Nitheesh NH

Introduction

In 2021, US jewelry specialists witnessed outstanding sales growth, driven by strong consumer demand and overall recovery in the economy, in turn supported by government stimulus packages. In this report, we provide our outlook for the US jewelry specialty retail sectors in 2022 and beyond. We also explore key growth drivers, competitive landscapes, notable retail innovators in the space and opportunities arising from four key jewelry trends.US Jewelry Market: Performance and Outlook

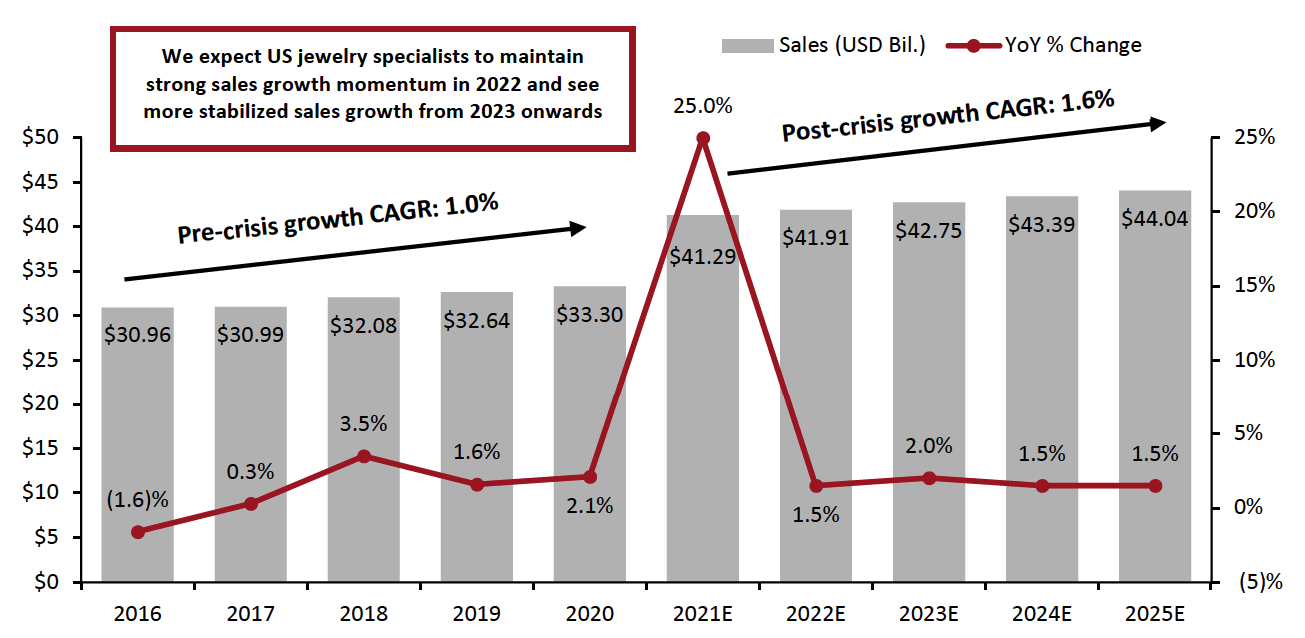

US Jewelry Specialty Sector: 2022 and Beyond In 2021, US specialists’ sales increased by 25.0% year over year to around $41 billion (excluding sales taxes), as Coresight Research estimates using US Census Bureau data. In 2021, jewelry was a great beneficiary of increased disposable income, as US consumers limited their travel—along with improved economic growth and income support measures, such as stimulus checks and child tax credits. In the third quarter of 2021, the US was one of the strongest performing jewelry markets, with total jewelry demand (which includes demand for products from both specialists and non-specialists such as e-commerce players) increasing by 12.0% year over year—the highest third-quarter growth since 2009. The strong third quarter followed outstanding 103% year-over-year demand growth in the second quarter of 2021, according to data compiled by World Gold Council and Metal Focus. In 2022, against very strong comparatives, we estimate that US jewelry specialists’ sales will increase by 1.5% year over year to $41.9 billion. We expect that strong demand for jewelry will continue in 2022, supported by the ongoing vaccine rollout, lifting consumer sentiment, and consumers’ return to more normal ways of living and spending. From 2023 onward, we expect the US jewelry specialty sector to see more stabilized sales growth. We discuss key long-term drivers for the US jewelry specialty retail sector later in the report.Figure 1. US Jewelry Specialists’ Sales (USD Bil.) and YoY % Change [caption id="attachment_140683" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

