Web Developers

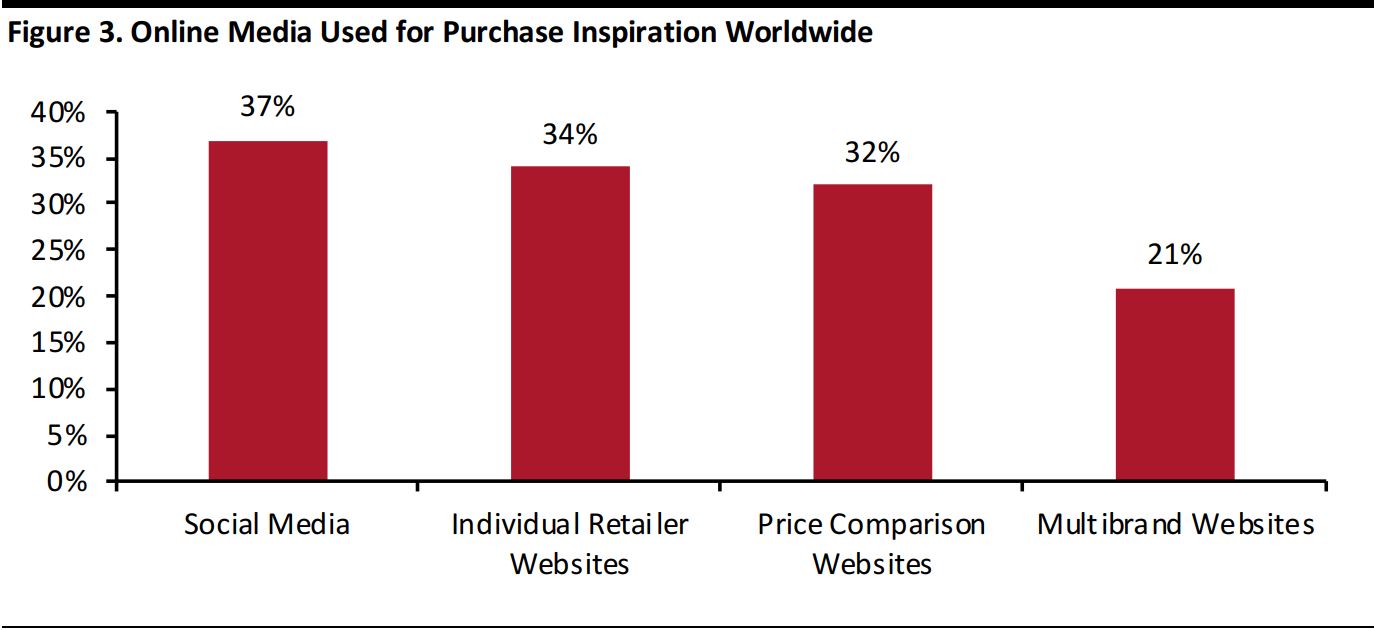

The holiday shopping season is nearly here, and with more than 290 million people now connected to the Internet in the US, social media will likely play a bigger role than ever before in the holiday shopping experience. Shoppers draw purchasing inspiration from social media more often than from any other form of online media, according to a March 2018 survey conducted by PwC.

In this report, we examine social media’s growing influence on holiday shopping. In particular, we analyze the increase in spending on social media advertising and the effectiveness of mobile and video content. Additionally, we discuss the niches of several social media platforms, and compare the social media followings of selected brands and companies.

Even though most social media users aren’t using the sites to make direct purchases, they are relying on them for research, recommendations and discovery. Only 14% of US social media users have never purchased a product based on a brand’s social media post, according to OnePoll and Curalate data.

