Projecting Holiday Sales Growth of 4%

Despite a substantial number of announcements of US store closures this year, 2018 is shaping up to be a bumper year for US retail with the sector growing very strongly, per the US Census Bureau, and with even long-struggling legacy retailers turning in better-than-expected top-line figures.

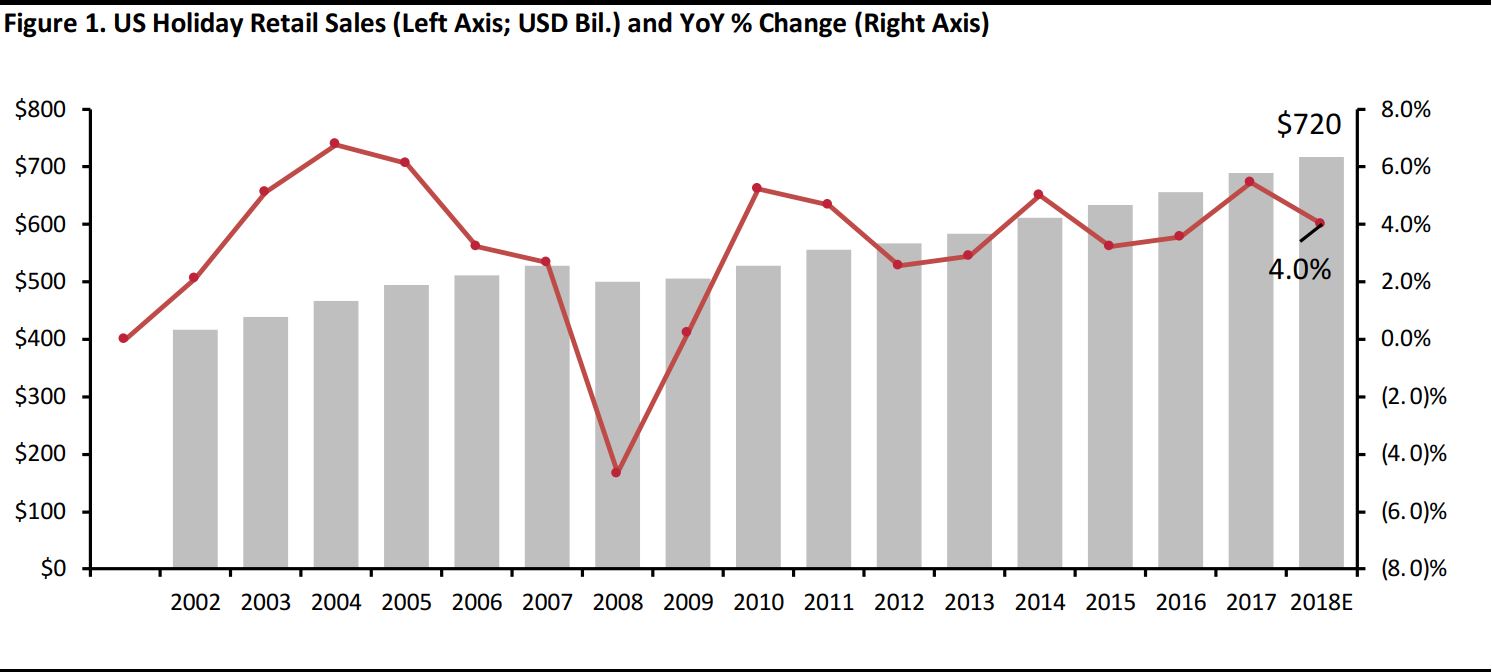

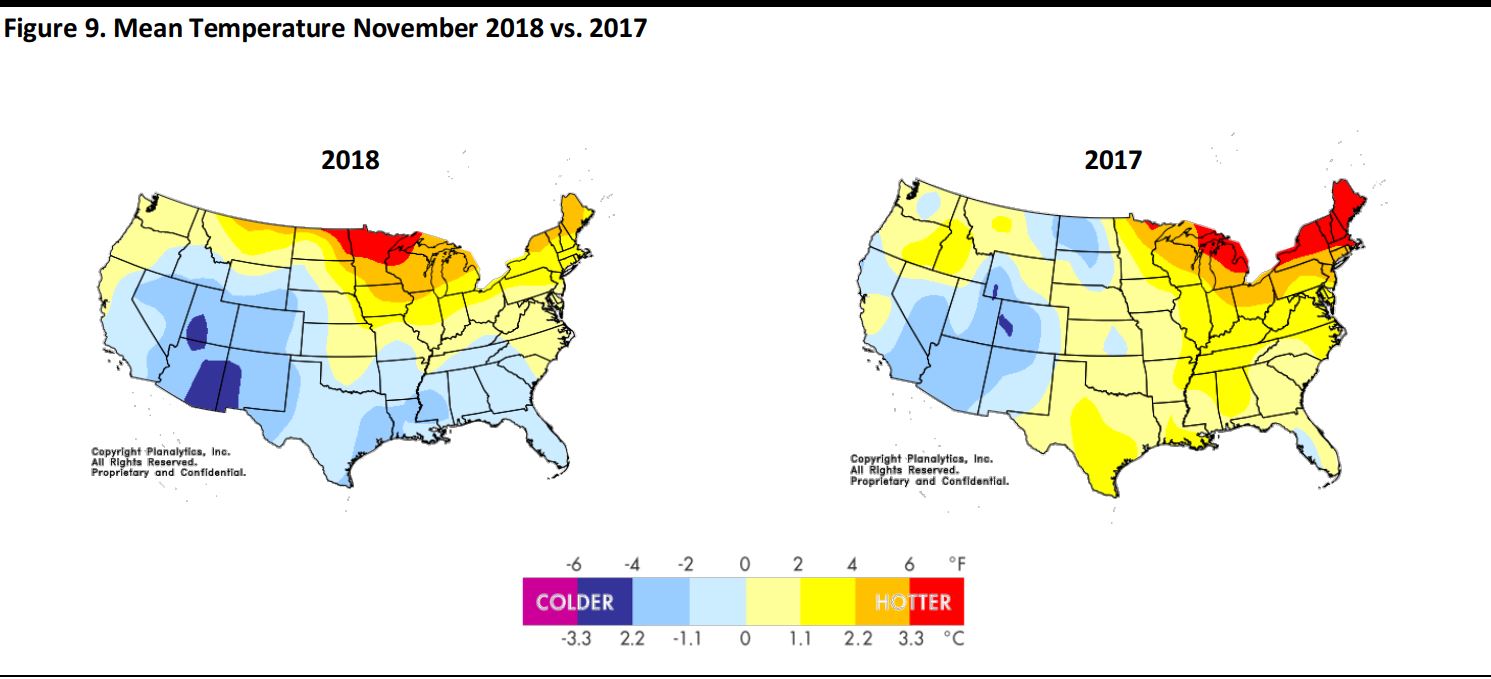

We are optimistic about the prospects for holiday sales this year and forecast year-over-year growth of 4% for November and December total retail sales (excluding automobiles and gasoline). This will take total holiday retail sales to $720 billion from $692 billion last year.

Our estimated growth projection represents a slowing from 4.5% retail sales growth so far this year (through July). This anticipated slowdown arises from the demanding comparatives from holiday 2017, when November and December sales were up 5.5% in total, with November sales up by a very strong 6.7%, per the US Census Bureau.

Our estimate is well above the 2.8% average seen over the last 10 years; that 10-year average includes the Global Financial Crisis and is based on data from the National Retail Federation (NRF).

Figure 1 shows annual holiday spending according to the NRF as well as the annual change in spending and our 4.0% projection for 2018 holiday spending.

Source: NRF/Coresight Research

Source: NRF/Coresight Research

E-Commerce Looks Set to Capture One in Every Five Nonfood Dollars in the Holiday Quarter

