Nitheesh NH

Introduction

The crippling effect that the coronavirus pandemic continues to wreak on global discretionary retail is well documented, and the US is among several other economies to be severely impacted. This report outlines how the US home and home-improvement sector has been impacted by Covid-19 and presents an outlook for the rest of 2020. To analyze the sector, we look closely at selected US retailers—including Home Depot, Lowe’s, RH, Tractor Supply, Wayfair and Williams-Sonoma. Our coverage focuses on two key areas within home and home improvement that have had somewhat contrasting fortunes —furniture retail and home-improvement retail.How Has Home and Home Improvement Been Impacted by Covid-19?

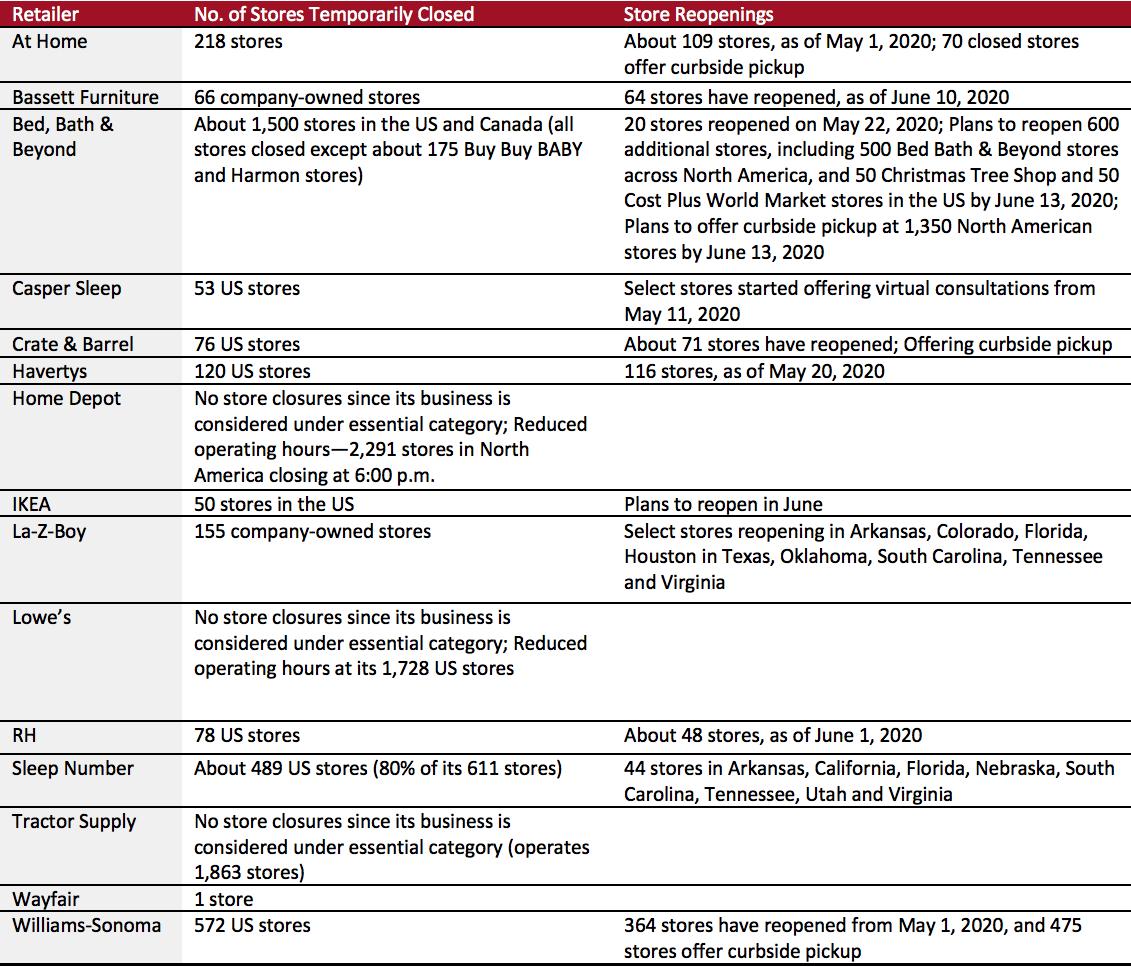

According to data from the Census Bureau, store-based furniture retail sales declined by 67% in April year over year, significantly steeper than the 19% decline in March. The sharp decline is primarily attributed to the enforced store closures amid the coronavirus lockdown in April. As a result of closed stores during the month, the furniture and home-furnishings sector registered total store sales of only $3.2 billion in April, according to the Census Bureau—which pales in comparison to the $9.4 billion that it registered in the same month last year. The sales decline in store-based furniture retail was second only to clothing and accessories stores, which declined 89.3% in April. It is noteworthy that store-based furniture retail still managed to recover almost one-third of last year’s sales in April, despite shuttered outlets. While overall consumer spending on furniture retail decreased during April, the spending that did continue was mainly through the e-commerce channel. Home-improvement retailers’ sales increased 7.2% in March and 1.2% in April. Although the spike in year-over-year sales growth in March subsided in April due to retailers taking measures to contain the spread of Covid-19, the home-improvement sector overall has benefitted from its essential business status and has largely been able to avoid the struggle