albert Chan

Introduction

Household care products became essential goods during the pandemic and gave consumers peace of mind about their safety. In this report, we explore the household care category, a massive $64.9 billion industry in the US which spans all fast-moving consumer goods used to improve or clean the home, and its key growth trends. The household care category can be further divided into the subcategories of cleaning, laundry and paper products.

US Household Care: Performance and Outlook

Household Care Growth Rate

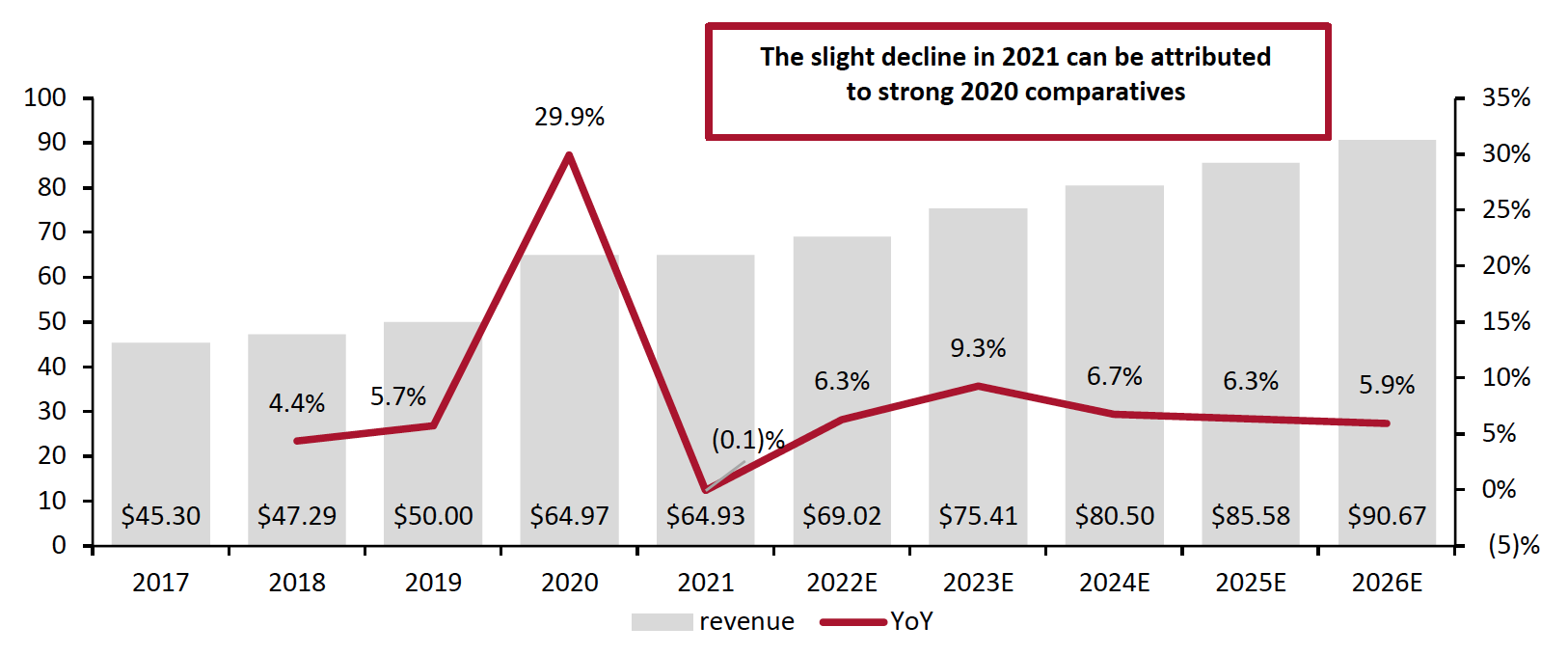

The US household care category showed steady mid-single-digit pre-pandemic growth that spiked to 29.9% year-over-year growth in 2020 due to the pandemic. The 0.1% year-over-year decline in 2021 points to the strong comparatives rather than a fundamental weakness in the household care category. We expect that revenues will remain above pre-pandemic levels in the coming years, as cleaning habits have become part of the wellness trend, making them a sticky consumer behavior.

However, high inflation, input costs and logistics costs will make it difficult for even the top household care producers to protect their margins. As the price of cleaning products increase, we expect that more price-sensitive or less wary consumers may forgo these products in favor of more essential products like groceries. Despite this, CPG companies such as Clorox and Reckitt believe that the vast majority of consumers will maintain the cleaning habits they formed during the pandemic, and this will result in levels of growth that are above pre-pandemic ones.

