DIpil Das

Introduction

What’s the Story? The pandemic caused drastic shifts in the fitness industry. Fitness centers were closed due to Covid-19 and consumers expanded their home fitness equipment while gyms, brands and retailers expanded fitness offerings through online classes, apps, and connected equipment and wearables to monitor health and fitness. This report analyzes the US home fitness market and its prospects. Why It Matters Consumer interest in health and wellness and staying physically fit has been increasing in recent years. The locations where consumers are working out have shifted in part due to gym closures during the Covid-19 pandemic as well as the advances in and convenience of home fitness technology and equipment. Consumer fitness behavior is influencing consumer spending expectations for retailers and brands in the following ways.- Gym closures and consumers working from home caused a massive increase in home fitness gyms during Covid-19. However, consumers are seeking to get out of their homes and are returning to gyms at levels higher than in 2019.

- Consumers are increasingly focusing on their health, which is the biggest growth opportunity in the home fitness space, particularly in the fitness wearables and apps market.

- Consumers that work out with brands and retailers through apps and connected fitness purchase more apparel than average consumers, as reported by NIKE and Lululemon.

US Home Fitness: Coresight Research Analysis

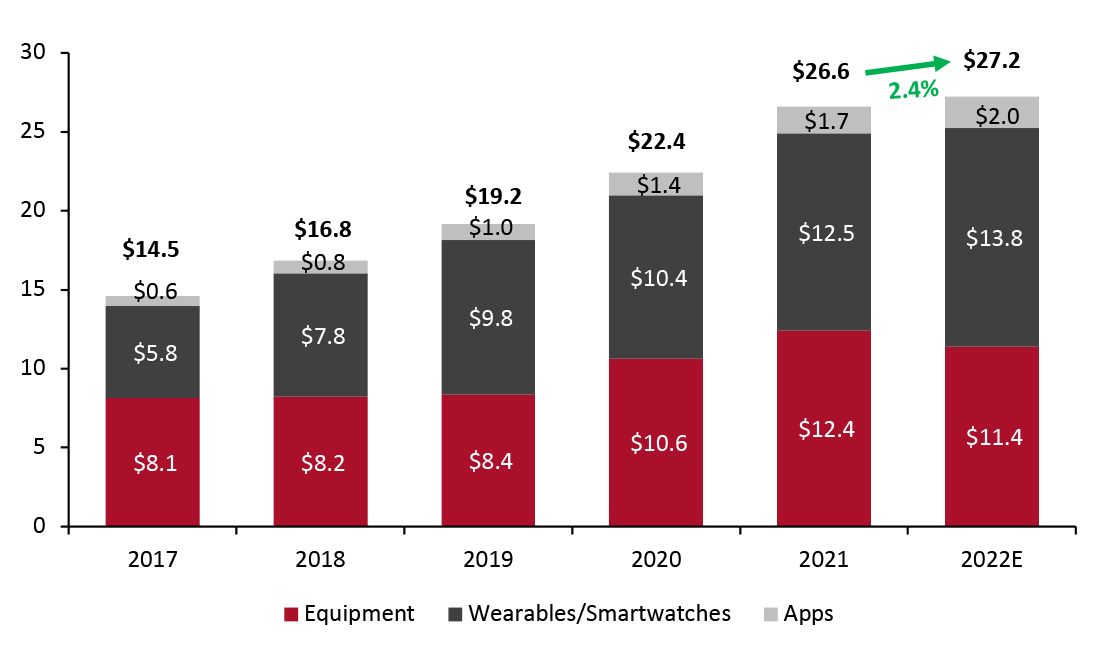

As shown in Figure 1, we estimate total spending in the home fitness industry will increase by 2.4% in 2022 following two consecutive strong years—an 18.6% year-over-year increase in 2021 and a 16.8% increase in 2020. We attribute a large spike in spending in 2020, and continuing into 2021, to consumers purchasing equipment for their homes as fitness facilities were closed during the pandemic. Fitness equipment sales increased by 27.0% in 2020 and moderated slightly in 2021 but were still high with 16.8% year-over-year growth. We estimate fitness equipment sales will decline by 8.1% in 2022. Consumers are invested