Introduction

The crippling effect that the coronavirus pandemic continues to wreak on global discretionary retail is well documented, and the US is among several economies to be severely impacted.

This report outlines how the US home and home-improvement sector has been impacted by Covid-19 and presents an outlook for the rest of 2020 and into 2021.

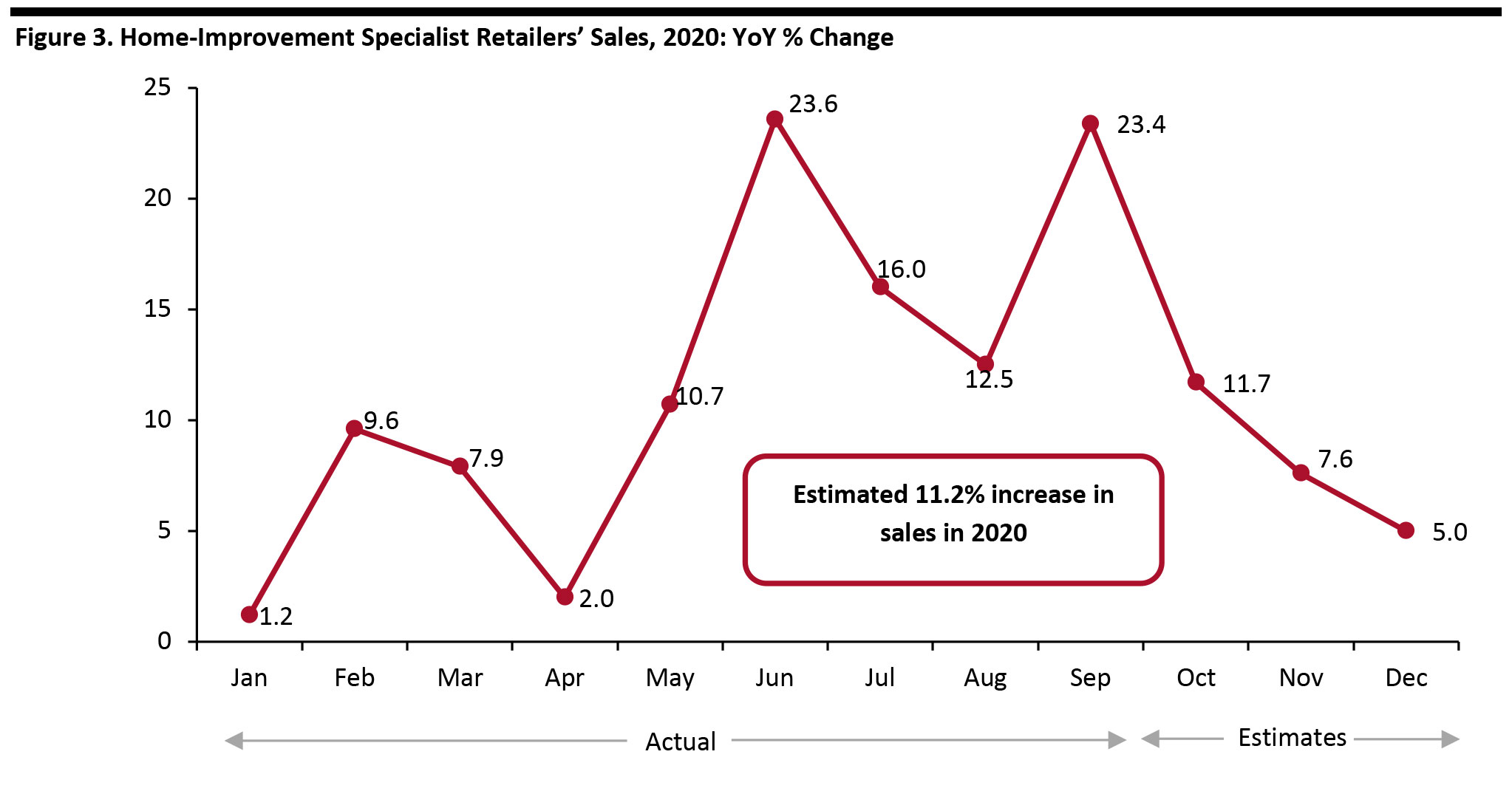

To analyze the sector, we look closely at selected US retailers—including Home Depot, Lowe’s, RH, Tractor Supply, Wayfair and Williams-Sonoma.

Our coverage focuses on two key areas within home and home improvement—furniture retail and home-improvement retail. In our coverage, we categorize Tractor Supply under home-improvement despite it not falling under the latter’s conventional definition. This is on the basis that home improvement is a notable, although not primary, component of the retailer’s overall business, and it competes with home-improvement stores in the garden and outdoor-living categories.