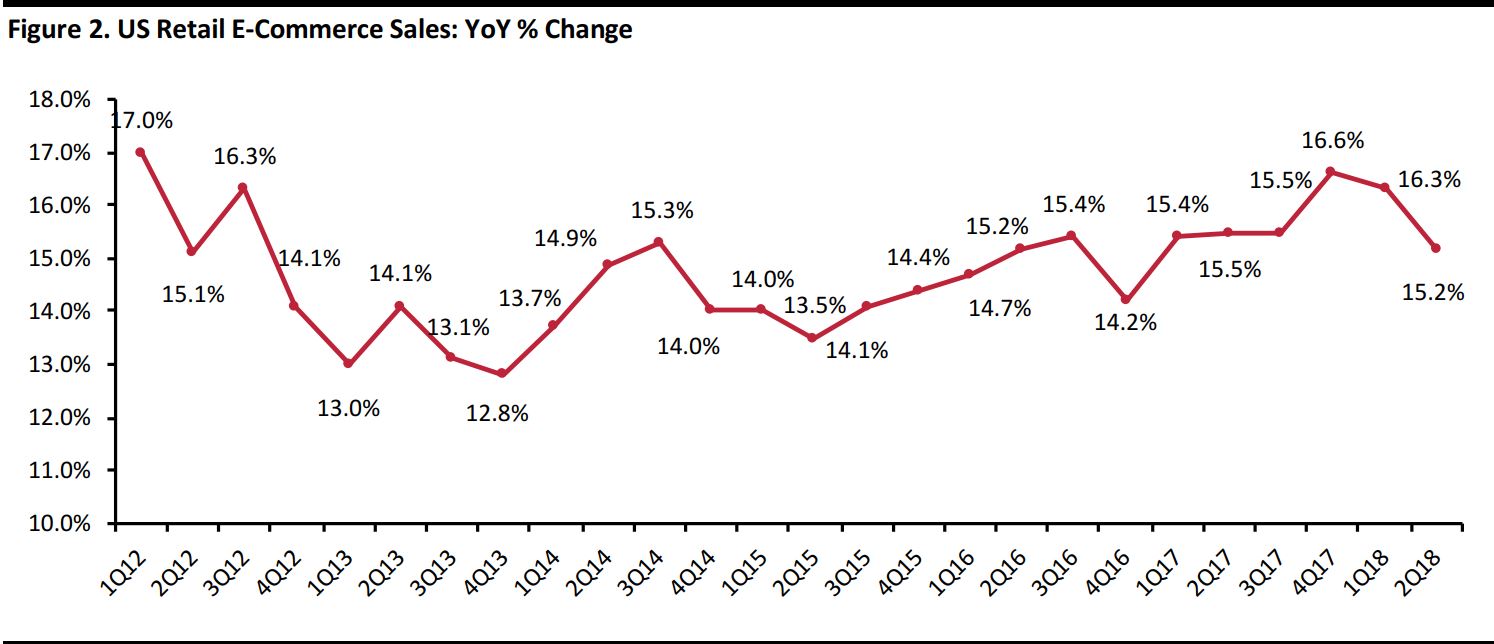

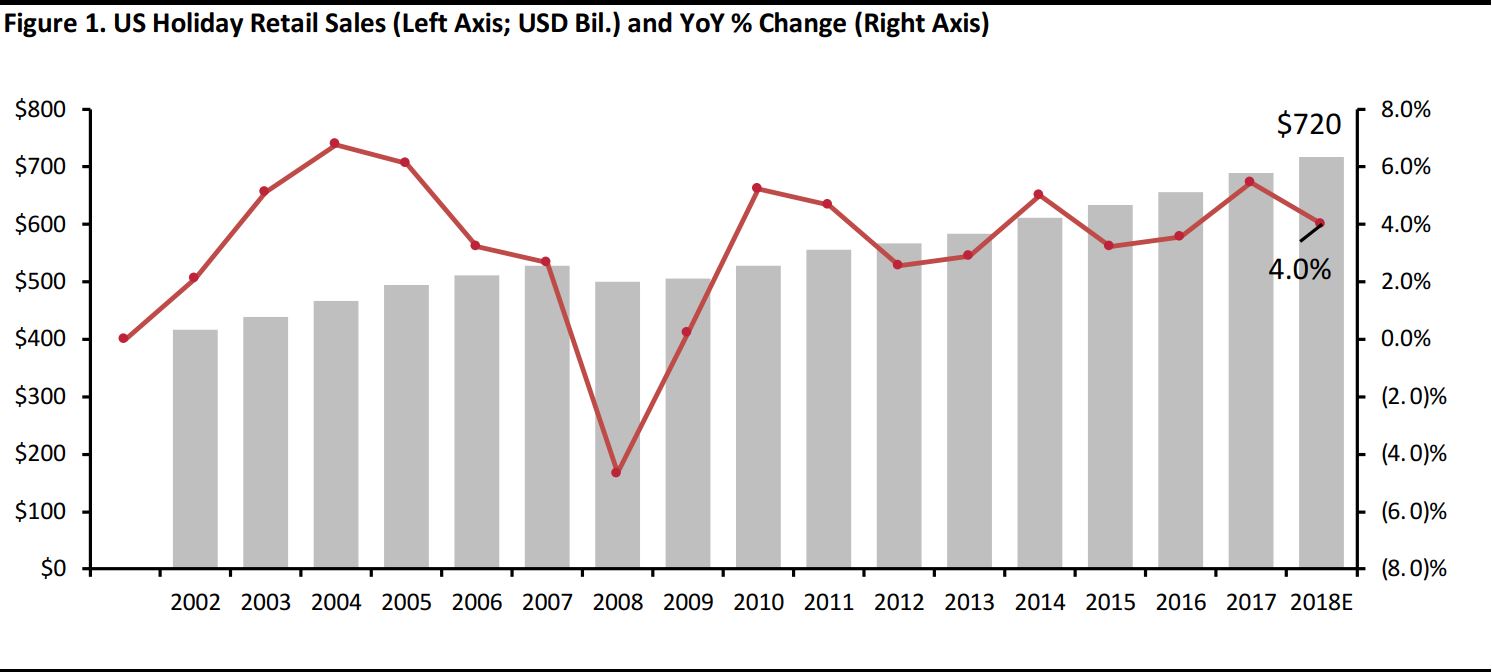

E-commerce has continued its relentless encroachment on brick-and-mortar retail and has been growing in the mid-teens this year, according to the US Census Bureau. For the holiday quarter 2018, we expect the following:

- Total online retail sales excluding automobiles will rise by around 16% year over year over the holiday period.

- E-commerce will capture almost 16% of all retail sales excluding automobiles and gasoline. This is up from 14.0% in the fourth quarter of 2017.

- E-commerce will capture fully 20% of all nonfood retail sales, up from around 18.5% for the final quarter of 2017.

The low-single-digit penetration rate of e-commerce in grocery products depresses the online channel’s share of all retail sales and, therefore, underplays the channel’s significance in nonfood retail. Moreover, e-commerce’s share of retail sales routinely jumps over the holiday period as consumers turn to the online channel for functional “shopping-list” gift purchases.

Over 2018 as a whole, we estimate that more than one-third of consumer electronics sales and over one-fifth of apparel sales will be made online, and e-commerce’s share of these categories is likely to be even higher over the holiday period.

Data are seasonally adjusted and are based on retail sales including motor vehicles and spare parts

Source: US Census Bureau

Data are seasonally adjusted and are based on retail sales including motor vehicles and spare parts

