albert Chan

US 2018 Holiday Comp Results Recap

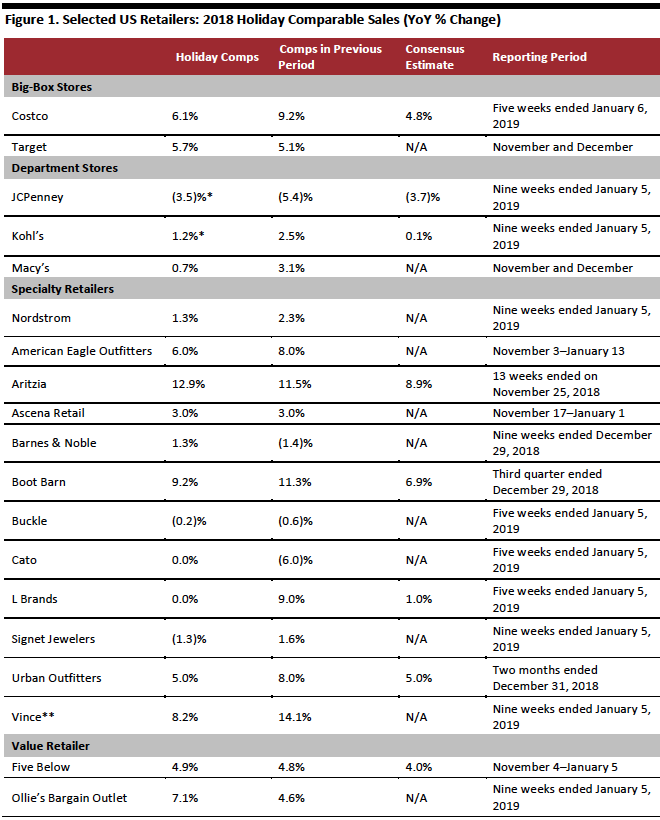

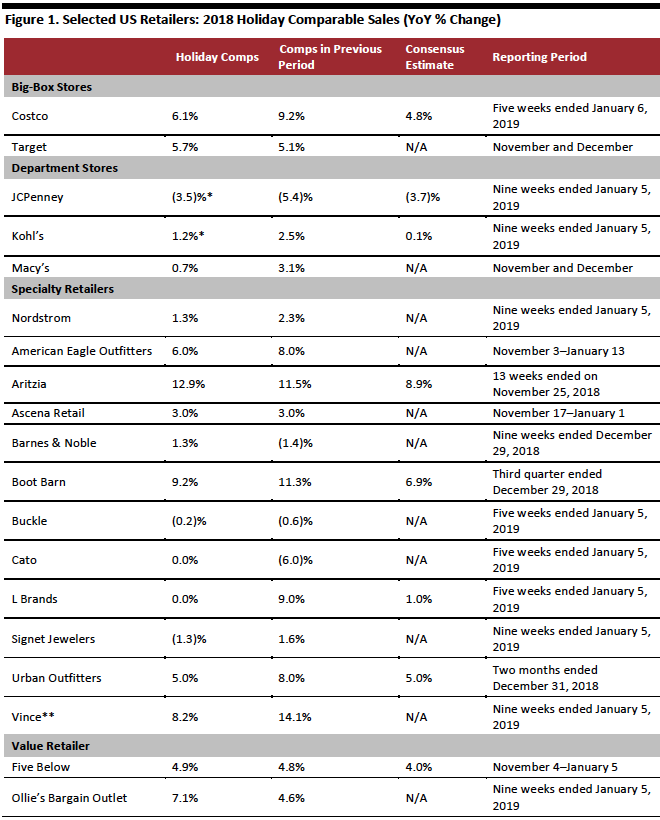

As U.S. retailers continue to report comparable sales for the 2018 holiday season, the results remain mixed.