Sector Outlook

Furniture Retail: 2020

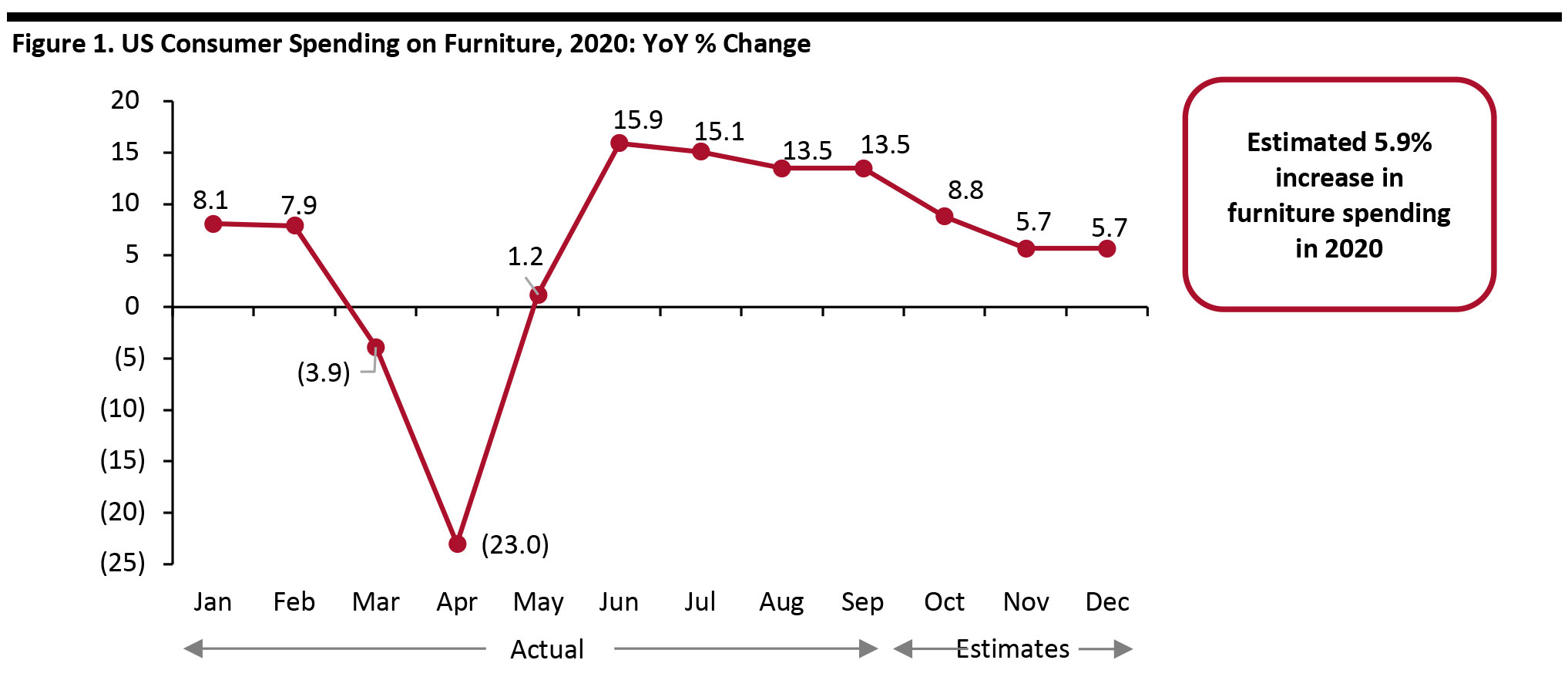

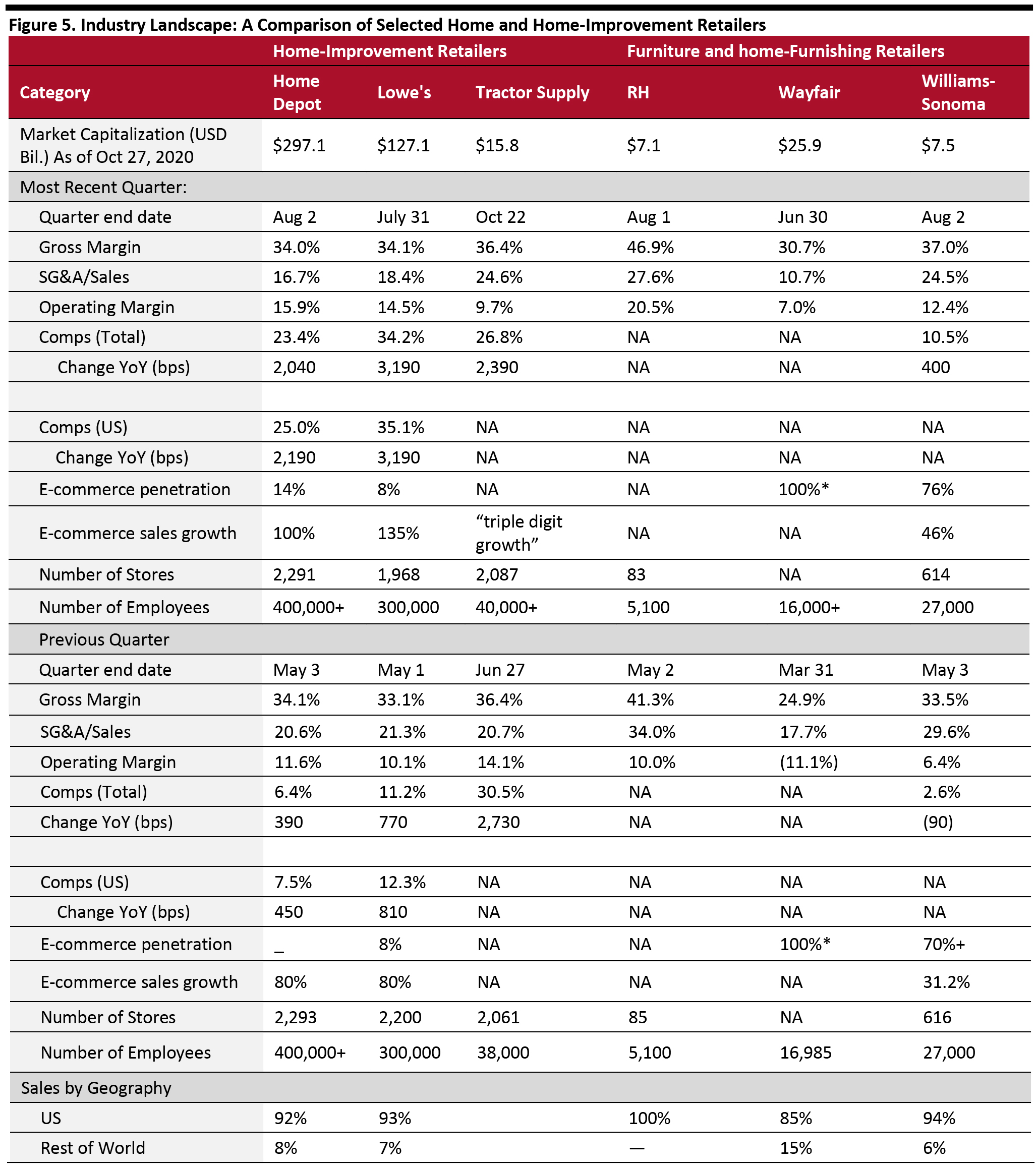

With stores having started to reopen from May, we saw a revival in furniture spending. While May saw modest growth of 1.2% in consumer spending, the subsequent months all saw double-digit growth (see Figure 1). Growth has been supported by demand for office furniture that supports working from home, as well as the nesting trend as consumers spend more time at home.

With consumer confidence declining in October—reflecting the ongoing increases in coronavirus cases across the country and growing uncertainty around when the pandemic will come to an end—and with no current stimulus plan to support growth, we currently model a deceleration of growth toward the end of the year, although growth is likely to remain solidly positive.

With holiday shopping starting earlier this year, demand drawn forward to October could temper growth in November and December.