The Rise of Social Media as a Marketing Tool

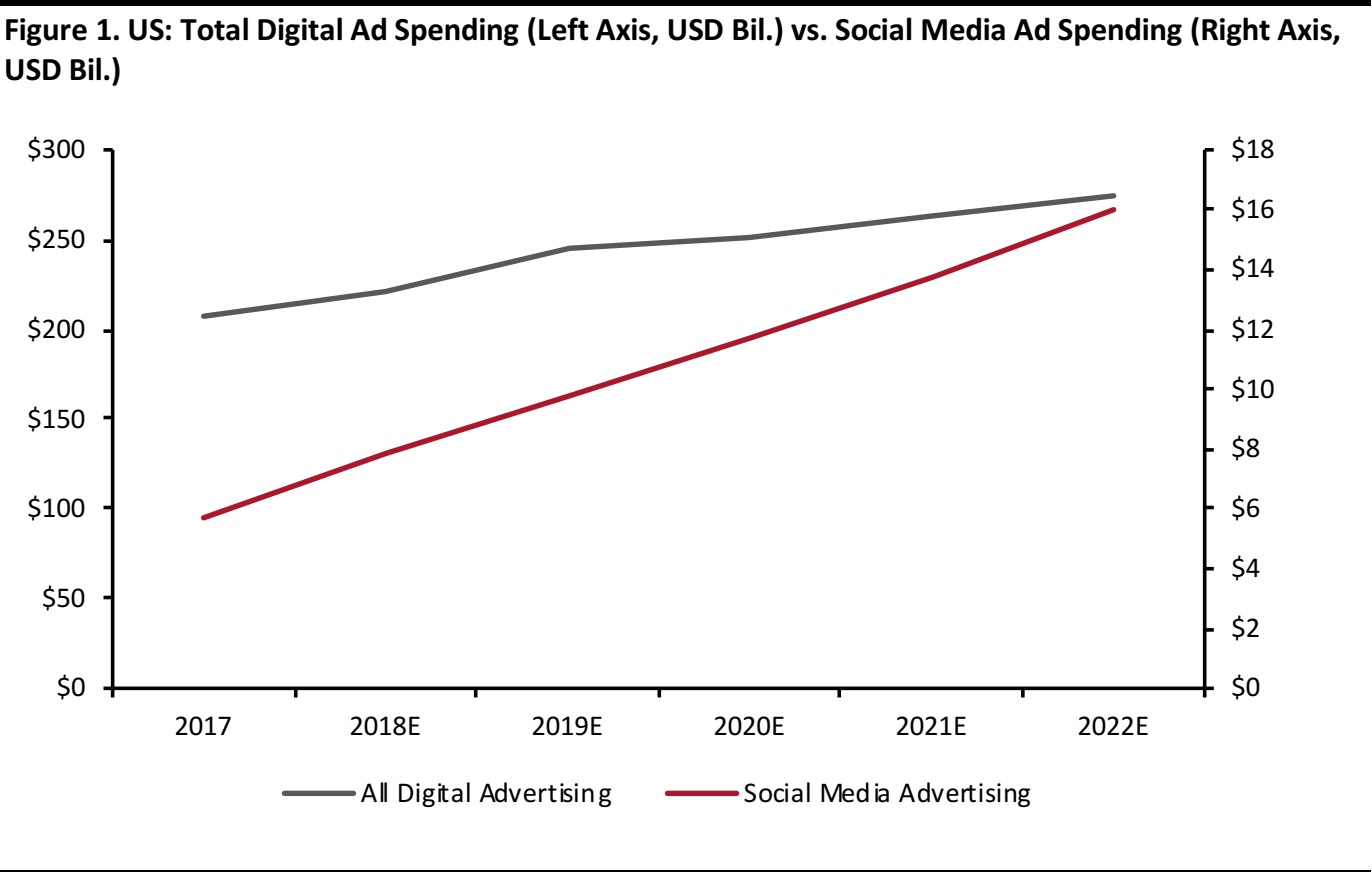

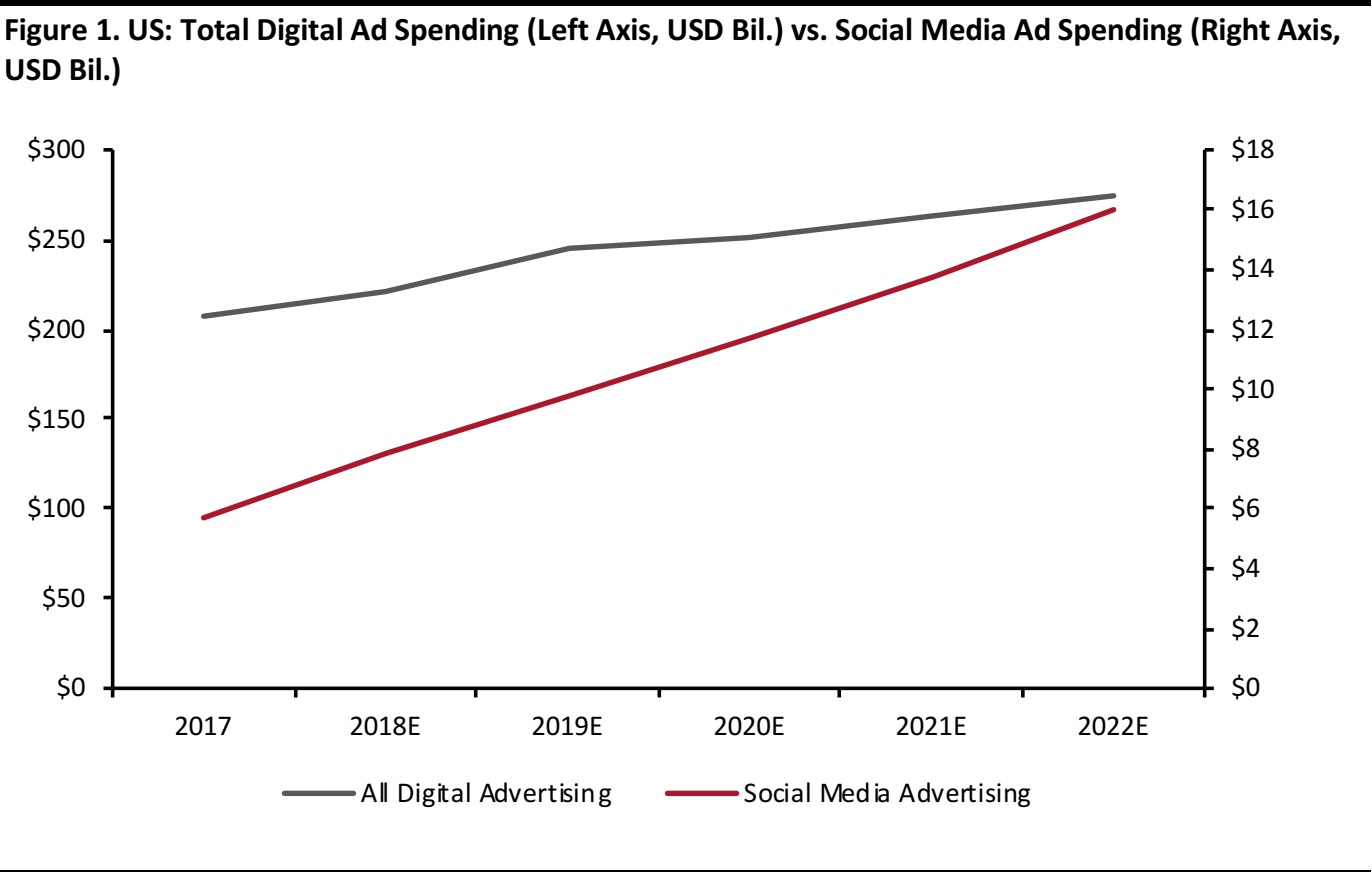

Social media has grown into one of the most important advertising vehicles over the past several years. Data from eMarketer indicate that ad spending on social media platforms will increase by 38% year over year in the US in 2018, and the firm’s projections suggest that a spending slowdown is unlikely. Social media ad spending is expected to more than double by 2022, from $7.85 billion to $16 billion, easily outpacing total ad spending growth. By way of comparison, the total US ad market is estimated to increase by 6.6% year over year, to reach $221 billion in 2018, according to eMarketer. However, brands can also market via unpaid posts on social media websites, which means that ad spending totals do not necessarily reflect the total influence of social media marketing campaigns.

