DIpil Das

What’s the Story?

The pandemic drove a fresh burst of interest and a new sense of optimism in the US meal-kit market, which has been struggling with profitability amid steep customer acquisition spending, logistical costs and poor subscriber retention. However, consumer demand for meal kits saw a spike in demand amid the pandemic, as homebound consumers sought convenient and healthy home-cooked meal options. In this report, we examine the market size and trajectory of the US meal-kit and recipe-box market, as well as the competitive landscape and three key themes we expect to see in 2021 and beyond.Why It Matters

Covid-19 lockdown and social distancing measures have drastically altered consumers’ food consumption habits. More than 70% of Americans who are cooking more amid the pandemic intend to continue doing so once it subsides, according to marketing firm Hunter’s December 2020 survey. Respondents cited saving money (67%), eating healthier (56%) and feeling good (56%) as leading motivators for their home cooking habits. Meal-kit providers capitalized on the increased at-home consumption trend in 2020 by expanding their operations and adjusting their offerings. Many are now banking on long-term shifts in culinary habits, flexible workweeks and work-from-home routines to support greater at-home food consumption. Coresight Research estimates that total US food and beverage e-commerce sales grew 81.5% year over year in 2020, reaching $55.3 billion—a vastly greater increase than any recent year. Although we expect to see a growth slowdown in 2021, in part, due to tough comparatives, increased adoption of grocery e-commerce is also a positive sign for the meal-kit market—we expect pandemic-induced channel stickiness to support strong sales for meal-kit providers going forward.US Meal-Kit Market: In Detail

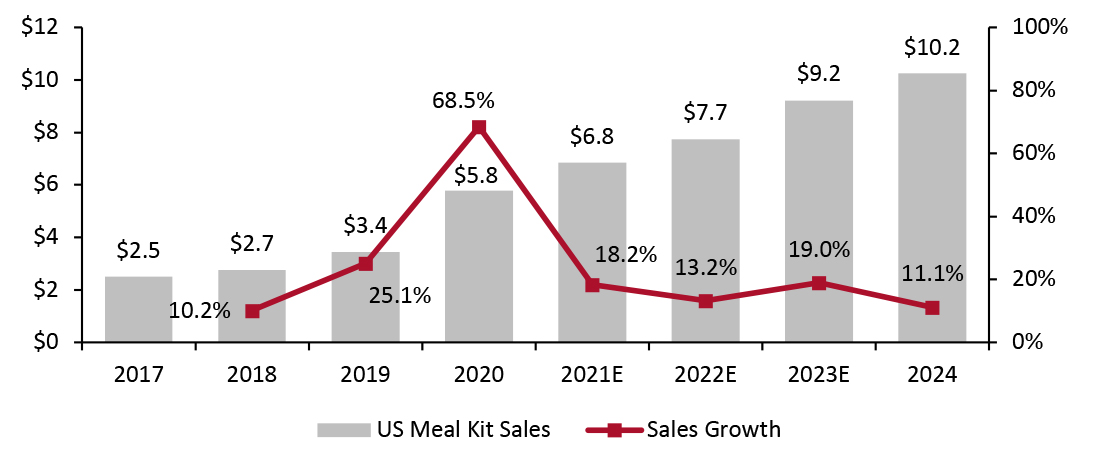

US Meal-Kit Market Performance and Outlook Coresight Research estimates that the US meal-kit market surged by 68.5% year over year to reach $5.8 billion in 2020, a vastly greater increase than any recent year. The tremendous growth was fueled by a combination of limited dining-out options due to lockdowns, families having little time to spare for cooking food, and consumers’ desire to eat an easy-to-make, well-balanced meal instead of takeout. As the health crisis moderates in 2021 and consumers return to more normal ways of living, working and spending, we expect market growth to slow to 18.2%, reaching $6.9 billion. Despite this deceleration, the US meal-kit market is set to significantly outperform overall US grocery sales, which Coresight Research expects to decline by 2.8% in 2021. We also anticipate that the meal-kit market will outperform online US food and beverage sales, which we expect to grow 11.0% in 2021—with the slowdown, in part, due to tough 2020 comparatives. The pandemic has created a fertile ground for meal-kit market growth, as indicated in Figure 1. Meal-kit providers have a unique opportunity to capitalize on shifting trends and the still-evolving meal-kit experience.Figure 1. US Meal-Kit Market: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_129323" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Competitive Landscape

