies to seek out deals with retailers to distribute their products through physical stores in order to lower their marketing and fulfillment expenses. 6. Strategies To Serve Current Demand Meal-kit companies are adopting the following strategies to continue meeting their customers’ evolving tastes and preferences and differentiate themselves in the crowded space. Menu Expansion Though the idea of easy preparation and simple instructions define the category, meal-kit companies are focusing on broadening the appeal of meal kits by including even easier options such as ready-to-eat kit ranges in addition to the traditional step-by-step cooking model.

- Blue Apron launched its “Heat and Eat” meal offerings in September 2021, marking its entry into the ready-to-eat category. In its earnings call for the fiscal year ended December 31, Blue Apron said that it had seen a steady uptick in volume since the new range’s introduction and that customers are adding these offerings on top of their standard recipes, which is helping drive average revenue per user. The company said that it plans to continue expanding its ready-to-eat range in the future.

- HelloFresh entered the ready-to-eat segment with its $177 million acquisition of US meal-kit startup Factor75 in 2020. HelloFresh reported triple-digit growth in the fiscal year 2021 in its ready-to-eat meal business, including Australian ready-to-eat provider Youfoodz (which it acquired in October 2021) and Factor75. In its earnings call for the fiscal year 2021, HelloFresh said sales of ready-to-eat meals are increasing rapidly and will be a strong source of growth.

- Marley Spoon acquired Australian ready-to-eat meal provider Chefgood in January 2022. According to the company, the acquisition will allow it to gain a foothold in the growing ready-to-eat category, address more customer segments and meal occasions, and support its strategy of increasing ARPU for its meal-kit brands.

- We believe expansion into the ready-to-eat category marks the next step in meal-kit companies’ growth plans to expand their total addressable market and tap into new customer segments—including demographics that are less likely to cook regularly from scratch.

- In July 2021, HelloFresh rolled out an online marketplace in the US, offering breakfast options, desserts, fresh produce, pantry essentials, ready-to-eat meals, sides and spice blends that customers can add to their weekly order. The US launch follows a successful implementation in Belgium, Luxembourg and the Netherlands.

- Sunbasket launched Sunbasket Marketplace in January 2021, featuring breakfasts, lunches, snacks and pantry staples from its partner brands, which can be added to the subscription box each week.

- Blue Apron’s online marketplace features a curated selection of add-on products, kitchen tools and pantry items, as well as a selection of non-subscription meal-kit boxes and wines.

- In October 2021, Sunbasket became the first meal-kit provider and direct-to-consumer company to partner with Instacart nationwide. Consumers can order Sunbasket’s prepared meals, meal kits and grocery add-ons through Instacart’s digital storefront without a subscription.

- In February 2022, Indian and South Asian meal-kit company Quicklly teamed up with Instacart to launch a storefront offering delivery of meal kits and ready-to-eat meals across the US. Quicklly also plans to expand its offerings to include rapid delivery of Indian pantry staples and spices in as little as one hour.

What We Think

Many consumers have a renewed appetite for meal kits in light of the pandemic as they look for easy and healthy at-home meal solutions. We expect meal-kit providers to turn their focus to improving customer retention and building long-term consumer habits from pandemic-driven demand. This will involve re-evaluating their strategies through category expansion, distribution channel diversification and strategic partnerships, as well as investing in innovative digital marketing to maintain brand awareness. Implications for Meal-Kit Companies- Customer retention continues to be a challenge for meal-kit companies. Many attract new customers with a discount and then offer no more benefits once they are on board. To retain customers, benefits and deals should be long-lasting and spread over time, incentivizing customers to make repeat purchases. Another way to incentivize loyalty is by offering a club or reward program. These options can provide benefits to customers that can only be redeemed if they stay signed on and must be re-accrued if the service is canceled and started again.

- Coresight Research survey data found that 43.3% of online grocery shoppers with household incomes lower than $25,000 have used a meal-kit subscription service in the past 12 months. Meal-kit companies should offer multiple price points with different service levels ranging from their value products to their most premium.

- Meal-kit services have an opportunity to diversify from subscription services to online marketplaces that offer more than just meal kits, such as specialty foods and pantry staples. This will allow them to reach a wider audience and expand their offering beyond dinnertime. CPG brands, especially niche and specialty brands, can become part of these new marketplaces and use them as an alternative to sampling to promote trial and exposure.