Source: eMarketer

Growing Usage

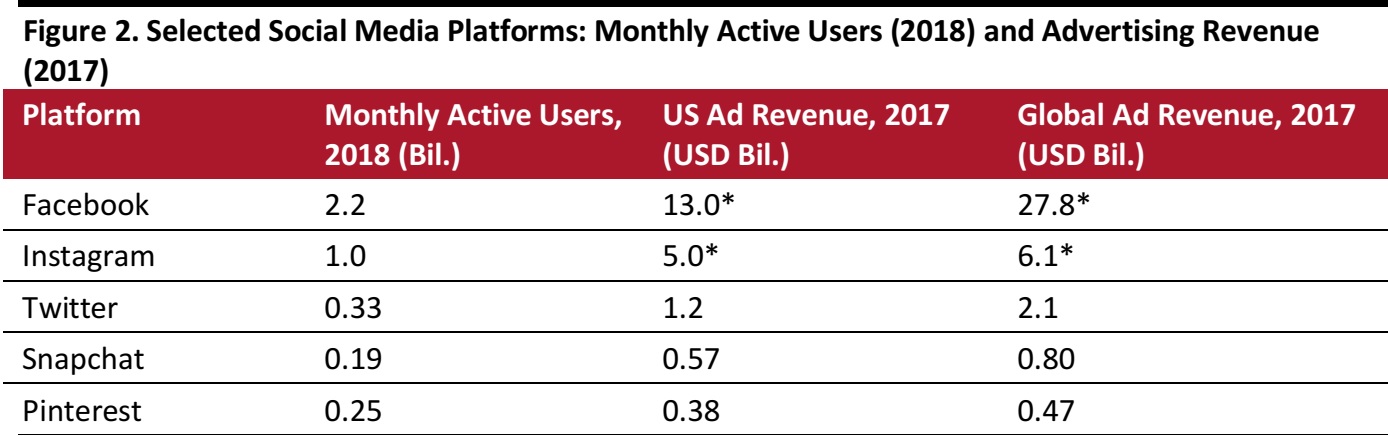

Social media sites are still growing in terms of accessibility and popularity, and advertisers continue to increase their spending on social media campaigns. As of the second quarter of 2018, Facebook alone had more than 2.2 billion active users, an 11% increase year over year, according to company reports. The company’s data indicate that the site’s active user numbers have grown at an average annual rate of more than 14% over the past five years. Some other social media companies have struggled to attract new users in recent years. Snapchat lost more than 3 million users between the first and second quarters of 2018, while Twitter’s number of active users has remained relatively stagnant at around 330 million over the past year, according to company reports. Meanwhile, Facebook has more users than Twitter, Snapchat and Pinterest combined, as does its photo-sharing subsidiary, Instagram. Facebook and Instagram are also both growing at a consistent pace and together are expected to account for 26.1% of all social media ad revenue this year, according to eMarketer. Monthly active users for each of these five major social media platforms are shown in the figure below. *Facebook and Instagram ad revenues are based on estimates of Facebook and Instagram’s share of Facebook Inc.’s overall advertising revenue.

Source: Company reports/TechCrunch/eMarketer/Bloomberg

*Facebook and Instagram ad revenues are based on estimates of Facebook and Instagram’s share of Facebook Inc.’s overall advertising revenue.

Source: Company reports/TechCrunch/eMarketer/Bloomberg

Increasingly Influential

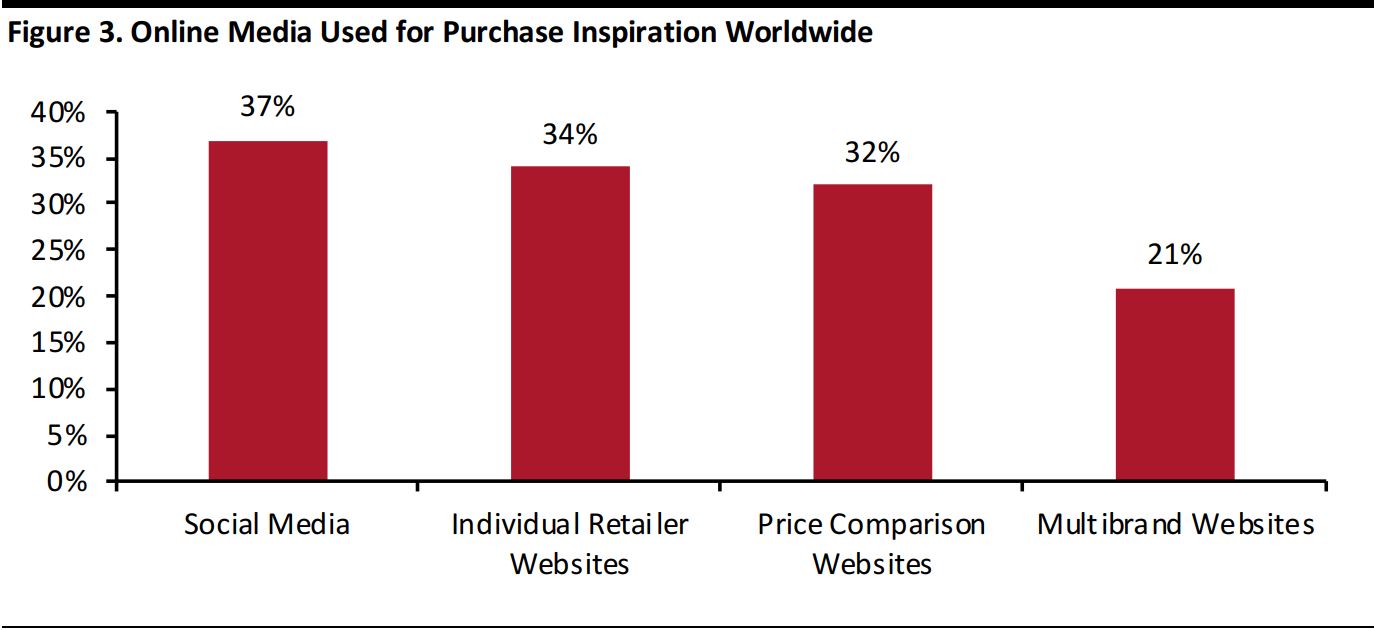

Another factor contributing to the rise of social media as an advertising tool and sales platform is an evolution in the way people are using these platforms. According to data from a March 2018 study by PwC, social media inspires more purchases than any other form of online media, as shown in the figure below.

