Nitheesh NH

In these extraordinary times, we offer our early thoughts on how holiday 2020 retail demand could look. We provide these views as highly tentative; they are based on what we currently know in a fast-evolving context.

Our conversations with major US retail firms have yielded a range of perspectives on the likely impact on the end-of-year holiday peak. At their most pessimistic, executives are preparing for discretionary demand to be as low as 65% of 2019 holiday demand—i.e., down by up to 35% year over year.

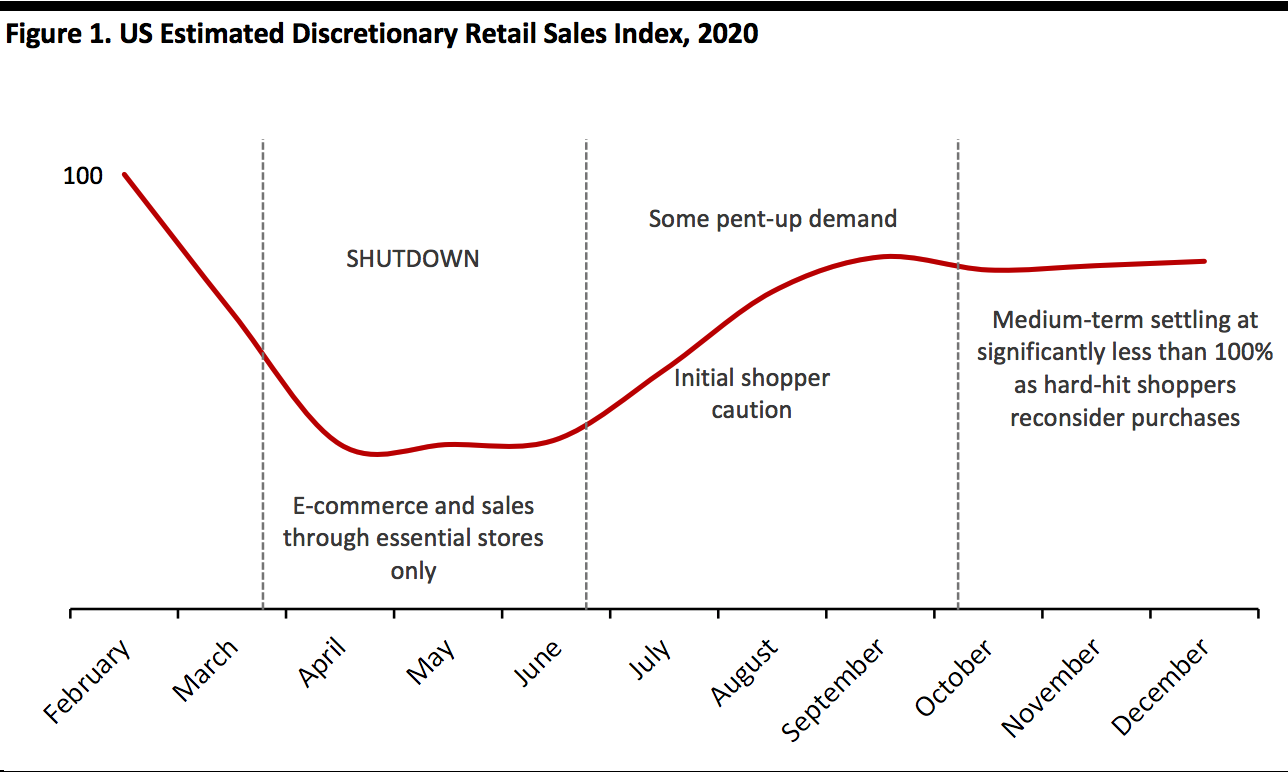

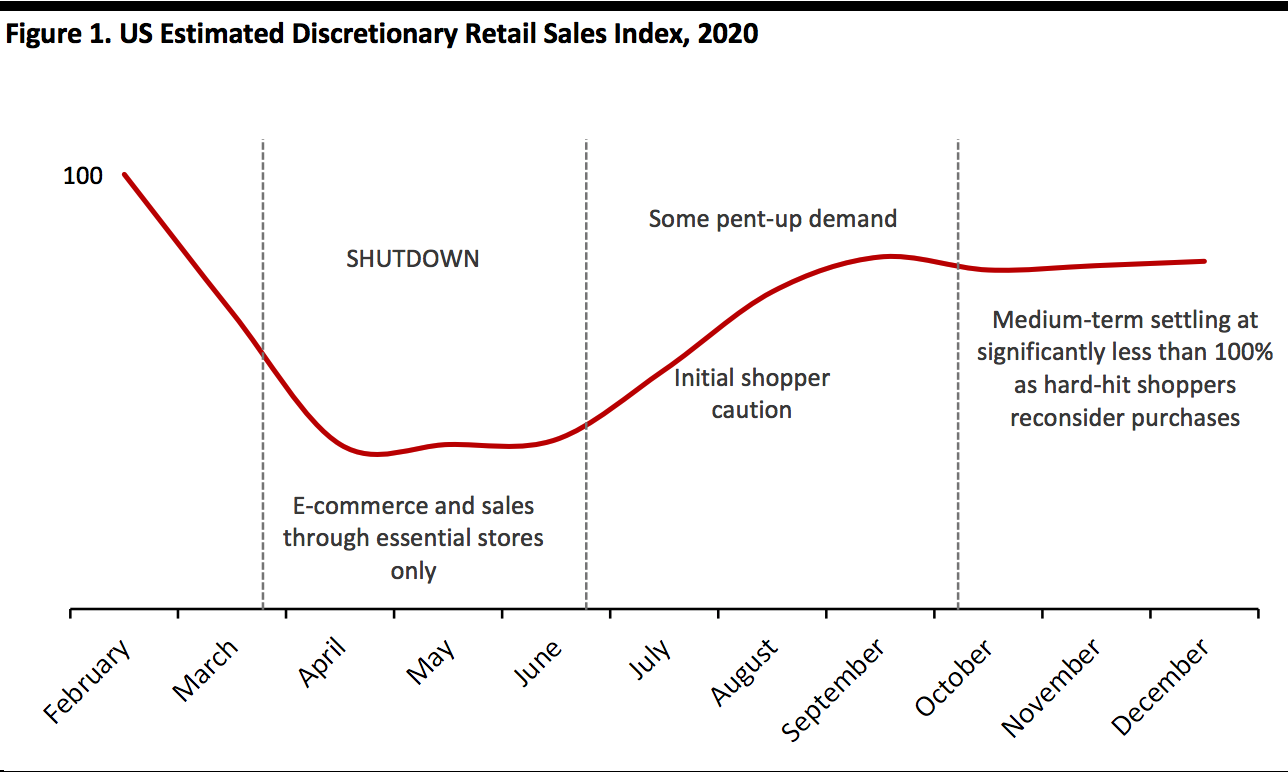

In the near term, we expect the hit to discretionary retail sales to be even deeper. As shown in Figure 1, we model discretionary retail sales in the US roughly based on three phases: very deep declines in the period from mid-March; a cautious improvement once coronavirus-related restrictions are eased; and retail demand settling at less than precrisis levels for the remainder of 2020. The timings and trends shown below are illustrative estimates based on current knowledge.

[caption id="attachment_107927" align="aligncenter" width="580"] Source: Coresight Research[/caption]

Supply Side

Our current base case is that US store closures last for roughly three months from mid-March, implying that physical retail would see reopenings around mid-June.

However, we expect that many stores will never reopen: As we recently delineated, we expect there to be a wave of bankruptcies and store closures on the back of the crisis. Even retailers that survive in reasonable health may take the opportunity to reconsider store fleets in the short-term context of rapidly changed consumer demand and the long-term context of structural shifts in retail.

Our assumptions therefore see physical retail reopen well before the holiday peak but with the brick-and-mortar landscape decimated. For holiday 2020, supply will therefore be considerably constrained versus prior years.

Demand Side

More meaningfully, we expect severe economic and labor-market shocks to continue resonating through the holiday peak. As we write, Americans have registered as unemployed in numbers never seen before. Many of these people will be furloughed, meaning they have jobs to return to—in theory—which assumes 100% business survival rates.