*On a shifted basis

*On a shifted basis

**Direct-to-consumer

Source: Company reports[/caption] Big-Box Retailers Post Strong Holiday Comparable Sales Growth Two big-box retailers, Costco and Target, posted strong numbers in the holiday season. Costco reported total same-store sales growth of 6.1% for December, which was below the 9.2% growth posted in November, but ahead of the consensus estimate of 4.8%. Costco grew its e-commerce sales by 13.6%. Target Corporation reported that comparable sales in the combined November and December period grew 5.7%, compared to 5.1% growth in the third quarter of fiscal 2018. Results were driven by positive store comps and comparable digital sales growth of 29%. Target expects that fiscal 2018 will be the fifth consecutive year in which its digital sales will grow more than 25%. Target gave guidance for fourth-quarter comparable sales growth of approximately 5%. Mixed Performance by Department Stores Since we published our first report on retailers’ holiday sales, Nordstrom has posted a comparable sales increase of 1.3% for the nine weeks ended January 5, 2019, compared to 2.3% growth in the previous quarter. Over the holidays, the company grew full-price comparable sales by 0.3%, compared to a 0.4% increase in the previous quarter, led by softer traffic in stores; off-price comparable sales increased 3.9%, below the 5.8% rise in the previous quarter. Digital sales rose 18% year over year, representing 36% of sales. Nordstrom reported year-to-date comparable sales growth of 2.1%, in-line with the company’s prior guidance of approximately 2% growth for fiscal 2018. It updated its FY18 guidance and expects EPS to be at the lower end of the prior outlook range of $3.27 to $3.37. As we noted in our first round-up of sales updates: JCPenney’s holiday comparable store sales declined 3.5% on a shifted basis, slightly ahead of the consensus of a 3.7% decline and better than the 5.4% decline in the third quarter of fiscal 2018. The company confirmed its expectations to generate positive free cash flow in fiscal 2018, reduce inventory by more than $225 million or 8%, and end the year with liquidity in excess of $2 billion. Kohl’s reported comparable sales growth of 1.2% for the combined November and December period, beating the FactSet 4Q consensus of 0.1%, but below the 2.5% growth in the third quarter of fiscal 2019. It raised the lower end of its full-year diluted EPS guidance range for to $5.50–$5.55, compared to prior guidance in the $5.35–$5.55 range. Macy’s reported November and December holiday comparable sales growth of 0.7%, following 3.1% growth in the third quarter. Holiday growth was below the expectations of analysts. The company attributed the poor performance to a fire at its West Virginia distribution center and changes to its pre-Christmas Earn and Redeem promotion. The company downgraded its full-year guidance with comparable sales growth reduced to 2% from prior guidance in the 2.3% to 2.5% range. It lowered its diluted EPS guidance to $3.95–$4.00 from $4.10–$4.30. Specialty Retailers Showed Improved Comps Specialty retailers Aritzia and Boot Barn reported better than expected comparable sales growth. Retailers such as Buckle, Cato and Barnes & Noble showed sequential improvements in comparable sales growth. Value retailer Five Below also posted better-than-expected comparable sales growth. Aritzia, the women’s fashion brand that operates stores in the U.S. and Canada, reported comparable sales growth of 12.9% in fiscal 3Q19, beating the consensus of 8.9% growth and above the 11.5% growth reported in the previous quarter. Net revenue increased 18.8% year over year. The performance was driven by strong momentum across all channels and geographies. Both existing and new boutiques, coupled with marketing efforts, helped drive sales growth. For fiscal 2019, the company maintained its outlook to deliver mid-teens revenue growth and consistent adjusted EBITDA margin, compared to fiscal 2018. American Eagle’s fourth quarter comparable sales through January 13, 2019, increased 6%, following an 8% comparable sales growth in the previous quarter. It delivered positive results across brands and channels. The company also maintained its fourth quarter EPS guidance of $0.40 to $0.42. Ascena Retail reported holiday comparable sales growth of 3% (for the period between November 17, 2018 and January 1, 2019), in line with the previous quarter. Its Premium Fashion, Value Fashion and Kids Fashion segments reported comparable sales growth of 12%, 2% and 1%, respectively. Plus Fashion comps fell 8%. The company expects comp sales for the second quarter to be in line with guidance, but as “elevated clearance activity at Plus and Kids segments” hurt the gross margin rate, the company expects a loss of 23 to 28 cents per share for the quarter. Signet Jewelers’ comparable sales declined 1.3% the in nine-week period ended January 5, compared to 1.6% growth in the previous quarter. Total sales at constant exchange rate declined 1.9% year over year. The company revised same store sales growth guidance for the fourth quarter to (1.6)%–(2.5)% from the previous guidance of (1.5)-1.0%. The revised guidance factors in the negative impact of 30 bps related to a timing shift of recognizing service plan revenue, and the lack of a 53rd week in the current year, which contributed $84 million in sales in the fourth quarter of fiscal 2018. Vince posted direct-to-consumer same-store sales growth of 8.2% in the nine-week period ended January 5, 2019, following a 14.1% growth in the previous quarter. Net sales grew 11.9% year over year. Good acceptance of new products by customers drove performance during the period. Five Below reported comps of 4.9% in the holiday season, slightly higher than the 4.8% growth in the previous quarter and beating the consensus of 4.0% growth. Net sales increased 24.6% year over year. The company maintained its previous comparable sales growth guidance of 3.3% to 3.7% for fiscal 2018. As we noted in our first round-up of sales updates: Barnes & Noble showed a sequential improvement, reporting comparable sales growth of 1.3%, compared to a decline of 1.4% in the second quarter of fiscal 2018. It reported a comparable store sales increase of 4.0% between Black Friday and New Year’s Day, saying it was the best comparable sales performance for the company in several years. The company noted that an increase in promotions supported sales but may cause it to reduce earnings guidance by up to 10% when it updates the market on February 28. Boot Barn reported 9.2% comparable sales growth for the third quarter ended December 29, 2018, beating the consensus estimate of 6.9%, but below the 11.3% growth in previous quarter. It saw strong double-digit growth in e-commerce sales, with a healthy increase in margins. Boot Barn’s strong sales momentum at retail stores was driven by growth across all major product categories and geographic regions, which have enabled the company to post seven consecutive quarters of same-store sales growth. Buckle showed a slight improvement in comparable sales growth from November, as comparable sales fell 0.2% in the five weeks to January 5, compared a 0.6% decline in November. Cato’s comparable sales growth was flat in the five-week period ended January 5, stabilizing after a 6% decline in November. L Brands also posted flat comparable sales in the five-week period ended January 5, slightly below the 1% consensus estimate and well below the 9% growth reported in November. Company guidance for 4Q EPS is $1.90–$2.10, while the FactSet consensus is $2.02. Strong comparable sales growth of 11% at Bath & Body Works was partially offset by Victoria’s Secret’s 6% decline in comparable sales. For the two months ended December 31, Urban Outfitters’ comparable retail segment net sales increased 5%, led by strong, double-digit growth in the digital channel, which was partially offset by negative retail store sales. The growth was in line with consensus but below the 8% growth in the third quarter of fiscal 2019.

