DIpil Das

Introduction

What’s the Story?

We offer our early thoughts on 2022’s holiday-season trading in US retail, to help retailers, suppliers and vendors plan for the peak season. We focus largely on consumer demand, but include discussion of input costs and holiday hiring.

Why It Matters

US retail generated $1.25 trillion in sales in the 2021 holiday quarter, representing a very strong 12.6% uplift on the prior year. Retailers, brands and suppliers are heading toward a 2022 holiday season marked by uncertainty and challenges. Reflecting this, major retailers such as Best Buy and Walmart have been updating guidance for the current fiscal year—typically for lower margins and/or lower sales.

US Holiday Retail 2022 Early Thoughts: Coresight Research Analysis

1. Inflationary Pressures Should Ease for Consumers and Retailers

We anticipate a welcome easing of input cost pressures, overall inflation in consumer prices and retail-specific inflation by the holiday peak. These should reduce the pressures on retailer margins and alleviate the stresses on consumers’ wallets. Inflation is currently the number-one pressure bearing down on discretionary retail demand, with the US Consumer Price Index (CPI) standing at 9.1% in June 2022 (latest) versus 8.6% in May, according to the US Bureau of Labor Statistics (BLS).

Coresight Research’s estimated measure of retail-only inflation stood at 7.6% in June and has proved variable in recent months. We expect soft demand in discretionary retail to apply downward pressure to this metric; meanwhile, gas prices are unwinding and shipping costs are falling back, easing input cost pressures. Labor cost pressures, however, look set to prove persistent given wage uplifts cannot be dialed back and there is a lack of slack in the labor market (more on hiring later in this report).

On a year-over-year basis, the percentage change in CPI in the second half of the year will be dampened by the more demanding comparatives of late-2021, when inflation began creeping up. Assuming a flow-through to consumer prices of depressing forces, inferred retail-specific inflation could be down by 100 bps (basis points) or greater by the final quarter.

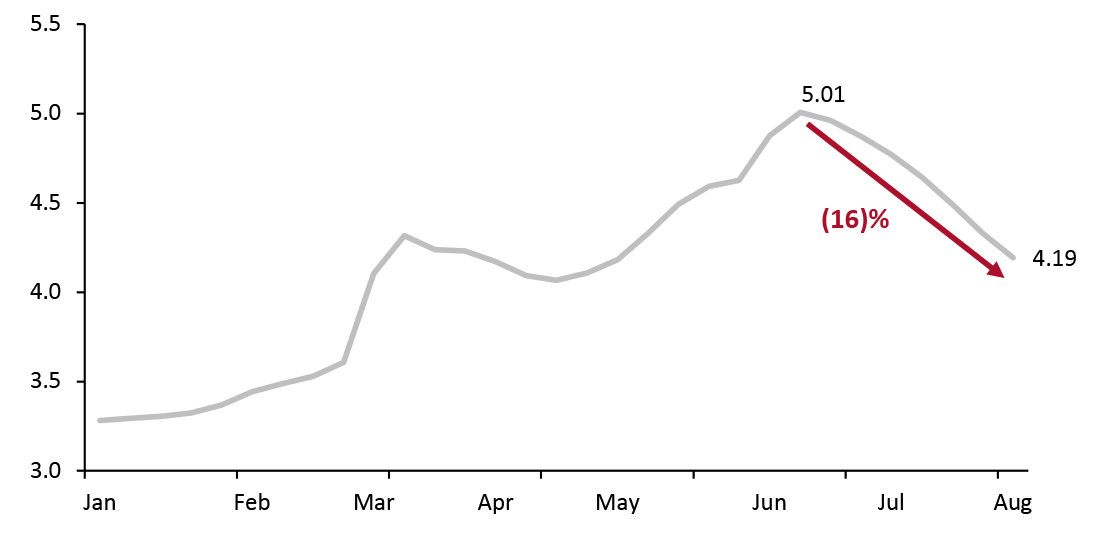

US gasoline prices peaked in June and have been on a consistent downward path since then, per the US Energy Information Administration (EIA). As of August 1, 2022, we have seen seven weeks of sequential declines, taking gas prices down by around 16% (see Figure 1). This trend will reduce a meaningful cost pressure for retailers and suppliers.