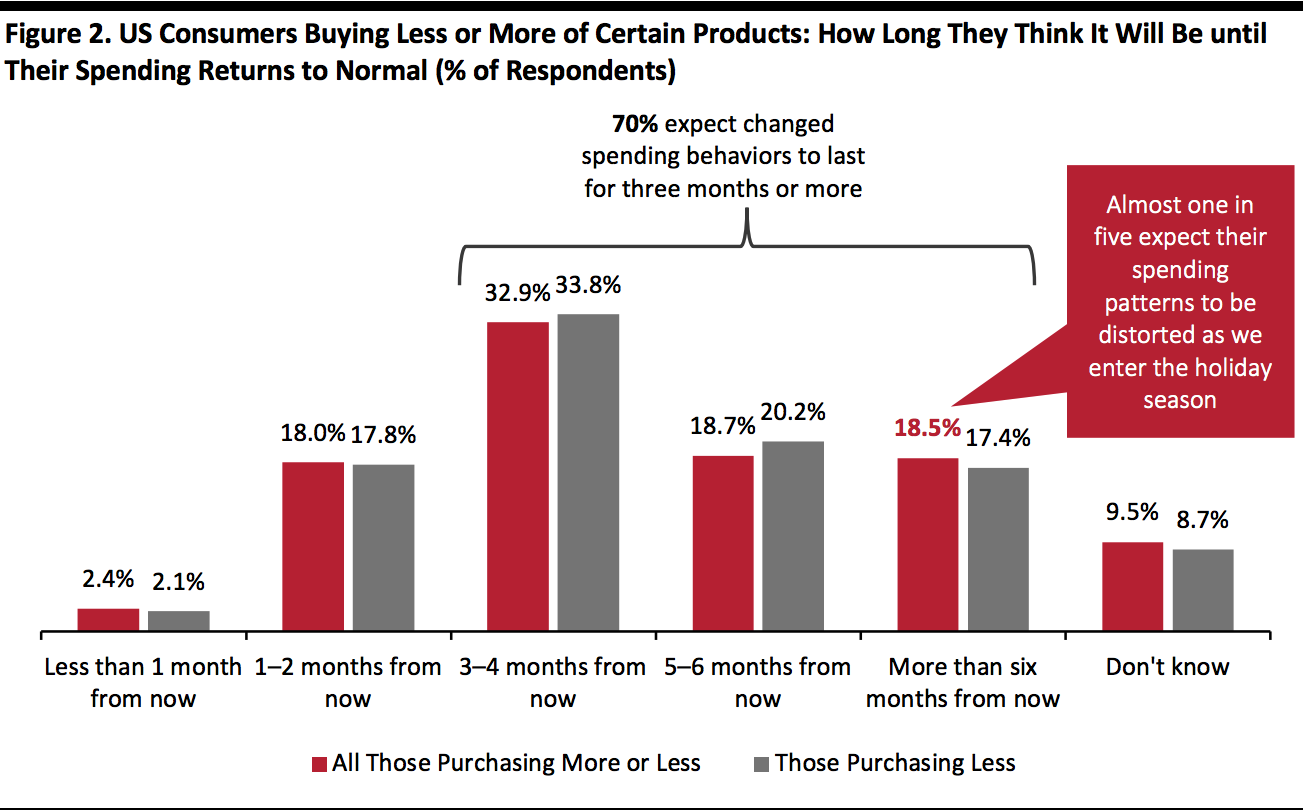

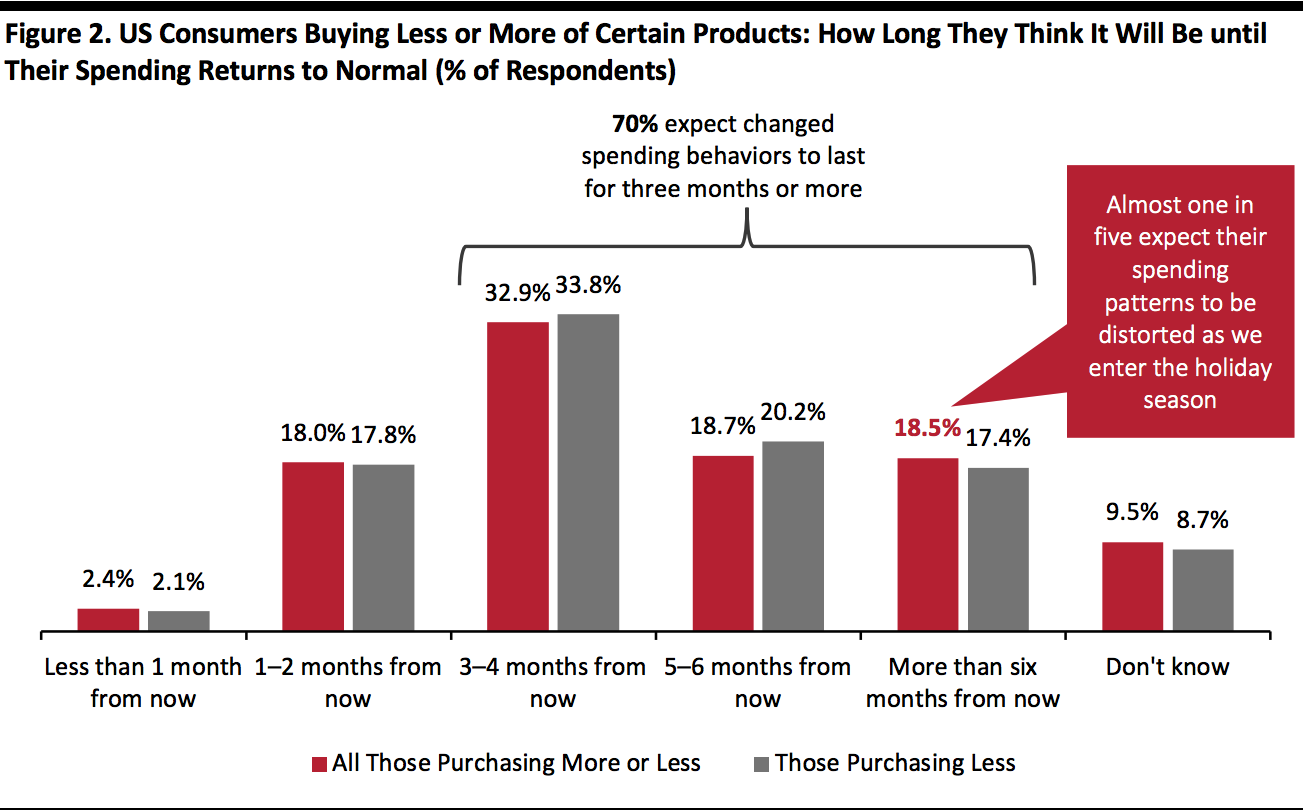

Our recent surveys of US consumers have revealed pessimism that life will return to normal rapidly. In our April 8 survey, we found that 63.8% of respondents are buying less of certain categories (led by apparel, furniture/home categories and beauty products) and 70.7% are purchasing more of certain categories (largely food and other essentials). We asked those who are spending less or spending more when they expect their spending to return to normal levels. Fully 70% of this group expected that this would only be the case in three months’ time or more, and almost one in five (18.5%) think it will take more than six months—which takes us up to the holiday season.

In the chart below, we break out those who said they are buying certain products less; however, the pattern is broadly the same for these consumers as for all those who have changed their purchasing habits.

[caption id="attachment_107929" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

Supply Side

Our current base case is that US store closures last for roughly three months from mid-March, implying that physical retail would see reopenings around mid-June.

However, we expect that many stores will never reopen: As we recently delineated, we expect there to be a wave of bankruptcies and store closures on the back of the crisis. Even retailers that survive in reasonable health may take the opportunity to reconsider store fleets in the short-term context of rapidly changed consumer demand and the long-term context of structural shifts in retail.

Our assumptions therefore see physical retail reopen well before the holiday peak but with the brick-and-mortar landscape decimated. For holiday 2020, supply will therefore be considerably constrained versus prior years.

Demand Side

More meaningfully, we expect severe economic and labor-market shocks to continue resonating through the holiday peak. As we write, Americans have registered as unemployed in numbers never seen before. Many of these people will be furloughed, meaning they have jobs to return to—in theory—which assumes 100% business survival rates.

Our recent surveys of US consumers have revealed pessimism that life will return to normal rapidly. In our April 8 survey, we found that 63.8% of respondents are buying less of certain categories (led by apparel, furniture/home categories and beauty products) and 70.7% are purchasing more of certain categories (largely food and other essentials). We asked those who are spending less or spending more when they expect their spending to return to normal levels. Fully 70% of this group expected that this would only be the case in three months’ time or more, and almost one in five (18.5%) think it will take more than six months—which takes us up to the holiday season.

In the chart below, we break out those who said they are buying certain products less; however, the pattern is broadly the same for these consumers as for all those who have changed their purchasing habits.

