Nitheesh NH

What’s the Story?

Despite the underwhelming narrative for much of discretionary retail in the US this year, home-improvement retail is one sector that has fared well. Home-improvement retailers such as Lowe’s and Home Depot have reported strong results following the outbreak of the coronavirus crisis, with solid performance across channels and categories. Notwithstanding home improvement’s status as essential goods, which allowed stores to stay open during lockdown, the strong showing in this category—particularly from e-commerce channels—is one of the key reasons for the success of these retailers. In addition, retailers in this category quickly developed, upgraded and revamped their e-commerce and omnichannel capabilities, taking stock of changes to the retail environment caused by the coronavirus pandemic. As well as sector specialists Lowe’s and Home Depot, we also cover rural lifestyle retailer Tractor Supply in this report. Home improvement is a notable, although not primary, component of the retailer’s overall business and it competes with home-improvement stores on garden and outdoor-living categories—witnessing impressive e-commerce growth since the start of the pandemic.Why It Matters

With consumers becoming increasingly comfortable with purchasing home-improvement products through e-commerce channels, the pivot to e-commerce among major retailers in the sector is likely to help them capture a larger slice of the total market and ensure that they do not lag behind major competitors. The investments toward enhancing e-commerce capabilities is also likely to lead to an evolution in the role of stores as fulfillment centers that enable curbside and in-store pickup, and not just spaces for in-store shopping. As the major retailers lead the way toward becoming efficient omnichannel operators, smaller retailers may well follow suit to avoid being left behind.Home-Improvement E-Commerce: A Deep Dive