Growth Analysis: Specialists’ Sales Versus Total Consumer Spending on Jewelry

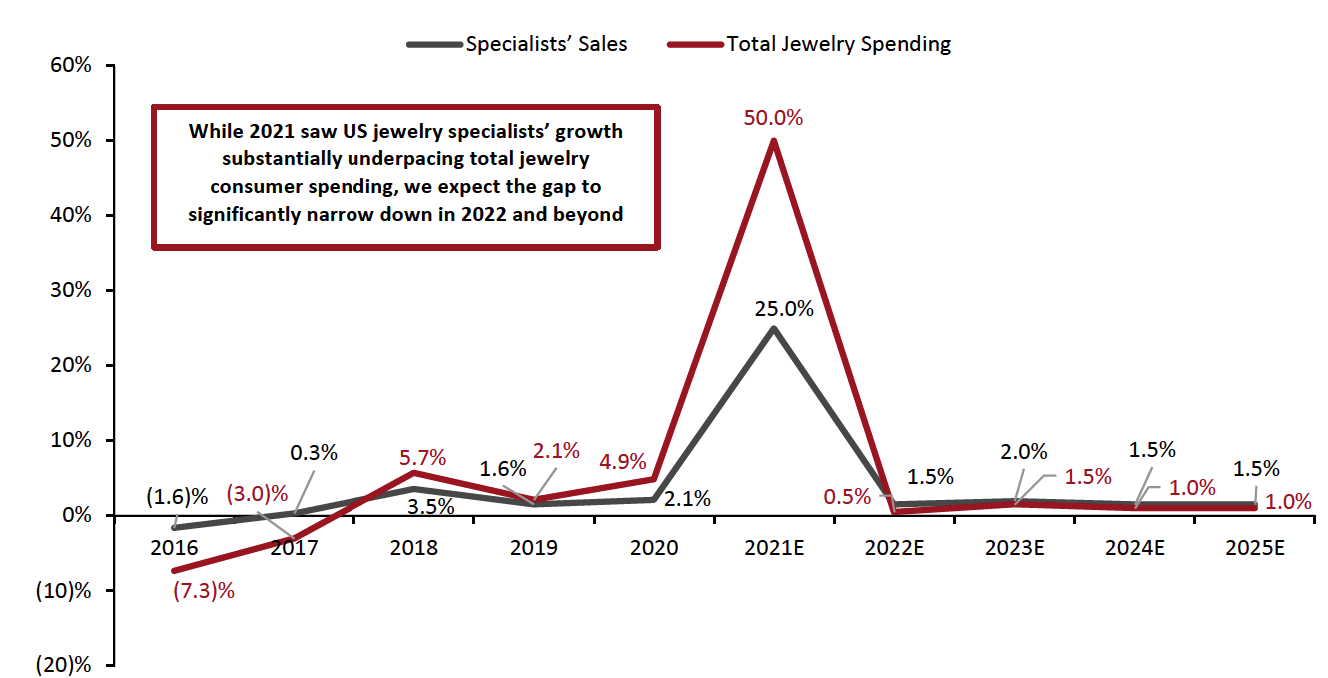

In 2021, Coresight Research estimates that total consumer spending on the jewelry category in the US grew 50.0% and reached $174.8 billion—with spending growth substantially outperforming jewelry specialists’ sales growth of 25.0%.

In 2022, we expect the growth gap to substantially reduce between jewelry specialists’ sales and total consumer spending. Against very strong comparatives, we estimate that total consumer spending on jewelry will increase by an almost flat 0.5% and reach $175.6 billion, driven by continued strong demand for jewelry.

Between 2023 and 2025, we expect both jewelry specialists and non-specialists, which includes e-commerce retailers, department stores and home-shopping channels, to see more stabilized growth, with a much narrower gap between growth rates of specialists’ sales and total consumer spending. Between 2021 and 2025, we estimate that total consumer spending on jewelry will grow at a CAGR of 1.0% and reach $181.8 billion by 2025.

Source: US Census Bureau/Coresight Research[/caption]

Growth Analysis: Specialists’ Sales Versus Total Consumer Spending on Jewelry

In 2021, Coresight Research estimates that total consumer spending on the jewelry category in the US grew 50.0% and reached $174.8 billion—with spending growth substantially outperforming jewelry specialists’ sales growth of 25.0%.

In 2022, we expect the growth gap to substantially reduce between jewelry specialists’ sales and total consumer spending. Against very strong comparatives, we estimate that total consumer spending on jewelry will increase by an almost flat 0.5% and reach $175.6 billion, driven by continued strong demand for jewelry.

Between 2023 and 2025, we expect both jewelry specialists and non-specialists, which includes e-commerce retailers, department stores and home-shopping channels, to see more stabilized growth, with a much narrower gap between growth rates of specialists’ sales and total consumer spending. Between 2021 and 2025, we estimate that total consumer spending on jewelry will grow at a CAGR of 1.0% and reach $181.8 billion by 2025.