in wearables and smartwatches to track and monitor their fitness and health; 39% of US consumers own a fitness wearable as of November 2021, according to Statista’s Consumer Fitness survey; we expect wearables to show strong growth of 10.8% in 2022 driven by advancements in smartwatches and health tracking as well as consumer interest in tracking fitness and health.Figure 1. US Home Fitness Market (USD Bil.) [caption id="attachment_148614" align="aligncenter" width="701"]

Source: Statista/Coresight Research [/caption]

1. Consumers Are Returning to Fitness Facilities, Exceeding 2019 Levels

During the Covid-19 pandemic, fitness centers and studios were hit hard as they were closed for many months. The International Health, Raquet and Sportsclub Association (IHRSA) reported that, as of December 31, 2021, 25% of all US health and fitness centers permanently closed during the pandemic.

The US fitness industry lost $20.2 billion in revenue in 2020 as fitness centers were closed for extended periods of time and consumers paused their memberships. However, fitness centers invested in online and on-demand classes, offering consumers virtual at-home workouts. As consumers return to in-person workouts, many are also opting for a hybrid workout option, working out both at home and at their fitness facilities. For example, Lifetime Fitness reported that of its 1.4-plus million customers, 1.1 million of them are regularly using its app. The company said that it is studying the content that they like to make it more robust. Lifetime Fitness streams approximately 500 of the 10,000 classes it teaches in its clubs. The company reported on its fourth-quarter earnings call of fiscal 2021 that consumers who are returning to the gym say they are thrilled to be back working out with a social community. Management added that there is a percentage of the population that will continue to just use digital while others may use a mix. Bahram Akradi, Lifetime Fitness’s Founder and CEO, said that its customers love the transformation to an omnichannel experience—and that the business is neither purely digital nor purely physical.