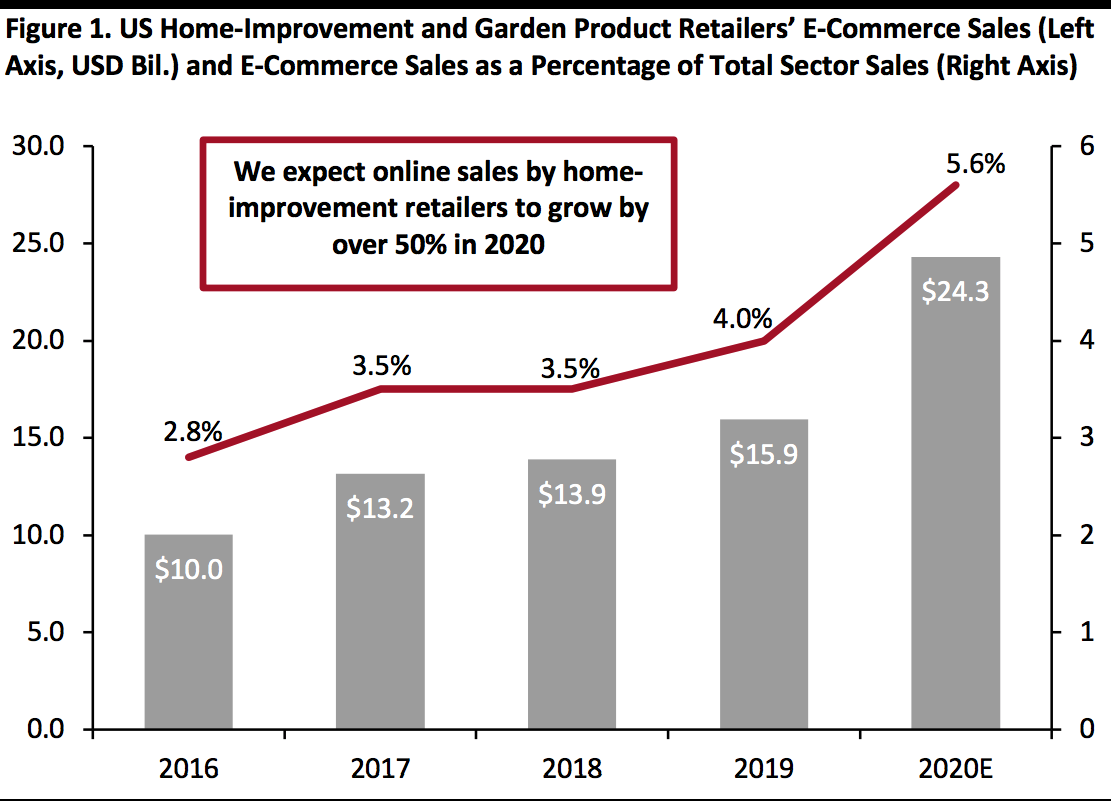

E-commerce penetration is growing among major retailers. Home Depot reported online penetration of 14% of sales and Lowe’s reached 8% in the second quarter of their respective current fiscal years. E-Commerce Sector Share In 2020, we expect online sales by home-improvement and garden supplies retailers to grow by just over half to around $24 billion. This represents a significant escalation— based on Census Bureau data, e-commerce sales by US home-improvement retailers grew at a CAGR of 16.7% between 2016 and 2019. However, online remains a niche channel for the sector. Coresight Research expects that it will grow to a still modest 5.6% of total sales in 2020. Major chains Home Depot and Lowe’s look likely to exceed this sector average, which is depressed by the presence of smaller, less digitally advanced retailers. [caption id="attachment_116805" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research [/caption]

Source: US Census Bureau/Coresight Research [/caption]

Key Home-Improvement Retailers Have Stepped Up Their E-Commerce Capabilities

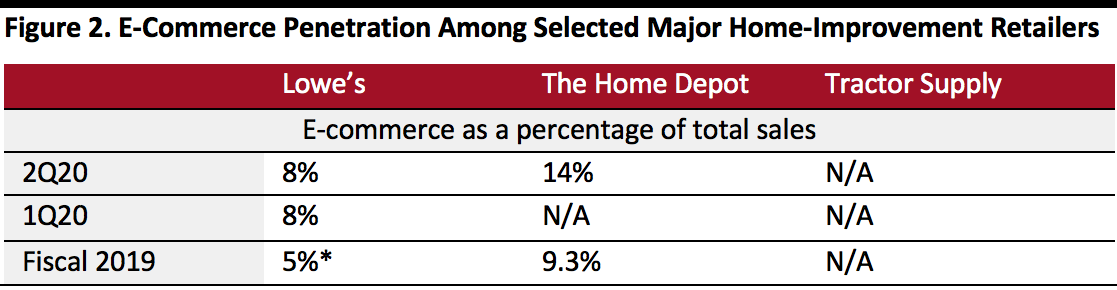

While the major home-improvement retailers have focused on scaling their e-commerce business in recent years, the outbreak of the Covid-19 pandemic has significantly accelerated this process. The chart below outlines this shift for major players Lowe’s and Home Depot. Tractor Supply has not shared data on its e-commerce business. [caption id="attachment_116806" align="aligncenter" width="700"] *Lowe’s e-commerce penetration for fiscal 2019 is an estimate based on a company statement in 2Q19.

*Lowe’s e-commerce penetration for fiscal 2019 is an estimate based on a company statement in 2Q19.Fiscal year 2019 for Lowe’s ended January 31, 2020, Home Depot, February 20, 2020 and Tractor Supply, December 28, 2019