Source: US Census Bureau

Favorable Economic and Calendar Backdrop for Holidays

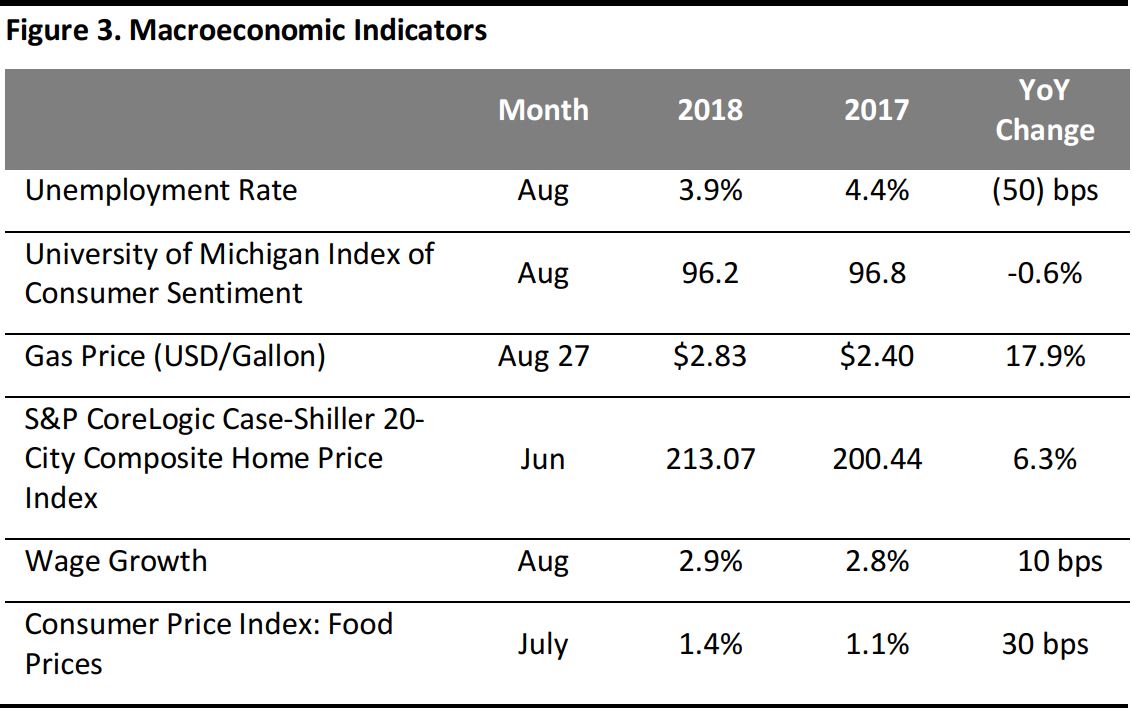

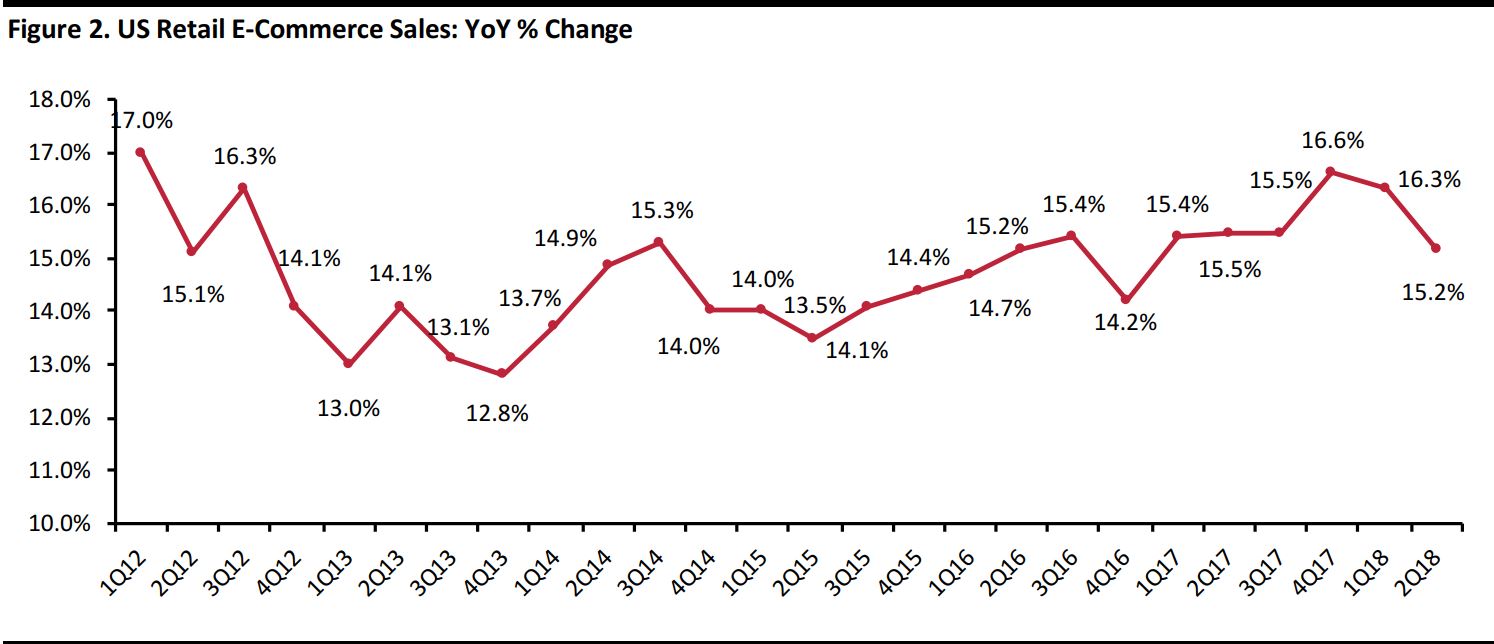

Recent economic trends bode well for a robust holiday season. The US is adding about 200,000 jobs a month and the unemployment rate, at 3.9%, is down 50 basis points year over year. The University of Michigan’s Consumer Sentiment Index stood at its lowest level since January 2018, but remains at a still high 96.8, up from the 70.8 reading in June 2009 (when the Great Recession ended) and the 83.0 average reading since the recovery began. Gas prices are high relative to same time last year but remain below the $3.00 mark, and with wage growth approaching 3%, relatively benign inflation in other items and reduced taxes for many, the macro landscape looks good for the 2018 holiday season (Figure 3).

Source: US Bureau of Labor Statistics/University of Michigan/US Energy Information Administration/S&P Dow Jones/US Bureau of Economic Analysis

Source: US Bureau of Labor Statistics/University of Michigan/US Energy Information Administration/S&P Dow Jones/US Bureau of Economic Analysis

Consumer Confidence, Moods and Spending Forecasts

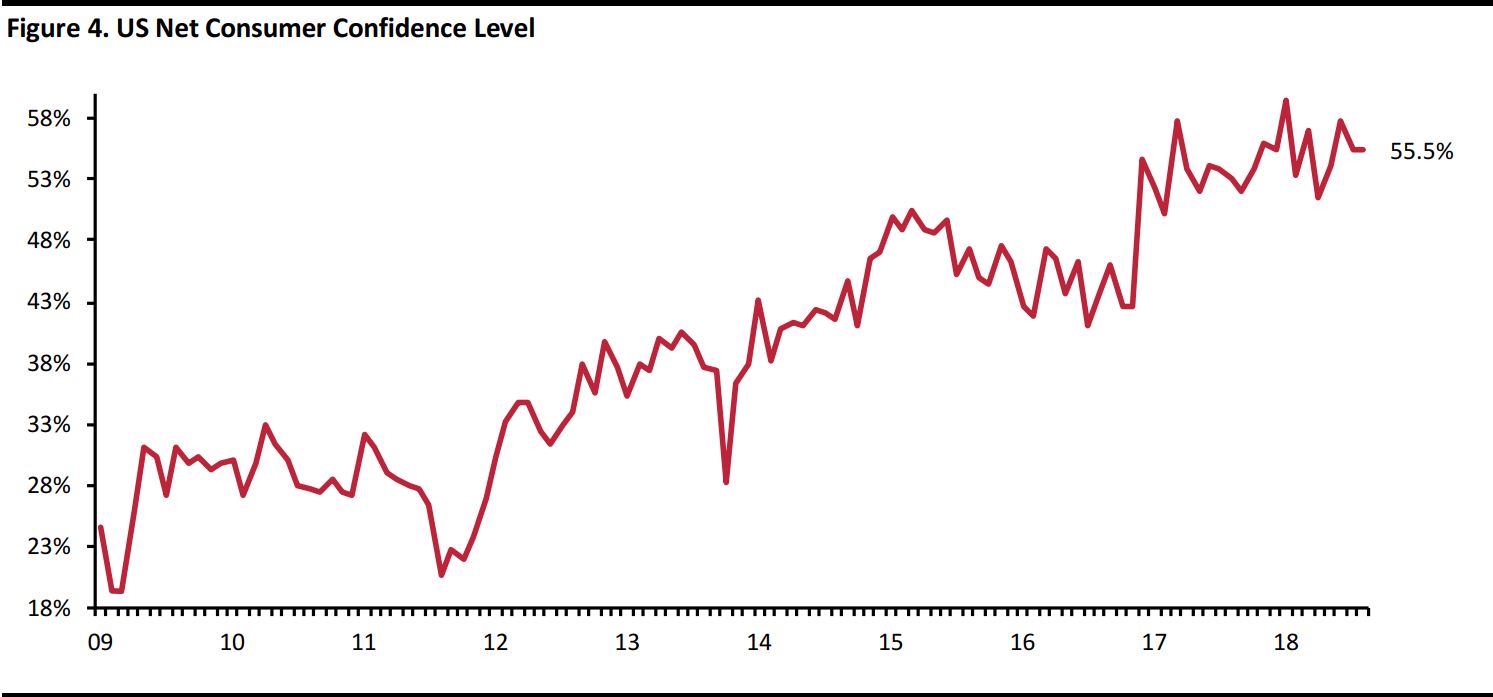

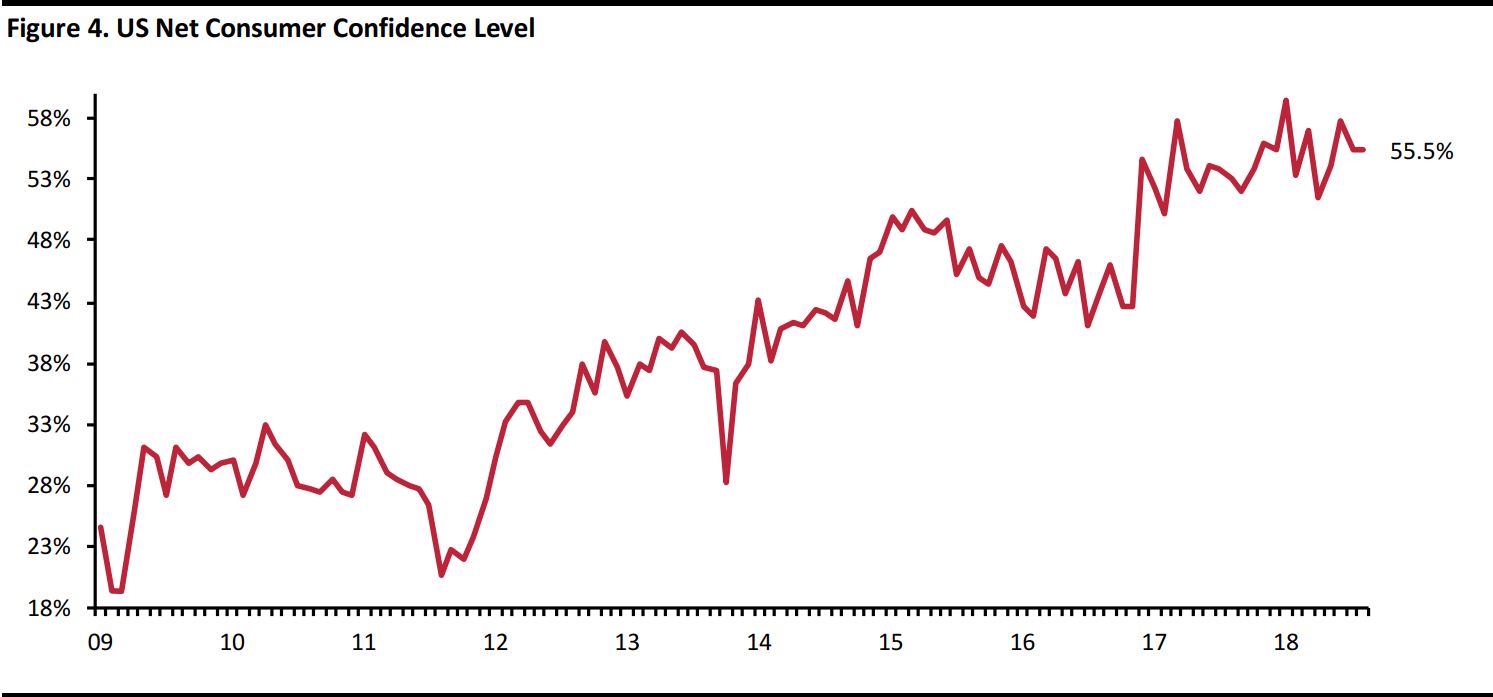

Although we still have several months to go before the culmination of the holiday season, strengthening consumer confidence bodes well for a good holiday retail season. As recorded by Prosper Insights & Analytics, consumer sentiment proved strong in August, with a net 55.5% of those surveyed expecting a strong economy in the next six months. That figure crept up from 55.3% in July.