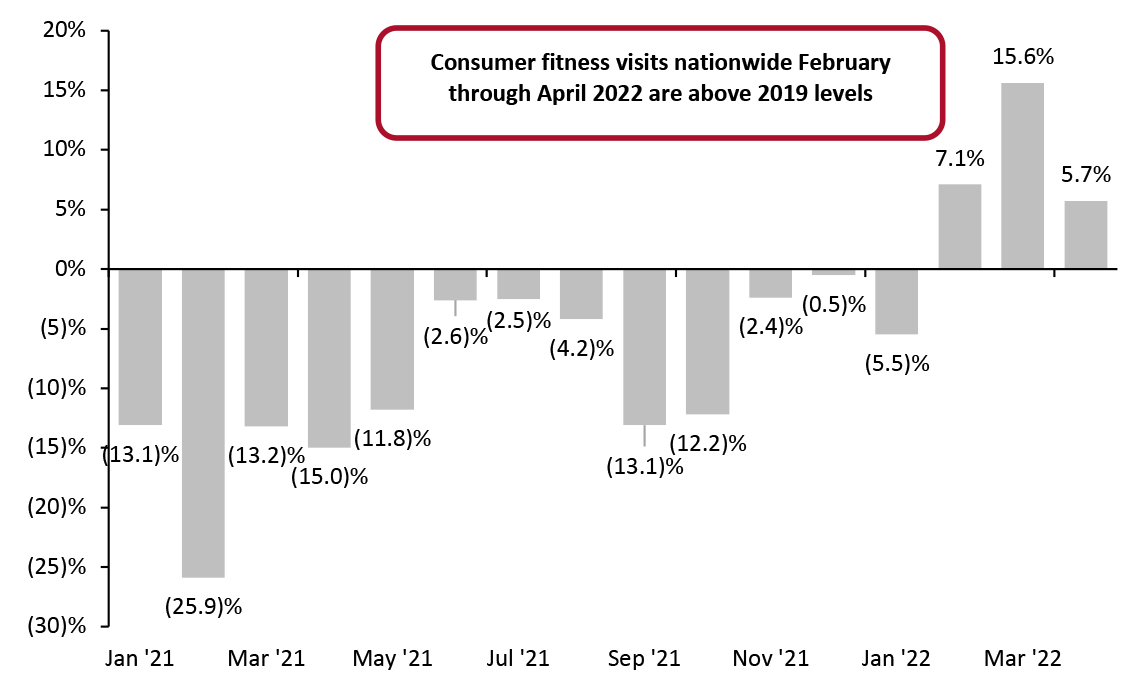

According to data from Placer.ai, as shown in Figure 2, consumers have been increasingly returning to their workout facilities as compared to 2019, with the exception of September and October 2021, likely due to the Delta variant. In February 2022, consumer fitness visits exceeded 2019 levels with 7.1% growth and have stayed elevated through 2022, reaching 5.7% growth in April.

Source: Statista/Coresight Research [/caption]

1. Consumers Are Returning to Fitness Facilities, Exceeding 2019 Levels

During the Covid-19 pandemic, fitness centers and studios were hit hard as they were closed for many months. The International Health, Raquet and Sportsclub Association (IHRSA) reported that, as of December 31, 2021, 25% of all US health and fitness centers permanently closed during the pandemic.

The US fitness industry lost $20.2 billion in revenue in 2020 as fitness centers were closed for extended periods of time and consumers paused their memberships. However, fitness centers invested in online and on-demand classes, offering consumers virtual at-home workouts. As consumers return to in-person workouts, many are also opting for a hybrid workout option, working out both at home and at their fitness facilities. For example, Lifetime Fitness reported that of its 1.4-plus million customers, 1.1 million of them are regularly using its app. The company said that it is studying the content that they like to make it more robust. Lifetime Fitness streams approximately 500 of the 10,000 classes it teaches in its clubs. The company reported on its fourth-quarter earnings call of fiscal 2021 that consumers who are returning to the gym say they are thrilled to be back working out with a social community. Management added that there is a percentage of the population that will continue to just use digital while others may use a mix. Bahram Akradi, Lifetime Fitness’s Founder and CEO, said that its customers love the transformation to an omnichannel experience—and that the business is neither purely digital nor purely physical.

According to data from Placer.ai, as shown in Figure 2, consumers have been increasingly returning to their workout facilities as compared to 2019, with the exception of September and October 2021, likely due to the Delta variant. In February 2022, consumer fitness visits exceeded 2019 levels with 7.1% growth and have stayed elevated through 2022, reaching 5.7% growth in April.

Figure 2. Nationwide Fitness Visits Growth, Compared to 2019 (%) [caption id="attachment_148615" align="aligncenter" width="699"]

Source: Placer.ai[/caption]