Source: PwC

Despite high usage rates and strong influence, social media’s relevance as a tool that inspires purchases may be stagnating in some areas. As covered in our US Back-to-School 2018 Digital Trends report, social media had less of an influence on back-to-school shopping in the US this year than it did in 2017. However, that may be partially due to the fact that back-to-school shoppers tend to know what they need to purchase. Holiday shoppers, by contrast, are frequently looking for inspiration for gift ideas. A June 2018 report by Facebook indicates that the platform is still having a major influence on holiday shopping, and that its importance as an influencer may be increasing. Some 54.7% of shoppers surveyed reported that Facebook was influential in their holiday shopping in 2017, nearly double the percentage who said that they planned to use social media to facilitate their back-to-school shopping this year. Facebook’s report also highlighted the increasing importance of mobile devices in holiday purchases. The number of mobile-first researchers (people who do most of their shopping research on a mobile device) and mobile-first shoppers (people who do most of their purchasing on a mobile device) grew by 14% and 20%, respectively, between 2016 and 2017.Mobile and Video Dominate

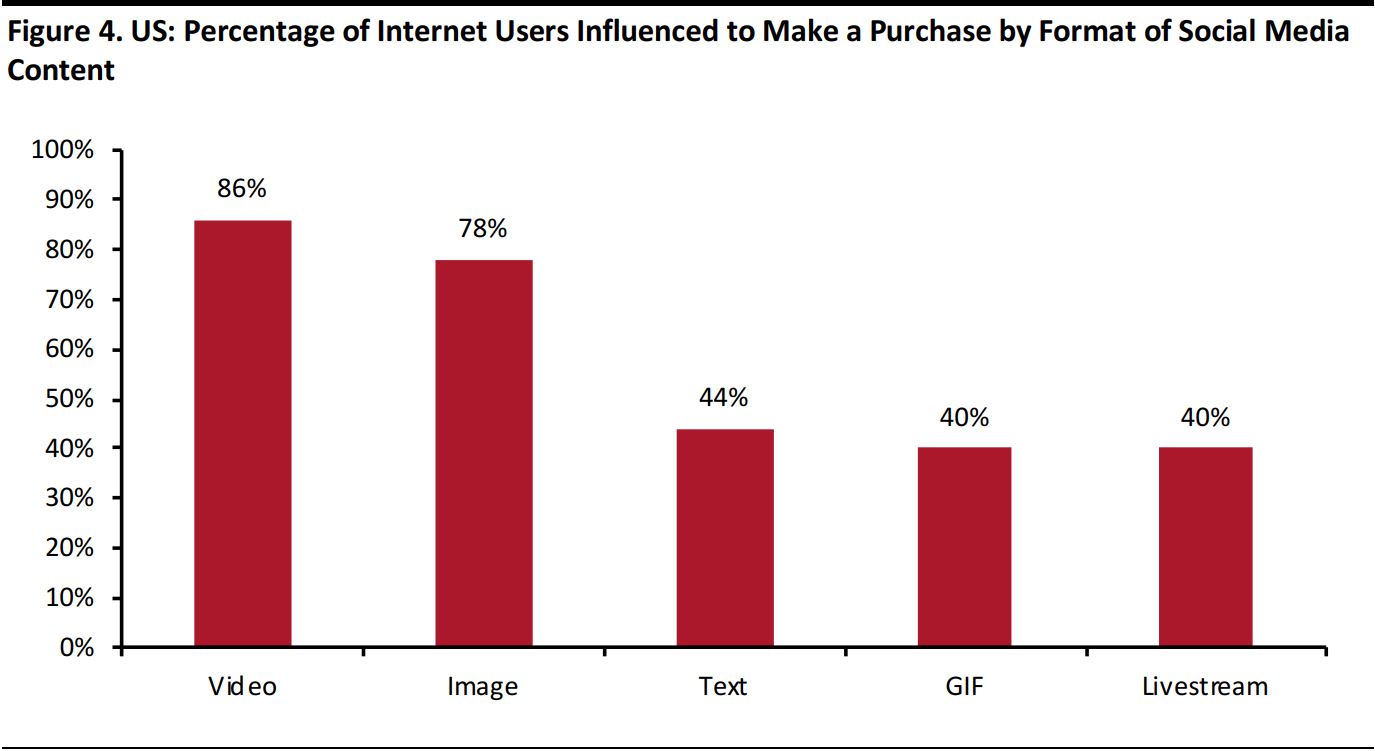

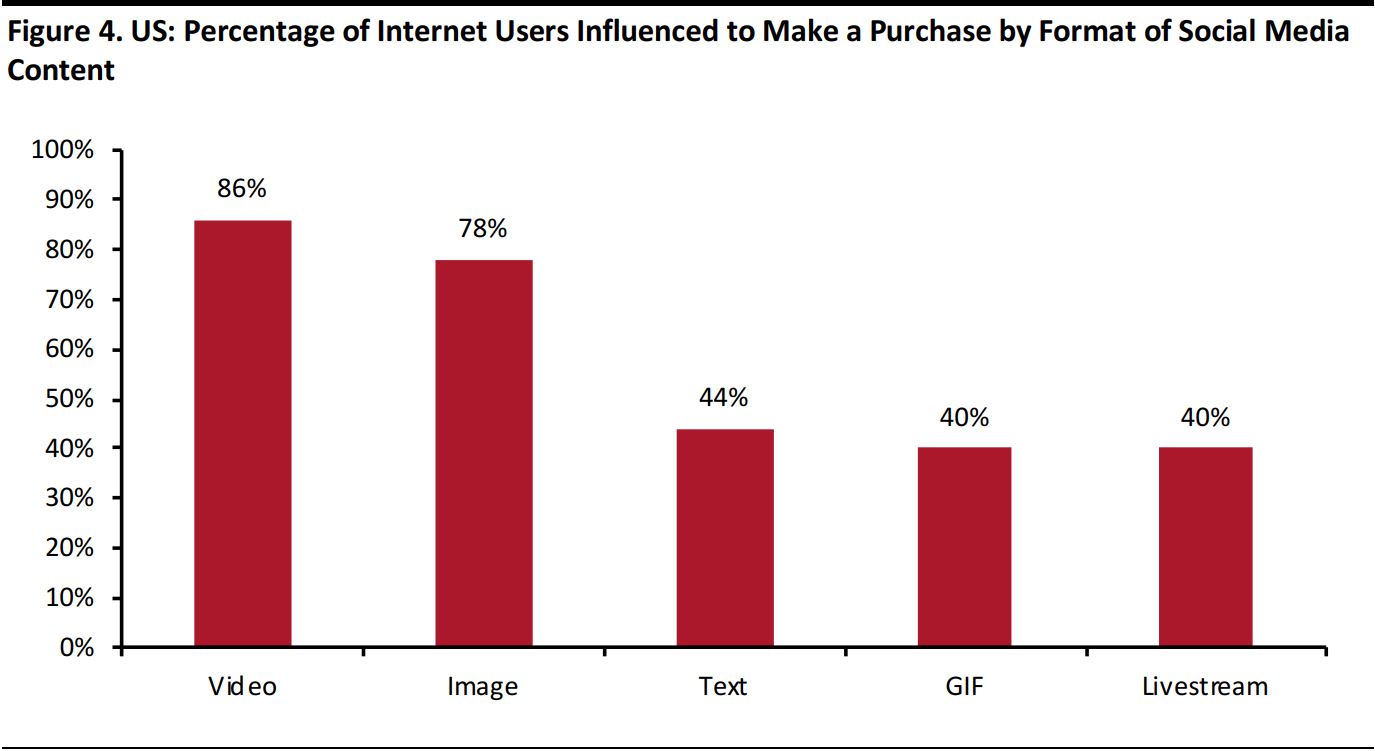

As social media continues to evolve and companies hurry to adapt, two trends are becoming clear in social media content and advertising: mobile optimization and video are key to successful social media campaigns. Over the 2016 holiday season, mobile conversions accounted for 51% of total online conversions, but that figure jumped to 77% in 2017, according to a study conducted by Facebook. This