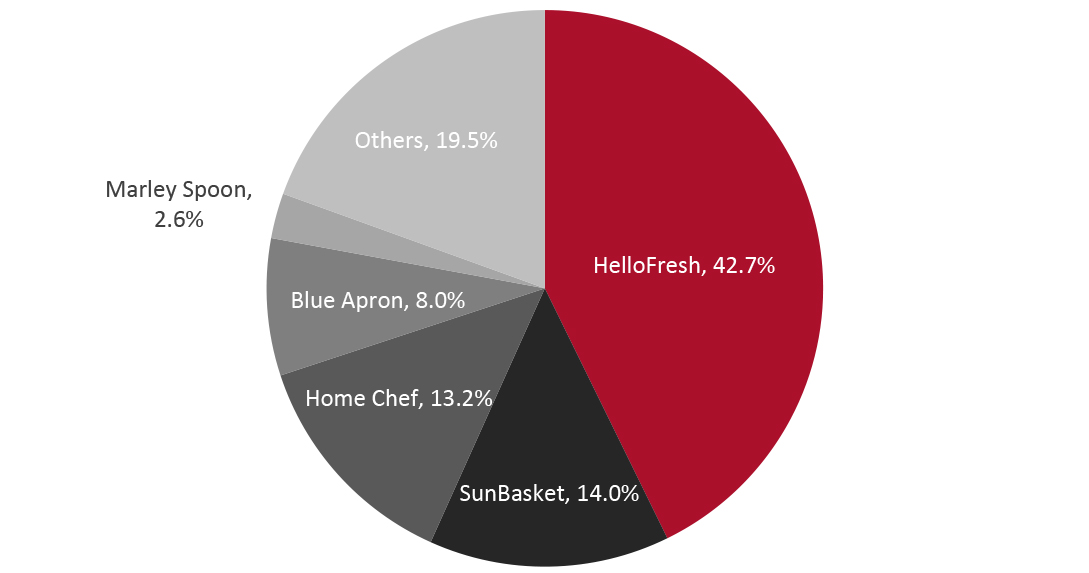

The US meal-kit market is highly concentrated, with HelloFresh and Sunbasket accounting for more than 50% of total meal-kit sales in the US in 2020. This market share represents a significant shift versus 2017 when Blue Apron was the market leader with an approximate 34% share. As the company struggled to retain customers, Blue Apron now accounts for just 8% of the market, as of 2020.

Source: Coresight Research[/caption]

Competitive Landscape

The US meal-kit market is highly concentrated, with HelloFresh and Sunbasket accounting for more than 50% of total meal-kit sales in the US in 2020. This market share represents a significant shift versus 2017 when Blue Apron was the market leader with an approximate 34% share. As the company struggled to retain customers, Blue Apron now accounts for just 8% of the market, as of 2020.

Figure 2. US Meal-Kit Market Share 2020 (%) [caption id="attachment_129064" align="aligncenter" width="724"]

Source: Company reports/Coresight Research[/caption]

Key Themes

We present three key trends that will impact the meal-kit market in 2021 and beyond.

1. Pandemic Momentum To Sustain Meal-Kit Subscription Providers

While some meal-kit companies were growing quickly prior to the pandemic, the ensuing shift in consumer behavior provided a significant growth boost, with many reporting operating margin improvements and progress toward profitability. We expect this momentum to continue in 2021.

Source: Company reports/Coresight Research[/caption]

Key Themes

We present three key trends that will impact the meal-kit market in 2021 and beyond.