N/A-Not available

Source: Company reports/Coresight Research[/caption] Lowe’s In the quarters prior to fiscal year 2020, Lowe’s e-commerce sales grew at a similar pace to its store sales—this growth rate was significantly slower than the e-commerce surge witnessed by its rival Home Depot. With the appointment of Marvin Ellison as CEO of Lowe’ just over two years ago, the retailer established improving e-commerce operations as a key focus area. According to Ellison, the company’s significant investment in enhancing e-commerce operations from fiscal year 2019 up to the latest quarter, has enabled a notable improvement in performance amid the current environment, as shown in Figure 2. These investments have led to improved search capability, increased channel stability, and most importantly, enabled curbside pickup of online orders. Given that a sizeable customer base is currently avoiding visiting stores, offering curbside pickup is a game changer. Before the pandemic, Lowe’s did not offer curbside pickup, but the crisis forced its hand and the retailer was able to set up the service in a short space of time. Features such as enabling customers to schedule a delivery within a short time window were not available until recently. The company also finished “re-platforming” its e-commerce site during its second quarter following a decision to accelerate this plan in response to the Covid-19 outbreak. Going forward, its more robust e-commerce capabilities will also help Lowe’s to cut down its in-store merchandise stock, particularly for slower-selling products, and sell them via e-commerce instead. This will help to facilitate social distancing measures for in-store shopping. Below, we explore key year-to-date developments in Lowe’s e-commerce capabilities for two quarters in fiscal year 2020. 1Q20 Beyond the favorable macro environment, the strong comparable growth that Lowe’s reported in the first quarter of fiscal year 2020 (12.3%, versus 4.2% in the first quarter of 2019) was largely driven by its improved e-commerce operations performance. This helped the retailer to capitalize on the surge in consumer spending on home improvement. The company’s total e-commerce sales grew 80% in the quarter, with an even stronger growth rate for online sales among Pro customers. Online penetration grew to 8% of total sales. The improvement in its online channel is helping Lowe’s to reduce Home Depot’s lead in e-commerce—as fourth largest online retailer in the US, Home Depot’s annual digital sales reach approximately $10 billion. 2Q20 E-commerce sales grew by 135%, driving online penetration to 8% of sales in the second quarter of fiscal 2020, ended July 31, 2020. The company finished re-platforming Lowes.com to the cloud during the quarter and highlighted this as a significant development for the company. As part of its endeavor to enhance its supply chain infrastructure, the retailer announced that it will open four e-commerce fulfillment centers over the next 18 months. Lowe’s will also open 50 cross-dock terminals and seven bulk distribution centers over the same period as it seeks to enhance its omnichannel capabilities. The company highlighted that it will continue to improve navigation and check-out features and enhance its buy online, pick up in store (BOPIS) and curbside pickup services going forward. Figure 3. Chronological Summary of Lowe’s Recent E-Commerce and Omnichannel Initiatives [wpdatatable id=469]

Source: Company reports/Coresight Research

The Home Depot Home Depot is widely recognized within the retail industry for its robust e-commerce business. According to Statista, the retailer ranks among the top five largest e-commerce businesses in the US, generating $10 billion in e-commerce sales in 2019. In 2017, Home Depot launched a multi-year strategy called One Home Depot with an investment of $11 billion. The strategy was aimed at developing an integrated omnichannel experience for customers with a seamless blend of digital and physical operations. The retailer recognized that e-commerce success is closely connected to the success of its in-store operations—in 2019, 50% of its online orders were collected from its stores. In fourth quarter of fiscal year 2019, Home Depot’s e-commerce sales grew 20% and comparable sales grew 5.2% . 1Q20 Home Depot’s e-commerce sales grew 80% in its first quarter, ended May 3, 2020, with more than 60% of online orders collected at a store. The retailer expanded its curbside pickup capabilities during the quarter, giving customers an additional outlet for fulfillment. The company’s digital businesses accelerated from around 30% growth in early March to triple-digit growth at the end of April. E-commerce penetration increased to slightly below 15% in the first quarter of fiscal year 2020. 2Q20 Sales through Home Depot’s digital channel grew by approximately 100% in its second quarter ended August 2, 2020, with over 60% of orders picked up from a store. The retailer also highlighted that the company’s mobile app registered a record number of downloads during the quarter and significant growth in conversion rates across all digital platforms. The company added that the surge in demand in its e-commerce channel did create several challenges, especially pertaining to delivery and fulfillment. However, it found that some of the investments in its supply chain network helped to cope with the pressure. During the quarter, the retailer also converted one of its newly opened market delivery centers (MDCs) to a direct fulfillment center (DFC) that mainly fulfills online orders. Over the last two years, Home Depot has introduced multiple fulfillment services, including BOPIS with convenient pickup lockers; buy online, deliver from store with express car and van delivery; and most recently, a curbside pickup option. Figure 4. Chronological Summary of The Home Depot’s Recent E-Commerce and Omnichannel Initiatives and Developments [wpdatatable id=471]Source: Company reports/Coresight Research