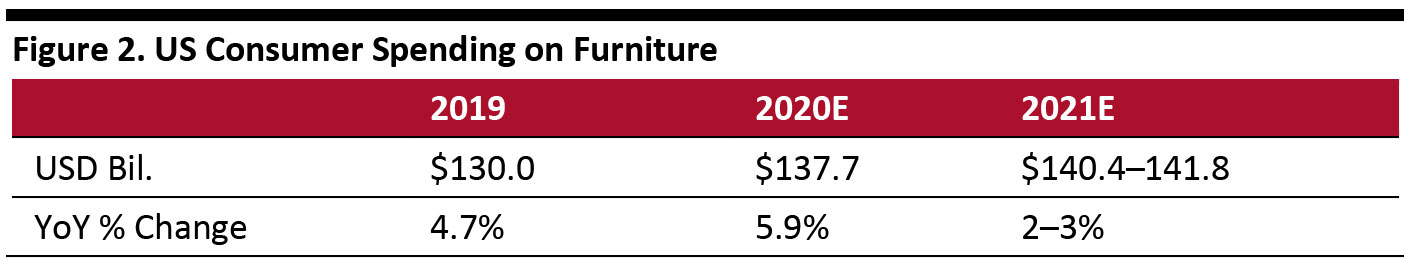

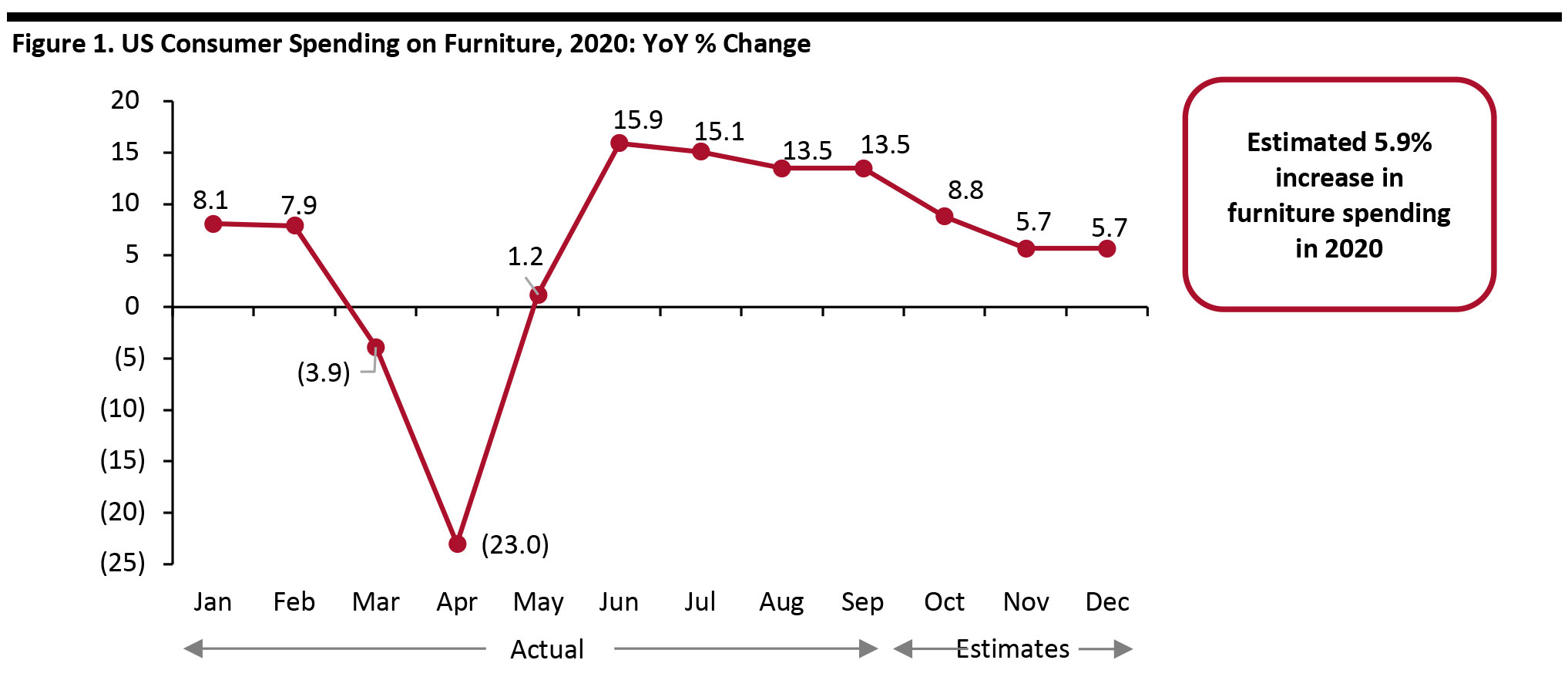

For 2020 overall, we estimate consumer spending on furniture to increase by approximately 5.9%, around $7.6 billion, to $137.7 billion (including sales taxes). This reflects spending through all channels, including lockdown-resilient, higher-growth e-commerce.

[caption id="attachment_119376" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Furniture Retail: Outlook for 2021

Against solid comparatives for 2020 overall, we anticipate that growth in spending on furniture will ease in 2021. We estimate an approximate 2–3% increase in total furniture spending in 2021. However, growth is likely to prove volatile as we lap the lockdown period and then the post-lockdown boom: In year-over-year terms, growth is therefore likely to be strongest in the first half of the year.

Although a vaccine now looks to be more certain, the coronavirus crisis is likely to keep consumers at home more in 2021 than pre-crisis. Any vaccination program is likely to take many months, by which time already established working-at-home and learning-at-home practices will become even more entrenched. This will support demand for furniture—but with the substantial caveat that most of this demand is likely to have been fulfilled in 2020. Assuming this exceptional demand eases off, the performance of the furniture category is likely to be more closely tied to cyclical economic forces than they have been in 2020.

A shift from cities to larger suburban homes is one coronavirus-driven trend that is likely to become a tailwind for consumer spending on furniture in 2021.

Being a big-ticket sector, the speed and scale of the economic recovery is a further factor that will impact its prospects: A slow recovery in employment is a potential inhibitor of growth in the furniture market. Projections from the Federal Reserve in September suggested that unemployment will fall to 7.6% by the end of this year and to 5.5% by the end of 2021. According to research firm The Conference Board’s base-case forecast, the US economy will see an estimated 3.5% growth in 2021, following a 3.5% decline in 2020.

[caption id="attachment_119377" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