faced by other sectors. The performance of the home-improvement sector during lockdown provides some optimism for the outlook of discretionary retail in the US: This resilience hints at a discretionary recovery that may be stronger than previously predicted. Store Closures Like many other discretionary sectors, various furniture and home-furnishing retailers were forced to close their stores temporarily during the lockdown phase in the US. Altough many of these stores have now begun to reopen as US states ease their restrictions, some retailers have announced the permanent closure of some or all of their stores, which we outline below. Pier 1 Imports filed for bankruptcy in February but did not disclose details on plans to close stores. After the pandemic started wreaking havoc, the retailer announced in May that it will close all 541 stores and sell its inventory, intellectual property and e-commerce business under a court-supervised process. Art Van Furniture filed for Chapter 11 bankruptcy in March owing to pre-existing problems, and the retailer announced that it intended to sell approximately 44 stores and two distribution centers operating under Levin and Wolf banners, as well as closing its remaining 125 store locations through a going-out-of-business sale process. However, Art Van Furniture then converted its Chapter 11 bankruptcy to Chapter 7 in April as the debilitating impact of the coronavirus kicked in. The retailer was forced to close all 169 stores, halting the store-closing sales while the going-concern sale of the company was terminated. Kitchenware chain Sur La Table is reportedly preparing to file for bankruptcy protection, according to a Bloomberg report in May. The chain, which is owned by investment firm Investcorp, is also pursuing a sale of its business. Sur La Table currently operates 125 stores, but if it files for bankruptcy, we may well see the retailer close most of these stores, if not all. Overall in the furniture and home-furnishing category, we expect that there will be between 2,500 and 3,000 permanent store closures this year.Sector Outlook