[caption id="attachment_107929" align="aligncenter" width="580"] Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak, surveyed on April 8, 2020

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak, surveyed on April 8, 2020

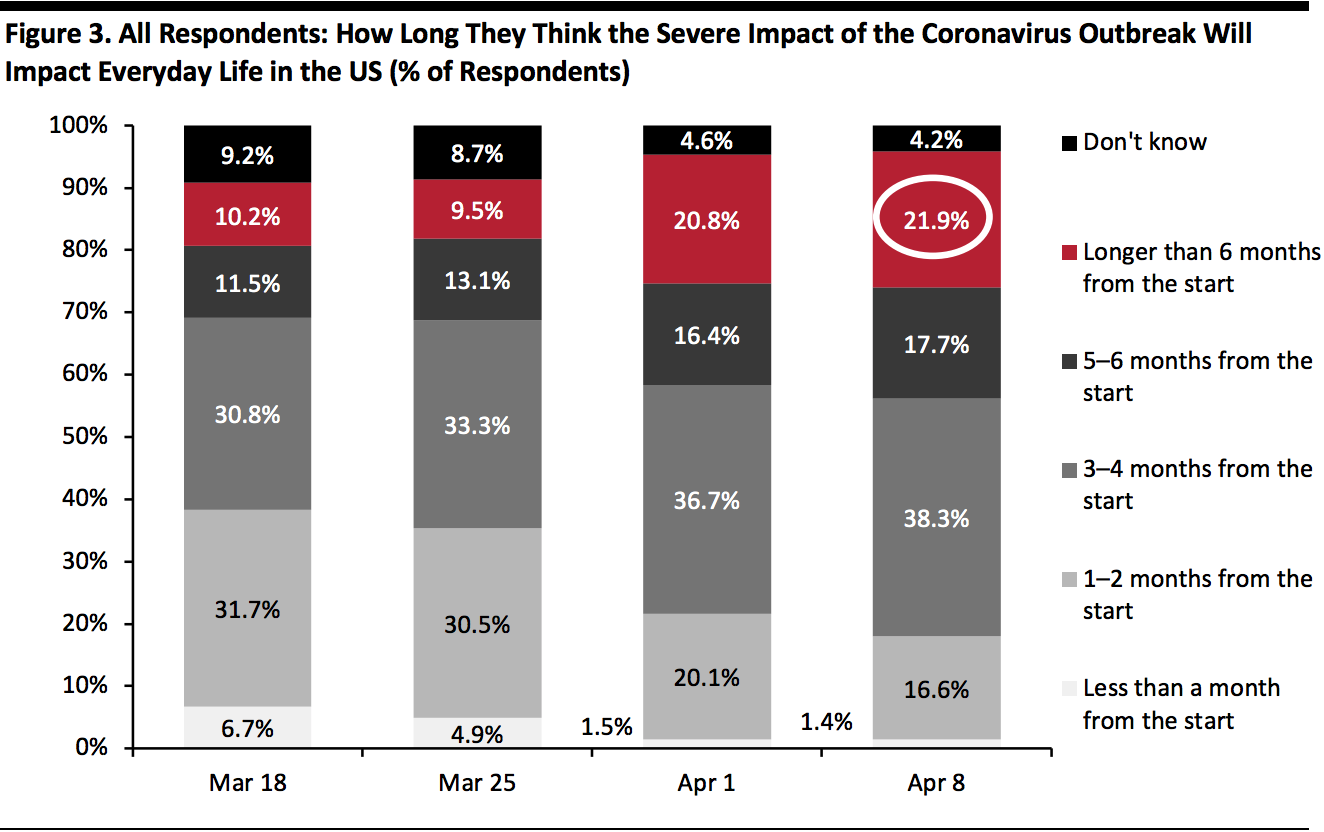

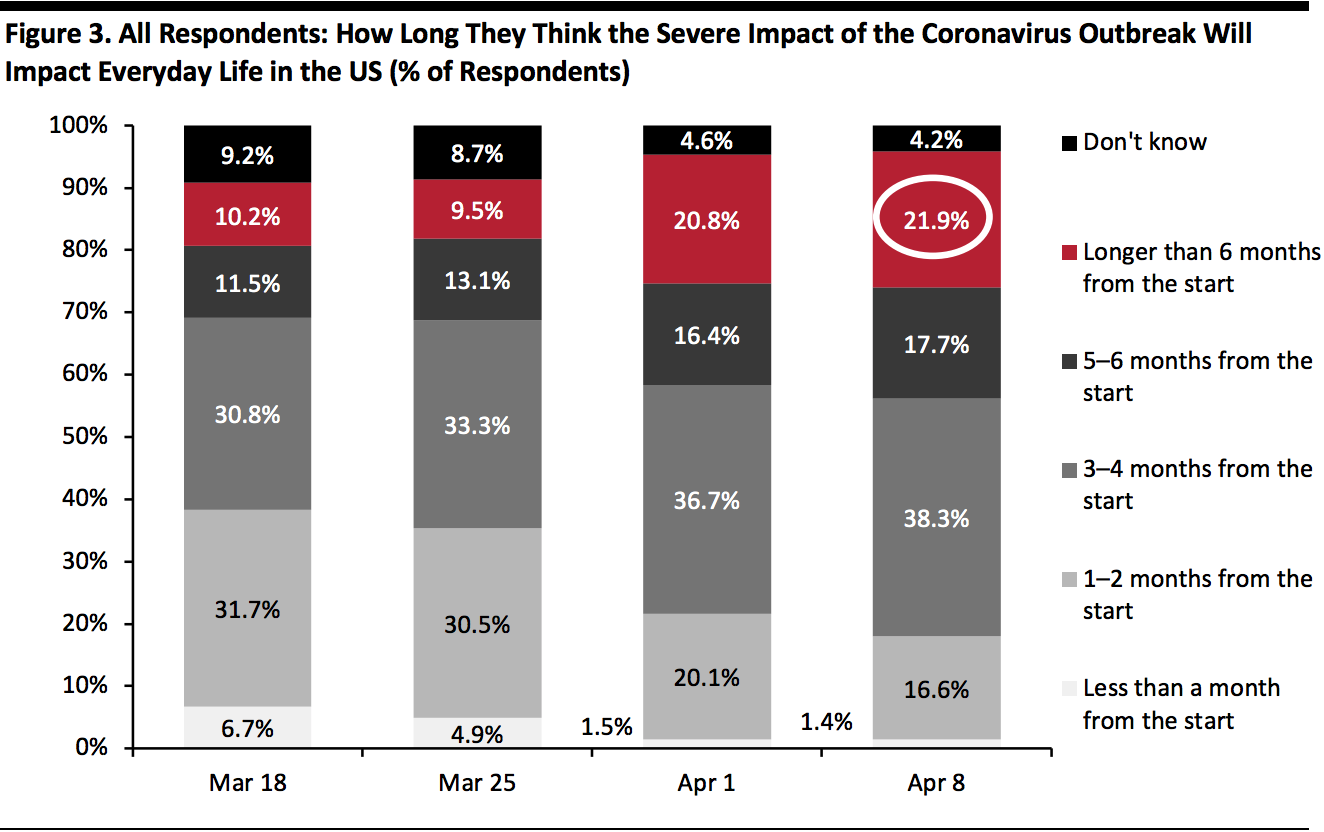

Source: Coresight Research[/caption] Our weekly surveys have also found that consumers’ expectations as to the length of the crisis continue to increase. In our most recent survey on April 8, almost 22% of respondents said that they expect the severe impact of the outbreak to last more than six months from its start—which again implies severe impacts running into the holiday peak. Furthermore, 78% of respondents expect the severe impact to last three months or more, up from 74% in the prior week. [caption id="attachment_107930" align="aligncenter" width="580"] Base: US Internet users aged 18+, surveyed on April 8, 2020

Base: US Internet users aged 18+, surveyed on April 8, 2020

Source: Coresight Research[/caption] Implications for US Retail We think that many retailers went into the coronavirus crisis with unduly optimistic expectations—demonstrated by announcing store closures for only two weeks, for example. The path out of the crisis and the timings around recovery remain uncertain: Some experts have indicated everyday life can return to a kind of normality only once a vaccine is rolled out or the population develops herd immunity. However, we think that postcrisis normality will not be the same as precrisis normality. Physical retail is likely to have been reshaped, and consumers may remain highly cautious and retain changed behaviors for some time. Retailers should not assume a later-2020 bounce back. Many are likely to enter the fall season with a glut of inventory, and they should review their holiday orders in view of what appears to be an increasingly pessimistic outlook.

Source: Coresight Research[/caption]

Supply Side

Our current base case is that US store closures last for roughly three months from mid-March, implying that physical retail would see reopenings around mid-June.