Figure 1. US Household Care Category Size (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_148464" align="aligncenter" width="700"]

Source: Information Resources Inc. (IRI)/Coresight Research[/caption]

Source: Information Resources Inc. (IRI)/Coresight Research[/caption]

Declines in multi-outlet and convenience channels, which fell 5.2% year over year, led to the 0.1% decline of the total household care category in 2021. In contrast, online household products grew at 22.9% year over year in 2021, driven by pest control (up by 39.4%), rug/upholstery/fabric treatment (up by 35.7%), and household cleaner products (up by 35.2%).

Market Factors

Inflation, Pricing Actions and Cost-Savings Programs

Consumer packaged goods (CPG) companies are addressing severe inflation in 2022 through a variety of pricing actions across their portfolios.

- In the second quarter of fiscal year 2022, P&G raised prices on 10 product categories across its portfolio: baby care, feminine care, adult incontinence, family care, home care, hair care, grooming, oral care and skincare. These price increases cover 80% of its US sales.

- Also in the second quarter of fiscal year 2022, Clorox increased its pricing plans to impact 85% of its portfolio, which is an increase from its first quarter plan to raise prices on 70% of its portfolio. Commodity and logistics inflation was estimated to reach $350 million in 2021, which is much higher than the $50-$60 million annual average. The company expects these headwinds will worsen to $500 million in 2022 due to persisting logistics complications.

- Kimberly Clark expects key input costs to increase by $750 million to $900 million in 2022. To offset these costs, its Focused On Reducing Costs Everywhere (FORCE) cost-savings program is expected to generate $300-$350 million in cost savings this year. The company also hopes to focus on its core businesses and growth in developing and emerging (D&E) markets to protect its margins from inflation costs.

- Reckitt’s cost of goods inflation accelerated and finished up 11% versus 2020. Material costs grew by low double digits, factory conversion costs grew by mid-single-digit rates due to inflation and logistics costs grew at strong double-digit rates.

- Unilever will achieve cost savings from reducing senior management by 15% and junior management by 5% in addition to nonpeople cost savings. The company expects these measures will lead to savings of $673 million (€600 million) that will be delivered during 2022 and 2023.

Logistics

Soaring logistics prices account for a major component of inflation that companies experience.

- Elevated demands for trucks and driver shortages are leading Clorox to move into the spot market, using a short term or one-time fee for deliveries which runs 50% to 75% higher than primary carriers. This move is temporary, and the company hopes to return to the primary carrier market once demand settles.

- P&G estimates that pandemic-related lockdowns and work stoppages in operations will cause $2.3 billion headwinds in 2022, in addition to $300 million in freight and transport costs.

Ukrainian War

Conflict in Europe between Russia and Ukraine has introduced new uncertainties into the supply chain given that Russia is the world’s third largest producer of petroleum. The war has led some energy producers around the world, including in the US, to cut ties with Russian oil and gas companies. Due to Russia’s ban on many foreign planes in its airspace and the heightened risks of traveling through nearby waterways, we expect air freight and shipping times to be longer and more expensive.

- With the ongoing war in Ukraine, we expect airspace restrictions to further limit large cargo transportation options as carriers may cancel their more costly routes. As the war has made traveling through key transit routes like those in the Black Sea more dangerous, insurance and re-routing costs have made shipping more expensive.

- Rising gas prices due to the isolation of Russian gas by North American and European energy companies will only increase air freight and ocean freight costs. In the first week of March 2022, West Coast and East Coast ocean rates rose 204% and 218% respectively compared to the week prior, which triggered fears that household care companies may be forced into locking long-term contracts at inflated price rates.

- We expect resin prices to soar on top of already inflated prices, as most common plastics and resins are derived from petroleum. Companies such as Clorox are planning to phase out plastic resins by 2025, but their current dependence on this raw material will likely be costly in 2022.

Competitive Landscape

A small number of top brand owners dominate the market in the US. Below we present 10 major household care products brand owners in the US, although revenues from other CPG categories are also included. Procter & Gamble (P&G) ranks at the top in terms of revenue generated in the US and maintained a strong 7.7% year-over-year growth rate in the year ended June 2021. Unilever is ranked second by 2021 US revenue but saw a small year-over-year decline.

Figure 2. Major Household Goods Brand Owners’ Total US Revenues (USD Bil.) [wpdatatable id=2022] Some companies’ data are for North America; revenues may include non household care products; data reported by companies in non-USD were converted to USD at yearly exchange rates Source: Company reports/Coresight Research

Procter & Gamble

P&G is a US CPG company and was the leading household goods brand owner in the US, by sales, in 2021.

