DIpil Das

What’s the Story?

The hyperlocal on-demand delivery model connects retailers’ local stores to customers through a digital platform. The model, sometimes referred to as quick commerce, allows customers to order groceries and other goods from nearby stores of participating retailers, with shopping and delivery carried out by a network of personal shoppers for rapid delivery. In this report, we discuss three key trends and three primary challenges in the US hyperlocal delivery space and their impact on brands and retailers.Why It Matters

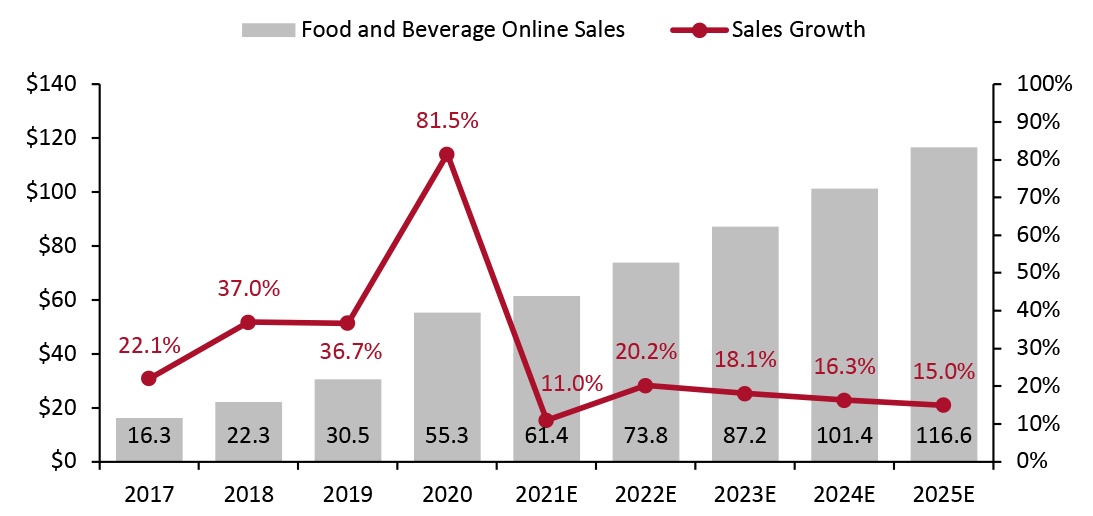

Grocery has traditionally been one of the most challenging retail categories to migrate to an online ecosystem due to low basket values and the logistics complexity of delivering perishables. As a result, developing online grocery infrastructure has been fairly low on many retailers’ priority lists. However, the Covid-19 pandemic acted as a significant catalyst in rapidly accelerating online grocery adoption and transformation. With the pandemic keeping consumers at home and away from stores, we estimate that total US food and beverage e-commerce sales grew to $55.3 billion in 2020, up 81.5% year over year—a vastly greater increase than any recent year. We anticipate that growth will slow to 11% in 2021, as shown in Figure 1—a change of pace that is, in part, a function of demanding comparatives from 2020. Nevertheless, we expect pandemic-induced channel stickiness to support solid online growth for grocery retailers.Figure 1. US Online Food and Beverage Market: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_129415" align="aligncenter" width="724"]

Online sales of alcoholic beverages not included

Online sales of alcoholic beverages not included Source: IRI E-Market Insights™/Coresight Research [/caption] Hyperlocal delivery companies such as Instacart have been around since 2012, but demand exploded during the pandemic as homebound consumers came to rely on on-demand delivery services in unprecedented numbers. We believe that hyperlocal delivery providers have staying power beyond Covid-19 as preferences for convenient and rapid grocery delivery become increasingly assimilated into the consumer psyche. According to Coresight Research’s US online grocery survey conducted in April 2021, around 26% of respondents who shopped online in the last 12 months opted for a rapid two-hour delivery service, while 42.7% opted for a service longer than two hours but still delivered on the same day.