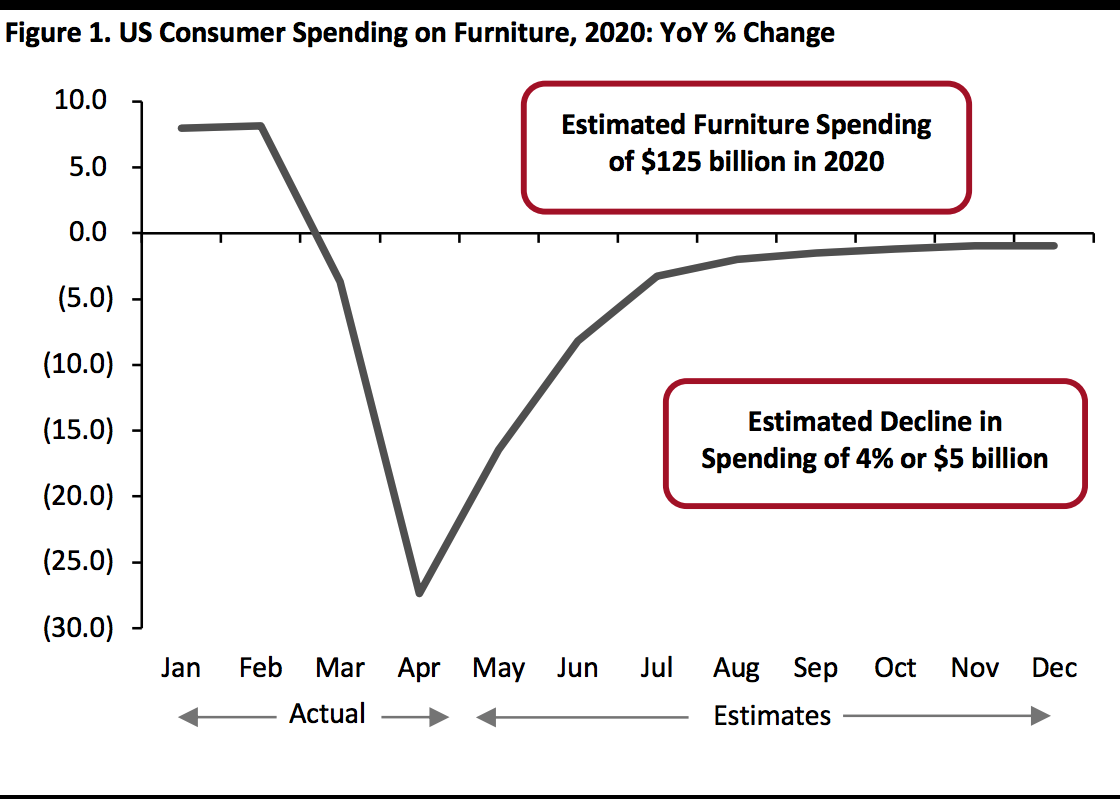

What the Rest of 2020 Will Look Like Furniture Retail In the months of March and April, consumer spending on furniture declined, owing primarily to shuttered stores during coronavirus-led lockdowns. The spending that did continue in these months was largely through e-commerce. With stores having started to reopen from May, we can expect to see a revival—and we expect that the recovery will be helped somewhat by pent-up consumer demand. Our estimates suggest an initial V-shaped recovery, with the majority of the lockdown-driven decline recouped in the months following April, and with furniture spending recovering more modestly thereafter (see Figure 1).- For 2020 overall, we estimate consumer spending on furniture to fall by approximately 4%, or around $5 billion, to $125 billion (including sales taxes). This reflects spending through all channels, including lockdown-resilient, higher-growth e-commerce.

- Furniture and home-furnishings specialist retailers will underpace this total: For 2020, we estimate that this sector will see an approximate 13% fall in sales to just under $103 billion (excluding sales tax).

