DIpil Das

What’s the Story?

With malls in the US already struggling even before the Covid-19 crisis, the pandemic has sounded the death knell for many of them, and we expect to see mall consolidation as a result over the next few years.Why It Matters

As consumers continue to abstain from visiting malls and shopping centers, a number of mall-based retail stores are shutting shop, and many malls are consequently finding it increasingly challenging to operate sustainably—ultimately driving mall closures. Coresight Research estimates that there will be 20,000–25,000 total US store closures in 2020, with around 55–60% of these being mall-based stores. Many Malls Were Already Struggling; Covid-19 Has Accelerated Their Downfall A number of malls were already experiencing significant struggles before the crisis, owing to reduced shopper traffic and heavy store closures, particularly in the core apparel sector. With discretionary spending incrementally shifting from products to services and sales migrating online, the physical retail landscape was witnessing ongoing store-rationalization trends as struggling retailers tried to optimize their brick-and-mortar fleets. Nonetheless, , the rationalization of mall space typically lagged store closures. The impact of the coronavirus and resulting economic fallout, however, could prove to be the tipping point for malls, accelerating the pace of mall-space consolidation through 2020 and beyond. Coresight Research estimates that around 25% of US malls will close in the next three to five years, roughly translating to around 300 of the country’s nearly 1,200 malls. The malls that will be most affected will be the Class B, C and D malls, which have higher vacancy rates and are most struggling with waning consumer appeal. Higher-end Class A malls are less likely to be as strongly impacted, given that they generate higher sales per square foot at superior locations and have a mixed-use value proposition—plus, their premium tenants tend to enjoy higher profit margins and are therefore in a better position to withstand the downturn. Some 36.4% of US malls were low-tier Class C or D malls in 2019, according to our analysis of data cited by Taubman, a US-based REIT. A further 36.3% of malls were Class B malls, and only 27.3% were top-tier Class A malls. Although there is no standard classification for malls, sales densities for in-line stores (less than 10,000 square feet) are typically used as a primary metric. For reference, we show the sales-density metrics used by one realty firm below.Figure 1. Mall Classification Based on Sales per Square Foot at In-Line Stores, 2019 [wpdatatable id=403 table_view=regular]

Source: Korpacz Realty Advisors

Department Store and Other Anchor Store Closures Are Exacerbating Mall Owners’ Challenges

Department stores are among the most affected retail casualties, with a number of them filing for bankruptcy and closing many stores—including prominent names such as JCPenney, Neiman Marcus and Stage Stores. Department stores range from approximately 100,000 square feet to over 160,000 square feet for a mall-based anchor store. Department store closures therefore create major vacant space challenges for mall owners. Although department stores have lost much of their consumer appeal, they still serve as the anchors for most shopping malls, and those centers risk losing their appeal, and thus traffic, when department stores close. Moreover, co-tenancy clauses enable many tenants of smaller, in-line stores to pay lower rent or break their leases when an anchor tenant leaves. Department store closures in malls therefore create a negative ripple effect throughout the mall environment. Mall owner CBL Properties, which has a portfolio of 100 properties in 26 states, announced on August 19 that it plans to file for bankruptcy by no later than October 1. The company has struggled due to losing anchor department stores such as JCPenney and Sears. In an effort to avoid this knock-on effect, some leading mall owners are considering acquiring bankrupt and struggling retailers. For instance, Simon Property Group, one of the largest US mall owners, has reportedly partnered with Brookfield Property Partners to make a joint offer of $1.65 billion to acquire department store chain JCPenney. In the months ahead, we anticipate that there may be more similar bids by mall owners for struggling department or anchor stores, considering their importance to malls’ ecosystems.Tenant Mix of Malls Make Them More Vulnerable in the Near Term