US Hyperlocal Delivery: In Detail

We discuss three key trends in the US hyperlocal delivery space. 1. Pandemic-Driven Growth Momentum The pandemic-induced online shopping surge caught many retailers off-guard as they did not have a substantial—or in some cases, any—e-commerce business to fall back on. Additionally, developing omnichannel capabilities in-house is expensive—and likely unaffordable for all but the most well-resourced brick-and-mortar grocery operators. Hyperlocal delivery companies such as Instacart and Shipt capitalized on this situation, allowing retailers to respond quickly and offer same-day delivery services from their stores, without the need to invest in complex e-commerce infrastructure and proprietary delivery networks. After seeing a dramatic spike in order volumes since the onset of the pandemic in the US, hyperlocal delivery providers have maintained their growth momentum, adding new retail partners and expanding their geographical reach.- From March 2020 to March 2021, Instacart onboarded more than 300 retail partners and 25,000 stores across more than 5,500 cities in North America. With many retailers looking to prioritize their online strategy amid the pandemic, Instacart is also rapidly adding new retail partners outside the core grocery business, including apparel (H&M), beauty (Sephora), general merchandise (Big Lots) over-the-counter medications and health products (Walgreens), and prescription delivery (Costco). According to the company, its delivery service is currently accessible to over 85% of US households and 70% of Canadian households.

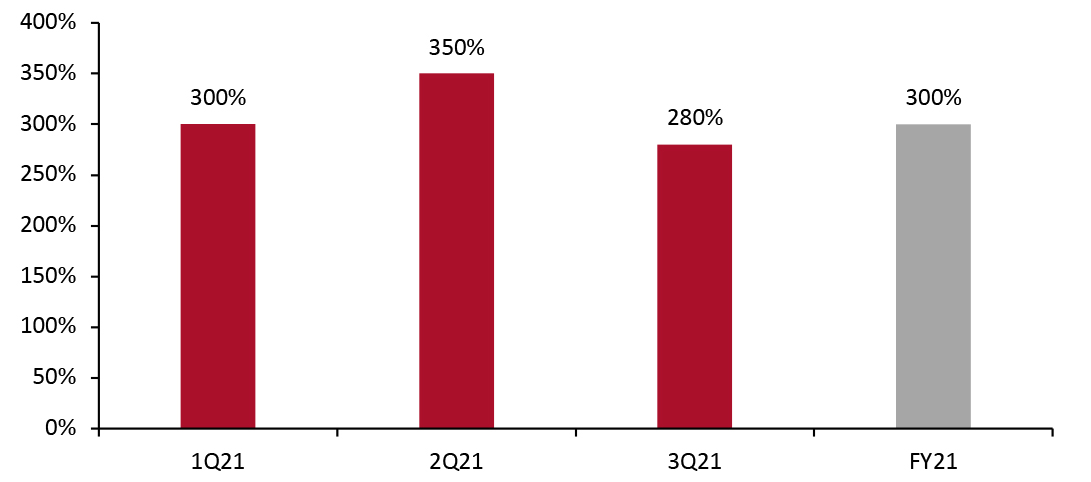

- Target-owned Shipt saw sales growth of more than 300% for its fiscal 2021. In 2020, the delivery provider added retailers outside its core grocery space, including Bed, Bath & Beyond, buybuy Baby, Office Depot and Party City. In its earnings call for its fiscal year ended January 30, 2021, Target stated that it plans to invest in broadening Shipt’s reach by entering new markets while expanding in existing ones. In the same earnings call, Target highlighted that it would invest around $4 billion per year for the next few years to build more e-commerce infrastructure, open new small-format stores and remodel existing stores. As of January 2021, Shipt is available to 80% of the US households in more than 5,000 US cities.

Figure 2. Shipt Sales Growth (YoY % Change) [caption id="attachment_129416" align="aligncenter" width="724"]