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Home-Improvement Retail

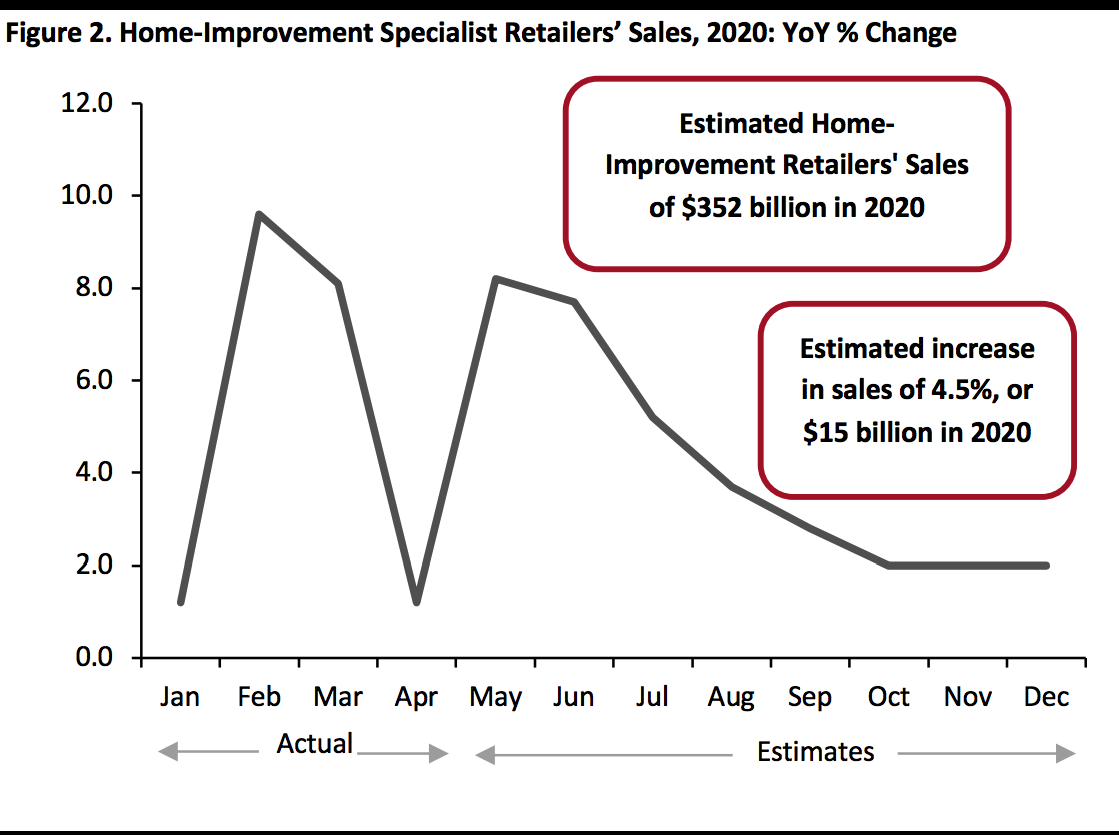

Home-improvement stores have bucked the downturn. In March, retail sales in the sector increased 8.1% year over year, according to the US Census Bureau. In April, this softened to 1.2%—but this was in the context of a universal lockdown. April saw retailers such as Home Depot take measures to limit the number of customers in their stores and cancel major sales events to restrict the spread of the virus. For May, Coresight Research estimates that sector sales will have climbed by approximately 8% year over year.

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Home-Improvement Retail

Home-improvement stores have bucked the downturn. In March, retail sales in the sector increased 8.1% year over year, according to the US Census Bureau. In April, this softened to 1.2%—but this was in the context of a universal lockdown. April saw retailers such as Home Depot take measures to limit the number of customers in their stores and cancel major sales events to restrict the spread of the virus. For May, Coresight Research estimates that sector sales will have climbed by approximately 8% year over year.

- For 2020 overall, we estimate sales by home-improvement specialist retailers to rise by approximately 4.5%, or around $15 billion, to $352 billion (excluding sales taxes).

- Our estimates see the home-improvement retail sector being the top-performing store-based nonfood sector in 2020.

Source: US Census Bureau/Coresight Research[/caption]

March to May

The period between mid-March and the end of April saw widespread discretionary retail shutdowns in the US, but retailers began cautiously reopening stores from May.

[caption id="attachment_111257" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

March to May

The period between mid-March and the end of April saw widespread discretionary retail shutdowns in the US, but retailers began cautiously reopening stores from May.

[caption id="attachment_111257" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

June to September

After an initial sharp uptick as stores reopen, the June-to-September period will see a more gradual recovery for furniture retail as consumer spending picks up and shoppers become more comfortable with going back to the offline channel. Retailers will look to open most, if not all, of their stores.