year, mobile ad spending is expected to account for 70% of all digital media ad spending, up from 65% two years ago. Video’s importance in influencing shopping on social media is also growing. According to eMarketer, US spending on social media video ads is expected to total $7.85 billion this year, a 38% increase over 2017. Consumer surveys indicate that this increased spending on video is justified: as of April 2017, 86% of US Internet users reported that video content on social media influenced them to purchase a product, according to research by eMarketer. That compares with 78% of users reporting that images influenced their purchasing decisions, and only 44% reporting that text-based content influenced their decisions.

Source: eMarketer

Social Media’s Role: Discovery, Research, Recommendations and, Sometimes, Purchasing

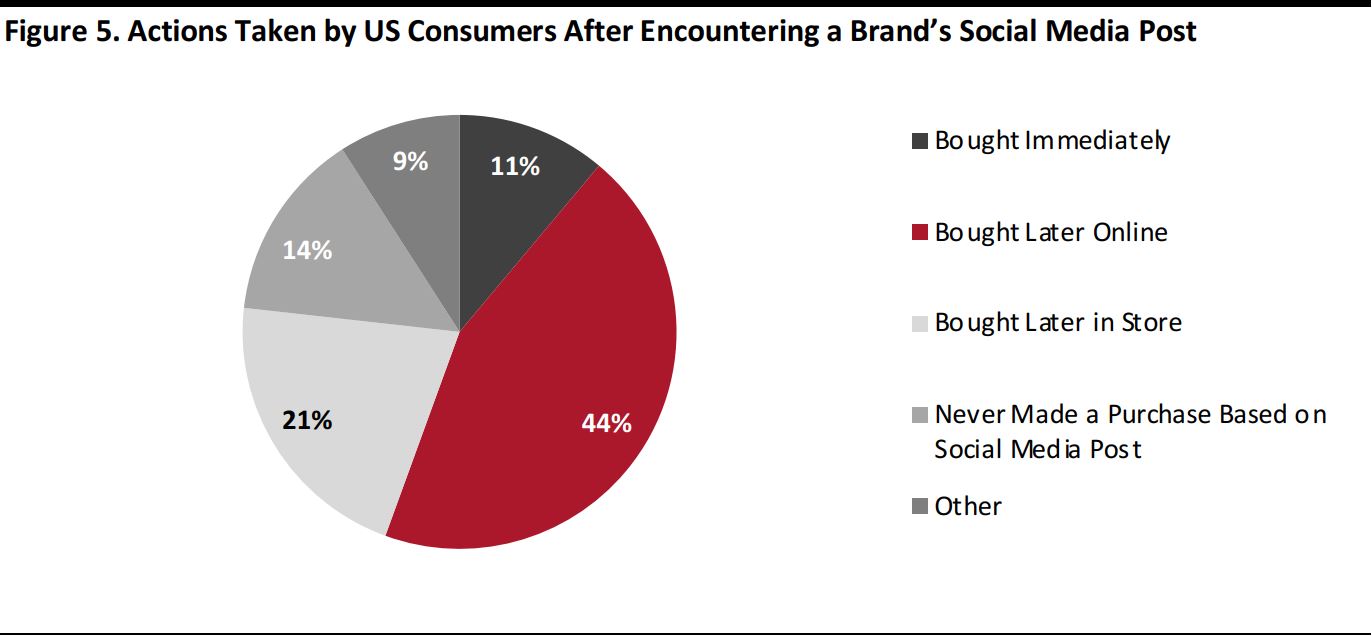

Social media can play a variety of roles in influencing and facilitating purchases. Sites such as Facebook can inspire purchases, facilitate sales directly, serve as a vehicle for endorsements and recommendations, and even help users discover new products or sales events. Although social commerce, or the direct purchasing of products through social media sites, may be on the rise, most consumers are not likely to use social media as their primary purchasing tool while doing their holiday shopping this year. According to data from OnePoll and Curalate, only 11% of consumers surveyed reported buying a product immediately after encountering a brand’s social media post, whereas 65% preferred to purchase the product later, either in-store or online. The graph below breaks down the actions US survey respondents said they took after seeing a brand’s social media post. Numbers may not sum due to rounding.