Target’s FY21 ended on January 30, 2021

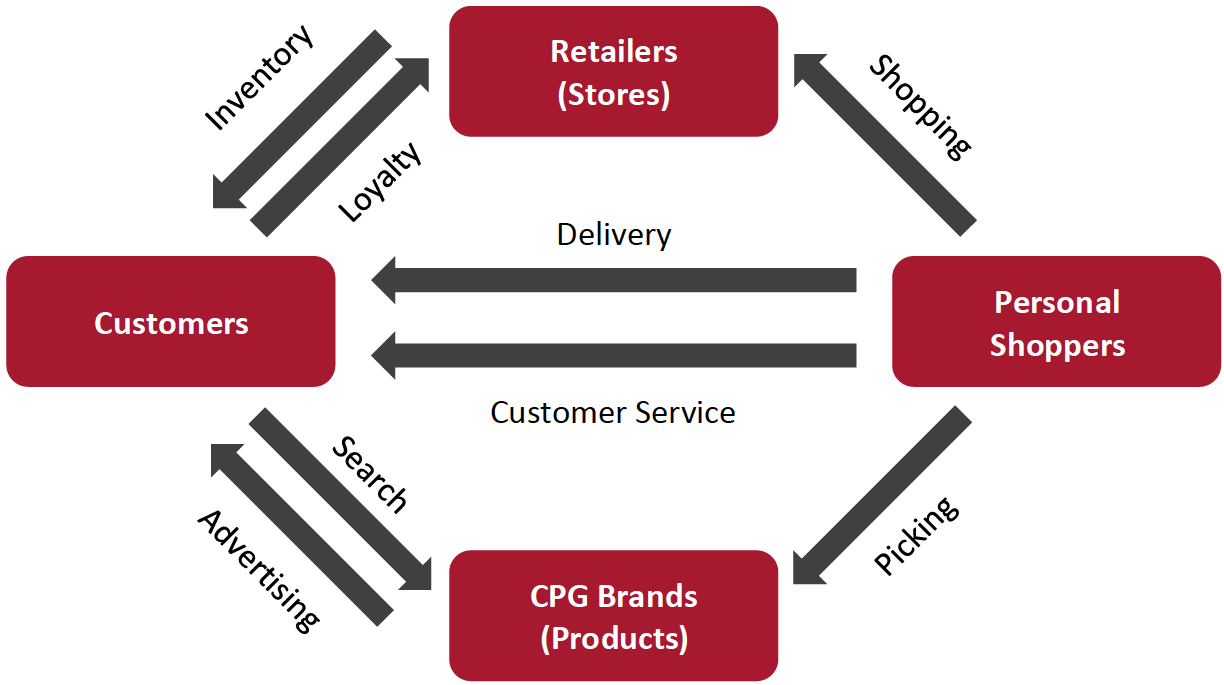

Target’s FY21 ended on January 30, 2021 Source: Company reports [/caption] 2. Advertising Revenue Diversification We expect to see more hyperlocal delivery providers venture into or expand their digital advertising solutions as they seek further revenue streams. Advertising opportunities arise within Instacart’s marketplace market model, whereby the balances the needs of four important stakeholders that interact with each other:

- Retailers make their store inventory available on Instacart and allow access to their stores for picking and packing

- End customers use the Instacart app to order groceries

- Personal shoppers pick a customer’s order from a store and deliver it to them

- CPG brands advertise within the Instacart app to reach consumers

Figure 3. Instacart’s Four-Sided Marketplace [caption id="attachment_129444" align="aligncenter" width="700"]