- Big-box retailers such as Costco and Target posted strong comparable sales growth in the holiday season.

- Department store performance has been varied, with Kohl’s and JCPenney beating consensus estimates, though JCPenney posted negative comps. Comps at Kohl’s, Macy’s and Nordstrom weakened sequentially over the holidays.

- Specialty retailers such as Aritzia, Cato, Barnes & Noble and Buckle showed sequential improvements in performance, while Boot Barn comps beat the consensus.

*On a shifted basis

*On a shifted basis**Direct-to-consumer

Source: Company reports[/caption] Big-Box Retailers Post Strong Holiday Comparable Sales Growth Two big-box retailers, Costco and Target, posted strong numbers in the holiday season. Costco reported total same-store sales growth of 6.1% for December, which was below the 9.2% growth posted in November, but ahead of the consensus estimate of 4.8%. Costco grew its e-commerce sales by 13.6%. Target Corporation reported that comparable sales in the combined November and December period grew 5.7%, compared to 5.1% growth in the third quarter of fiscal 2018. Results were driven by positive store comps and comparable digital sales growth of 29%. Target expects that fiscal 2018 will be the fifth consecutive year in which its digital sales will grow more than 25%. Target gave guidance for fourth-quarter comparable sales growth of approximately 5%. Mixed Performance by Department Stores Since we published our first report on retailers’ holiday sales, Nordstrom has posted a comparable sales increase of 1.3% for the nine weeks ended January 5, 2019, compared to 2.3% growth in the previous quarter. Over the holidays, the company grew full-price comparable sales by 0.3%, compared to a 0.4% increase in the previous quarter, led by softer traffic in stores; off-price comparable sales increased 3.9%, below the 5.8% rise in the previous quarter. Digital sales rose 18% year over year, representing 36% of sales. Nordstrom reported year-to-date comparable sales growth of 2.1%, in-line with the company’s prior guidance of approximately 2% growth for fiscal 2018. It updated its FY18 guidance and expects EPS to be at the lower end of the prior outlook range of $3.27 to $3.37. As we noted in our first round-up of sales updates: JCPenney’s holiday comparable store sales declined 3.5% on a shifted basis, slightly ahead of the consensus of a 3.7% decline and better than the 5.4% decline in the third quarter of fiscal 2018. The company confirmed its expectations to generate positive free cash flow in fiscal 2018, reduce inventory by more than $225 million or 8%, and end the year with liquidity in excess of $2 billion. Kohl’s reported comparable sales growth of 1.2% for the combined November and December period, beating the FactSet 4Q consensus of 0.1%, but below the 2.5% growth in the third quarter of fiscal 2019. It raised the lower end of its full-year diluted EPS guidance range for to $5.50–$5.55, compared to prior guidance in the $5.35–$5.55 range. Macy’s reported November and December holiday comparable sales growth of 0.7%, following 3.1% growth in the third quarter. Holiday growth was below the expectations of analysts. The company attributed the poor performance to a fire at its West Virginia distribution center and changes to its pre-Christmas Earn and Redeem promotion. The company downgraded its full-year guidance with comparable sales growth reduced to 2% from prior guidance in the 2.3% to 2.5% range. It lowered its diluted EPS guidance to $3.95–$4.00 from $4.10–$4.30. Specialty Retailers Showed Improved Comps Specialty retailers Aritzia and Boot Barn reported better than expected comparable sales growth. Retailers such as Buckle, Cato and Barnes & Noble showed sequential improvements in comparable sales growth. Value retailer Five Below also posted better-than-expected comparable sales growth. Aritzia, the women’s fashion brand that operates stores in the U.S. and Canada, reported comparable sales growth of 12.9% in fiscal 3Q19, beating the consensus of 8.9% growth and above the 11.5% growth reported in the previous quarter. Net revenue increased 18.8% year over year. The performance was driven by strong momentum across all channels and geographies. Both existing and new boutiques, coupled with