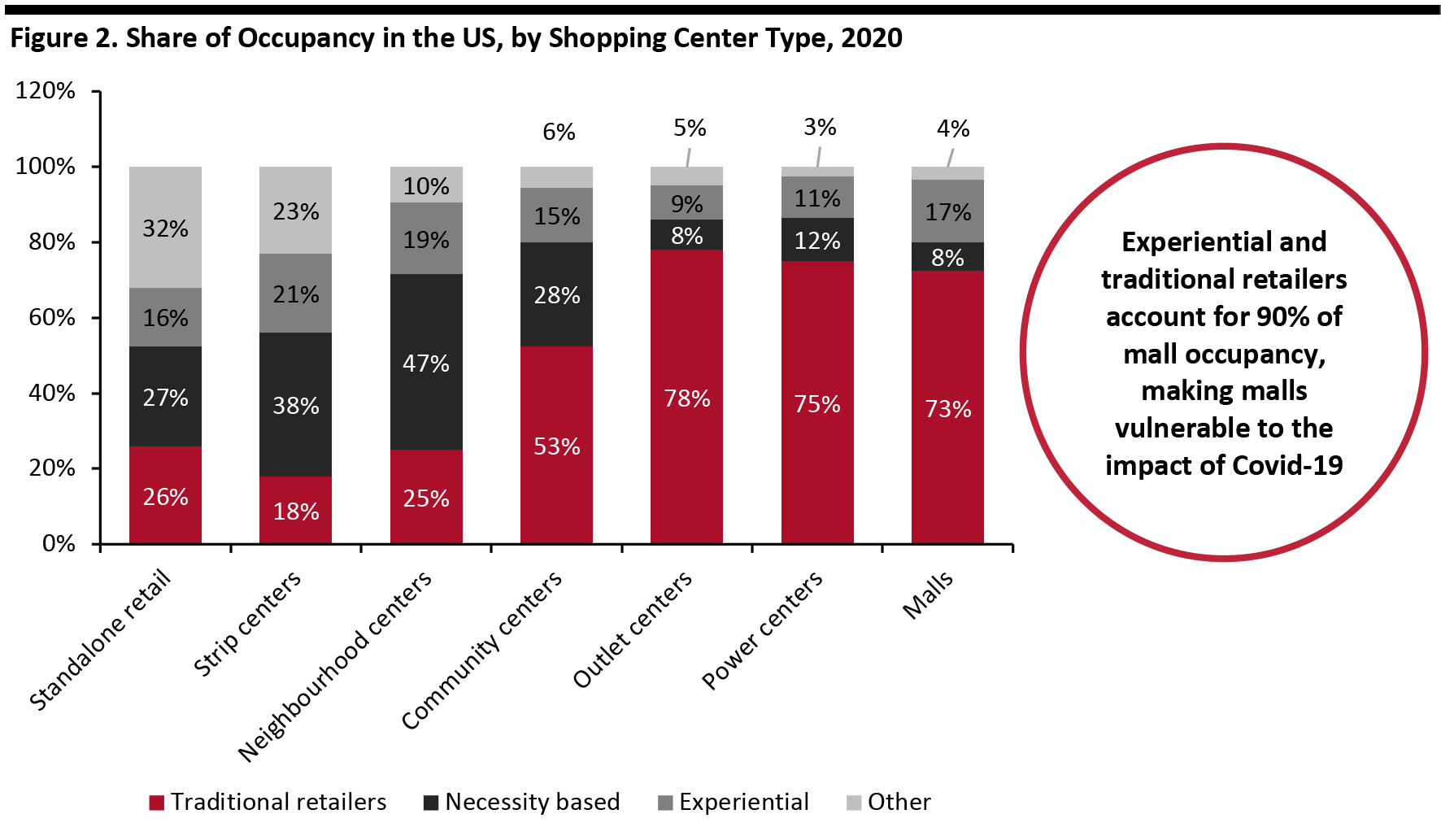

Prior to Covid-19, many mall owners were expanding their experience-led offerings prior to the pandemic—by adding food services, fitness centers, children’s entertainment and movie theaters to their tenant mix. However, in a “mask economy,” this strategy is unlikely to help malls toward a quick recovery. Shopping centers were the first casualties of social-distancing public health protocols and will probably be among the last coming out of them as well. As of 2020, traditional and experiential retailers together account for around 90% of mall occupancy (73% traditional retailers and 17% experiential retailers)—the highest proportion compared to other types of shopping centers (see Figure 2), implying that malls are highly vulnerable to the adverse effects and downturn caused by the coronavirus crisis. On the other hand, necessity-based retailers—which are relatively at lower risk—form just 8% of mall owners’ tenant mix, the lowest proportion compared to other types of shopping centers. [caption id="attachment_115084" align="aligncenter" width="700"] Source: Statista/CoStar Group[/caption]

Source: Statista/CoStar Group[/caption]

Malls May Alter Their Tenant Mix

With a view to ensuring their long-term sustenance against the backdrop of a challenging environment, we expect that mall operators are likely to be inclined to backfill the vacant space left by anchor tenants such as department store chains by onboarding logistics tenants and “essential services” providers to their tenant mix. These companies are in a better position to offer low risks of rental-rate volatility, as well as steady cash flow and stable occupancy levels during the uncertain market environment. However, it will likely continue to be a long-term challenge for many mall operators to lease out vacant spaces, given that demand for such large spaces could dwindle further. Fulfillment: An acceleration in consumer demand for products through e-commerce has resulted in a greater need for fulfillment, and in line with this trend, we could see some mall space repurposed as local distribution centers, including as dark stores—i.e., “stores” that purely fulfill online orders. Particularly as mall owners seek to repurpose the substantial space vacated as department stores close, nontraditional tenants such as fulfillment centers could prove appealing. Amazon, for example, is reportedly in talks with mall owner Simon Property Group to take over closed or current JCPenney and Sears department stores and convert them into fulfillment