That 55.5% is around double the rates that we were seeing back in 2011 and was the strongest August reading recorded by Prosper in a decade. Underpinning this confidence are rising wages, moderate overall inflation (even though gasoline prices are up sharply), and—crucially—the income tax cuts that many consumers are enjoying and the corporate tax cuts that are flowing through as raised wages for many.

Source: Prosper Insights & Analytics

Source: Prosper Insights & Analytics

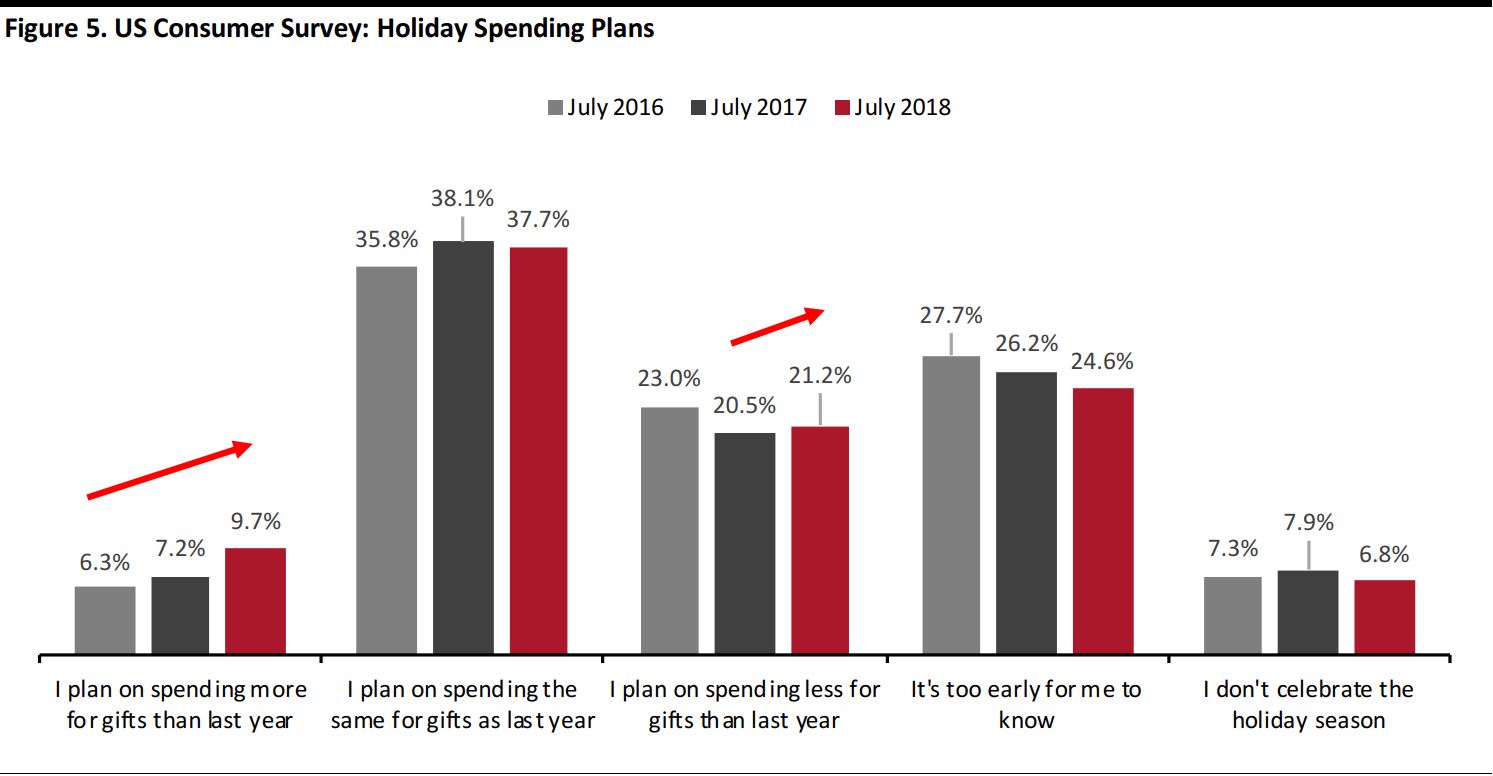

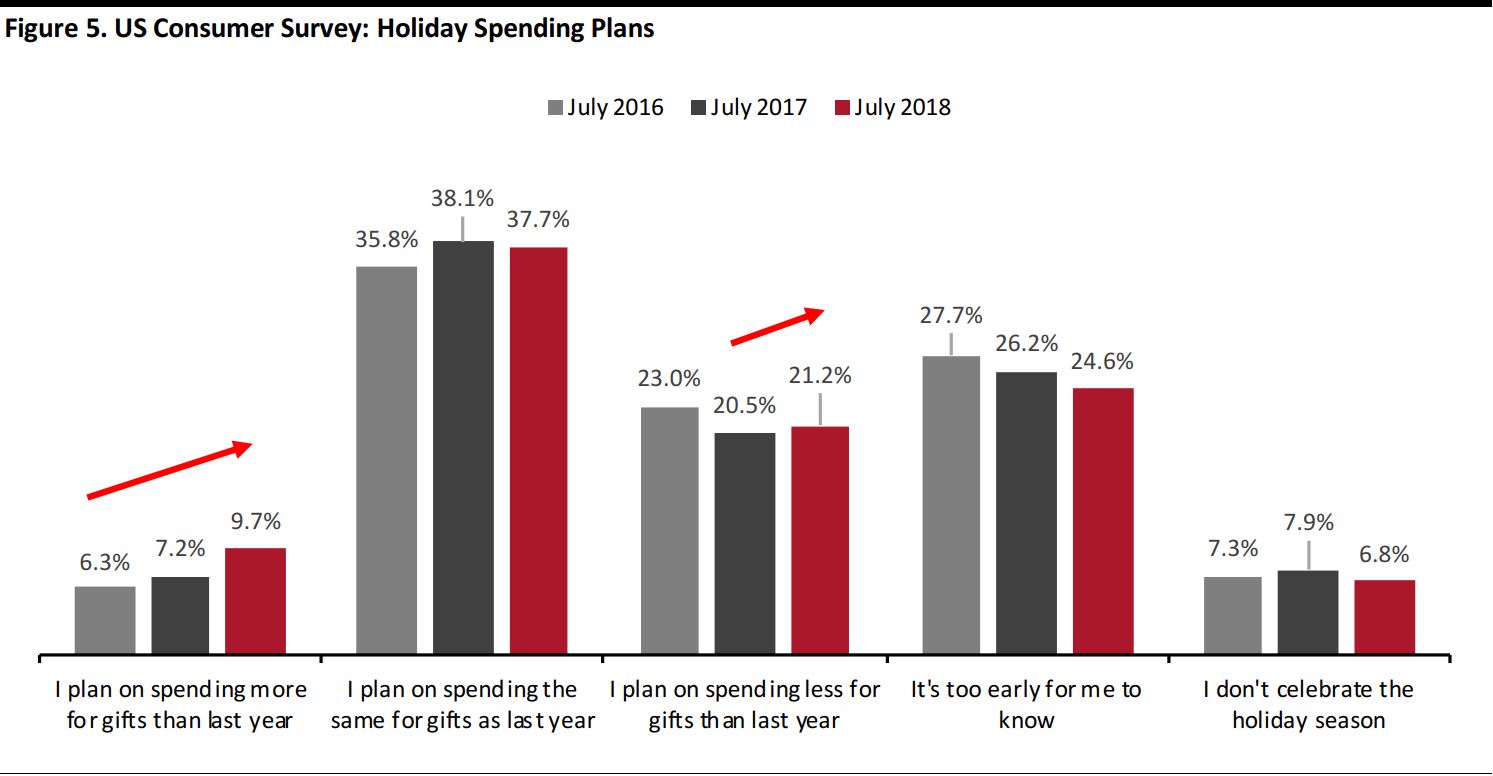

Further survey findings from Prosper Insights & Analytics point to a solid, though possibly mixed, season ahead. The firm’s July survey of consumers’ spending plans for the holidays recorded a further year-over-year jump in the number saying that they expect to spend more than they did last year; this was up 250 basis points. However, the number of respondents saying that they plan to spend less also increased versus last year, although the percentage change was less (70 basis points) than that recorded for the “spend more” cohort.