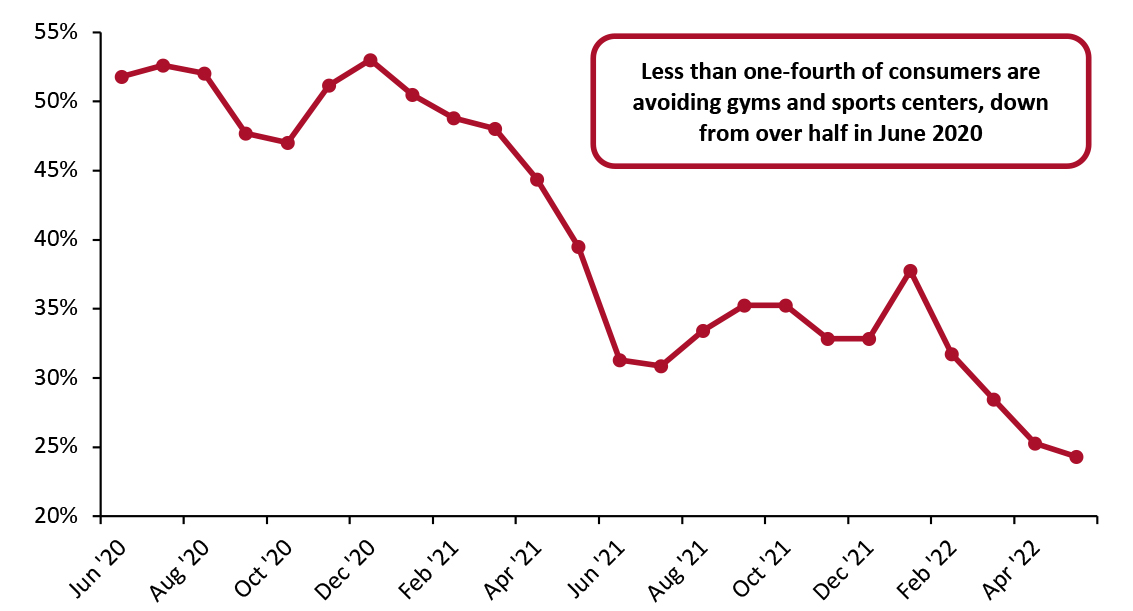

This is consistent with Coresight Research’s US Consumer Tracker weekly survey data, where we ask consumers the places that they are currently avoiding or where they are limiting visits. In May 2022, 24.3% of respondents were avoiding gyms and sports centers, a decrease from 51.8% of respondents in June 2020.

Source: Placer.ai[/caption]

This is consistent with Coresight Research’s US Consumer Tracker weekly survey data, where we ask consumers the places that they are currently avoiding or where they are limiting visits. In May 2022, 24.3% of respondents were avoiding gyms and sports centers, a decrease from 51.8% of respondents in June 2020.

Figure 3. Percent of Consumers Avoiding or Limiting Visits to Gyms and Sports Centers [caption id="attachment_148616" align="aligncenter" width="699"]

June 2020-May 2022; US weekly online survey of adults over 18; each survey conducted with a minimum of 400 participants