Tractor Supply Tractor Supply expects that the shift toward online buying will hold long term and has therefore focused on enhancing its e-commerce capabilities. The retailer has been among the strongest performers online since the outbreak of the pandemic and its quick pivot to e-commerce played a significant part in this success. We detail some of its e-commerce key initiatives from its two most recent quarters below: 1Q20 Without disclosing specific numbers, Tractor Supply revealed that its digital orders increased notably in the later weeks of the first quarter, ended March 28, 2020—coinciding with coronavirus-related lockdowns. Bloomberg reported that around 80% of these orders were either delivered or picked up curbside. Orders that were delivered were close to three times the average ticket. The company expanded its same-day or next-day delivery services from all Tractor Supply stores—achieved by forming a new partnership in April with Atlanta-based delivery platform Roadie, which has a deep-rooted presence in rural America. This was a notable transformation considering that before the pandemic, the company offered same-day delivery from just 20% of its stores. Tractor Supply now offers contactless curbside delivery for BOPIS orders, contactless payment options and increased mobile point-of-sale services across the retail chain to provide a seamless checkout process for its customers. 2Q20 In its second quarter earning call, Tractor Supply announced that e-commerce sales (including BOPIS orders) witnessed triple-digit growth and increased considerably as a percentage of its overall sales. During the quarter, the retailer launched new technology and services, including curbside pickup and same day and next day delivery—as well as relaunching its website and introducing a new mobile app in early July. The company confirmed that it is accelerating its focus on digital transformation for its platforms and services. Figure 5. Chronological Summary of Tractor Supply’s Recent E-Commerce and Omnichannel Initiatives and Developments [wpdatatable id=472]Source: Company reports/Coresight Research

Other Retailers Apart from the three major Coresight 100 companies that we covered in detail above, other home-improvement retailers have also experienced strong e-commerce sales growth in their recent quarters.- Ace Hardware reported that revenues from its digital business grew 493% year over year in its second quarter, ended June 27, 2020.

- Online home remodeling platform Houzz reported that it saw a 58% growth in project leads for home professionals as of June, with consumers showing strong inclinations to add pools, spas, decks and patios to their living environments, according to CNBC.