Figure 1. Weekly US Gasoline Prices, Regular All Formations, 2022 (USD) [caption id="attachment_153191" align="aligncenter" width="701"]

Through August 1, 2022

Through August 1, 2022 Source: EIA [/caption]

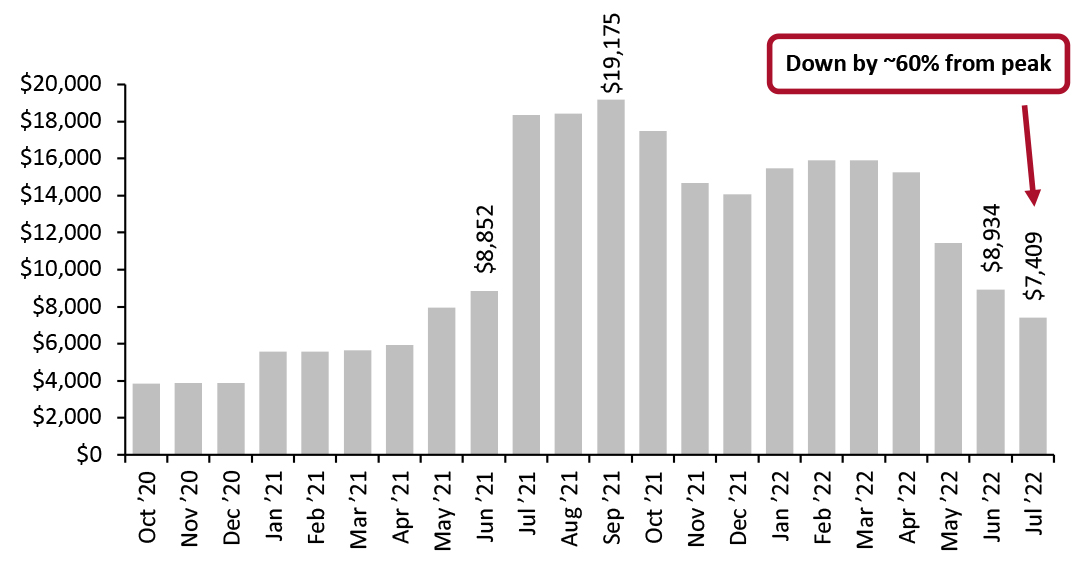

China-US freight rates are falling and are already down by around 60% from their late-2021 peak, based on data from shipping platform Freightos. While still high in relative terms, this unwinding will flow into easing year-over-year changes in retailers’ costs.

Figure 2. China/Eastern Asia to North American West Coast: Average Weekly Freight Rate per 40-Foot Container (USD) [caption id="attachment_153192" align="aligncenter" width="700"]

Freight rates are an average of the five business days of the last full week in each month, except for July 2022

Freight rates are an average of the five business days of the last full week in each month, except for July 2022 Source: Freightos [/caption]

2. Volumes Decline in Retail

Elevated inflation has been concealing real declines in US retail for some time. In recent months, we have been pointing to the volume declines implied by the combination of our retail-specific inflation estimate and the Census Bureau’s reported total sales growth (which is reported in nominal terms). Especially given the strength of demand last year, we currently expect real total retail declines to continue into the holiday season.