centers. A trend of retail-to-logistics conversions would align with the emphasis by REITs on repurposing space for other nonretail uses, from housing to coworking spaces, in recent years. Grocers: Grocery stores have a distinct ability to draw shoppers often two or three times per week, even in a downturn. This enables a grocery-anchored mall to attract consistent traffic that benefits in-line tenants, and this is especially appealing in the context of a coronavirus-induced recessionary environment. Health-care centers: Property owners could tap health-care providers to help them reinvigorate their malls amid global uncertainty. Health-care clinics boast higher credit ratings and sign longer leases—10–12 years in comparison to the typical five-year lease for traditional retailers—offering the stability of regular rental income for an extended period. In addition, health-care centers can draw higher daytime traffic to malls compared to other tenants, such as restaurants, which bring in evening customers. The number of retail health-care clinics in the US increased by 47% during 2016–2019, but despite this potential, only 10% of US shopping centers had a health-care-related tenant, according to a JLL research report published in 2019.What We Think

Implications for Brands/Retailers- Substantial mall closures would represent an overdue consolidation in mall space and would accelerate the multiyear shift to higher-quality mall formats as a complement to the functionality of e-commerce. Functional brick-and-mortar formats such as discount stores are likely to remain focused on off-mall locations.

- Opportunities will exist for retailers to set up fulfillment centers such as dark stores in malls, possibly with favorable lease agreements given the struggles being experienced by mall owners.

- Mall owners may look to alter their tenant mix with a focus on non-apparel retail tenants such as grocery and nonretail tenants such as fulfillment centers and health-care centers.

- Mall owners can no longer rely significantly on experience-led retail to revive their businesses.

- REITs may look to acquire a limited number of struggling department store retailers or major tenants in order to limit vacancies at their malls, which may prevent other retailers from exiting their leases or demanding reduced rents under co-tenancy agreements. However, we do not see keeping failed or dying retail banners alive as a sustainable strategy to revive malls over the long term—this kind of opportunism does not fix the fundamental problems facing many malls.