Instacart’s four-sided marketplace

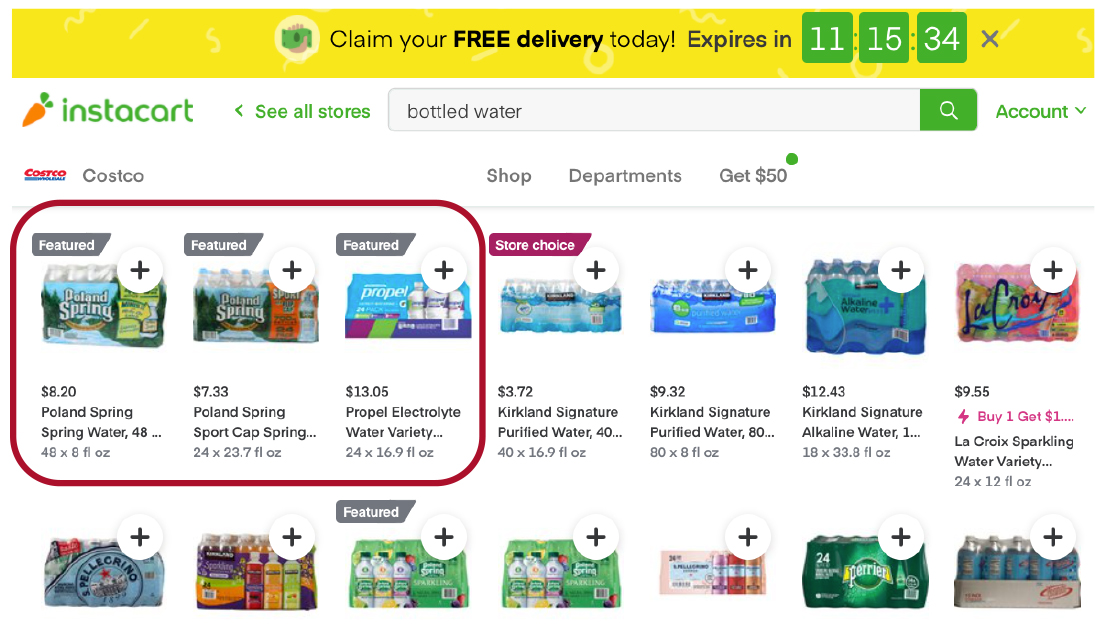

Instacart’s four-sided marketplaceSource: Instacart[/caption] In May 2020, Instacart launched an advertising program that CPG brands can use to promote their products on Instacart’s website and app. The self-service tool provides advertisers with the option to have their products “Featured” in Instacart searches, ranking them highest so they appear to consumers first. The program requires advertisers to bid on keywords associated with products they want to promote. Instacart’s other ad formats, including coupons, promotions for free delivery and banner ads (referred to as marketplace ads), will remain part of its managed-service advertising business. [caption id="attachment_129418" align="aligncenter" width="725"]

Featured product ad for ‘bottled water’ in a keyword search on Instacart

Featured product ad for ‘bottled water’ in a keyword search on Instacart Source: Coresight Research [/caption] We believe that Instacart aspires to become a significant advertising platform, reflecting the strong profitability of ad revenue as a revenue stream for marketplaces. The number of advertisers on the platform grew five times over in 2020 and Featured Products placements saw fill-rates triple in 2020, according to digital media company Digida. Moreover, Coresight Research has identified from job advertisements posted by Instacart that the company is looking to grow its ads revenue by five times over the next two to three years. Instacart’s growth trajectory will likely spur many CPG brands to initiate or accelerate their relationships with the company. Currently aggregating over 600 retailers onto a single platform, Instacart has an extensive geographical footprint and allows brands to allocate to their entire retailer network with a single investment. As the entire shopping cycle takes place on Instacart (research, browsing, transacting and repurchasing), brands can use Instacart as a means to engage customers at each stage of their buying journey. Instacart also opens up opportunities for CPG brands looking to advertise alcohol and spirits that cannot market online with traditional retailers. In June 2021, US hyperlocal delivery company Gopuff, which advertises home-delivery of groceries within 30 minutes, teamed up with retail media solutions provider CitrusAd to launch Gopuff Ad Solutions. The new feature will enable the delivery provider to monetize its digital shelf-space by allowing brand partners to run media placements of sponsored products or display ads to target customers as they shop on Gopuff. 3. Gradual Shift To In-House Logistics Retailers have adopted hyperlocal delivery services enthusiastically, but in the long term, we expect to see retailers shift toward in-house logistics. We anticipate that customer relationships and experiences, as well as margin erosion, will drive this trend. Customer Relationships and Experiences By conceding control of the last mile to hyperlocal companies—the only stage of e-commerce where a retailer physically meets the customer—retailers lose a lot of their involvement in user experiences. Therefore, building a positive customer experience through last-mile delivery is critical. However, as consumers increasingly grow to trust hyperlocal delivery services to deliver their groceries, some may switch their loyalty to the hyperlocal platform over the retailer. According to Barclay’s August 2019 survey of Instacart users, some 43% said they would switch to another retailer if their preferred one was no longer available on Instacart. When retailers outsource to hyperlocal delivery companies, they also lose customer data, including shopping frequency, product preferences and household information, considered an important asset by most companies, as it is subsequently collected and owned by delivery providers. This inhibits retailers from predicting future demand and deploying data-driven resources to improve customer experiences, spending and loyalty. Moreover, store layouts are currently optimized to increase basket sizes, not to facilitate quick shopping trips. Too many personal shoppers can clog stores, impacting the browsing experience for in-store customers. This poses a dilemma for retailers on operating to meet the needs of both personal shoppers looking to find items and exit the store quickly and in-store customers browsing and shopping for themselves.

- Read more in Coresight Research’s Playbook on evolving the last mile.

- Costco partnered with Shipt in October 2017 and Instacart in February 2016. In a shift toward in-house logistics capabilities, in March 2020, Costco acquired third-party delivery and installation company Innovel (now named Costco Logistics) for $1 billion from Transform Holdco, the holding company for Sears and Kmart. Innovel has 11 distribution centers and more than 100 delivery centers nationwide.

- Supermarket chain H-E-B onboarded Shipt in May 2016 and Instacart in September 2015. In February 2018, H-E-B acquired Favor, an on-demand delivery company, to scale its own e-commerce operations.

- Kroger partnered with Instacart in August 2018 and Shipt in July 2017 but is simultaneously building its own fulfillment centers and delivery infrastructure with Ocado.

