albert Chan

US 2018 Holiday Comp Results Recap

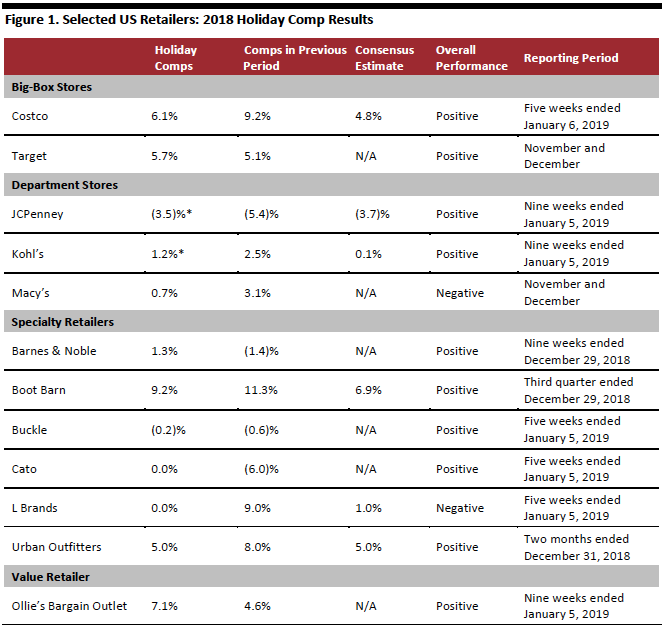

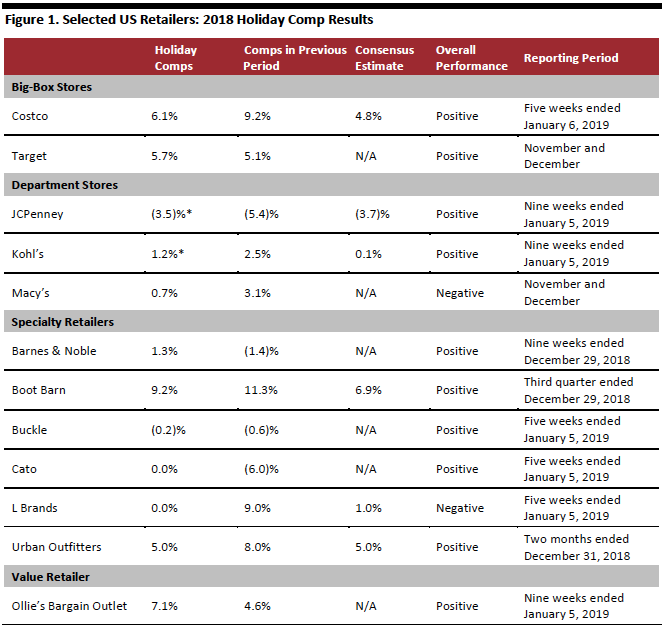

As US retailers report comparable sales for the 2018 holiday season, we’re seeing a mixed bag of results. Some retailers such as Costco and Boot Barn did well, reporting strong comparable sales growth and beating consensus estimates. Retailers such as Target, Barnes & Noble and Buckle showed sequential comparable sales growth improvement, but not as strong. Comparable sales at Macy’s and L Brands weakened sequentially.

Overall US holiday sales increased 5.1% year over year to over $850 million, the strongest growth in six years, according to estimates by Mastercard SpendingPulse, for the period between December 1 and December 24, 2018. Apparel sales grew 7.9% year over year, home improvement sales were up 9%, and home furniture and furnishings sales increased 2.3%, according to Mastercard.

Five out of 12 companies that have reported so far posted comparable sales growth that could be considered “good” (even if those included flat or negative growth in some cases) due to low expectations. Four out of six companies for which consensus estimates were available beat the consensus. And seven of the 12 companies showed a sequential improvement in comparable sales growth.