These findings further bolster our expectation that the holiday season will be robust even though it may be more mixed than current trajectories imply. Shoppers stand ready to open their wallets this holiday but we think that retailers should not expect a spectacular end to the year.

Base: 6,800+ US Internet users ages 18+ surveyed in each period

Source: Prosper Insights & Analytics

Base: 6,800+ US Internet users ages 18+ surveyed in each period

Source: Prosper Insights & Analytics

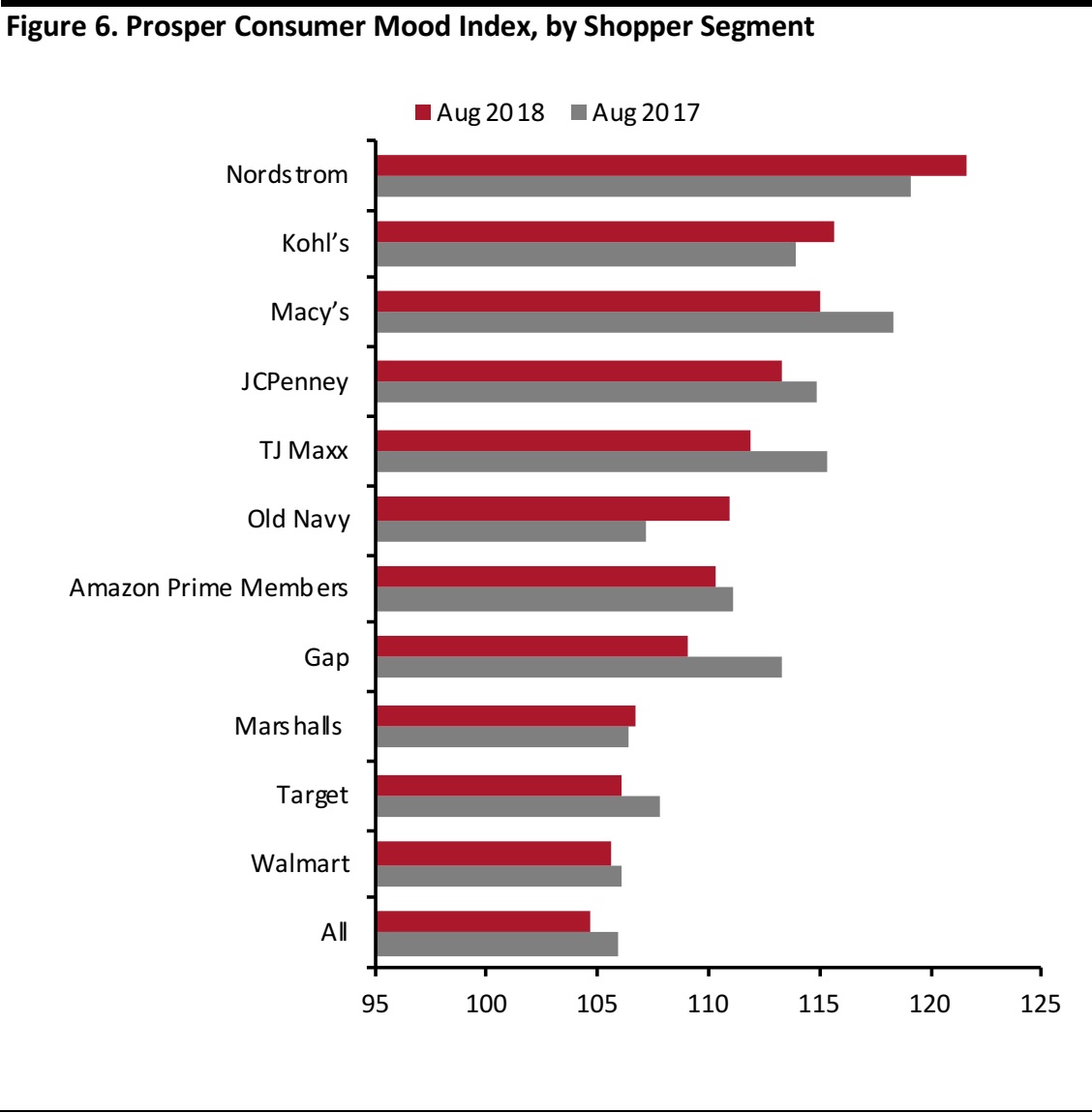

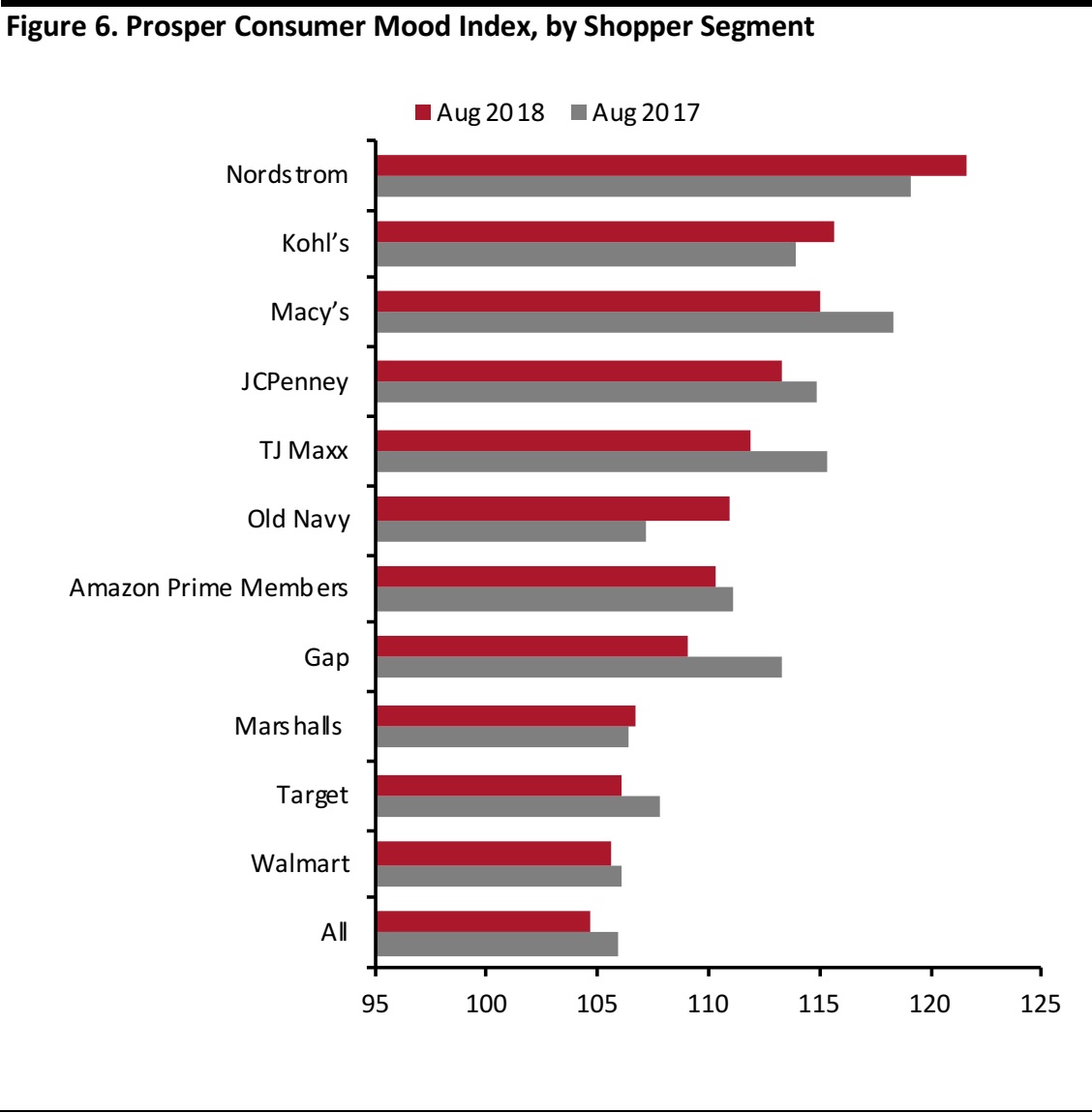

According to the Prosper Consumer Mood Index charted below, of those who shop at major retailers, Nordstrom shoppers were in the jolliest mood at the end of August with an index reading of 121.6 versus 104.7 for the general adult population. Nordstrom shoppers exhibited the greatest year-over-year increase in the spending forecast as well, up 4.5% or 3.8 index points to 88.2. Kohl’s and Old Navy shoppers are in a better mood this year versus last year, while Gap and Macy’s shoppers are in a worse mood. However, it is worth noting that for all the above-mentioned retailers, shoppers were in a better mood this August than the general adult population.