1. Pandemic Momentum To Sustain Meal-Kit Subscription Providers

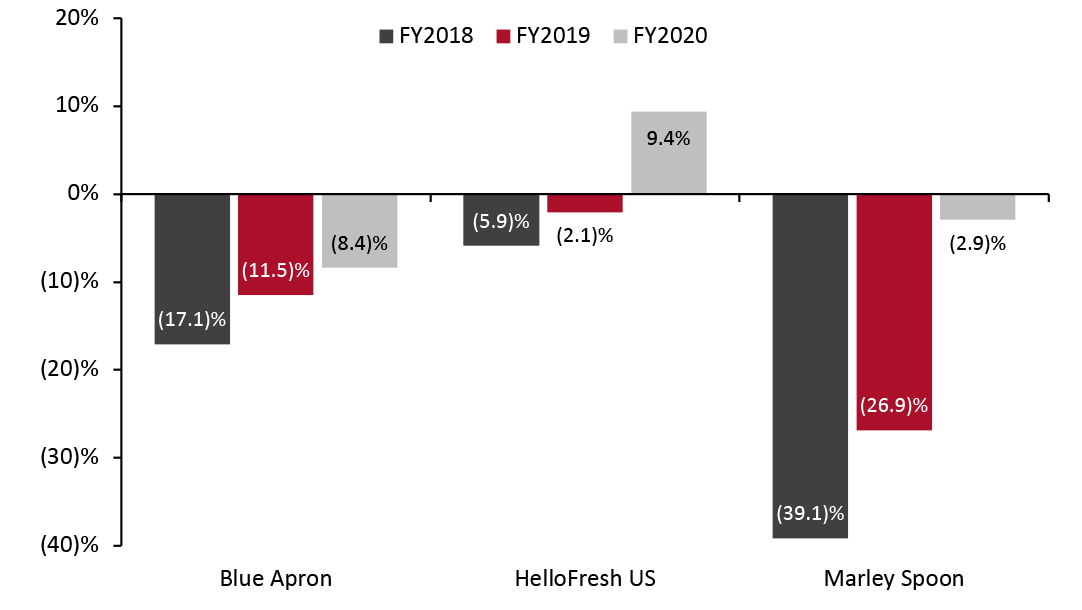

While some meal-kit companies were growing quickly prior to the pandemic, the ensuing shift in consumer behavior provided a significant growth boost, with many reporting operating margin improvements and progress toward profitability. We expect this momentum to continue in 2021.

- Blue Apron acknowledged in February 2020 that it did not have the required capital to execute a turnaround strategy and was evaluating a range of options, including a sale of the company. However, the company posted a 22% jump in its fourth quarter ended December 31, 2020. The value of its average order rose to $61, its highest level since 2015. Blue Apron expects to generate double-digit revenue growth and boost marketing spend to sustain growth momentum in 2021. The company noted that it launched more products in 2020 than any other year and plans to introduce a range of new offerings to grow its menu in 2021. Blue Apron is set to expand its fulfillment capabilities to cater to increased demand.

- HelloFresh reported that its US sales surged by 99% to reach $705 million in its fourth quarter, ended December 31, 2020. The company stated that its active subscribers increased sequentially throughout 2020 to reach 2.6 million in its fourth quarter. HelloFresh forecasts sales growth at constant exchange rates of 20–25% in 2021.

- For its fiscal 2020, Marley Spoon reported that its US segment saw the fastest growth, at 126% year over year. Growth was supported by strong sales across its three brands Marley Spoon, Martha Stewart & Marley Spoon, and Dinnerly. The company emphasized that the US will remain a “significant growth engine” in 2021 and expects its revenue to grow in fiscal 2021 given the uptick in online meal-kit adoption. The company plans to expand its fulfillment center capacity, as well as broaden its approach to customization and personalization through digital platform development.

Figure 3. Blue Apron, HelloFresh US and Marley Spoon: Operating Margins (%) [caption id="attachment_129066" align="aligncenter" width="725"]

Source: Company reports[/caption]

While the pandemic boosted the prospects of the meal-kit market, the challenges associated with the subscription business remain. The meal-kit subscription model comes with high customer acquisition and retention costs as convincing shoppers to switch to unfamiliar purchasing models and preventing existing customers from returning to traditional channels is challenging. Moreover, the lack of marketing visibility that physical retail formats enjoy and competition from rivals seeking to tempt shoppers with introductory offers, leading to high subscriber churn rates, requires strong marketing investment.