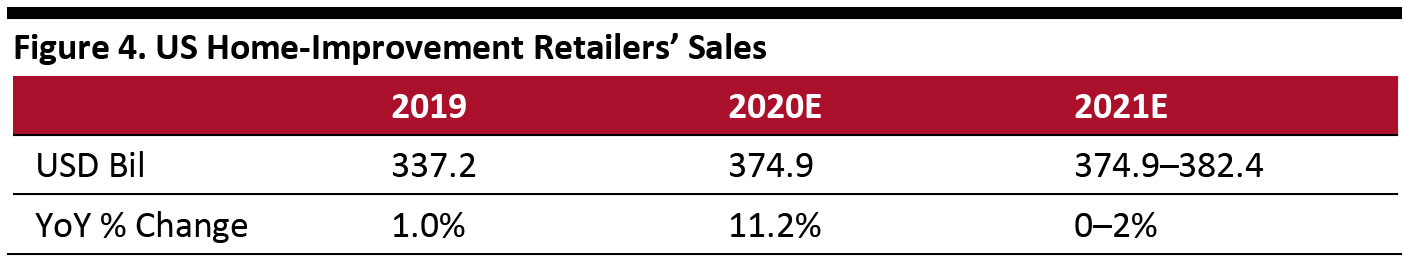

Home-Improvement Retail: 2020

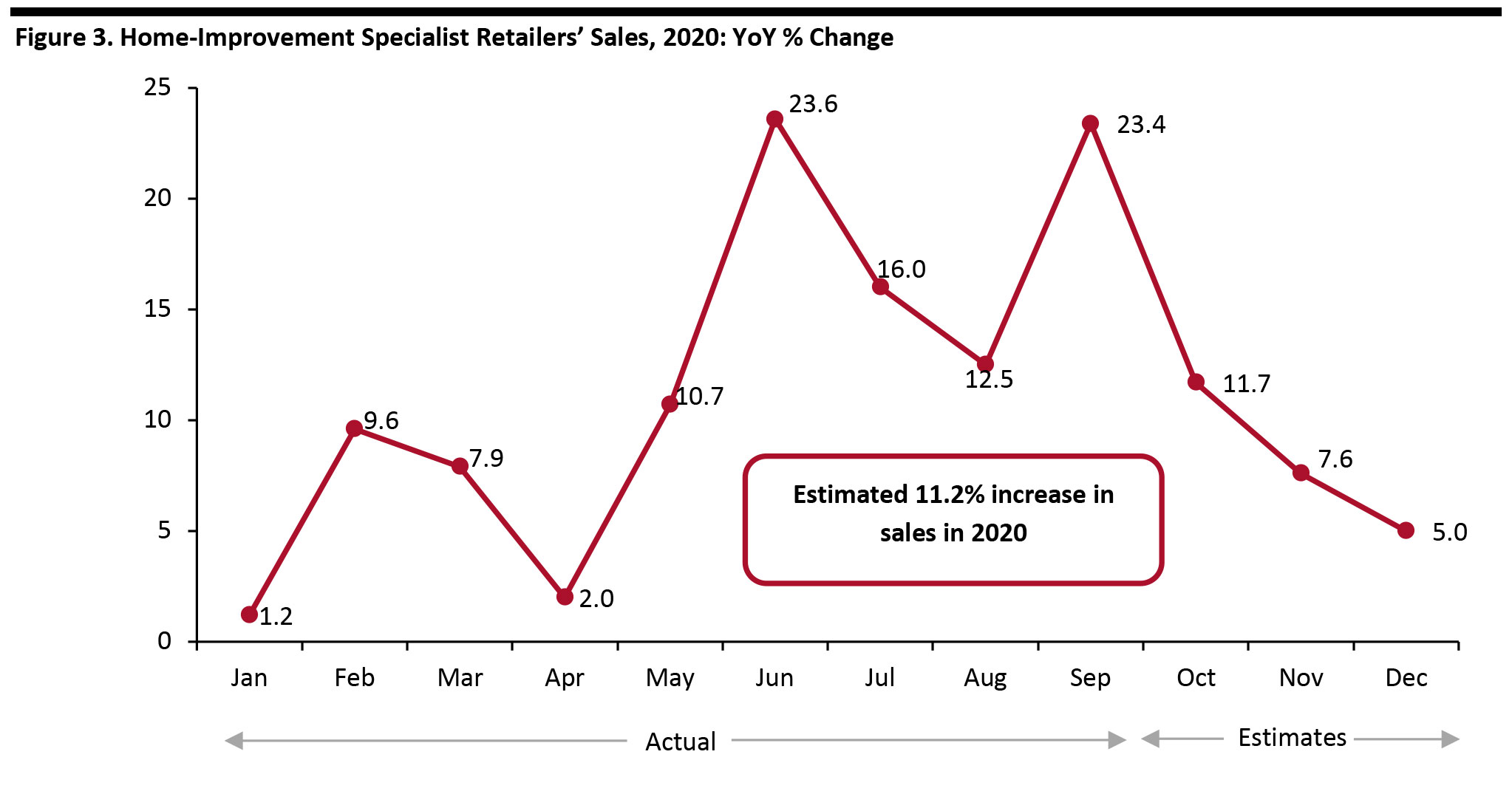

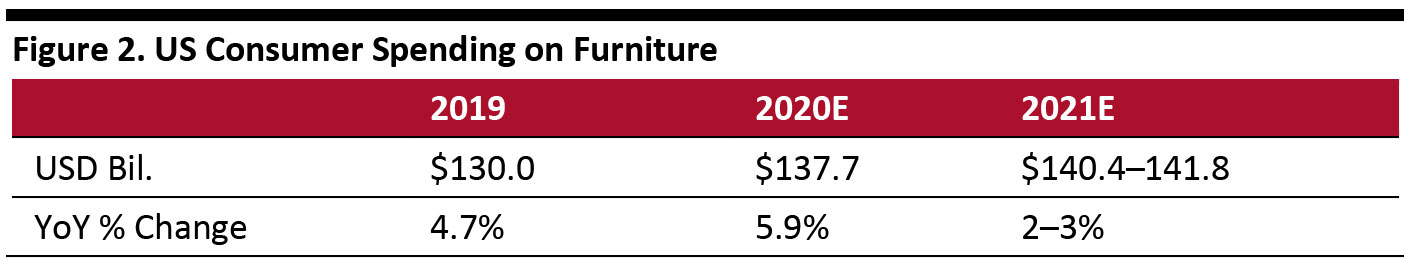

Home-improvement stores have spectacularly bucked the downturn. The double-digit year-over-year growth in each of the last five reported months (June to September) indicates how well the sector has fared overall following lockdowns. Although we expect year-over-year growth to continue for the last three months of the year, we expect a deceleration in the growth rate amid a decline in consumer confidence and more uncertainty in the face of a surge in coronavirus cases in the US.

Our forecast (growth deceleration) for the home-improvement sector also takes housing market trends into account, which are closely linked to the sector’s prospects. With housing inventory falling to record lows, mortgage lending standards tightening and rising unemployment, new and existing home sales are likely to slow down over the rest of this year, and home improvement will therefore also be impacted.

Furthermore, with some of the holiday spending having been drawn forward to October, spending growth in November and December will be comparatively tempered.

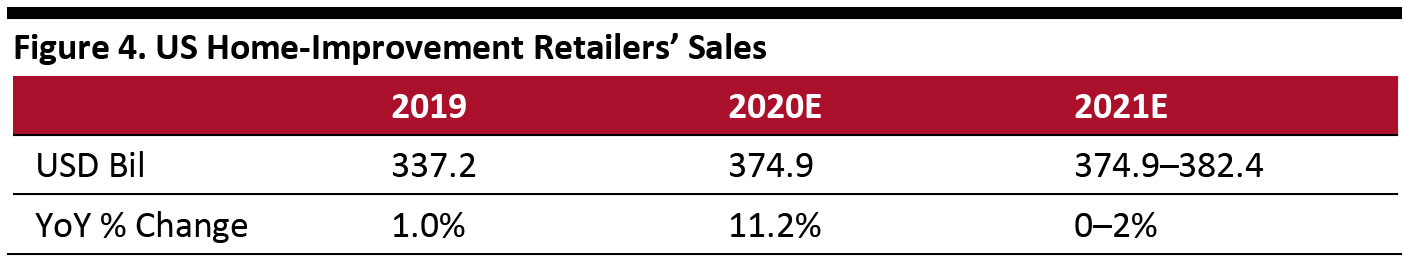

- For 2020 overall, we estimate sales by home-improvement specialist retailers to rise by approximately 11.2%, around $38 billion, to $375 billion (excluding sales taxes).

- Our estimates see the home-improvement retail sector being the top-performing store-based nonfood sector in 2020.

Both Home Depot and Lowe’s have not issued guidance for the full fiscal-year 2020, owing to limited visibility into the future economic environment, but have reaffirmed that they are confident about their business prospects in the future. Tractor Supply is guiding for 15–20% comparable sales growth in the fourth quarter of 2020 (4Q20), easing from the 26.8% comp growth reported for the third quarter (which ended September 26).

[caption id="attachment_119378" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research

Source: US Census Bureau/Coresight Research[/caption]

Home-Improvement Retail: Outlook for 2021

With the strong showing in 2020, home-improvement retail sales in 2021 will be weighed against demanding comparatives, and we estimate a flat to low single-digit increase in total home-improvement retail sales in 2021 under an optimistic assumption of a moderate recovery in the US economy. As with furniture, growth is likely to prove variable through the course of 2021: In year-over-year terms, growth is likely to be more robust earlier in the year, when the sector will be annualizing more moderate growth rates from 2020.