Base: 7,200+ US Internet users ages 18+ surveyed in each period

Source: Prosper Insights & Analytics

Base: 7,200+ US Internet users ages 18+ surveyed in each period

Source: Prosper Insights & Analytics

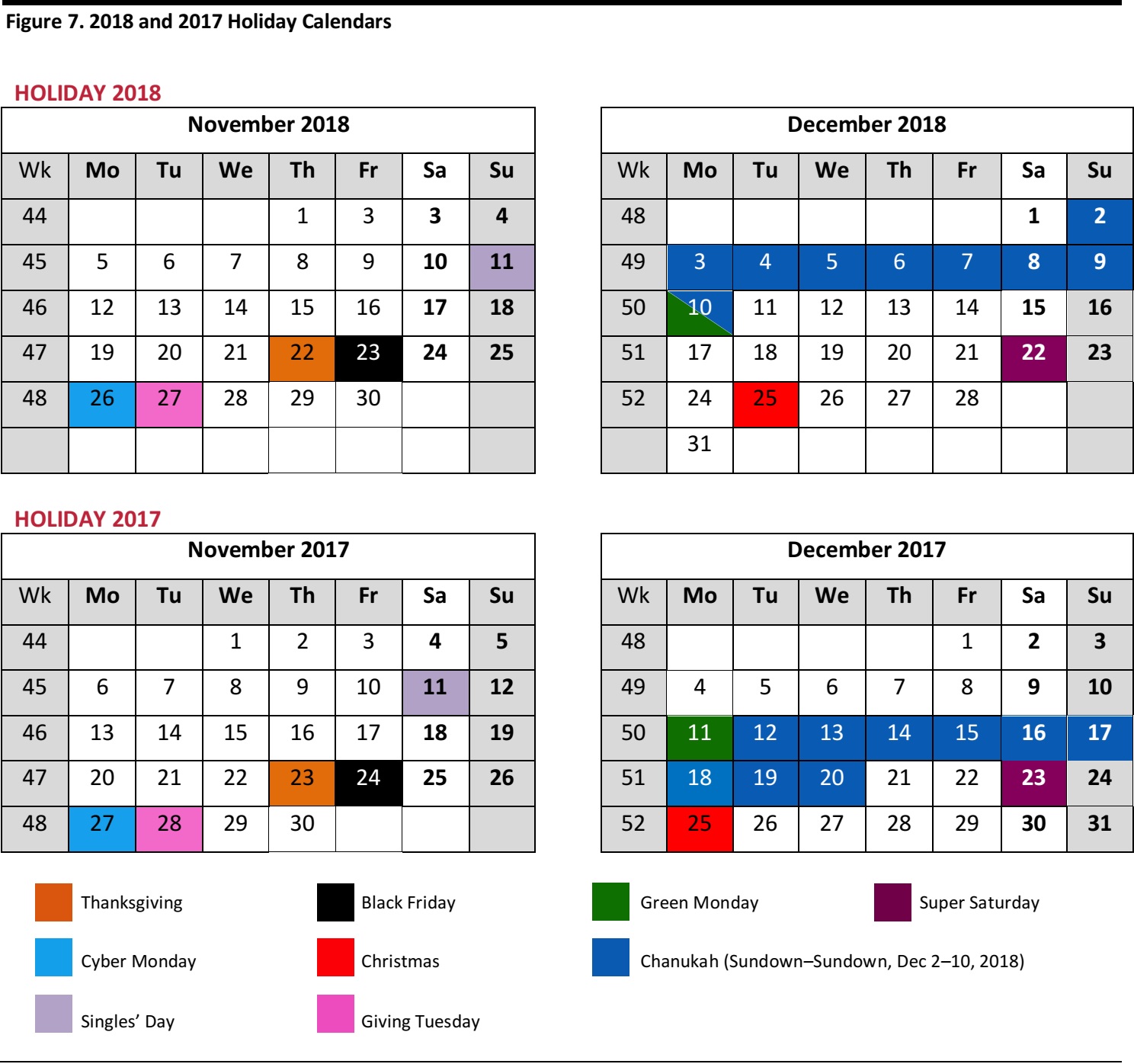

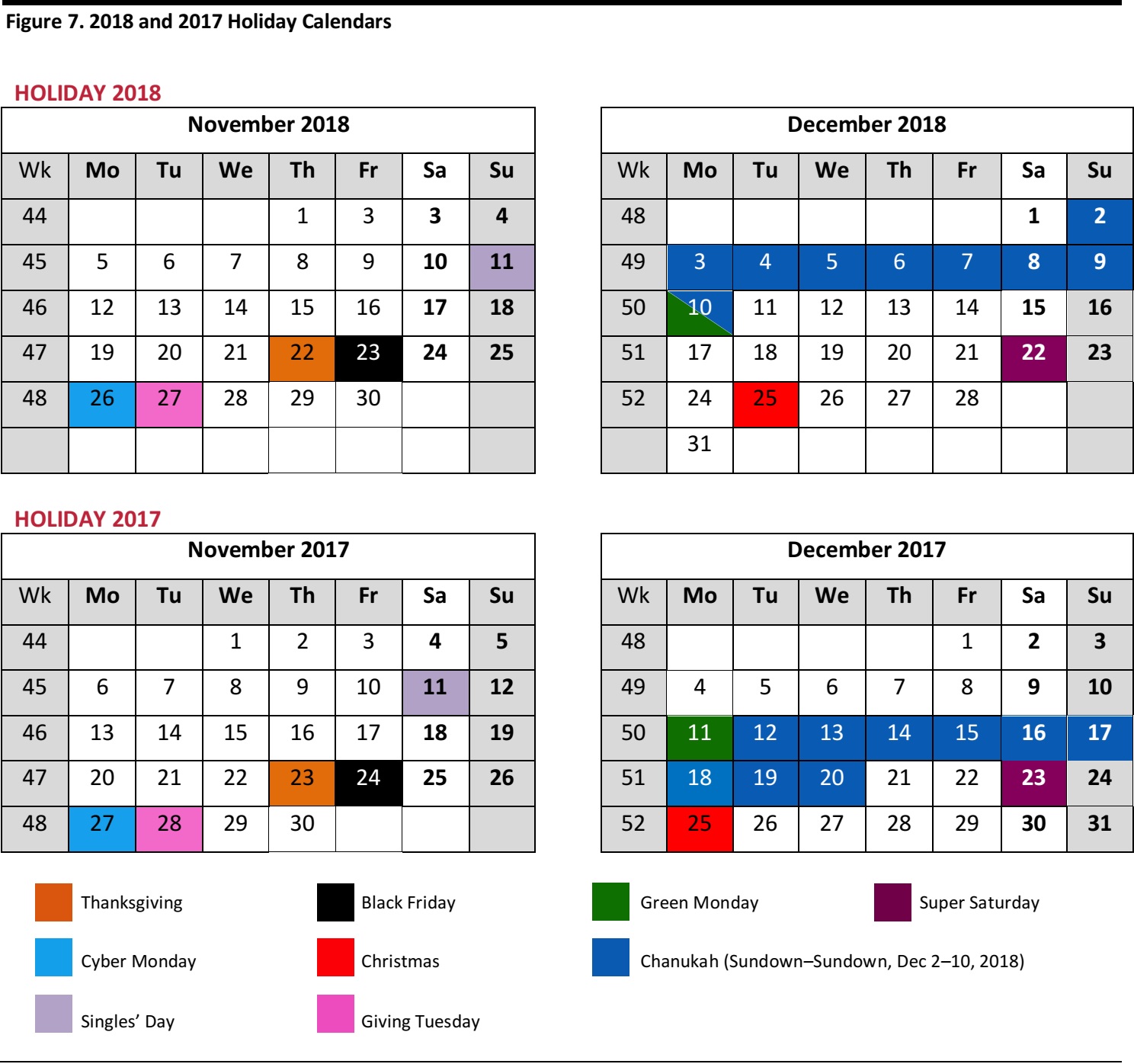

Favorable Calendar Means a Super-Long Holiday Season

This year, there is one more shopping day between Thanksgiving and Christmas than there was last year and the holiday season (timed from Thanksgiving) is the longest that it can be: there are 32 days between the holidays this year versus 31 last year; the number of days between Thanksgiving and Christmas varies between 26 (as in 2013) and 32.

Christmas falls on a Tuesday this year versus a Monday in 2017. Additionally, Chanukah falls earlier in December, from sundown December 2 through sundown December 10, and this will support a strong start to the holiday shopping season. An earlier Chanukah will shift shopping into November.

The first major global shopping holiday on the fall calendar is Singles’ Day, also called 11.11 and Double 11, which falls on November 11. This is the most significant online shopping day in China, though it has yet to permeate Western markets, in part because it falls on Veterans Day (also called Armistice Day in some countries). Alibaba launched this festival in 2009 as an occasion for those who are single to indulge themselves; it

sold $25 billion of goods on Singles’ Day 2017.

Thanksgiving in the US is celebrated on the fourth Thursday in November and this year it falls on November 22—the earliest that it can fall. Black Friday (November 23) is the day after Thanksgiving and it represents the day when retailers traditionally became profitable for the first time during the year (they went “in the black” on Black Friday). Cyber Monday falls on the following Monday (November 26 this year). Giving Tuesday, now in its seventh year, falls on the day after Cyber Monday (November 27 this year). This global event is designed to encourage charitable giving and relies heavily on social media and word of mouth.