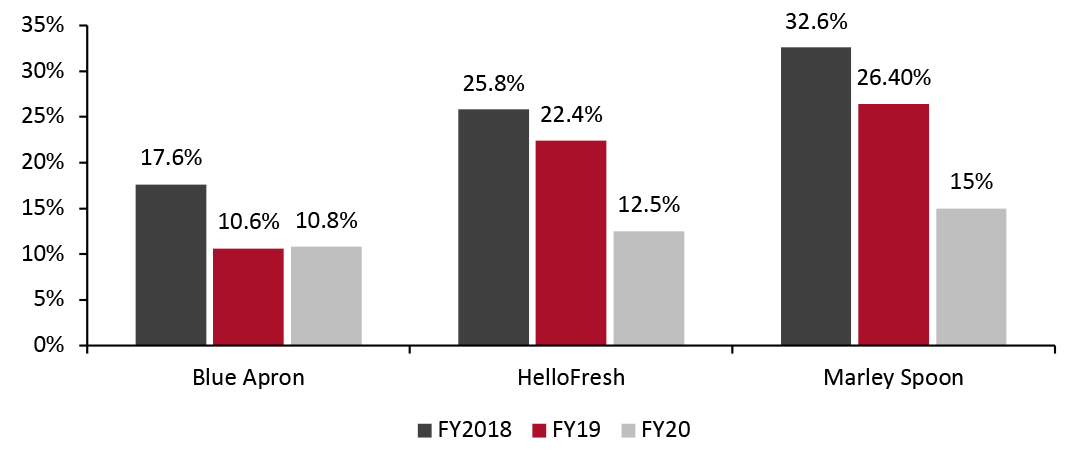

Although meal-kit subscription providers have managed to reduce their marketing expenditure from historic levels, as shown in Figure 3, we believe that companies will continue to incur high marketing costs typically associated with building a customer base. For instance, in its latest earnings call, Blue Apron stated that it will significantly step up its marketing investment to drive additional customer engagement and retention in 2021.

As marketing expenditure is set to comprise a significant portion of meal-kit companies’ operating expenses going forward, we expect that many will find it challenging to consistently achieve profitability down the line.

Source: Company reports[/caption]

While the pandemic boosted the prospects of the meal-kit market, the challenges associated with the subscription business remain. The meal-kit subscription model comes with high customer acquisition and retention costs as convincing shoppers to switch to unfamiliar purchasing models and preventing existing customers from returning to traditional channels is challenging. Moreover, the lack of marketing visibility that physical retail formats enjoy and competition from rivals seeking to tempt shoppers with introductory offers, leading to high subscriber churn rates, requires strong marketing investment.

Although meal-kit subscription providers have managed to reduce their marketing expenditure from historic levels, as shown in Figure 3, we believe that companies will continue to incur high marketing costs typically associated with building a customer base. For instance, in its latest earnings call, Blue Apron stated that it will significantly step up its marketing investment to drive additional customer engagement and retention in 2021.

As marketing expenditure is set to comprise a significant portion of meal-kit companies’ operating expenses going forward, we expect that many will find it challenging to consistently achieve profitability down the line.

Figure 4. Blue Apron, HelloFresh US and Marley Spoon: Marketing Expenditure (% of Revenue) [caption id="attachment_129067" align="aligncenter" width="725"]

Source: Company reports[/caption]

2. Foodservice Operators Heat Up Competition in the Meal-Kit Market

Amid the pandemic, meal-kit solutions have expanded beyond online subscription services to incorporate offerings from foodservice establishments. Despite the renewed interest in cooking while consumers spend more time at home, many miss the experience of dining out and eating food from their favorite restaurants. To cater to this gap while consumers were unable to dine-in due to social distancing restrictions, some foodservice chains and restaurants pivoted to offering meal kits for consumers to assemble at home. These options add an interactive element to a restaurant meal, providing consumers with a chance to participate in preparing and assembling their dish.

Source: Company reports[/caption]

2. Foodservice Operators Heat Up Competition in the Meal-Kit Market

Amid the pandemic, meal-kit solutions have expanded beyond online subscription services to incorporate offerings from foodservice establishments. Despite the renewed interest in cooking while consumers spend more time at home, many miss the experience of dining out and eating food from their favorite restaurants. To cater to this gap while consumers were unable to dine-in due to social distancing restrictions, some foodservice chains and restaurants pivoted to offering meal kits for consumers to assemble at home. These options add an interactive element to a restaurant meal, providing consumers with a chance to participate in preparing and assembling their dish.

- Chick-Fil-A launched its meal-kit varieties nationally in May 2020. Consumers can order a meal kit at a Chick-Fil-A drive-thru, through its mobile app or through one of its third-party delivery partners such as DoorDash and Uber Eats.

- Family restaurant chain Denny’s launched Make-at-Home meal kits in May 2020, which include all the ingredients needed to cook a family meal. Denny’s meal-kit portfolio provides breakfast, lunch and dinner options.

- Chicago’s Siena Tavern launched Siena’s Scratch Kitchen in March 2020, offering an At-Home Pasta Kit and At-Home Pizza Kit geared to families. The pasta kit allows consumers to mix and match pasta made from scratch with one of Siena’s homemade sauces. The pizza kit includes the required ingredients to construct and bake a pizza at home.

- Portillo’s offers Italian beef and all the associated for customers to replicate their own sandwich at home.

- Additionally, numerous US pizza brands and ramen hot spots are selling meal kits for customers who want to have a hot meal ready to cook quickly at home.