As physical retail tries to revive its operations, we can expect many retailers to invest in their stores to provide additional safety measures for employees and customers: Social distancing practices, protective equipment, temperature checks, sanitation and disinfection of premises will comprise a regular part of operations. Retailers will also look to regulate the maximum number of customers allowed in a store at any one time.

E-commerce will continue to be popular among consumers who are cautious about venturing outside. Overall, sales will pick up, but we estimate year-over-year growth in each month during this period will likely stay negative.

Home-improvement retail will continue to see growth during this period, but we model a steady easing of growth for the period after a post-lockdown spring/summer peak. This sector is heavily impacted by external macro forces—the number of housing transactions (because people renovate when they move), rising house prices (which creates a wealth effect that flows through to spending on the home) and consumers' personal financial circumstances, including wage growth and perceptions of job security. The housing market outlook remains uncertain and sector growth has been trending above its recent historical average, so we assume a softening of growth after the summer peak.

October to December

This period is likely to see a further revival in spending and retail sales in furniture retail, and we estimate spending will be close to flat, year over year, toward the end of 2020—although a more optimistic scenario could see positive growth return in 2020. As a big-ticket home category, the furniture market is impacted by the housing market and consumers' personal financial circumstances. The prospects for these look somewhat uncertain, and this feeds into our assumptions. By the tail end of the year, consumers will likely be more confident about shopping offline.

Protective measures for customers and employees will remain in focus, and the new operational practices will become ingrained in the wider industry as the new normal. Operating costs will go up to this end, and retailers will look closely at other areas to cut costs with a view to remaining profitable.

We estimate that home-improvement retail growth will ease further during the holiday period—but we expect that it will continue to see growth both in November and December compared to last year. We noted above the reasoning for a softening of recent strong growth rates through 2020.

Source: Company reports/Coresight Research[/caption]

June to September

After an initial sharp uptick as stores reopen, the June-to-September period will see a more gradual recovery for furniture retail as consumer spending picks up and shoppers become more comfortable with going back to the offline channel. Retailers will look to open most, if not all, of their stores.

As physical retail tries to revive its operations, we can expect many retailers to invest in their stores to provide additional safety measures for employees and customers: Social distancing practices, protective equipment, temperature checks, sanitation and disinfection of premises will comprise a regular part of operations. Retailers will also look to regulate the maximum number of customers allowed in a store at any one time.

E-commerce will continue to be popular among consumers who are cautious about venturing outside. Overall, sales will pick up, but we estimate year-over-year growth in each month during this period will likely stay negative.

Home-improvement retail will continue to see growth during this period, but we model a steady easing of growth for the period after a post-lockdown spring/summer peak. This sector is heavily impacted by external macro forces—the number of housing transactions (because people renovate when they move), rising house prices (which creates a wealth effect that flows through to spending on the home) and consumers' personal financial circumstances, including wage growth and perceptions of job security. The housing market outlook remains uncertain and sector growth has been trending above its recent historical average, so we assume a softening of growth after the summer peak.

October to December

This period is likely to see a further revival in spending and retail sales in furniture retail, and we estimate spending will be close to flat, year over year, toward the end of 2020—although a more optimistic scenario could see positive growth return in 2020. As a big-ticket home category, the furniture market is impacted by the housing market and consumers' personal financial circumstances. The prospects for these look somewhat uncertain, and this feeds into our assumptions. By the tail end of the year, consumers will likely be more confident about shopping offline.

Protective measures for customers and employees will remain in focus, and the new operational practices will become ingrained in the wider industry as the new normal. Operating costs will go up to this end, and retailers will look closely at other areas to cut costs with a view to remaining profitable.

We estimate that home-improvement retail growth will ease further during the holiday period—but we expect that it will continue to see growth both in November and December compared to last year. We noted above the reasoning for a softening of recent strong growth rates through 2020.