Figure 2. US: Jewelry Specialists’ Sales Compared to Total Jewelry Consumer Spending (YoY % Change) [caption id="attachment_140684" align="aligncenter" width="700"]

Source: US Census Bureau/Bureau of Economic Analysis/Coresight Research[/caption]

Source: US Census Bureau/Bureau of Economic Analysis/Coresight Research[/caption]

Market Factors

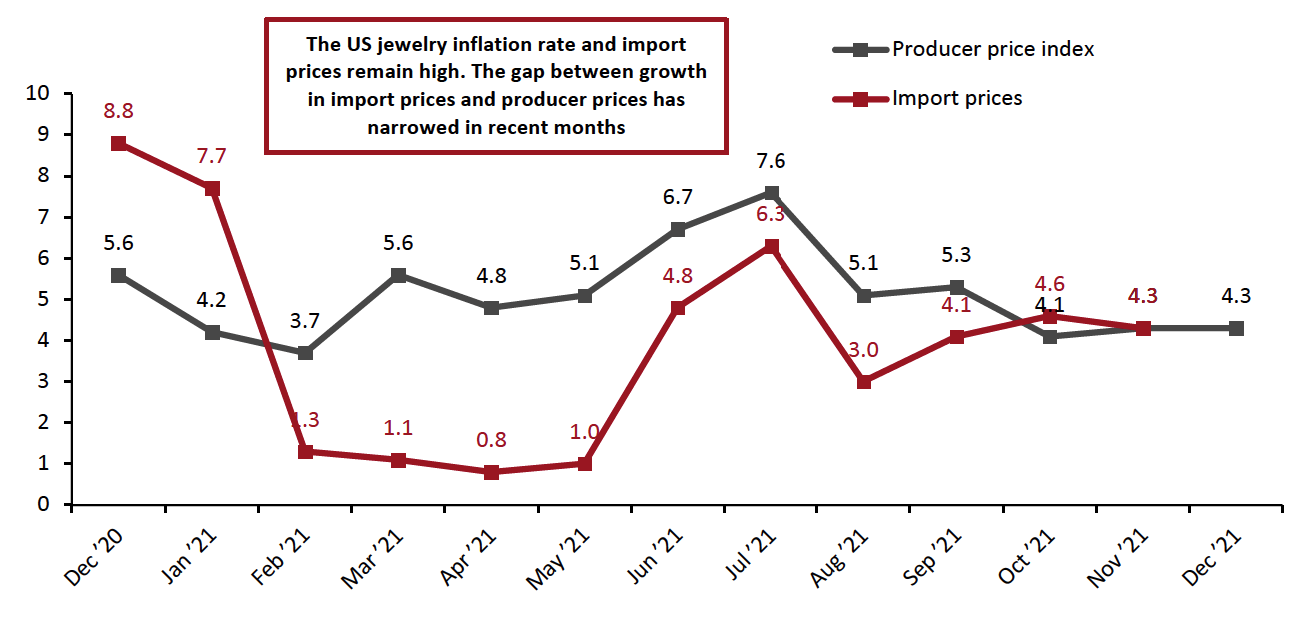

Below, we list three key factors that will drive the growth of the US jewelry market: 1. Surge in US Weddings and High Spending on Bridal Jewelry In 2022, about 2.5 million couples in the US are expected to tie the knot, with an average spend of $24,300, up from 1.9 million weddings at an average spend of $22,500 in 2021, according to a June 2021 survey by a wedding research company The Wedding Repoof on 2,229 consumers and 283 businesses. US-based jewelry retailers often substantially rely on wedding trade since couples spend a notable amount on their wedding jewelry—in 2020, US couples on average spent $5,500 on engagement rings plus $900 for a woman’s wedding band and $500 for a man’s wedding band, according to 2020 study by wedding planning company The Knot. We expect that the surge in weddings and high spending on bridal jewelry will drive growth in the US market in 2022. Within bridal jewelry, customization continues to be a roaring trend. Around 80% of bridal customers seek some level of personalization and wedding ring customization, according to the US leading jewelry specialists Signet Jeweler’s survey in September 2021. 2. Innovations in the Functionality of Jewelry Products Recent technological advancements have brought jewelry fashion and technology together. Smart jewelry that capitalizes on innovative technologies is gaining strong momentum among US jewelry shoppers and jewelry brands and retailers should look to capitalize on this trend. The global smart jewelry market is expected to grow at a CAGR of 10.2% between 2020 and 2026, according to ReportLinker, a data technology company powered by artificial intelligence (AI). “Leaf Urban” by wearable wellness company Bellabeat is one such smart jewelry item. “Leaf Urban” can be worn as a bracelet, brooch or necklace and is used to monitor stress levels, keep track of menstrual cycles and guide in meditation. The leaf-shaped body is encased in a metal clip that is available in rose gold or silver. Jewelry companies are aiming to innovate in other areas as well—Denmark-based jewelry company Pandora, a leading jewelry specialty retailer in the US, is looking to innovate in its bracelet’s offerings, adding new functionalities. On Pandora’s Capital Markets Day held on September 14, 2021, the company’s Senior VP and Chief Product Officer Stephen Fairchild stated, “We will expand charm wearing occasions through charm carrier innovations, innovating first on bracelets. The wearing occasion platform gives us infinite possibilities to innovate on bracelets and beyond; e.g., new shapes, new functionalities, new materials and new meetings. This will contribute to building moments, relevance and desirability. In addition, we will focus on personalization to drive uniqueness with engraving.” With the recent rise of wearable technology and the internet of things, innovative products, such as smart jewelry, has strong business potential. We expect the ongoing innovations in the functionality of jewelry products to drive the overall market. 3. Increasing Adoption of Male Jewelry Products Male jewelry products, such as engagement rings and pearls, are witnessing increasingly strong demand, as a growing number of men want to own jewelry as symbols that showcase their fashion sense or high status. In 2020, male shoppers buying jewelry surged by 150% year over year, according to global fashion technology company Lyst’s Virtual Window Shopping: Jewelry 2020 report, which analyzed online shopping behavior of over 9 million global consumers who searched jewelry products across 12,000 brands and retailers. The report stated that pearls have become one of the hottest accessories for men, averaging 11,000 monthly searches—and worn by the popular US male celebrities, such as A$AP Rocky, Shawn Mendes, Pharrell, Billy Porter and Harry Styles. After Styles was photographed wearing a pearl necklace in December 2019, searches for similar necklace pieces rose by 31% year over year and searches including the term “men’s pearls” have grown 17%, according to Lyst’s report. Furthermore, in 2021, we saw more male celebrities, such as Justin Bieber and Pete Davidson photographed wearing necklaces. We expect this to further influence the jewelry shopping habits and demand of male shoppers in the US. Inflation The producer price inflation of jewelry has been high throughout 2021, peaking in July—since this peak, year-over-year inflation has been slowing but remains high. Jewelry prices continued to increase in December 2021, marking 25 consecutive months of year-over-year growth, according to the latest data from the Bureau of Labor Statistics. In 2021, strong jewelry demand from consumers has coincided with constrained supply as a result of supply chain challenges. With continuing high demand, retailers will have little incentive to offer discounts and this dialing down of promotions will equate to indirect inflation in consumer prices. As the majority of jewelry products sold in the US are imported from Canada, China and Mexico, import prices are a relevant metric for the US jewelry specialty retail sector. Unlike producer prices, import prices grew at a much slower rate in early 2021, but picked up pace from June 2021. In the last few months of the year, the gap in growth rates between producer prices and import prices substantially narrowed. Ongoing supply chain challenges have been the major factor in driving import prices. In 2022, we expect the US jewelry inflation to slightly slow, with the government planning to raise key interest rates in three rounds this year. On December 18, 2021, the US Central Bank announced that the government could bring the stimulus to an end in March 2022, after which the bank will raise key interest rates. The Federal Reserve expects three interest rate upsurges in 2022, followed by three more in 2023. Likewise, we expect that jewelry import prices will stabilize by the end of 2022, with the ongoing disruption in the supply chain subsiding, and retailers, shippers and other supply chain stakeholders clearing their backlogs.Figure 3. US Jewelry: Import Prices vs. Producer Price Index (YoY % Change) [caption id="attachment_140685" align="aligncenter" width="700"]