We also attribute the forecast for the easing of sales growth in 2021 to many homeowners having brought forward planned

home-improvement projects to this year. Assuming this exceptional, crisis-prompted demand falls away, the sector’s performance is likely to become more closely tied to traditional underlying economic forces.

Online real estate database firm Zillow recently improved its housing market forecasts for 2021, taking into account the strong sales in the summer months of 2020 amid increasingly short inventory and high demand, but said that economic uncertainty might temper these forecasts. It expects housing sales in 2021 to stay high but taper off through 2021, and we expect home-improvement sales trends to have a somewhat similar trajectory.

Drivers of demand in 2021 will include the following:

- Consumers will continue to spend more time at home than they did pre-crisis and limit travel for work or leisure, freeing up time and budget to spend on home-improvement projects.

- Consumers shifting from cities to suburbs could be a driver for long-term home-improvement sales growth in 2021 and even beyond.

[caption id="attachment_119379" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research

Source: US Census Bureau/Coresight Research[/caption]

Furniture and Home-Improvement Retail: Holiday 2020 (October to December)

Overall, consumers are likely to continue spending more time at home this holiday season compared to previous years, meaning that shoppers who might have otherwise budgeted for travel and hospitality-related spending during this season will have more to spend on home furnishings, holiday decor and DIY home-improvement projects, which augurs well for the sector as a whole.

The holiday period is likely to see continued year-over-year growth in spending and sales in furniture retail, but we expect the growth rate to ease during these months. This is owing mainly to the growing uncertainty and decline in consumer confidence amid the recent surge in coronavirus cases.

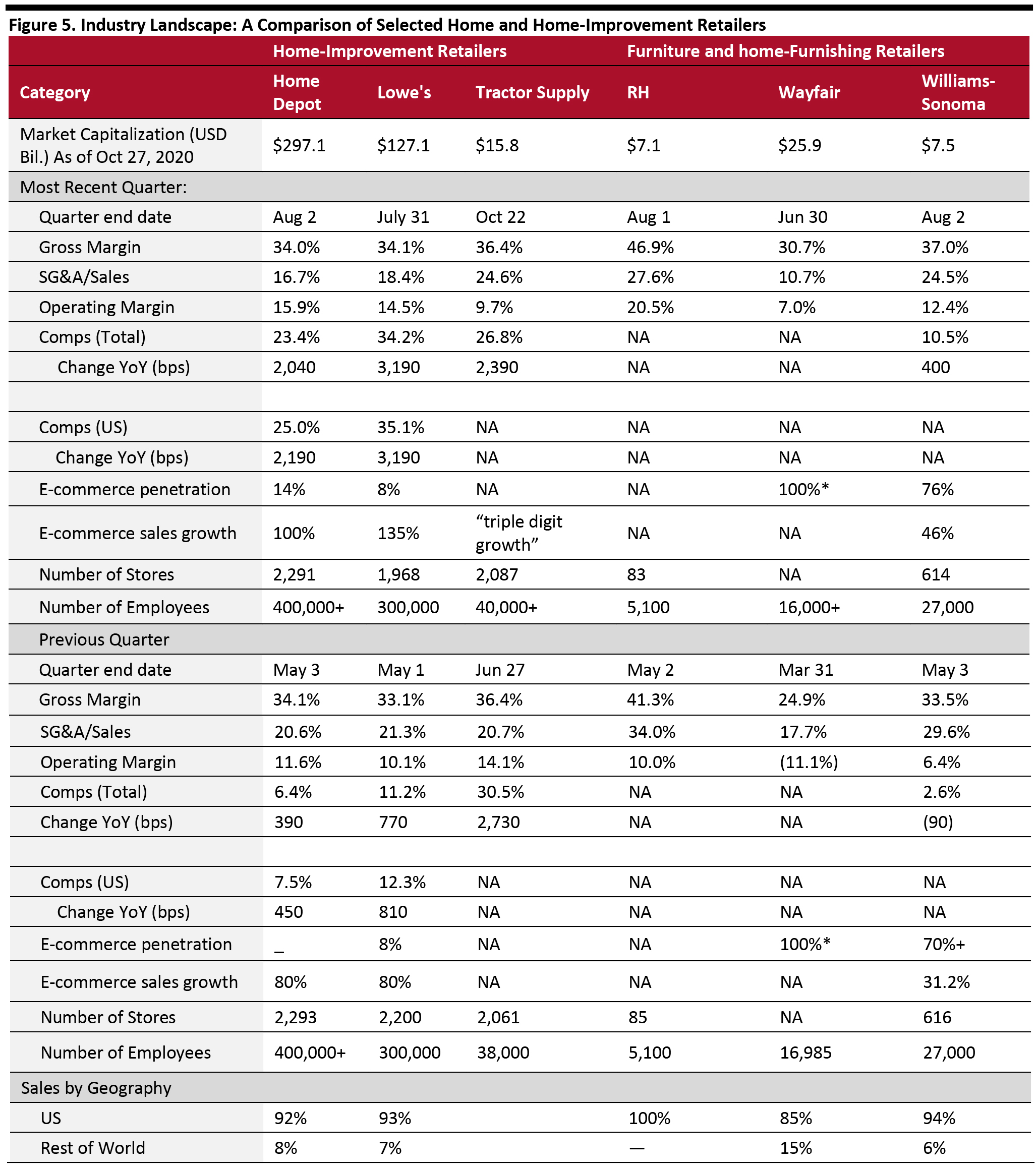

Home and Home-Improvement Retail: Competitive Landscape

In this section, we take a closer look at some of the key players in the home and home-improvement sector and how they have responded to the Covid-19 crisis. In Figure 5, we depict key comparative data between our six covered home and home-improvement retailers.

[caption id="attachment_119359" align="aligncenter" width="700"]

*Wayfair has a retail store in Natick, Massachusetts and an outlet store in Florence Kentucky, but total in-store sales from these outlets does not constitute a material proportion of total sales.

*Wayfair has a retail store in Natick, Massachusetts and an outlet store in Florence Kentucky, but total in-store sales from these outlets does not constitute a material proportion of total sales.

Note: Sales by geography is as of the latest completed financial year. Tractor Supply’s store count for its most recent quarter includes 1,904 Tractor Supply and 183 Petsense stores.

Source: Company reports/S&P Capital IQ/Coresight Research [/caption]

Wayfair

Digital-first furniture and home-goods retailer Wayfair is among the discretionary retail companies that seem to be benefiting from the crisis. Wayfair stated that demand for its offerings spiked as consumers looked to set up their home offices and decorate their homes as they spent more time indoors under lockdown restrictions.

The company experienced a solid second quarter (ended June 30, 2020), with Covid-19 tailwinds driving accelerated e-commerce adoption and thereby supporting sales momentum. The company managed to generate profit for the first time since it went public in 2014, driven by a consumer shift toward buying home goods online. Enterprise revenue grew 84.2% to $4.3 billion; US revenue grew 83%; and international revenue grew 91%. The gross margin in 2Q20 was 30.7%, significantly higher than the 26% that the company had previously estimated for the quarter. The company’s active customer base rose 46% year over year, to 26 million at the end of 2Q20.