Source: OnePoll/Curalate

Numbers may not sum due to rounding.

Source: OnePoll/Curalate

Even though most social media users aren’t using the sites to make direct purchases, they are relying on them for research, recommendations and discovery. Only 14% of US social media users have never purchased a product based on a brand’s social media post, according to OnePoll and Curalate data.

Different Platforms, Different Niches

Facebook remains the dominant social media platform in the US and around the world, now boasting more than 2.2 billion users. In 2018, Facebook is expected to account for more than 86% of all US social media video ad spending, according to data from eMarketer. While Americans under age 18 largely ignore the social media giant (only about 3% of Facebook users are under 18, according to company data), it continues to have generally well-rounded demographic usage: just under 9% of the network’s users are between the ages of 18 and 24, while a similar number are between the ages of 35 and 44, according to company reports. Other social networks might be more suited for posts and ads specifically targeted toward young consumers. According to data from Hootsuite and We Are Social, 68% of Instagram users are under the age of 34, making Instagram perhaps the best starting point for many youth-focused brands this holiday season. YouTube is another important social media platform for holiday shopping. The site now reaches more Americans between the ages of 18 and 49 than any broadcast TV channel, according to a study by Google and Ipsos Connect. YouTube brand channels and creators are increasingly influencing this demographic’s shopping decisions. Some 74% of people in the 18–49 age group watch brand channels on YouTube on a weekly basis, while 63% have taken action because of content they watched on a brand or creator channel, according to the study. These data, combined with evidence of the effectiveness of video advertising, indicate that YouTube could be one of the most influential social media platforms during the upcoming holiday shopping season.Brand Comparison: Who’s “Winning” Social Media?