Data are not seasonally adjusted

Data are not seasonally adjustedSource: US Bureau of Labor Statistics[/caption]

Competitive Landscape

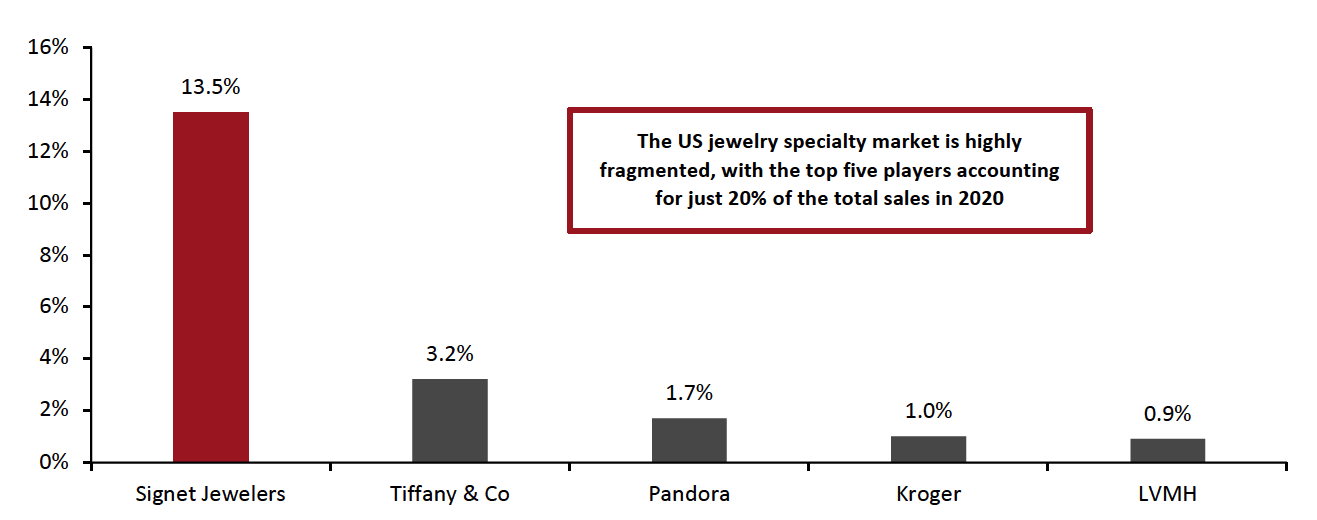

The US jewelry specialty retail is a highly fragmented sector, with numerous retailers competing for market share. The top five jewelry and watch specialists accounted for just 20.3% of total jewelry and watch specialists’ retail sales in 2020, according to Euromonitor International. In 2020, Signet Jewelers held the leading position in the country, with a 13.5% market share, followed by Tiffany & Co (3.2%) and Pandora (1.7%). International luxury goods conglomerate LVMH was also in the top five US jewelry and watch specialty retailers by sales in 2020. Additionally, in January 2021, LVMH acquired Tiffany & Co—further consolidating its market share and becoming the second-largest jewelry retailer in the US.Figure 4. US: Market Shares of Top Five Jewelry and Watch Specialists, 2020 (%) [caption id="attachment_140686" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Key Metrics of Leading Players