- The company’s fabric and home care category is its largest category, standing at 34.3% of total revenue, and was one of three main growth driver categories in 2021. The other two categories are personal health care and feminine care.

- P&G will continue investing in its brand superiority, which has risen to 75% in 2021 from 30% in 2016. The company has delivered 100% of the US’s hand dishwashing category in the last two years.

- The company expects high inflation throughout 2022 and has started introducing its pricing strategy that will cover all 10 product categories in the US, which amounts to 80% of sales in the country.

Unilever

Unilever ranked second in total revenues generated by US household goods producers in 2021. Its home care segment makes up 20.2% of total revenues. Although the company has adopted a similar approach to P&G in its focus on product superiority and cost-savings, its growth is not as substantial. Its ongoing process of portfolio rearrangement appears to be another factor that dampened 2021 revenues.

- Reflecting product innovation, Unilever says that its brand superiority in blind testing versus its competitors has risen to over 70%, which is up from less than 50% in 2019.

- Unilever is rolling out Clean Future technologies across its home care markets, which are more effective and environmentally friendly.

- E-commerce during 2021 grew 44% year-over-year even with strong comparatives in 2020.

- Unilever will achieve cost savings from reducing senior management by 15% and junior management by 5% and additional nonpeople cost savings will lead to savings of $673 million (€600 million) that will be achieved over the course of 2022 and 2023.

- However, the company’s recently acquired DTC brands are not performing as expected. Dollar Shave Club, Blueair, and Carver Korea suffered from unexpected channel and policy changes.

Kimberly-Clark

Kimberly-Clark is one of the world’s largest producers of consumer tissue products. The company faces constraints due to inflation and is also implementing pricing actions to protect its margins.

- Half of the inflation Kimberly-Clark has experienced is due to distribution and energy prices while the other half is due to raw material prices, according to the company. The company projects that key cost inputs will increase $750 to $900 million, and it plans to take pricing actions to reduce the pressure of these costs on its margins.

- The 2018 global restructuring program Focused On Reducing Costs Everywhere (FORCE) savings are forecast to reach $300-$350 million in 2022.

- Kimberly-Clark continues to invest in advertising, particularly digital advertising, which makes up around 70% of the media mix.

- The company retains its long-term goal of expanding its categories and markets to reach more consumers.

Clorox

Inflation costs and logistics slowdowns hit Clorox particularly hard in 2021. The company has made various plans to drive growth through cost-saving programs, as well as the use of the spot market and third-party manufacturers.

- Clorox’s primarily attributes cost inflation to commodity prices, logistics and transportation. The former accounts for about two-thirds of inflation, while the latter accounts for one-third.

- Clorox expects that its pricing and cost-savings program will recover costs and rebuild margins in the latter two quarters of 2022, as it takes 12-18 months on average to implement, but will likely take longer this inflationary cycle.

- The company has extended its supply chain during the pandemic, and it plans to take out fixed costs in the supply chain to increase efficiency.

- The increase in the number of manufacturing nodes in Clorox’s network will lead to greater inventory levels to manage ongoing supply chain disruptions

- Elevated demands for trucks and driver shortages are leading Clorox to move into the spot market for truckers, which runs 50% to 75% higher than primary carriers. This move is temporary, and the company hopes to return to the primary carrier market once demand settles.

Reckitt Benckiser

Reckitt Benckiser is a UK household and personal products producer which is focused on innovation and portfolio rearrangement to drive growth and relieve margin pressures from inflation and logistics.

- Reckitt expanded its innovation pipeline by 50% in 2021, which primes it for rapid product innovation.

- The company expects that the cost inflation of goods will be in the low teens in 2022, and it will apply appropriate pricing and net revenue growth management actions in 2022 to offset commodity inflation pressures.

- The company also expects logistics prices to soar due to the rising prices of tinplate, crude oil and transport.

- Reckitt plans to actively manage its portfolio towards higher growth: it sold IFCN China Business and Scholl in 2021, plans to complete the sale of E45 in 2022 and has acquired Biofreeze, a top double-digit growth US-based topical analgesic business.

Colgate-Palmolive

Colgate-Palmolive is a US CPG company that makes products in the oral, personal and home care categories. The company is implementing the majority of its productivity program this year; this will add to its costs but have long-term supply chain benefits.

- Home care faced difficult comparisons in 2021 due to high comparatives in 2020, which were driven by pandemic-related demand.