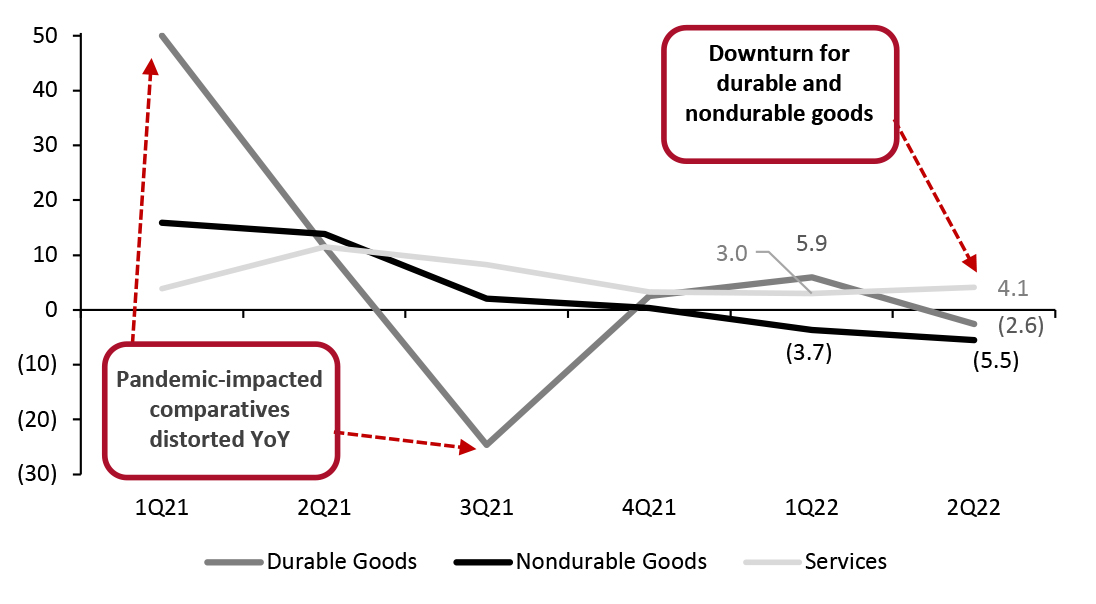

The US Bureau of Economic Analysis (BEA) confirmed real cuts in consumer spending on goods in its second-quarter GDP release: as shown below, consumers cut their purchases of durable goods by 2.6% and nondurable goods by 5.5% in the second quarter of 2022.

· The BEA reported that declines in durable goods were led by recreational goods and vehicles (Coresight Research’s measure of retail sales excludes automobiles), and furnishings and durable household equipment. Food and beverages led the declines in nondurable goods in the second quarter.

· Meanwhile, real growth in consumer spending on services strengthen, to 4.1%. Partially reflecting a “summer of experiences”, this was led by food service and accommodation, healthcare (admittedly less experiential) and “other”—in turn, that last category was led by international travel.

Figure 3. US Real Consumer Spending by Overall Category (YoY % Change) [caption id="attachment_153193" align="aligncenter" width="700"]

Source: BEA[/caption]

Source: BEA[/caption]