Wayfair highlighted strong growth through both new and repeat customers, whereas typically, the company’s order growth from repeat orders significantly outpaces order growth from new customers. Despite repeat orders in the quarter more than doubling year over year, new customer orders grew even faster, marking the first instance of this dynamic playing out since the company’s IPO (initial public offering).

On November 2, 2020, the company released its third-quarter results: Enterprise revenue grew 66.5%; US revenue increased by 66.5%; and international revenue grew 66.7%. Wayfair reported its second consecutive quarter of profit, with net profit of $278 billion. The number of active customers in the company’s Direct Retail business grew 50.9%, reaching 28.8 million as of September 30, 2020. Around 60% of total orders delivered for the company’s Direct Retail business in the third quarter were placed via mobile devices, versus 53.8% in the year-ago quarter. Wayfair’s repeat customers accounted for 71.9% of total orders in the 3Q20, versus 67.3% in the 3Q19.

Outlook

Wayfair expects accelerated e-commerce adoption, compared to pre-Covid, to continue.

For the fourth quarter of 2020, the company expects the following:

- Gross margin to be between 26% and 28%.

- Capital expenditure to be in the range of $75–85 million, subject to expected timing.

Management expressed confidence that it has a long runway for continued strong, profitable growth ahead, even after the current circumstances pass. CFO Michael Fleisher said, “Quarter to date, our gross revenue growth is trending at roughly 50% year over year. We did see moderation in growth in the latter half of [the third quarter], excluding Way Day, so we still expect strong growth for the whole of [the fourth quarter] and obviously well above pre-Covid levels. Although we are optimistic that holiday demand for the category will prove healthy and expect that many will prefer to shop online, there are still tremendous unknowns.”

We expect the company to perform strongly through the rest of the year and beyond—with the current environment proving to be conducive to growth.

Wayfair is set to capitalize on e-commerce in the furniture sector gaining acceptance among consumers, and the company believes that there are clearly defined long-term advantages accruing to it during the current period.

Williams-Sonoma

Williams-Sonoma’s e-commerce operations constituted around 56% of its total revenues in fiscal 2019, and in the current Covid-19 affected environment, its digital-first channel mix held it in good stead amid the challenging environment for store sales.

According to a recent report published by creative agency Digital Silk, Williams-Sonoma ranked fourth among the 11 best-performing e-commerce sites across sectors during the Covid-19 crisis. The agency considered various parameters including sales, digital traffic and customer retention in evaluating the best performers. IKEA was the only other company under the home and home-improvement sector to feature in the list.

In 2Q20 (ended August 2), Williams-Sonoma saw record earnings growth of more than 100%, driven by strong performance in the e-commerce channel, which grew 46% (includes purchases made through omnichannel services such as curbside pickup and ship-from-store) versus the year-ago quarter. Gross margin grew to 37% in 2Q20 versus 35.4% in 2Q19, driven by higher merchandise margins and occupancy leverage.

Management said that store performance was better than the company expected and saw improved performance through the quarter following the reopening of stores. E-commerce penetration touched a record high of close to 76% of total company revenues in 2Q20.

Brand-wise, the Williams Sonoma brand was the strongest, delivering comp growth of 29.4%, while Pottery Barn and West Elm registered comp growth of 8.1% and 7%, respectively.

Outlook

The company said that the quarter-to-date sales in the third quarter, as of August 27, 2020, was strong across all brands and will continue to improve over the rest of the year. From a margin perspective, Williams-Sonoma said that shipping will be a key headwind in the second half of the year because of various surcharges announced by third-party shippers on all retailers.

The company highlighted that its long-term plans include the following:

- Acceleration of digital growth and a fundamental shift of the channel mix of its business

- A marketing strategy focus on content and building customer relationships

- Stepping up profitability and longer-term earnings outlook

CEO Laura Alber said, “Longer term, we believe the behavioral changes and industry shifts that have emerged from the pandemic will persist and continue to favor our business. We are investing in the next phase of our growth and the opportunities that position us for accelerated market share gain.”

RH

Being a primarily brick-and-mortar operator, RH naturally faced challenging times during lockdowns, and the company took tough measures thereafter—including announcing furloughs, temporary salary reductions and reduction of capital expenditure—to cope with the difficult climate. Despite the challenges that it faced in the first quarter, RH maintained its faith in its business model, while also disclosing that it will invest in enhancing its digital capabilities.

Driven by its investments to elevate the RH brand, product margins grew 490 basis points in 2Q20, driving adjusted gross margin expansion of 550 basis points to 47.5%, compared to 42% in 2Q19. Adjusted SG&A (selling, general and administrative expenses) as a proportion of sales declined by 140 basis points, owing to lower advertising and compensation costs partly offset by a 40-basis-point drag pertaining to incremental coronavirus-related expenses.

Although total demand grew by 16% in 2Q20, RH was negatively impacted by a 23% reduction in open store days for its “galleries” as a result of the pandemic, restrictions limiting capacity in its restaurants, lower demand in its Contract division (attributed to a pullback in capital spending in the hospitality industry) and a drag to company revenues from lower sales in its Outlet division.

Owing to global supply chain disruptions caused by the pandemic, the company’s revenue growth lagged behind demand by around 16 points in 2Q20, with the gap between the two widening as demand accelerated beyond the company’s expectations.

Outlook

RH expects a positive impact to its revenues in the second half of the year as production recovers and inventory receipts catch up to demand. For the full-year 2020, the company expects the year-over-year decrease in Outlet sales to cause an approximate four-percentage-point drag to total company revenues.

RH expects revenues to lag demand by five to 10 points in 3Q20 and begin to normalize in 4Q20 as manufacturing and inventory receipts catch up to demand. The company expects that some level of elevated spending on home will continue through 2021 and possibly beyond. The company believes that trends such as booming real estate activity in second-home markets, an accelerated shift of families moving to larger suburban homes and the rise in homebuilding activity among consumers should drive increased spending in its market for an extended period of time. RH expects to open its first RH Guesthouse in New York in late spring 2021.

The company said that it remains confident in its gallery transformation strategy despite the accelerated shift to online. Until the pandemic struck, RH’s store-dominated model held its own amid the e-commerce wave, as its target consumers were well-to-do individuals who preferred to shop in-store—as with many other luxury nondiscretionary categories. While RH has now reopened all its previously shuttered galleries, the retailer’s main threat is higher e-commerce adoption among affluent customers. If the prolonged crisis permanently changes the way a sizeable cohort of luxury consumers shop for furniture and home-furnishing goods, it would represent a tailwind from RH’s perspective, particularly if the retailer does not significantly step up its digital capabilities.

Home Depot

Although operating with reduced hours, Home Depot was able to keep its stores open through the lockdown phase as its business is considered essential.

In its second quarter, ended August 2, 2020, US comps grew 25% year over year. The retailer highlighted that results were driven by broad-based strength across stores and geographies in both the Pro and DIY segments. It added that both ticket and transactions registered double-digit growth in the quarter.

Home Depot specified that big-ticket categories such as appliances, riding lawnmowers and patio furniture recorded strong performance, but this was partly offset by weaker performance in certain indoor installation-heavy categories such as special order kitchens and countertops.

Home Depot stated that sales through its digital channel grew approximately 100% in the quarter, with customers choosing to pick up their orders at a store over 60% of the time.