However, we expect that many stores will never reopen: As we recently delineated, we expect there to be a wave of bankruptcies and store closures on the back of the crisis. Even retailers that survive in reasonable health may take the opportunity to reconsider store fleets in the short-term context of rapidly changed consumer demand and the long-term context of structural shifts in retail.

Our assumptions therefore see physical retail reopen well before the holiday peak but with the brick-and-mortar landscape decimated. For holiday 2020, supply will therefore be considerably constrained versus prior years.

Demand Side

More meaningfully, we expect severe economic and labor-market shocks to continue resonating through the holiday peak. As we write, Americans have registered as unemployed in numbers never seen before. Many of these people will be furloughed, meaning they have jobs to return to—in theory—which assumes 100% business survival rates.

Our recent surveys of US consumers have revealed pessimism that life will return to normal rapidly. In our April 8 survey, we found that 63.8% of respondents are buying less of certain categories (led by apparel, furniture/home categories and beauty products) and 70.7% are purchasing more of certain categories (largely food and other essentials). We asked those who are spending less or spending more when they expect their spending to return to normal levels. Fully 70% of this group expected that this would only be the case in three months’ time or more, and almost one in five (18.5%) think it will take more than six months—which takes us up to the holiday season.

In the chart below, we break out those who said they are buying certain products less; however, the pattern is broadly the same for these consumers as for all those who have changed their purchasing habits.

[caption id="attachment_107929" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

Supply Side

Our current base case is that US store closures last for roughly three months from mid-March, implying that physical retail would see reopenings around mid-June.

However, we expect that many stores will never reopen: As we recently delineated, we expect there to be a wave of bankruptcies and store closures on the back of the crisis. Even retailers that survive in reasonable health may take the opportunity to reconsider store fleets in the short-term context of rapidly changed consumer demand and the long-term context of structural shifts in retail.

Our assumptions therefore see physical retail reopen well before the holiday peak but with the brick-and-mortar landscape decimated. For holiday 2020, supply will therefore be considerably constrained versus prior years.

Demand Side

More meaningfully, we expect severe economic and labor-market shocks to continue resonating through the holiday peak. As we write, Americans have registered as unemployed in numbers never seen before. Many of these people will be furloughed, meaning they have jobs to return to—in theory—which assumes 100% business survival rates.

Our recent surveys of US consumers have revealed pessimism that life will return to normal rapidly. In our April 8 survey, we found that 63.8% of respondents are buying less of certain categories (led by apparel, furniture/home categories and beauty products) and 70.7% are purchasing more of certain categories (largely food and other essentials). We asked those who are spending less or spending more when they expect their spending to return to normal levels. Fully 70% of this group expected that this would only be the case in three months’ time or more, and almost one in five (18.5%) think it will take more than six months—which takes us up to the holiday season.

In the chart below, we break out those who said they are buying certain products less; however, the pattern is broadly the same for these consumers as for all those who have changed their purchasing habits.

[caption id="attachment_107929" align="aligncenter" width="580"] Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak, surveyed on April 8, 2020

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak, surveyed on April 8, 2020Source: Coresight Research[/caption] Our weekly surveys have also found that consumers’ expectations as to the length of the crisis continue to increase. In our most recent survey on April 8, almost 22% of respondents said that they expect the severe impact of the outbreak to last more than six months from its start—which again implies severe impacts running into the holiday peak. Furthermore, 78% of respondents expect the severe impact to last three months or more, up from 74% in the prior week. [caption id="attachment_107930" align="aligncenter" width="580"]

Base: US Internet users aged 18+, surveyed on April 8, 2020

Base: US Internet users aged 18+, surveyed on April 8, 2020Source: Coresight Research[/caption] Implications for US Retail We think that many retailers went into the coronavirus crisis with unduly optimistic expectations—demonstrated by announcing store closures for only two weeks, for example. The path out of the crisis and the timings around recovery remain uncertain: Some experts have indicated everyday life can return to a kind of normality only once a vaccine is rolled out or the population develops herd immunity. However, we think that postcrisis normality will not be the same as precrisis normality. Physical retail is likely to have been reshaped, and consumers may remain highly cautious and retain changed behaviors for some time. Retailers should not assume a later-2020 bounce back. Many are likely to enter the fall season with a glut of inventory, and they should review their holiday orders in view of what appears to be an increasingly pessimistic outlook.