In Figure 4, we present key metrics of the leading jewelry specialists in the US—Signet Jewelers, LVMH (after its acquisition of Tiffany) and Pandora—and below we provide more details on their strategies.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Key Metrics of Leading Players

In Figure 4, we present key metrics of the leading jewelry specialists in the US—Signet Jewelers, LVMH (after its acquisition of Tiffany) and Pandora—and below we provide more details on their strategies.

Figure 5. Key Details of Signet Jewelers, Pandora and LVMH [wpdatatable id=1663]

Source: Company reports

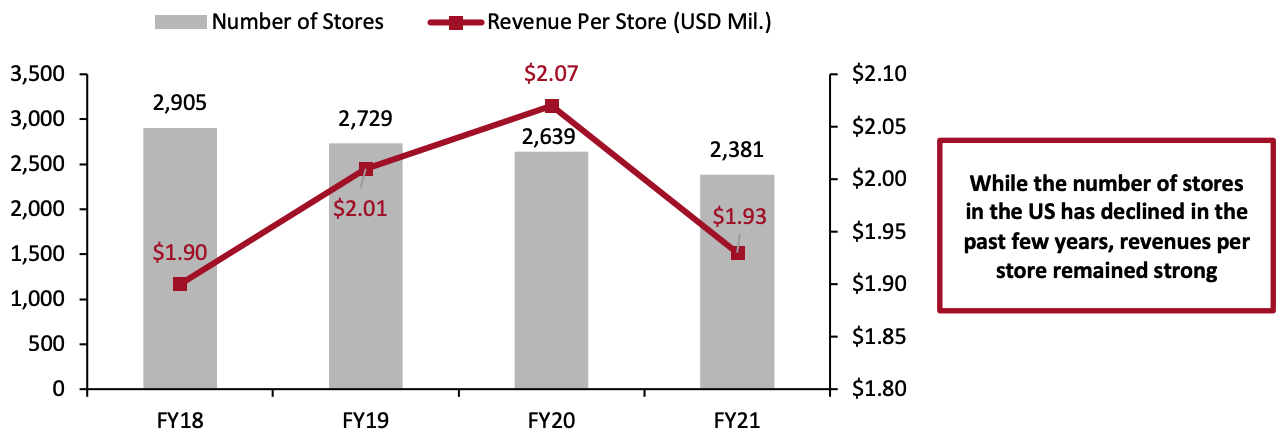

1. Signet Jewelers Signet Jewelers generates the majority of its revenues from the US market: North America contributed more than 85% of its sales in fiscal 2021 (ended January 30, 2021). Signet substantially transformed itself through its strategic turnaround plan, Path to Brilliance, launched in early 2018—which focused on enhancing its digital platform, expanding its omnichannel capabilities, offering innovative products and providing customers early access to unique products from a diverse range of emerging jewelry designers. Furthermore, in March 2021, Signet announced a new strategy, Inspiring Brilliance, which emphasizes innovation and sustainable growth. As part of the new strategy, Signet is shifting toward off-mall formats in response to changes in consumers’ buying patterns after the pandemic. Signet is looking to expand its flagship banners, Kay and Zales, which mainly cater to the mid-range in the jewelry market and contribute 60% of the retailer’s revenues. The company’s Jared brand focuses on a higher-priced assortment and personalized items, while Piercing Pagoda offers piercing services at low prices to children and adults. While past sales growth at Signet has been largely led by physical store expansion, the retailer has ramped up its e-commerce initiatives in recent years, with online demand seeing a particular boost during the pandemic. The company is changing the course of its distribution by shrinking its store estate, particularly at lower-tiered malls, and switching focus to e-commerce. Shrinking store estates Since fiscal 2018, Signet has closed more than 20% of its total store fleet, notably reducing the company’s exposure to lower-traffic malls and opening and repositioning its stores into preferred locations—in higher-tiered malls and off-malls. In its US fleet, the company closed 524 stores between fiscal 2018 and fiscal 2021. However, Signet achieved sales transference (from stores to online) about 60% higher than the company’s expectations—which it attributes to its Connected Commerce strategy (part of Signet’s overall Inspiring Brilliance strategy), enabling seamless interaction across all customer touchpoints, online and in store. For fiscal 2022, ending in January 2022, Signet plans to close about 100 stores globally and open new 100 stores, reducing exposure to lower-traffic malls and opening and repositioning stores into preferred locations.Figure 6. Signet Jewelers: Number of Stores in the US and Revenue per Store (USD Mil.) [caption id="attachment_140441" align="aligncenter" width="700"]