- Raw material inflation, supply chain disruptions, factory closures and volatile consumer demand put pressure on margins in 2021.

- The majority of Colgate-Palmolive’s productivity program will be executed this year. It has an estimated cost of $200–$240 million and an estimated annualized savings of $90-$110 million. The plan will reallocate resources to strategic priorities and faster growth business channels, streamline the company’s supply chain and reduce structural costs.

Figure 3. Comparison of the Top Five Household Care Producers in the US (USD Bil.) [wpdatatable id=2023] *Global revenues in the household care category—scope and definitions may differ by company Source: Capital IQ/Coresight Research

Themes We Are Watching

Sustainability Drives Product Innovation

Consumer demand for sustainable products is on the rise, with many willing to pay higher prices for these goods. This demand drives sustainable product innovation and allows producers to justify higher prices for these new products.

- Household products companies find it more costly to procure plastic products as resin prices rose 75% in 2021, according to Clorox. We expect these increased costs will drive innovation for plastic alternatives in 2022.

- Clorox is committed to sustainability through its product innovations. The company is producing reusable sprayers and refills, as well as using 80% less plastic in select 16-ounce bottle products.

- Unilever is rolling out its Clean Future technology that uses product formulations that are more effective and more environmentally friendly.

Incorporating Household Care into Wellness Routines

Household care products have become a component of the wellness lifestyle during the pandemic, and this will likely stick after the pandemic as consumer habits have changed. This is exemplified by the popularity of at-home activities such as cooking and at-home workouts, both of which are correlated with cleaning activities. Moreover, consumers are associating a clean living space with health and wellness, which further cements the importance of household care products in consumers’ baskets.

- Concerns over health and wellness drove the sales of cleaning products during the peak pandemic years. Sales of fabric and home care products rose 7% in P&G’s second quarter of 2021 because of the spread of the Omicron variant.

- Sanitation habits are likely to continue as 80% of global respondents to Reckitt’s survey claimed they will maintain their sanitation habits post-Covid-19.

- Clorox has tried to cast its cleaning products as essential to maintaining health and wellness during the pandemic and seeks to transform consumers’ trust in the brand into consumer loyalty.

E-Commerce Growth Poised to Grow in 2022

Across household care producers, we see companies investing in digital media advertising, which has helped drive double-digit e-commerce growth in 2021 that reached $12.0 billion according to IRI, on top of strong comparatives in 2020. As e-commerce growth remains a priority for these companies, we expect investment in digital advertising to continue in 2022. E-commerce revenues are totaled by adding the company’s direct sales to consumers through online platforms with the estimated e-commerce sales achieved by its brands through omnichannel distributors and retailer websites.

- Clorox’s e-commerce sales have almost doubled to 14% of sales, and the company believes that it will continue to see this channel accelerate. It spent $100 million in 2020 on advertising and $100-$125 million in 2021 as it sees an opportunity to capitalize on the goodwill it generated during the pandemic. Two-thirds of the advertising budget is spent on digital solutions, and we expect greater brand recognition and loyalty to drive sales in 2022.

- P&G saw e-commerce sales grow 35% year-over-year in 2021, reaching 14% of total sales. The company is using messages and educational videos across platforms like TikTok, YouTube and gaming to engage with consumers.

- Unilever’s 2021 e-commerce segment grew 44% on the back of strong comparatives in 2020. This channel has grown to 13% of Unilever’s turnover in 2021, up from 2% in 2016. The company plans to invest competitively in digital media advertising this year.

What We Think

2021’s growth suffered from high 2020 comparatives, when the pandemic was a primary concern and consumers flocked toward household care products to keep themselves safe. However, as consumers are regaining the confidence to enter public spaces and inflation squeezes consumer budgets, purchasing these products may be less of a priority. Despite this, cleaning is a wellness habit that consumers gained during their prolonged time spent at home. For these reasons, we expect revenues for cleaning products will decline in 2022 but remain above 2019 levels.

Implications for Brands/Retailers

- We recommend that brands and retailers focus on weathering the high inflation this year not only through taking pricing actions, but also through product innovations. Consumers are looking for products that will benefit their health and wellness, and we believe that products that cater to specific needs will generate stronger engagement and result in higher conversion rates.

- We believe brands and retailers can also protect their margins in 2022 through continued dedication to e-commerce. Support for this channel includes investing in digital advertising and a focus on building connections with consumers through educational and engaging social media content.

The information contained herein is based in part on data reported by IRI through its Market Advantage service as interpreted solely by Coresight Research, Inc. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other sources. Any opinions expressed herein reflect the judgment of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.