Web Developers

More than 165 million Americans shopped during the Thanksgiving weekend, according to a new survey from the National Retail Federation (NRF) and Prosper Insights & Analytics. That compares with 174 million shopping the five-day Thanksgiving weekend in 2017, meaning this year saw a decline about 9 million shoppers. However, the total was up a million when compared with advance estimates from the NRF/Prosper Insights & Analytics survey completed October 29–November 7, when an estimated 164 million were projected to shop the Thanksgiving weekend.

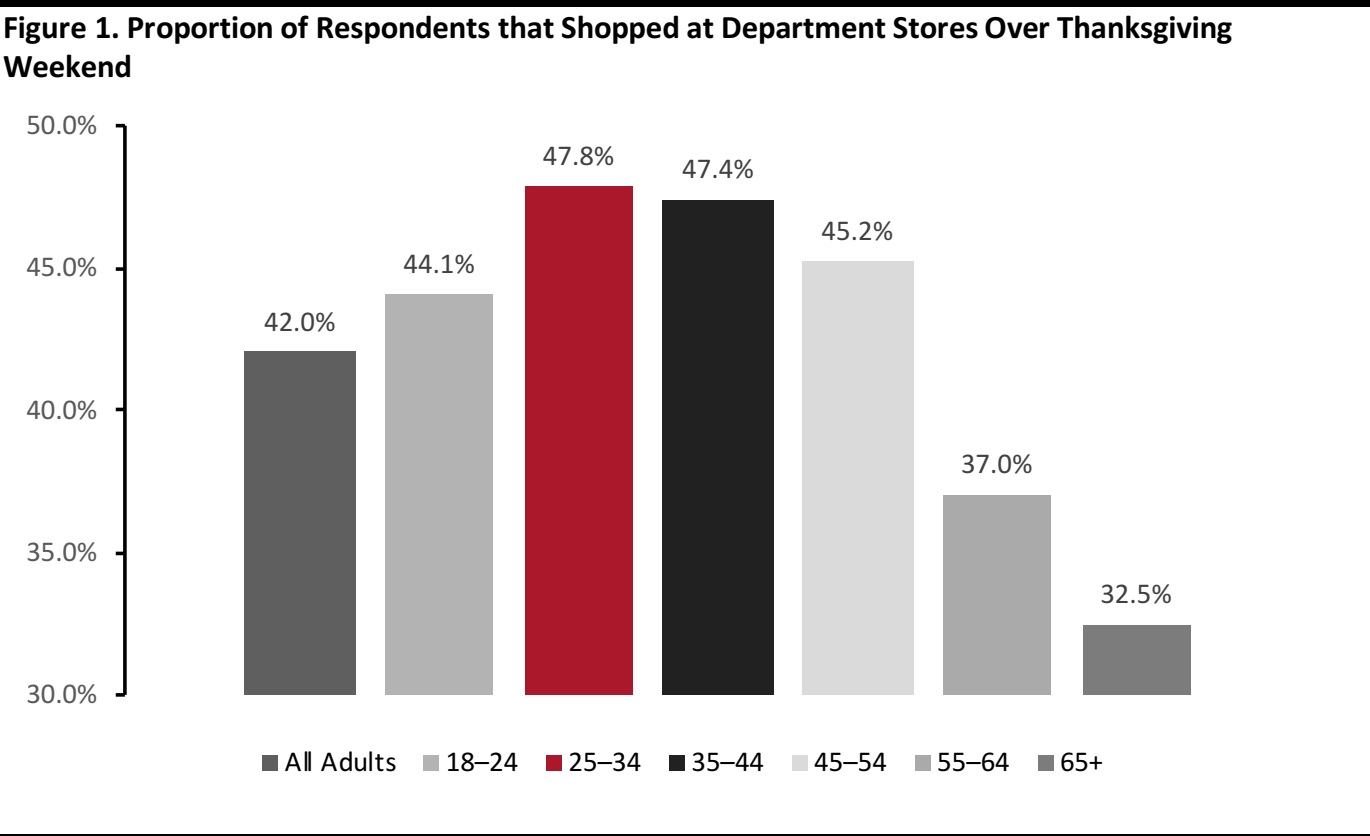

The average spend over the five days was $319.29, which compares with $335.47 last year, as more consumers took advantage of promotions this year (65% this year versus 61% last year). Gen Xers (those ages 35–44) were the highest spenders, at $413.05, followed by older millennials (25–34), who spent an average $388.22. The NRF projects the average spend for the holiday will be $1,007.

Black Friday has become the traditional start to the holiday shopping spree with family and friends shopping together in the spirit of the holidays. However, iIn terms of the number of shoppers, it is superseded by Cyber Monday. Cyber Monday was the most popular day to shop this past weekend, when an estimated 67.4 million shopped, followed by Black Friday with 65.2 million.

More than half of adults ages 18–44 shopped in stores on Thanksgiving Day before 8pm; on Black Friday, 44% of those ages 55–64 shopped at 10am or later. The holiday shopping calendar is drifting to an earlier start and online access is reducing the draw of early morning door busters. Some retailers advertised early online access (three-days early) to door buster items, which skews the results for the five-day Thanksgiving shopping period to earlier in November.

According to the Prosper data, younger millennials ages 18–24 spent an average of $149 on self-gifting during the Thanksgiving weekend, more than any other age cohort. While 77% of shoppers have begun their holiday shopping, 23% haven’t, and that compares with an 80/20 proportion in 2017; on average, 44.2% of shoppers have finished their shopping, down from 46.8% last year. In sum, much holiday shopping is still ahead as 50% of consumers expect upcoming promotions to equal those of Thanksgiving weekend.

Source: Prosper Insights & Analytics

Source: Prosper Insights & Analytics