Signet fiscal year ends on January 31

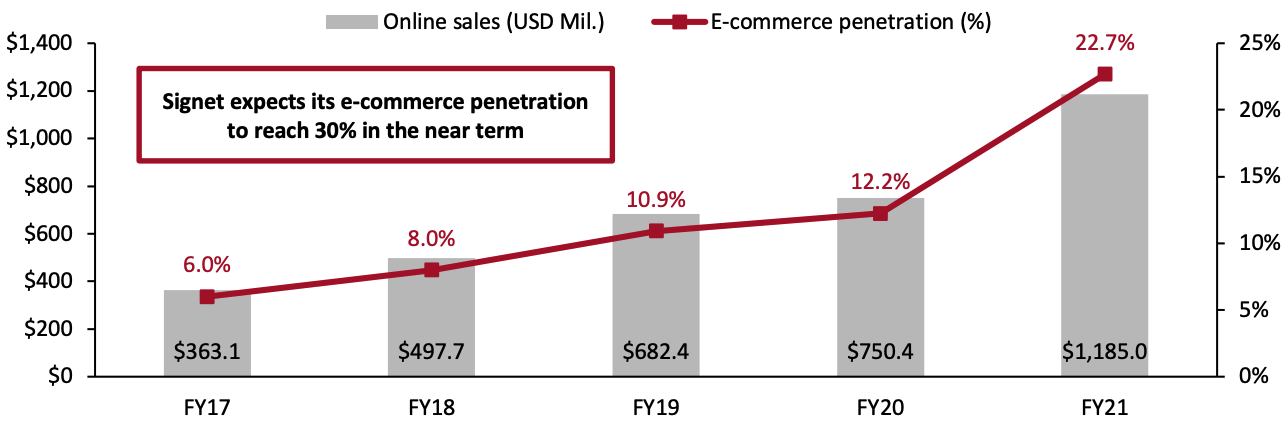

Signet fiscal year ends on January 31Source: Company reports/Coresight Research[/caption] Switching focus to e-commerce In fiscal 2021, Signet Jewelers’ global e-commerce penetration surged to nearly 23%, from just 6% in fiscal 2017, prior to the launch of its Path to Brilliance plan in 2018. The strategy, along with the company’s August 2017 acquisition of the US-based online jewelry company James Allen helped Signet to bolster its digital capabilities significantly. In the near term, Signet is striving to achieve total e-commerce penetration of over 30% of its $9 billion global revenue goal. The company is still expanding its digital and omnichannel capabilities. For fiscal 2022, the company plans to incur capital expenditure of $175–200 million, mainly on digital and technology investments, aiming to further strengthen its competitive edge and long-term positioning. Additionally, in October 2021, Signet Jewelers entered into an agreement to acquire the US-based direct-to-consumer (DTC) retailer Diamonds Direct, which we believe will strengthen Signet’s digital and e-commerce capabilities substantially.

Figure 7. Signet Jewelers’ Global Online Sales* (USD Mil.) and E-Commerce Penetration (%) [caption id="attachment_140442" align="aligncenter" width="700"]

*Signet Jewelers does not provide a breakdown by region for online sales

*Signet Jewelers does not provide a breakdown by region for online salesSignet fiscal year ends on January 31 of the same calendar year

Source: Company reports/Coresight Research[/caption] 2. Pandora Pandora operates and manages a vertically integrated affordable jewelry business model, covering in-house design and manufacturing to global marketing and direct distribution. Although headquartered in Denmark, the company’s largest market is the US, which contributes nearly 24% of its total sales. The jewelry retailer produces about 90% of its volume in-house, capitalizing its supply bases in Thailand and Vietnam. Nearly 75% of the company’s total business is carried out through direct channels, online and in store. On Pandora’s Capital Markets Day held in September 2021, management stated that Pandora wants to double the size of its US business in the mid to long term compared to before the pandemic. To achieve this aim, Pandora will invest to broaden its customer reach, particularly among Generation Z, introduce new and innovative products, such as the recent launch of Pandora Me in the US, and bolster its omnichannel capabilities. In terms of logistics and merchandising in the US, Pandora is redrawing its product flows and processes to bring together both its online and the physical store inventory, enhancing product availability. On Capital Markets Day, management stated also stated that Pandora-owned concept store penetration is lower in the US compared to the company’s other core markets, such as the UK, and it sees notable opportunities for expanding its concept store network in the US. Like Signet, Pandora is also ramping up its e-commerce strategy. In 2019, the company relaunched its global online business, which saw 103% year-over-year growth in 2020 and accounted for 29% of its global revenues. In the US, the company expanded its digital capabilities by launching “buy online pick up in store” (BOPIS) offerings in 300 stores in 2020. Furthermore, in 2020, the company launched virtual try-ons using augmented reality (AR) tools, remote selling assistance and virtual queueing (where shoppers scan a QR code and are notified when it is their turn to enter a store) in its key markets, including the US. In its 2021 Capital Markets Day, Pandora’s management stated that virtual try-on, virtual queueing and remote selling assistance have generated incremental revenues of 5% in its e-commerce channel. The company also plans to roll out “buy online and return in store” (BORIS) in 2023 across its major markets including the US and expects it to have a positive impact on the conversions of its e-commerce channel. Furthermore, Pandora is investing $160 million for its in-house capacity expansion in both Thailand and Vietnam, which will expand the company’s total crafting and supply capacity by about 60% over the next five years. 3. LVMH LVMH’s Watches and Jewelry division is the newest of its five business divisions, comprising 7% of the company’s revenues in 2020. Prior to the acquisition of Tiffany, the US contributed just 8% of the LVMH’s Watches and Jewelry division’s revenues in 2020. However, we believe the company’s acquisition of the second-largest US jewelry specialty retailer Tiffany in early 2021 will substantially help LVMH to expand its operations in the fast-growing US jewelry market. In its third-quarter 2021 earnings call, held in October 2021, LVMH’s CFO Jean-Jacques Guiony stated that Tiffany operates a big business in the US and is witnessing strong consumer demand in the country, particularly from millennials, and LVMH is capitalizing on this opportunity. Furthermore, LVMH noted that the company is developing the US business for its Italy-based Bulgari brand, which it acquired in 2011. Jewelry Retailers: Latest Quarterly Growth and Outlook Reports We present recent quarter growth numbers of major publicly listed jewelry retailers and summarize key commentary on their future outlook.