Outlook

In its 4Q19 earnings call, Home Depot had provided fiscal-year 2020 guidance. However, the retailer reported in its 1Q20 earnings call on May 19 that it is suspending its guidance for fiscal 2020, given the uncertainty around the impact of Covid-19 on economic activity and customer demand going forward. Home Depot did clarify that this is more a reflection of the multiple potential outcomes for the economy and its business, rather than a reflection of the state of demand for home improvement. The company went on to highlight that its strategic investments have positioned it well and that it is in a strong financial position to withstand challenges.

In its 2Q20 earnings call on August 18, the retailer said that it remains focused on maintaining the momentum of its One Home Depot investment strategy that it expects will position it for sustained growth over the long term, while at the same time remaining nimble to navigate the demands of the current environment.

The retailer mentioned that although it remains committed to completing its strategic investments, it has decided to defer certain in-store investments, given the current complex operating environment and the priority around safety. It explained that some of the projects that it had originally planned to complete in fiscal 2020, will now be completed in fiscal 2021 instead.

Lowe’s

With the company having been considered an essential business through the Covid-19 shutdown, Lowe’s has fared considerably well and continues to be well positioned.

In its second quarter, ended July 31, 2020, Lowe’s comps grew 34.2%, driven by transaction growth of 22.6% and ticket growth of 11.6%, with strong repeat orders from both new and existing customers. US home-improvement comps grew 35.1%, driven by strong project demand from both DIY and Pro customers. The retailer highlighted that DIY comps outpaced Pro comps in 2Q20, due to strong consumer trends toward spending on home improvement.

Lowe’s added that there was broad-based growth across channels, product categories and geographies and a significant rise in total new Pro, DIY and millennial customers. Geographically, comps were 30% or more in all 15 regions for all three US divisions.

E-commerce sales grew 135% in 2Q20, with both Pro and DIY customers increasing their online shopping—resulting in online penetration rising to 8% of sales.

Outlook

Although Lowe’s first-quarter performance had been strong, the company decided to withdraw its full-year guidance for 2020 sales, operating income and earnings per share, owing to limited visibility into the future economic environment. The company did, however, express confidence regarding the future of its business and its ability to sustainably drive long-term shareholder value.

In its second-quarter earnings call on August 19, 2020, Lowe’s stated that it will reinvest in its business in the second half of the year, with a view to improving its product offering, simplifying its store environment and elevating its service offering. The company clarified that these investments would include store resets to “improve product adjacencies, bay productivity and sales per square feet.” Lowe’s is also enhancing its supply chain infrastructure and reconfirmed its update from early August that it plans to open 50 cross-dock delivery terminals, seven bulk distribution centers and four e-commerce fulfillment centers over 18 months. The retailer stated that investments into its stores and supply chain are aimed toward enabling it to become a world-class omnichannel retailer and to drive long-term sales growth, operating profitability and sustainable shareholder returns.

DIY-sector brands such as Lowe’s and Home Depot tend to perform well in a recessionary climate, as consumers become more inclined to fix what they currently own rather than buy new items.

Tractor Supply

Tractor Supply responded well to the coronavirus pandemic, and with its business being considered essential, the retailer has fared comparatively well.

The company expanded its same-day or next-day delivery services from all Tractor Supply stores—which it achieved by forming a new partnership in April with Atlanta-based delivery platform Roadie, which has a deep-rooted presence in rural America. Tractor Supply also began offering contactless curbside delivery for BOPIS (buy online, pick up in store) orders, contactless payment options and increased mobile point-of-sale services across the chain to provide a seamless checkout process for its customers.

In 2Q20, the company saw a 14% year-over-year increase in identifiable new customers—equating to around 3.3 million new customers. Tractor Supply highlighted that it is gaining new customers at the fastest ever rate in the company’s history. The retailer also managed to reactivate around 2 million lapsed customers, representing a rise of 42% year over year—a higher growth rate than ever before. Moreover, Tractor Supply stressed that customers are also becoming repeat customers at the fastest rate in the company’s history.

During the quarter, Tractor Supply added 5,000 new staff (mainly across its stores and distribution centers) to handle the increase in demand for its products. The company also launched curbside pickup, same-day delivery and next-day delivery, and relaunched its website during the quarter.

In 3Q20, ended September 26, 2020, comps increased by 26.8%, versus 2.9% growth in 3Q19, driven by robust demand for everyday merchandise, including consumable, usable and edible products, and strong growth in summer seasonal categories. Moreover, comp growth was strong across all geographic regions. Sales via the company’s e-commerce sales registered triple-digit-percentage growth.

Outlook

Tractor Supply’s CFO and Treasurer Kurt Batron said:

Looking forward, our view assumes no significant worsening of the pandemic or any dramatic reclosing of the economy. To date, we continue to see strong sales momentum in the business. We expect this momentum to continue, albeit at a lower level than the third quarter, as we forecast delivering strong sales and profitability for the fourth quarter.

We continue to believe it is always better to look at our business by the halves of the year. Due to the unique situation related to Covid-19, we are providing our view on the fourth quarter similar to how we did last quarter. Factors contributing to a heightened level of uncertainty include the duration and impact of shelter-in-place restrictions and social distancing measures, the potential for incremental government stimulus benefits, elevated unemployment levels and the November elections.

Additionally, the fourth quarter is sensitive to shifts in weather trends and seasonal holiday shopping patterns. With this backdrop, we would anticipate the strength in our comparable sales trends to moderate as we move through the fourth quarter.

The company provided guidance for 4Q20 as follows:

- Net sales in the range of $2.60–2.70 billion

- Comp growth in the range of 15–20%

- Net income in the range of $163–175 million

- EPS in the range of $1.37 to $1.47

Trend Analysis and Insights

E-Commerce Set To Capture a Larger Share of the Pie for the Long Haul

Over the years, e-commerce has been chipping away at the share of brick-and-mortar retail in the furniture and home-furnishing sector, much like for many other sectors. E-commerce accounted for

around 17% of US furniture and homeware sales in 2019, according to Statista estimates, and will have accounted for a higher proportion by the end of 2020. For home improvement, Coresight Research expects that e-commerce share of sales will grow from 4% of total sales in 2019 to a still modest 5.6% of total sales in 2020.

The extended impact of the coronavirus pandemic has accelerated this trend, and traditional retailers are looking to catch up with their digital-first counterparts in terms of digital capabilities, while online players are looking to solidify their core strength in digital operations.

Digital-First Retailers Are Well Positioned To Capitalize; Offline-Focused Retailers Investing and Enjoying Spurt in E-commerce Sales Growth

Digital-first retailers such as Wayfair were significant beneficiaries during the Covid-19 lockdowns, at the expense of brick-and-mortar-focused retailers, with consumers purchasing more online. Williams-Sonoma, whose business is primarily driven by e-commerce sales, also performed well. Some of the forced shift in consumer behavior toward digital purchases is expected to stick with a segment of the consumer base, which augurs well for digitally strong retailers.

Although brick-and-mortar-focused retailers have faced significant challenges in the changed environment, retailers including Home Depot, Lowe’s and Tractor Supply have all invested in their digital capabilities and realized triple-digit growth in their most recent quarter.