Company Overview

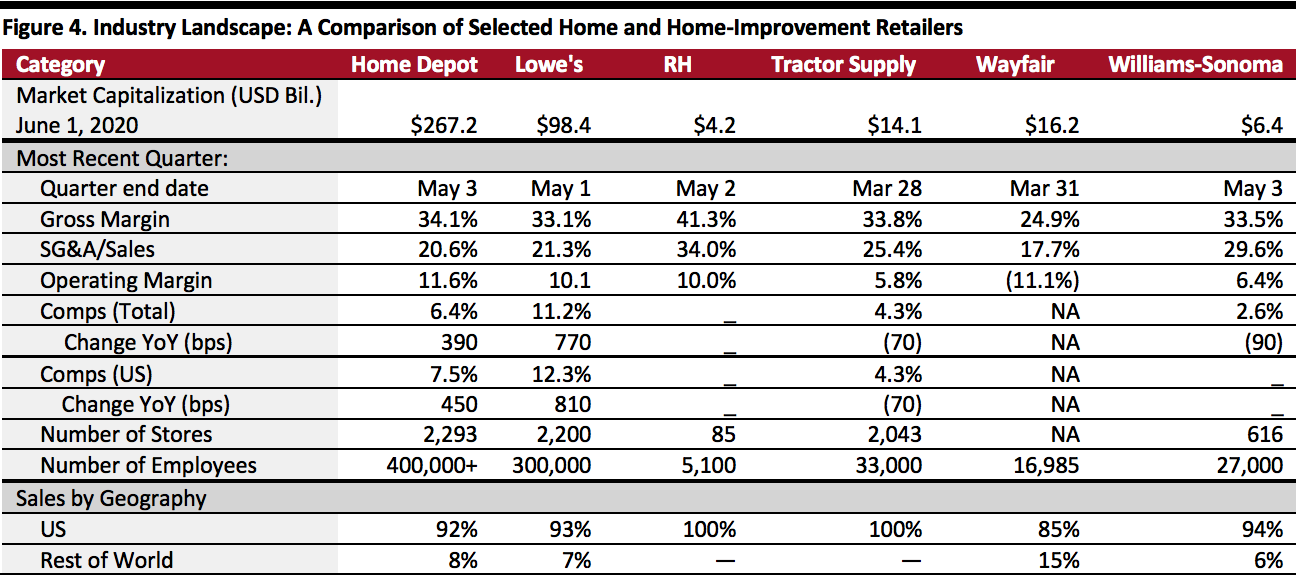

In this section, we take a closer look at some of the key players in the home and home-improvement sector and how they have responded to the Covid-19 crisis. Wayfair Digital-first furniture and home-goods retailer Wayfair is among the discretionary retail companies that seem to be benefitting from the crisis. The company reported that its revenue growth at the beginning of March was just below 20%, in line with trends in January and February, but toward the end of the month, sales growth doubled and momentum continued into April. Direct retail net revenue experienced a 20.3% year-over-year increase, to hit $2.3 billion, while US net revenue grew by 19.1% year over year. Both traffic and conversion picked up from mid-March, with strong repeat custom as well as an acceleration in new customer orders. Wayfair stated that demand for its offerings spiked as consumers looked to set up their home offices and decorate their homes as they spent more time indoors under lockdown restrictions. On May 5, 2020, Wayfair reported that in the second quarter to date, its year-over-year gross revenue growth was trending at around 90%, which equates to more than $800 million added on a constant-currency basis year over year. The retailer added that the momentum was widespread through more or less all categories. Outlook Wayfair did not provide specific guidance ranges for its second quarter, but on the back of its solid performance in the first quarter, we expect the company to perform strongly through the rest of the year—with the current environment proving to be conducive towards growth. With e-commerce in the furniture sector gaining acceptance among consumers, Wayfair is set to capitalize and belives that there are clearly defined long-term advantages accruing to it during the current period. Williams-Sonoma Williams-Sonoma’s e-commerce operations constitute around 56% of its total revenues, which holds it in good stead amid today’s challenging environment for store sales. Although the retailer had to close all its stores in the US and Canada, its e-commerce sites, distribution centers and customer-care centers stayed open. Williams-Sonoma also offered curbside pickup and ship-from-stores services, following local regulatory guidelines. According to a recent report published by creative agency Digital Silk, Williams-Sonoma ranked fourth among the eleven best-performing e-commerce sites across sectors during the Covid-19 crisis. The agency considered various parameters including sales, digital traffic and customer retention in evaluating the best performers. IKEA was the only other company under the home and home-improvement sector to feature in the list. WIlliams-Sonoma expressed satisfaction with having reported overall comp growth of 2.6% in the first quarter of 2020, despite all 616 stores being shuttered for over half of the quarter. DTC comps grew 31.2%, capitalizing on the surge in online demand. Brandwise, Williams-Sonoma reported comp growth of 5.4% despite having the largest store base, whereas Pottery Barn Children's Home Furnishings business registered comp growth of 8.5%. West Elm's comps grew 3.3%, and although Pottery Barn recorded a comp decline of 1.1%, its e-commerce business accelerated significantly, leading to a positive comp in the second quarter to date (May 28, 2020). Within the Williams-Sonoma brand, there was significant growth across nearly all categories—with electrics, cookware, food and houseware being particularly strong. Outlook Williams-Sonoma did not provide full-year guidance given the uncertainy around future economic activity, but the retailer gave an update on the second quarter to date, stating that it continues to see strong trends in e-commerce acceleration across all of its brands. The retailer