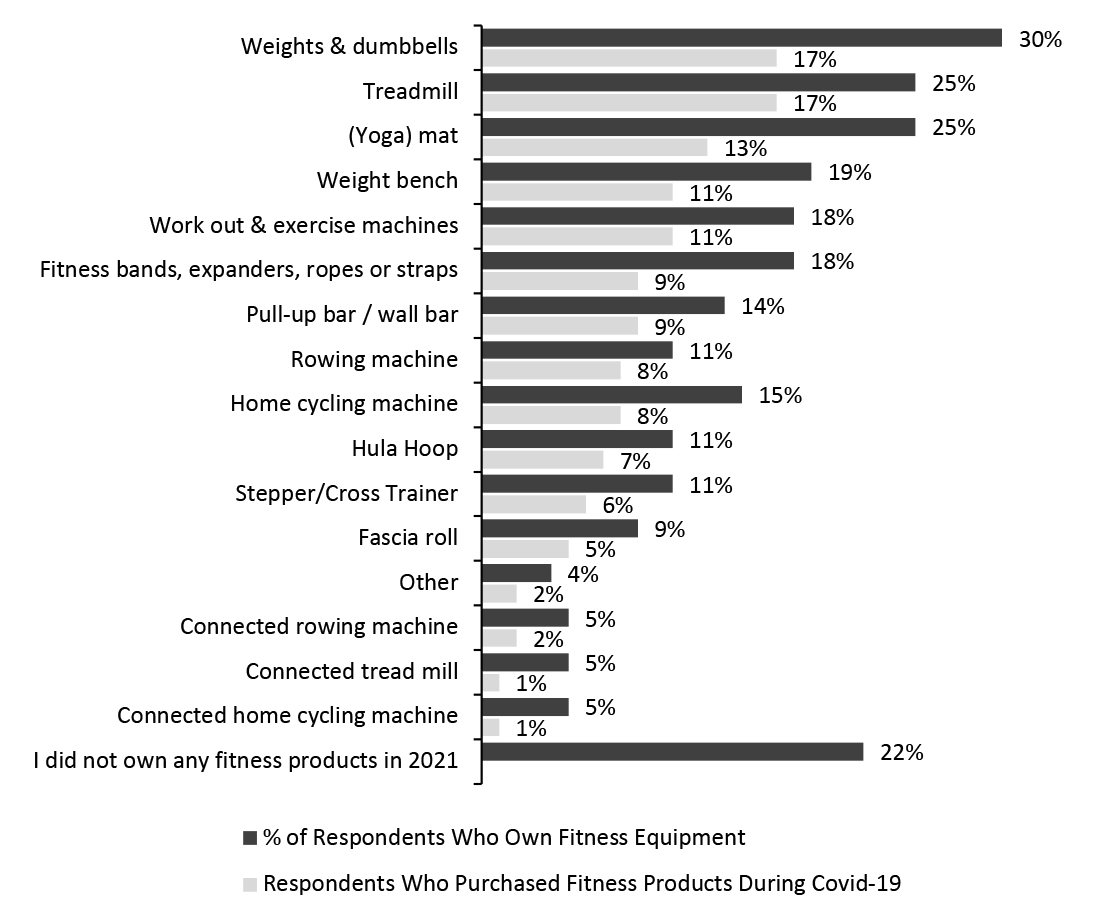

June 2020-May 2022; US weekly online survey of adults over 18; each survey conducted with a minimum of 400 participants Source: Coresight Research [/caption] 2. Consumers Bolstered Home Gyms During the Pandemic Coresight Research expects sports equipment purchases to moderate and normalize in 2022 with growth of 2.8% from already peak levels in 2020 and 2021 of 27% and 17%, respectively. We expect that most fitness aficionados who were seeking to replace their in-person gym experience with a home fitness experience have already purchased equipment and we expect to see more normal category growth, particularly as fitness retailers including Planet Fitness and Lifetime Fitness have reported that their members are happy to back in the gym environment. Consumers, spending an estimated $4.0 billion on sports equipment between 2020 and 2021. In a survey conducted by Statista in September 2021, weights, dumbbells, and treadmills were the most popular fitness equipment purchased during the pandemic, purchased by 17% of respondents.

Figure 4. US Consumers Who Bought Fitness Products During Covid Pandemic, By Product Type (% of Respondents) [caption id="attachment_148648" align="aligncenter" width="700"]

September 2021; 1,000 online consumers ages 16-50; consumers could select more than one product type

September 2021; 1,000 online consumers ages 16-50; consumers could select more than one product type Source: Statista Global Consumer Survey (GCS) [/caption] 3. Connected Equipment Brands Focus on Digital and Retail Partnerships Connected fitness brands are investing in their digital offerings and subscription-based services to grow their consumer base. Over the past few years, connected equipment brands—brands that offer fitness equipment with monthly digital subscription service packages including instructors—saw a big increase in demand. However, after a tremendous boom in 2020 and 2021, sales have been declining in connected fitness equipment. For example, Peloton’s connected fitness equipment segment grew by 115% in fiscal year 2021 and 98% in fiscal year 2020. However, in the most recent quarter, Peloton reported its connected equipment sales were down by 41.9% compared to the first quarter of last year through subscriptions were up by 54.5%. As equipment sales have been declining, brands are further emphasizing their subscription services.

- Peloton announced in its third quarter of fiscal year 2022 earnings release that it intends to focus less on hardware and more on software. It will grow its business by focusing on its subscriber base in two ways. First, it intends to grow its digital app by providing consumers outside of Peloton access to its content. Second, it intends to test and broaden the rollout of its Fitness-as-a-Service rental program that combines the cost of connected fitness hardware and its subscription service into one low monthly fee. The company is also broadening its distribution to third-party retailers.