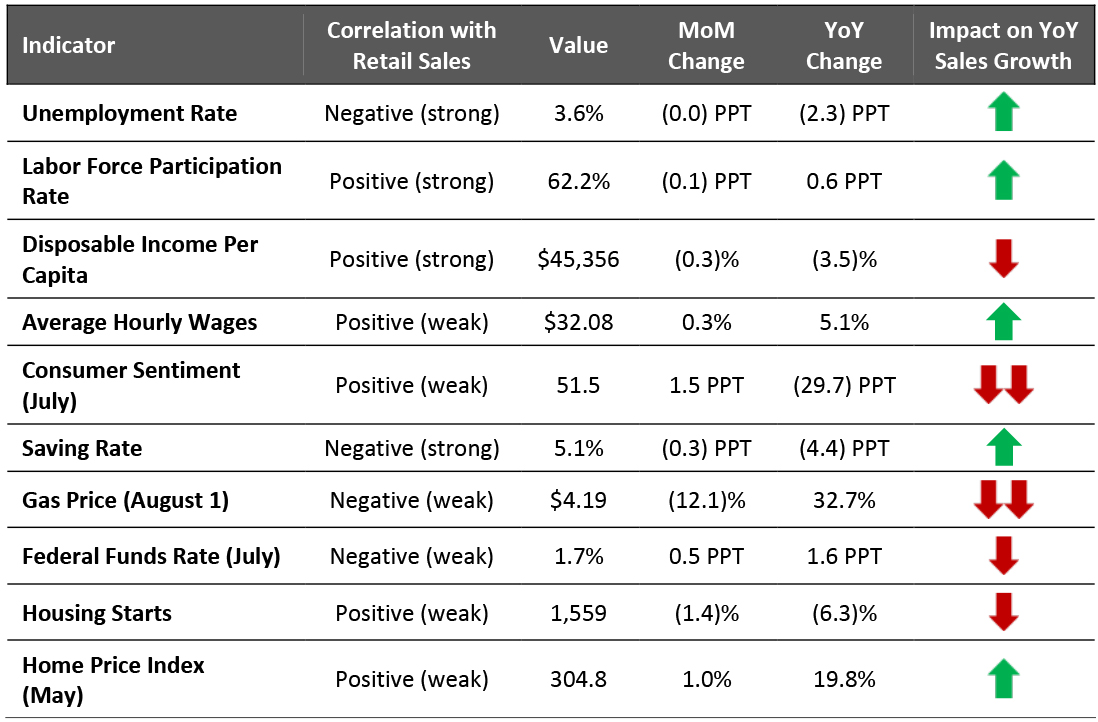

As of early August, five of the 10 indicators we examine each month in our Leading Indicators of Retail Sales report are likely to positively impact retail sales, on a year-over-year basis, in the coming months. In addition, we are seeing positive sequential (month-over-month) trends in consumer sentiment, the saving rate and gas prices.

In June, the unemployment rate remained near a half-century low. Average hourly wage growth remains historically high at around 5%, although it is not keeping pace with inflation. As of early July, consumer sentiment has marginally improved from a record-low June reading due to gas prices retreating.

Figure 4. US: Leading Indicators of Retail Sales as of August 2, 2022 [caption id="attachment_153194" align="aligncenter" width="700"]

Latest available data from June unless otherwise indicated

Latest available data from June unless otherwise indicated Source: BEA/BLS/Federal Reserve Board of Governors/S&P/University of Michigan/US Energy Information Administration/Coresight Research [/caption]