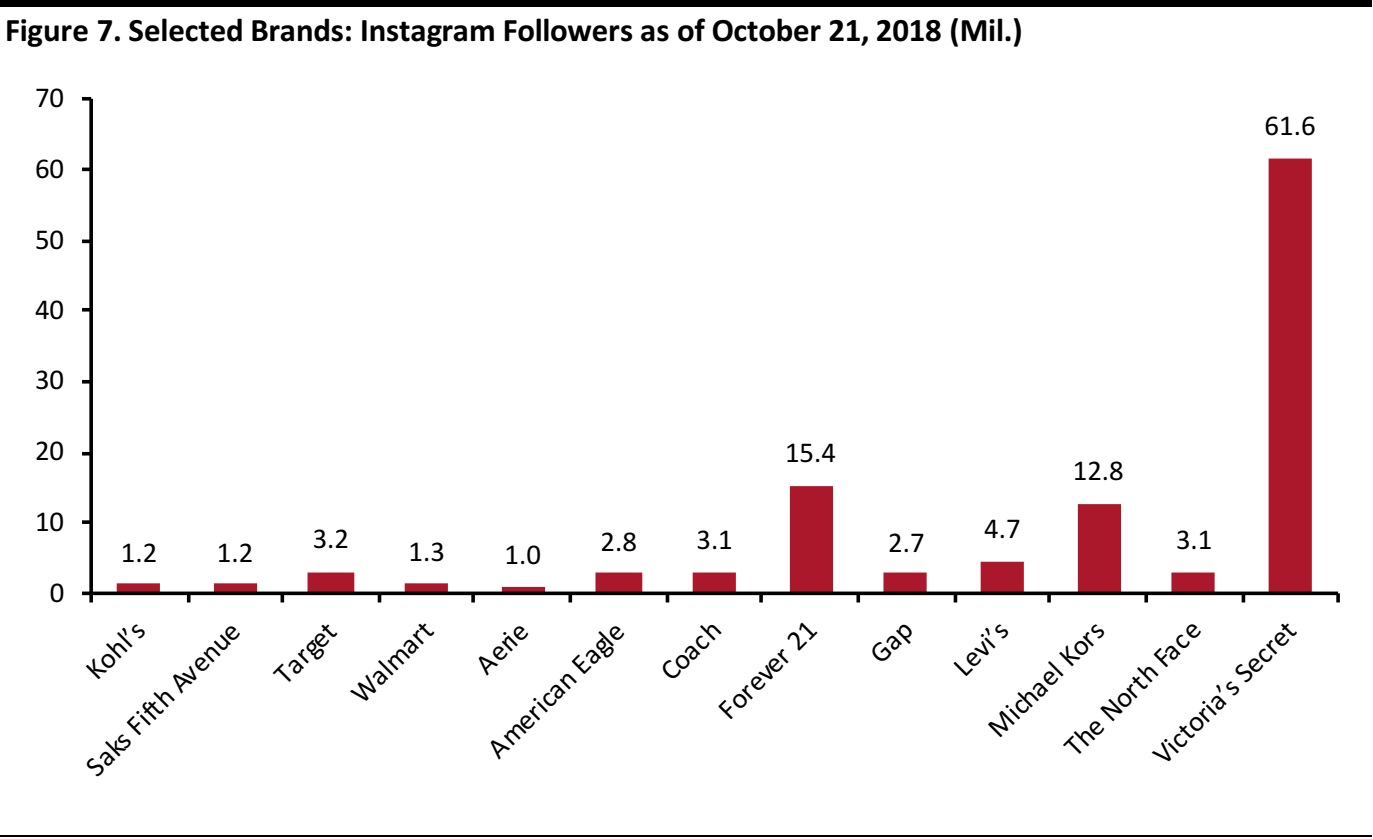

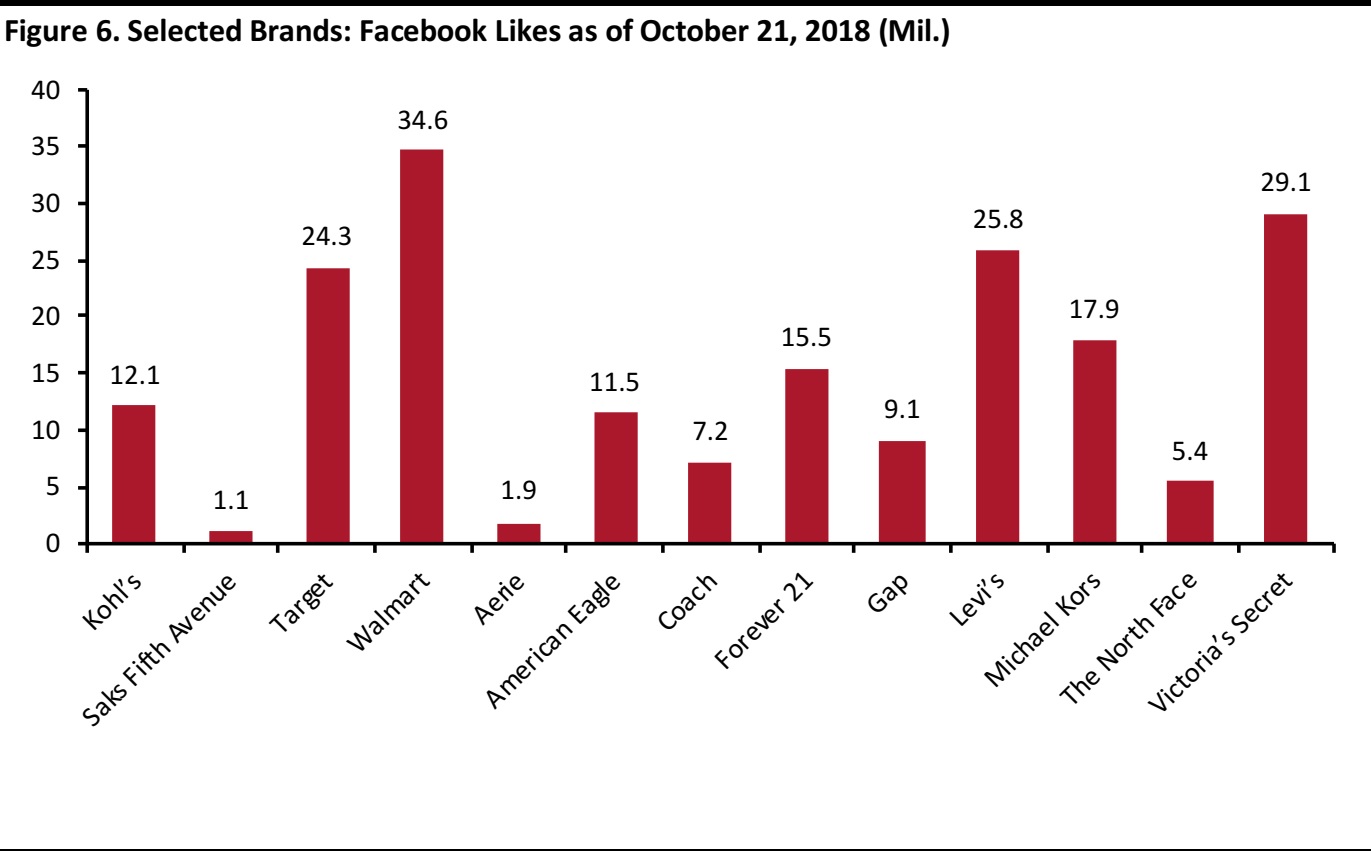

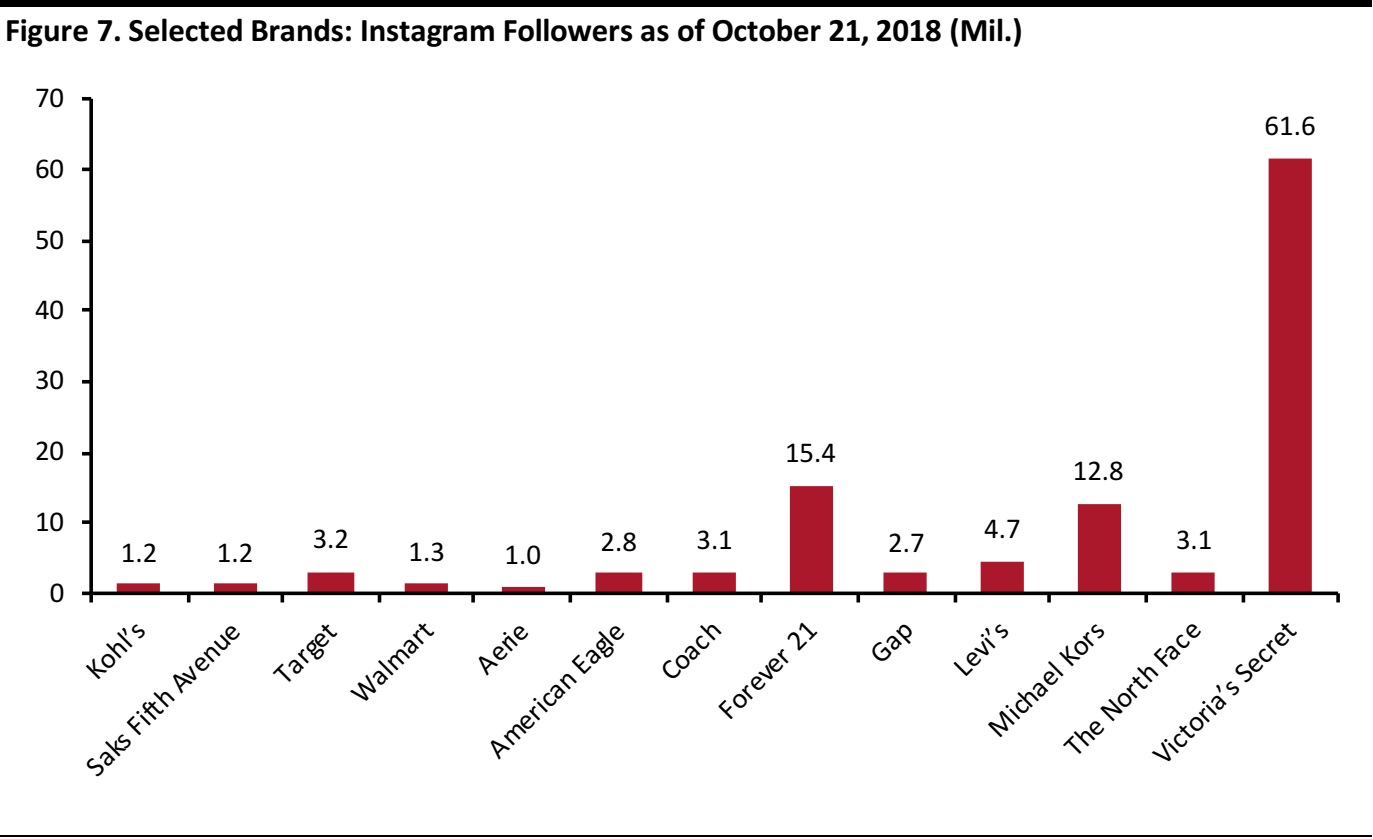

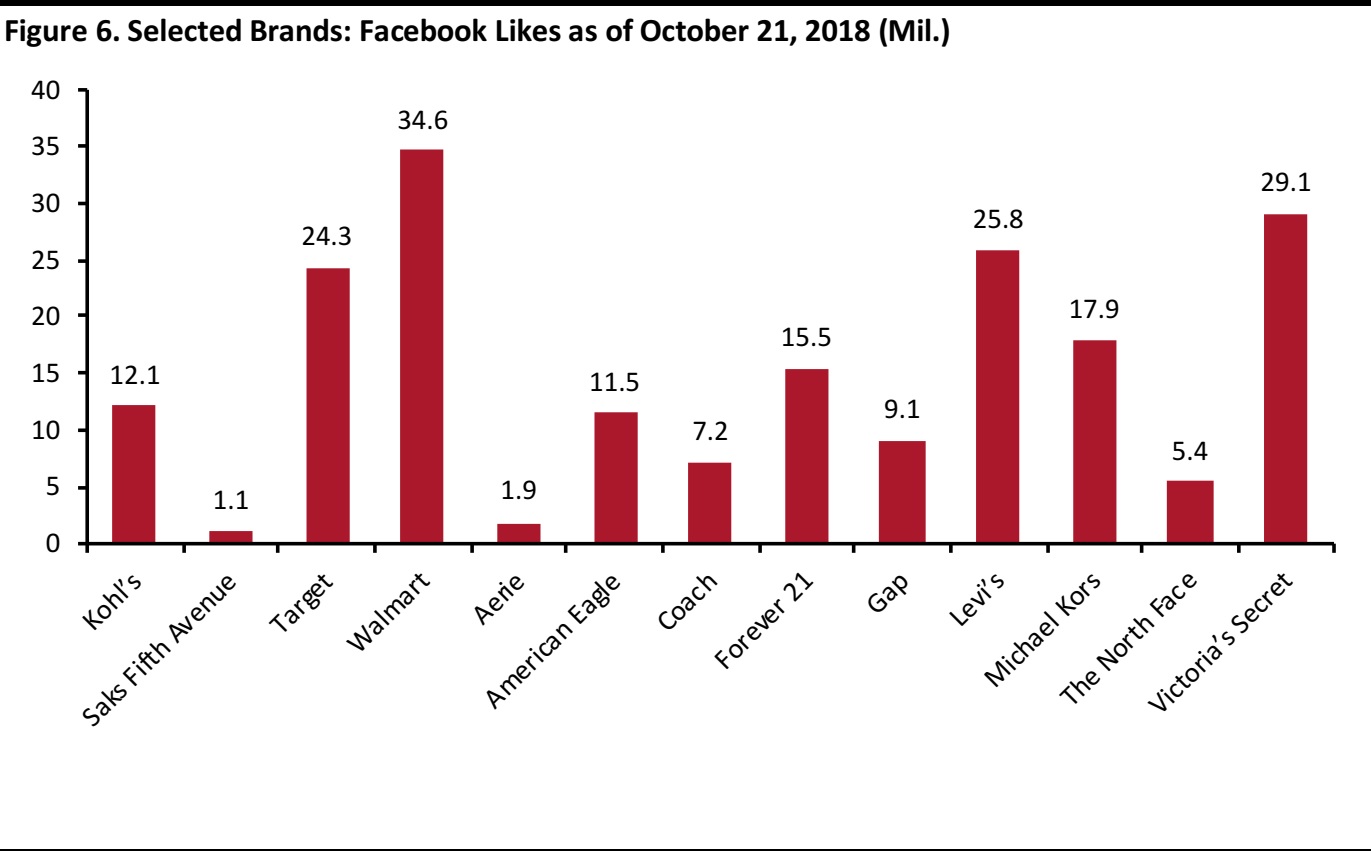

Most brands and retailers have not yet begun their full holiday push on social media platforms, but last year produced some notable campaigns on social networks. Walmart introduced the #RockThisChristmas campaign on social media in 2017 and also created the best Black Friday social media campaign, according to a list compiled by social media analytics firm Talkwalker and marketing news site Marketing Dive. Outdoor retailer REI may have taken the most ambitious approach to social media marketing last holiday season by heavily promoting its #OptOutside campaign, which highlighted the fact that its stores would be closed on Black Friday and encouraged people to spend at least part of the long Thanksgiving weekend outdoors with their family. REI’s campaign also ranked high on Talkwalker’s and Marketing Dive’s list of effective holiday 2017 social media campaigns, coming in among the top five.Walmart’s and REI’s efforts perhaps indicate that memorable hashtags are key to successfully using platforms such as Facebook and Instagram as marketing tools. In addition to launching specific campaigns, having a large quantity of followers on social media sites is also critical to a brand’s success. The two figures below show the number of “likes” selected brands had received on Facebook as of October 21 this year and the number of followers those brands had on Instagram as of the same date.

Source: Facebook