- Lululemon announced at its Investor Day on April 20, 2022, that customers who purchase the Mirror hardware will have access to Mirror’s subscription model, which offers over 10,000 classes across 50 different fitness modalities for $39 a month, and consumers will gain access to content from Lululemon Mirror instructors and studio partners. Customers will receive discounts for in-person classes and programs offered by studio partners and guests will also receive benefits and early access to Lululemon products and services. Lululemon reported that its customers who work out more on Mirror buy significantly more Lululemon products than the average guest.

Figure 5. Connected Fitness Equipment Brands [wpdatatable id=2037 table_view=regular]

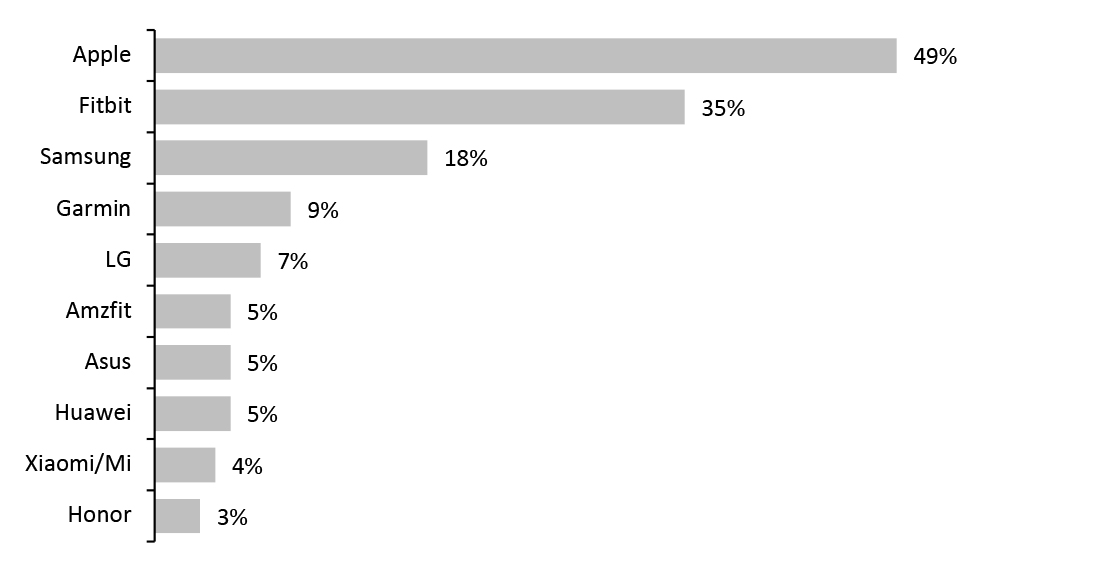

Source: Company reports/Coresight Research 4. Wearable Technology Will Continue to Grow Wearable technology, which includes fitness or activity trackers, smart watches and heart rate monitoring devices, is a growing category as consumers are increasingly interested in tracking fitness levels. Wearables continue to gain popularity as consumers are increasing their precision in tracking steps, calories, heart rate, body temperature, sleep time, sitting time, and blood pressure. According to a 39% of US households owned a wearable; Figure 6 shows the top fitness and wearable brands in the US by ownership among this segment. Apple does not segregate its smartwatch sales; however, the company reported in its annual report for the fiscal year ended September 25, 2021, that in its “Wearables, Home, and Accessories” category, which increased by 25% globally and includes sales of AirPods, Apple TV, Apple Watch Beats products, HomePod, iPod touch and accessories, “net sales increased during 2021 compared to 2020 due primarily to higher net sales of accessories and Apple Watch.”