marketing efforts, helped drive sales growth. For fiscal 2019, the company maintained its outlook to deliver mid-teens revenue growth and consistent adjusted EBITDA margin, compared to fiscal 2018. American Eagle’s fourth quarter comparable sales through January 13, 2019, increased 6%, following an 8% comparable sales growth in the previous quarter. It delivered positive results across brands and channels. The company also maintained its fourth quarter EPS guidance of $0.40 to $0.42. Ascena Retail reported holiday comparable sales growth of 3% (for the period between November 17, 2018 and January 1, 2019), in line with the previous quarter. Its Premium Fashion, Value Fashion and Kids Fashion segments reported comparable sales growth of 12%, 2% and 1%, respectively. Plus Fashion comps fell 8%. The company expects comp sales for the second quarter to be in line with guidance, but as “elevated clearance activity at Plus and Kids segments” hurt the gross margin rate, the company expects a loss of 23 to 28 cents per share for the quarter. Signet Jewelers’ comparable sales declined 1.3% the in nine-week period ended January 5, compared to 1.6% growth in the previous quarter. Total sales at constant exchange rate declined 1.9% year over year. The company revised same store sales growth guidance for the fourth quarter to (1.6)%–(2.5)% from the previous guidance of (1.5)-1.0%. The revised guidance factors in the negative impact of 30 bps related to a timing shift of recognizing service plan revenue, and the lack of a 53rd week in the current year, which contributed $84 million in sales in the fourth quarter of fiscal 2018. Vince posted direct-to-consumer same-store sales growth of 8.2% in the nine-week period ended January 5, 2019, following a 14.1% growth in the previous quarter. Net sales grew 11.9% year over year. Good acceptance of new products by customers drove performance during the period. Five Below reported comps of 4.9% in the holiday season, slightly higher than the 4.8% growth in the previous quarter and beating the consensus of 4.0% growth. Net sales increased 24.6% year over year. The company maintained its previous comparable sales growth guidance of 3.3% to 3.7% for fiscal 2018. As we noted in our first round-up of sales updates: Barnes & Noble showed a sequential improvement, reporting comparable sales growth of 1.3%, compared to a decline of 1.4% in the second quarter of fiscal 2018. It reported a comparable store sales increase of 4.0% between Black Friday and New Year’s Day, saying it was the best comparable sales performance for the company in several years. The company noted that an increase in promotions supported sales but may cause it to reduce earnings guidance by up to 10% when it updates the market on February 28. Boot Barn reported 9.2% comparable sales growth for the third quarter ended December 29, 2018, beating the consensus estimate of 6.9%, but below the 11.3% growth in previous quarter. It saw strong double-digit growth in e-commerce sales, with a healthy increase in margins. Boot Barn’s strong sales momentum at retail stores was driven by growth across all major product categories and geographic regions, which have enabled the company to post seven consecutive quarters of same-store sales growth. Buckle showed a slight improvement in comparable sales growth from November, as comparable sales fell 0.2% in the five weeks to January 5, compared a 0.6% decline in November. Cato’s comparable sales growth was flat in the five-week period ended January 5, stabilizing after a 6% decline in November. L Brands also posted flat comparable sales in the five-week period ended January 5, slightly below the 1% consensus estimate and well below the 9% growth reported in November. Company guidance for 4Q EPS is $1.90–$2.10, while the FactSet consensus is $2.02. Strong comparable sales growth of 11% at Bath & Body Works was partially offset by Victoria’s Secret’s 6% decline in comparable sales. For the two months ended December 31, Urban Outfitters’ comparable retail segment net sales increased 5%, led by strong, double-digit growth in the digital channel, which was partially offset by negative retail store sales. The growth was in line with consensus but below the 8% growth in the third quarter of fiscal 2019.