Figure 8: Selected Leading Jewelry Retailers: Quarterly Sales Growth and Key Commentary for the US Market [wpdatatable id=1664]

*Coresight Research’s estimates Source: Company reports/Coresight Research

Themes We Are Watching

1. Environmental, Social and Governance (ESG) Concerns Consumers’ increasing awareness of the jewelry industry’s impact on the environment has kickstarted a fast-growing market for more sustainable practices in jewelry in the US. Several jewelry retailers, such as Signet Jewelers and Pandora, have prioritized environmental, social and governance (ESG) initiatives in recent years. Signet Jewelers: In June 2021, Signet Jewelers unveiled its comprehensive sustainability goals for 2030. The new sustainability framework laid down 44 goals, including human capital management and climate change goals, which are aligned with United Nations Agenda 2030. Furthermore, Signet aims to achieve net-zero greenhouse emissions by 2050. Signet’s CEO stated, “Our 2030 Corporate Sustainability Goals provide a roadmap for the next decade of our journey as a company. From prioritizing our team in creating a rewarding and welcoming culture to protecting human rights throughout our supply chain and innovating in ways such as embracing the circular economy and continually reducing carbon emissions, we’re committed to operating in ways that create positive change for our planet and people.” Signet’s new sustainability goals complement its existing sustainability framework with the objectives defined by two key areas:- Environment: Signet has committed to adhere to operating practices and policies to address climate change. Furthermore, Signet commits to developing circular economy initiatives, including repair, care and custom design with repurposed and reclaimed diamonds. To build trust with its customers and encourage long-lasting relationships, Signet has also incorporated digital documentation of each piece of jewelry at intake and provides text updates and informational videos to guide consumers through each stage of the process.

- Diversity and Inclusivity: Signet has committed to increasing diversity in its leadership positions at the level of Director and above by 25% by 2030, along with becoming an employer of choice for the LGBTQ+ community. Additionally, in collaboration with its direct and indirect suppliers, Signet will showcase Black, Indigenous and People of Color (BIPOC) jewelry designers and create programs across the globe to offer women career opportunities and financial growth.

- Reduce energy consumptions: Pandora plans to minimize its energy consumption across its crafting facilities, distribution centers and stores worldwide.

- Source renewable energy: Currently, Pandora sources 100% renewable energy at its crafting facilities in Thailand and plans to implement it across its distribution centers, offices and stores globally.

- Offset unavoidable emissions: For unavoidable emissions linked to the company’s direct business, which it estimates to be less than 5% of its total emissions, Pandora will buy carbon offsets, but will ensure that it comprises only a marginal part of its efforts to mitigate emissions.

- Huge volumes of first-party customer data from its app, websites and social media channels, including personal or professional interests, demographics (such as gender, income, marital status and occupation), shopping and channel preferences, and products’ experience, among others.

- Third-party data—in May 2021, Signet signed a multi-year renewal agreement with Alliance Data Systems. The third-party data collected includes customer demographic information, shopping habits and preferences, and social media consumption, among others.

Signet Jewelers has collaborated with Amazon Web Services and Accenture since early 2021 to bolster Signet’s data analytics program and cloud technology.