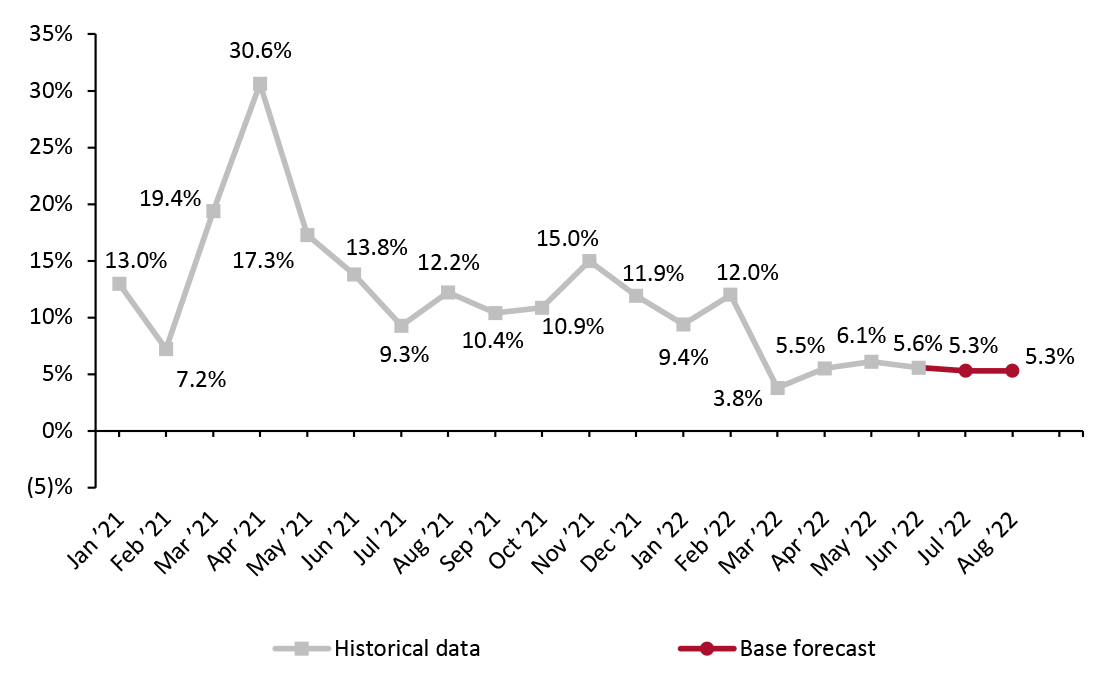

Coresight Research’s predictive model analyzes correlations between retail sales and selected macroeconomic indicators. Our most recent two-month outlook projects nominal retail sales growth to remain in the mid-single digits for July (still to be reported) and August, with sales growing 5.3% from a year earlier. Continued elevated inflation (even if following a moderating trend) is likely to mean these nominal growth rates translate into negative real growth in total retail sales.

Figure 5. US Retail Sales ex. Auto and Gas (YoY % Change) [caption id="attachment_153195" align="aligncenter" width="700"]

Projection as of July 20

Projection as of July 20 Source: US Census Bureau/Coresight Research [/caption]

3. Inventory in Abundance Compared to Last Year

Fears of further supply chain snarl-ups have prompted a number of retailers and brands to bring in inventory earlier. In the toy industry, management at Mattel recently pointed to “an earlier seasonal inventory build… to reduce supply chain risk.” Rival Hasbro has similarly brought in inventory early “to avoid the out-of-stock positions of last year’s holiday season.”

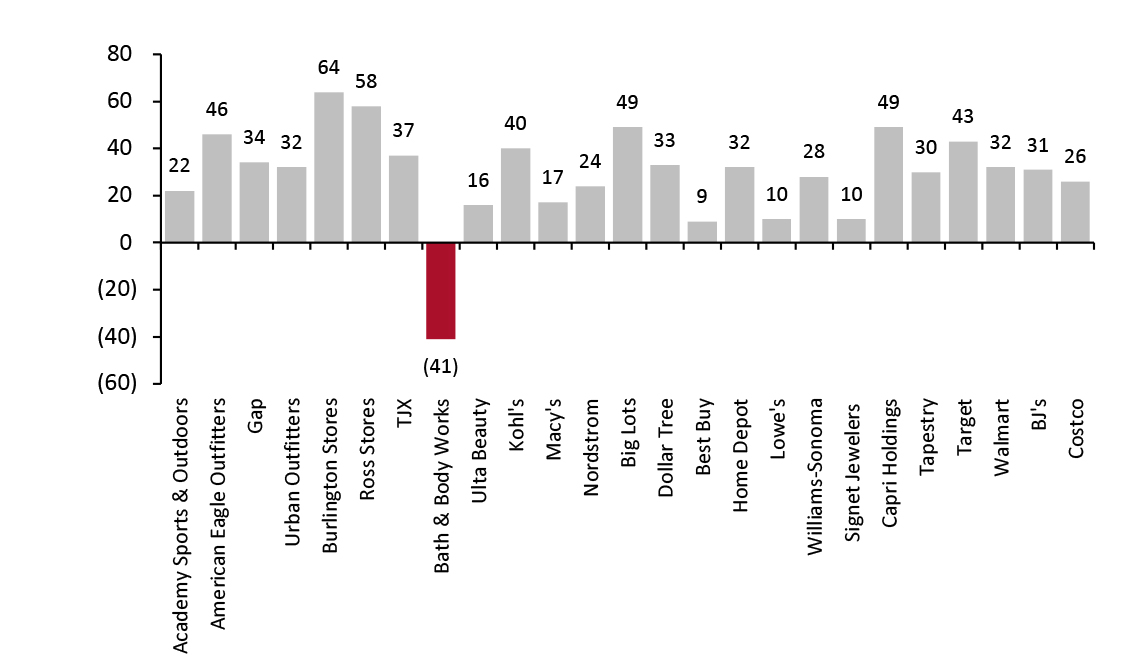

Amid softer discretionary demand and extended inventory lead times (to ensure adequate supply), and annualizing supply chain challenges from last year, all but one of the companies covered in our Inventory Tracker exited the first quarter with inventories up compared to one year earlier, and all but one of those saw double-digit percentage increases. We suspect that some retailers will have overordered to offset supply chain hold-ups, and that the challenges this year are likely to be more on the demand side than the supply side.