The Experience Economy’s Loss Is Home and Home Improvement’s Gain

With Covid-19 leading to consumers largely avoiding the experience economysports, events, concerts and travel—many are instead opting to invest in their homes. This has represented a tailwind for the home and home-improvement sector this year. While this may continue to some extent even in 2021, it will be offset by economic uncertainty, high unemployment levels and the fact that many intended purchases were drawn forward to this year.

Furniture-as-a-Service Startups Are Performing Well

One business model that appears to be flourishing during the pandemic is the “furniture-as-a-service” or

subscription model.

As a case in point, furniture-as-a-service company

Fernish has registered 300% growth in home-office orders between mid-March and mid-May, according to Forbes. It also saw 90% growth in accessories and decorative-item sales and 75% growth in rugs, pillows, vases and bowls, while lamp rentals grew 40%. On May 27, 2020, Fernish raised $15 million in a Series A funding round spearheaded by Khosla Ventures, Real Estate Technology Ventures and PLG Ventures, taking its total funding so far to $45 million.

New York-headquartered furniture rental startup

Feather has also seen a spike in demand, and the retailer has recently expanded its range of products under the “Home Office” category.

East Coast furniture rental startup

Conjure raised $9 million via a seed round in September and plans to invest the funding towards broadening its collection of home furniture and accessories, expanding its consumer base, hiring more designers and artists and widening its delivery beyond the greater New York City area. According to co-founder and CEO Daniel Ramirez, the company has seen more than 7.6 times revenue growth in the past two years and in March, it registered 3.8 times growth in monthly signups.

Outlook

We expect US consumer spending on furniture to increase by around 5.9% in 2020, and we see home-improvement retailers growing by low double digits to be the fastest-growing store-based nonfood retail sector this year.

The outlook for growth in 2021 is more uncertain. The home-improvement sector in particular will see demanding comparatives from a very strong 2020. Sector growth for both components of the home and home-improvement market is likely to prove volatile through the year as we lap lockdown and then the post-lockdown surge. Both sectors may be supported by virus-driven shifts, such as spending more time at home, but we expect the bulk of that demand to have been satisfied in 2020. This would leave these big-ticket sectors more dependent on the cyclical economic forces than they have been in 2020.

We expect that trends such as heightened real estate activity in second-home markets, a pronounced increase in families shifting to large suburban homes and the growing traction of homebuilding activities among consumers will augur well for the home and home-improvement sector in the short-to-medium term. But this will likely be tempered by growing economic uncertainty, high unemployment levels and low consumer sentiment if coronavirus cases continue to rise, as is the case currently. As such, the double-digit growth that the home-improvement sector enjoyed over the last few months looks unsustainable.

Operating in conditions that represent the new normal, digitally strong retailers continue to be in a favorable position for growth, while brick-and-mortar-dependant retailers are investing more toward enhancing their digital operations and becoming efficient omnichannel operators to keep up with competitors.

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Home-Improvement Retail: 2020

Home-improvement stores have spectacularly bucked the downturn. The double-digit year-over-year growth in each of the last five reported months (June to September) indicates how well the sector has fared overall following lockdowns. Although we expect year-over-year growth to continue for the last three months of the year, we expect a deceleration in the growth rate amid a decline in consumer confidence and more uncertainty in the face of a surge in coronavirus cases in the US.

Our forecast (growth deceleration) for the home-improvement sector also takes housing market trends into account, which are closely linked to the sector’s prospects. With housing inventory falling to record lows, mortgage lending standards tightening and rising unemployment, new and existing home sales are likely to slow down over the rest of this year, and home improvement will therefore also be impacted.

Furthermore, with some of the holiday spending having been drawn forward to October, spending growth in November and December will be comparatively tempered.

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Home-Improvement Retail: 2020

Home-improvement stores have spectacularly bucked the downturn. The double-digit year-over-year growth in each of the last five reported months (June to September) indicates how well the sector has fared overall following lockdowns. Although we expect year-over-year growth to continue for the last three months of the year, we expect a deceleration in the growth rate amid a decline in consumer confidence and more uncertainty in the face of a surge in coronavirus cases in the US.

Our forecast (growth deceleration) for the home-improvement sector also takes housing market trends into account, which are closely linked to the sector’s prospects. With housing inventory falling to record lows, mortgage lending standards tightening and rising unemployment, new and existing home sales are likely to slow down over the rest of this year, and home improvement will therefore also be impacted.

Furthermore, with some of the holiday spending having been drawn forward to October, spending growth in November and December will be comparatively tempered.

Source: US Census Bureau/Coresight Research[/caption]

Home-Improvement Retail: Outlook for 2021

With the strong showing in 2020, home-improvement retail sales in 2021 will be weighed against demanding comparatives, and we estimate a flat to low single-digit increase in total home-improvement retail sales in 2021 under an optimistic assumption of a moderate recovery in the US economy. As with furniture, growth is likely to prove variable through the course of 2021: In year-over-year terms, growth is likely to be more robust earlier in the year, when the sector will be annualizing more moderate growth rates from 2020.

We also attribute the forecast for the easing of sales growth in 2021 to many homeowners having brought forward planned home-improvement projects to this year. Assuming this exceptional, crisis-prompted demand falls away, the sector’s performance is likely to become more closely tied to traditional underlying economic forces.

Online real estate database firm Zillow recently improved its housing market forecasts for 2021, taking into account the strong sales in the summer months of 2020 amid increasingly short inventory and high demand, but said that economic uncertainty might temper these forecasts. It expects housing sales in 2021 to stay high but taper off through 2021, and we expect home-improvement sales trends to have a somewhat similar trajectory.

Drivers of demand in 2021 will include the following:

Source: US Census Bureau/Coresight Research[/caption]

Home-Improvement Retail: Outlook for 2021

With the strong showing in 2020, home-improvement retail sales in 2021 will be weighed against demanding comparatives, and we estimate a flat to low single-digit increase in total home-improvement retail sales in 2021 under an optimistic assumption of a moderate recovery in the US economy. As with furniture, growth is likely to prove variable through the course of 2021: In year-over-year terms, growth is likely to be more robust earlier in the year, when the sector will be annualizing more moderate growth rates from 2020.

We also attribute the forecast for the easing of sales growth in 2021 to many homeowners having brought forward planned home-improvement projects to this year. Assuming this exceptional, crisis-prompted demand falls away, the sector’s performance is likely to become more closely tied to traditional underlying economic forces.

Online real estate database firm Zillow recently improved its housing market forecasts for 2021, taking into account the strong sales in the summer months of 2020 amid increasingly short inventory and high demand, but said that economic uncertainty might temper these forecasts. It expects housing sales in 2021 to stay high but taper off through 2021, and we expect home-improvement sales trends to have a somewhat similar trajectory.

Drivers of demand in 2021 will include the following:

Source: US Census Bureau/Coresight Research[/caption]

Furniture and Home-Improvement Retail: Holiday 2020 (October to December)

Source: US Census Bureau/Coresight Research[/caption]

Furniture and Home-Improvement Retail: Holiday 2020 (October to December)

*Wayfair has a retail store in Natick, Massachusetts and an outlet store in Florence Kentucky, but total in-store sales from these outlets does not constitute a material proportion of total sales.

*Wayfair has a retail store in Natick, Massachusetts and an outlet store in Florence Kentucky, but total in-store sales from these outlets does not constitute a material proportion of total sales.