Signet Jewelers has collaborated with Amazon Web Services and Accenture since early 2021 to bolster Signet’s data analytics program and cloud technology.Source: Signet Jewelers[/caption] Pandora: In the past few years, Pandora has made significant investments in building its data and digital capabilities. The company deploys IBM Sterling Order Management, which automates order orchestration processes, enabling an end-to-end view across inventory, order placement and order delivery status. Pandora’s detailed view on order and order lines, along with data-driven real-time inventory management has helped the company to improve insights throughout their systems chain, spanning warehouse management, e-commerce and customer contact centers. Pandora is also capitalizing on data-driven marketing initiatives, such as personalized e-mails, to target its customers effectively. In early 2020, Pandora launched data-driven personalized campaign newsletters and initial results saw a 60% revenue boost as compared to standard newsletters, according to the company. In July 2020, the company inaugurated its Digital Hub in Denmark, which houses a group of 100 software engineers and data analysts to bolster Pandora’s use of data and omnichannel expertise globally. Furthermore, in January 2021, Pandora announced the consolidation of its digital units with all of data and tech to create one global function, digital and technology. In 2022, Pandora plans to further expand the coverage of its data analytics platform by applying AI and data science to areas like sales forecasting and financial planning.

Retail Innovators

We discuss two innovators whose solutions can benefit the US Jewelry market. 1. Nano Innovator Holdings Founded in 2001 and based in New York, Nano Innovator Holdings (NIH) offers a prototype platform for end-to-end identification of rough to polished mined diamonds, along with lab-grown diamonds, utilizing nanotechnology applications, cloud-based storage solutions, smartphone consumer app and a smartphone optic system. NIH’s system uses laser technology to place a proprietary nano tag under the diamond’s surface and enables consumers to detect and read subsurface nano tags by using a smartphone app. This allows the buyer of a diamond ring anywhere in the world to discover the lifecycle of their diamond. Additionally, retailers can trace if the diamond has been ethically and sustainably sourced and clear the supply chain of imposters and conflict gemstones by tracking every mined stone from its source to the final consumer. NIH’s system was launched in February 2021 after being in development for over three years. At the time of launch, NIH’s CEO Bruno Scarselli stated, “It’s been a long road, but we finally have a scientific, mine-to-market, chain of custody solution that everyone in the diamond pipeline has been seeking. NIH will be a legacy for three generations of our family in the diamond business and will provide the industry with an opportunity to ensure consumer confidence for years to come.” 2. Syte Launched in 2015 and headquartered in Italy, Syte offers visual searches, personalization and recommendation engines for various verticals, including jewelry. Syte’s clients include Signet Jewelers. According to Syte, Signet Jewelers has increased consumer engagement after it implemented Syte’s Visual Discovery Suite on its US and UK banners—which includes features such as Camera Search, the Discovery Button and the Shop Similar recommendation carousel for simplifying product discovery for goal-oriented consumers. With Syte’s platform, shoppers can upload an image of a piece of jewelry and instantly find similar items. Furthermore, online shoppers can use the Discovery Button and Shop Similar recommendations to continue their shopping journey until they uncover the perfect piece. Syte’s visual discovery tools have enabled new on-site journeys for Signet customers, which have led to a 6.8-times increase in conversion on the company’s UK websites after the implementation, with shoppers spending 17.7% more per order on average when interacting with the product discovery solutions, according to Syte. Furthermore, the average revenue per user (ARPU) for Signet UK’s website has grown by 585% after the implementation of Syte’s platform, while the bounce rate has significantly reduced among consumers noticing and using the Discovery Button. [caption id="attachment_140444" align="aligncenter" width="700"] Syte’s virtual discovery platform for jewelry products

Syte’s virtual discovery platform for jewelry productsSource: Syte[/caption]

What We Think

Against very strong comparatives, Coresight Research estimates that US jewelry specialists’ sales will increase by 1.5% in 2022. While we expect that strong growth momentum will continue from 2021 to the first half of fiscal 2022, we believe the growth will substantially decelerate in the second half of the next year—with a significant turn in wallet share away from the jewelry category towards experience-oriented categories, such as travel and restaurants. In the near future, we expect to see some consolidation in the US jewelry specialty retail market—while Signet Jewelers, LVMH and Pandora will continue to hold the leading positions in the market. We see e-commerce as a strong opportunity for US jewelry specialists to adjust product and service offerings and drive sales. Furthermore, we believe that growing online demand will drive consolidation in the industry, with leading players ramping up M&A activity to expand their digital businesses. Implications for Brands/Retailers- With the impacts of the e-commerce surge likely to continue, jewelry brands and retailers should remain focused on enhancing their online presence and adopting advanced technologies such as AI and AR to provide seamless shopping experiences.

- Shoppers are turning to jewelry brands and retailers that have social and environmental causes as core parts of their values and mission. As awareness of sustainability increases, jewelry brands and retailers should consider how to integrate practices such as recycling and reduction of carbon emission into their operations and developing lab-created diamonds from renewable energy, to appeal to environmentally minded jewelry shoppers.

- Jewelry brands and retailers should combine algorithms and data science to offer their consumers effective personalization and empower inventory optimization and digital marketing. Instead of relying on one source of consumer data, retailers and brand owners should collect, sort and analyze a variety of data from several sources, including both first-party and third-party data.

- With jewelry brands and retailers expanding digital operations, technology vendors are well-placed to offer AI and analytics, enabling them to process huge volumes of online consumer data and support a variety of solutions, such as demand forecasting and optimizing inventory.

- Jewelry retailers are aiming to offer their customers a superior virtual shopping experience. AR technology vendors can provide digital fitting solutions.