- In its earnings call for its fiscal year ended January 3, 2021, Sprouts Farmers Market stated that 15% of its online sales are coming through its own platform shop.sprouts.com, underscoring the value of being able to control the relationship with online customers by handling transactions on its own systems rather than a third-party e-commerce platform. Following its partnership with Instacart in 2018, Sprouts Farmer Market has now substituted its own employees in place of Instacart gig workers to pick and pack orders.

- Walmart initiated a pilot with Instacart in August 2020 in four markets: Los Angeles, San Diego, San Francisco and Tulsa. At the same time, Walmart has been building its own micro-fulfillment centers and growing its digital offerings, including Express Delivery, which it launched in April 2020 and plans to roll out to more than 2,000 stores within a matter of weeks. Walmart’s team of 74,000 personal shoppers will pick online orders from stores and deliver them to customers.

- In August 2020, DoorDash expanded beyond restaurant food delivery with the launch of a new grocery delivery service with partners including Fresh Thyme, Meijer and Smart & Final. DoorDash uses a hybrid model of local retail stores and its own facilities, known as DashMarts, to carry out grocery fulfillment.

- In July 2020, Uber announced its foray into US on-demand grocery delivery through its subsidiary Cornershop in Dallas and Miami. In September 2020, Cornershop expanded its service in Florida, adding Jacksonville, Orlando and Tampa to its markets in partnership with Southeastern Grocers. Uber bought a majority stake in Chile-based hyperlocal delivery company Cornershop in October 2019.

- In March 2021, Gopuff raised $1.5 billion in new funding, more than doubling the company’s valuation to $8.9 billion. The company will use the funds to expand its geographic footprint, diversify into new product lines and invest in technology. Gopuff holds its own inventory of more than 2,500 products across cleaning supplies, groceries, and over-the-counter medications in its small warehouse facilities. As of March 2020, Gopuff had more than 250 facilities across 650 US cities.

- Fridge No More, an instant grocery delivery service startup, announced In March 2021 that it raised $15.4 million to expand its operations across New York City and the US East Coast and scale its network of cloud stores. Fridge No More promises delivery within 15 minutes with no minimum order requirement.

What We Think

Last year was a year of inflection for the US online grocery industry and hyperlocal delivery providers have capitalized on boosted demand for rapid delivery by scaling their capabilities and expanding their geographical footprints. We have witnessed a rush to capture consumer demand on these marketplaces among brands and retailers alike. Implications for Brands- Brands must focus on actively promoting their most popular assortment on Instacart. Top-selling products are more likely to end up as repeat purchases, further solidifying their placement in future searches and purchases.

- Brand should look to up their advertising on Instacart a few days before major holidays and events as the platform’s fast delivery network works well for last-minute customers.

- Brands can bypass retailers to leverage hyperlocal companies as a third-party provider for rapid delivery. DTC (direct-to-consumer) brands with well-developed infrastructure can also use them to deliver to customers looking for immediate delivery.

- Newly launched products will only be available on Instacart marketplace once a retailer displays the items as in stock, reflecting the importance for brands of developing close relationships with retailers. Brands must inform retailers of their expectations for the product and the accompanying marketing plan.

- In the long term, as retailers continue to shift toward their own logistics infrastructure, brands must prepare themselves to operate across an increasingly fragmented online marketplace space. A brand that might actively work with three e-commerce platforms today (such as Amazon, Shipt and Instacart) might work with more than ten in the future. This means that advertising, product content and operations management must be handled individually for each marketplace.

- Diversification outside of the traditional grocery domain may prove essential if grocery retailers that had outsourced delivery and pickup services seek to bring more last-mile operations in-house and build their own e-commerce infrastructure. Globally, the online grocery market is seeing retailers take greater control of last-mile logistics compared to nonfood retailers, including owning fleets of delivery vehicles.

- While Instacart and Shipt have an early-mover advantage, we expect competitors to offer lower commission rates, which will make it harder for the two platforms to retain retail partners.

- In the near future, Instacart may pivot to providing white-label solutions for retailers. In addition to actually being the shopping marketplace, there is an opportunity for it to sell e-commerce infrastructure to retailers, competing with the likes of Ocado.

- Though Instacart’s advertising platform is in its infancy, it represents a huge growth opportunity for the company. We believe that Instacart will rapidly develop its advertising capabilities with new features, such as livestreaming and conversational AI. Creating a more immersive experience will unlock opportunities for more sponsored content from brands.

- Hyperlocal delivery providers have solved the notoriously difficult challenge of last-mile delivery and retailers must piggyback on their growth momentum and secure partnerships to stay ahead of the competition.