[caption id="attachment_63869" align="aligncenter" width="662"] *On a shifted basis

*On a shifted basis

Source: Company reports[/caption] Big-Box Retailers Post Strong Holiday Comparable Sales Growth Two big-box retailers, Costco and Target, posted strong numbers in the holiday season. Costco reported total same-store sales growth of 6.1% for December, which was below the 9.2% growth posted in November, but ahead of the consensus estimate of 4.8%. Costco grew its e-commerce sales by 13.6%. Target Corporation reported that comparable sales in the combined November and December period grew 5.7%, compared to 5.1% growth in the third quarter of fiscal 2018. Results were driven by positive store comps and comparable digital sales growth of 29%. Target expects that fiscal 2018 will be the fifth consecutive year in which its digital sales will grow more than 25%. Target gave guidance for fourth-quarter comparable sales growth of approximately 5%. Mixed Performance by Department Stores JCPenney’s holiday comparable store sales declined 3.5% on a shifted basis, slightly ahead of the consensus of a 3.7% decline and better than the 5.4% decline in the third quarter of fiscal 2018. The company confirmed its expectations to generate positive free cash flow in fiscal 2018, reduce inventory in excess of $225 million or 8%, and end the year with liquidity in excess of $2 billion. Kohl’s reported comparable sales growth of 1.2% for the combined November and December period, beating the FactSet 4Q consensus of 0.1%, but below the 2.5% growth in the third quarter of fiscal 2019. It raised the lower end of its full-year diluted EPS guidance range for to $5.50–$5.55, compared to prior guidance in the $5.35–$5.55 range. Macy’s reported November and December holiday comparable sales growth of 0.7%, following 3.1% growth in the third quarter. Holiday growth was below the expectations of analysts. The company attributed the poor performance to a fire at its West Virginia distribution center and changes to its pre-Christmas Earn and Redeem promotion. The company downgraded its full-year guidance with comparable sales growth reduced to 2% from prior guidance in the 2.3% to 2.5% range. It lowered its diluted EPS guidance to $3.95–$4.00 from $4.10–$4.30. Specialty Retailers Showed Improved Comps Specialty retailers Boot Barn and Urban Outfitters posted strong comparable sales growth in the holiday season. Retailers such as Buckle, Cato and Barnes & Noble showed sequential improvements in the comparable sales growth. Boot Barn reported 9.2% comparable sales growth for the third quarter ended December 29, 2018, beating the consensus estimate of 6.9%, but below the 11.3% growth in previous quarter. It saw strong double-digit growth in e-commerce sales, with a healthy increase in margins. Boot Barn’s strong sales momentum at retail stores was driven by growth across all major product categories and geographic regions, which have enabled the company to post seven consecutive quarters of same-store sales growth. For the two months ended December 31, Urban Outfitters’ comparable retail segment net sales increased 5%, led by strong, double-digit growth in the digital channel which was partially offset by negative retail store sales. The growth was in line with consensus but below the 8% growth in the third quarter of fiscal 2019. Buckle showed a slight improvement in comparable sales growth from November, as comparable sales fell 0.2% in the five weeks to January 5, compared a 0.6% decline in November. Cato’s comparable sales growth was flat in the five-week period ended January 5, stabilizing after a 6% decline in November. L Brands also posted flat comparable sales in the five-week period ended January 5, slightly below the 1% consensus estimate and well below the 9% growth reported in November. Company guidance for 4Q EPS is $1.90–$2.10, while the FactSet consensus is $2.02. Strong comparable sales growth of 11% at Bath & Body Works was partially offset by Victoria’s Secret’s 6% decline in comparable sales. Barnes & Noble showed a sequential improvement, reporting comparable sales growth of 1.3%, compared to a decline of 1.4% in the second quarter of fiscal 2018. It reported a comparable store sales increase of 4.0% between Black Friday and New Year’s Day, saying it was the best comparable sales performance for the company in several years. The company noted that an increase in promotions supported sales but may cause it to reduce earnings guidance by up to 10% when it updates the market on February 28.