Figure 6. Ownership of Fitness Tracker and Smartwatch Brands (% of Respondents That Own a Fitness Tracker or Smartwatch) [caption id="attachment_148618" align="aligncenter" width="699"]

November 2021;1,963 respondents ages 16-50; consumers could select more than one product type

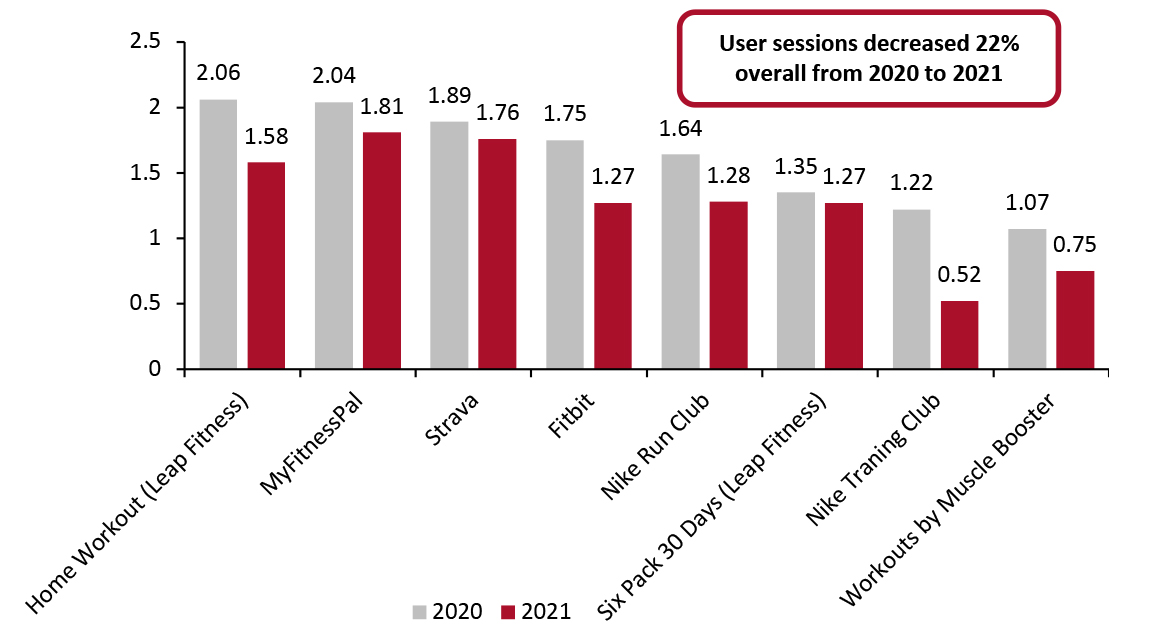

November 2021;1,963 respondents ages 16-50; consumers could select more than one product type Source: Statista Global Consumer Survey (GCS) [/caption] According to the ACSM Worldwide Survey of Fitness Trends for 2022, wearables was the top trend out of its 20 trends in its 16th annual survey of 4,546 global professionals. According to the survey, new innovations including blood pressure, oxygen saturation, body temperature, respiratory rate, and electrocardiogram push the wearables category forward. 5. Activewear Companies Invest in Apps to Increase Community Engagement The fitness app space is a burgeoning market with over 47 million users in 2021 on paid and free fitness and wellbeing apps; fitness and wellbeing apps are expected to grow 15.8% in 2022 to $1.98 billion, according to Statista. The top fitness app, Home Workout (Leap Fitness), recorded 28.1 million downloads in 2021 and 1.58 billion user sessions, according to Apptopia. Figure 7 shows the top fitness apps by number of sessions, declining by an average of 21% from 2020 to 2021. While consumer demand for fitness apps has declined, consumer engagement is still high. We see consumers continuing to use fitness apps for multiple purposes including tracking, workouts, goal orientation, routines and community engagement. For example, some fitness apps are specialized around a specific fitness goal such as Strava’s highly competitive biking app targeting cyclists; over 120 of the 176 Tour de France cyclists uploaded stage results on Strava. Additionally, some running apps are targeted to runners with specific training routines.