said that its multibrand, multichannel model with a strong e-commerce presence positions it well for the future. Williams-Sonoma added that it will continue to invest in strengthening its digital-first model and will also prioritize cross-brand initiatives and growing its West Elm brand. Home Depot Although operating with reduced hours, Home Depot was able to keep its stores open through the lockdown phase as its business is considered essential. Home Depot introduced various operational changes beginning mid-March in order to offer a safe environment for associates and customers. Store hours were adjusted to give more time to associates for proper cleaning, sanitization and restocking of shelves. Store traffic was restricted to maintain social distancing protocols. The retailer also decided to cancel its annual Spring Black Friday event. Total comps grew by 6.4% in the first quarter of 2020, versus 2.5% in the first quarter last year, and US comps grew by 7.5% versus 3% in the first quarter of 2019. E-commerce sales grew 80% in the quarter, with customers opting to pick up their online orders at a store more than 60% of the time. Home Depot expanded its curbside-pickup capabilities during the quarter, giving customers an additional outlet for fulfillment. Home Depot reported that in the three-week period between late March and early April, it saw double-digit negative comp growth as a result of measures to curb store traffic—with higher-volume stores underperforming lower-volume stores by more than 30 percentage points in some areas. According to data from analytics firm Placer.ai, Home Depot’s traffic declined 0.5% in the first quarter of 2020 versus the same period last year. However, as customers turned to repairs and home-improvement projects, the last three weeks of April and the first two weeks of the second quarter saw a significant acceleration to double-digit comp growth, driven by strong performance across most stores. Outlook In its fourth-quarter 2019 earnings call, Home Depot had provided fiscal-year 2020 guidance, and the company recently stated that its year-to-date performance has exceeded initial expectations. However, the retailer reported in its first-quarter 2020 earnings call that it is suspending its guidance for fiscal year 2020, given the uncertainty around the impact of Covid-19 on economic activity and customer demand going forward. Home Depot did clarify that this is more a reflection of the multiple potential outcomes for the economy and its business rather than a reflection of the state of demand for home improvement. The company went on to highlight that its strategic investments have positioned it well and that it is in a strong financial position to withstand challenges. Lowe’s With the company having been considered an essential business through the Covid-19 shutdown, Lowe’s has fared considerably better than some of its competitors. The company saw sales grow 11.3% year over year in the first quarter of 2020, while comps grew 11.2% vesus 3.5% in the first quarter last year. Comps for the retailer’s US home-improvement business grew 12.3% versus 4.2% in the first quarter of 2019, with strong performance in both its DIY and Pro segments. DIY comp outpaced Pro comp slightly, driven by the arrival of spring weather in many western and southern regions, along with increased interest among consumers in home-improvement projects. Lowe’s estimates that coronavirus-related sales accounted for 850 basis points in total comp growth: 700 basis points attributed to the acceleration of projects among DIY customers; 80 basis points of cleaning product sales; and 70 basis points of refrigerator and freezer sales. Total e-commerce sales grew 80%, with the growth rate for online sales among Pro customers being even stronger. Online penetration grew to 8% of total