Figure 3. Latest-Quarter Inventory Values of Covered US Retailers: YoY % Change [caption id="attachment_153196" align="aligncenter" width="701"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

4. Five Wildcards To Watch Out For

Trickle-up caution: Luxury demand has been strong, and may continue to prove so into the holiday peak. Buying luxury is among the most experiential product purchases, which may support demand. However, we also point to the risk of a “trickle up” effect, whereby inflation fatigue and weak macroeconomic indicators prompt increased caution among higher-income groups, bringing with it the kind of contractions recently seen among modest-income consumers. Recent confirmation of two consecutive quarters of economic contraction and the consequent prospect of a recession could shock some consumers into behavior changes. Our latest temperature check of consumers and inflation confirmed that higher-income consumers seek out deals and cut coupons when shopping for essentials (such as grocery) and nonessentials. Retailers tapping this more affluent segment should cater to that demand with selective deals, in a way that does not undermine pricing integrity over the long term. And, those retailers should stand ready to any softening of demand with an acceleration in promotional or gifting activity.

Redirection of spend: Maybe not such a wildcard as a more-likely sustained threat to retailers is any continued prioritization of experiences among consumers. For many consumers, this winter is likely to provide the most restriction-free holiday season in three years. They look set to be freer to attend parties (including corporate parties), travel to meet loved ones, dine out more extensively. As exhibited by the BEA’s real consumer spending data charted earlier, consumers are upping their spend on services while cutting back on goods. The summer of experiences could end up stretching into a winter of experiences, to the detriment of retail purchases.

Covid surge: The potential counterpoint to a winter of experiences is a further wave of serious Covid-19 infections. However, given the apparently increasing mildness of symptoms of the most recent waves, any subsequent wave could result in relatively limited disruption to overall consumer behaviors.

Global jitters: Political tensions on the global stage could easily ramp up or (maybe not so easily) dial down. US-China tensions could increase on the issue of Taiwan, and any military incursion into Taiwan by China would raise a serious dilemma for international brands and retailers—do they respond as they did to Russia’s invasion of Ukraine, which saw most Western firms quit Russia, or do they look away out of financial expediency? Even without any reactive moves by brands and retailers, an escalation would intensify economic challenges and hit stock markets, dampening the wealth effect among invested consumers, who will disproportionately be more affluent consumers. While it is possible that we could see a cessation of the Russia-Ukraine conflict by or in the holiday season, this looks unlikely and in any case that may arise too late to have a meaningful impact during the holiday season, such as with decreased inflationary pressures.

Labor shifts: Amid very strong consumer demand, 2021’s holiday season was a strong one for holiday hiring in the retail and fulfillment sectors. Coresight Research tracked plans to hire almost 1 million (999,400) seasonal workers (although in a tight labor market, those plans may not have been fulfilled), up from 647,474 one year earlier. Last year, hiring was solid in e-commerce. This year, we are seeing much weaker top-line performances at e-commerce players—including Amazon, where first-party online sales were flat (at constant currency) in its latest quarter. This is likely to flow through to slower expansion or pockets of decline in e-commerce-related hiring this year. At the same time, those retailers looking to fill roles are likely to be hiring in a still-strong labor market, making it another challenging year for seasonal recruitment and likely ramping up the costs of attracting workers to retail.

What We Think

At an aggregate level, we see more potential negatives than possible positives for the trajectory of retail this holiday season—and, in contrast to 2021, we see those negatives lying much more on the demand side than the supply side.

The most positive prospect is decelerating inflation, which looks probable given gas and shipping costs, and the comparatives from one year earlier. Even with a moderation, however, inflation is likely to be higher than is comfortable for many consumers, and we expect shoppers to continue to reduce in their total purchase volumes in retail.

Big-ticket categories—such as electronics and home goods—which proved popular during the pandemic’s peak, look most vulnerable to cutbacks. Clothing and footwear, which had a very strong 2021, is likely to see pockets of meaningful weakness, too—although a likely increased level of holiday socializing will provide some support.