Figure 7. Fitness Sessions by App (Bil.) [caption id="attachment_148619" align="aligncenter" width="700"]

Source: Apptopia [/caption]

Some brands and retailers are launching apps offering a variety of workouts. They are using apps as a way to build a community, with like-minded individuals meeting around a common purpose—in this case, fitness. Brands and retailers are reporting that the more active their consumers are, whether working out on their apps or through their connected equipment (as Lululemon reported with Mirror), the more they purchase apparel. Here are major fitness brands and retailers with apps.

Source: Apptopia [/caption]

Some brands and retailers are launching apps offering a variety of workouts. They are using apps as a way to build a community, with like-minded individuals meeting around a common purpose—in this case, fitness. Brands and retailers are reporting that the more active their consumers are, whether working out on their apps or through their connected equipment (as Lululemon reported with Mirror), the more they purchase apparel. Here are major fitness brands and retailers with apps.

- Asics Runkeeper:, which has over 33 million users worldwide and is available for the iPhone and Android, with smartwatch apps and links to other fitness tracking apps and platforms. The running app uses GPS on a smartphone to track routes, times and distance.

Asics Runkeeper App

Asics Runkeeper App Source: Asics.com [/caption]

- Athleta: In July 2021, Athleta launched AthletaWell, an immersive digital platform including interest-based groups, where members can join in conversations or start their own; access to Athleta “guides,” such as yoga teachers, medical doctors, mediation guides, strength trainers, dietitians, physical therapists and motivational speakers; and links to events, both virtual and in-person around the country, such as run clubs and exercise classes. The platform helps Athleta shoppers create community.

AthletaWell App

AthletaWell App Source: Athleta.com [/caption]

- NIKE Run Club and Training App: The NIKE Run Club and NIKE Training Club apps remain popular with consumers, with each topping, according to Apptopia. The company saw an all-time high percentage of members working out on the NIKE Training Club app in September 2020—at the height of the pandemic—more than 50% of members worldwide starting a workout in the period. For the NIKE Running Club, the company saw four consecutive months of more than 1 million downloads of audio-guided runs. In its second-quarter earnings call of fiscal 2022, management stated that it launched new wellness content and workouts featuring Megan Thee Stallion on its Training Club app. Megan's content drove record engagement, doubling daily active users, and her curated looks saw more than double the demand compared to any other product content viewed during that same time period.

NIKE Running Club App sign

NIKE Running Club App sign Source: NIKE store window, Fifth Avenue, New York City [/caption]

What We Think

The home fitness category boomed over the past two years as consumers created home fitness centers to replace fitness facilities that were closed due to Covid-19. This also caused a spike in app usage as consumers sought online workouts from home. Now, consumers’ lives are beginning to return to normal and we are seeing them eagerly returning to gyms. We expect that, after the flood of home equipment sales over the past two years, the future of home fitness will be focused in two major areas: wearables and digital. Implications for Brands/Retailers- Consumer interest in health will power wearable growth

As consumers are increasingly interested in transparency to learn more about their health as it relates to fitness, we expect that health in conjunction with fitness will drive the next level of wearable growth.

- Brands and retailers can grow their communities and apparel sales with a targeted approach

The digital space is very competitive. To build a lucrative community, brands will need to identify who they are serving and why. As there are very specific apps and subscriptions that are supporting consumers for every need from biking to running to yoga to hiking, brands and retailers should be very focused on their goals. Lululemon and NIKE each reported that their apps have helped to grow apparel sales.

Implications for Real Estate Firms- Fitness brands are seeking to collaborate with retailers

- The future of fitness is “fitness as a service” with technology as its backbone

As fitness transitions to a service-oriented model, technology providers have an opportunity to become the go-to “gym” subscriber for consumers.