sales. All 15 geographic regions and three US divisions saw broad-based growth to positive comps. Placer.ai data reveals that traffic in Lowe’s stores grew 9.1% year over year in the first quarter of 2020, and with May proving to be a strong month for the retailer historically, its strong performance looks set to continue. With Home Depot’s traffic showing a marginal decline during the same period, Lowe’s has outperformed its larger rival on this front. Responding to the coronavirus crisis, Lowe’s created a cross-functional Covid-19 task force, opened a company-wide command center and reprioritized its first-quarter objectives. At a time of high unemployment across retail sectors, Lowe’s hired more than 100,000 store associates for the spring season. Outlook Although Lowe’s first-quarter performance has been strong, the company decided to withdraw its full-year guidance for 2020 sales, operating income and earnings per share, owing to limited visibility into the future economic environment. The company did express confidence regarding the future of its business and its ability to sustainably drive long-term shareholder value. DIY-sector brands such as Lowe’s and Home Depot tend to perform well in a recessionary climate, as consumers become more inclined to fix what they currently own rather than buy new items. Tractor Supply Tractor Supply responded well to the coronavirus pandemic, and given its business is considered essential, the retailer has fared comparatively well. The company anticipated the challenges that the crisis would cause and took necessary measures to deal with it. Tractor Supply reorganized its shopping logistics and expanded its delivery services. The company expanded its same-day or next-day delivery services from all Tractor Supply stores—which it achieved by forming a new partnership in April with Atlanta-based delivery platform Roadie, which has a deep-rooted presence in rural America. Tractor Supply also began offering contactless curbside delivery for BOPIS (buy online, pick up in store) orders, contactless payment options and increased mobile point-of-sale services across the chain to provide a seamless checkout process for its customers. Tractor Supply’s comps grew 4.3% in the first quarter of 2020 versus 5% in the same period last year. Although it did not disclose specific numbers, the retailer stated that its digital orders have increased in recent weeks and that around 80% of these are either delivered or picked up curbside. Orders that are delivered are close to three times the average ticket. The company highlighted that demand has been stable through the first quarter and that it has seen sustained and elevated comps through more or less every day of the eight weeks. Hiring In May, Tractor Supply announced plans to hire over 5,000 full- and part-time staff across its store fleet of eight distribution centers and 1,863 stores in 49 states. Outlook After initially announcing in its first-quarter earnings call a decision to withdraw guidance, Tractor Supply reversed this decision in late May in a separate announcement and provided guidance for its second quarter of 2020 as follows:- Net sales growth of 24–29%

- Comp growth of 20–25% (versus 3.2% in the second quarter of 2019)

- Diluted EPS of between $2.45 and $2.65

Note: RH earnings are for the fourth quarter 2019, as it is yet to report first-quarter earnings. Sales by geography as of latest completed financial year. Tractor Supply store count includes 1,863 Tractor Supply and 180 Petsense stores.

Note: RH earnings are for the fourth quarter 2019, as it is yet to report first-quarter earnings. Sales by geography as of latest completed financial year. Tractor Supply store count includes 1,863 Tractor Supply and 180 Petsense stores.Source: Company reports/S&P Capital IQ/Coresight Research[/caption]