“Green Monday”, coined by retailers to represent the best shopping day in December, falls at least 10 days before Christmas. This year’s Green Monday falls on December 10. The Saturday before Christmas is called Super Saturday and it is one of the most important shopping days for retailers before the end of the holiday shopping season. Super Saturday falls on December 22 this year.

Source: Coresight Research

Source: Coresight Research

Store Fleet Rationalization Continues at A Rapid Pace

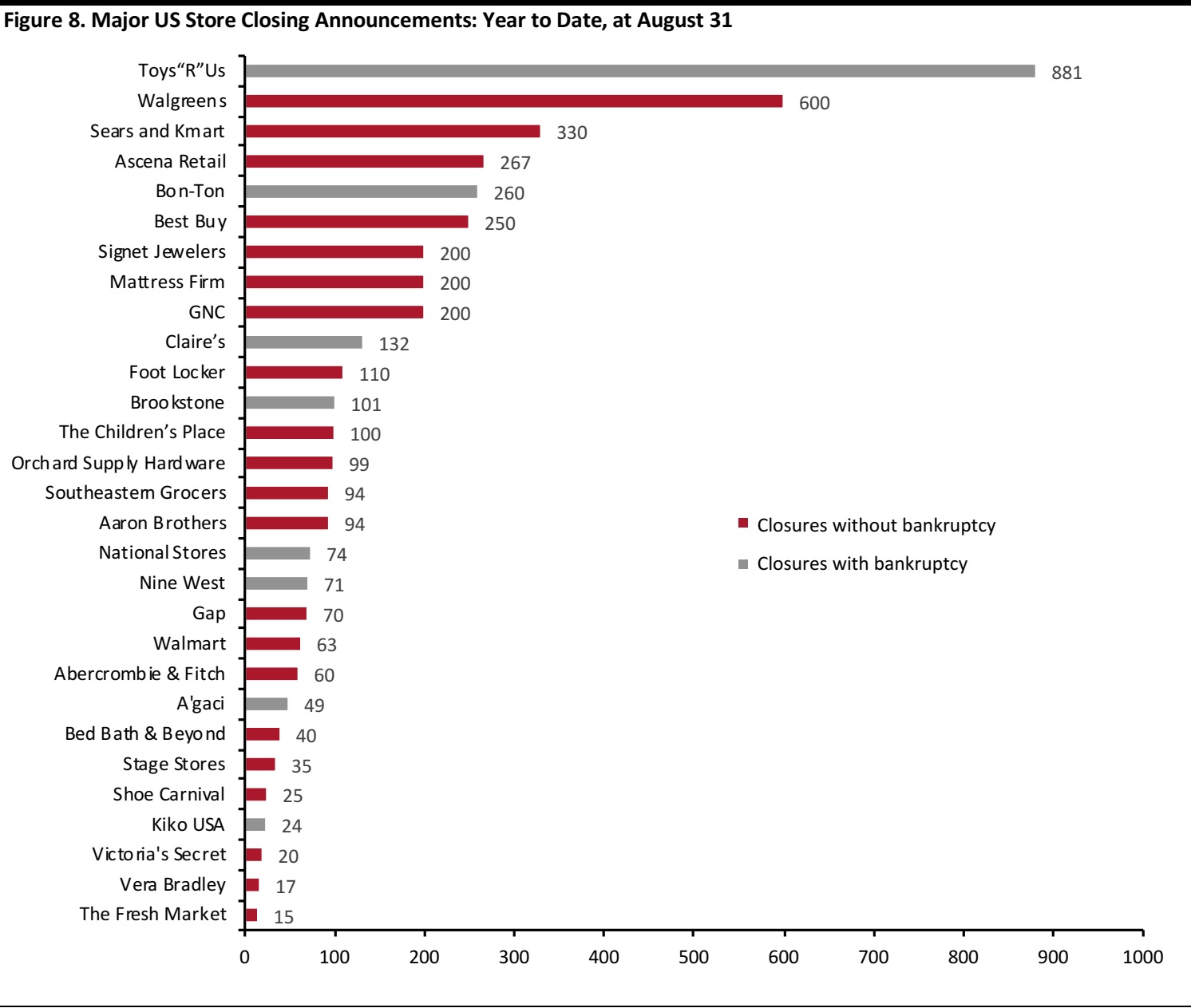

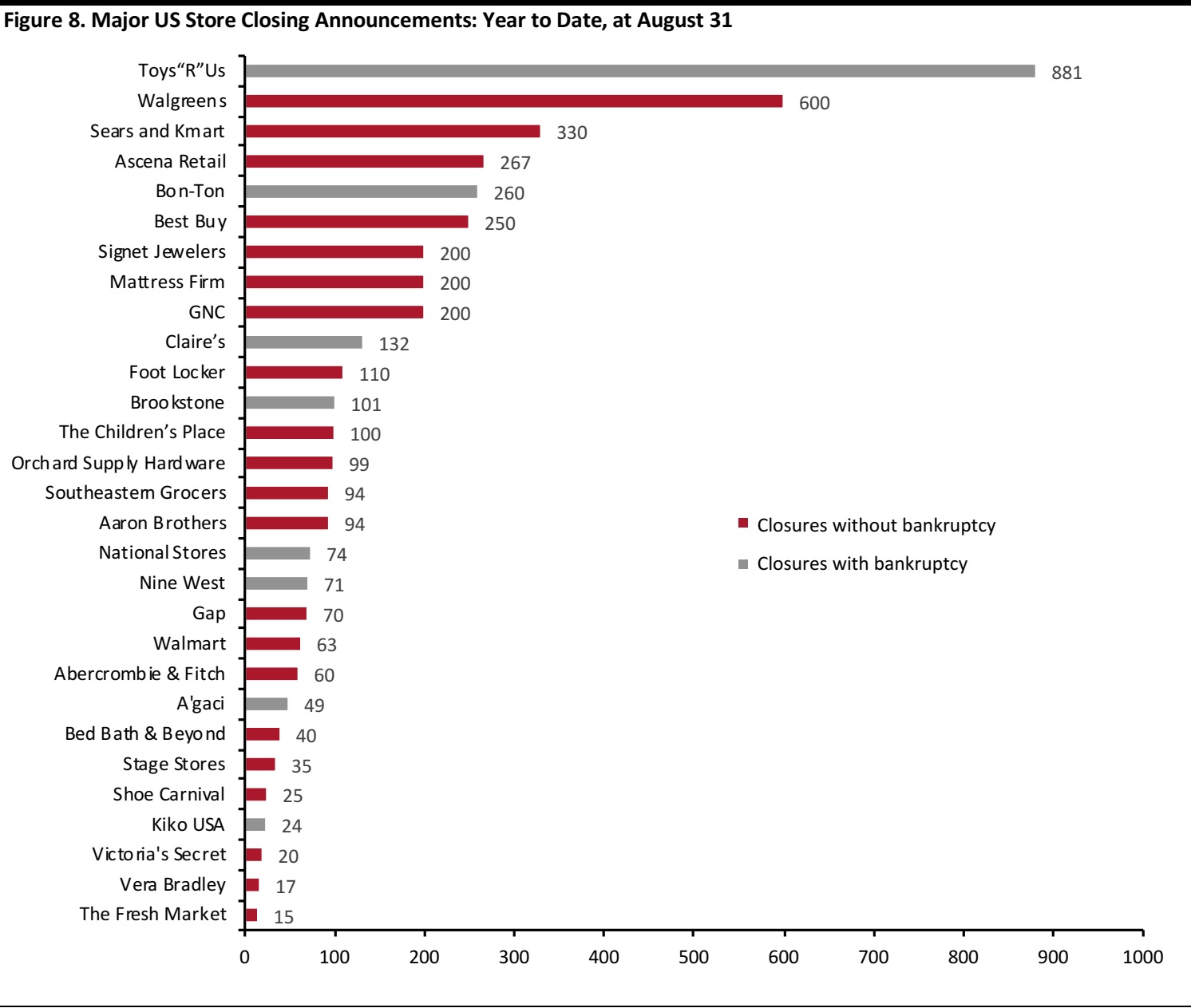

Our

Weekly Store Openings and Closures Tracker has tallied 4,579 US-announced store closures year-to-date through August 31, 2018, in tandem with 2,380 store openings, for a net 2,199 announced store closures.

The Toys“R”Us bankruptcy accounts for 19.2% of the 2018 store closures and Walgreens’ Rite Aid closures account for another 13.1%; Sears and Kmart, Ascena Retail, Bon-Ton and Best Buy are among the top five retailers in 2018 store closures and together account for 56.5% of announced store closures.

Dollar General’s plan to open 900 stores accounts for 37.8% of 2018 store openings. We estimate that the year will end with around 8,000 store closures, up from 7,066 in 2017. Painful, retail rationalization alongside omnichannel, personalization and customer relationship management (CRM) strategies will allow the industry to emerge healthier and more productive.

Our stated closures total includes some closures not charted above.

Source: Company reports/Coresight Research

Our stated closures total includes some closures not charted above.