*On a shifted basis

*On a shifted basisSource: Company reports[/caption] Big-Box Retailers Post Strong Holiday Comparable Sales Growth Two big-box retailers, Costco and Target, posted strong numbers in the holiday season. Costco reported total same-store sales growth of 6.1% for December, which was below the 9.2% growth posted in November, but ahead of the consensus estimate of 4.8%. Costco grew its e-commerce sales by 13.6%. Target Corporation reported that comparable sales in the combined November and December period grew 5.7%, compared to 5.1% growth in the third quarter of fiscal 2018. Results were driven by positive store comps and comparable digital sales growth of 29%. Target expects that fiscal 2018 will be the fifth consecutive year in which its digital sales will grow more than 25%. Target gave guidance for fourth-quarter comparable sales growth of approximately 5%. Mixed Performance by Department Stores JCPenney’s holiday comparable store sales declined 3.5% on a shifted basis, slightly ahead of the consensus of a 3.7% decline and better than the 5.4% decline in the third quarter of fiscal 2018. The company confirmed its expectations to generate positive free cash flow in fiscal 2018, reduce inventory in excess of $225 million or 8%, and end the year with liquidity in excess of $2 billion. Kohl’s reported comparable sales growth of 1.2% for the combined November and December period, beating the FactSet 4Q consensus of 0.1%, but below the 2.5% growth in the third quarter of fiscal 2019. It raised the lower end of its full-year diluted EPS guidance range for to $5.50–$5.55, compared to prior guidance in the $5.35–$5.55 range. Macy’s reported November and December holiday comparable sales growth of 0.7%, following 3.1% growth in the third quarter. Holiday growth was below the expectations of analysts. The company attributed the poor performance to a fire at its West Virginia distribution center and changes to its pre-Christmas Earn and Redeem promotion. The company downgraded its full-year guidance with comparable sales growth reduced to 2% from prior guidance in the 2.3% to 2.5% range. It lowered its diluted EPS guidance to $3.95–$4.00 from $4.10–$4.30. Specialty Retailers Showed Improved Comps Specialty retailers Boot Barn and Urban Outfitters posted strong comparable sales growth in the holiday season. Retailers such as Buckle, Cato and Barnes & Noble showed sequential improvements in the comparable sales growth. Boot Barn reported 9.2% comparable sales growth for the third quarter ended December 29, 2018, beating the consensus estimate of 6.9%, but below the 11.3% growth in previous quarter. It saw strong double-digit growth in e-commerce sales, with a healthy increase in margins. Boot Barn’s strong sales momentum at retail stores was driven by growth across all major product categories and geographic regions, which have enabled the company to post seven consecutive quarters of same-store sales growth. For the two months ended December 31, Urban Outfitters’ comparable retail segment net sales increased 5%, led by strong, double-digit growth in the digital channel which was partially offset by negative retail store sales. The growth was in line with consensus but below the 8% growth in the third quarter of fiscal 2019. Buckle showed a slight improvement in comparable sales growth from November, as comparable sales fell 0.2% in the five weeks to January 5, compared a 0.6% decline in November. Cato’s comparable sales growth was flat in the five-week period ended January 5, stabilizing after a 6% decline in November. L Brands also posted flat comparable sales in the five-week period ended January 5, slightly below the 1% consensus estimate and well below the 9% growth reported in November. Company guidance for 4Q EPS is $1.90–$2.10, while the FactSet consensus is $2.02. Strong comparable sales growth of 11% at Bath & Body Works was partially offset by Victoria’s Secret’s 6% decline in comparable sales. Barnes & Noble showed a sequential improvement, reporting comparable sales growth of 1.3%, compared to a decline of 1.4% in the second quarter of fiscal 2018. It reported a comparable store sales increase of 4.0% between Black Friday and New Year’s Day, saying it was the best comparable sales performance for the company in several years. The company noted that an increase in promotions supported sales but may cause it to reduce earnings guidance by up to 10% when it updates the market on February 28.