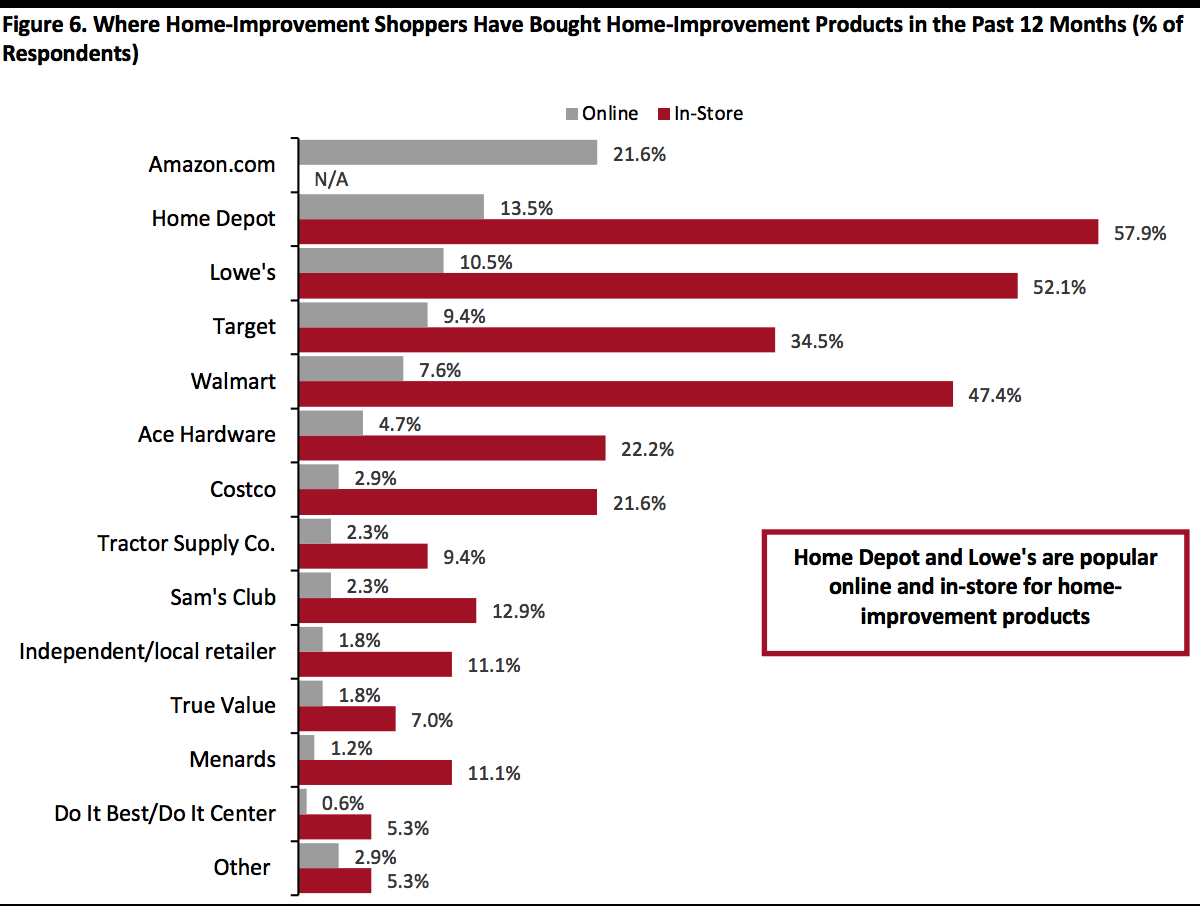

- Amazon does not typically disclose information on specific retail categories, so we have little direction from the company on the performance of, or its total sales in, the home-improvement category. Amazon is well-positioned to take advantage of the growing adoption of e-commerce channels for home-improvement purchases, albeit without the advantages of stores in terms of immediate availability, service and in-person product experiences. As detailed below, Coresight Research’s proprietary survey revealed Amazon to be the most-shopped retailer for online purchases of home-improvement products.

Survey Insights

Coresight Research conducted a survey on US consumers’ shopping behavior on July 29. Respondents answered questions regarding their online and offline shopping behavior pertaining to home-improvement products. Home-improvement continues to see relatively low online shopping rates compared to other sectors, in spite of the booming sales figures of 2020—only one-third of respondents that had bought home-improvement products in the past 12 months had bought said products online. While Home Depot and Lowe’s are specialist home-improvement retailers that are popular among consumers for both in-store and online purchase, Amazon’s popularity in this category is the most significant. Mass merchandisers, such as Walmart and Target, have also proved popular among consumers for home-improvement products, with both in-store and online purchases at these retailers trailing just behind the sector’s specialist retailers. Although e-commerce sales are growing in the sector, the fact that in-store shopping remains the most popular channel is unsurprising given that purchases are often driven by key factors such as in-store expertise at specialist retailers and the spontaneous nature of some of the work requiring home-improvement products. [caption id="attachment_116808" align="aligncenter" width="700"] Base: 171 US Internet users aged 18+ who had bought home-improvement products in the past 12 months

Base: 171 US Internet users aged 18+ who had bought home-improvement products in the past 12 monthsSource: Coresight Research[/caption]

What We Think

As the adoption of e-commerce accelerates across both discretionary and non-discretionary retail, we expect to see major home-improvement retailers continue to invest in enhancing their e-commerce and omnichannel capabilities. Implications for Brands/Retailers- With accelerations in the shift to e-commerce in the sector, online shopping giant Amazon is well positioned to capture a larger share of the market, providing further impetus for specialist home-improvement retailers to continue developing their omnichannel offerings.

- Being an efficient omnichannel operator will be key for leading players such as Lowe’s and Home Depot. These retailers therefore need to streamline their operations in a way that leads to seamless integration of their in-store and e-commerce sales. Done successfully, these omnichannel operations will be a key competitive advantage over pure plays such as Amazon—offering shoppers the convenience of faster access to products than ordering for delivery and the convenience of collection options, as well as confidence that the products they need will be in stock when they go in store, should they use BOPIS or stock-checker services.

- Among millennials who may be less disposed to DIY, stores can be centers of advice and service layered on top of omnichannel convenience, helping to build long-term shopper loyalty.

- In an “mask economy” where experiential retail is likely to be less of a focus area for physical stores, retailers should aim to capitalize on the opportunity to offer great experiences in digital and omnichannel retail.