Source: Company reports/Coresight Research

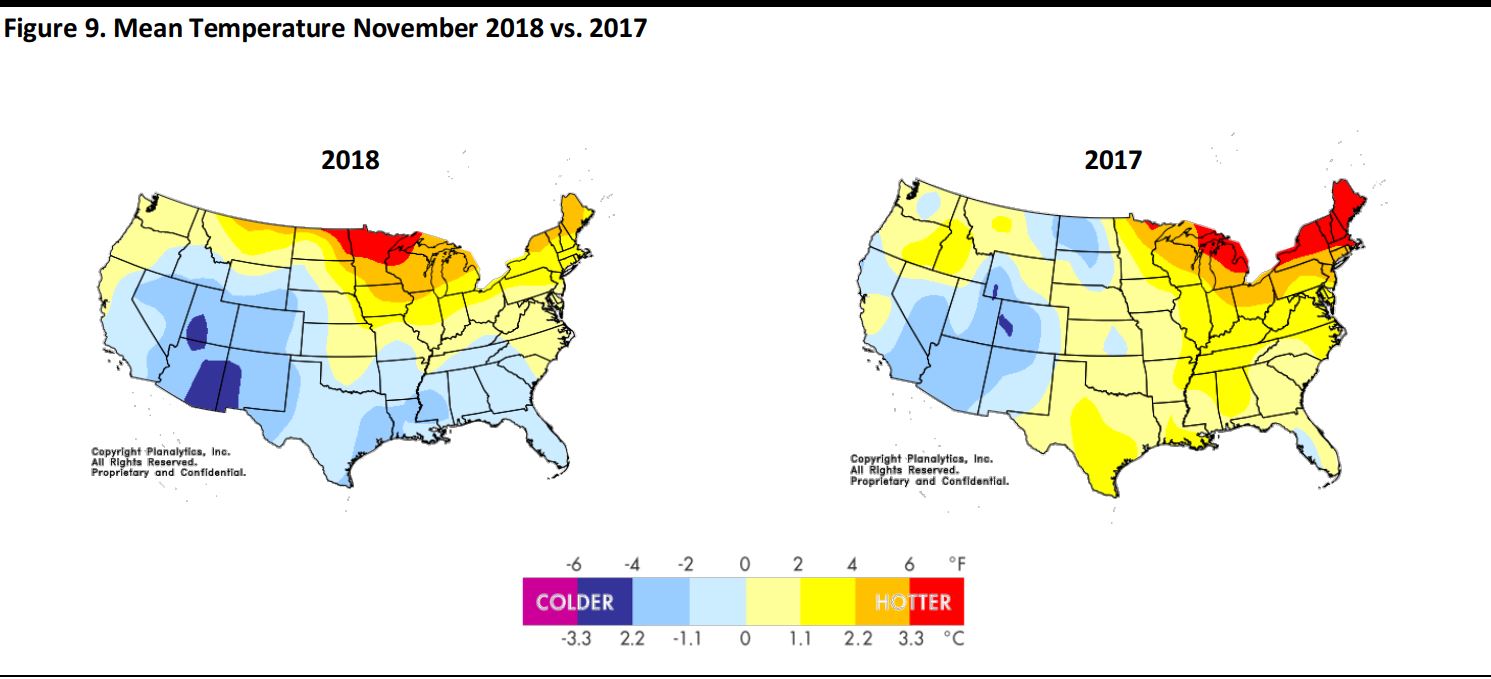

Weather Outlook a Plus

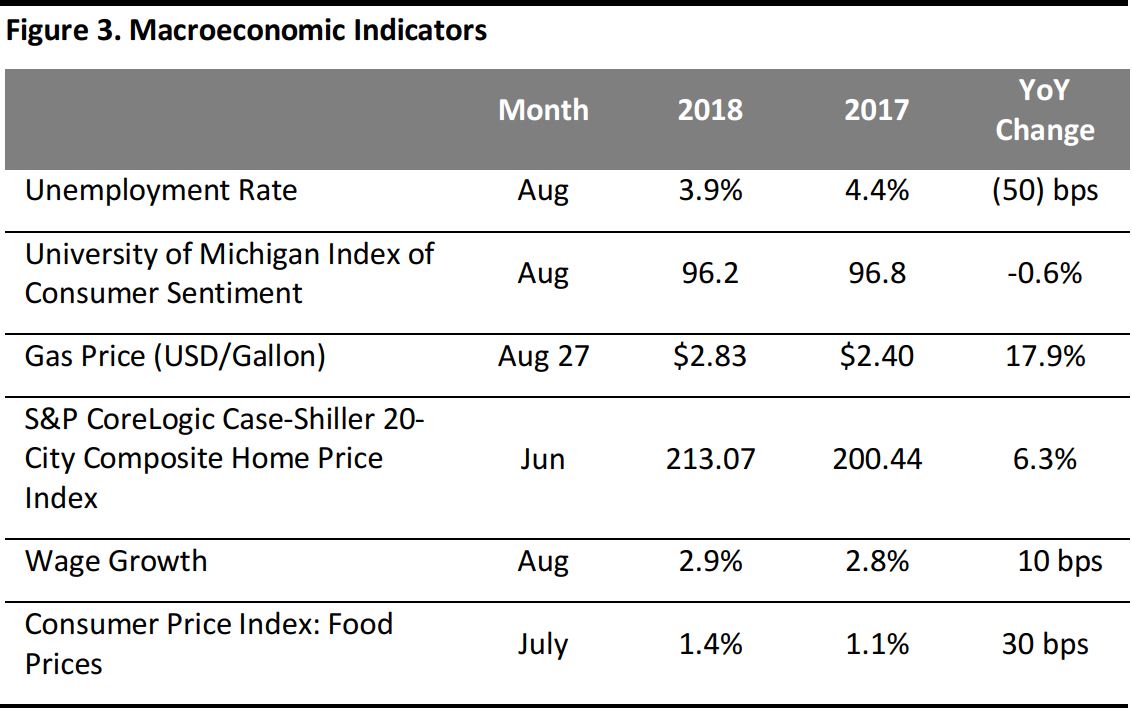

According to weather data provider Planalytics, November will see warmer temperatures year over year throughout most of the US with portions of the Great Lakes and New England seeing the warmest anomalies. The Southern Tier and Intermountain West will experience a colder trend versus 2017. These weather trends are likely to increase demand for seasonal apparel such as jackets, gloves and sweaters in Southern markets from the Southeast through Texas and the Southwest, while the warmer regions of the Midwest and Northwest should see more favorable foot traffic versus 2017. During the week of Thanksgiving and Black Friday, temperatures are expected to be colder than last year and that will support demand for cold-weather gear.

Source: Planalytics

Source: Planalytics

For December, Planalytics expects temperatures to trend warmer versus last year across the eastern half of the country. The warmest anomalies will be found in the New England region. The Pacific Northwest will also see a warmer trend and a colder trend is anticipated for the Southwest and Intermountain West. Seasonal merchandise should enjoy strong demand in the Southwest this December, while store traffic in the major markets of the Northeast and Midwest should benefit from the forecasted weather trends.

Key Takeaways

We expect US holiday retail spending to increase by 4% in 2018 as several positive data points suggest a healthy shopping season this year. The macroeconomic environment features a lower unemployment rate, stronger housing prices, wage gains and stable consumer sentiment, all amid benign inflation.

The barrier to stronger total year-over-year growth will be the demanding comparatives from the strong 2017 holiday season.

Total online retail sales look set to increase by around 16% year over year. We expect e-commerce to account for almost 16% of all retail sales and around one in every five dollars spent across nonfood retail.

Upcoming Holiday Reports

In the coming weeks, our Holiday 2018 reports series will cover the following themes:

- Holiday Hiring

- New Fashion Trends for Holiday (Self) Gifting

- Social Media Holiday Strategies

- US and European Hottest Holiday Gifts

- Sustainable Gifting

- US and European Hottest Holiday Toys

- Consumer Moods and Spending Forecast with Prosper Analytics

- The 11.11 Impact

- Our Black Friday coverage from the US and the UK

- US and European Digital Retail Trends

- Mid-Season Temperature Taking with Planalytics

- The Holiday Homestretch

- Store Traffic Trends

Source: NRF/Coresight Research

Source: NRF/Coresight Research Data are seasonally adjusted and are based on retail sales including motor vehicles and spare parts

Source: US Census Bureau

Data are seasonally adjusted and are based on retail sales including motor vehicles and spare parts

Source: US Census Bureau Source: US Bureau of Labor Statistics/University of Michigan/US Energy Information Administration/S&P Dow Jones/US Bureau of Economic Analysis

Source: US Bureau of Labor Statistics/University of Michigan/US Energy Information Administration/S&P Dow Jones/US Bureau of Economic Analysis Source: Prosper Insights & Analytics

Source: Prosper Insights & Analytics Base: 6,800+ US Internet users ages 18+ surveyed in each period

Source: Prosper Insights & Analytics

Base: 6,800+ US Internet users ages 18+ surveyed in each period

Source: Prosper Insights & Analytics Base: 7,200+ US Internet users ages 18+ surveyed in each period

Source: Prosper Insights & Analytics

Base: 7,200+ US Internet users ages 18+ surveyed in each period

Source: Prosper Insights & Analytics Source: Coresight Research

Source: Coresight Research Our stated closures total includes some closures not charted above.

Source: Company reports/Coresight Research

Our stated closures total includes some closures not charted above.

Source: Company reports/Coresight Research Source: Planalytics

Source: Planalytics