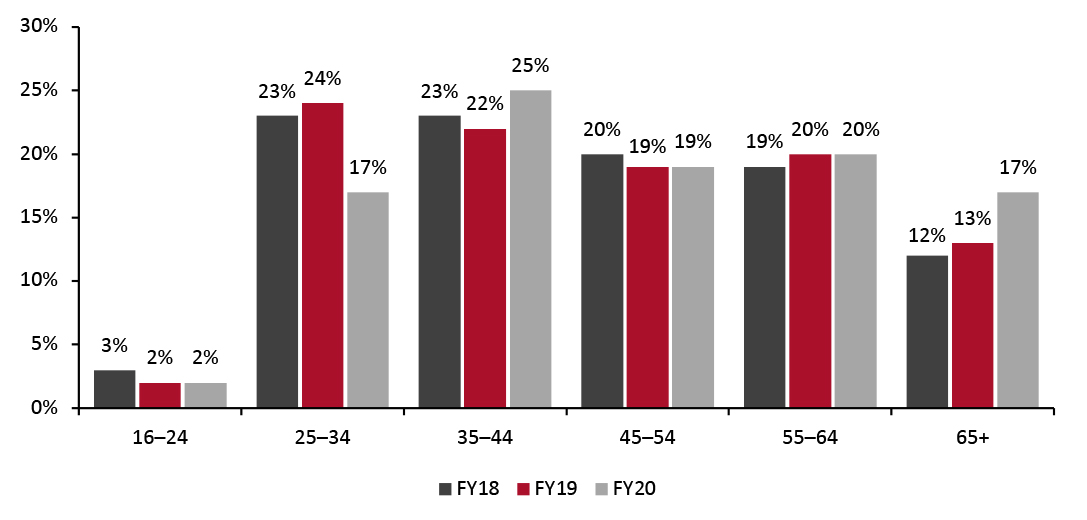

Figure 5. Blue Apron Customers by Age Group (%) [caption id="attachment_129068" align="aligncenter" width="725"]

Source: Blue Apron[/caption]

Older demographics represent a significant untapped opportunity for meal-kit providers. While many older consumers are experienced cooks who enjoy a homemade meal, some affluent retirees may be interested in shortcuts to make their cooking easier. Moreover, some older consumers may be limited in their ability to leave home to shop for groceries. Meal-kit companies can appeal to these customers by taking the hassle out of sourcing ingredients.

Meal-kit companies can benefit from the broader customer base by refocusing their marketing efforts to target affluent older demographics. We believe that the change in messaging would warrant a shift in marketing strategy—meal-kit companies should move a portion of marketing investment offline in order to reach an older consumer base.

Source: Blue Apron[/caption]

Older demographics represent a significant untapped opportunity for meal-kit providers. While many older consumers are experienced cooks who enjoy a homemade meal, some affluent retirees may be interested in shortcuts to make their cooking easier. Moreover, some older consumers may be limited in their ability to leave home to shop for groceries. Meal-kit companies can appeal to these customers by taking the hassle out of sourcing ingredients.

Meal-kit companies can benefit from the broader customer base by refocusing their marketing efforts to target affluent older demographics. We believe that the change in messaging would warrant a shift in marketing strategy—meal-kit companies should move a portion of marketing investment offline in order to reach an older consumer base.

What We Think

The meal-kit industry, which has struggled with cooling consumer sentiment and unsustainable business model requirements, is set to evolve in the coming years. Many consumers have a renewed appetite for meal kits in light of the pandemic as they look for easy and healthy at-home meal solutions. We expect meal-kit providers to focus on driving customer retention and establishing long-term consumer habits out of the pandemic-induced demand. This will involve re-evaluating their strategies through brand expansion, strategic partnerships or acquisitions, as well as investing in innovative digital marketing to maintain brand awareness. Implications for Brands/Retailers- The US meal-kit industry faces a serious subscriber retention challenge, primarily because kits are sold at a premium price, making the service unappealing to low-income consumers or consumers looking for areas to cut back their spending. As the US economy is still recovering from the recession, companies will have to offer more than basic convenience and offer affordable pricing or shift the perception of value to retain customers.

- Though the idea of easy preparation and instructions define the category, meal-kit companies must focus on broadening the appeal of meal kits by including even easier options such as “ready to heat” or “ready to eat” kit ranges in addition to the traditional step-by-step cooking model.

- Meal kits and recipe boxes are often considered cheaper and healthier alternatives to takeaways, given the emphasis on fresh produce. Although meal-kit companies will face challenges in the coming years as they return to competing with restaurants for food spending, meal-kit providers should seek to convert the pandemic boost into long-term habits by offering value, convenience and meaningful culinary experiences.